|

Navigation: Previous Page | Contents | Next Page

The Superannuation Legislation Amendment (Reform of Self Managed

Superannuation Funds Supervisory Levy Arrangements) Bill 2013

Introduction

1.1

On 14 February 2013, the House of Representatives Selection Committee referred

the Superannuation Legislation Amendment (Reform of Self Managed Superannuation

Funds Supervisory Levy Arrangements) Bill 2013 to the Parliamentary Joint

Committee on Corporations and Financial Services (the committee) for inquiry

and report.

1.2

The bill proposes to amend the Superannuation (Self Managed

Superannuation Funds) Supervisory Levy Imposition Act 1991 (Imposition Act)

and the Superannuation (Self Managed Superannuation Funds) Taxation Act 1987

(Taxation Act) to:

- increase the maximum supervisory levy payable by self managed

superannuation funds (SMSFs) from $200 to $300 (the specific amount of the levy

for a given income year is prescribed in the regulations—the government has

indicated that the actual levy will increase from $191 to $259 per annum from

the 2013–14 income year);[1]

and

- bring forward payment of the SMSF supervisory levy so that it is

levied and collected in the year of income that the supervision relates to.

1.3

These measures were announced by the government on 22 October 2012 in

the 2012–13 Mid-Year Economic and Fiscal Outlook.[2]

Conduct of the inquiry

1.4

The committee advertised the inquiry on its website inviting submissions

from interested parties by 1 March 2013. The committee also wrote directly to

stakeholders to invite submissions. In total, five submissions were received.

Details about these submissions can be found in Appendix 1.

1.5

The committee conducted a public hearing on 14 March 2013. A list of

witnesses can be found in Appendix 2.

1.6

The committee thanks the organisations that provided evidence to this inquiry.

Overview of the SMSF levy

1.7

An SMSF is a private superannuation fund with one to four members and where

the members of the fund are also the trustees. As at June 2012, there were over

478,000 SMSFs in Australia. As Table 1 shows, the number of SMSFs has increased

significantly over the past nine years. With assets of $439 billion as at June

2012 (representing more than 31 per cent of Australia's total superannuation

savings of $1.4 trillion), by this measure SMSFs are the largest segment

of the superannuation sector.[3]

Table 1: Number of SMSFs, June 2004 to June

2012

|

Date

|

Number of SMSFs

|

% change in number from previous year

|

Total assets of SMSFs ($ billion)

|

SMSF assets as a % of total superannuation assets

|

|

June 2004

|

271,515

|

–

|

127.5

|

20.1%

|

|

June 2005

|

289,512

|

6.63%

|

160.8

|

21.4%

|

|

June 2006

|

309,088

|

6.76%

|

203.2

|

22.5%

|

|

June 2007

|

350,142

|

13.28%

|

312.2

|

26.6%

|

|

June 2008

|

375,738

|

7.31%

|

321.4

|

28.4%

|

|

June 2009

|

399,742

|

6.39%

|

326.2

|

30.6%

|

|

June 2010

|

414,956

|

3.81%

|

366.2

|

30.6%

|

|

June 2011

|

442,987

|

6.76%

|

423.2

|

31.3%

|

|

June 2012

|

478,263

|

7.96%

|

439.0

|

31.3%

|

Source:

Based on Australian Taxation Office, 'Self-managed super fund statistical

report—June 2012', 12 July 2012, www.ato.gov.au/superfunds/content.aspx?menuid=0&doc=/content/00332225.htm&page=6 (accessed 18 February 2013); Australian Prudential

Regulation Authority, Annual superannuation bulletin, June 2012 (issued

9 January 2013), p. 40.

1.8

While other superannuation funds, such as corporate, industry and retail

funds, are regulated by the Australian Prudential Regulation Authority (APRA),

SMSFs are regulated by the Australian Taxation Office (ATO). However, all

superannuation funds are subject to a supervisory levy intended 'to fund the

regulatory costs of ensuring funds comply with the superannuation legislation'.[4]

This principle was reinforced by the recommendations of the 1997 Financial

System Inquiry chaired by Mr Stan Wallis (the Wallis Inquiry), which observed

that:

For reasons of equity and efficiency, as a general principle

the costs of financial regulation should be borne by those who benefit from it.

This principle must, however, be applied in a practical way.[5]

1.9

The Wallis Inquiry recommended that regulatory agencies should, through

a mix of direct service fees and annual levies, collect from the financial

entities which they regulate 'enough revenue to fund themselves, but not more'.[6]

1.10

A fee or supervisory levy has been imposed on small superannuation funds

since 1987.[7]

The levy relevant to SMSFs is imposed by the Imposition Act and the entities

that are liable to pay the levy are determined by the Taxation Act. The

Imposition Act sets a maximum SMSF supervisory levy that may be imposed and the

Superannuation (Self Managed Superannuation Funds) Supervisory Levy Imposition

Regulations 1991 (Imposition Regulations) determines the specific amount of the

levy payable for a particular income year within that cap. At present, the

Imposition Act restricts the amount that may be prescribed by the regulations to

$200.[8]

The Imposition Regulations currently provide that the amount of the levy is $200

for the 2011–12 income year and $191 for subsequent income years.[9]

Provisions of the bill

1.11

The bill proposes to amend the Imposition Act to increase the maximum

supervisory levy payable by SMSFs from $200 to $300 for the 2013–14 income year

onwards. During the ministerial second reading speech on the bill, the

Parliamentary Secretary to the Treasurer indicated that the government will

amend the Imposition Regulations to prescribe an actual levy of $259.[10]

1.12

The bill also proposes to change when the payment of the levy is due. Currently,

a trustee of an SMSF is liable to pay the levy when lodging the fund's annual

return.[11]

The due date of the payment occurs on a day specified in the Superannuation

(Self Managed Superannuation Funds) Taxation Regulations 1999 (Taxation

Regulations).[12]

Therefore, the payment of the supervisory levy for an income year occurs after

the year of income that has been supervised. The bill proposes to amend the

Imposition and Taxation Acts so that the SMSF levy can be levied and collected in

the same year of income. To facilitate this:

- proposed new section 15DA of the Taxation Act would provide that

a trustee of a superannuation entity which is an SMSF at any time during an

income year is liable to pay the levy;[13]

and

- a proposed amendment to section 6 of the Imposition Act would

remove the reference to the amount of the levy being 'payable on the lodgment

of a return'.[14]

1.13

The day that the payment will be due will remain specified in the

Taxation Regulations.

Transitional arrangements

1.14

While the amendments will apply to the 2013–14 income year onwards, the

bill proposes that the regulations may provide a phase‑in arrangement for

the levy payable in 2013–14. The government has announced that, 'to give SMSFs

time to adjust', the SMSF levy will indeed be phased in over 2013–14 and

2014–15, as follows:

-

in 2013–14 SMSFs will be required to pay the 2012–13 levy and half

of the 2013–14 levy (a total of $321);

- in 2014–15 SMSFs will be required to pay the remaining half of

the 2013–14 levy and the 2014–15 levy (a total of $388); and

-

from 2015–16 SMSFs will pay the levy during each income year (a

total of $259 per annum).[15]

Rationale for the changes

1.15

The government argues that the current levy 'does not fully recover the

ATO's cost of supervising this rapidly growing and diverse sector'.[16]

The ATO also has stated that the revenue from the SMSF levy is not fully

recovering the costs of regulating the sector and suggests that the proposed

increase will enable it 'to continue to regulate this rapidly growing and

diverse sector effectively'.[17]

1.16

The change to the timing of the levy payment is intended to ensure

consistency with the levy that applies to APRA-regulated superannuation funds,

which pay their levy in the same financial year that the levy applies to. The

government considers that this framework 'is appropriate for a cost recovery

levy'.[18]

Previous changes to the SMSF supervisory

levy

1.17

Table 2 outlines the previous changes to the amount of the SMSF

supervisory levy. The significant change to the levy in 1999–00 occurred as the

responsibility for regulating SMSFs was transferred from APRA to the ATO, and

was a response to earlier industry concern that the levy was being used to

subsidise the regulatory activities required for large funds.[19]

Ensuring that the SMSF supervisory levy was a genuine cost-recovery levy

continued to influence subsequent adjustments. In September 2006, as part of

the then government's Simplified Superannuation reforms, it was announced that

the levy would be increased to $150. The change was in recognition that the

levy had not increased since 1999, and that it no longer covered the ATO's

costs.[20]

The findings of a 2007 report by the Australian National Audit Office (ANAO)

support this reasoning; as Figure 1 shows, for most of the period that the ANAO

reviewed the estimated levy collections were less than both the funding

provided to the ATO for regulating SMSFs and the ATO's actual expenditure.[21]

Table 2:

SMSF levy applicable to various years of income

|

Income years

|

Amount of SMSF levy

|

|

1992–93

to 1998–99

|

$200

|

|

1999–00

to 2006–07

|

$45

|

|

2007–08

to 2009–10

|

$150

|

|

2010–11

|

$180

|

|

2011–12

|

$200

|

|

2012–13

onwards

|

$191

|

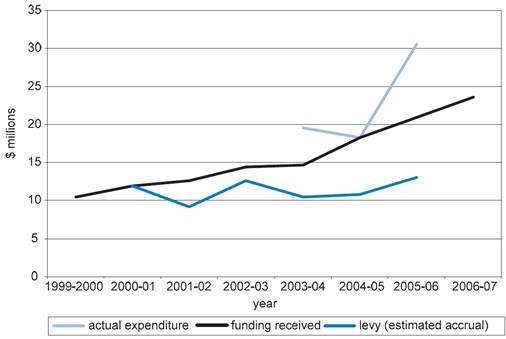

Figure 1: ATO SMSF-related funding, expenditure and SMSF levy

collections from 1999–2000 to 2006–07

Source: Australian National

Audit Office, The Australian Taxation Office's Approach to Regulating and

Registering Self Managed Superannuation Funds, Audit Report no. 52 2006–07,

June 2007, p. 66.

Notes: Data for ATO

expenditure on SMSF regulation between 1999–00 and 2002–03 are unavailable as

the ATO did not have adequate systems in place to record such expenditure.

1.18

The further changes to the levy made in 2011 and 2012 were intended to

offset the costs associated with the implementation of reforms to the SMSF

sector that form part of the government's Stronger Super package.[22]

Revenue implications

1.19

Combined with the continued growth in both the number of SMSFs and the

value of assets managed by the sector (as Table 1 shows, total assets increased

from less than $130 billion to almost $440 billion between 2003–04 and 2011–12)

the changes to the levy made from 2007–08 onwards have significantly increased

the revenue collected (see Table 3).

Table 3: Net SMSF levy collected, 2002–03 to 2011–12 ($

millions)

|

|

2002–03

|

2003–04

|

2004–05

|

2005–06

|

2006–07

|

2007–08

|

2008–09

|

2009–10

|

2010–11

|

2011–12

|

|

SMSF levy

|

13

|

9

|

13

|

13

|

11

|

19

|

41

|

51

|

87

|

70

|

Source:

Australian Taxation Office, Commissioner of Taxation Annual report 2011–12,

October 2012, p. 54.

1.20

The measures contained in the bill are expected to add around $319

million in net revenue over the forward estimates (see Table 4). These figures

reflect both the proposed increase in the levy and the proposed change to the

timing of levy payments. The spike in additional revenue projected for 2014–15

is due to the bill's transitional arrangements (see paragraph 1.14).

Table 4: Financial impact of the proposed changes

($ million)

|

|

2012–13

|

2013–14

|

2014–15

|

2015–16

|

|

Revenue

|

–

|

70.0

|

164.0

|

88.0

|

|

Related expense

|

0.6

|

1.3

|

0.8

|

0.5

|

Source:

Explanatory memorandum, p. 3.

1.21

The projected changes to revenue were questioned by the committee. The

ATO noted that the projections would be affected by cash flow issues. The

committee has requested further information about these projections.[23]

Submitters' views

1.22

The Australian Institute of Superannuation Trustees (AIST), which

represents the trustee directors and staff of industry, corporate and

public-sector superannuation funds, expressed its support for reform of the

supervisory levy. The AIST supports the amendments on the basis that they will

provide for appropriate recovery of the ATO's costs, including helping to

offset the cost associated with the SMSF Stronger Super reforms. However, in

its submission the AIST also argued that SMSFs will benefit from the

SuperStream reforms and, accordingly, should contribute to the funding of these

reforms. The AIST suggested that the cost attributable to SMSFs from the

SuperStream reforms would be approximately $146 million, or $311 per SMSF. The

AIST noted that it had previously put this argument to APRA.[24]

1.23

The Association of Superannuation Funds of Australia (ASFA) similarly

supported the principle that supervisory costs incurred by the ATO which are

directly related to SMSFs should be recovered from SMSFs. ASFA, however, called

for greater disclosure by the ATO of the amount collected and the costs

incurred.[25]

1.24

The Self Managed Superannuation Funds Professionals' Association of

Australia (SPAA) also argued that there is a need for greater disclosure of the

ATO's costs. SPAA argued that the need for the current SMSF levy cap to be

increased had not been sufficiently justified. Accordingly, it does not support

the proposed increase without 'a commitment from the ATO to consult with the

SMSF industry and justify future increases in the levy as part of the ATO's

cost recovery for administering SMSFs'.[26]

SPAA also suggested that, as a result of the proposed change in the timing of

the collection of the SMSF levy, it was not clear whether the levy would still

be collected through the annual SMSF tax return.[27]

Evidence from the ATO

1.25

The issues raised by stakeholders were put to the ATO at the committee's

public hearing. First, the ATO addressed SPAA's concern that the current

arrangements for collecting the levy through the annual return may be changed

to a separate invoicing process. The ATO's Deputy Commissioner, Superannuation,

stated that there is 'no intention to change the process that we have now,

which is that [collection of the levy] would be done through the tax return':

There is not a proposal at all to pull that out and invoice

separately or anything like that, it will just be as part of the tax return.[28]

1.26

The ATO also advised that it intends to prepare a cost recovery impact

statement prior to the measures taking effect on 1 July 2013, which will

include 'all the detail which we believe

that the SMSF Professionals' Association and others should be seeking and are

entitled to have'. An ATO officer explained:

What we will do is expose the costs of progressing with the

work on administering self-managed super funds and we will show the methodology

for projecting forward. In terms of the methodology for projecting forward,

what we have done, effectively, is take 2011–12 as a base year and apply to

that a couple of variations. The first is growth in the level of self-managed

super funds, and you heard Mrs Slattery [of SPAA] say that they are growing at

a rate of about 30,000 funds a year at the present time, which is fairly

substantial. We and SPAA are quite proud of the level of growth in the

industry. That represents the growth year-on-year over the past several years

of about six to eight per cent. On a go-forward basis, we are projecting five

to 5½ per cent. Our sense is that you have to have a discipline of expecting

some efficiency in the work you do so we are projecting at a lower level than

we actually expect the growth to be ... We have also factored in the

cost of pay rises [for ATO staff].[29]

1.27

The ATO also confirmed that it has released some information about the

costs it incurs from supervising SMSFs during its regular meetings with

stakeholders, and confirmed that its costs for 2011–12 were $85.2 million.[30]

However, an ATO officer noted that levy revenue and the ATO's costs are 'not

meant to balance year-on-year'. The ATO officer explained:

What it is seeking to do is get a balanced picture across a

five-year period, which is the normal period of review for cost-recovery

arrangements in line with government guidelines.[31]

Committee view

1.28

Provided that doing so is cost effective, efficient and consistent with

other policy objectives, governments should recover the costs associated with regulation

through a dedicated charge imposed on the entities that are actually regulated,

as this will result in an outcome that is superior to the alternative option of

such regulation being financed through general taxpayer funding. This principle

is expressed in the Australian Government Cost Recovery Guidelines,

a document applied by successive recent governments.

1.29

The measures contained in the bill are supported by the committee.

Requiring payment of the SMSF supervisory levy in the year that the supervision

relates to, rather than in a subsequent year, is a logical change that is

consistent with the treatment of APRA‑regulated funds. Given that the

supervisory levy is a cost recovery charge, it is also appropriate that the

levy be reviewed periodically and adjusted upwards when full cost recovery is

not occurring.

1.30

The committee acknowledges the calls from industry bodies for greater

transparency of the actual costs incurred by the ATO in regulating the SMSF

sector. However, the committee notes that the ATO does provide at SMSF

consultation meetings high level information about these costs. The ATO has

also advised that it will prepare and publish a cost recovery impact statement

prior to the commencement of the levy increase on 1 July 2013. Nonetheless, provided

that it would not cause an unreasonable diversion of the ATO's resources and

that the information can be presented in a timely and meaningful way, the

committee considers that the ATO should release information on a regular and

publicly accessible basis about the costs that it incurs as a result of its

SMSF regulation functions.

Recommendation 1

1.31

The committee recommends that the bill be passed.

Ms Deborah

O'Neill MP

Chair

Navigation: Previous Page | Contents | Next Page

Top

|