Chapter 1

Introduction

Referral

1.1

The Social Services Legislation Amendment (Budget Repair) Bill 2015

(Bill) was introduced into the House of Representatives by the Hon Christian

Porter MP, Minister for Social Services (Minister), on 2 December 2015.[1]

1.2

On 3 December 2015, on the recommendation of the Selection of Bills

Committee, the Senate referred the provisions of the Bill to the Community

Affairs Legislation Committee (committee) for inquiry and report by 4 February

2016.[2]

Purpose of the Bill

1.3

The Bill reintroduces three measures that were removed from the Social

Services Legislation Amendment (Fair and Sustainable Pensions) Bill 2015 during

its passage through the House of Representatives in June 2015.[3]

These three measures seek to:

-

reduce from 26 weeks to six weeks, the length of time for which

recipients of the Age Pension, and a small number of other payments with

unlimited portability, would be paid the basic means tested rate while outside

Australia, from 1 January 2017;

-

cease the Pensioner Education Supplement, from 1 January 2016;

and

-

cease the Education Entry Payment, from 1 January 2016.[4]

1.4

The Bill also reintroduces a measure from the Social Services

Legislation Amendment (Youth Employment and Other Measures) Bill 2015 that was

negatived at the second reading stage in the Senate on 9 September 2015.[5]

This measure seeks to maintain at level for three years:

-

the income free areas for all working age allowances (other than

student payments) and for parenting payment single, from 1 July 2016; and

-

the income free areas and other means test thresholds for student

payments (including student income bank limits), from 1 January 2016.[6]

1.5

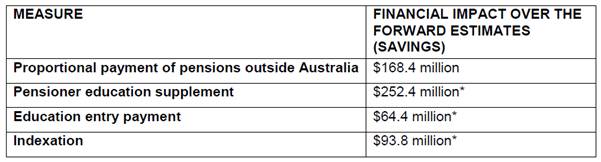

According to the Financial Impact Statement in the Explanatory

Memorandum (EM), the measures reintroduced in the Bill are expected to achieve

savings of about $579.0 million over the forward estimates, excluding some implementation

funding.[7]

Source: EM, p. 1.

1.6

In introducing the Bill, the Minister emphasised that the Government's

budget repair strategy aims to achieve—on average—budget surpluses over the

course of the economic cycle, and emphasised that the measures contained in

the Bill support the Government's efforts in this regard. Further:

We are, as a government, committed to fiscal discipline in

the Social Services portfolio. While significant savings from this portfolio

have been secured through recent federal budgets, we must continue with our

efforts to spend our Social Services budget more effectively to reduce the long‑term

pressures, to make available resources that will better target support to those

who need it most, and to ensure that Australia's social security safety net is

sustainable for future generations.[8]

Overview and key provisions of the Bill

1.7

The Bill comprises four schedules, each of which sets out provisions

relating to one of the proposed measures. The key provisions of these schedules

are described below.

Proportional payment of pensions

outside Australia (Schedule 1)

1.8

Part 4.2 of Chapter 4 of the Social Security Act 1991 (Social

Security Act) provides for overseas portability. At present, the Social

Security Act allows for a 26 week absence from Australia before a person's rate

of payment is affected. After 26 weeks, the rate is adjusted based on the

length of time a person has resided in Australia during their working life

(Australian working life residence, AWLR). People with less than 35 years

of AWLR (the maximum working period specified in the formula) receive a reduced

pension (proportional portability).[9]

1.9

Schedule 1 to the Bill proposes to amend the relevant provisions in Part

4.2 of Chapter 4 to require:

-

a person's rate of Age Pension to be calculated using the Pension

Portability Rate Calculator (set out in section 1221), if the person has been

continuously absent from Australia for more than six weeks (item 2, paragraph

1220A(a));

-

the rate of Disability Support Pension for a person with an

unlimited maximum portability period (as determined under sections 1218AA or

1218AAA) to be calculated using the Pension Portability Rate Calculator (set out

in section 1221), if the person has been continuously absent from Australia for

more than six weeks (item 3, paragraph 1220B(a)); and

-

an entitled person's rate of Wife Pension or Widow B Pension to

be calculated using the Pension Portability Rate Calculator (set out in section

1221), if the person has been continuously absent from Australia for more than

six weeks (item 4, paragraph 1221(1)(a)).[10]

Pensioner Education Supplement

(Schedule 2)[11]

1.10

Part 1 of Schedule 2 to the Bill contains one key item (item 17) that

would repeal Part 2.24A of Chapter 2 of the Social Security Act. Part 2.24A

provides for the Pensioner Education Supplement, a payment that assists eligible

students with the ongoing costs of full‑time or part‑time study in

a secondary or tertiary course.[12]

1.11

In the second reading speech, the Minister clarified that, despite its

name, the Pensioner Education Supplement is not available to recipients of the

Age Pension:

The most common payment type whose recipients also receive

pensioner education supplement is parenting payment single (43 per cent),

followed by disability support pension (41 per cent) and carer payment (9 per

cent).

As at the end of September 2015, the pensioner education

supplement provided fortnightly payments to around 46,000 people studying

full-time or part-time in secondary or tertiary education while on income

support payments.[13]

Education Entry Payment (Schedule 3)[14]

1.12

Part 1 of Schedule 3 to the Bill contains two key items that would

repeal Part 2.13A of the Social Security Act (item 3) and Part VIIAA of the Veterans'

Entitlements Act 1986 (item 19). These Parts provide for the Education

Entry Payment, a payment that assists eligible income support recipients with

the costs of study.[15]

In 2014–15, about 83,000 people received Education Entry Payment.[16]

1.13

The Minister noted that cessation of the Pensioner Education Supplement

and the Education Entry Payment would be consistent with the recommendations of

the 2015 report, A New System for Better Employment and Social Outcomes:

Ceasing these supplements will also help to simplify the

income support system by reducing the number of payment supplements, consistent

with the recommendations of the McClure review of welfare.[17]

Indexation (Schedule 4)[18]

1.14

Part 3.16 of Chapter 3 of the Social Security Act provides for the annual

indexation, in line with Consumer Price Index (CPI) increases, of the basic

rates in column 2 of the CPI Indexation Table (set out in section 1191). The

CPI Indexation Table includes:

-

income free areas—such as the pension free area (item 14), the

Youth Allowance (YA) and AUSTUDY ordinary income free area (item 14AA), and

the payment free area (item 14AAA), both indexed 1 July;

-

YA and AUSTUDY range reduction boundary—YA and AUSTUDY range

reduction boundary (item 14AB) and student income bank balance limit

(item 15), both indexed 1 January; and

-

assets value limits—YA (non-independent) assets value limit (item

24), indexed 1 January.

1.15

Section 1192 of the Social Security Act sets out various rules for the

indexation of the basic rates. Schedule 4 to the Bill proposes to amend section

1192 to insert three new rules which would provide that:

-

the payment free area will not to be indexed on 1 July 2016,

1 July 2017 and 1 July 2018 (item 1, new subsection 1192(4AC));

-

the pension free area will not be indexed on 1 July 2016, 1

July 2017 and 1 July 2018, to the extent that it relates to the amount in

column 2 of Table E in point 1068A-E14 of the Pension 13 PP (Single) Rate

Calculator (item 2, new subsection 1192(5AAA)); and

-

the income free areas and other means test thresholds for student

payments would not be indexed on 1 January 2016, 1 January 2017 and 1

January 2018 (item 2, new subsection 1192(5AAB)).

Consideration by other committees

1.16

The Parliamentary Joint Committee on Human Rights concluded that the

Bill does not raise human rights concerns.[19]

1.17

The Senate Standing Committee for the Scrutiny of Bills had no comment

on the Bill.[20]

Conduct of the inquiry and acknowledgement

1.18

In accordance with its usual practice, the committee advertised the

inquiry on its website, and wrote to 88 organisations, inviting submissions to

the inquiry by 18 January 2016. The committee received 14 submissions, all

of which were published on the committee's website. These submissions are

listed at Appendix 1. The committee thanks those organisations who

assisted with the inquiry.

Navigation: Previous Page | Contents | Next Page