Budget Resources

Michael Klapdor and Dr Matthew Thomas

The 2023–24 Budget includes 4 ‘cost-of-living relief’

measures aimed at those in receipt of government payments:

- a $40 per fortnight increase in the rate of JobSeeker Payment and

other working-age payments

- allowing long-term, single JobSeeker Payment recipients aged 55+

to access the higher rate currently paid to those aged 60+

- a 15% increase in the maximum rate of Commonwealth Rent

Assistance (CRA)

- co-funding new state and territory government energy rebates for

social security recipients and concession card holders.

Separate measures that will benefit some social security

recipients are covered in other Budget review articles: ‘Expanding

eligibility for Parenting Payment Single and ending ParentsNext’ and increased

bulk-billing incentives for GPs (see ‘Medicare’).

Treasurer

Jim Chalmers stated that the measures were ‘a modest increase in support to

our most vulnerable because we know they’re doing it tough’.

Working-age payment increases

The Government

has proposed a $40 per fortnight increase to the base rates of JobSeeker

Payment, Youth Allowance, Parenting Payment Partnered, Austudy, ABSTUDY Living

Allowance, Disability Support Pension (Youth), Special Benefit and Farm

Household Allowance. The higher rate of JobSeeker Payment currently paid to

those who are single, aged 60 years and over who have been on income support

for 9 continuous months, will be extended to those aged 55 and over in the same

circumstances. The measure

is estimated to have a net cost of $4.7 billion

over the forward estimates and will commence on 20 September 2023 (p.

199).

The current

rate of JobSeeker Payment for a single person with no children is $701.90

per fortnight (including the $8.80 Energy Supplement) (p. 23). A $40 per

fortnight boost is equivalent to a 5.8% increase on the current base rate. The

current rate for a single person aged 60+ on income support for 9 continuous

months is $761.30 per fortnight (including relevant supplements) (p. 23). For

comparison, the minimum

wage for a full-time worker is currently $1,625.20 per fortnight.

The last time these working-age payments were increased

outside of normal adjustments in line with Consumer Price Index movements was

April 2021 when the Coalition

Government increased the base rates by $50 per fortnight. The 2021 increase

followed the withdrawal of the temporary COVID Supplement, paid from April 2020

to March 2021 (pp. 7–8). Unlike the 2021 increase, the 2023–24

budget measure will not apply to Parenting Payment Single. It is unclear

why this payment has been excluded from the rate increase.

Rate increase does not address

longstanding issues

Ten years ago, the Parliamentary Library’s Briefing

book for the 44th Parliament noted:

Debate over welfare policy in the 43rd Parliament was

dominated by concern as to whether allowance payments were adequate to support

recipients with basic living expenses and with their search for paid work.

Little has been done to address this concern and the issue will remain contentious.

Since then, the only major increase to these payment rates has

been the temporary relief of the COVID Supplement, which effectively doubled

JobSeeker Payment rates. In 2022, the Briefing

book for the 47th Parliament stated that the use of ad hoc, temporary

income support changes in response to COVID-19 ‘suggests the design of the

social security safety net may need to be reconsidered to ensure it can

withstand future economic shocks’. A call for major reform was also made in

2020 by the

Senate Community Affairs References Committee inquiry into the adequacy of

Newstart (the previous name for JobSeeker Payment) and related payments:

Evidence to the inquiry has made clear the need for major

reform of the social security system to ensure the income support system

provides an adequate safety net for working-age unemployed people and becomes a

strong enabler for economic participation. It is timely and critical to engage

in major reform to ensure the social security system provides an adequate

safety net for all Australians at all times. (p. xviii)

In its April 2023 report, the Labor

Government’s Economic Inclusion Advisory Committee raised many issues with

the design of the social security system and concluded it was ‘essential that

further analysis is undertaken of the overall system of support for working age

households’ (pp. 4; 47). The committee discussed issues around measuring the

adequacy of payment rates, issues with supplements such as Rent Assistance,

work incentives, and the changing demographics of those supported by

unemployment payments. While calling for more analysis, the committee concluded

‘the immediate priority is a substantial increase to the base rates of

JobSeeker Payment and related payments’ (p. 47). The committee considered a

substantial increase would be to 90% of the Age Pension rate (p. 16).

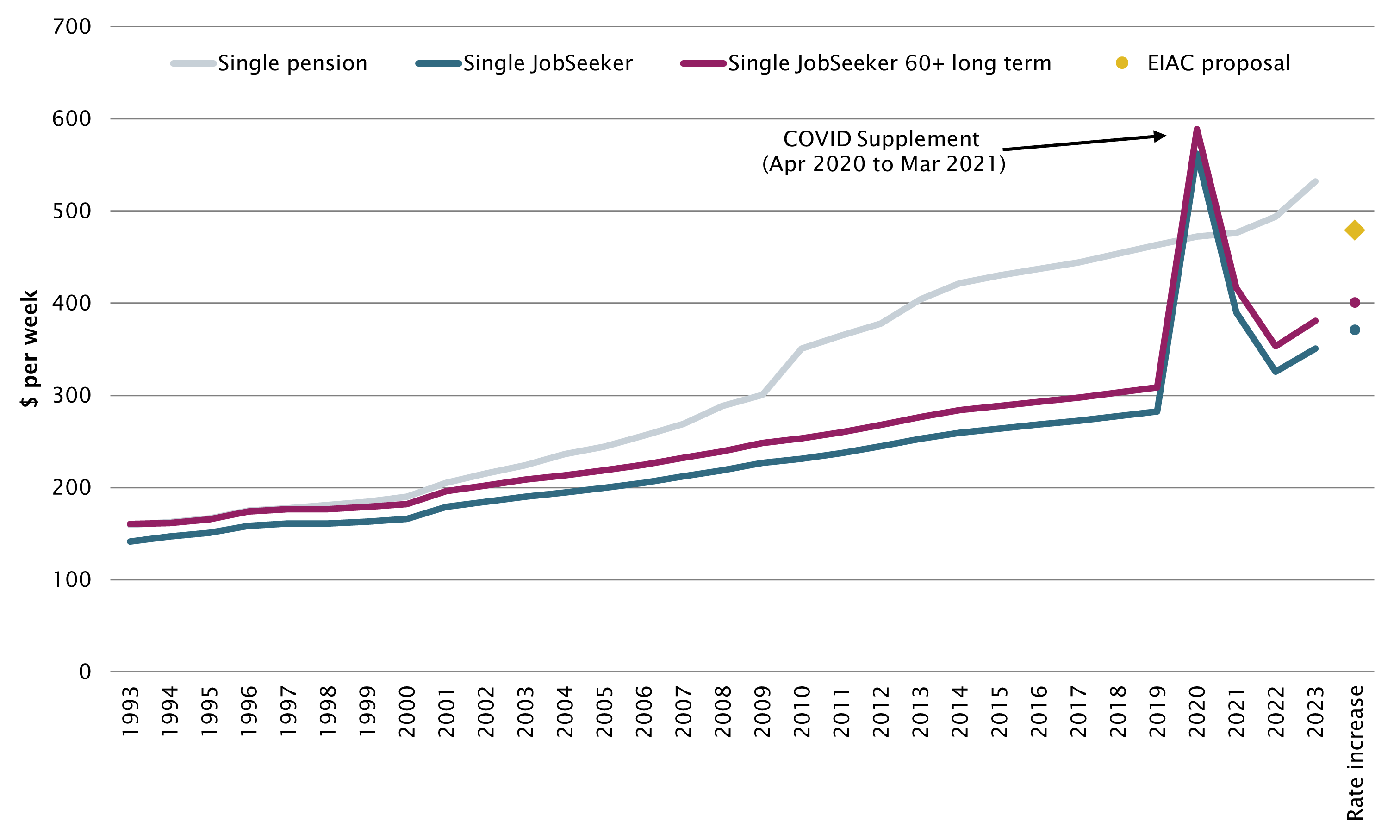

Figure 1 compares JobSeeker Payment rates since 1993 with

the single pension rate. It includes the proposed rate increases and the

Economic Inclusion Advisory Committee’s recommended increase. These weekly

rates are the maximum rate available, including relevant supplements. The

growing disparity between JobSeeker and pension rates is due to different indexation

methods, particularly the fact that pension rates are adjusted by price

movements and benchmarked to a percentage of average wages. JobSeeker rates are

normally only adjusted in line with price movements. The Government’s $20 per

week increase will not reduce this disparity.

Figure 1 Comparison of

JobSeeker Payment, pension rates and proposed increases, $ per week

Notes:

rates are ‘typical’ maximums and include all supplements automatically paid.

Rates are as at 20 March each year (2020 data includes COVID Supplement,

although it was not paid until April 2020). Rates increases are compared to

current rates as indexation adjustments will also occur on 20 September 2023.

Sources: Department of Social Services (DSS), ‘5 Payment Rates’

Social Security Guide, 8 May 2023; DSS, JobSeeker, Student Payments and Commonwealth Rent

Assistance, Budget Factsheet, 9

May 2023; Economic Inclusion Advisory Committee, 2023–24 Report to the Australian Government, (Canberra: DSS, 2023), 16.

Stakeholder reaction

Australian Council of Social Service (ACOSS) CEO Cassandra

Goldie stated:

… the real increases to base rates of JobSeeker, Youth

Allowance and Rent Assistance will still leave more than one million people in

poverty, unable to afford three meals a day and a roof over their head. Whilst

every dollar counts, the $20 a week increase to JobSeeker and related payments

is well below the Economic Inclusion Advisory Committee’s finding that it needs

to rise by at least $128 a week to ensure people can cover the basics.

The Antipoverty

Centre, an advocacy group comprised of social security recipients,

described the proposed rate increases as ‘meagre’.

Commonwealth Rent Assistance

The

Budget provides $2.7 billion over 5 years from 2022–23 (and $0.7 billion

per year ongoing) to increase the maximum rates of CRA by 15% (p. 200).

At

the end of June 2022 there were 1,398,661 income units receiving CRA (an

income unit comprises a single person with or without dependent children or a

couple with or without dependent children). A majority of CRA recipients

(78.9%) were paying enough rent to be eligible for the maximum rate of

assistance. A single person with no children can get a maximum

CRA payment of $157.20 per fortnight if they are paying at least $350 per

fortnight in rent (p. 37).

CRA helps to reduce the number of private renters in housing

stress – that is, paying more than 30% of their income on housing costs. As

at June 2022, 72% of CRA recipients would have been in housing stress had

they not received the supplement, but CRA reduced the proportion to 44%.

However, as

the Productivity Commission notes, ‘the value of the payment has declined

over time, relative to rents, reducing its effectiveness’ (p. 46).

Recent calls for an increase to CRA

In response to rising housing costs for private renters and

falling vacancy rates, a number of organisations have called for a substantial

increase to the maximum rate of CRA. For example, in the lead-up to the Budget,

ACOSS

called for CRA to be benchmarked to rents paid for outer Sydney, Melbourne

and Brisbane, which would result in an increase of 50% to the CRA threshold

(pp. 45–46).

Unsurprisingly, ACOSS has expressed

dissatisfaction with the size of the increase, arguing that ‘the 15% rise

will still leave people on JobSeeker and Youth Allowance renting privately in

housing stress because these payments have fallen so far behind basic costs’

(p. 5).

Inflationary effects of CRA

increase

One of the criticisms of demand-side housing subsidies like

CRA is that they can have inflationary effects, pushing up rents, while not

contributing to an increase in affordable housing. Following the CRA increase,

some commentators

have argued for the imposition of rent caps as a solution to this potential

problem.

Based on modelling of the likely effects of raising the CRA

maximum rate by 30%, Rachel

Ong et al. found that when estimated across all private renter households,

such an increase does not have a statistically significant effect on market

rents. However, in moderately to severely disadvantaged areas any increase in

CRA could be expected to translate into higher rents. This is because in

markets with relatively inelastic rental housing supply, any CRA-induced rise

in rental housing consumption cannot be adequately met by new housing supply,

resulting in increased rents (p. 3).

Ong et al. argue that while some portion of a CRA increase

would be shifted into higher rents in severely disadvantaged areas, these

effects would not significantly dampen the effectiveness of the increase. This

is because many low-income renters in such areas would be paying such low rents

that they would fall below the rent thresholds required to qualify for CRA (p.

62).

Need for further changes to CRA

For some time, housing and welfare experts have been calling

for changes

to be made to CRA arrangements, including increasing the rate at which it

is paid, changing its indexation method, and better targeting it to those in

need (pp. 12–15). In the context of its recent review of the National Housing

and Homelessness Agreement, the Productivity

Commission recommended that the Government should ‘review Commonwealth Rent

Assistance as a priority. There is a strong case for changes to improve its

adequacy and targeting’ (p. 2).

Energy bill relief

The Budget includes funding for the Energy

Price Relief Plan announced in December 2022. Part

of this measure includes $1.5 billion to establish an Energy Bill Relief

Fund that will provide energy rebates to some concession card holders and

Family Tax Benefit recipients, as well as some small businesses (p. 86). State

and territory governments will match the Commonwealth’s funding for the fund

and will administer the energy rebates.

The amount of the rebate and the timing differs by state and

territory due to differences in existing rebates and tariff schemes (Table 1). According

to the Minister for Climate Change and Energy, Chris Bowen, the assistance

delivered through the Energy Bill Relief Fund is conditional on it being in

addition to existing support provided by state and territory governments. More

than 5 million households and 1 million small businesses are

expected to benefit.

Table 1 Energy Bill Relief

for households; value and timing by jurisdiction

|

State/territory

|

Total

value of bill relief

(per household)

|

Timing

|

|

ACT

|

$175

|

Quarterly

in 2023–24

|

|

NSW

|

$500

|

Quarterly

in 2023–24

|

|

NT

|

$350

|

Quarterly

in 2023–24

|

|

Qld

|

$500

|

Quarterly

in 2023–24

|

|

SA

|

$500

|

Quarterly

in 2023–24

|

|

Tas

|

$500

|

Bills

in September and September and June quarters of 2023–24 and 2024–25

|

|

Vic

|

$250

|

In

instalments in 2023–24

|

|

WA

|

$350

|

With bills

in July and December 2023

|

Source: ‘Energy Bill Relief for Households’, Department of Climate Change, Energy, the

Environment and Water.

To be eligible

for the household bill relief, an individual needs to be an electricity

account holder who receives an eligible government payment or holds an eligible

concession card. Eligibility

varies by state and territory but all holders of a Pensioner Concession

Card, Health Care Card, Commonwealth Seniors Health Card, Veterans Gold Card,

and all recipients of Carers Allowance or Family Tax Benefit, are eligible. The

Energy Bill Relief Fund supports a broader range of households than most

existing state and territory energy rebate schemes. Some middle-income

households will benefit from the measure – for example, a family with 3 teenage

children and a combined income of $140,000 per year can be eligible for some

Family Tax Benefit and therefore eligible for a rebate (p. 3).

ACOSS

described the measure as ‘welcome relief’, but was disappointed that the

plan was not better targeted to provide the most relief to people on the lowest

incomes.

All online articles accessed May 2023

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Entry Point for referral.