Chapter 3

Promotion of land banking schemes

3.1

All land banking schemes investigated by the committee were promoted and

sold through investment seminars or wealth creation programs. Investors

attended the seminars in person or were part of a wealth creation program and

received 'study' materials straight to their home. Beyond the complicated

nature of the options agreement and the land banking schemes themselves,

significant risks are associated with investment seminars and wealth creation

programs. In this chapter, the committee examines the marketing of land banking

schemes.

Property spruikers

3.2

While the nature of the property investment schemes being promoted has

changed over time, the behaviour of property spruikers is largely consistent across

time. The significant problems associated with the provision of property

investment advice were considered in two inquiries in the 2000s: the

Parliamentary Joint Committee on Corporations and Financial Services report, Property

Investment Advice —Safe as Houses?, released in June 2005 (PJC report) and

the Victorian Parliament Law Reform Committee's report, Inquiry into

Property Investment Advisers and Marketeers, released in April 2008

(Victorian Parliament report).

3.3

The PJC report and the Victorian Parliament report were both triggered

by significant problems with the provision of property investment advice and

'wealth creation' services, such as investment seminars which arose during the

property boom of the early- to mid-2000s. The recent property boom in Australia

seems to have provided similar conditions for property spruikers seeking to

exploit interest in the benefits of property investments, however tenuous that

link may be in the case of land banking schemes. As Mr Cohen, Director of

Consumer Affairs Victoria, told the committee:

Property spruikers have been of interest to national, state

and territory agencies for a number of years. In our experience they generally

emerge where rising prices create the opportunity for profit from property

investment and where homeownership is less affordable—for example, property

prices were rising in the early 2000s when Henry Kaye began offering

get-rich-quick investment advice.[1]

3.4

The use of the term 'property spruikers' has a particular connotation.

The committee adopts the term used by the Australian Consumer Law National

Project which defines property spruikers as:

...property investment promoters—usually not licensed as real

estate agents or financial service providers—who run wealth creation seminars,

and offer property investment.[2]

Investment seminars and retail clients

3.5

Investment seminars are often characterised as 'educational services' that

provide advice on strategy. Few seminars appear to disclose at the outset that

the focus will be on selling particular investments. Importantly, despite the

seminars being about investment activities, they are not represented as

providing 'financial advice'. Mr McIntyre, for example, was adamant that he was

an educator and did not give financial advice:

I am an educator. There is a distinct difference. I am

probably the biggest critic of the financial-planning industry in the country.[3]

3.6

According to Mr McIntyre, he educated people on a range of strategies

and that it was not financial advice because, 'if you want financial advice,

you go and see a financial planner'. He accepted that he received a commission

on the options he sold and this was disclosed, stating that if 'we are selling

a product, we disclose our interest'. He reiterated:

We do not give advice. We offer them [potential investors] an

opportunity to go and do their due diligence. It is up to them to do that.[4]

3.7

Mr McIntyre agreed with the description that he was selling an

opportunity.[5]

3.8

As a result of publicising these events as educational, the seminars

attracted a wide range of attendees. Some people who attended were interested

in learning more about potential investment strategies, whereas others were attracted

by the offer of a free form of financial information.[6]

3.9

As mentioned earlier, the committee received a DVD copy of a recording

of an investment seminar presented by 21st Century Property Direct

in late 2010 or early 2011 promoting the Moira Park Green City development in

Shepparton, Victoria.[7]

The Moira Park Green City development appears to be the first time the practice

of selling options to purchase land was used.[8]

Mr Steven Molnar, who is reportedly a former business associate of Mr Kaye,

presented the seminar.[9]

Asked at the start of the seminar as to why they were attending the session,

audience members stated reasons including to:

-

achieve a positive cash flow;

-

provide for an early retirement;

-

find a good investment with little money down;

-

obtain information;

-

learn some skills;

-

have a better lifestyle; and

-

take advantage of a special opportunity.[10]

3.10

In relation to how attendees became aware of the investment seminar, Mr

Guy reported receiving an email about the seminar after somehow ending up on a

marketing list for Global1 Training Pty Ltd, an event management company. Ms Baxter

recounted seeing online advertisements promoting the seminar while she was

researching property on a real estate website.[11]

3.11

Investment seminars often targeted people keen to secure their future

through acquiring a tangible asset such as property. Building retirement

savings is one of the main reasons people invest in property. Market First's

schemes, for example, were marketed as an opportunity 'to give you [the

investor] the chance to invest in Australia's future blue chip suburbs, today'.[12]

In particular, investment seminars were often aimed at people looking to build

wealth but lacking investment experience. Previous property investment schemes

promoted through investment seminars have often focused on 'get-rich-quick'

schemes such as rent-to-buy and vendor terms.[13]

Dr Elizabeth Lanyon from Consumer Affairs Victoria described the

types of people who have been singled out as potential investors in these

schemes:

In the past, these schemes have been mainly rent-to-buy and

vendor terms. Those legal forms are not in themselves problematic. However,

consumers who are being targeted are those who have limited access to

mainstream finance, are often underemployed or commonly underemployed, have low

financial literacy and are generally in need of easy or quick financial gains.

Our national work is identifying the unique consumer risks that arise with

these schemes.[14]

3.12

Those promoting land banking schemes have an arsenal of persuasive

arguments designed to entice potential investors. These are explored below.

Privileged access

3.13

An important sales technique was to make the investor feel special by

convincing them that they were being presented with a unique deal—an

opportunity too good to be missed. The court presiding over the Midlands case

cited the following examples of the marketing and promotional material used by

Property Direct on behalf of Midland:

- "a 'never seen before'

property investment opportunity that enables you to secure prime land for a

measly, tiny fraction of what others could ever negotiate";

- "a fool-proof plan to grab

seven properties over twelve years worth potentially millions of

dollars—without relying on the banks or unmanageable payments";

- "potential to make $1.25m in

return in 10 years time with the buy and hold strategy, or 125% return in two

years if you want to sell out and cash it out early. Feel at ease, safe and

secure with our no-risk exit strategy".[15]

3.14

When considered in isolation, the benefits and ease of investing in land

banking schemes would appear to be 'too good to be true' to most people. In

fact, spruikers often acknowledged that this strategy seemed unrealistic, but

only because, they argued, 'mum and dad' investors do not usually have access

to these opportunities.

3.15

Potential investors were encouraged to feel as though they had been

given privileged access to special deals and opportunities not available to

others due to the hard work of the schemes' promoters and developers. For

example, one slide at the 21st Century Property Direct seminar was

titled 'We are pleased to offer you an exclusive investment opportunity within

one of Australia's fastest growing areas'.[16]

Mr McIntyre made the same point to the committee:

What is land banking? Effectively, it has been around since

medieval days; it is not actually new. It essentially [is] the banking of land

for the future—ideally to be converted from farm land to residential,

high-value use. The strategy is generally reserved in Australia for the very

wealthy and is commonly used by them to create wealth.

...

The 21st Century Group, being a financial innovator that does

not like strategies being monopolised solely by the rich and believes that it

should also be accessible to the middle class, decided to innovate with the use

of property options combined with land banking to help solve the housing

affordability crisis that this country urgently faces.[17]

3.16

Investors were being offered relatively affordable option prices (around

$20,000 to $40,000 each),[18]

which were often marketed as 'wholesale' options or at a cheaper price because

of the buying power of the promoter of the scheme. Ms Liesl Baxter,

an investor, heard the same sales pitch at three Market First investment

seminars in Perth in 2013, explaining that the seminar was:

...an introduction to the idea of land banking, which they

described as buying wholesale lots in potential development sites before

planning approval was given, and then there would be a public release after

that. The idea was to take advantage of the uplift that comes with the better

use and development of urban fringe land. What I understood was that we were

coming in at the ground level before the bulldozers came there. I am from a

rural family. I have seen it done many times before where a paddock close to

town is sold and then you cut it up into little bits...[19]

3.17

Mr McIntyre confirmed that this was part of the strategy for 21st

Century Group informing the committee that the developer was effectively

selling land at 'wholesale' in exchange for getting 'presales for its project

in advance'.[20]

Market First also made big claims about the discounted pricing of their

developments in a marketing brochure:

We've been talking about the premium prices paid for 'Rolls

Royce' high end properties. However, you may be thinking these properties must

be way too expensive for the average investor to afford.

So here's possibly the best news about Market First: as our

member you get heavily discounted 'pre-retail pricing'. In other words, you get

'Rolls Royce' properties at 'Holden prices'.[21]

Success stories

3.18

Spruikers often relied on assumptions about property as well as making

selective and often unsubstantiated claims about the local area where the

development was located to convince potential investors that the promoted

scheme was a good deal.

3.19

For example, the main upside of investing in land banking options that

Mr McIntyre outlined for the committee is that land in Australia generally

increases in value over time.[22]

He gave the example of Mr Harry Triguboff of the Meriton Group, who:

...reportedly made $200 million alone from increases in the

value of his group's landholdings. Property options have also been used in the

property industry for decades to acquire land—as a way to secure the land

without needing to initially borrow or to be obligated to eventually purchase

the land. Large land developers also use options regularly.[23]

3.20

While this may generally be true (though there are exceptions), there

was no evidence before the committee that the fee investors paid for their option

to purchase land reflected its value. After all, investors who paid an option

fee were not actually purchasing any land at the time they entered into the

option agreement.

3.21

Spruikers built on these property success stories with unfounded

promises of incredible returns. The suggested returns on land banking schemes were

higher than the typical returns for property, which ASIC's MoneySmart

website suggests are around 6 per cent per annum.[24]

Notably, while the figures that were discussed at seminars or distributed to

potential investors were very clear, the connection between the figures and the

actual investment being promoted were not. For example, Market First provided

one investor with two optimistic sets of calculations titled 'Property

Investment Projections over 40 years' and 'Property Investment Analysis'.[25]

The documents did not specify which property the calculations were about, but

did estimate that a property valued at $590,000 in year 1 would be worth an

incredible $38.351 million in 40 years.[26]

3.22

Similarly, 21st Century Group's Moira Park Green City

spruiker showed the audience slides outlining capital growth at 8, 10 and 12

per cent per annum—growth which is both higher than average and which was not

directly linked to the investment being promoted.[27]

3.23

To justify the investment and the claims made about high returns,

marketers often made assertions about the local area or the special features of

the development that would increase the value of the investment. This was

particularly the case with land banking schemes, as the land being proposed for

redevelopment was located in regional or farmland areas that were inexpensive

compared to the price of land in capital cities. 21st Century

Group's Moira Park Green City spruiker highlighted a number of features of the

Shepparton region that would apparently increase the value of the land,

including fruit and vegetable farms in the region. One slide during the

presentation stated:

It [Shepparton] is one of the wealthiest regions in

Australia. Shepparton has more BMWs and Mercedes Benz per capita than anywhere

else in Australia.[28]

3.24

The connection between the abundance of farms, expensive motor vehicles

and the outlook for the development, which was 8 kilometres outside of

Shepparton, was left unexplained. Similarly, while discussing the environmentally

sustainable design elements for the Moira Park Green City development, another

slide stated that 'Residents are prepared to pay the same prices for properties

outside of Melbourne, as for inner suburb properties if they are unique and

different'.[29]

3.25

Interstate investors unfamiliar with local market conditions were

particularly susceptible to paying above market value for developments. For

example, it appears that both Market First and 21st Century Group

held many seminars in Perth during the mining boom; all four investors who gave

evidence to the committee were Western Australians who invested in Victorian

land banking schemes.

Risks

3.26

In addition to making unsubstantiated and exaggerated claims about the

developments they were promoting, spruikers often failed to disclose risks associated

with the schemes. The confusion about the nature of the investment in land

banking schemes (discussed earlier) is a clear example of how investors were

not aware of the complexities surrounding these highly speculative investments,

including the timeframe for rezoning and development and the intricate web of

mysterious people behind the schemes.

3.27

As well as being marketed as affordable and accessible, land banking

schemes were often promoted as risk-free or very low-risk. For example, a 21st Century

Group's salesperson, in a presentation on the Moira Park Green City

development, compared options to putting purchases on 'layby' at a retail store

because of the alleged maximum flexibility associated with options agreements.[30]

3.28

Mr McIntyre told the committee that the biggest risk in land banking was

that the project does not receive development approval (which often includes

approval for rezoning). Most investors, he claimed, were willing to accept that

risk:

The answer to the question 'What happens if it does not get

rezoned and the development is not approved?' is that most investors are happy

to take the risk, as the upside is very good and there is low potential

downside'.[31]

3.29

Wealthy investors with diversified investment portfolios who make a

small investment in start-ups, for example, may be prepared to wear the risk

that they either lose or do not receive the expected return on their

investment. The investors targeted by Mr McIntyre's land banking schemes were

often those who did not have enough savings or access to credit to invest in an

investment property. In most cases, the decisions made by investors in land

banking schemes do not align with their risk profile and point to unsound

advice on the part of the so-called 'educator'.

3.30

The messages emanating from investment seminars and promotional material

were often designed to appeal to inexperienced investors aspiring to own

property but lacking either the savings or the access to mainstream credit to

purchase investment properties directly. For example, Mr Guy explained to the

committee that he invested in a land banking scheme because of his financial

situation:

My background is that in 2010 my company was liquidated and

we had no money. We just went broke. What we tried to do was look for some

future investment that could get us some long-term income and value, and this

looked like a good opportunity, so we did that. However, when the bank knocked

us back we thought we still had opportunities so we raised the capital

ourselves out of our own cash. We supplied $43,000, as directed, to another law

firm.[32]

3.31

In outlining one of 21st Century Group's land banking

projects in Victoria, Mr McIntyre described the investors that the project

was aimed at:

Our land banking division was able to offer home buyers and

investors who might not be ready yet to build a home, or who cannot afford it

but still want to be investors, the right to acquire land in the future in one

of our planned estates.[33]

3.32

It is important to note, however, that it is not only clients who might

be considered to be vulnerable who are caught out by these schemes. Some people

with previous experience in property investment have invested in land banking

schemes, and many of those who invested have experience in buying property

through purchasing their residential home. It may be the case that people who

have some experience with purchasing property think they understand property

investment better than other investment options, such as managed investments.[34]

Investors, of course, require some savings (either inside or outside

superannuation) to invest in options or off-the-plan contracts, or assets with

which to use as security for a bank guarantee. For example, Ms Liesl Baxter, an

investor in a Market First project, had prior experience with property

investing and went to the seminar because she was looking for a good investment

opportunity:

I had had two very successful developments in Perth that I

had been a part of where I had subdivided and built projects and made a reasonable

amount of money through hard work and research, and I was looking for my third

investment opportunity.[35]

3.33

The Victorian Parliament report pointed out that even relatively

well-educated consumers had been caught by rogue traders, with evidence

suggesting that all consumers require extra protection in certain markets and

situations.[36]

Exclusive membership

3.34

Seminar attendees were encouraged to purchase education products like

DVDs or books, and to become members of 'exclusive' clubs which offered special

investment deals, mentoring and individualised property advice. For example,

Market First's website promoted its membership program as 'first class

membership with first class advantages':

Market First members get access to blue chip, A-grade, real

estate at prices and terms the average investor could rarely negotiate or

obtain.

These deals are only possible because our members' combined

group buying power gives us the ability to negotiate mass discounts with

property developers on behalf of our hundreds of members. The net result is our

members can secure prestige properties at exceptional prices and terms.[37]

3.35

In some cases, potential investors were told they needed to purchase a

membership with 21st Century Group or Market First to gain access to

the wholesale price. At one of its investment seminars, a 21st

Century Property Direct spruiker (a related company to the 21st

Century Group) told potential investors that to invest in the Moira Park Green

City development, one of the earliest land banking schemes offering options,

'You have to join first and be a member—full stop, that is the bottom line'.[38]

3.36

Similarly, Mr Guy, an investor in a Market First scheme, told the

committee about his experiences at a Market First investment seminar in Perth

in 2013:

We were told that it was also a private buying group—a small

buying group—that we were buying into so that we could get the land at wholesale

price, and we had to pay a $5,000 platinum membership to be in that little

group.[39]

3.37

It is therefore unsurprising that all four investors who provided

evidence to the committee paid membership fees for access to the land banking

schemes; three investors became members after attending Market First investment

seminars, while one investor (Ms Monka) became a member of 21st

Century Group after receiving promotional material from 21st Century

Group as a 'home study' participant.[40]

A promotional Market First flyer provided to one investor promised a

number of membership benefits, particularly for 'Platinum' members, including:

-

a personalised strategy session;

-

unlimited property purchases;

-

residences and land with 3–5 year settlements;

-

options settlement period 5–7 years;

-

$12,000 investment grant;

-

up to 100 per cent finance for residences;

-

up to 90 per cent finance for self-managed super fund (SMSF)

residences;

-

a consumer protection plan with a 10-year rental guarantee; and

-

a value guarantee ('to cover any market downside at settlement').[41]

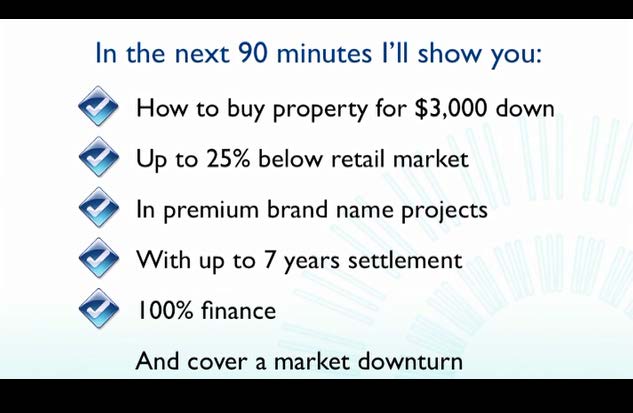

3.38

These were some of the many promises made to investors about the

benefits and accessibility of land banking schemes. In an investment seminar

titled 'Property Education Seminar 2013', Market First's CEO, Mr Burn, outlined

his 'ultimate property investment strategy' that centred on investing in Market

First's Foscari or Veneziane developments on the outskirts of Melbourne. The

promised benefits of the strategy are highlighted in Figure 1. These outlandish

and unproven benefits are typical of those promised for land banking schemes operated

and promoted by Market First and 21st Century Group. As ASIC's MoneySmart

financial literacy website warns consumers: 'Big promises equal big risks'.[42]

Figure 1: Slide from Mr Rowan Burn's presentation on Market

First's land banking schemes[43]

Endorsements and appearances by

celebrities

3.39

Investment seminars often featured guest speakers who purportedly became

wealthy using the tips and tricks taught at the seminar ('success stories') or who

were well-known celebrities paid to promote the investment. For example, 21st

Century Group brought Mr Arnold Schwarzenegger, famous film star and former

Governor of California, to Australia to headline its 2013 'national tour' and

give the event (and 21st Century Group) significant publicity.[44]

In promotional material, Mr Schwarzenegger is reported as saying:

Jamie McIntyre is an extraordinary human being who has helped

hundreds of thousands of people achieve their full potential. I love that he

has a PhD in results...[45]

3.40

One investor, Mr Haynes, reported attending a Market First seminar

primarily to watch Mr Richard Branson, renowned entrepreneur and founder

of the Virgin Group, speak at the Perth Convention Centre. Attendees had to

first sit through two days of presentations in the lead-up to Mr Branson's

presentation. When asked what it meant that Mr Branson was appearing at this

seminar, Mr Haynes told the committee:

It made it more legitimate than it was. He is obviously a

person everyone admires in some way. By putting him on last, you had to put up

with everyone else speaking first. I guess it is that simple.[46]

3.41

Even for investors who were not drawn to the seminars because of the star

speakers, the celebrity presentations often gave the scheme being promoted an

air of authenticity and credibility. Mr Guy provided the committee with a

poster of the 2014 'Property Millionaires Tour', which featured TV personalities,

real estate agent Mr John McGrath and Mr Burn, Market First's CEO.[47]

The tour was 'proudly supported' by Century 21 real estate agents and Smart

Property Investment magazine.[48]

The committee is not suggesting that these other parties had any improper involvement

in land banking schemes, but their association was certainly intended to

convince potential investors of the integrity and viability of the products.

3.42

Mr Benjamin Kingsley, Chair of the Property Investment Professionals of

Australia, told the committee that spruikers hired celebrities to speak at

investment seminars 'for instant social credibility'.[49]

It appears that, in many cases, celebrity endorsements and appearances at

investment seminars helped convince attendees of the legitimacy of the scheme

and the probity and trustworthiness of the spruiker.

3.43

The celebrity endorsements and national seminar tours often continued to

provide this sense of legitimacy long after investors had invested in their

scheme. Ms Monka noted:

I was just thinking that he [Mr McIntyre] is getting his

circle of very influential friends and it is just getting bigger, because at

the time when I attended the seminar, it was only Tony Robbins, the

motivational speaker.[50]

Disclaimers—the fine print

3.44

The land banking schemes examined by the committee commonly included

lengthy disclaimers at the start of investment seminars and on marketing

brochures and other documents provided to investors. For example, the slide at Figure

2, which was displayed by a 21st Century spruiker illustrates the

type of disclaimer used at seminars intended to alert attendees to the

reliability of the information provided.

Figure 2: Slide from 21st Century Group's presentation on

the Moira Park Green City development[51]

3.45

The slide was accompanied by the following statement by the presenter:

So basically I am here to give you lots of information, a lot

of it is general in nature. I am going to tell you where we find this

information so you can go and double-check it, triple check-it for yourself and

get further updates on this information. At no point am I here to give you any

specific financial advice for your specific situation. Is everyone ok with

that? Please say yes. Alright, terrific.[52]

3.46

Other examples of disclaimers can be found at the end of Market First's

emails to investors and in Market First's marketing brochures.[53]

One Market First brochure for the Foscari project included this disclaimer

(extracted in part):

This is a conceptual brochure created for the purpose of

providing information to both current and prospective purchases. Accordingly, it

is not to be relied on as to the accuracy, completeness and suitability of the

information contained in this brochure and in the described materials ('the

information'). The brochure is presented for illustrative and educative

purposes and shall not be represented or treated as real estate advice, legal

advice, investment advice, tax advice and other similar advices. The brochure

does not and will not form part of an offer or contract between the parties.[54]

3.47

The optimistic sets of calculations (discussed earlier) in the Property

Investment Analysis documents provided by Market First to one investor both

featured the same disclaimer, which acknowledged that these calculations were

essentially speculations based on unknown assumptions:

Disclaimer: Note that the computer projections listed above

simply illustrate the outcome calculated from the input values and the

assumptions contained in the model. Hence the figures can be varied as required

and are in no way intended to be a guarantee of future performance. Although

the information is provided in good faith, it is also given on the basis that

no person using the information, in whole or in part, shall have any claim

against Market First Property Consulting Pty Ltd - Melbourne, its servants,

employees or consultants.[55]

3.48

While such disclaimers may be used as a device to protect the promoter

from claims of misleading advertising, they are ineffective as a means of

alerting investors to risks associated with the investment, especially

considering the context in which disclaimers are issued.[56]

High-pressure sales tactics

3.49

Having listened to compelling arguments to invest in a land banking

scheme and been presented with testimonials extolling its virtues, attendees

were often pressured to sign up to such schemes through high-pressure sales

tactics. As noted earlier, potential investors were encouraged to feel as

though they had exclusive access to the special deal on offer: that they would

be the only ones to have heard about investment strategies usually available to

wealthy people only, not 'mum and dad' investors.[57]

Promoters would then emphasise the importance of grasping the opportunity

before it slipped away. Thus, land banking schemes were often promoted with a

sense of urgency, as potential investors were told they had to invest quickly,

usually by signing up at the seminar, or otherwise risk missing out on the

chance. For example, a 21st Century Property Direct spruiker

emphasised that the time frame to invest in the Moira Park Green City

development was limited and the demand high:

If you wait, guess what is going to happen? You are going to

miss out, full stop. Because we have plenty of other people who want to see

this around the country. You will still get your five years to buy your five

blocks, or seven blocks, or how many blocks you've got going, no problem. But

this deal will be gone. So this is why you have got to be thinking to yourself,

you need to be thinking how do you get the maximum result from this, because

this is a deal which can't actually be repeated.[58]

3.50

Such practices negate any guidance offered in disclaimers to obtain

independent professional assistance. Instead, potential investors were

pressured into making decisions without first taking the time to reflect on

their actions and without seeking outside professional advice.

3.51

ASIC recognised that property spruiking events and investment seminars

were often high pressure environments where participants could 'be rushed into

making a decision'. ASIC informed the committee of its concern that high pressure

tactics employed by some promoters urging investors to sign up to arrangements,

meant the investors were not given enough time to consider their investment

carefully. They 'do not adequately read the agreements that they enter into to,

or seek independent advice in relation to the scheme'.[59]

3.52

In summary, while investors in land banking schemes were provided with

an overwhelming amount of information and promises about the developments, this

information and the way it was promoted was designed to persuade prospective

investors to sign up to the scheme. None of the information provided by Market

First or 21st Century Group was presented in a way that encouraged

the investor to make an informed choice. In reality, investors were taken in by

professional marketing techniques and overly optimistic predictions despite the

ubiquitous use of disclaimers. They were rushed into making a decision without time

to consider the investment or to consult other sources for guidance or

information.

Conclusion

3.53

Land banking schemes were sold through property investment seminars or

wealth creation programs and through glossy brochures. The seminars:

-

were usually attended by retail clients who were interested in

knowing more about property investment but who were not usually knowledgeable

about the industry;

-

offered privileged access to purported special deals;

-

featured persuasive marketeers who relied on property myths,

concept plans and unsubstantiated claims to make the schemes seem like a good

deal;

-

used endorsements and appearances by celebrities to attract

attendees and to give legitimacy to the products being promoted and

respectability to the promoters; and

-

used high-pressure sales tactics to push 'exclusive' membership

offers and make big promises.

3.54

Although it may not have been in their financial interest, consumers

sometimes succumbed to the 'hype' generated by investment seminars, with their

celebrity endorsements, offers of special 'exclusive' deals and high-pressure

sale tactics. A legitimate property investment adviser would have no difficulty

allowing a consumer time to speak to their friends and relatives about any

proposed deal and to research the offer as well as encourage their client to

seek advice from independent financial advisers, lawyers, accountants or

brokers.

3.55

The overriding message coming out of the evidence is that consumers must

be wary of trusting documents and material provided by spruikers and resist the

pressure to sign up to a deal without first seeking independent advice. But,

the developers and promoters of these schemes should also be held accountable

for their actions.

Navigation: Previous Page | Contents | Next Page