Chapter 4

Costs and conditions of small business finance

Interest rates

4.1

The Reserve Bank observes that most small business loans are at variable

interest rates (Chart 4.1):

About two-thirds of lending to small businesses is through

commercial bills and other loans with variable interest rates. The remaining

third of lending is at fixed rates; the interest rates on these loans are

generally fixed for between one and five years.[1]

Chart 4.1:

Composition of banks' outstanding small business lending

Loans of less than $2

million; December 2009

Source: Reserve Bank of Australia, Submission 2, p. 2.

4.2

As interest rates have been relatively low, more small businesses have

been taking out fixed rate loans (Chart 4.2).

Chart 4.2

Source: Reserve Bank of Australia (www.rba.gov.au)

4.3

The interest rates charged by banks on small business loans are compared

with those on other interest rates in Chart 4.3.

Chart 4.3: Australian

Small Business Interest Rates

Source: Reserve Bank of Australia (www.rba.gov.au)

4.4

The Australian Chamber of Commerce and Industry notes that the banks did

not fully pass on the reductions in the cash rate between August 2008 and

September 2009 to small business borrowers (Chart 4.4) but fully passed on the

subsequent increases (Chart 4.5).

Chart 4.4: Changes in

lending rates – August 2008 to September 2009

Source: ACCI, Submission 32, p. 8.

Chart 4.5: Changes in

lending rates –September 2009 to March 2010

Source: ACCI, Submission 32, p. 9.

4.5

As a result while the cash rate is still below its longer-term average,

the indicator rate on small business loans is now above its longer-term average

(upper panel in Chart 4.6). This overstates the average interest rate paid

by small businesses, as over time they have either found cheaper products or

have offered more security.[2]

Even allowing for this, however, the average interest rate on outstanding

variable interest rate loans for small business is now back to around the

longer-term average (lower panel in Chart 4.6).

Chart 4.6: Small

Business Variable lending Rates

Source: Reserve Bank of Australia, Statement on Monetary Policy,

May 2010, p. 43.

4.6

Professor Sathye notes that the differential between the interest rate

charged to small business and that charged to large businesses was narrowing

from 2001 to 2008 but has since widened.[3]

4.7

Some calculations by the Australia Institute suggest that this premium

is unlikely to be justified by the riskiness of the loans:

...a large margin of 8.68 per cent on small business loans of

that type, much higher than the average margin of 2.13 per cent over all bank

lending, which implies a penalty rate on small business of around 6.5 per cent.

A penalty interest rate on bank loans may be justified if there were a very

high failure rate on bank lending. A 6.5 per cent margin on small business

loans suggests around 6.5 per cent of those loans will go bad every year. There

is of course no data on small business loan failures. However, for the four big

banks as a whole, the total charge for bad or doubtful debts in the year to

September 2009 was ...just 0.67 per cent of total liabilities. [4]

4.8

The Reserve Bank has provided the following analysis, relating the

relative increase in small business interest rates to increased risk:

Most lending to small businesses is secured against

residential property, and over the past few years the banks’ indicator rates

have been representative of the actual rates paid by most small business

borrowers. The interest rates on residentially secured, small business loans

are currently about 80 basis points above those on prime, low doc housing

loans. This compares with a differential of just 30 basis points in mid 2007

and about 50 basis points earlier in the decade. The recent widening in this

differential is related to the higher arrears on small business lending...From

the late 1990s until 2007, banks adjusted their small business indicator rates

mainly in response to changes in the cash rate. As the financial crisis

unfolded and banks’ funding costs increased, all lending rates have risen

relative to the cash rate...the major banks’ average variable indicator rate for

residentially-secured term loans has risen by about 200 basis points relative

to the cash rate since mid 2007...This is larger than the rise of 110 basis

points in the housing loan indicator rate but is similar to the increase in the

average large business borrowing rate. The greater increase in business rates

than housing rates in large part reflects a reassessment of risk margins on

business lending in light of the difficult economic and financial conditions of

the past couple of years.[5]

4.9

While the media fuels the belief that banks' lending rates should follow

(and only follow) movements in the RBA's cash rate, less than half of banks'

costs of funds vary with the cash rate. Large proportions of bank lending are

funded by overseas borrowing or by household deposits paying no or low

interest. A significant proportion of funds is longer-term and so only very

gradually adjusts to movements in short-term interest rates. (Chart 4.7)

Chart 4.7:

Composition of Australian Banks' Funding

Source: Reserve Bank of Australia, Statement on Monetary Policy,

May 2010, p. 38.

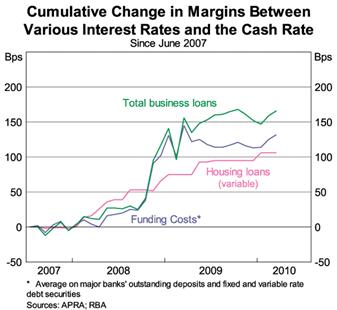

4.10

A better indicator of the 'reasonableness' of the interest rates charged

by banks is therefore to compare movement in these rates with movements in the

banks' overall cost of funds. This is done in Chart 4.8, and shows that overall

business loan interest rates have risen by more than the banks' cost of funds.

Given the evidence discussed above that interest charged on small business

loans has increased more than that on large business loans, this suggests small

businesses have been getting a poor deal.

Chart 4.8

Source: G Debelle, 'The state of the mortgage market', address to

Mortgage Innovation Conference, 30 March 2010, www.rba.gov.au

4.11

The larger increase in banks' lending interest rates than in their cost

of funds is consistent with the recent widening in their overall interest

margin (Chart 4.9).

Chart 4.9: Major

banks' net interest margin

4.12

The Australia Institute's interpretation is:

The clear impression from watching bank interest rate changes

is that official interest rate changes are taken as the signal to change bank

lending rates whether bank costs justify an increase or not. It looks like a

textbook example of oligopolistic pricing in which the main players set a

common price to maximise their collective earnings...Price leadership itself is

not illegal even if the end result is the same as illegal collusion...In the case

of banking, it is actually the RBA that acts as an unofficial price leader. The

RBA announces interest rate changes which are followed by the banks, at least

on their lending side.[6]

4.13

Small business representatives observe that small business interest

rates are less politically sensitive than are home loan rates:

Since mid-2008 we have seen the spread between small business

loans and the cash rate increase from around 200 basis points in 2008 to over

400 basis points in 2010. To put this into some perspective, if that

skimming of the 200 basis points occurred in the residential mortgage market,

it would be akin to the banks adding an additional 40 basis points for each of

the five interest rate increases that we have had over the past seven months. I

suspect that, if this had actually happened, there would have been riots in the

streets. The fact that this has not happened in relation to the gouging of

small businesses is in part because no-one within government feels any

compulsion to name and shame the banks on this particular issue. This is

despite the fact that small business directly employs over five million

Australians.[7]

4.14

The National Farmers' Federation has called for greater transparency

concerning bank interest rates:

Unfortunately it is extremely difficult for consumers of

credit to keep financial institutions to account for their decisions regarding

interest rates. It is all too difficult, particularly for farm businesses, to

monitor how much of the official cash rate cut is being passed on by their own

financial institution, or indeed to monitor the actions by competing financial

institutions. The NFF believes that, in the interests of enhancing competition

within the banking sector, that a mechanism should be created whereby rate

change decisions by financial institutions are lodged and publicly reported.[8]

4.15

Treasury thought the banks may have over-reacted and that margins should

fall back over time:

...the risk factors that the banks have factored into the price

of lending to small business are probably too high. As economic conditions

improve and as things get back to normal, that should come down...I think the

banks may have overplayed their hand in terms of the price of risk they are

charging to small business.[9]

4.16

The banks commented:

... that period particularly from October 2008 through to

October 2009; there is no question that credit risk during that period became a

much dicier proposition. There is no question during that period that the price

for credit, quite apart from the cost of funds element demanded by banks,

increased.[10]

...the difference for the Commonwealth Bank between a standard

variable rate and a residentially secured home loan is 50 basis points...due to a

difference in the risk profile of a home loan and a residentially secured

business loan taken out for business purposes. We derive that 50 basis points

difference through a statistical model that analyses 20-plus years of history

and the difference in the probability of default for a business loan versus a

home loan, despite the same type of security.[11]

Over the past couple of years, banks have generally also

raised risk margins and strengthened non-price loan conditions, such as

collateral requirements and loan covenants.[12]

4.17

The above discussion refers to the average situation across all sectors

of small business. Different sectors have faced different increases in interest

rates:

...you would find interest rates for, say, anyone associated

with commercial property are probably relatively more than for other sectors of

the economy.[13]

4.18

There are also differences across banks. The Commonwealth Bank told the

Committee:

Since the period that the cash rate peaked in July 2008, we

have reduced our residentially secured business reference rate by 2.53

percentage points, and over the same period comparative rates by other major

banks have been reduced by less than 2.1 percentage points.[14]

Security for small business loans

4.19

There are widespread reports of banks having tightened lending criteria

and demanding more security, such as asking for security over the home of a

small business owner before they will advance them a loan:

...banks have imposed stricter lending criteria, such as higher

loan to valuation ratios et cetera.[15]

...the REI survey found that four-fifths of respondents

believed that the requirements by financial institutions, such as loan evaluation

ratios and asset-backing mortgages over personal assets etcetera, were more

stringent compared with the period before October 2008.[16]

Even when [estate agents'] rent rolls were considered as an

asset, the loan to valuation ratio had changed markedly since the global

financial situation, despite the risk associated with the rent rolls remaining

unchanged. This lending ratio had dropped from around 90 per cent before the

GFC to about 65 per cent in more recent times.[17]

...the internal costs associated with obtaining finance have

increased, as banks require more documentation and information in relation to

lending.[18]

...the major banks were asking for increased collateral to

support loans...[19]

We are finding that members are being asked now to provide

collateral in the form of their own homes, whereas previously they have not

been asked for this by the financial institutes.[20]

Like many sectors of the economy, credit access has tightened

for farmers since the global financial crisis. We have seen a noticeable impact

on banks’ treatment of loan security requirements...[21]

...whereas two or three years ago they might have loaned 85 per

cent of the value of the business, today it will be about 35 per cent of the

value of the business with the rest made up by your home and a mortgage on your

home; and your dog has to sign it and everything else so that everything that

you own is at risk on a daily basis.[22]

4.20

But, even with the home as security, the interest rate charged is higher

than for a home loan.

4.21

The Australian Industry Group is concerned about this emphasis on

security and its implications for small business:

There has been little incentive for businesses to improve

their risk profile via better management, with the view that the banks only

look at asset backing to determine the interest rate.[23]

4.22

The banks responded:

The first and primary criteria that we apply is the ability

of the business to be able to service the loan, to be able to pay for the loan,

and to be able to operate within the environment of their business plan. The

volatility of potential earnings for a small business tends to be on average

higher, because there is less security about where income comes versus, say, a

wage earner...We do not want to go and seek access to the asset that secures that

particular loan. We look to the ability of the business to service the loan,

and for a small business we see in the evidence over the years that there is

greater risk associated with a small business supporting a loan than there is

with, say, a salary earner.[24]

Fees

4.23

The Reserve Bank commented in their submission:

The RBA Bank Fees Survey shows that in the 2008 financial

year, banks’ fee income from businesses (both small and large) amounted to $6.7

billion. ...During the 2009 financial year, banks’ fees appear to have risen more

quickly than in previous years. Liaison suggests that the faster growth is

mainly due to a greater incidence of existing fees, owing in particular to the

reduced availability of fee waivers. However, fees are only a small part of the

overall cost of a loan for most businesses. In 2008, lending fees were

equivalent to about 50 basis points on the stock of banks’ outstanding business

lending, less than one-tenth of the average interest rate paid on outstanding

business loans.[25]

4.24

The Reserve Bank has since released its 2009 survey of bank fees. It

showed that fee income from business had accelerated, rising by 13 per cent to

$7.6 billion, despite lending to the business sector being little changed in

the year. Most of the increase came from higher fees on loans and bill

facilities, rather than on deposits (Chart 4.10).

Chart 4.10: Growth in

Banks' Business Fee Income

Source: Reserve Bank Bulletin, June Quarter 2010, p. 32.

4.25

Merchant service fees charged for providing credit and debit card

transactions services account for about a quarter of fees banks charge

business, and around three‑quarters of these fees are paid by small

businesses. The Reserve Bank notes that since their credit card interchange

reforms in 2003, these fees have been restrained (Chart 4.11).

Chart 4.11: Merchant

Service Fee Income and the Value of Purchases

Source: Reserve Bank Bulletin, June Quarter 2010, p. 33.

4.26

A specific example of increased fees raised by ACCI is increases of

around $1,000 on overdraft facilities which banks have attributed to being

required to put aside capital for unused lines of credit.[26]

The Pharmacy Guild report their members are facing significant increases in

fees such as business facility fees and application fees.[27]

4.27

By contrast, the banks claim:

There have been significant downward movements in bank fees

for small business and other customers over the last 12 to 18 months, and in

some cases, an abolition of certain fees.[28]

4.28

Asked specifically about fees and penalties applying to overdrafts, the

Australian Industry Group replied that this had been raised by their members in

2009 but seemed less of a problem this year.[29]

Navigation: Previous Page | Contents | Next Page