Appendix 4 - Institute of Chartered Accountants in Australia (ICAA) – suggested amendments

Option 1: Input taxing the supply of

Australian tour packages by foreign tour operators to non-resident tourists

Under this option,

non-resident suppliers of Australian tour packages or components thereof would

not be able to claim input tax credits on acquisition of these. The ICAA suggests that this would be achieved

by inserting into the GST Act the following provision:-

40-XX Australian holidays supplied by non-residents

- A supply of an *Australian holiday is input-taxed if:

- the supplier is a *non-resident; and

- the supplier is not *carrying on an *enterprise in Australia.

- For

the purposes of subsection (1), the supply of an Australian holiday includes a

right to any one or more of transport, accommodation, meals, attractions and

other holiday-related supplies in Australia where:-

- the

supplier will not be making to the person undertaking the Australian holiday the underlying supplies to

which the right relates; and

- the

underlying supplies will be used by the person undertaking the Australian

holiday for purposes not connected with the *carrying on of an *enterprise by

the recipient of the supply.

Option 2: Limiting the existing GST registration

requirements to entities carrying on (or intending to carry on) an enterprise

within Australia

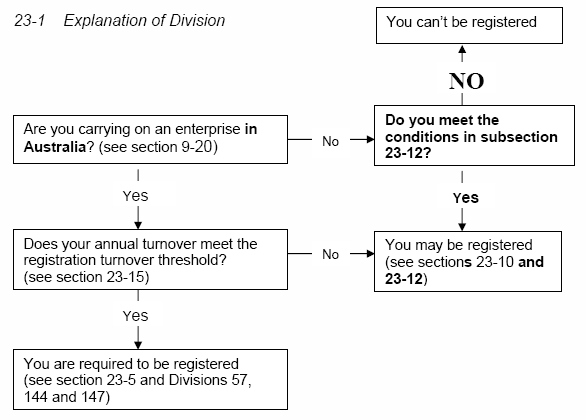

ICAA's Option 2 involves substituting the references to “carrying on an

enterprise” in sections 23-1, 23-5 and 23-10 of the GST Act to “carrying on an

enterprise in Australia”. As the

non-resident tour operators do not carry on enterprise in Australia, they would

not be entitled to register. The result

of this would be that foreign tour operators would cease to have a GST input

tax credit entitlement.

In addition, to ensure that entertainers or sportsmen/women who perform

in Australia will continue to be subject to GST, the ICAA suggest that a new

sub-section be inserted after section 23-5 stating that:

For the avoidance of doubt, you are *carrying

on an *enterprise in Australia if you make supplies that are *connected with

Australia within section 9-25(5)”.

In order to allow entities which are

considering investing in Australia or which do business in Australia (e.g.

negotiating the acquisition of products to be exported from Australia) to claim

input tax credits on qualifying business expenses incurred, the ICAA suggest

that either:-

- a

provision be inserted to allow registration in these limited circumstances; or

- a system similar to the

VAT Reclaim system utilised in some overseas countries, be set up to permit

businesses which do not carry on an enterprise in Australia to claim back GST

on qualifying business expenses which they incur in Australia.

Method 1

If the issue is resolved under the first of

these methods, the ICAA suggest that section 23-1 be amended as indicated below

in bold and that a provision be inserted as

indicated below:

23-1 Entities not carrying on enterprise in

Australia which may be registered

- You

may be *registered under this Act if you are a non-resident and you make or

intend to make *qualifying acquisitions in Australia in the course of carrying

on an enterprise (whether or not your turnover is at, above or below the

*registration turnover threshold).

- For

the purposes of subsection 23-12(1), qualifying acquisitions means acquisitions

which:

- are effectively used and

enjoyed by you; and

- are not supplied by you to

another entity.

The ICAA notes an

unresolved problem associated with this option, noting that FTOs could use this

to get registered and then claim ITCs, unless ITCs are also limited for

non-residents who are not carrying on enterprise in Australia to qualifying

expenses. The ICAA advised that time pressures had not permitted them to draft

provisions appropriate for this purpose.

Method 2

Alternatively, if

the issue is resolved under the second of those methods, the ICAA suggest a new

Division “Division 169 – Non-Resident Business Refund Scheme” with the

following provisions:-

169-1 What this

Division is about

If you are a

non-resident and you carry on an enterprise but not in Australia, you may be

entitled to a refund of the GST that was payable on certain acquisitions made

by you in Australia.

Non-Resident

Business Refund Scheme

- If:

- you are a non-resident; and

- you do not carry on an

enterprise in Australia; and

- you make

a *qualifying acquisition in Australia in the course of carrying on an enterprise; and

- the supply to you of the

qualifying acquisition is a *taxable supply;

the Commissioner must, on behalf of the Commonwealth, pay to you an

amount equal to:

- the amount of the GST

payable on the supply; or

- such proportion of that

amount of GST as is specified in the regulations.

- The amount is payable within the period and

in the manner specified in the regulations.

- For the purposes of subsection 169-5(1), a

qualifying acquisition means an acquisition which:

- is effectively used and

enjoyed by you; and

- is not supplied by you to

another entity.

Details of the

scheme should be set out in GST Regulations in terms similar to those of

regulations 168-5.04, 168-5.05, 168-5.11 to 168-5.17 (inclusive).

Option 3: Commissioner’s discretion to not

register non-residents that do not carry on an enterprise within Australia

Under this option,

the Commissioner would be granted a discretion to not register or to

de-register non-residents who do not carry on an enterprise in Australia. The exercise of this discretion would result

in the non-resident not being able to claim input tax credits. To implement this option, the ICAA suggest

that Division 23 be amended as indicated in bold below and insert provisions

into Subdivisions 25-B and 25-C as set out below:-

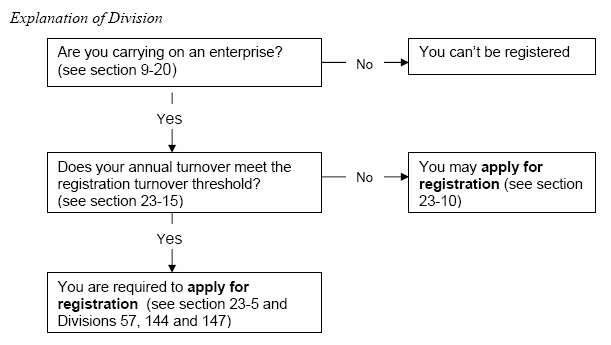

Who is required

to apply to be registered

Insert “to apply”

before the words “to be registered” in the title and in the body of the section.

23-10 Who may apply to be registered

Insert “to apply”

before the words “to be registered” in the title and both subsections 23-10(1)

and (2).

25-8 When the Commissioner has a discretion to not

register you

- The Commissioner has a discretion to not

*register you if:

- you are a *non-resident; and

- you are not *carrying on an

*enterprise in Australia.

- In exercising the discretion in subsection

25-8(1), the Commissioner must have regard to:

- whether you intend to *carry

on an *enterprise in Australia;

- whether

you are making supplies to non-residents where the use and enjoyment of the

supplies or, if the supplies are rights, the underlying supplies to which the rights relate takes place in Australia; and

- any other relevant matters.

- The Commissioner must notify you in writing

of any decision he or she makes in relation to you under this section. If the Commissioner decides to register you,

the notice must specify the following:

- the date of effect of your

registration;

- your registration number;

and

- the tax periods that apply

to you.

25-58 When the Commissioner has a discretion to

cancel your registration

- The Commissioner has a discretion to cancel

your *registration if:

- you are a *non-resident; and

- you are not *carrying on an

*enterprise in Australia.

- In

exercising the discretion in subsection 25-58(1), the Commissioner must have

regard to:

- how long you have been

*registered;

- whether

you previously *carried on an *enterprise in Australia, the nature of that enterprise and the length of time for

which it was carried on;

- whether you intend to *carry

on an *enterprise in Australia;

- whether

you are making supplies to non-residents where the use and enjoyment of the supplies or, if the supplies are rights,

the underlying supplies to which the rights relate takes place in Australia;

and

- any other relevant matters.

- The Commissioner must notify you in writing of

any decision he or she makes in relation to you under this section. If the Commissioner decides to cancel your

*registration, the notice must specify the date of effect of the cancellation.

Option 4: Leaving the amendments in their

present form, but providing to the non-resident supplier the right to elect

that its supplies of Australian tour packages be input-taxed

While this option

was not articulated in the ICAA's submissions to the Committee, it was

subsequently raised by an ICAA member and is considered by the ICAA to have

merit. It is a variation on Option 1 and

has a precedent in Subdivision 40-E of the GST Act in relation to supplies made

by school tuckshops.

If this option is

adopted, the ICAA suggests that subsection 9-25(5), as currently drafted,

should be extended as follows:

A supply of anything other than goods or * real property is connected

with Australia

if:

- the thing is done in

Australia; or

- the

supplier makes the supply through an *enterprise that the supplier *carries on in Australia; or

- all of the following apply:

- neither

paragraph (a) nor (b) applies in respect of the thing;

- the

thing is a right or option to acquire another thing;

- the

supply of the other thing would be connected with Australia.

Example: A holiday package for Australia that is supplied overseas

might be connected with Australia under paragraph (5)(c).

The ICAA considered

that in addition, a new Subdivision will need to be inserted into Division 40:

Subdivision 40-G – Non-resident suppliers of

rights

40-180 Non-resident suppliers of

rights

- A supply connected with

Australia under section 9-25(5)(c) is input taxed if:

- the supply is made by a non-resident through

an enterprise that is not carried

on in Australia; and

- the

recipient of that supply is a non-resident; and

- the

supplier chooses to have all supplies it makes through that enterprise that

are connected with Australia under section 25(5)(c) treated as input taxed.

- A

non-resident supplier may make the choice referred to in subsection 40-180(1)(c) at any time prior to the lodgment of a GST return in which

the supplies are reported.

- However, the non-resident

supplier:

- cannot revoke the choice within 12 months after

the day on which the non-resident

made the choice; and

- cannot make a further choice within 12 months

after the day on which the non-resident

revoked the previous choice.

Navigation: Previous Page | Contents | Next Page