Chapter 2

Spending initiatives

Australian stimulus measures since the global financial crisis

2.1

The Government has undertaken various fiscal initiatives since the

collapse of Lehman Brothers in September 2008 sparked the global financial

crisis.

2.2

The first package to be described as a stimulus measure was the Economic

Security Strategy (ESS) in October 2008. This package included combined

expenditure of $10.4 billion through various cash payments, a boost to the

First Home Owners grant and further investment through the Nation Building

Funds.[1]

2.3

In November 2008, the Council of Australian Governments (COAG) announced

a $15.2 billion COAG funding package which included measures to address

housing, hospitals and education.

2.4

A further $4.7 billion in stimulus expenditure was announced in December

2008 through the Nation Building Plan, which included investment in road, rail

and the higher education sector.

2.5

A much larger stimulus package, the Nation Building and Jobs Plan, was

announced in February 2009, adding approximately $42 billion worth of stimulus

expenditure.

2.6

There were further measures announced in the May 2009 Budget which

included $8.5 billion for investment in road, rail and port

infrastructure, an initial investment of $4.7 billion in the National Broadband

Network, $3.6 billion for development of clean energy technologies and $5.8

billion for various investments in the health, tertiary education and research

sectors.

2.7

Summing up all these announced measures gives a total of more than $90 billion

over five years (Table 2.2). Treasury itself indicated in the 2009–10 Budget

Paper No. 1 that the scale of fiscal stimulus over four years would be almost

$90 billion (Table 2.1).

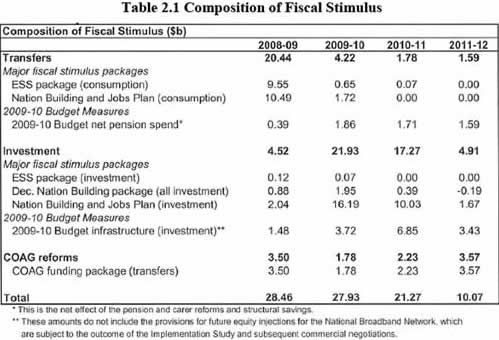

Table

2.1 Composition of Fiscal Stimulus

2.8

The Treasury Secretary's tally was that:

...around $79 billion of what may broadly be characterised as

fiscal stimulus measures are expected to impact on the economy over three years

from 2008-09 through to 2010-11.[2]

2.9

However, other Treasury forward estimates[3]

operate through to 2011-12.

2.10

From Table 2.1, it would appear that there is at least $31 billion of discretionary

stimulatory spending out of the remaining $45 billion over the forward

estimates unspent. This discretionary stimulatory spending comes from the

construction of the building and infrastructure elements of the stimulus

package to ensure stimulus projects and funding will impact in the 2009-10 to

2011-12 financial years.[4]

2.11

Appendix 3 outlines the composition of the ESS, the COAG Funding

Package, the December Nation Building Package and the Nation Building and Jobs

Plan.

2.12

Chart 2.1 shows the projected contribution of the pre-budget packages

over time, while Table 2.2 provides an itemised breakdown of the five packages.

Chart 2.1: Fiscal stimulus packages delivered by the

Australian Government

Table 2.2:

Itemised Expenditure by Package

|

Economic Security Strategy

– $10.4 billion (October 2008)

|

|

($billion)

|

Item

|

|

$4.8

|

Cash payments ($1000-$1400)

to various pension categories

|

|

$3.9

|

Cash payments ($1000) to

families based on Family Tax Benefit or for dependent children

|

|

$1.5

|

First Home Owners Grant Boost

|

|

$0.2

|

Training – Productivity

Places Program

|

|

|

Fast tracking of nation

building funds

|

|

COAG Funding package –

$15.2 billion (November 2008)

|

|

$4.8

|

Increased funding for the

Australian Healthcare Agreement

|

|

$3.5

|

Funding for the National

Education Agreement and education initiatives

|

|

$2.0

|

Indigenous reform (health,

housing, economic development and service delivery)

|

|

$1.8

|

Hospitals and health

workforce reform

|

|

$0.8

|

Affordable housing

|

|

$0.7

|

Improvements to emergency

departments

|

|

$0.6

|

Business sector deregulation

|

|

$0.5

|

Preventative health measures

|

|

$0.5

|

Other

|

|

Nation Building Package - $4.7billion

(December 2008)

|

|

$1.2

|

New funds for Australian Rail

Track Corporation

|

|

$1.6

|

Investment in university and

TAFE infrastructure

|

|

$1.6

|

10% temporary capital

investment allowance

|

|

$0.4

|

Bringing forward of road

spending including black spots program

|

|

Nation Building and Jobs

Plan - $41.5 billion (February 2009)

|

|

$14.7

|

Building the Education

Revolution (School construction and refurbishment)

|

|

$12.7

|

Cash payments to various

categories

|

|

$6.6

|

Construction of 20,000 Social

housing and Defence homes

|

|

$3.8

|

Energy Efficient Homes

(Insulation and solar hot water rebate)

|

|

$2.7

|

Small business and general

business tax break

|

|

$0.9

|

Black spots, boom gates and

community infrastructure

|

|

2009–10 Budget – Nation

Building Infrastructure Measures - $22.5billion (May 2009)

|

|

$3.4

|

Road Network Investment

|

|

$4.6

|

Metro Rail

|

|

$0.4

|

Ports

|

|

$4.7

|

National Broadband Network

|

|

$3.6

|

Clean Energy Initiative (does

not include $1b of existing funding)

|

|

$2.6

|

Investment in tertiary

education, research and innovation

|

|

$3.2

|

Hospitals and Health

Infrastructure

|

|

Total of all measures

listed: $94.3 billion

|

Navigation: Previous Page | Contents | Next Page