Chapter 3

Overview of ASIC

3.1

This chapter aims to acquaint readers with the Australian Securities and

Investments Commission (ASIC). ASIC is the corporate, markets, financial services

and consumer credit regulator. It has existed as an independent Australian

government statutory authority[1]

since 1991, when the Australian Securities Commission, as it was then known,

commenced operation.[2]

3.2

ASIC has general administration of the Corporations Act 2001, the

principal legislation governing the affairs of companies in Australia. ASIC

oversees company registration and notifications, and is tasked with seeking to

ensure that companies, schemes, directors, company officers, auditors,

insolvency practitioners and other market participants fulfil their legal obligations.

ASIC licenses providers of financial services. It also licenses and regulates individuals

and businesses that engage in consumer credit activities. In addition, ASIC's market

regulation role makes it responsible for supervising financial market operators

and participants, including real‑time trading on Australia's domestic

licensed markets.

3.3

These responsibilities mean that ASIC's work involves over two million

companies, 5,000 Australian financial services (AFS) licensees, 5,800 credit

providers, 4,800 registered company auditors, 680 registered liquidators,

4,150 registered managed investment schemes and 18 authorised financial

markets.[3]

Illustrating its broad remit, ASIC provided an overview of its activities and

outcomes achieved. In the last three years to October 2013, ASIC:

-

completed over 4,000 surveillances and 554 investigations with a

broad range of regulatory outcomes;

-

banned 131 individuals from providing financial services or

credit services and 228 directors from managing a corporation;

-

completed 73 civil and 79 criminal proceedings;

-

entered into 56 enforceable undertakings with entities, as well

as numerous other negotiated outcomes;

-

cancelled, suspended or varied 72 AFS licences and credit

licences;

-

obtained over $349 million in compensation for consumers;

-

handled over two million telephone and 200,000 email queries;

-

participated in over 1,500 stakeholder meetings;

-

launched the MoneySmart consumer education website;

-

implemented the new national business names register;

-

granted relief (waivers) from the law to over 3,000 applicants to

facilitate their business transactions; and

-

handled nearly 40,000 complaints about misconduct.[4]

ASIC's statutory objectives and functions

3.4

ASIC has functions under the Australian Securities and Investments Commission

Act 2001 (ASIC Act), the Corporations Act and other legislation.[5] The ASIC Act requires that, in performing its functions and exercising its

powers, ASIC must strive to:

-

maintain, facilitate and improve the performance of the financial

system and the entities within that system in the interests of commercial

certainty, reducing business costs, and the efficiency and development of the

economy;

-

promote the confident and informed participation of investors and

consumers in the financial system;

-

administer the laws that confer functions and powers on it

effectively and with a minimum of procedural requirements;

-

receive, process and store, efficiently and quickly, the

information given to ASIC under the laws that confer functions and powers on

it;

-

ensure that information is available as soon as practicable for

access by the public; and

-

take whatever action it can take, and is necessary, in order to

enforce and give effect to the laws of the Commonwealth that confer functions

and powers on it.[6]

3.5

In its main submission to the committee, ASIC provided the following

overview of how it sees its role:

[ASIC] has a growing regulatory remit and operates in a

global environment that is both complex and dynamic.

The forces of market-based financing, financial

innovation-driven complexity and globalisation that are converging on our

financial system create opportunities to fund economic growth; however, they

also create risks.

Our challenge as a regulator is to respond quickly to the

matters that require our attention, inform and educate investors and financial

consumers so they can make confident and informed decisions, and ensure we have

the capacity to effectively regulate financial markets, financial products and

financial services providers, within the resources we have.[7]

3.6

When it was established in 1991, the main stated purpose of the

Australian Securities Commission, as ASIC was then known, was 'to regulate

companies and the securities and futures industries in Australia'.[8]

ASIC's responsibilities have increased since then following various reforms

pursued by successive governments, including as a result of intergovernmental

agreements that resulted in the Commonwealth taking over certain

responsibilities from the states and territories. In particular, ASIC gained

significant new responsibilities between 2009 and 2012. However, as indicated

by the following observation made in 2004 by ASIC's then acting chairman, ASIC

has been required to operate in an environment of reform and change for a

sustained period:

The background to all of these activities of ours is one of

constant and continuous change. You have seen that the evolution of financial

and corporate regulation in Australia over the last decade has been rapid and

dramatic. Reform—legislative, common law, self-regulatory,

industry-driven—seems to have been constant and will certainly not stop or

really even pause in 2004. But that reform has been necessary, simply to try

and keep pace (if indeed it has done that), with the growth and evolution of

the markets in Australia that rely on effective regulation.[9]

3.7

A timeline of key legislative reforms and other developments that are

relevant to ASIC's responsibilities is at Appendix 4.

Powers available to ASIC

3.8

ASIC has the ability to register companies, businesses and managed

investment schemes; grant AFS licences and Australian credit licences; register

auditors, self-managed superannuation fund (SMSF) auditors and liquidators;

grant relief from various legislative requirements; make rules aimed at

ensuring the integrity of financial markets; order the winding up of a company

in certain circumstances; and impose a stop order if a product disclosure

statement is defective. To assist it to carry out its functions, ASIC has been

granted a variety of investigative and enforcement tools under the ASIC Act and

the Corporations Act. These include the power to:

-

conduct investigations into suspected contraventions of the ASIC

Act and the Corporations Act (s. 13 of the ASIC Act);

-

obtain a search warrant to investigate criminal offences (s. 3E

of the Crimes Act 1914, pursuant to the general investigative power in

s. 13 of the ASIC Act);[10]

-

require persons to appear and answer questions under oath, and to

give all reasonable assistance with an investigation (s. 19 of the ASIC Act);

-

conduct hearings related to the performance or exercise of ASIC's

functions or powers, including the power to summon witnesses to give evidence

and produce documents (ss. 51 and 58 of the ASIC Act);[11]

-

access telecommunications records (part 4-1 of the Telecommunications

(Interception and Access) Act 1979) and make an application for a stored

communications warrant (s. 110 of the Telecommunications (Interception and

Access) Act 1979);

-

inspect the books of a corporation (s. 29 of the ASIC Act), require

the production of books relating to financial products, futures contracts and

financial services (ss. 31, 32 and 32A of the ASIC Act); require the production

by any person of books relating to the affairs of corporations and other

regulated entities (s. 33 of the ASIC Act); and apply for a warrant

to seize books not produced (ss. 35 and 36 of the ASIC Act);

-

require a person to identify property of a corporation and

explain how the corporation has kept account of that property (s. 39 of the

ASIC Act);

-

require a financial services business operator to disclose

particulars relating to the acquisition or disposal of financial products (s.

41 of the ASIC Act) and require an officer of a corporation to disclose

information relating to dealings with financial products (s. 43 of the ASIC

Act);

-

make orders in relation to securities, for example restraining

persons from disposing or acquiring interests or exercising voting rights (ss.

72 and 73 of the ASIC Act);

-

prosecute alleged offences against the corporations legislation[12]

(s. 49 of the ASIC Act);

-

institute civil proceedings for the recovery of damages or

property (s. 50 of the ASIC Act);

-

order that a person pay the expenses of an investigation that led

to conviction or declaration of contravention (s. 91 of the ASIC Act);

-

apply to the court for enforcement of an undertaking given to

ASIC (ss. 93A and 93AA of the ASIC Act);

-

disqualify a person from managing corporations for up to five

years in defined circumstances (s. 206F of the Corporations Act);

-

apply for the enforcement of a licensed market's operating rules

(s. 793C of the Corporations Act);

-

apply for orders freezing assets, appointing receivers, requiring

the surrender of passports to the court and prohibiting a person from leaving

Australia (s. 1323 of the Corporations Act);

-

apply for an injunction regarding contraventions or proposed

contraventions of the Corporations Act (s. 1324 of the Corporations Act);

-

issue an infringement notice for alleged breaches of the

provisions of the Australian Consumer Law that relate to financial products and

services (s. 12GXA of the ASIC Act) or the continuous disclosure

provisions (s. 1317DAC of the Corporations Act);

-

issue a notice requiring claims made regarding financial services

to be substantiated (s. 12GY of the ASIC Act).

Governance and organisational structure

3.9

ASIC is established under the ASIC Act. It comprises a chairperson, a

deputy chairperson and between one and six other members (the commission).[13] ASIC's governance structure is considered in more detail in Chapter 26.

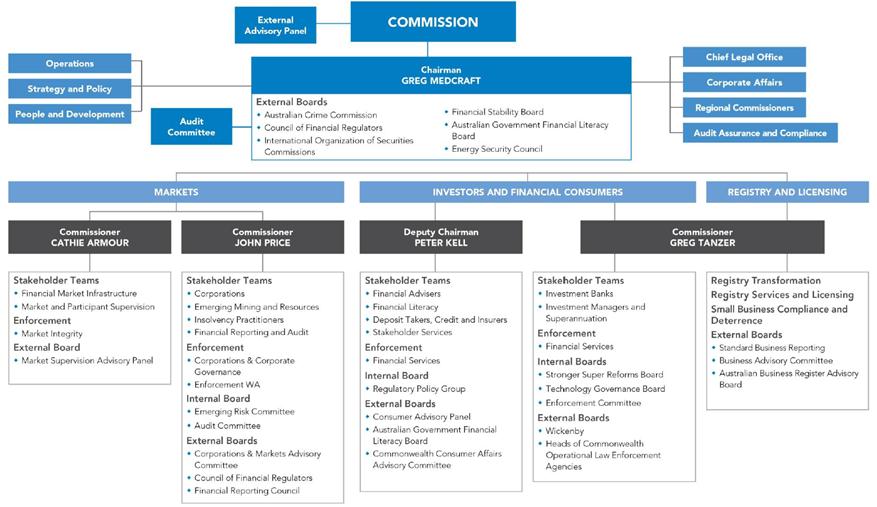

3.10

ASIC's overall organisational structure separates its operations into three

broad 'clusters': markets; investors and financial consumers; and registry

and licensing. Within these broad operations areas are multiple stakeholder and

enforcement teams. ASIC's organisational structure is depicted at Figure 3.1.

Figure 3.1:

ASIC's corporate structure (as at October 2013)

Source: ASIC, Submission 45.2, p. 15.

ASIC's resources

3.11

In 2012–13, ASIC received $350 million in appropriation revenue and

$17 million from other sources. Its operating expenses were approximately

$411 million. ASIC employed 1,844 staff on a full-time equivalent (FTE)

basis.[14]

3.12

At times, ASIC has been granted additional funding through the Budget

process either as a result of new responsibilities it has been given or to

supplement its operations. Some recent examples are listed below:

-

The 2013–14 Budget included around $10 million over the forward

estimates in additional funding for ASIC's client contact centre (as a result

of the national business names registration system); over‑the‑counter

derivatives market supervision; the Superannuation Complaints Tribunal (SCT);

and the tax agent licensing regime for financial advisers.[15]

-

In the 2012–13 Mid-Year Economic and Fiscal Outlook (MYEFO),

it was announced that ASIC would receive additional operating funding of

$20 million over two years to support its regulation and supervision of

financial markets. An additional $2.1 million relating to the administration

of transferring unclaimed monies to ASIC was also announced.[16]

-

In the 2012–13 Budget, an additional $101.9 million over

four years for ASIC's operational funding was announced. Also allocated was $23.9

million to facilitate the implementation of the Future of Financial Advice (FOFA)

reforms and $43.7 million over four years to enhance ASIC's market surveillance

system.[17]

-

ASIC received an additional $4.6 million over four years 'for

licensing, compliance and deterrence activities in relation to [AFS] license

holders dealing in carbon permits' in the 2011–12 MYEFO.[18]

-

In the 2011–12 Budget, ASIC received $28.8 million to supplement

its operating activities.[19]

-

In the 2010–11 Budget, an extra $29.1 million was provided for

the national business names register. An additional $5.9 million over four

years was also provided for the SCT.[20]

3.13

However, ASIC has also been subject to the efficiency dividend applied

to government departments and agencies.[21]

ASIC's funding over the forward estimates was also reduced as part of the most

recent Budget. The amount of funding provided to ASIC and the funding model

utilised to determine its funding clearly will have

a significant impact on the agency's performance. These issues are examined in

more detail in Chapter 25.

Navigation: Previous Page | Contents | Next Page