Regional snapshot |

| 3.1 |

The countries of North Africa are a growing but relatively untapped market for Australian exporters and investors. At present, the trade is heavily in Australia’s favour and is dominated by Australian farm exports (grains, pulses, live animals and meat and semi- and processed foods) |

| 3.2 |

Overall, there appears to be no discernable trend in Australian trade with the region. Both imports and exports show significant fluctuations from year to year in each of the countries in North Africa.1.

|

| 3.3 |

Australian investment in the region includes mining or minerals processing and there has been considerable Australian investment in the countries which possess oil and gas reserves (see box below).2

|

| 3.4 |

Outside the minerals and energy sectors, there appears to be lesser Australian interest in investment in the region.3 This is due partly to lack of transparency in the treatment of foreign investment by the

countries in the region, an area in which the region still has a way to go before it will be seen as an attractive target for foreign direct investment.4

Australian Oil and Gas Companies in North Africa5

A number of Australian oil and gas exploration and production companies are engaged in significant operations in North African countries

BHP Billiton has currently two major developments in Algeria – the Ohanet wet gas development – in which Woodside Energy Ltd is among the joint venture participants and the Rhourde Oulad Djemma (ROD) integrated oil development. The Ohanet gas project involves the development of four gas condensate reservoirs in the Ohanet region which is around 1300 kms south east of Algiers . Gas production commenced in October 2003. The ROD development comprises development of the ROD oilfield and five satellite fields. Production commenced in October 2004. In 2004 BHP Billiton successfully bid for two further blocks in Algeria

Woodside Energy Ltd has major (onshore) exploration interests in the Sirte Basin and the Murzuq Basin in West Libya with the National Oil Corporation of Libya and other joint venture partners. In January 2005 Woodside and joint venture partners acquired four additional offshore blocks. Woodside’s Algerian joint venture interests with BHP Billiton are described above.

Oil Search Limited , which is active in Papua New Guinea , has sought to complement its position in PNG by developing interests in the Middle East ( Yemen ) and North Africa ( Egypt and Libya ). Oil Search was awarded an interest in Egypt’s East Ras Qattara block where it has performed some seismic work and is scheduled to drill one well in 2006. In Libya Oil Search was successful (in 2005) in bidding for an offshore block

Santos is investing over $70m in a joint exploration venture with its U.S. partner, Devon , in the Gulf of Suez in Egypt |

|

| 3.5 |

Statistical confidentiality considerations make it difficult to obtain accurate and meaningful data on investment relations between

Australia and the countries of North Africa . The tables below provide a general picture of inward and outward investment across all sectors in 2001-2004.

|

2001 |

2002 |

2003 |

2004 |

|

Trans-actions |

Levels $m |

Trans-actions |

Levels $m |

Trans-actions |

Levels $m |

Trans-actions |

Levels $m |

Total |

36 |

285 |

21 |

270 |

42 |

212 |

213 |

362 |

Direct |

* |

* |

* |

* |

* |

* |

* |

* |

Portfolio |

1 |

* |

1 |

* |

1 |

* |

* |

* |

Other |

* |

* |

* |

* |

* |

* |

* |

* |

Source DFAT, Submission No. 9, p.20. * = not published

|

2001 |

2002 |

2003 |

2004 |

|

Trans-actions |

Levels $m |

Trans-actions |

Levels $m |

Trans-actions |

Levels $m |

Trans-actions |

Levels $m |

Total |

112 |

113 |

97 |

18 |

49 |

66 |

62 |

4 |

Direct |

* |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

Portfolio |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

Other |

* |

113 |

97 |

18 |

49 |

66 |

62 |

4 |

Source DFAT, Submission No. 9, p.20. * = not published |

| 3.6 |

Australia’s merchandise exports to the region in 2001-2004 were dominated by Australian wheat exports to Egypt. |

| 3.7 |

However, the figures in Table 3.3 below illustrate that Australian exporters can do and are doing business in North Africa, and that there is scope for further growth.6

|

| 3.8 |

Again, the Australian Bureau of Statistics restricts the release of statistics on certain commodities to avoid divulging commercially-sensitive details of any single firm’s operations. A consequence of this policy is that the DFAT Composition of Trade data used in the following table does not identify exports of a number of commodities,

including wheat, alumina and sugar.7 However, although the volume and value of these commodities are not separately available, their values are included in total export figures below.

Country |

Balance of trade |

Main exports |

Main imports |

Egypt

- Population 73 million

- Est. GDP US$85 billion (2004)

|

$611 million

|

Total value $646 million

- Wheat

- Fresh vegetables

- Coal

- Dairy products

- Machinery/equipment

|

Total value $35 million

- Refined petroleum

- Floor coverings

- Textiles

- Fertilizers

|

Libya

- Population 5.7 million

- Est. GDP US$25 billion (2004)

|

$14 million |

Total value $14 million

- Meat

- Measuring instruments

- Telecom equipment

- Civil engineering equipment

|

Total value $0 |

Algeria

- Population 33.4 million

- Est. GDP US$76 billion (2004)

|

$70 million |

Total value $69 million

|

Total value $15 million

- Combustion engines

- Pumps for liquids

- Electrical equipment

|

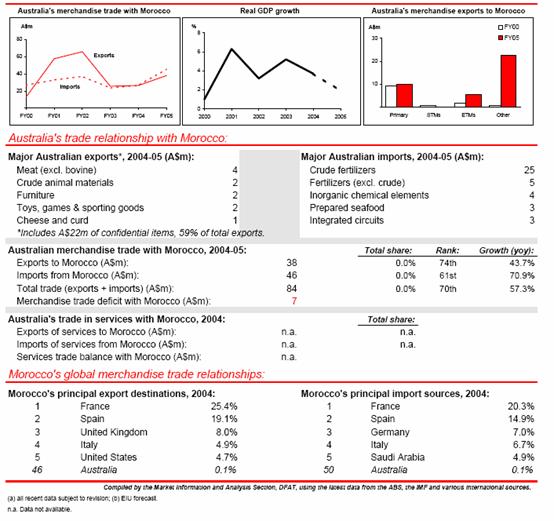

Morocco

- Population 31.1 million

- Est. GDP US$53 million (2004)

|

$9 million |

Total value $29 million

- Crude animal materials

- Dairy products

- Toys/games/sporting

- Crude vegetable materials

|

Total value $20 million

- Fertilizers

- Integrated circuits

- Seafood

- Textiles/clothing

|

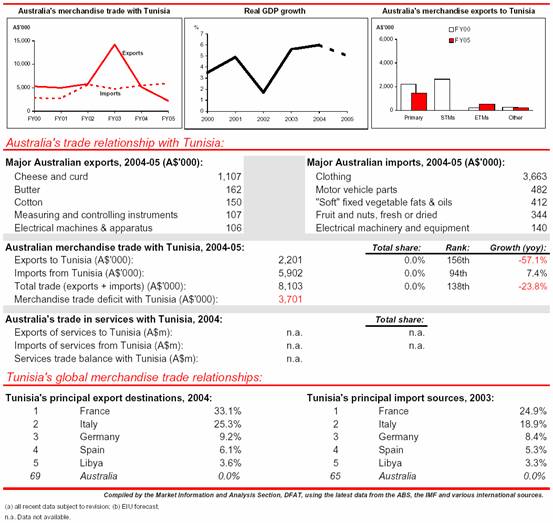

Tunisia

- Population 9.9 million

- Est. GDP US$28 billion (2004)

|

- $1.7 million |

Total value $3.4 million

- Inorganic chemicals

- Dairy products

- Measuring instruments

- Printing machinery

|

Total value $5.2 million

- Clothing

- Textiles/knitwear

- Vegetable fat/oils

- Vehicle parts

|

Source Source: DFAT, Composition of Trade Statistics (Calendar Year 2004) cited in Austrade Submission No. 5, p.8 |

| 3.9 |

In evidence to the committee, Dairy Australia indicated that the trade statistics for, for example, Libya would not include products sold into the region then transhipped and onsold to Libya.8

|

|

|

Trade and investment by country |

Algeria |

| 3.10 |

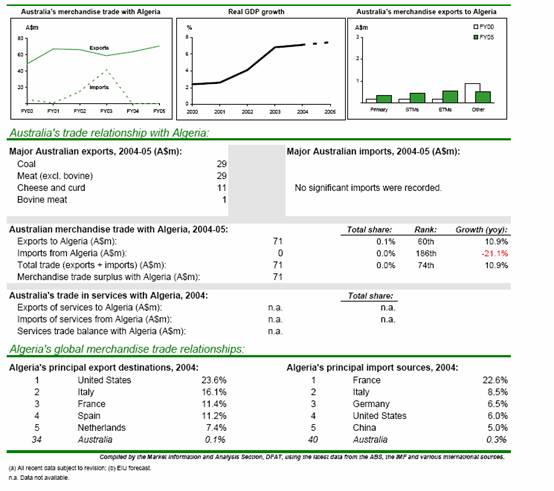

Approximately half of Algeria’s trade is with the EU with the US its next most important trading partner.9

Source DFAT Country Factsheet |

|

|

Background |

| 3.11 |

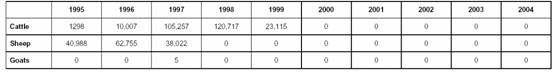

As the Table above indicates, Australia exported nearly A$71m worth of goods to Algeria in 2004/5, which, as in other years, consisted

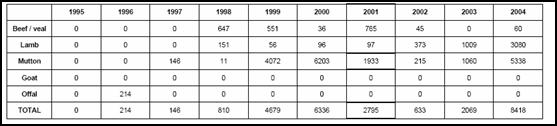

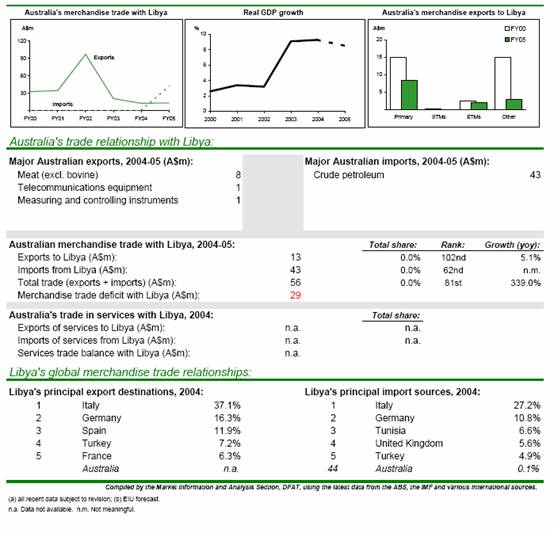

mainly of meat ($29m) and coal ($29m). Although Algeria is the largest importer of dairy products in the world, particularly of milk powders10 , it took only $11m worth of cheese and curd in 2004/5. In addition to bovine meat exports worth $1m in 2004/5, Algeria is also a principal destination for Australian lamb and mutton (see Table 3.4).11 |

| 3.12 |

Imports were negligible in 2004/5, although in the previous three years Australia purchased significant quantities of liquefied propane (worth A$55.1m in 2002).12

Source DAFF |

Summary |

| 3.13 |

Algeria ranked second in value of Australia ’s export trade to North Africa in 2004/5 and third in overall trade value. |

|

|

Egypt |

| 3.14 |

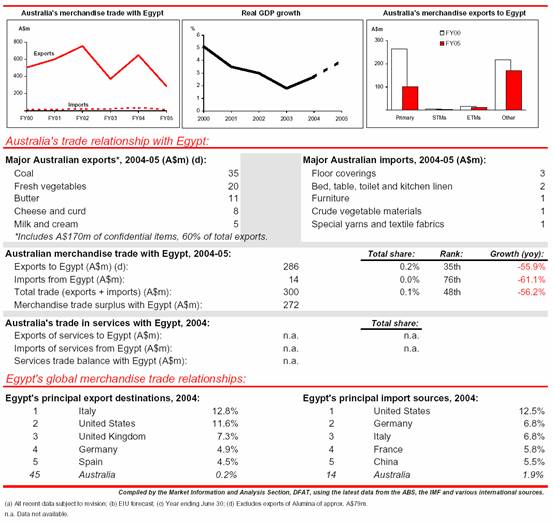

Egypt is Australia’s major trading partner in the region. The long standing relationship is built on Australian wheat, pulses and other food exports.

Source: DFAT Country Factsheet |

|

|

Background |

| 3.15 |

Egypt is a particularly important market for Australian wheat: in 2003/4, Australia ’s share of Egypt ’s wheat imports was 35%, second only to the US .13 Egypt accounted for 97% of wheat exports to the

region.14 Australia has also had some success in exporting manufactured and high technology products. |

| 3.16 |

Exports to Egypt have fluctuated. Since a after a sharp drop in 2003 due to the impact of drought in Australia and a depreciated Egyptian currency, the value rebounded to just under A$646m in 2004, and slowed to $286m in 2004/5.15

|

| 3.17 |

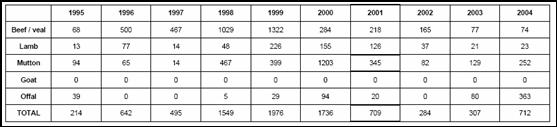

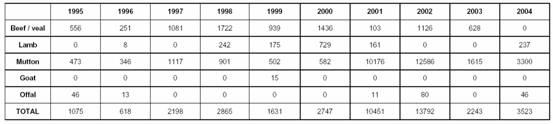

The reduction of Australian meat and livestock shipments to Egypt over the last several years reflected the currency depreciation as well as high prices in other markets and competition from other suppliers. Livestock shipments averaged 140,800 head over the 2000-2003 period, but there were no shipments in 2004 (see Tables 3.5 and 3.6).16 In May 2005, however, approximately 7,000 head of cattle were shipped from Australia to Egypt and Middle East reports suggested that reduced supplies in North Africa have caused price rises that could see Australian livestock become more competitive.17

Source: Department of Agriculture, Fisheries and Forestry

Source: Australian Bureau of Statistics |

| 3.18 |

As with other North African countries, Egypt’s exports to Australia are minimal. They are confined mainly to refined petroleum, floor coverings, textiles and furniture.18

|

| 3.19 |

Australia and Egypt intend to expand the bilateral trading relationship. This is reflected in the number of framework agreements signed over the past two decades. These include: an Agreement on Trade (1988); Memoranda of Understanding (MOU) on Electrophoretic testing of Exports of Australian Grains and pulses to Egypt, on Air Services Arrangements (signed in 1997) and on Mutual Cooperation on Trade Promotion (1998); an Agreement on the Promotion and Protection of Investments (2001); a draft MOU on Live Animal Trade is under consideration and a draft Trade and Economic Framework has also been mooted.19

|

| 3.20 |

Opportunities are expanding in the mining sector. Current Australian investment activity in Egypt includes:

- significant AWB Ltd investment in Five Star Flour Mills, Egypt’s largest private flour mill which uses only Australian wheat to produce high quality flour;

- Centamin Egypt Ltd announcing in 2005 that it had discovered, and is developing, a strategy to extract high quality gold from Egypt;

- Gippsland Ltd signing an agreement in January 2005 with the Egyptian mineral Resources Authority to purchase 320,000 pounds of tantalum concentrate each year when commercial mining operations begin at the Abu Dabbab mine in southeast Egypt in 2006. Gippsland Ltd has 50% equity in the mine;

- Santos Ltd investing approximately A$70m in a joint exploration venture for oil and gas in the Gulf of Suez;

- Oil Search Ltd’s 49.5% interest in the onshore East Ras Qattara block;

- P&O Ports’ right to become a 60% shareholder in a new company which will operate a new multi-million dollar shipping terminal in Sinai; and

- Magnesium International Ltd negotiation with the Egyptian authorities to build and operation a magnesium smelter on the Red Sea.20

|

| 3.21 |

Apart from these ventures, Egypt is not a major destination for Australian investment, partly because Egypt has wanted to protect its services sector from foreign competition. This is starting to change, however. Egypt recently made an offer of new commitments relating to insurance and air transport services (computer reservation systems, aircraft repair and maintenance services). Australia is also encouraging Egypt to look at similar commitments in areas including:

- professional services (legal, mining, scientific and technical, urban planning, landscape architecture);

- banking services;

- pipeline transport;

- construction services;

- air transport; and

- management consulting.21

|

Summary |

| 3.22 |

Egypt is Australia’s primary trading and investment destination in North Africa. The value of overall trade in 2004/5 was 3.5 times that of Morocco, the next ranked country in North Africa. |

|

|

Libya |

| 3.23 |

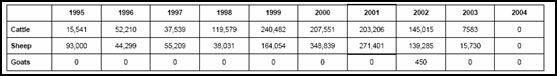

Following normalisation of relations in 2002, Australian merchandise and services exports to Libya increased. The opening in October 2005 of an Australian Consulate-General in Tripoli furthered the commercial relationship.22

Source: DFAT Country Factsheet

|

Background |

| 3.24 |

Merchandise exports to Libya were worth $13m in 2004/5 while Libyan exports to Australia in that year were $43m. Australia ’s main exports to Libya in recent years have been meat, grains, other food,

civil engineering equipment, telecommunications equipment and measuring instruments.

|

| 3.25 |

Libya has been a key market for Australian mutton and livestock exports. Demand for Australian mutton is driven by its price and availability compared to other cheap protein sources such as lower-grade beef, poultry and buffalo (see Tables 3.7 and 3.8).23

Source Meat and Livestock Australia Ltd, Submission No 11, p.9.

Source Meat and Livestock Australia Ltd, Submission No 11, p.11. |

| 3.26 |

In the first nine months of 2005 Australia’s meat exports increased significantly,24 and Toyota announced plans to export Australian-made Camry vehicles to Libya.

|

| 3.27 |

Woodside Energy has acquired significant onshore and offshore acreage in Libya for oil and gas exploration and production. Woodside and its partners are the second-largest holders of exploration acreage in Libya.25

|

| 3.28 |

Australia first participated in the Libya International Fair in 2004, fielding 12 companies, and the Western Australian Government

promoted an additional 40 to more than 80,000 visitors. Five of the exhibitors are now doing business with Libya .26 |

Summary |

| 3.29 |

Trade with Libya has only recently resumed and in 2004/5 was Australia’s fourth-ranked trading partner in North Africa. |

|

|

Morocco |

| 3.30 |

Morocco has free trade agreements with the United States, Egypt, Jordan, Tunisia and Turkey in addition to its Euro-Mediterranean partnership arrangements.27

Source: DFAT Country Factsheet |

Background |

| 3.31 |

In 2004/5 Australian exports to Morocco were valued at A$38m and consisted mainly of grain, meat, crude animal materials, furniture and toys, games and sporting goods. Morocco exports of A$46m to

Australia included fertilizers, inorganic chemical elements prepared seafood and integrated circuits. |

| 3.32 |

Morocco has signed a deal with two Australian companies (Pancontinental Oil and Gas NL and Cooper Energy BVI Ltd) and a British company to explore for oil in an offshore zone in the Mediterranean.28

|

Summary |

| 3.33 |

Morocco was Australia’s second largest North African trading partner in 2004/5 after Egypt. |

|

|

Tunisia |

| 3.34 |

Tunisia’s wheat requirements are mainly met by the EU and Canada and dairy from the EU and it is almost self-sufficient in red meat.29

Source: DFAT Country Factsheet |

Background |

| 3.35 |

In 2004/5 Australia exported merchandise to Tunisia worth A$2.2m, the principal item being cheese and curd ($1.1m). In June 2005, the first shipment of Australian frozen sheep meat occurred.30

|

| 3.36 |

Tunisian exports to Australia in 2004/5 were valued at A$5.2m and included clothing ($3m), vegetable fats and oils ($1m), fruit and nuts, motor vehicle parts and textiles.31

|

| 3.37 |

Currently there is not a high degree of interest in investing or trading with Tunisia amongst Australian companies. Austrade has not recorded any business dealings with Tunisia in 2004/5.32

|

| 3.38 |

DFAT believes that, although Tunisia’s level of commercial activity with Australia is small, scope exists for further development.33

|

| 3.39 |

With this background knowledge, the committee visited the region in November 2005. The visit report comprises the next chapter.

|

| 1 |

See DFAT, Composition of Australian Trade 2003-2004. Back

|

| 2 |

DFAT, Submission No. 9, p. 19. Back |

| 3 |

DFAT, Submission No. 9, p. 19. Back |

| 4 |

DFAT, Submission No. 9, p. 19. Back |

| 5 |

DFAT, Submission No. 9, p. 19. Back |

| 6 |

DFAT, Submission No. 9, p. 20. Back |

| 7 |

DAFF, Submission No. 18, p. 3. Back |

| 8 |

Mr P Goode , Manager, International Policy, Dairy Australia , Evidence, 4/11/05 , p. 2. Back |

| 9 |

Austrade, Submission No. 5, p. 6. Back |

| 10 |

10% of world imports, Australian Dairy Industry Council, Submission No. 10, p. 1; Mr P Goode, Manager, International Policy, Dairy Australia, Evidence, 4/11/05, p. 1. Back |

| 11 |

Meat and Livestock Australia, Submission No. 11, pp. 2-4. Back |

| 12 |

DFAT, Submission No. 9, p. 21. Back |

| 13 |

AWB Ltd, Submission No. 8, p.6. Back |

| 14 |

Dr M O’Flynn , Acting Executive Manager, International Division, DAFF, Evidence, 2/8/05 , p. 3. Back |

| 15 |

DFAT, Submission No. 9, p. 21 and Figure 3.2 above Back |

| 16 |

Meat and Livestock Australia, Submission No. 11, pp. 2-4. Back |

| 17 |

DAFF, Submission No. 18, p. 7. Back |

| 18 |

DFAT, Submission No. 9, p. 21. Back |

| 19 |

DFAT, Submission No. 9, p. 23. Back |

| 20 |

DFAT, Submission No. 9, pp. 22-23. Back |

| 21 |

DFAT, Submission No. 9, p. 22. Back |

| 22 |

DFAT, Submission No. 9, p. 23. Back |

| 23 |

Meat and Livestock Australia, Submission No. 11, pp. 2-4. Back |

| 24 |

The frozen mutton trade was worth approximately $10 million in 2004. Dr M O’Flynn , Acting Executive Manager, International Division, DAFF, Evidence, 2/8/05 , p. 3 . Back |

| 25 |

DFAT, Submission No. 9, p. 24. Back |

| 26 |

Austrade, Submission No. 5, p. 13. Back |

| 27 |

DFAT, Submission No. 9, pp. 14-15. Back |

| 28 |

DFAT, Submission No. 9, p. 24. Back |

| 29 |

DAFF, Submission No. 18, p. 8. Back |

| 30 |

DAFF, Submission No. 18, p. 8. Back |

| 31 |

DFAT, Submission No. 9, p. 24. DAFF, Submission No. 18, p. 8. Back |

| 32 |

AUSTRADE, Submission No. 5, p. 9. Back |

| 33 |

DFAT, Submission No. 9, p. 24 Back |