Introduction

Referral and conduct of the inquiry

1.1

On 26 November 2015, the Senate referred the following matters to the

Senate Economics References Committee (the committee) for inquiry and report by

the last sitting day in June 2016 (30 June 2016):

- the future sustainability of Australia's strategically vital steel

industry and its supply chain; and

-

any other related matters.[1]

1.2

Details of the inquiry were placed on the committee's website. The

committee also wrote to individuals and organisations, inviting submissions by

15 February 2016.

1.3

The committee held three public hearings and performed two site visits.

On 1 April 2016, the committee conducted a site visit of BlueScope

steelworks and then held a committee hearing in Wollongong, New South Wales. On

5 April 2016, the committee conducted a site visit of the Arrium steelworks and

subsequently held a public hearing in Whyalla, South Australia. The third

hearing was held on 6 April 2016 at Parliament House, Canberra. A list of

witnesses who appeared at the hearings is at Appendix 3.

1.4

On the dissolution of the Senate and the House of Representatives on

9 May 2016 for a general election on 2 July 2016, the parliamentary

committees of the 44th Parliament ceased to exist. At that time, the

committee's inquiry lapsed.

1.5

On 11 October 2016, the Senate agreed to the committee's recommendation

that the inquiry be re-referred in the 45th Parliament and for a

final report to be presented by 1 December 2017.[2]

1.6

The committee resolved to re-open submissions with a closing date of

17 February 2017. This was notified on the committee's website and

additional direct invitations were issued to stakeholders.

1.7

At the time of tabling this interim report, the committee has received 39 submissions

to the inquiry. A list of the submissions received by the committee is provided

at Appendix 1. Other documents authorised for publication by the committee are

listed at Appendix 2.

Interim Report

1.8

The committee has decided to table this interim report primarily focused

on the issues affecting Arrium, drawing on evidence provided by submitters and

witnesses from the Whyalla region. The committee will table a final report by

1 December 2017 which will cover in depth the broader issues canvassed in

this inquiry.

1.9

The interim report is structured as follows:

-

chapter 1—provides background information to the inquiry and

presents an overview of the steel industry in Australia and the current

challenges and pressures; and

-

chapter 2—outlines the current position of Arrium and its contribution

to Whyalla and sets out the committee's conclusions and recommendations.

Note on terminology

1.10

Arrium Limited is an international diversified mining and materials

company with three business segments: Arrium Mining Consumables, Arrium Mining

and Arrium Steel. Unless otherwise specified, references to 'Arrium' in this

report are in relation to the activities of Arrium Steel (Arrium).

Background to the steel industry in Australia

1.11

Significant steelmaking activities have occurred in Australia

since 1915.[3]

The modern Australian steel industry is comprised of a large number of

companies involved in different segments of the steel production and supply

chain. In addition to two companies producing crude steel in Australia, the

industry incorporates downstream steel products manufacturers, steel

distributors and steel recyclers.[4]

1.12

There are two integrated steel producers in Australia: Bluescope Steel,

with Australian production operations based primarily in the Illawarra region,

New South Wales; and Arrium (formerly OneSteel), with production facilities in

Whyalla, South Australia.

1.13

Both of these steelworks are connected to downstream steel fabrication

and distribution networks Australia wide. In 2015, total Australian crude steel

output of 4.9 million tonnes (Mt) represented about 0.3 per cent of world

output. The Department of Industry, Innovation and Science (the department) submitted

the following summary of the two producers in Australia:

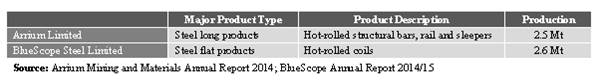

Table 1: Summary of Australia

Producers[5]

1.14

Further to this, the department submitted:

The volume of Australian crude steel production has fallen in

recent years. World Steel Association time series data starting from 1980

indicates that Australian crude steel output was 7.6 Mt in 1980 reaching a peak

of 8.9 Mt in 1998; Australian steelworks were still producing 7.3 Mt in 2010.[6]

1.15

Arrium Ltd developed from the demerged long products segment of BHP

Steel, a wholly owned subsidiary of BHP Ltd, in 2000 and listed on the

Australian Stock Exchange (ASX) originally as OneSteel. Arrium stated in its

submission:

Arrium generates approximately 14,000 jobs through its

activities, employs nearly 7,000 people directly, and spends nearly $4b in

goods, services and taxes each year. We produce approximately 44 per cent of

the total amount of crude steel made in Australia each year, with a total

steelmaking capacity of 2.6 million tonnes per annum (MTPA).[7]

1.16

BlueScope, formerly BHP Steel, de-merged from BHP Billiton in 2002 to

form a stand-alone public company. The steelworks now operated by BlueScope in

Port Kembla were first opened in 1928.[8]

BlueScope stated in its submission that it employs approximately 7,500 workers

in total in its Australian operations, as well as a further 8,500 employees

overseas.[9]

According to its website, BlueScope employs around 3,000 directly in the

Illawarra and supports about 10,000 jobs in the Illawarra - including

contractors, suppliers and other service providers who are dependent on the

Port Kembla Steelworks.[10]

Steel manufacturers and

distributors

1.17

The steel supply chain in Australia also incorporates a large number of

diverse small and medium-sized enterprises. This includes over 200 steel

distribution outlets across Australia, as well as other businesses including

steel fabrication and advanced engineering firms. As of June 2014, a total

of 12,253 businesses were registered as operating in the Australian steel

industry supply chain.[11]

Contribution of the steel industry

1.18

The steel industry makes a significant contribution to the Australian

economy. Submitters referred to ABS data showing that in 2013-14, the entire

steel industry supply chain employed over 100,000 people in Australia, with an

annual turnover in excess of $35 billion.[12]

Within this supply chain, the upstream steel industry (iron smelting and steel

manufacturing) employed about 18,500 people, paid annual wages of $1.5 billion

and had an annual sales and service income of about $11.1 billion.[13]

1.19

According to the World Steel Association, Australia produced 4.9 million

tonnes of crude steel in 2015 and 4.6 million tonnes in 2014. This production

ranked Australia as 29th and 30th respectively out of the

top 50 crude steel producing countries. The top three producers in 2015 were

China (803.8 million tonnes), Japan (105.2 million tonnes) and India (89.4

million tonnes).[14]

Challenges and pressures affecting the steel industry

1.20

Evidence to the inquiry highlighted the challenges and pressures

affecting the Australian steel industry which are briefly summarised below.

Further details and analysis of these challenges will be provided in the

committee's final report.

1.21

Australia is a relatively small contributor to global steel output. Furthermore,

Australian steel imports as well as exports have declined in recent years. Data

provided by the department indicated that in the 2014-15 financial year,

approximately 0.83 million tonnes of steel product was exported from Australia,

while approximately 1.6 million tonnes of steel product was imported. This

compares to the export of approximately 2.6 million tonnes and import of 2.3

million tonnes of steel in the 2006-07 financial year.[15]

1.22

The Australian experience mirrors the international situation. Since the

onset of the Global Financial Crisis, excess global steel production has led to

an oversupply in the international market.[16]

In addition, there has also been falling investment in 'downstream' industries

that use iron and steel manufacturing products.[17]

1.23

On this issue, Arrium submitted:

In recent times...the significant global oversupply has

resulted in an increasing amount of marginally costed/priced imported steel

being used in Australian projects. In turn, these low-priced imports have

pushed Australian prices to unsustainable lows.[18]

1.24

Evidence to the inquiry highlighted concerns about the ongoing

competitiveness of Australian steel producers and manufacturers.[19]

1.25

The department submitted that productivity costs, in particular the

relatively high contribution of labour and overhead costs to total production

costs have also been a challenge for the industry.[20]

Sustainability of the Australian

steel industry

1.26

The committee notes that domestic conditions and international market

pressures are impacting the steel industry and that these challenges are

expected to continue. Submitters and witnesses expressed concern that, should

the current situation continue unabated, the steel industry will cease to operate

in Australia.[21]

1.27

The Australian Manufacturing Workers' Union argued that maintaining the

domestic industry is important to ensure a supply of steel during times of

international conflict.[22]

Other submitters noted that maintaining a domestic steel industry is important

both for the economic performance of other industries in the supply chain[23]

and the overall economy.[24]

1.28

A majority of submitters and witnesses advocated for a higher level of

government support and intervention to ensure the sustainability of the

domestic steel industry. The committee received evidence suggesting a range of

assistance options including:

-

direct financial assistance and support;[25]

-

changes to procurement rules and processes to provide:

-

a preference for domestic labour;[26]

-

a requirement to assess whole of life costs (not only up-front

costs);[27]

-

mandating local content procurement targets;[28]

and

-

further review and amendment of anti-dumping regulations. Whilst

some submitters were broadly supportive of the changes implemented in November

2015,[29]

several submitters and witnesses argued that the current anti-dumping regime is

inadequate and that further work was required to provide adequate safeguards

for the domestic industry.[30]

Context of the interim report

1.29

The committee notes the ongoing uncertainty affecting the Australian

steel industry, in particular the operations of Arrium.

1.30

Arrium was placed into voluntary administration on 7 April 2016. On

12 April 2016, KordaMentha were appointed as voluntary administrators of

Arrium Ltd and its 93 subsidiaries.[31]

1.31

On 5 October 2016, KordaMentha advised that the sale process for Arrium

is continuing: non-binding indicative offers are due in October 2016 and

shortlisted bidders are expected to submit final bidding offers during December

2016.[32]

1.32

On 4 November 2016, following a vote in favour by the majority of

creditors, the voluntary administrators (Mark Mentha, Martin Madden, Cassandra

Mathews and Bryan Webster) were appointed as Deed Administrators of the Arrium

Group Companies. The Arrium Group Companies will continue to operate on a

business as usual basis, and the Deed Administrators will continue to progress

the sale and recapitalisation process.[33]

1.33

The committee notes the recent sale of the mining consumables segment of

Arrium (Moly-Cop). In accordance with the terms of reference, the interim

report focuses on Arrium in the context of its steel business.[34]

1.34

Further details about Arrium's position and activities undertaken since

being placed into voluntary administration are provided in chapter 2.

Navigation: Previous Page | Contents | Next Page