Chapter 2

ASIC's role in context

2.1

Australia's population of 23.2 million[1]

represents only around 0.03 per cent of the world's estimated population of 7.1

billion people. Despite this, Australia is the world's 12th largest

economy.[2]

The Australian Securities Exchange (ASX) has a total market capitalisation of

around $1.5 trillion.[3]

In 2012–13, the total annual turnover on Australia's financial markets was $135

trillion.[4]

The superannuation system now represents the fourth largest pool of

superannuation savings in the world; as at December 2013, Australia's

superannuation assets were estimated to total $1.8 trillion.[5]

2.2

ASIC's role and its performance needs to be considered in the context of

the growing importance of Australia's financial sector. This chapter outlines

some key developments and likely future directions for the sector. The

remainder of this chapter is principally based on research undertaken for the

committee by the Parliamentary Library. The committee is grateful to the Library

for this assistance.

Relative size and growth of the financial services industry

2.3

The financial services industry as a share of the Australian economy has

grown significantly since the introduction of the superannuation guarantee in

1992, rising from around six per cent to eight per cent by 2012 (Figure 2.1). However,

this growth was preceded by growth in the industry from around the mid-1980s in

response to a range of deregulation measures including the floating of the Australian

dollar, the entry of foreign banks, removal of controls on bank deposits and

the introduction of dividend imputation.[6]

Figure 2.1:

Financial services industry as a share of the economy (1975 to 2012)

Source:

Australian Bureau of Statistics, Australian National Accounts: National Income,

Expenditure and Product, cat. 5206.0, Table 33, December 2013 and March 2014.

2.4

Contributing to this growth has been the expansion of the global

presence of Australia's financial services industry and a rise in services

exports from the industry. Although Australian financial services businesses

are concentrated in the Asia Pacific region, they also have a presence in

Europe and the Americas (Figure 2.2).

Figure 2.2: Australian financial services

global footprint, 2009

|

|

Asia Pacific

|

Europe

|

Americas

|

Africa and Middle East

|

|

Banking

|

China, Fiji, Hong Kong, India, Indonesia, Japan, NZ, Singapore,

Vietnam

|

Malta, UK

|

Canada, Cayman Islands, USA

|

|

|

Funds management

|

Fiji, Hong Kong, Japan, Korea, Malaysia, NZ, Singapore, Taiwan,

Thailand

|

Germany, Ireland, Luxembourg, Netherlands, Switzerland, UK

|

Canada, USA, Brazil

|

Oman, UAE, South Africa

|

|

Financial planning

|

Hong Kong, Singapore, Thailand

|

|

|

|

|

Insurance

|

China, Fiji, Indonesia, NZ, Samoa

|

|

|

|

|

Investment administration

|

China, Hong Kong, Malaysia, NZ, Singapore, Taiwan

|

France

|

Canada, USA, Brazil

|

|

|

Mortgage broking

|

China, NZ

|

|

USA

|

|

|

Stock brokering

|

Hong Kong, Indonesia, Japan, Korea, Malaysia, Philippines, Singapore,

Taiwan, Thailand

|

Germany, Switzerland

|

Canada, USA

|

South Africa

|

Source:

Innovation & Business Skills Australia, Environment Scan 2013: Financial

Services Industry, p. 13 (accessed 8 May 2014).

Expansion in retail investors

2.5

Government privatisations during the 1990s (including the Commonwealth

Bank of Australia (CBA), Telstra, various state banks and Qantas) and

demutualisation of a number of financial services providers and other entities

(AMP, National Mutual and the NRMA) provided opportunities for household

investors

to participate in the ownership of equities.[7]

2.6

Regular surveys of share ownership in Australia by the ASX since 1991

show the considerable growth in the number and proportion of people investing

directly and indirectly (via superannuation for example) in shares. In 1991,

only 1.8 million (15 per cent) of Australian adults directly or indirectly

held shares (Figure 2.3).

By 2012, 6.7 million (38 per cent) of Australian adults directly or indirectly

held shares. While there has been some decline in share ownership since the

peak of 2004—this has been attributed to the repayment of debt, the exit of

'passive' investors and a shift to property investment[8]—the

level of share ownership in Australia remains high compared to other developed

countries.[9]

Figure 2.3:

Share ownership in Australia, 1991 to 2012

Source: ASX, 2012 Australian

Share Ownership Study, May 2013, www.asx.com.au (accessed 1 May 2014) and

previous issues.

Overall significance of Australia's capital markets

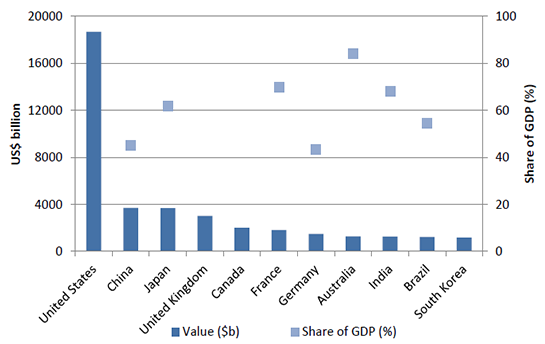

2.7

Capital markets comprise a range of financial products including loans,

equities, bonds and other financial instruments. In 2012, Australia had the

eighth highest equity market capitalisation of global equity markets by value (Figure

2.4).

Figure 2.4:

Market capitalisation of equity markets, 2012 ($US billion)

Source:

The World Bank, World Development Indicators 2014, 9 April 2014.

Overall significance of large financial sector firms to the Australian

economy

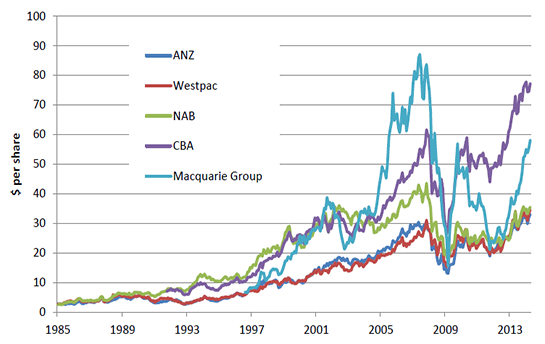

2.8

Of the top 20 companies by market capitalisation listed on the ASX, half

are classified as being in the 'financials' sector. These include companies

such as the big four banks (CBA, NAB, Westpac and ANZ) and insurance providers

AMP, QBE, Suncorp and Insurance Australia. Fund managers Macquarie Group and

Westfield were also part of the sector.[10]

At the end of April 2014, these ten companies accounted for around one-third of

total ASX market capitalisation.[11]

For these ten companies, share prices are generally still below peaks

experienced prior to the global financial crisis. However, most shareholders of

these companies have enjoyed significant increases in share prices in recent

years and over the long term (Figure 2.5).

Figure 2.5:

Share price trends, financials sector companies in the top 20 ASX listed

companies by market capitalisation, 1985 to 2014 (as at April 2014)

Source: Datastream.

Indications of where Australia's financial sector is headed

2.9

The superannuation industry will continue to benefit from growing

superannuation contributions. The gradual increase in the superannuation

guarantee from nine per cent to 12 per cent by 2019–20 and strong positive

cashflows into superannuation funds will see net superannuation contributions

(contributions less payments) result in significant additional funds flowing

into the financial system.

One projection has total assets in superannuation funds rising to more than

$7.6 trillion by 2033.[12]

2.10

This growth in superannuation funds should provide a solid cornerstone

for the growth in the financial services industry generally, with a substantial

portion of these funds to be invested in Australian equities and providing

liquidity in cash deposits with banks. A growing skilled labour force of

advisers, accountants and information technology providers will also be

required to invest these additional funds efficiently.

2.11

The health of the financial sector in Australia is heavily dependent on

general economic and financial market conditions. With strong domestic economic

growth compared to much of the developed world and the growing pool of

superannuation funds, there appears to be no shortage of available domestic

capital and business opportunities to grow the sector.

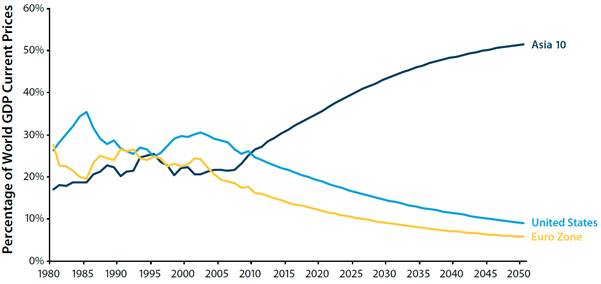

2.12

There will also be a significant rebalancing of the world economy in the

next 40 years, with around half of global economic production expected to take

place in Asia by 2050 (Figure 2.6). While Australia's traditional merchandise

export destinations still account for most of Australia's exports of financial

services,

the presence of Australia's financial services companies in the fast growing

Asian region will support future export opportunities for the industry.

Figure 2.6: Projected share of world GDP, by

specific regions, 1980 to 2050

Source: ANZ Research, 'Caged

Tiger: The transformation of the Asian Financial System', ANZ Insight,

Issue 5, March 2014, www.media.anz.com/phoenix.zhtml?c=248677&p=irol-insight

(accessed 8 May 2014). Based on CEIC and ANZ projections.

2.13

To position Australia to benefit from this change, successive governments

have pursued an interest in developing Australia into a regional financial

services hub. The current government's Financial System Inquiry is another

opportunity to look again at how Australia's financial services industry can

better interact with international capital markets and benefit from economic

growth in our region.

That superannuation will be a key consideration of the inquiry is clear: one

estimate presented to the inquiry was that in 40 years, funds controlled by

superannuation will exceed that of the banking industry.[13]

Some issues raised in submissions to that inquiry have included how to better

link superannuation to the economy, the need

to support technological innovation and consumer protection requirements.[14]

Committee comment

2.14

This inquiry has necessarily required the committee to review ASIC's

past performance, however, the committee has also been mindful of the likely future

directions of Australia's financial system and their implications for ASIC's

role.

2.15

The size and growth of Australia's financial sector and the fact that

millions of Australians are involved in it, not least because of compulsory

superannuation, makes it essential that modern and adaptable regulations are in

place and regulators such as ASIC are at the top of their game. Although

Australia's experience during the global financial crisis demonstrated that the

regulation of Australia's financial system is fundamentally sound, there cannot

be complacency about the effectiveness of

the regulations in place and the performance of the regulators charged with

administering them. As a key financial regulator, ASIC's role and performance

should be of interest to all Australians.

Navigation: Previous Page | Contents | Next Page