Chapter 2 - Central bank independence

Background

2.1

It is now part of the economic canon that central bank

independence is desirable to achieve low inflation and maximise longer run

economic growth.[1]

2.2

The explanatory memorandum for the bill refers to central bank

independence as being 'regarded as international best practice'. This was

supported in evidence to the inquiry. For example, Professor Sinclair Davidson,

representing the Institute of Public Affairs, stated:

Broadly speaking, the economic literature is in agreement or

shows a consensus that central banks that are more independent are more likely

to be associated with low levels of inflation.[2]

2.3

Then Reserve Bank Governor Bernie Fraser put it this way in a

1996 speech:

The usual argument for an independent central bank is that

governments and politicians cannot be trusted to do the right thing with

interest rates. They are assumed to be driven by the electoral cycle, and prone

to manipulate monetary policy for short-term political gains...The corollary of

this argument is that an independent, expert body not bound up in the electoral

cycle would do a better job than politicians in conducting monetary policy.

This seems to me to be the strongest reason for entrusting responsibility for

monetary policy to an independent central bank.[3]

2.4

Economist Saul Eslake explained how more independent central

banks may lead to lower inflation:

...inflation expectations are...informed by people’s understanding

of how economic policy will react to a rise in inflation. If it is widely believed

that those responsible for economic policy are unwilling to take firm action in

response to an acceleration in inflation, or that they will be unable to

sustain that action in the face of an adverse public reaction to slowing

economic growth and rising unemployment, or that they will postpone a response

because of an imminent election, then people will expect inflation to

accelerate and hence will seek to take actions to protect themselves against it

– actions which will make a further rise in inflation more likely.[4]

2.5

He continued:

As the significance of inflation expectations to the

inflationary process became more widely recognized and understood among

economists, the importance of policy credibility to influencing inflation

expectations gained more recognition. ‘Policy credibility’ means the belief

that those responsible for formulating and implementing economic policy have

both the intention and the ability to achieve their stated policy objectives,

even if it entails some political or other costs. In the context of monetary

policy, ‘policy credibility’ has come to be associated with central bank

independence – that is, the ability of central banks to set monetary policy

without any requirement to seek approval or permission from elected officials for

their proposed course of action. [5]

2.6

If the central bank is perceived as independent, financial

markets, businesses and employers and employees are less likely to revise up

medium-term inflationary expectations when there is inflationary shock to the

economy such as a jump in petrol or food prices. This means that the central

bank does not have to keep interest rates as high or for as long to return

inflation to its target band.

2.7

Associate Professor Steve Keen is less impressed by the

performance of independent central banks. While they have performed well on

keeping inflation low, he argues they have not maintained the stability of the

financial system.[6]

Empirical studies of the impact of central bank independence

2.8

There is now an extensive body of econometric research on this

topic. The majority of studies conclude central bank independence is associated

with lower inflation.[7]

This does not in itself prove that central bank independence causes low

inflation. It could be that countries with a particular aversion to inflation

would tend to have both independent central banks and low inflation and the

correlation between the two overstates the degree of causality from central

bank independence to inflation.[8]

2.9

These studies involve quantifying the degree of central bank

independence. For example, a study by some International Monetary Fund

economists shows that, in terms of institutional autonomy, the RBA scores as

'independent' on only two out of eight criteria, ahead of only Japan and Korea,

whereas the European Central Bank scores a full eight and the central banks of Sweden

and Switzerland seven.[9]

2.10

A similar study by Princeton University academics showed that in

an examination of legal indicators of independence, Australia's score varies depending

on the indicators used.[10]

Overseas practice in appointment and dismissal of governors

2.11

A variety of practices is evident in a study of the appointment

of the governors of 98 central banks worldwide, although as shown in Chart 1

the most common procedure is appointment by the head of state (although for

some countries this is also the head of government).

Chart 1 – Party who nominates or appoints [11]

![The chart shows who appoints and - in case a second body is involved - nominates the governor [Source: IMF/Lybeck, N=98]](/~/media/wopapub/senate/committee/economics_ctte/completed_inquiries/2008_10/rba_08/report/c02_1_gif.ashx)

2.12

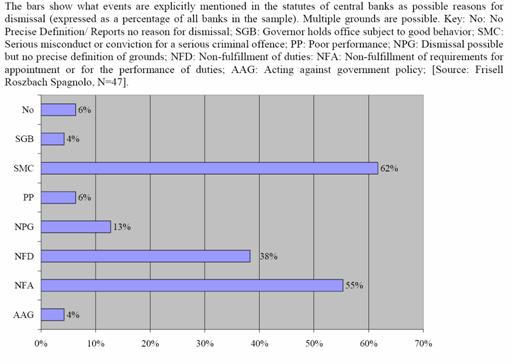

Similarly, a study of the dismissal of central bank governors

showed that this is most commonly done by the head of state (Chart 2).

Chart 2 – Party who dismisses [12]

![The bars show by whom central bank governors can be fired. The numbers sum up to more then 100% because more than one body in a country may be able to do so [Source: Frisell Roszbach Spagnolo, N=47]](/~/media/wopapub/senate/committee/economics_ctte/completed_inquiries/2008_10/rba_08/report/c02_2_gif.ashx)

The

grounds for dismissal of governors of central banks also vary. (Chart 3)

Chart 3 – Grounds for

dismissal [13]

The reality and perception of central bank independence

2.13

Even when the central bank is effectively independent, the

perception of independence may be easily damaged. A famous example was the

effect of then Treasurer Paul Keating's 'Placido Domingo' speech of December

1990. Speaking at a supposedly off-the-record function, the day after the death

of his Treasury Secretary and friend Chris Higgins, an emotional Keating said:

‘I have Treasury in my pocket, the Reserve Bank in my pocket,

wages policy in my pocket, the financial community both here and overseas in my

pocket’.[14]

2.14

No-one present thought that Keating literally had the global

financial community under his complete control. But the phrase about the

Reserve Bank was lifted out of context. As then Reserve Bank Governor Bernie Fraser

commented about the phrase:

I believe Mr Keating regretted being associated with those

throwaway lines and, to my knowledge, he never repeated them. On more than one

occasion, he complained that the Bank had acted in ways which were contrary to

his own preferences – clear enough evidence, I would have thought, that the Bank

was not in his pocket. I also have denied that the alleged ‘in the pocket’ jibe

was ever an accurate description of the relationship between the Treasurer and

the Reserve Bank, as did my predecessor, Bob Johnston. The original quip was

unfortunate enough, but its repetition ad nauseam, in the face of all the

denials, was even worse in my view; it certainly did nothing to enhance the

Bank’s standing in financial centres around the world.[15]

2.15

Almost two decades later, the phrase is still trotted out.[16]

It is this difficulty in maintaining a reputation for independence that leads

to attempts to convince outside observers of the central bank's independence by

grounding it in legislation.

Cross-party support for central bank independence

2.16

An independent Reserve Bank has cross-party political support in Australia.

Both the current and previous Treasurers have signed agreements with the

Reserve Bank Governor publicly expressing their 'common understanding...on key

aspects of Australia’s monetary policy framework'. It includes a commitment by

the Government which 'recognises the independence of the Reserve Bank and its

responsibility for monetary policy matters'.[17]

Navigation: Previous Page | Contents | Next Page