Broader implications of corporate avoidance of the Fair Work Act

9.1

It stands to reason that increases in gross domestic product (GDP)

should be reflected in wage growth—workers should benefit from the economic

growth their labour helps create. In Australia, this is increasingly not the

case. Instead, latest statistics reveal that the proportion of economic output

paid to workers in Australia has fallen to an all-time, record low.[1]

9.2

Wage stagnation must be seen in the context of this inquiry. In previous

chapters, the committee looked at corporate avoidance strategies individually.

Each of the subjects covered in the chapters of this report are, however,

linked, and together they paint a picture of blithe disregard for the spirit,

and at times the letter, of the Fair Work Act 2009 (FWA) in some

sections of corporate Australia. The use of labour hire, sham contracting,

avoidance of collective enterprise bargaining, downright wage theft—each of

these examples represents a scramble by some employers to identify weaknesses

or loopholes in the legislation which allow them to drive down wages and strip

workers of conditions to the greatest extent possible, in the interests of

boosting profit margins. Profit margins achieved through undermining the

regulatory floor on wage reduction become eroded across industries and the

economy as businesses adhering to the FWA core tenets of good faith bargaining

lose business or are induced to compete on the same terms, to remove the

relative advantage and margins of unethical competitors.

9.3

Wage stagnation is not only problematic in the context of fairness,

however; it impedes economic growth and is stirring increasing concerns among

economists and budget forecasters alike.

9.4

This chapter looks at the broader implications of corporate avoidance of

industrial law.

Wage stagnation

9.5

GDP is the overall measure of a country's production—the total market

value of goods and services produced. Producing goods and services is

impossible without labour—workers. A report from the Australia Institute, Labour

Share of Australian GDP Hits All-Time Record Low, provides valuable context

and is outlined below.

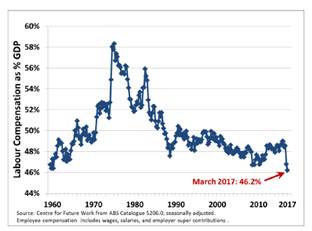

9.6

While wage growth continues to slow, total quarterly nominal GDP grew by

over $31 billion in the year ending March 2017. Only 9.9 per cent of new GDP

was reflected in higher labour compensation and overall labour compensation as

a share of nominal GDP fell to 46.2 per cent.[2]

The graphs below, based on data released by the Australian Bureau of Statistics

(ABS), illustrate the disparity in wages versus GDP growth rates:

Figure 9.1—Labour compensation as a share of nominal GDP[3]

9.7

In other words, the Australia Institute concluded, less than 10 cents of

each dollar in new GDP produced in the past year resulted in increased labour

compensation. As seen by the graph below, 'the link between GDP expansion and

workers' incomes has never been weaker.'

Figure 9.2—GDP growth and labour compensation[4]

9.8

Furthermore, it should be noted that the measure of labour compensation

used by the ABS includes salaries paid to executives and senior managers. The

true degree to which labour compensation for typical workers is dropping is in

all likelihood even more pronounced, as a breakdown of the share of national

income going to executive and non-executive workers is not available.[5]

The law is skewed against

collective bargaining

9.9

The increase in precarious work is only part of the picture. In the view

of some of Australia's leading labour law experts, the problem stems from the

fact that the past thirty years of policy-making have diminished workers'

ability to negotiate higher wages.[6]

Rules imposed on unions have been so draconian, and the pendulum swung so far

in employers' favour, that collective bargaining—the primary vehicle for growth

and maintenance of wages and conditions—is under attack, even under the FWA. Previously

of concern only to workers whose wages dwindled while costs of living rose, the

effects are spreading across the economy, as growth has now slowed so that it

threatens economic stability:

We have an industrial environment that was designed to

disempower workers and disempower unions... We are now seeing that it has shifted

the power balance way too much in favour of employers and workers aren't

getting the share that is needed for economic stability.[7]

9.10

The reason for this is that reducing wages reduces consumer spending,

thereby reducing public financing through taxation—from the goods and services

tax, income tax and tax on profits. This equates to decreasing public spending

and investment, further reductions in consumer spending, slowing employment and

falling productivity in the longer term.[8]

This is the view of the Organisation for Economic Co-operation and Development

(OECD), which reports that rising wage differentials and inequality will only

serve to inhibit economic growth.[9]

9.11

Furthermore, considering that the FWA was designed to foster enterprise

agreement it is concerning that rates of enterprise agreement making appear to

be declining.[10]

Therefore the FWA is not successfully fulfilling this function, and as a result

Australia's industrial system is falling behind international standards.

9.12

Evidence before this committee suggests that our industrial system is in

need of an overhaul.

Committee view and conclusion

9.13

Slowing wage growth despite growing GDP is highly pertinent in the

context of this inquiry. Increasing income polarisation and a falling share of

labour compensation are inescapably tied to the growing trend in parts of corporate

Australia of avoiding provisions of the FWA—provisions which are intended to

bolster enterprise agreement-making and ensure that workers get a fair share of

the economic growth their labour plays a critical role in generating.

9.14

The FWA was intended to bury the inequities of the Coalition's

WorkChoices legislation. Initially at least, the Act did so, preventing

employers from placing workers on new individual agreements and instead

fostering collective enterprise bargaining. Nearly a decade on, however,

growing corporate disregard for the objectives of the FWA is evident as

loopholes in the Act are being exploited.

9.15

The committee agrees that casual employees, whether directly engaged or

through labour hire firms, who work regular, systematic hours for a single

employer over lengthy periods, are in fact engaged in ongoing jobs—but denied

the 'security or peace of mind that comes with a permanent job.'[11]

The committee is also firmly of the view that many 'independent contractors',

including those engaged through online portals, are instead 'dependent

contractors who work at the behest and under the control of the host employer.'[12]

9.16

The committee concludes, however, that Australia's industrial system is

failing to achieve one of the fundamental objectives at the heart of the

FWA—promoting enterprise bargaining as the optimal vehicle for protecting

workers' rights.

9.17

It is difficult, noting the sheer weight of evidence presented to this

committee on corporate avoidance and at times even malfeasance, to conclude

anything other than that the system is being exploited by employers seeking to

avoid their obligations to workers. Given examples of avoidance and even

underpayment seen in evidence before the committee, it is also difficult to

conclude anything other than that some employers pay wages almost grudgingly,

at the lowest possible rates, looking for ways to manipulate the industrial

system wherever possible.

9.18

The committee notes that there have been calls, from no less than the

Reserve Bank of Australia, for workers to demand higher wages.[13]

This inquiry has shown, however, a concerning trend of workers being unable to

hold onto existing conditions under the current industrial system, let alone

being in a position to seek higher wages in their own interests or that of the

national economy.

9.19 The committee has seen how de-unionisation, the

removal of organising rights for workers and a lack of rights for workers

representatives to engage with underpayments and breaches of employment

conditions has created a free for all in some parts of the economy where the

FWO has little interest or ability to prevent employer abuses.

9.20 Often the committee has heard evidence of a lack of

knowledge on what the appropriate wage rate or condition a worker should receive

for a particular job. There is a clear need to provide additional information

and easier access to justice with many workers being denied their rights by

employers making cold calculations about likelihood of detection, potential for

punishment, scale of penalty and making a determination that avoidance of the

law and exploitation of workers is a profitable path.

9.21 The committee has seen clear evidence of a system

that has become unbalanced with substantial power vested in employers who are

able to make use of multiple vehicles to further diminish workers power to

negotiate higher wages and better conditions at the enterprise level. The

definitions which categorise employer and employee are too restrictive and

these definitions must be reviewed to ensure they are adequate to protect the

interest of workers. This should include examination of application of the

provisions of WHS legislation that places responsibility with the controller of

the business. It should also encourage workers to join their union and allow

workers to collectively negotiate at the point of economic power.

9.22 Technological advancements are not in of themselves

imbued with positive or negative attributes. The committee has seen how the use

of technology with little regard for the social and economic context in which

it operates can recreate problems that policy makers thought were adequately

addressed. The gig economy, appropriately regulated to conform with social

standards on labour rights, can provide additional flexibility and opportunity

for many people. A gig economy that is not appropriately regulated and only

conforms to the free market theory of "clearing prices" results in

underpaid workers, undermined labour markets and the personal and social

problems associated with uncompensated injured workers.

9.23 In many cases it appeared that the avoidance of the

FWA was accompanied by an equal desire to minimise or avoid tax obligations on

the part of the employer, or controlling economic entity, which speaks to a

broader cultural concern in some parts of the Australian business community.

This has negative knock on impacts for commonwealth revenue, market competition

(where those complying are at a disadvantage) and overall aggregate demand

which in turn will lead to lower government investments, less wage growth and,

an increase in inequality.

9.19

Unless the law is amended to close loopholes which are being exploited

and protect workers in an increasingly fragmented workforce, a further erosion

of wages growth and the industrial system is inevitable. It is an inescapable

fact that the world the FWA was designed to regulate is rapidly changing. Policymakers

have not kept pace with this change. Noting the need for considerable improvements

to our industrial system, the committee urges policymakers to bear in mind that

labour, economic growth and national prosperity have one goal: ensuring a

decent standard of living for all Australians. As put by the National Union of

Workers:

We all need work that allows us to make not just a decent living,

but a decent life. Time to be with and care for our families, time to be part

of our communities. We need the ability to plan ahead, save for a rainy day and

take a holiday. These are what we should all expect in exchange for our work.[14]

9.20

The committee calls on policymakers to consider and implement its

recommendations, and put into place a modern and fair industrial system.

Senator Gavin Marshall

Chair

Senator Chris Ketter

Navigation: Previous Page | Contents | Next Page