Joseph Ayoub

The Black Economy Taskforce

The

Black Economy Taskforce (the Taskforce) is chaired by Michael Andrew AO (the

current Chair of the Board of Taxation) and was established in December 2016 to

develop a multi–pronged policy response to combat the black economy in

Australia.[1]

The Taskforce provided the Black Economy

Taskforce: final report—October 2017 (Final Report) to the Government

in October 2017, which was publicly released with this year’s budget.[2]

The release was also accompanied by the Government’s response Tackling

the Black Economy: Government Response to the Black Economy Taskforce Final

Report (Government Response).[3] The Final Report contains

80 recommendations which span the whole economy.[4]

| Examples of black economy activities |

- Not reporting or under-reporting income

- Paying for work cash-in-hand

- Underpayment of wages

- Sham contracting

- Phoenixing — when a new company is created to continue the business of a company that has been deliberately liquidated to avoid paying its debts

- Bypassing visa restrictions and visa fraud

- Identity fraud

- Australian Business Number (ABN) fraud

- GST fraud

- Origin of goods and duty fraud

- Duty evasion and illicit tobacco

- Tobacco excise evasion

- Money laundering

- Unregulated gambling

- Illegal and criminal activities

- Counterfeit goods

- Motor vehicle fraud

- Illegal drugs1

|

What is the black economy?

There is no internationally agreed definition of the black economy

and definitions vary within Australia. According to the Taskforce it generally

covers activities which take place outside the tax and regulatory systems

involving both legal and illegal activities.[5] Examples of black economy

activity are listed in the adjacent box.[6]

What is the size of the black

economy?

In 2012, the Australian Bureau of Statistics (ABS) estimated

that ‘underground production’ or the ‘cash economy’ accounted for 1.5% of

Australia’s Gross Domestic Product (GDP).[7] According to the

Taskforce, this amounted to approximately $25 billion. Earlier this year KPMG

estimated that the total, annual, aggregate tax gap including losses to Pay As

You Go (PAYG) income tax, GST and self-assessed personal income tax to be $5.8

billion.[8]

In its Final Report the Taskforce stated that the black

economy is larger than estimated by the ABS in 2012 and could be as large as 3%

of GDP—in 2015–16 this equated to $50 billion.[9] It is also likely that

certain elements of the black economy are continuing to grow as a result of a

combination of ‘strong incentives, poor transparency and limited enforcement’.[10]

Figure 1 shows the Taskforce’s estimation of the breakdown of black economy

activity.

Figure 1: Partial indicators

of black economy related activity (citations excluded)[11]

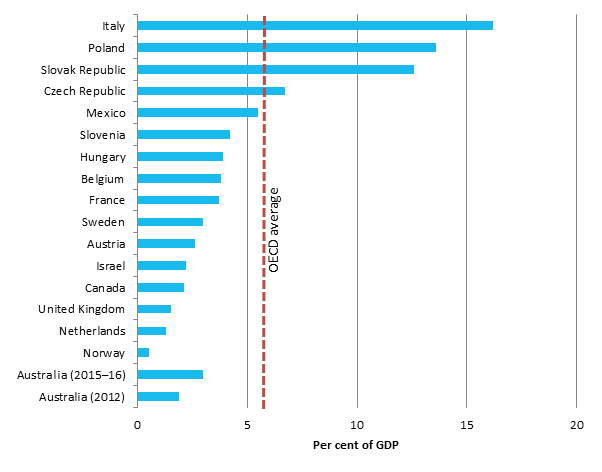

International experience

In the Taskforce’s Black Economy

Taskforce: interim report–March 2017 to Government, it estimates

Australia’s black economy may be at the lower end of the range, close to

the UK and Canada.[12] However, this was based

on the above ABS 2012 data which estimated that ‘underground production’ accounted

for 1.5% of Australia’s GDP and on data collected by the Organisation for

Economic Co-operation and Development (OECD) on the black economy in various

countries (excluding Australia).

Based on the latest available OECD data and the Taskforce’s

revised estimate of the black economy, the Parliamentary Library has produced

Figure 2 which is an estimate of the size of Australia’s black economy compared

to other OECD countries for 2015–16.

Figure 2: OECD comparison of

Australia’s black economy

Note: this comparison is based on a 2011–12

survey by the OECD of participating countries. Australia was not included in

the survey. The 2012 figure for Australia is based on the 2012 estimate by the

ABS. This estimate was provided by the Taskforce in its Interim Report. The

2015–16 figure for Australia is based on the Taskforce’s estimate in its Final

Report. Figure 2 should be interpreted with significant caution.

Source: OECD and ABS statistics[13]

What drives the black economy?

The Taskforce found that there are a range of drivers that

interact with one another and ultimately lead to the decision to participate in

the black economy.[14] These drivers range from

high tax and regulatory burdens through to changing business and technological

landscapes. Other examples of drivers include:

- economic conditions and commercial pressures

- social norms which legitimise participation in the black economy

- availability, use and cost of cash

- inadequate knowledge about the system.[15]

The Taskforce found that drivers can ‘offset or

counter-balance each other’ and can either work to dissuade or encourage black

economy participation.[16] However, where the

drivers encourage participation in the black economy, the Taskforce has

observed the emergence of a ‘disturbing pattern’ in areas of public policy as

outlined in the adjacent box.[17]

| Development of black economy activity |

| Phase 1: there is an inherited policy, regulatory, and enforcement architecture which does not keep pace with economic, social or technological change. |

| Phase 2: some people exploit the regulatory gaps which have failed to keep pace with the above changes—when others see them ‘getting away with it’ they also move into the black economy. |

| Phase 3: as more people move into the black economy there is an economic and social race to the bottom. |

What are the consequences?

Participation in the black economy produces both direct and

indirect costs.[18] The most immediate and

obvious direct cost is the loss of taxation revenue and abuse of the welfare

system — underreporting income enables a person to claim a benefit that they

would otherwise not be entitled to. However, there are also a range of indirect

costs including:

- harm suffered by individuals who are not within the relevant

regulatory systems (such as workplace relations, immigration, occupational

health and safety) because they are, for example, ‘off the books’

- by offering goods and services below the market value because,

for example, payment is made in cash, the tax and regulatory costs are avoided.

This provides the individual or business with a competitive advantage which penalises

businesses and individuals who comply with their obligations

- if the community has a perception that the system is unfair or

they lack confidence in the administration of system, this may result in their

own participation in the black economy.[19]

The Taskforce considered that it is not realistic or cost

effective to try to limit the costs entirely because ‘a number of black economy

initiatives stem from basic design features of our tax and other systems’. An

example given is the ‘tightly means-tested transfer systems’.[20]

However, ‘well-designed measures to counter the black economy can be expected

to yield meaningful budgetary dividends over time’.[21]

Government response

The Government has already begun to implement measures that

arose out of recommendations in the Taskforce’s Interim Report – for example,

the Treasury

Laws Amendment (Black Economy Taskforce Measures No. 1) Bill 2018

criminalises the production, supply, use or possession of sales suppression

technology and also extends the taxable payments reporting system to cleaning

and courier businesses that have an ABN. The Fair

Work Amendment (Protecting Vulnerable Workers) Bill 2017, among other

things, introduced higher penalties for contravention of workplace laws.

Many of the Taskforce’s 80 recommendations addressed by the

Government in its Response will be considered in the context of the

Government’s existing policy review or processes.[22]

That said, the Government has expressed agreement or agreement in principle,

with a number of measures. The measures that the Government disagreed with

include:

- Recommendation 7.3—offer a time–limited amnesty for small

businesses followed by an ‘enforcement blitz’.[23]

- Recommendation 10.2—change the alienation of personal services

income rules and strengthen enforcement.[24] Alienation of personal services

income occurs when the services of an individual are provided through an

interposed entity such as a company, trust or partnership, the profits of which

are retained by that entity or diverted to associates in order to take

advantage of a lower tax rate. It can also involve structuring in a particular

way in order to take advantage of deductions which wouldn’t be available to an

individual providing the same services as an employee.[25]

- Recommendation 13.3—examine the feasibility of introducing

technology which marks cigarette packs and cases to show when excise has been

correctly paid.[26]

Consistent with the Final Report, the Government acknowledges

that it will need to address the root causes and drivers, while the current

focus must be on the most urgent and costly problems.[27]

2018–19 Budget announcements

The 2018—19 Budget builds on these measures and implements

some of the Taskforce’s recommendations contained in the final report,

including:

- an economy-wide limit of $10,000 for cash payments made to

businesses for goods and services from 1 July 2019. (see separate Parliamentary

Library brief: Black economy measures: limits on cash payments)

- a range of measures aimed at combatting the sale and production of

illicit tobacco and to improve the collection of excise and customs duty on

tobacco (see Parliamentary Library brief: Tobacco)

- expansion of the Taxable Payment Reporting System (TPRS) to:

- security

providers and investigation services

- road

freight transport

- computer

system design and related services

- providing Treasury with $12.3 million over five years (with $1.7

million in 2022–23) to manage a whole of Government response to the Taskforce’s

Final Report

- providing the ATO with $3.4 million over four years to lead a

multi-agency Black Economy Standing Taskforce (the BEST). (see separate

Parliamentary Library brief: Black economy standing taskforce)

- providing $318.5 million over four years to implement strategies

including:

- establishing

ATO ‘mobile strike teams’ and increasing the ATO ‘audit presence’

- establishing

a black economy hotline which the public can use to report black economy

activity including phoenix activities

-

providing the ATO with $9.2 million to develop a ‘Procurement

Connected Policy’, initially requiring businesses seeking to tender for

Australian Government procurement contracts over $4 million to provide a

statement from the ATO that they are tax compliant

- removing certain deductions for those taxpayers who fail to

comply with their Pay As You Go (PAYG) withholding obligations

- designing a new regulatory framework for the Australian Business

Numbers (ABN) system

- a range of measures aimed at combating illegal phoenixing.

Financial impact

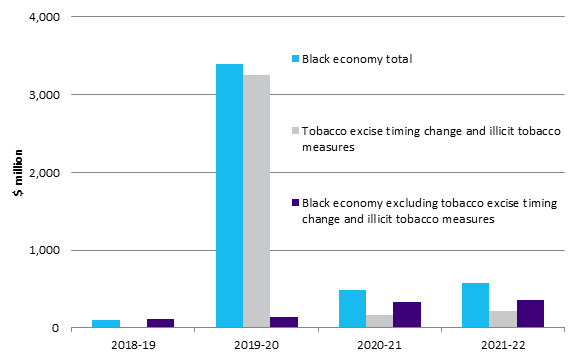

The above measures include both revenue and expense measures. Figure 3 shows

the total cost of the black economy and related measures announced in the 2018–19

Budget over the forward estimates. Based on the figures available in Budget

Paper No. 2, it appears that the measures will produce a net gain of $4.6

billion over the forward estimates. This includes the measure to bring forward

the payment of excise on all warehoused tobacco to 2019–20, and measures to

combat illicit tobacco, which together is worth about $3.6 billion (see

Parliamentary Library brief: Tobacco).

When this measure is excluded the net gain is reduced to about $950 million

over the forward estimates.[28]

Figure 3: total cost of 2018–19

Budget black economy and related measures

Source: Budget

measures: budget paper no. 2: 2018–19

[1]. The

Treasury, ‘Black

Economy Taskforce’, The Treasury website.

[2].

Black Economy Taskforce (Taskforce), Black Economy

Taskforce: final report–October 2017, The Treasury, Canberra, October

2017.

[3].

Australian Government, Tackling

the black economy: government response to the Black Economy Taskforce final report,

The Treasury, May 2018.

[4].

Ibid., p.1; Taskforce, Black Economy

Taskforce: final report–October 2017, op. cit., pp. vii-xi.

[5].

Taskforce, Black Economy

Taskforce: final report–October 2017, op. cit., p. 12.

[6].

Ibid., pp. 12–18.

[7]. Australian

Bureau of Statistics (ABS), The

non-observed economy and Australia’s GDP, 2012: information paper, cat. no.

5204.0.55.008, ABS, Canberra, 12 September 2013.

[8]. KPMG,

The

last frontier: shining a light on the black economy, KPMG, March 2018,

p. 2.

[9].

Taskforce, Black Economy

Taskforce: final report–October 2017, op. cit., p. 35.

[10].

Ibid.

[11].

Ibid., p. 36. The taskforce notes that the figures presented are not

additive and should be taken as indicative only.

[12].

Taskforce, Black

Economy Taskforce: interim report–March 2017, op. cit., p. 14.

[13].

Estimates based on: OECD Statistics OECD (2014) The

Non-Observed Economy in the System of National Accounts, OECD

Statistics Brief, No. 18; Australian Bureau of Statistics (ABS), The

non-observed economy and Australia’s GDP, 2012: information paper, op.

cit.; Taskforce, Black

Economy Taskforce: final report–October 2017, op. cit., p. 35.

[14].

Taskforce, Black

Economy Taskforce: interim report–March 2017, op. cit., pp. 15–20.

[15].

Ibid.

[16].

Ibid., p. 19.

[17].

Ibid., pp. 18–19.

[18].

Ibid., p 37.

[19]. Ibid.,

p. 37–38; Taskforce, Black Economy

Taskforce: interim report–March 2017, op. cit., pp. 1, 11.

[20].

Taskforce, Black

Economy Taskforce: final report–October 2017, op. cit., p. 37.

[21].

Ibid.

[22].

Australian Government, Tackling

the black economy: government response to the Black Economy Taskforce final report,

op. cit., p. 14.

[23].

Ibid., p. 20.

[24].

Ibid. p. 26.

[25].

Australian Taxation Office (ATO), ‘General

anti-avoidance rules and PSI’, ATO website, last modified 30 March 2017.

[26].

Australian Government, Tackling

the black economy: government response to the Black Economy Taskforce final

report, op. cit., p. 35.

[27].

Ibid., p. 14.

[28].

Australian Government, Budget

measures: budget paper no.2: 2018–19, pp. 1–6, 47–68 and 194–199.

All online articles accessed May 2018

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.