|

Navigation: Previous Page | Contents | Next Page

Chapter 2

Bodies established under Parts 9–11 the ASIC Act

2.1 This chapter considers the 2012–13 annual reports of the:

- Companies Auditors and Liquidators Disciplinary Board (CALDB);

- Corporations and Markets Advisory Committee (CAMAC); and

- The Takeovers Panel (the Panel).

Companies Auditors and Liquidators Disciplinary Board

2.2 CALDB was first established as an independent statutory body in 1989 and is currently established by Part 11 of the Australian Securities and Investments Commission Act 2001. Its primary purpose, in the administration of Australia's financial services system, is to hear applications and consider cancellation or suspension of a liquidator's or auditor's registration. The Board's casework is not self-generated as it holds no powers to instigate applications. Rather, applications are brought by either ASIC or the Australian Prudential Regulation Authority (APRA) for the Board's adjudication.[1] Accordingly, the Board operates as an expert disciplinary body for auditors and liquidators in Australia.

2.3 CALDB's annual report stated:

The responsibilities conferred on CALDB by the Corporations Act are intended to provide an incentive to registered auditors and liquidators to maintain high professional standards. CALDB's jurisdiction to cancel or suspend an auditor's or liquidator's registration also has a public protective and educative role.[2]

Annual report of CALDB

2.4 The ASIC Act directs that the annual report is to 'describe the operations' of CALDB for the relevant financial year.[3] New applications received by CALDB are categorised as either 'administrative' or 'conduct'.

2.5 There were six new applications brought before CALDB between 1 July 2012 and 30 June 2013. Four of these applications were conduct matters which, as CALDB notes, will carry over to 2013–14 due to their late referral.[4] Orders were issued for one administrative matter and another administrative matter was withdrawn.[5] As raised previously,[6] on the information provided, it is unclear whether matters were referred by ASIC or APRA. The committee recommends CALDB include this distinction in subsequent reports.

2.6 A decision of CALDB may be appealed to the Administrative Appeals Tribunal (AAT) or to the Federal Court of Australia.[7] The annual report does not indicate if any decisions were the subject of judicial or AAT review during the 2012–13 financial year.

2.7 The report provides the following statistics regarding the number of matters before the Board.

Figure 2.1: Results by nature of sanction of cases before CALDB

|

Results of application

|

08/09

|

09/10

|

10/11

|

11/12

|

12/13

|

|

Registration cancelled

|

6

|

1

|

-

|

1

|

1

|

|

Registration suspended

|

2

|

2

|

-

|

-

|

|

|

Admonition

|

-

|

-

|

-

|

-

|

-

|

|

Reprimand

|

-

|

-

|

-

|

-

|

-

|

|

Undertakings required to be given

|

2

|

2

|

-

|

-

|

-

|

|

Dismissed

|

1

|

-

|

-

|

-

|

-

|

|

Withdrawn by ASIC

|

8

|

-

|

-

|

-

|

-

|

Source: CALDB, Annual report: 2012–13, Table: 'Results by nature of sanction', p. 8.

2.8 In its report, CALDB stated that it was informed by ASIC that a review would be undertaken by ASIC in relation to the cost of providing support to CALDB. No outcome has yet been provided from this review.

2.9 An analysis of data provided in previous annual reports indicates that the Board's caseload has significantly declined since 2003–04 (see Figure 2.2). Matters relating to auditors comprise the majority of the Board's caseload over the past decade.

Figure 2.2: Number of cases referred: 2003–04 to 2012–13

|

Financial year

|

Auditors

|

Liquidators

|

|

2012–13

|

1

|

4

|

|

2011–12

|

5

|

2

|

|

2010–11

|

2

|

1

|

|

2009–10

|

0

|

0

|

|

2008–09

|

11

|

1

|

|

2007–08

|

5

|

0

|

|

2006–07

|

7

|

0

|

|

2005–06

|

9

|

3

|

|

2004–05

|

23

|

12

|

|

2003–04

|

32

|

1

|

Source: CALDB, Annual report: 2012–13, pp 7–8; CALDB, Annual report: 2011–12, p.13; CALDB, Annual report: 2010–11, p.13; CALDB, Annual report: 2009–10, pp 14–15; CALDB, Annual report:2008–09, pp 13–14; CALDB, Annual report: 2007–08, pp 13–14; CALDB, Annual report: 2006–07, pp 13–14; CALDB, Annual report: 2005–06, p. 11; CALDB, Annual report: 2004–05, p. 11; CALDB, Annual report: 2003–04, p. 10.

Committee view

2.10 The committee will continue to monitor the low number of referrals to CALDB. The decline in CALDB's activity is particularly evident when viewed against its caseload in previous years.

2.11 The committee notes that in December 2012, improvements to the regulatory framework applying to the corporate insolvency industry were proposed by an exposure draft of the Insolvency Law Reform Bill 2013. The committee will continue to monitor the progress of this draft for any developments.

2.12 The committee is not satisfied the Board has given due attention to the report prepared by the Senate Economics Legislation Committee tabled 14 March 2013. The recommendations have not been implemented in the current annual report, as that committee suggested:

The committee considers that CALDB has met its reporting requirements under the ASIC Act, but suggests that more content be added to future annual reports. The report does not have a table of contents. It contains no reference to work health and safety, or environmental matters. In addition, under the Freedom of Information section of the report, it should indicate where FOI requests can be submitted. Although the report states that 'Members of the Board are remunerated in accordance with rates determined by the Commonwealth Remuneration Tribunal', the information on salary ranges and benefits should be included in the report for the purpose of transparency and accountability.[8]

Recommendation 1

2.13 The committee recommends CALDB distinguish in subsequent annual reports whether matters were referred by ASIC or APRA.

Recommendation 2

2.14 The committee recommends CALDB explicitly indicate in subsequent annual reports whether any decisions were the subject of either judicial or AAT review during the year.

Recommendation 3

2.15 The committee recommends that CALDB examine Parliamentary committee reports and include appropriate discussion in the section on external scrutiny of the CALDB annual reports.

Corporations and Markets Advisory Committee

2.16 The Corporations and Markets Advisory Committee (CAMAC) was first established in 1989 and is currently established by Part 9 of the Australian Securities and Investments Commission Act 2001.[9] CAMAC's role in the administration of Australia's financial services system is to provide informed and expert advice to the Minister about the content, operation and administration of the corporations legislation, corporations, financial products and markets.[10] On its own initiative or at the Minister's request, CAMAC may provide advice or recommendations about any matter connected with:

- a proposal to make corporations legislation, or to make amendments of the corporations legislation;

- the operation or administration of the corporations legislation;

- law reform in relation to the corporations legislation;

- companies or a segment of the financial products and financial services industry; or

- a proposal to improve the efficiency of the financial markets.[11]

2.17 As detailed in the annual report, CAMAC states that its role is '...to promote a sound and effective regulatory framework for corporate activity and financial services and efficient financial markets'.[12]

2.18 CAMAC is divided into two committees; namely, an Audit Committee and a Legal Committee.[13] However, in its annual report, CAMAC notes it has advised the government that since the introduction of a sub-committee system it is unnecessary to continue with the Legal Committee as a separate entity.[14] During the 2012–13 financial year there were sub-committees for managed investments, annual general meetings, charitable trusts and crowd sourced equity funding.[15]

2.19 CAMAC is supported by a full time executive, which for the 2012–13 financial year consisted of an SES officer, an Executive Level 2 officer and an APS Level 6 officer.[16]

2.20 There is a high degree of interaction between ASIC and CAMAC, with CAMAC receiving administrative assistance from ASIC's finance section, information technology officers, payroll section and library.[17]

Annual report of CAMAC

2.21 The annual report details CAMAC's activities during 2012–13. Following the first stage of its inquiry into the regulation of managed investment schemes, CAMAC published its report in August 2012.

2.22 In September 2012, CAMAC published a discussion paper concerning the future of the annual general meeting and shareholder engagement in Australia. CAMAC conducted three roundtables and received 36 submissions from interested parties. It is currently considering the matters raised and intends to submit its report to government in 2013–14.[18]

2.23 CAMAC was also requested to consider various matters concerning the administration of charitable trusts. Interested parties were invited to make submissions and a roundtable was conducted in April 2013 with stakeholders in Melbourne. The committee's report was submitted to government in May 2013 and includes Stage 1 recommendations for early implementation.[19] The first recommendation addresses information gathering:

CAMAC is of the view that a productive way to gain a better understanding of what is occurring in practice with the administration of charitable trusts operated by licensed trustee companies (LTCs) is through a structured review in the form of Stewardship audits. The purpose of these audits would be to focus on how each trustee has exercised its powers and assumed its responsibilities for the purpose of fulfilling the primary intent of the donor.[20]

2.24 The second recommendation proposes amendments be made to Chapter 5D of the Corporations Act regarding the adoption of a 'fair and reasonable' requirement for fees charged against a client charitable trust. Each LTC 'would be required to provide an annual statement to the designated regulator that the fees and costs charged against the trust are fair and reasonable'.[21] It proposes the expansion of the jurisdiction the court possesses in dealing with disputes alleging the charging of excessive fees. A standardised approach to the disclosure of fees was also recommended.[22]

2.25 Thirdly, the report recommends a judicial process to resolve disputes concerning charitable trusts administered by LTCs. This aims to improve access to the court and grant it greater power to determine fee disputes and tenures of trustees.[23]

2.26 CAMAC is conducting a review of the regulation of crowd sourced equity funding. A discussion paper published in September 2013 took into account the current position in Australia as well as developments in the Unites States, Canada, Europe and New Zealand. CAMAC anticipates finalising its report in April 2014.[24]

2.27 The annual report notes that CAMAC's expenditure for the 2012–13 financial year included a payment of $70 000 to ASIC. The report clarifies that this payment to ASIC was 'for administrative support, including financial management, payroll, library services and information technology.'[25]

Committee view

2.28 The committee commends CAMAC on implementing the recommendations suggested by the Senate Economics Legislation Committee tabled 14 March 2013.[26]

2.29 The committee considers that CAMAC has fulfilled its regulatory and reporting responsibilities during the 2012–13 financial year and the committee is satisfied with the annual report.

The Takeovers Panel

2.30 The Takeovers Panel was established by Part 10 of the Australian Securities and Investments Commission Act 2001 as a peer review body largely comprised of takeover experts, whose main purpose is the resolution of takeover disputes. During a takeover bid, the Panel is able to declare unacceptable circumstances with respect to the public interest in relation to the affairs of a company, in addition to establishing orders to remedy those circumstances.[27]

2.31 The Panel is also able to review decisions made by ASIC[28] and maintains its operations with a rule making power.[29] The Panel's annual report states 'the Panel improves the certainty, efficiency and fairness of Australia's takeovers market.'[30]

2.32 As at 30 June 2013, the Panel had 48 members. Members are nominated by the Minister and appointed by the Governor-General. Members are chosen so that there is a mix of expertise, geographical representation and gender.[31]

Annual Report of the Takeovers Panel

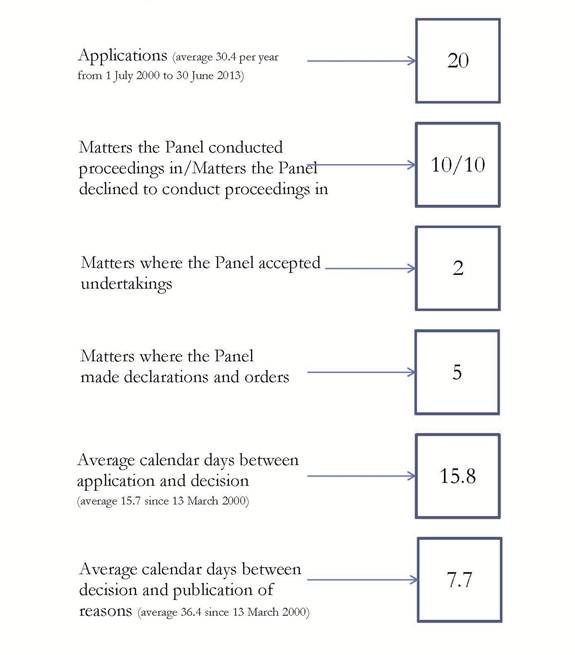

2.33 During the 2012–13 financial year the Takeovers Panel received 20 applications,[32] below the yearly average of 30 applications, though still greater than the 16 applications received in the previous year.[33]

2.34 As shown in Figure 2.3, the Takeovers Panel declined to conduct proceedings for 50 per cent of the applications it received. Over the previous decade the proportion of applications for which the Takeovers Panel declined to conduct proceedings has grown steadily from 6% in 2001 to 50% in 2013–14. In 2010 it was suggested that the trend:

...may indicate that in the early years of the ‘new’ Panel it was reluctant to dismiss an application without commencing proceedings. With experience, the Panel is now more willing to dismiss applications it considers lack merit.[34]

2.35 The committee will continue to monitor the trend in the proportion of application dismissed by the Takeover Panel.

2.36 Five declarations and orders were issued and undertakings were accepted for two matters. The Takeovers Panel conducted proceedings for three matters, however no unacceptable circumstances were found. There were no proceedings withdrawn in the 2012–13 year.[35]

Figure 2.3 The takeovers panel at a glance

Source: Takeovers Panel, Annual Report 2012–13, p. 5.

Figure 2.4 Issues dealt with by the Takeovers Panel in 2012–13

|

Issue

|

2012–13

|

|

Disclosure

|

6

|

|

Association

|

3

|

|

Lock-up devices[36]

|

3.5

|

|

Rights issues

|

2

|

|

Interpretation of contract in the context of a bid

|

2

|

|

Section 606 breach[37]

|

1.5

|

|

Other

|

2

|

|

Total

|

20

|

|

|

|

Source: Takeovers Panel, Annual Report 2012–13, Table: 'Issues in 2012–13', p. 21; Takeovers Panel, Annual Report 2012–13, p. 22.

Interaction with other bodies

2.37 The Panel was subject to one judicial review regarding The President's Club Limited. Proceedings were issued in September 2012 and heard by the Federal Court of Australia in July 2013. The decision has been reserved.[38] The Takeovers Panel did not use its rule making power,[39] nor were any matters referred from the court during the financial year.[40]

2.38 The Takeovers Panel maintains contact with the Australian Securities Exchange, the Australian Competition and Consumer Commission and with ASIC, with which the Panel has a Memorandum of Understanding.[41] The annual report notes the Panel may refer matters to ASIC that it considers ASIC should inquire into, as aspects of the application may present concerns under the Corporations Act. The Panel recommended two matters to ASIC in the 2012–13 period.[42] The report also states that the Panel was not the focus of any reports by the Australian National Audit Office (ANAO) in 2012–13.[43]

2.39 In November 2012, ASIC released a consultation paper proposing to update and consolidate its takeover regulatory guidance. The paper received seven submissions and in June 2013, ASIC made significant changes to regulatory guidelines to improve the existing body of takeovers policy.[44] The changes have allowed prompter correspondence to parties by removing the requirement of the Panel to provide reasons at the time of notification 'to not conduct proceedings'.[45] An amendment to the guidelines has also created greater efficiency by removing the requirement to create and retain transcripts of conferences thus enabling the use of electronic conferences.[46]

2.40 The annual report indicates a substantial reduction of time between a Panel decision and its publication of reasons. The average number of calendar days between a decision and the publication of reasons was 7.7 days for 2012–13, down from the average of 36.4 calendar days for over a decade.[47] The Panel has also maintained a consistent time frame of approximately 15 calendar days between receipt of application to decision since March 2000.[48]

2.41 The committee notes that during the year the Panel generated an index of past decisions for future guidance.[49] The annual report notes that:

The creation of the index reflects that, with more than 400 applications, the Panel has its own specialised quasi-jurisprudence, and the index will assist practitioners in understanding how the Panel applies legislation and policy to the facts of each case.[50]

Committee view

2.42 The committee considers that the Panel fulfilled its regulatory responsibilities during the 2012–13 financial year. However, the committee is not satisfied that the recommendation made by the Senate Economics Legislation Committee in its report tabled 14 March 2013 has been applied to this year's annual report:

...the Panel 'has adopted Treasury's policies and procedures in relation to the Commonwealth disability strategies' however, it would be useful to include a statement in the Panel's report as to what those policies entail.[51]

Recommendation 4

2.43 The committee recommends that the Takeovers Panel examine relevant Parliamentary committee reports and include appropriate discussion about the content of committee reports in the Panel's future annual reports.

Navigation: Previous Page | Contents | Next Page