Navigation: Previous Page | Contents | Next Page

Chapter 1

Introduction

1.1

On 29 November 2012, the House of Representatives referred the Superannuation

Legislation Amendment (Service Providers and Other Governance Measures) Bill

2012 to the committee for inquiry and report. The committee resolved to table

its report by 5 February 2013.

1.2

The bill is the fourth tranche of legislation implementing the MySuper

and governance elements of the Stronger Super reforms. This inquiry continues

the committee's scrutiny of the legislation that will give effect to these

reforms; the earlier tranches of legislation have been the subject of previous

inquiries by this committee, and readers can view those reports on the

committee's website. The earlier tranches are referred to throughout this

report, and for reference are listed below:

- Superannuation Legislation Amendment (MySuper Core Provisions)

Act 2012 (Core Provisions Act);

- Superannuation Legislation Amendment (Trustee Obligations and

Prudential Standards) Act 2012 (Trustee Obligations Act); and

- Superannuation Legislation Amendment (Further MySuper and

Transparency Measures) Act 2012 (Further MySuper Act).

1.3

Included in this bill are a range of distinct and unrelated measures

that form part of the MySuper and governance reforms but which were not

addressed by the earlier legislation. The bill includes proposed amendments

that would:

- implement certain recommendations of the 2010 final report of the

review into the governance, efficiency, structure and operation of Australia's

superannuation system (also referred to as the Super System Review or the

Cooper Review);

- address concerns raised by the superannuation sector about how some

aspects of the earlier tranches will operate; and

- make consequential amendments to ensure the effective operation

of the first three tranches of legislation.

1.4

Specifically, this latest bill proposes to amend the Superannuation

Industry (Supervision) Act 1993 (SIS Act), the Corporations Act 2001 and

other Acts to:

- override any provisions in a fund's governing rules that require

the trustee to use a specified service provider, investment entity or financial

product;

- provide the Australian Prudential Regulation Authority (APRA)

with the power to issue infringement notices for certain breaches of the SIS

Act;

- require persons to seek leave of the court before bringing action

against an individual director for a breach of their duties;

- extend legal defences available for trustees and directors to

proceedings involving breaches of MySuper obligations;

- amend existing defences related to the making of an investment or

the management of reserves;

- require trustees to provide reasons for decisions made in

relation to a complaint;

- increase the time limit for members to lodge complaints with the

Superannuation Complaints Tribunal;

- apply the Corporations Act's requirements for adequate resources

and risk management systems to dual regulated entities;

- provide that directors of corporate and individual trustees are

only prohibited from voting on any company business in limited circumstances;

and

- introduce other measures and make consequential amendments.

Conduct of the inquiry

1.5

The committee advertised the inquiry on its website and in The

Australian, inviting submissions from interested parties by 17 January

2013. The committee also wrote directly to stakeholders to invite submissions.

In total, ten submissions were received. Details about these submissions can be

found in Appendix 1.

1.6

The committee held a public hearing in Melbourne on 22 January 2013. It

received evidence from representative bodies for the superannuation and

financial services sectors, a representative of superannuation law

practitioners, and the relevant government department—the Australian Treasury. Further

details about this hearing can be found in Appendix 2.

1.7

The committee thanks the organisations that made submissions and the witnesses

who gave evidence at the public hearing in Melbourne. Given the short period of

time between the hearing and the reporting date, the committee would also like

to express its appreciation to the witnesses that provided prompt answers to

questions on notice.

Structure of the report

1.8

This report is comprised of four chapters. The remainder of this chapter

provides some brief details about the Stronger Super reforms with a particular

focus on the nature of and rationale behind the MySuper product. Chapter 2

examines the amendments related to legal actions brought against directors, the

legal defences available and the requirements for processing and considering

certain claims and complaints. Chapter 3 considers the proposed infringement

notice scheme. Chapter 4 examines the remaining amendments, including the

service provider measures and the proposed dual regulated entities requirements.

A discussion of other matters that were raised during the inquiry and the

committee's overall assessment of the bill can also be found in chapter 4.

Background to the Stronger Super reforms[1]

1.9

The Stronger Super reform package was initiated in response to the 2010

report of the Cooper Review. The review panel was tasked with developing

options to improve the regulation of the superannuation system, to promote the

best interests of members and maximise retirement incomes for Australians,

while reducing business costs.[2]

One of the main recommendations of the Cooper Review was that a simple, low

cost, default superannuation

product called 'MySuper' be introduced.

1.10

On 16

December 2010, the government formally responded to the Cooper Review by

releasing 'Stronger Super'.[3]

The Stronger Super reforms aim to:

- introduce MySuper;

- make the

processing of everyday transactions easier, cheaper and faster, through the

'SuperStream' package of measures; and

- strengthen

the governance, integrity and regulatory settings of the superannuation system,

including in relation to self‑managed superannuation funds.[4]

1.11

From 1 July 2013, superannuation funds will be able to offer MySuper.

This product is intended to improve the simplicity, transparency and

comparability of default superannuation products.[5]

From 1 October 2013, employers must make contributions for employees who have

not made a choice of fund to a fund that offers a MySuper product in order to

satisfy superannuation guarantee requirements.[6]

1.12

The following statements by the Minister for Financial Services and

Superannuation and a senior Treasury officer help explain the government's

reasoning behind introducing MySuper and the principles that informed its

design:

... around

60 per cent of Australians do not make active choices in relation to their

superannuation. And this government believes that Australians should not be

charged for valet parking when they are catching the train ... Having

created an industry which flourishes on the back of compulsory savings mandated

by legislation, it is fair that this industry, which benefits so much from the

compulsory saving system in Australia, contributes to higher retirement savings

through greater efficiency and lower fees.[7]

* * *

... a

key driving principle behind MySuper is that, for those people who do not

actively choose an option for their superannuation savings, we want public

policy to mandate a default option with carefully designed features that we

judge will promote the wellbeing of those who use this option.

Crucially,

this mandated default option is not imposed on anyone. Freedom of choice is a

central feature of the choice architecture model that underpins the MySuper

proposal. Actively engaged people can choose a MySuper default option, or they

can choose from a potentially wide array of alternative 'choice' options.

The

evidence is that around 80 per cent of members of superannuation funds in

Australia are invested in the default option in a super fund chosen by their

employer or an award. Of that 80 per cent, anecdotal evidence suggests around

20 per cent explicitly choose the default option, with the rest making no

active choice.

... The

idea is not to have a centrally determined option for everybody; nor is it

laissez faire. While the system compels people to save into super through the

Super Guarantee, the Cooper Review's proposed choice architecture means that

people are able to choose between the default option (which must be a MySuper

product), or opt for a saving plan with greater choice but greater responsibility.[8]

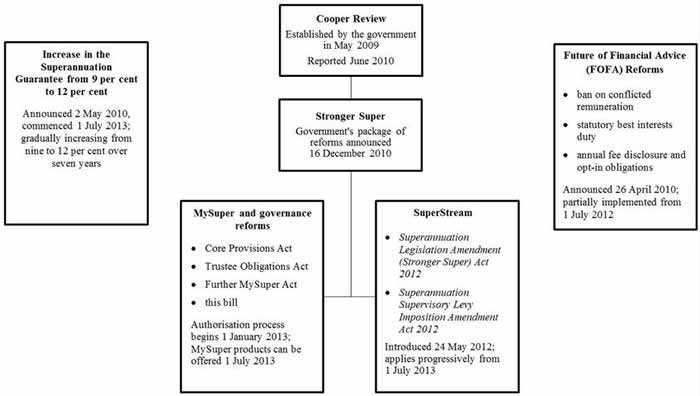

Figure 1.1: Recent reforms to Australia's

superannuation system

Navigation: Previous Page | Contents | Next Page

Top

|