Chapter 2

The Australian dairy industry

Description

2.1

The dairy industry is Australia's third largest rural industry. It

consists of about 8,000 dairy farms and directly employs approximately 40,000

people.[1]

It has a farmgate value of $4 billion.[2]

A reduction in dairy farm numbers since deregulation of the industry has been more

than offset by an increase in average herd size and productivity, the effect

being that the volume of milk produced by the 8,000 farms in 2009 is over 70

per cent above the volume produced by the 22,000 farms in 1980.[3]

2.2

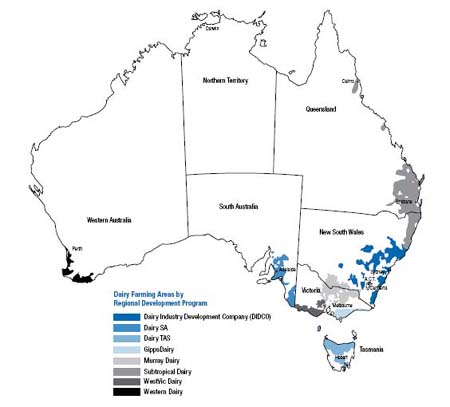

Australia's main dairying areas are identified on the map below.

Chart 2.1: Australian

dairying regions

Source: www.dairyaustralia.com.au

2.3

Over two-thirds of the 9.4 billion litres of milk produced in 2008-09 was

produced in Victoria, 10 per cent in New South Wales and 7 per cent in

Tasmania.[4]

Dairying occupies a relatively large proportion of the agricultural sector in

Tasmania.[5]

2.4

Australia's milk production sector is dominated by owner-operated farms

(approximately 80 per cent).[6]

Although these farmers operate efficiently they remain vulnerable to unstable

climatic conditions which in turn affect their ability to successfully manage

the costs of production. Milk production is highly seasonal, peaking in October

and tapering off in the cooler months from April (Chart 2.3 below).

2.5

Just over half the milk produced in Australia during 2008-09 was consumed

by the domestic market; the remainder being exported as either drinking milk or

manufactured products.[7]

Recent developments

2.6

In 2008, Dairy Australia reported that the Australian dairy industry was

'enjoying the best world market conditions in decades...international dairy

commodity prices rose to record levels through 2007', due to consistent strong

demand and tight supplies, as well as the effects of exchange rates and cuts in

export subsidies.[8]

This led to higher farmgate milk prices for Australian dairy farmers – prices

increasing by more than 50 per cent in southern regions during 2007-08 (see

Chart 6.1).[9]

Dairy Australia did note that despite the optimism, the industry 'remain[ed]

constrained by the high cost and limited availability of production inputs,

uncertain climatic conditions and reducing dairy herd numbers'.[10]

2.7

Higher farmgate prices continued into the 2008-09 season until,

following the global financial crisis, milk processors reduced the price paid

to farmers sharply.

2.8

The reduction in price per litre paid to farmers was initiated by Murray

Goulburn who announced a 'step-down' in response to the weakening international

commodity market. Following Murray Goulburn's announcement, the remaining major

milk processors also announced reductions in the price they would pay.

2.9

The economic effect on the dairy industry of these announced reductions

in prices paid to farmers has been a focus of this inquiry, evidence gathered

by the Committee indicating that the impact on dairy farmers and their

communities has been severe:

In July, August, September and October, suppliers have lost

substantial income. I myself am losing in excess of $100,000 a month... There

are individual examples of farmers having to sell furniture in order to put

food on the table for their family and, in some circumstances, offering to hand

their farms back to the bank. The first forced sale of a farm which supplies

National Foods is taking place on 19 November.[11]

Whilst we have had downturns of this nature to cope with

practically ever since we have been involved in farming, this is by far the

worst that we have ever had to deal with. I guess the main reason that it is

the worst is that we were faced with a 40 per cent drop in milk price in

January of last season. In terms of our operation, we are relatively big

farmers, with 550 or 600 cows. That cut $380,000 worth of income out of the

last half of our business last season.[12]

On my calculations, losing 6c a litre equates to a combined

loss of $7.8 million across 90 suppliers in Tasmania. If you add a

conservative multiplier of 2.5 to that loss, that translates into a regional

economic impact of minus $20 million. That is just a conservative estimate of

economic loss. The social cost is almost impossible to quantify and the

qualitative impact is real. It is not just employment loss; it is family

breakdowns, bankruptcy and loss of life, sometimes in the most tragic

circumstances.[13]

The economic effect on the dairy industry of reductions in

prices to be paid to producers will be devastating to the industry and may see

further farmer numbers being reduced as farmers are unable to receive a

reasonable return (cost plus margin) to survive. ...farmers are being forced to

supply the total Australian market at a price that relates to the conditions

relative to commodity markets around the world...[14]

2.10

The step down in farmgate prices in 2008–09, the first such occurrence

since 1973, led to a downturn in confidence within the industry from its 2008

optimism, albeit only back to somewhere around the longer-term average (Chart

2.2).

Chart 2.2: Farmers'

attitude to the future of the dairy industry

Source: Dairy Australia, Australian

Dairy Industry in Focus 2009, p. 5.

2.11

This has in turn been followed by a reduction in milk production.[15]

This year's production levels are tracking lower (Chart 2.3) and annual

production is expected to return to the level of 2007-08 due to the lower

prices, reduced demand and the effects of both drought and flood.[16]

Chart 2.3: Monthly

milk production

Source: Dairy Australia, www.dairyaustralia.com.au.

2.12

Although the international market has shown signs of stabilising in

recent months,[17]

the continuing appreciation of the Australian dollar (Chart 2.4) represents an

additional challenge for the Australian dairy industry putting downward

pressure on export returns.

Chart 2.4: Exchange rates

Source: Reserve Bank of Australia, www.rba.gov.au.

2.13

Dairy Australia predicts that global dairy demand 'based on continued

economic recovery is likely to continue to improve over the course of 2010 in

most key markets; albeit at a slower pace.'[18]

Caution remains however as any number of factors could negatively affect demand

and cause a reduction in commodity prices.

Committee view

2.14

The Committee recognises that the impact of the global financial crisis

on the Australian dairy industry was severe. The Committee acknowledges that it

will take some time for the industry, particularly dairy farmers, to recover

and suggests that the Government consider its role in the industry's recovery particularly

in terms of facilitating its long term sustainability.

2.15

The Committee has further considered these matters in Chapter 6 of this

report.

Dairy industry deregulation

2.16

Until 2000, the Australian dairy industry was regulated. The price paid

for manufacturing milk was determined by factors including world prices of

manufactured dairy products, although support was provided through the use of

national export pools that ensured farmers received an average pool price for

their product regardless of its quality, use and destination.[19]

State authorities set the farmgate price for fresh drinking milk to ensure the

additional costs of year round supply were covered. Today, however, Australia's

dairy farmers operate in a deregulated and open market; the determination of

prices is described in Chapter 3.

2.17

Steps towards market deregulation commenced in the mid 1980s and

continued throughout the 1990s. Deregulation was largely driven by the dairy

industry itself as participants sought opportunities for growth. On 28

September 1999 a government support package was announced to support all states

in deregulating their dairy industries from 1 July 2000.[20]

2.18

At the time deregulation was being considered, the Senate Rural and

Regional Affairs and Transport References Committee investigated the domestic

dairy industry with particular reference to market conditions, competitiveness,

regulatory arrangements and measures that the government could take to

facilitate a transition to a less regulated environment.[21]

Their comprehensive report, Deregulation of the Australian Dairy Industry,

concluded that 'sooner rather than later the market [would] force deregulation

and that a managed outcome with a soft landing [was] preferable to a

commercially driven crash.'[22]

In their findings however, they also noted that of serious concern was the

suggestion that the control regulation provided would 'shift to processors and

large retailers who would then be able to dictate terms to the industry and

marketplace.'[23]

2.19

Following deregulation, the reduction in dairy farm numbers was coupled

with an increase in herd sizes and milk yields per cow as farmers sought to

benefit from the efficiencies of larger operating systems.[24]

Similarly, there has been considerable consolidation within the processing

sector as processors have experienced sustained pressure to reduce costs.[25]

Increased concentration of processors

2.20

The manufacturing sector of the Australian dairy industry has become

more concentrated since the first stages of deregulation in the late 1980s; the

outcome being increased foreign ownership and a reduction in the market share

of farmer owned cooperatives. The five major companies have increased their

milk processing capacity from 50 per cent to 75 per cent of the market.

2.21

In 1999, the five largest milk manufacturers in Australia were Murray

Goulburn, Bonlac, Dairy Farmers Group (all three entities were cooperatives),

National Foods Ltd and Pauls/Parmalat.[26]

Pauls/Parmalat, National Foods and Dairy Farmers Group dominated the market for

drinking milk sales (cumulatively they held an 80 per cent share of this

market) while the cooperatives of Murray Goulburn and Bonlac dominated the

manufacturing milk market, the two entities responsible for processing 55 per

cent of all Australia's manufacturing milk.[27]

2.22

Today, Bonlac is owned by Fonterra, and the Dairy Farmers Group has been

acquired by National Foods. Fonterra (20 per cent),together with Murray

Goulburn (the largest remaining farmer owned cooperative, supplying 37 per cent

of Australia's milk) are the prominent market players in the manufacturing milk

market (Chart 2.5).

Chart 2.5: Market

share of milk volume (2008-09)

Source: Fonterra, Submission

10, Attachment 1, p. 2.

2.23

The remaining milk produced in Australia is sold into the domestic

drinking milk market which, like the manufacturing milk market, is dominated by

two players – National Foods and Parmalat (Chart 2.6).

Source: Figures from AMVA, Submission

32, p. 3.

2.24

Milk sold into the drinking milk market is marketed through various

channels including fast food outlets, supermarkets, independent grocers, corner

stores, and service stations. However, the sale of milk through the supermarket

channel has slowly been increasing; Dairy Australia noting a recent change in

the behaviour of the two large chains – they have embarked on a marketing

campaign encouraging consumers to make comparisons between their own generic

branded milk with that of branded products.[28]

Dairy Australia comment that although this behaviour is 'unlikely to affect the

volume of dairy products consumed there may be an impact on the channel and

value of dairy sales as consumers seek greater value in their purchases' and move

to generic labelled and price discounted branded products.[29]

Committee view

2.25

The Committee notes with concern the increasing market share of the

major retailers in the drinking milk market through their sale of generic milk.

The Committee wishes to bring this situation to the attention of the Government,

particularly as the processors dominating the fresh milk market are directly

competing with their own products as they also supply Woolworths and Coles with

their generic branded milk. This situation suggests to this Committee that the

'serious concern' of the Senate Select Committee which undertook the 1999

inquiry into deregulation of the industry that the control regulation provided

would 'shift to processors and large retailers who would then be able to

dictate terms to the industry and marketplace'[30]

has been realised to the detriment of the industry as a whole and the consumer.

The Committee has further explored these issues with a view to addressing the concerns

in Chapters 3, 4 and 5.

Navigation: Previous Page | Contents | Next Page