National Health Amendment (Pharmaceutical Benefits Scheme) Bill 2007 [Provisions]

THE INQUIRY

1.1

The National Health Amendment (Pharmaceutical Benefits Scheme) Bill 2007

(the Bill) was introduced into the House of Representatives on 21 May 2007. On 13 June 2007, the Senate, on the recommendation of the Selection

of Bills Committee (Report No. 9 of 2007), referred the provisions of the Bill

to the Community Affairs Committee (the Committee) for report on 18 June 2007.

1.2

The Committee received 9 submissions relating to the Bill and these are

listed at Appendix 1. The Committee considered the Bill at a public hearing in Canberra

on Friday, 15 June 2007. Details of the public hearing are referred

to in Appendix 2. The submissions and Hansard transcript of evidence may

be accessed through the Committee's website at https://www.aph.gov.au/senate_ca

.

1.3

Issues surrounding the Pharmaceutical Benefits Scheme (PBS) and this

reform package are complex. While the package of measures to reform the pricing

of drugs on the PBS was announced on 16 November 2006 and there have been

discussions with stakeholders during the formulation of the legislation, a

number of concerns were raised in submissions and evidence. Some evidence

questioned not only specific details of the legislation but the philosophy on

which it is premised.

1.4

Information exchanged at the public hearing was able to clarify some

misunderstandings and allay a number of other concerns. Nevertheless, the

Committee wishes to record that this very short inquiry has provided

insufficient time to analyse the specifics of some concerns raised in evidence,

especially in relation to longer term possible impact of these reforms. A

number of these concerns are flagged in this report, while the response to

others may be found in the transcript from the public hearing.

THE BILL

1.5

The purpose of the Bill is to amend the National Health Act 1953 (the

Act) to change the way in which drugs on the Pharmaceutical Benefits Scheme

(PBS) are priced over time, in particular as they enter a commodity phase of

production with the aim of:

- achieving price reductions in the short term for drugs that can

sustain lower prices;

- better value for PBS listed drugs over the long term; and

- a smooth transition for affected stakeholders.[1]

1.6

The Bill achieves this by amending the Act, with effect from 1 August 2007, as follows:

- Formularies – medicines on the PBS will be divided into

two separate formularies, one for single brand medicines (F1) and the other for

multiple brand medicines (F2). This division will address the difficulty that

the Government has experienced in paying competitive prices for multiple brand

drugs as, through reference pricing, these prices could flow on to single brand

drugs. If the suppliers of these drugs are unable to absorb the reduction, this

may threaten the continued availability of essential medicines in the

Australian market.[2]

Until 1 January 2011, F2 will be further separated into two parts: F2A (drugs where price competition between

brands is low) and F2T (drugs where price competition between brands is high).

- Pricing – pricing rules for drugs on each formulary will

be specified, in particular the circumstances in which price reductions will

occur. In summary, these are:

- a minimum 12.5 per cent reduction in the price of any

bioequivalent or biosimilar brand of a drug that lists provided that drug has

not previously been subject to a 12.5 per cent reduction;[3]

- from 1 August 2008, a price reduction of 2 per cent for three

years for F2A drugs; and

- from 1 August 2008 a one-off price reduction of 25 per cent for

F2T drugs.

In addition, the

Minister may determine that certain formulations of drugs are exempt from these

mandatory price reductions, based on specified criteria. The exemption will

apply while there is only one brand of that formulation on the PBS.[4]

- Price disclosure – price disclosure provisions for drugs

on the F2 formulary ensure that the price that the Government pays for a

multiple brand drug more closely reflects the actual price at which the drug is

being supplied to pharmacies. From 1 August 2007 for drugs on F2A and from 1 January 2011 for all drugs on F2, all new brands that list on the PBS will be subject to

new price disclosure requirements. Related brands of that drug listed on the

PBS provided by the same supplier will also be subject to price disclosure

requirements. Suppliers of other brands of that drug may also volunteer to

price disclose. The requirements for the provision of price data and the

calculation of the weighted average disclosed price will be specified in the

Regulations. The Bill provides sanctions, available at the discretion of the

Minister, for failure to comply with price disclosure requirements.

- Guarantee of supply – From 1 August 2007, suppliers listing a new bioequivalent or biosimilar brand of a drug on the PBS, and suppliers

of existing brands of F2 drugs who offer price reductions, will be required to

guarantee the supply of these brands. The guarantee of supply period will be

for a minimum of 24 months or until a new brand is listed, or new lower

price offer is made and accepted by the Minister, whichever is sooner. If

during the supply period, the supplier forms the belief that they will fail to

supply or be unable to supply, or if they do actually fail to supply or are

unable to supply, they must notify the Minister in writing. If they fail to do

this they may be subject to a penalty of $33,000 for a corporation. If the

supplier fails to comply with the guarantee of supply requirements, the Bill

also provides sanctions which are available at the discretion of the Minister.

1.7

A number of elements of the reforms will be managed through regulations

and legislative instruments:

- The two formularies will be established through regulations.

Changes to the formularies will be made by Ministerial determination. New

determinations will be made each time a new drug is listed or a new brand of a

drug is listed which cause a drug to move from F1 to F2.

- Exempt items which are unique formulations of drugs that serve a

specific sub-population, and there is no suitable alternative formulation of

the drug for that sub-population, will be established through Ministerial

determination, subject to criteria set out in the legislation. These unique

formulations will be exempt from mandatory price reductions and from price

disclosure, so long as there is only one brand of the item listed. New

formulations can be added to the unique formulations list by Ministerial determination.

- Drugs that are subject to the new streamlined authority provision

– whereby the need for doctors to seek individual Medicare authorisation of the

prescribing of certain drugs is modified – will be listed in the legislative

instruments. The commencement list of streamlined authority drugs has been

considered by the Pharmaceutical Benefits Advisory Committee (PBAC).

- The method for collecting and analysing data for price disclosure

purposes will be provided in the Regulations.[5]

1.8

The Minister concluded that 'these reforms achieve the necessary change

to the PBS to make it sustainable into the future, without changing the

fundamentals of how it works'.[6]

BACKGROUND

1.9

The PBS was first established in the 1940s to provide a limited number

of 'life saving and disease preventing drugs' free of charge to the community. The

PBS has evolved into a subsided scheme with 680 drugs listed, available in 1,600

forms and marketed as 2,900 differently branded items. In 2005-06, 168 million

PBS subsided prescriptions were dispensed.[7]

This equates to 8.2 prescriptions per capita. An estimated 72 per cent of all

prescriptions dispensed in Australia are subsidised under the PBS.[8]

PBS medicines attract a co-payment of up to $30.70 for general patients or up

to $4.90 for concession card holders.

1.10

The total Commonwealth expenditure for the PBS in 2005-06 was $6.2

billion with an additional $1.1 billion paid through patient co-payments.[9]

In 2006-07, PBS expenditure is expected to be $6.4 billion rising to $7.0

billion in 2007-08. The Department of Health and Ageing (DoHA) provided the

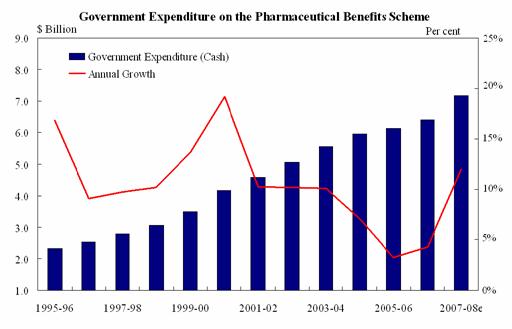

following graph showing trends in PBS growth between 1995-96 and 2007-08.

Source: Submission

4, p.5 (Department of Health and Ageing).

1.11

The Department noted that the PBS is a demand driven program, with

expenditure each year determined by a number of factors including the price of

listed drugs, the number of prescriptions dispensed for each drug and the

number and cost of new drugs added to the PBS each year. For example, recent

high cost drug listings include Herceptin® for early breast cancers at a cost

of $470 million over the next four years and extended eligibility for Ezetrol®

and Vytorin® for blood cholesterol at cost of $77.6 million over the next four

years.[10]

1.12

Although there has been a recent slowing of the PBS growth rate, the

Government has expressed concern that the PBS, as it is currently structured,

is not sustainable in the long term. Over the last decade, the Government has

introduced initiatives aimed at containing the growth in the PBS. These have

included increased patient co-payments, programs aimed at changing prescribing

behaviour and improved monitoring of entitlements to pharmaceutical benefits.

1.13

Further measures in 2004-05 included changes to the PBS safety net

entitlements; moving towards cost recovery funding for the administration of

the PBAC and the PBS listing process from 2007-08; and introduction of an

automatic reduction of at least 12.5 per cent in the price of a drug following

the listing of a new brand of that drug on the PBS.

1.14

The Department noted that, in order to achieve better value from PBS

listed drugs in the long term, modifications are required to the current system

of 'reference pricing', which links PBS drugs that provide similar health

outcomes. The current system results in the Commonwealth paying a similar

amount for each drug in a reference pricing group that provide similar health

outcomes. The Department provided the following example:

...the drugs aripiprazole, olanzapine and ziprasidone all treat

schizophrenia, are price linked to each other and form a reference pricing group.

If the price of one of the drugs in the group is reduced the prices of the

other drugs will reduce accordingly.[11]

1.15

However, reference pricing does not distinguish between single brand

medicines and multiple brands operating in a competitive market. So while

multiple brand medicines may be sold at a discount to pharmacies by suppliers, it

has been difficult to achieve significant savings from multiple brand medicines

because any price reductions flow on to single brand medicines. The Minister

stated:

In this environment, it has been difficult to impose price

reductions on those multiple-brand medicines which the Government knows are

being discounted at pharmacies. This is because, in many cases, the reductions

flow directly on, through price linking, to single brand medicines that are not

being discounted. This has caused some difficulties for industry and places

patients at risk of losing subsidised access to many worthwhile medicines.[12]

1.16

By dividing the Schedule into two separate formularies with no price link

between them, the Commonwealth will be able to reduce the price paid for

medicines operating in a competitive market while protecting single brand

medicines from unsustainable price reductions.

ISSUES

1.17

The Minister indicated in his Second Reading Speech that key industry

stakeholders, particularly Medicines Australia, the Pharmacy Guild and the

Australian Medical Association (AMA), are generally supportive of the reforms.[13]

The AMA stated:

With a large number of patents for high volume brand

pharmaceuticals due to expire soon, the AMA supports PBS reform aimed at

ensuring efficient pricing arrangements so that money is not wasted needlessly

on super profits for the retail sector. Our preference is that the savings

available from utilisation of the generic options are captured and retained

within the PBS.[14]

1.18

The Pharmacy Guild also expressed its support for the reforms and stated

that it believed that the reforms will:

- deliver lower prices to patients – Guild estimates suggested that

more than 400 PBS-listed brands priced below the maximum patient co-payment of

$30.70 will fall in price;

- ensure a sustainable PBS for the future;

- deliver greater certainty for the industry while delivering very

significant savings for the Government;

- ensure the continuing viability of pharmaceutical manufacturing

in Australia – the more stable environment that the package delivers will

ensure the continuation of research and development activities in Australia;

- introduce more transparent pricing arrangements to the Scheme;

and

- give community pharmacies and the pharmaceutical industry time to

adapt and make adjustments to this substantial package of reform.[15]

1.19

Although it suggested areas where improvements to the Bill may be made, Medicines

Australia also supported the Bill and focussed on three major areas of

benefits:

- benefits for patients through the development of new medicines

that will be subsidised by the PBS and cheaper prices for medicines;

- benefits for government through a financially sustainable PBS in

the future and more competitively priced generic medicines; and

- net benefit for the pharmaceutical industry despite short term

detrimental impact from mandated price cuts.[16]

1.20

However, some witnesses were not supportive and raised issues which they

considered would have an adverse impact on the PBS, as well as a number of

possible unintended consequences of the legislation which may undermine the aim

of the legislation.

Savings through retention of the current arrangements

1.21

Generic Medicines Industry Association (GMiA) argued that substantial

savings of more than $2.8 billion had already been achieved through brand

substitution policies and that if the current system was maintained that

savings of approximately $8 billion would be achieved by 2010 due to increased

availability of generic drugs as patents expire as compared to the half billion

dollar saving anticipated by the Government from the proposed changes.[17]

1.22

The Department commented that under the current arrangements it is very

difficult to get the price reductions that are available in the marketplace.

The level of discounting to pharmacy that is occurring indicates that price

reductions are available. The Department stated:

It is very hard to capture those for taxpayers and for patients

with respect to the under co-payment medicines when the current arrangement

would drag down simultaneously the price of these single brand medicines. And

then you basically get two outcomes: either these medicines are withdrawn from

the PBS, and they will be necessary medicines and essential for patients, or

there will probably be additional patient charges associated with those

medicines. The fact that there is much better value to be had for medicines

that are operating in a competitive market is driving these reforms. What they

are trying to achieve is a structural change that enables those savings to be

captured without affecting patients' access to other medicines.[18]

The Department also indicated that over the next 10 years, savings

in the order of $3 billion are anticipated from these measures.[19]

Adverse impact on the PBS

1.23

Dr Thomas Faunce submitted that sustainability of the PBS will not be

enhanced by the proposed changes and argued that a number of factors will

result in an adverse impact on the PBS.

1.24

Dr Faunce argued that the proposed amendments have been influenced by

the Australia-United States Free Trade Agreement (AUSFTA) where it was agreed that

the reference pricing system would not be undermined. Dr Faunce commented that this

would however occur with the division of the PBS into two formularies. Rather,

'we agreed in the actual text of the free trade agreement to preserve our

evidence based system of assessing cost effectiveness and the health value of

new pharmaceuticals'.[20]

Dr Faunce concluded that 'the main problem will be restraining the unaccountable

costs of new patented medicines. These changes, by undermining reference

pricing, fundamentally alter that important fiscal lever for community value

from patent medicines prices'.[21]

1.25

Dr Faunce also raised concerns with industry funding of the Pharmaceutical

Benefits Advisory Committee (PBAC) and argued that this would save 'the

Australian people a pittance, but what it is doing is creating a client

relationship with our core cost-effectiveness regulator'.[22]

Dr Faunce noted that this practice has been criticised overseas 'as creating

dangerous conflicts of interest for the US Food and Drug Administration (FDA)

and strong calls being made for their removal'.[23]

1.26

Dr Faunce went on to make four major recommendations for amendment to

the Bill:

- that a definition of 'interchangeable on an individual patient

basis' be included in new sections 101 (3BA) and 84 (AG);

- clarification in the legislation that the initial listing process

of cost effectiveness analysis and cost minimisation will not be affected;

- prevention of 100 per cent industry funding of the PBAC; and

- that AUSFTA Medicines Working Group and the Access to Medicines

Working Group have broader membership and that their minutes be published.

1.27

GMiA also raised concerns about the impact of the proposed changes on

the fundamentals of the PBS. In particular, GMiA argued that the Bill

'dismantles reference pricing and instead classifies medicines into different

formularies based on whether or not there are other brands of the same

medicines. As a result the community will pay different prices for the same

health outcomes'. GMiA concluded that the Bill confuses the patentability of

medicines with cost effectiveness.[24]

1.28

GMiA went on to note that currently, if a new listed medicine is found

to have no demonstrated improvement in effectiveness in a comparative clinical

trial, the price of the new medicine remains around the level already paid by

the comparator. GMiA commented that:

The proposed amendment to the Act, appears to be risking the

efficiency of this process, by protecting price based on whether the medicine

has an active patent, rather than whether the medicine offers a true

improvement to health outcomes...Consequently, the PBS will no longer be paying

for improved health outcomes, but rather patent protection.[25]

1.29

The Department responded to concerns about possible adverse impact on

the PBS:

The purpose of these reforms is to make sure that the way that

PBS medicines are priced into the future adapts to changes in the

pharmaceutical industry and enables good value from listed medicines. By

separating the PBS into single and multiple brand formularies and requiring

price reductions for medicines that are operating in a commodity market, the

aims of retaining necessary medicines on the PBS while paying competitive

prices are met.[26]

1.30

The Department also responded to specific concerns about the role of the

PBAC and reference pricing:

The role and responsibilities of the PBAC are already in the act

at sections l01 (3A) and (3B). In summary, a medicine cannot be listed on the

PBS without a recommendation from the PBAC that it is effective and

cost-effective compared to alternative therapies. This bill does not change

these parts of the act. In fact it expands the role of the PBAC to provide

advice to the minister on whether drugs are interchangeable at the patient

level and whether a formulation of a medicine is unique and therefore should be

treated differently for pricing purposes. These are appropriate areas for the

expert input of the PBAC and in reality put into legislation a function they

already fulfil.

Secondly, there seems to be misunderstanding about reference

pricing and therapeutic groups. There are six therapeutic groups on the PBS

which group medicines that the PBAC has determined as interchangeable. Interchangeability

means that these drugs are pharmaceutically related, have the same mechanism of

action and provide similar therapeutic outcomes at equivalent doses at the

individual patient level. These therapeutic groups continue to exist on the new

formularies. Five of the six TGPs are on the F2T formulary.

There are another 106 reference pricing groups, which link

medicines that are similar but not the same, that have been listed on a cost

minimised basis. For example, the oncology reference pricing group comprises

seven different molecules that treat three different types of cancer—lung,

breast and ovarian. Some are only PBS listed for treating advanced stages of a

cancer and some can only be used in combination with other drugs.

Under the proposed new formularies, single brand medicines in

reference pricing groups will remain price linked. Eighty reference pricing

groups will continue to link the price of 140 single brand drugs. Medicines

across F1 and F2 will no longer be price linked. These are not the same

molecules. This allows commodity prices to be paid for F2 medicines. It is

important to stress that the price at which a medicine is initially listed will

continue to comply with current cost-effectiveness assessment processes of the

PBAC.[27]

1.31

In relation to industry funding of the PBAC, the Department stated:

The rationale for that is that there is clearly commercial

advantage to companies of being listed on the PBS. That is not its primary

purpose; the primary purpose of the PBS is delivering necessary and effective

medicines to patients. But there is no doubt that there is significant

commercial advantage, and in that environment it was the government’s view that

it was appropriate, as the TGA is fully cost recovered, that elements of the

PBS listing process could also be cost recovered, and we are moving to

implement that policy.[28]

1.32

In relation to the membership of the Access to Medicines Working Group,

the Department commented that there had been some misunderstanding. In the

past, there have been a variety of engagements between the Department, the PBAC

and Medicines Australia in relation to the evidentiary requirements of bringing

new medicines and cost effective medicines to the PBS. The Working Group was

established in 2006 with the aim of working generally on administrative and

process oriented issues between the Department and Medicines Australia. The

Department concluded:

I think there is a misunderstanding about what this group is. It

is really working around some of the issues around listing new medicines on the

PBS, so inevitably it is predominantly an engagement that we have with the

industry organisation – and have had for a long period of time. It is just that

now we are saying that it is good to have this ongoing dialogue...there is

nothing very different and exciting about this, we are just channelling the

work that we already do through a different avenue.[29]

1.33

In relation to concerns that the Working Group may inform decision

making, the Department stated that 'if it were the case that anything that was

to come out of this group would affect others, then there would be a process of

consulting and engaging with others as part of that. I think the minister would

require that.'[30]

Impact on the Australian generic medicines industry

1.34

GMiA argued that it has been the generics industry which has triggered

savings in the PBS and thus has created headroom for the listing of newer and

more expensive drugs. GMiA warned that the proposed amendments, along with

existing pricing arrangements, 'have the potential to drive down generic prices

to a level that could make it uneconomical for companies to continue to market

their products in Australia'. This would impact on the ability of the Government

to guarantee continued and affordable access to new and expensive medicines in

the future.[31]

1.35

GMiA also argued that the proposed changes would introduce uncertainty

for industry. GMiA pointed to two factors:

- the impact on industry of ad hoc price reduction in the context

of PBS changes; and

- the impact of proposed disclosure arrangements on industry's

ability to plan for the future.

GMiA concluded:

The real concern here is the ability for generics industry to

operate in an environment where conditions oppose investment. These reforms

fail the test on providing certainty against key indicators driving investment

decisions...such as stable regulatory environment, effective implementation of

government decisions, transparency in government policy thereby providing

predictability and certainty for business planning, management of shareholder

value.[32]

1.36

The Department commented that the proposed changes are designed to

capture the benefits of competition that already exists. These medicines are

being provided at discounted rates to pharmacy – some heavily discounted and

some not so heavily. The general characteristic of all these medicines that are

on the F2 formulary is that there will be brands of those medicines that are

being provided at a discount. The Department concluded that 'the purpose of

these is to actually have the Government and the taxpayer getting better value

from those medicines'.[33]

Evergreening of patents

1.37

GMiA argued that it believed that the proposed changes will encourage companies

to extend patents so as to remain in the F1 formulary in order to stave off

mandatory price reductions and generic competition. This practice is known as

'evergreening' of patents. Evergreening will increase PBS costs and 'make a

mockery of Australia's robust intellectual property regime'.[34]

GMiA concluded that:

The delay in generic entry weakens the single most effective

brake on PBS growth – generic price pressure.[35]

1.38

Dr Faunce also raised concerns with evergreening and stated that since

the free trade agreement, evergreening has been promoted making it more

difficult for generic manufacturers to enter the market. Generic manufacturers

will be required to notify patented drug owners if they want to enter the

market and this allows patented drug owners to then bring legal claims against

them for infringing patents. Dr Faunce concluded 'we have created the climate

now where it is going to be very easy for these patented drug manufacturers to

preserve their little territory in F1'.[36]

1.39

Medicines Australia disputed that evergreening takes place and stated:

We often hear claims of evergreening. We are yet to see any

example of an evergreened medicine. Our assertion is that it does not happen.

It is a great story, but let us see the evidence.[37]

1.40

The Department responded to claims that the reforms will provide

incentives for evergreening. The Department commented:

It is important to reiterate that the trigger for a medicine to

move from F1 to F2 is the entry of a bioequivalent brand or in the case of

biologics, a biosimilar brand. This is a technical assessment made by the TGA

based around the active pharmaceutical ingredient. Once bioequivalence has been

determined the legislation will trigger the movement of the whole molecule and

price reduction will occur.[38]

Below co-payment medicines

1.41

A number of witnesses raised the issue of medicines that are priced

below the co-payment. In 2005-06, an estimated 33 million prescriptions for PBS

listed drugs were dispensed at a cost less than the co-payment. Consumers'

Health Forum of Australia (CHF) stated that consumers have identified concerns

about varying costs of PBS medicines through pharmacies and that this is an issue

which may become more pronounced for general patients as more medicines become

available below the co-payment. Consumers anticipate a fair price for PBS

medicines, whether the price is paid by the individual consumer for medicines

below the general patient co-payment or by Australian taxpayers through PBS

reimbursement of pharmacists. Price disclosure would appear to provide a

framework for improving pricing arrangements.[39]

1.42

GMiA noted that there is no mechanism for the Commonwealth to monitor

the cost of those medicines below the co-payment. GMiA stated:

As part of the compensation package offered to pharmacy, the

agreed mark-up for many of these medicines will increase from 10% to 15%.

Whilst competition between pharmacies could see some control on prices, it is

not easy for unwell consumers to do price comparisons between pharmacies on the

high street, especially if those pharmacies do not display their prices for

below co-payment PBS listed medicines.[40]

Uptake of generic drugs

1.43

A number of witnesses noted that the uptake of generic drugs in Australia

is low, 28 per cent of prescriptions, compared to other countries, for example

the United Kingdom with approximately 75 per cent.[41]

Support was given to the Government's funding of $20 million for a community

education campaign to ensure that consumers and health professionals are aware

of the safety, health and economic benefits of generic drugs.

1.44

GMiA also welcomed the payment of $1.50 to pharmacists for dispensing benchmark-priced

medicines but it considered that the payment should be restricted to 'true'

generics. It also considered that there should be a reward for consumers for

choosing generics such as a reduced co-payment.[42]

Dr Ken Harvey also recommended that section 87 (2) of the Act be amend to

provide lower co-payments to consumers where genuine generic drugs are

prescribed.[43]

1.45

The Department indicated that the Government did not favour a lower

co-payment for generics as there are significant equity issues in patients

being treated differently depending on whether or not a generic alternative is

available. In addition there are significant administrative issues about how a

PBS safety net would operate in that environment. As to the $1.50, the

Department stated that 'the focus is on the patient. It is about providing an

incentive for the patient to receive a premium-free medicine. It is not about

providing a subsidy to a particular industry sector.'[44]

Combination products

1.46

Medicines Australia suggested that the reform package could be improved

by amendment to the way in which combination products are treated. Combination

products are made up of more than one chemical and pricing is usually based on

the sum of the individual components in accordance with PBAC guidelines. The Bill

proposes a separate list for single brand fixed dose combination products

(FDCs) and states that the price of these products will be linked to the price

of their component parts.[45]

1.47

Medicines Australia argued that this proposal:

- will result in patients being disadvantaged – they will have less

choice as fewer combination products will be available and will pay more as patients

on combination products only have one prescription and, therefore, only pay one

co-payment;

- does not give due consideration of the value to patients of

combination products;

- is inconsistent with other aspects of the policy including that most

single brand 'fixed dose combinations' of medicines are neither interchangeable

with multiple brand medicines nor available as multiple brands;

- is a disincentive to industry innovation;

- is inconsistent with current PBAC guidelines; and

- will have a substantial negative impact on a number of companies.[46]

1.48

Medicines Australia recommended that single brand combination products

be classified into the F1 formulary.

1.49

The Department responded that there are around 50 combination products

that will be put on a separate list and that:

The treatment of single brand combination products under these

proposed reforms is highly consistent with the way in which combination

products are currently priced – so the way which the PBAC has come to a view

about the pricing of these products...In these cases the intention is that a

reduction in the price of one element will flow on to the combination, keeping

the same relativity. So you will not have the combination products basically

becoming priced in a different way to the component parts. That is simply

reflective of what happens now.

...If both parts of the product, for example, are on the F1

formulary, then until there is competition within an element and it moves to

the other formulary then triggering price reductions, it will remain at the

price it is now. So the prices will reduce as price competition is occurring

within the elements and that will flow through, whether it be through the

mandatory price reductions in legislation or over time through price

disclosure.[47]

Patient premiums

1.50

Under the PBS, the Commonwealth subsidises each brand of a multiple

brand medicine up to the cost of the lowest priced brand of that medicine. If a

patient chooses a brand with a higher price, the patient pays a brand premium,

that is, the difference between the subsidised price and the higher priced

brand. The brand premium is payable in addition to the patient co-payment.

1.51

Medicines Australia noted that the existing regime allows companies to

apply to the Minister for premium increases at any time. Medicines Australia

noted that this is 'consistent with the general principle that while the

Government may control the size of its own reimbursement price, there is no

Government price setting controls in the private market'.[48]

1.52

Patients may also pay a therapeutic group premium where they are

prescribed a medicine within a therapeutic group that is priced higher than

lower priced medicine subsidised by the Commonwealth within that group. Special

Patient Contributions apply where there is a disagreement between the

manufacturer and the Commonwealth over the dispensed price for a medicine.

1.53

Medicines Australia commented that the Bill contains mandatory reduction

of premiums, and a prohibition on the introduction of, or changes to, premiums

at the same time as mandatory price reductions are implemented. The Bill

requires that patient premiums be reduced by the same percentage as mandatory

reductions in the Government's reimbursement price and other reductions arising

from the price disclosure provisions. The Bill also prohibits companies

changing their premiums on the day a mandatory price reduction occurs.

1.54

Medicines Australia argued that there were a number of problems with

this proposal and it will be an impediment to achieving one of the key PBS

reform objectives, namely more price competition in the off-patent market. The

problems highlighted included:

- the Government's role in pricing, in that the Bill effectively

seeks to control the market price of a medicine;

- the impediment to competition in the off-patent market;

- increased regulatory complexity and burden for business and the

Government;

- lack of additional benefit for patients;

- patients will save money from PBS reform; and

- questionable constitutional validity.

Medicines Australia recommended the removal of the

legislative provisions related to premiums so that the existing practice for

managing patient premiums is maintained.[49]

1.55

GMiA also voiced concern with patient premiums and argued that the

changes proposed in the legislation 'will likely drive the costs of medicines

up' for many concession card holders as 'originator companies will determine

what consumers pay by virtue of the quantum of their premiums'. While there are

mechanisms in the Bill to reduce premiums, GMiA noted that originator companies

will be able to increase their premiums four months after the reduction in the

next round of price adjustments.[50]

1.56

CHF stated that 'special patient contributions are not an acceptable

alternative to a negotiated price'. CHF went on to state:

The mandatory price reductions may mean that the companies

become more willing to risk market share by charging more or higher brand

premiums. It is critical for consumers to know that there is always at least

one brand of medicine at the base price, with no additional premium for

patients. It is also important for people who use a lot of medicines to know

that the brand premium does not count towards the PBS Safety Net and to ask

their doctor about a lower cost alternative.[51]

1.57

The Department commented that largely, the existing arrangements are

maintained:

...where there is an alternate at the benchmark price then there

is a capacity for the supplier to make a decision about whether or not they

wish to have a brand premium on the medicine. If there is no alternative at the

benchmark price, they cannot have a premium. The only change here is that at

the point in time when we are deeming price reductions – so these are mandatory

price reductions which are being deemed under the legislation – there is not a

negotiation occurring with suppliers about the price of the medicine. It is

basically a mandatory or deemed outcome. It is a different way of pricing to

the way we have priced in the past...Where in the past there has been a

negotiation, underpinned by some consideration about a cost-effective price at

listing – that may have been many years before, but then there is a negotiation

over time around price – the difference here is, because we are dealing with

mandatory price reductions applying across a very large range of medicines all

on the same day, which will be 1 August 2008, it is pretty difficult to start

negotiating in regard to individual brands and individual items at that time.

So the way in which it has been drafted in the legislation is that it is a

deemed price reduction and the price reduces from the claimed price...

So where there is a premium, it will reduce by the same

proportion, more or less, [as] the base price. Leading up to 1 August 2008 and after 1 August 2008 there is no reason why the premiums cannot be changed – they

can be removed, they can be reduced, they can be increased. That is going to be

a matter for the manufacturers to consider, taking account of their market

plans.[52]

Biologicals

1.58

Biopharmaceutical products (biologics) have unique characteristics

because of their high molecular weights, their complex three-dimensional

structures, the complexity of their manufacturing processes by living organisms

and the dependence of biological activity on reproducibility of the production

process, thereby ensuring patient safety. Owing to this complexity the approval

processes used for generic small molecule drugs are inadequate. In response, the

Therapeutic Goods Administration (TGA) has adopted European (EMEA) Guidelines

for the evaluation of similar biological medicinal products.

1.59

Both Medicines Australia and Amgen Australia commented that there is no agreed

definition of the term 'biosimilar'. Amgen Australia stated that 'it is

critical that at no stage is "biosimilar" assumed to equal

"bioequivalence" in the movement of a drug from F1 to F2'.[53]

1.60

Medicines Australia noted that when the TGA registers a biosimilar

product, although this is unlikely to be 'interchangeable' with the innovator,

registration implies that the product is similarly safe and effective compared

to the innovator biological product. While Medicines Australia accepted that

such registration may be used as a trigger for the cost savings identified in

the PBS reform legislation, it argued that such cost savings must only be

applied to the biosimilar and the reference innovator product. It further

commented that 'it is critical that the goals and outcomes of the PBS reform

align with those of the TGA'. Medicines Australia concluded:

While the Government has already proposed sensible amendments to

the legislation with regard to biosimilars, Medicines Australia believes there

is need for further dialogue between the industry and Government to ensure the

legislation implements the intent of the Government's reforms with respect to

biosimilars and ensure consistency with TGA regulatory processes, by the

inclusion of a deeming provision in the regulations that would make the above

clear.[54]

1.61

When questioned on this matter, the Department commented that it had not

gone into the detail of biosimilarity and bioequivalence in the legislation,

because it is not possible or appropriate to do so. The TGA makes the decision

as to what is bioequivalent and what is biosimilar following guidelines and

this decision is used in the PBS.[55]

Lack of appeal provisions

1.62

GMiA raised the issue of the lack of appeal processes. GMiA provided

advice which indicated that many of the determinations made by the Minister

will be unreviewable by the courts and tribunals.[56]

1.63

The Department responded that it did not think that GMiA's view was correct

and that it had sought advice from the Australian Government Solicitor who

agreed that the fact that they are legislative instruments does not, of itself,

mean that they are not subject to judicial review under the Administrative

Decisions (Judicial Review Act (AD(JR) Act). It will depend on whether they are

properly characterised as administrative decisions or not. The Department

stated that if they are of an administrative character they will still be able

to be reviewed judicially under AD(JR). Even if they were not of an

administrative character, common law rights of review by the courts under the

Judiciary Act would still be available. Judicial review of a ministerial

decision on merit was not considered as 'to date, it has not been considered

that the whole PBS process is one that is amenable to merits review and that,

because there are independent committees and criteria set up in the way that they

are, there were enough safeguards there without having a merits review process

overlaid on it'.[57]

Pricing arrangements

1.64

The AMA commented that while it was comfortable with price disclosure to

allow the Government to pay a price for medicines closer to their market price,

it is less comfortable with the decision to compensate retail pharmacy for the

loss of profits as a result of the initiative. The AMA stated that 'in our

view, distribution costs of PBS medicines are already excessive and should be

allowed to fall'.[58]

CHF also commented that it was unclear why incentives to encourage dispensing

of the most affordable medicine for consumers are necessary, 'given the

financial arrangements already in place for pharmacists to dispense PBS

medicines'.[59]

Monitoring of reforms

1.65

The proposed reforms are aimed at improving the sustainability of the

PBS and improving affordability of medicines. A number of witnesses called for

the impact of the reforms to be monitored in terms of affordability of

medicines for consumers with savings for consumers as well as for the PBS.[60]

Conclusion and recommendations

1.66

The Committee has flagged a number of concerns that were raised in

evidence. As noted earlier, the Committee has had insufficient time to analyse

the specifics or to form a concluded view of the merit of some of these

concerns. However, the Committee has noted that there is general support for

the legislation across stakeholders and therefore the Committee recommends that

the Bill be supported, subject to the following issues being further considered.

Combination Products

1.67

The Committee acknowledges the need to ensure that, when a combination

drug has been demonstrated to be no more effective than its component drugs,

the level of the subsidy for the combination drug should be no more than that

justified on the basis of its components. The Committee also notes Medicines

Australia’s concerns that there may be instances where a combination drug does

provide benefits compared to its components.

1.68

The Committee noted that the proposed Bill would not allow the Minister

to take such factors into account when determining the new price of a

combination drug, following a statutory price reduction for its component

medicines.

Recommendation 1

1.69

The Committee recommends that the Bill be amended to allow the Minister,

in determining the price of a combination drug when a statutory price reduction

applies to its component drugs, to take into account the advice of the PBAC on

whether the combination drug has advantages over its component drugs or other

alternative therapies. In providing such advice the PBAC should consider

evidence of significant improvements in compliance, clinical benefit or reduced

toxicity associated with the combination drug compared to alternative

therapies.

Monitoring of implementation

1.70

The Committee considers that as the changes implemented by the Bill will

have major implications for the sustainability of the PBS and will impact on

consumers and taxpayers, the Government should monitor the reforms as they are

being progressively implemented and make as much information publicly available

as possible.

Recommendation 2

1.71

The Committee recommends that the Minister report to the Senate

12 months after the implementation of the reforms, on the impact of the

reforms, particularly on the cost of medicines to consumers.

Recommendation 3

1.72

The Committee recommends that the Department make publicly available

information on outcomes of the processes being employed to effect the changes

contained in the Bill.

1.73

In making these recommendations, the Committee considers that the

Government should assess the significance of the other issues that have been

raised.

Recommendation 4

1.74

The Committee recommends that, subject to the issues referred to above, the

National Health Amendment (Pharmaceutical Benefits Scheme) Bill 2007 be passed.

Senator Gary

Humphries

Chairman

June 2007

Navigation: Previous Page | Contents | Next Page