Appendix 3 - Relationship between the current account deficit and foreign liabilities[206]

Australia has nearly always had a deficit on its

current account, although it wasn't until the 1980s that these deficits were

associated with a build up of foreign debt (borrowings). Earlier deficits were

not associated with a build up of debt because the deficits were generally

lower and the capital inflow to finance these deficits was largely in the form

of long-term equity investments. From the early 1980s, however, Australia experienced persistently high current

account deficits (CAD) and almost all the capital inflow needed to finance

these deficits was in the form of overseas borrowings.

While current

account deficits contribute to a nation's net foreign liabilities, the CAD for

a given period does not have to equal the change in net foreign liabilities that

occurred over that period. For example, in round figures in 2004-05 the current

account deficit totalled $57 billion, but net foreign debt (borrowings) increased

by $35 billion and net foreign equity increased by $11 billon, giving a total

increase in net foreign liabilities of $46 billion over that 12 months.

The Valuation Effect

A current account

deficit in a given period is equal to the change in net foreign liabilities

(i.e. debt plus equity) that occurred over that period minus the valuation

effects. Valuation effects, which can be

substantial, are those changes in the value of net foreign liabilities that are

due to exchange rate movements and equity revaluations (mainly revaluations of

issued shares and securities purchased by overseas investors).

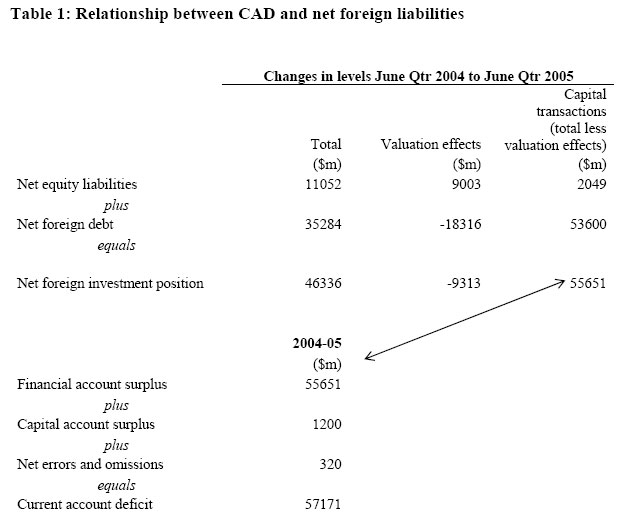

Table 1 illustrates

the relationship between the current account deficit in 2004-05 and the change

in net foreign liabilities that occurred during that 12 months.

Table 1: Relationship between CAD and net

foreign liabilities

From the figures in

Table 1, Australia had a financial account surplus of $55 651 which, after adjustments, resulted

in a CAD of $57 171 million in 2004-05.

That deficit was financed by an inflow of $53 600m in debt (borrowings)

and $2 049m in equity investment. The

valuation effects during the 12 months totalled -$9 313m, so the increase in Australia's net foreign liabilities was $46 336m.

In theory a current

account deficit should equal the capital account surplus, but in practice these

items are rarely in balance and equality has to be achieved by a balancing item,

called 'errors and omissions' in Table 1.

It should also be

noted that just as current account deficits can affect the level of Australia's net foreign debt, so the cost of servicing

this debt can add directly to our current account deficit by increasing the

income deficit.

Table 2 shows the

value of the components involved in calculating the increase in net foreign

debt (borrowings) since 1988-98. Table 3 shows the same process for net foreign

equity. Table 4 shows how net foreign

debt and net foreign equity added to net foreign liabilities or Australia's net international investment position

(i.e. basically the total of Tables 2 and 3).

Table 5 shows the

adjustments made to the CAD each year to arrive at the Financial Account

Surplus figure.

Note that the

figures in Table 1 are in $ millions, but in Tables 2, 3, 4 & 5 are in

$ billions rounded

to the first decimal point.

Effect of Revisions on the Size of the Current Account Deficit

The monthly balance of payments estimates are often subject

to considerable revision.

Revisions may occur for a number of reasons, including:

-

revisions to estimates provided by a data source;

-

estimates from a more timely but less accurate

data source are replaced by estimates from a different, less timely but more

accurate data source;

-

improvements in the method of compiling the

balance of payments estimates from the data source; and

-

changes in the concepts underlying the

estimates.

A study of the monthly current account deficit figures

published over the 10 years June 1986 to June 1996 found that initial estimates

were lower than the later estimates on 55 occasions and greater than the later

estimates on 66 occasions. So there was not a great difference in the frequency

with which first estimates of the current account deficit are either

underestimates or overestimates. Moreover, the size of the revision was about

the same, being on average $219 million for a revision upward to the current

account deficit and $212 million for a revision downward to the current account

deficit.

Table 2: Components

of Annual Increase in Net Foreign Debt (borrowings), $billion

| |

Net foreign

debt at

beginning of

period |

Transactions |

Valuation effects |

Net foreign

debt at end

of period |

Total increase

in net debt |

|

1988-89 |

96.5 |

14.9 |

2.6 |

114.0 |

17.5 |

|

1989-90 |

114.0 |

16.1 |

0.8 |

130.8 |

16.8 |

|

1990-91 |

130.8 |

6.7 |

5.7 |

143.2 |

12.3 |

|

1991-92 |

143.2 |

13.6 |

5.7 |

162.5 |

19.3 |

|

1992-93 |

162.5 |

7.9 |

7.1 |

177.5 |

15.0 |

|

1993-94 |

177.5 |

4.6 |

-10.7 |

171.3 |

-6.1 |

|

1994-95 |

171.3 |

19.4 |

0.05 |

190.8 |

19.5 |

|

1995-96 |

190.8 |

10.0 |

-6.9 |

193.9 |

3.1 |

|

1996-97 |

193.9 |

12.6 |

2.2 |

208.6 |

14.8 |

|

1997-98 |

208.6 |

5.1 |

14.0 |

227.8 |

19.2 |

|

1998-99 |

227.8 |

13.7 |

-10.8 |

230.7 |

2.9 |

|

1999-00 |

230.7 |

37.9 |

4.1 |

272.6 |

42.0 |

|

2000-01 |

272.6 |

5.2 |

24.7 |

302.5 |

29.9 |

|

2001-02 |

302.5 |

38.0 |

-16.3 |

324.2 |

21.7 |

|

2002-03 |

324.2 |

45.9 |

-12.2 |

357.9 |

33.7 |

|

2003-04 |

357.9 |

51.8 |

-15.0 |

394.7 |

36.8 |

|

2004-05 |

394.7 |

53.6 |

-18.3 |

430.0 |

35.3 |

Source: ABS, Balance

of Payments and International Investment Position (Cat. No. 5302.0)

Table 3: Components of Annual Increase in Net Foreign Equity,

$billion

| |

Net foreign

equity at

beginning of

period |

Transactions |

Valuation effects |

Net foreign

equity at end

of period |

Total increase

in net equity |

|

1988-89 |

31.3 |

1.9 |

2.8 |

36.0 |

4.71 |

|

1989-90 |

36.0 |

4.9 |

1.2 |

42.0 |

6.0 |

|

1990-91 |

42.0 |

9.2 |

-2.8 |

48.3 |

6.31 |

|

1991-92 |

48.3 |

-1.4 |

-3.2 |

43.7 |

-4.6 |

|

1992-93 |

43.7 |

6.0 |

-6.1 |

43.7 |

0.0 |

|

1993-94 |

43.7 |

12.2 |

8.9 |

64.8 |

21.1 |

|

1994-95 |

64.8 |

9.0 |

-9.1 |

64.7 |

0.1 |

|

1995-96 |

64.8 |

7.9 |

8.9 |

81.4 |

16.6 |

|

1996-97 |

81.4 |

5.0 |

-4.9 |

81.5 |

0.1 |

|

1997-98 |

81.5 |

19.5 |

-31.9 |

69.2 |

-12.3 |

|

1998-99 |

69.2 |

16.4 |

5.4 |

91.0 |

21.8 |

|

1999-00 |

91.0 |

-6.8 |

-28.0 |

56.1 |

-34.9 |

|

2000-01 |

56.1 |

11.1 |

-4.1 |

63.1 |

7.0 |

|

2001-02 |

63.1 |

-18.8 |

-3.2 |

41.0 |

-22.1 |

|

2002-03 |

41.0 |

-5.6 |

34.9 |

70.3 |

29.3 |

|

2003-04 |

70.3 |

-5.9 |

11.4 |

75.8 |

5.5 |

|

2004-05 |

75.8 |

2.1 |

9.0 |

86.9 |

11.1 |

Source: ABS, Balance

of Payments and International Investment Position (Cat. No. 5302.0)

Table 4: Net

international investment position at end of period, $ billion

| |

Net foreign debt (borrowings) |

Net foreign equity |

Net international investment position |

|

1988-89 |

114.0 |

36.0 |

149.9 |

|

1989-90 |

130.8 |

42.0 |

172.8 |

|

1990-91 |

143.2 |

48.3 |

191.5 |

|

1991-92 |

162.5 |

43.7 |

206.2 |

|

1992-93 |

177.5 |

43.7 |

221.1 |

|

1993-94 |

171.3 |

64.8 |

236.1 |

|

1994-95 |

190.8 |

64.7 |

255.5 |

|

1995-96 |

193.9 |

81.4 |

275.3 |

|

1996-97 |

208.6 |

81.5 |

290.2 |

|

1997-98 |

227.8 |

69.2 |

296.9 |

|

1998-99 |

230.7 |

91.0 |

321.7 |

|

1999-00 |

272.6 |

56.1 |

328.8 |

|

2000-01 |

302.5 |

63.1 |

365.6 |

|

2001-02 |

324.2 |

41.0 |

365.1 |

|

2002-03 |

357.9 |

70.3 |

428.1 |

|

2003-04 |

394.7 |

75.8 |

470.5 |

|

2004-05 |

430.0 |

86.9 |

516.8 |

Source: ABS, Balance

of Payments and International Investment Position (Cat. No. 5302.0)

Table 5: Adjustments

involved in calculation of the current account deficit and the financial

account surplus, $ billion

| |

Financial account surplus |

Capital account surplus |

Net errors and omissions |

Current account deficit |

|

1988-89 |

16.9 |

2.0 |

0.2 |

19.0 |

|

1989-90 |

20.9 |

2.0 |

-0.1 |

22.7 |

|

1990-91 |

15.9 |

2.1 |

-0.5 |

17.5 |

|

1991-92 |

12.1 |

2.1 |

-1.0 |

13.3 |

|

1992-93 |

13.9 |

0.6 |

0.6 |

15.1 |

|

1993-94 |

16.8 |

0.3 |

-1.0 |

16.1 |

|

1994-95 |

28.4 |

0.6 |

-0.6 |

28.4 |

|

1995-96 |

17.8 |

1.1 |

2.6 |

21.5 |

|

1996-97 |

17.6 |

1.3 |

-1.3 |

17.6 |

|

1997-98 |

24.6 |

1.1 |

-3.0 |

22.8 |

|

1998-99 |

30.1 |

1.2 |

2.3 |

33.6 |

|

1999-00 |

31.1 |

1.1 |

0.5 |

32.6 |

|

2000-01 |

16.3 |

1.1 |

0.8 |

18.2 |

|

2001-02 |

19.2 |

1.0 |

0.9 |

21.1 |

|

2002-03 |

40.3 |

1.0 |

0.3 |

41.6 |

|

2003-04 |

45.9 |

1.1 |

0.8 |

47.8 |

|

2004-05 |

55.7 |

1.2 |

0.3 |

57.2 |

Source: ABS, Balance

of Payments and International Investment Position (Cat. No. 5302.0)

Navigation: Previous Page | Contents | Next Page