Kai Swoboda, Economics

Key Issue

There are a number of emerging issues in energy markets that have an impact on the price and reliability of energy supply.

Addressing these challenges is complex; it requires joint action by the Australian and state and territory governments and regulators to provide the appropriate incentives in energy markets.

The supply of energy to households and businesses in

Australia involves complex interactions between governments and privately-owned

businesses. These interactions typically occur in markets regulated under a

national co-operative approach between governments and involve national,

regional and state-based regulators.

Energy markets are affected by a range of factors

including the historical development of energy supplies in each state, market

and weather conditions, as well as exposure to international markets. There are

several specific issues that affect some energy markets.

East coast gas exports

The recent development of export-oriented liquefied

natural gas (LNG) terminals in Queensland has provided significant economic

benefits through the scale of investments and export revenues. However, the

increase in gas prices that are an outcome of the link to international gas

markets has created problems for domestic gas users. Indeed, a recent analysis

of industrial gas prices conducted

for the Department of Industry, Innovation and Science found significant

price increases for industrial gas users in recent years.

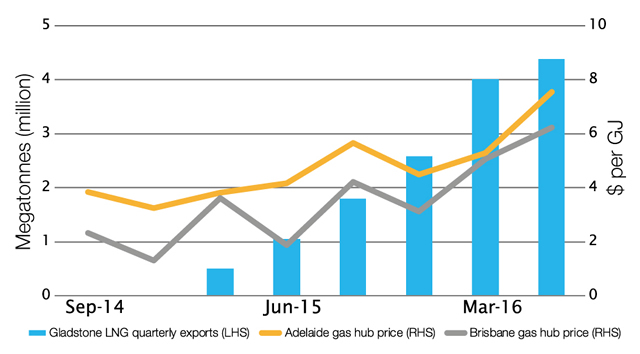

Gas prices, as determined at key ‘hubs’, have

increased in association with the commencement of LNG exports from Gladstone in

January 2015 (Figure 1).

Figure 1: Recent LNG exports from Gladstone

and Adelaide and Brisbane gas hub prices

Source: Thomson Reuters Eikon and

Australian Energy Regulator (AER), STTM

quarterly prices, AER website.

While monthly LNG export quantities from Gladstone

have stabilised since the start of 2016, future volumes will be largely

dependent on Asian LNG prices. These in turn, will be affected by changes in

oil prices and competition from other exporters, including the United States which

has recently commenced exporting LNG.

Policy prescriptions for addressing the potential

for higher gas prices as a result of LNG exports include: the development of

additional gas resources, restrictions on LNG exports, more and higher capacity

interconnections, improved access arrangements for gas pipelines and improved

market information for participants.

Wholesale electricity markets

The national electricity market (NEM) covers

eastern Australian states and the ACT. In this market generators compete to

supply electricity to electricity retailers. Wholesale prices in the NEM are

typically determined in each state and are influenced by demand conditions, the

mix of generation technologies in place and the extent of interconnections with

states. Consumer behaviour and industrial demand are also factors that influence

the market.

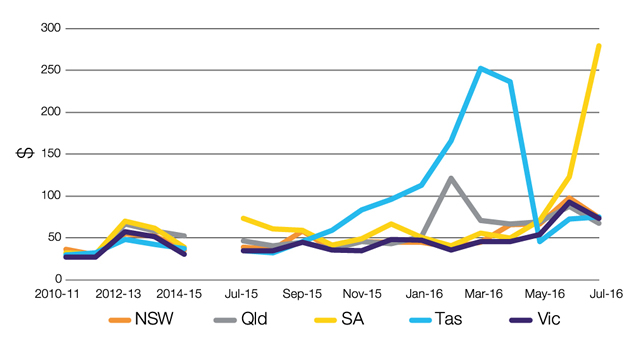

Between July 2012 and June 2014 there was a period

of relative stability and declining wholesale electricity prices in the NEM as

a result of the repeal of the carbon price arrangements. Since that time,

however, prices in some states—particularly Tasmania, Queensland and South

Australia—have been more volatile (Figure 2).This is particularly the case

since mid-2015.

Figure 2: National electricity market

wholesale prices, 2009-10 to July 2016 ($ per MWh)

Source: Australian Energy Market Operator

(AEMO), ‘Average

price tables’, AEMO website.

Electricity retailers and industrial customers can

use long-term supply contracts and financial instruments to manage the risks of

volatility in wholesale prices. However, should higher prices persist over the

medium to long term, these higher prices need to be passed on to consumers.

Recent changes in wholesale prices are related to

jurisdiction-specific events as well as to broader policies that specifically apply

within a jurisdiction. For example, fluctuation in prices in Tasmania in the

past 12 months was related to the interconnection

between Tasmania and Victoria being unavailable between December 2015 and

June 2016. It was also the result of low levels of water storages available for

hydroelectricity generation and the need to use imported diesel generation to

meet demand.

In South Australia, recent rises in wholesale

prices are the result of a combination of state-specific factors and broader

policies that specifically pertain to the state. These include:

- the high share of wind energy in electricity generation that displaces

other sources of generation when conditions are favourable

- a reliance on two capacity-constrained interconnections with

Victoria to import and export electricity

- the closure of uneconomic, older, higher-cost fossil fuel generation

as demand remains flat and renewable generation capacity has been added and

- the historically wider use of gas-fired generation in the state and

the impact on LNG export‑related higher gas prices.

Policy prescriptions for addressing the issues

faced in South Australia, and to a lesser extent, Tasmania’s reliance on the

interconnector to Victoria include addressing competitive pressures through

more and higher capacity interconnectors between states. Other proposed

approaches include recognising the role of fossil fuel generation in providing

supply reliability and developing market signals to incentivise such

generation.

Security of supply issues

associated with an increasing share of renewable generation

A secure electricity supply

generally requires a system that can quickly adjust to changes in the level of

demand and supply across the system (such as when air conditioners turn on or

where a generator fails). Another important element of supply security requires

the frequency and voltage in the system to be maintained within an acceptable

level.

The addition of renewable

wind and solar rooftop generation is generally not able to provide this

stability of frequency and voltage. Therefore it needs to be supported by

‘synchronous’ generation—which is typically supplied by fossil fuel generation.

The challenge of incorporating additional renewable

generation will need to be accommodated by the market. The 44th

Parliament reduced the legislated

renewable energy target (RET) from 41,000GWh to 33,000GWh by 2020. It was estimated

by the Clean Energy Council in mid-2015, however, that meeting this lower target would require approximately 6,000 MW of additional renewable generation

capacity to be built.

A recent summary by the Office

of the Chief Economist noted that 320MW of renewable generation capacity

had been completed in the year to October 2015. In addition, 3,747MW of

renewable generation capacity was at the committed stage—where projects are

either under construction or preparing to commence construction—and a further

20,000MW was at the feasibility stage.

Electricity retail markets

Electricity retail markets, where retailers compete

for residential and business customers, have seen progressive removal of price

regulation since the early 1990s. However, at present, only Victoria (from

2009), South Australia (from 2013) and New South Wales (from 2014) have fully deregulated

retail markets—although South East Queensland had price regulation removed from

July 2016.

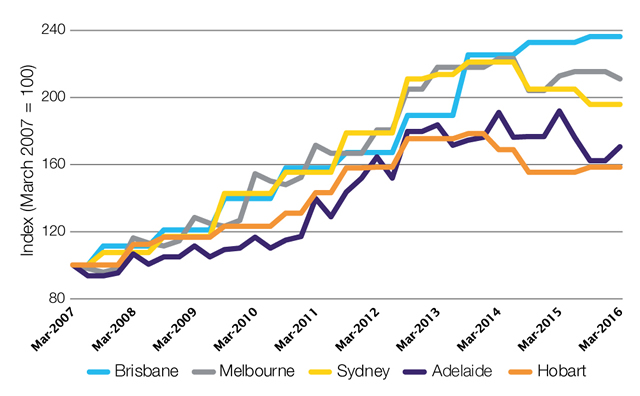

Higher network prices largely drove the increase in

electricity prices between 2007 and 2012. In contrast, the repeal of the carbon

price arrangements—in place between July 2012 and June 2014—and a moderation in

regulated network costs have combined to provide a period of relative stability

or decline in household electricity prices in most capital cities (Figure 3).

Electricity price increases for households in most jurisdictions are expected

by the Australian Energy Market Commission in December 2015 to be relatively

flat in 2016–17 (except in South Australia where a rise of seven per cent is predicted).

A rise of between two to four per cent in most jurisdictions is anticipated in

the following year.

Figure 3: Nominal household electricity

price changes, selected capital cities, 2007 to 2016

Source: Australian Bureau of Statistics, Consumer Price

Index, Australia, March 2016.

Although switching between retailers in a

competitive market applies some pressure on prices, there are a number of

issues in retail markets that will have an impact on the ability of customers and

retailers to reduce electricity prices. These include technological changes

such as time‑of‑use ‘smart’ electricity metering and the widespread

use of roof top solar generation. In the medium term, the availability of

affordable household battery storage will also affect retail markets.

Role of energy policy in meeting emissions

reductions targets

There is a degree of complementarity but also tension

between emissions reduction policies and objectives for low-cost and secure

energy supplies.

The consumption of non-transport energy is a

significant contributor to Australia’s domestic greenhouse gas emissions,

accounting for 53 per cent of emissions in 2015 as

estimated by the Department of the Environment.

In recent years, emissions from electricity generation have

been falling; a consequence of the closure of several energy-intensive

industrial facilities, flat or declining consumer demand in response to rising

electricity prices and a shift to higher renewable generation. Contributing to

this fall has been the closure of a number of ageing fossil fuel power

stations, including:

- the Northern power station in May 2016, (capacity 520MW, operating

since 1985) and the Playford B power station in 2012 (capacity 240MW, operating

since1960) in South Australia

- the Anglesea power station in Victoria in August 2015 (capacity

160MW, operating since 1969), and

- the Munmorah power station in New South Wales in July 2012 (capacity

1,400MW, operating from between 1967 and 1969).

There are several existing policies in place, such

as the RET and the Government’s

‘safeguard mechanism’, that will exert some influence on incentives for generators and

retailers. State-based policies that support renewables will also be a factor. There

are also a number of policies under development or being proposed that may

assist emissions reductions targets and these will need to be considered in

terms of their energy market impact. These include policies such as:

- measures to improve energy efficiency and productivity, such as the ‘National

Energy Productivity Plan 2015–2030’

- programs that aim to encourage the adoption of more energy efficient

technologies and practices by consumers and

- the encouragement of technological innovation in energy supply

through entities such as the Clean Energy Finance Corporation and Australian Renewable

Energy Agency.

Further reading

Australian Competition and Consumer Commission, Inquiry into the east coast gas market, April 2016.

Australian Energy Regulator, State of the energy market 2015, December 2015.

Australian Energy Market Commission,

2015 residential electricity price trends, December 2015.

Back to Parliamentary Library Briefing Book

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.