|

Navigation: Previous Page | Contents | Next Page

Chapter 5

Introduction of caps and new regulations for certain kinds of credit

contracts

5.1

Schedules 3 and 4 of the Enhancements Bill propose significant

modifications to the lending requirements for small amount credit contracts,

also known as 'pay-day loans'. These include restrictions on the number of

contracts that a borrower may simultaneously hold, and caps on fees and

charges.

5.2

The proposed reforms to the short-term lending industry generated substantial

comment. The majority of evidence provided through submissions and at the

hearing on 24 October 2011 focused on the short-term loan reforms. Evidence

presented was on the whole extremely detailed, with individuals and organisations

across the spectrum of views presenting in-depth information that included case

studies, pro‑forma short-term credit contracts, research reports, and

projections of business costs.

5.3

This chapter is divided into five parts:

- overview of the proposed reforms (paragraphs 5.4–5.31)

- features of the short-term loan industry (paragraphs 5.32–5.46)

- consumer profile – financial circumstances of short-term loan

borrowers

(paragraphs 5.47–5.81)

- the case for the short-term loan reforms (paragraphs 5.82–5.134)

-

industry concerns with the short-term loan provisions (paragraphs

5.135–5.203)

- other sources of short-term credit contracts (5.204–5.219), and

- committee view (5.219–5.245).

Overview of the proposed reforms

5.4

As noted in chapter one, COAG identified the regulation of short-term

lending as a matter requiring consideration under phase two of the consumer

credit reforms.[1]

Options for a new approach to short-term lending were subsequently outlined in

Treasury's 2010 Green Paper.[2]

Further background to the reforms is provided in the Regulation Impact

Statement included at chapter 11 of the Explanatory Memorandum for the

Enhancements Bill:

One of the issues identified during the course of Phase One

of the National Consumer Credit Protection reforms was the approach to be taken

to short term, small amount lending [...]

It was agreed that during Phase Two of the reforms, the need

for Commonwealth intervention in relation to the cost of short term lending

would be considered. As part of this, an examination would be undertaken of the

role of interest rate caps. In the meantime those States and Territories who

had interest rate caps would retain them.[3]

5.5

The statement also outlines the policy objectives underlying the reform

proposals:

The objectives of government action are to:

- assist consumers to have a greater degree of social and financial

inclusion; and

- mitigate the particular risks associated with short term credit

(and to do so in a way that minimises the risk of avoidance).[4]

5.6

It was apparent that an assumption underlying the measures in Schedules

3 and 4 is the vulnerability of consumers who access short-term loans. As

stated in the media release accompanying the Exposure Draft legislation:

People desperate for a small loan to replace a broken household

appliance or to tide them over until their next pay packet will have more

protection from inappropriate lending practices...

"For some people, taking out a payday loan might seem

like the only answer – but more debt at ridiculously high cost can create more

problems than it solves" Mr Shorten said.[5]

5.7

The Second Reading Speech indicates the reforms are intended to balance

consumer protection with industry stability:

...government strongly believes that short-term loans do have

a role in the Australian economy and should be a part of everyday life, but we

are also focussed on protecting vulnerable consumers, not terminating the

payday lending industry. We do believe it is time that the interests of

consumers are improved.[6]

5.8

Paragraphs 5.10–5.34 provide an overview of the measures proposed in

Schedules 3 and 4.

Schedule 3

5.9

Schedule 3 contains several measures intended to increase protections

for borrowers who enter into 'small amount credit contracts'. The measures

would commence 1 July 2012.[7]

5.10

‘Small amount credit contracts’ would be defined as contracts for less

than $2,000 over less than two years. However, such a contract would not be a

small amount credit contract if it is a continuing contract, a contract

provided by an ADI or a contract secured by a mortgage.[8]

5.11

The following measures are proposed:

- requirements to provide web-based disclosure statements

- prohibition on multiple concurrent contracts

- prohibition on refinancing contracts, and

- prohibition on increasing credit under existing contracts.

Web-based disclosure statements

5.12

Credit providers with websites offering access to small amount credit

contracts would be required to ensure the website complies with ‘the

requirements prescribed by the regulations’.[9]

Failure to do so would be an offence carrying a maximum penalty of 50 penalty

units and would also attract a civil penalty of 2,000 penalty units.[10]

5.13

Credit providers would also be required to ensure that, if their

websites can be used by a consumer to apply for, or make an inquiry about, a

small amount credit contract, the websites ‘complies with the requirements

prescribed by the regulations’. Failure to do so would be an offence carrying a

maximum penalty of 50 penalty units and would also attract a civil penalty of

2,000 penalty units.[11]

5.14

The Explanatory Memorandum provides detail of the unspecified

‘prescribed requirements’. It is intended that the regulations would require

the websites to include ‘a short high-impact statement disclosing the

availability of sources of assistance...and alternative and cheaper sources of

credit.’[12]

Prohibition on multiple concurrent

contracts and on refinancing contracts

5.15

Credit providers would be prohibited from suggesting, offering,

arranging or providing concurrent small amount credit contracts. Were a credit

providers to do so, the credit provider would commit two offences both with a

maximum penalty of 50 penalty units and would also be subject to two civil

penalties of 2,000 penalty units.[13]

5.16

This would have the effect of restricting consumers from entering into

more than one small amount credit contract at a time.

5.17

Credit providers would also be prohibited from entering into, or

offering, a small amount credit contract where some or all of the contract

would be used to refinance an existing small amount credit contract. Were a credit

provider to do so, the credit provider would committee an offence with a

maximum penalty of 50 penalty units and would also be subject to a civil

penalty of 2,000 penalty units.[14]

According to the Explanatory Memorandum, the restriction would apply regardless

of whether the original small amount credit contract was with the same credit

provider.[15]

Prohibition on increasing credit

under existing contracts

5.18

Credit providers would also be prohibited from increasing, or suggesting

an increase to, the credit limit of existing small amount credit contracts.

Were a credit provider to do so, the credit provider would be liable to two

offences each with a maximum penalty of 50 penalty units and would also be

subject to two civil penalties of 2,000 penalty units.[16]

Remedies available to credit

borrowers

5.19

The Enhancements Bill would extend section 180 of the NCCP Act to apply

where a credit provider has breached one or more of the above prohibitions.[17]

Section 180 of the NCCP Act authorises a court to make orders in relation

to ‘unlawful credit activities’, to prevent the credit provider from profiting

from the unlawful activity, or to compensate the borrower for loss, or to

prevent or to reduce the loss or damage suffered or likely to be suffered. Such

orders may include orders refusing to enforce the terms of the small amount

credit contract and orders that the credit provider refund money or return

property to the borrower. A court may make orders under section 180 on the

application of the borrower or the Australian Securities and Investments

Commission (ASIC), where the application is made within six years of the

conduct occurring.

Schedule 4

5.20

Schedule 4 would introduce caps on the charges that may be imposed on

borrowers under small amount credit contracts, and caps on the costs under

certain other credit contracts. The caps would commence on 1 January 2013.[18]

5.21

A ‘credit contract’ is defined in section 5 of the NCCP Act as ‘a contract

under which credit is or may be provided’. Credit contracts therefore would

include small amount credit contracts. However, it is proposed that the cap

would differ between small amount credit contracts and other credit contracts.

Cap on small amount credit

contracts

5.22

For small amount credit contracts, the following would be the maximum

costs that could be charged:[19]

- an establishment fee not exceeding 10 per cent of the amount of

credit the borrower receives

- monthly fees of two per cent of the amount of credit the borrower

receives

- any government fees, charges or duties payable in relation to the

contract; and

- a fee payable in the event of default, not exceeding twice the

adjusted credit amount and any enforcement expenses.[20]

5.23

Under the proposal, a small amount credit contract could not include

interest charges. Interest charges and fees in excess of the permissible amounts

would be void. Monies paid under the void provisions would be a debt due to the

borrower.[21]

5.24

A credit provider would commit an offence if entering into, or seeking

payment under, a small amount credit contract that breaches the above

conditions. The offence would be a strict liability offence with a maximum

penalty of 100 penalty units.[22]

A person would also commit an offence with a maximum penalty of 50 penalty

units if suggesting or assisting a person to enter into a small amount credit

contract with a particular credit provider knowing; or being reckless as to

whether, the contract contains prohibited fees and charges.[23]

Cap on all other credit contracts –

the ‘48% cap’

5.25

For credit contracts that are not short-term small amount credit contracts,

bridging finance contracts or contracts provided by an ADI, it proposed to

introduce a cap on the 'annual credit cost rate'. A credit provider would commit

an offence, with a maximum penalty of 50 penalty units, if entering into a

contract with an annual credit cost rate exceeding 48 per cent. The Enhancements

Bill would prescribe a formula for calculating the annual credit cost rate. The

formula allows for matters to be prescribed by regulations.[24] The

Explanatory Memorandum states that this would allow the Government to address

attempts by credit providers to circumvent the cap through charging borrowers

additional amounts that do not fit within the definition of ‘costs’ but none

the less result in credit providers receiving more than a 48 per cent return on

the credit contract.[25]

5.26

The Explanatory Memorandum states that the formula is derived from the

New South Wales model, modified to address avoidance practices that have arisen

in response to the cap. As outlined in the Explanatory Memorandum, consumer

credit legislation in the Australian Capital Territory, New South Wales and

Queensland applies a 48 per cent cap that includes interest, fees and charges.

Victoria reportedly applies a 48 per cent cap, although this does not apply to

fees and charges. Caps are not in place in the Northern Territory, South Australia,

Tasmania or Western Australia.[26]

Consultation on further amendments

5.27

Treasury released for consultation a late amendment, subsection 32A(2),

to the Bill on 14 September 2011, after the Bill had been introduced in the

House of Representatives. The amendment was sent to members of Treasury's

Credit Consultation Group, with a short time frame to respond. Treasury stated

that the amendment was originally included in the Exposure Draft of the Bill.

5.28

The provision in question is subsection 32A(2):

32A Credit provider must not enter into a credit contract if the annual cost rate

exceeds 48%

(1) A credit provider must not enter into a

credit contract (other than a small amount credit contract) if the annual cost

rate of the contract exceeds 48%. Criminal

penalty: 50 penalty units.

(2) A person must not be a credit provider

under a credit contract (other than a small amount credit contract) if the

annual cost rate of the contract exceeds 48% at any time. Criminal penalty: 50 penalty units.[27]

5.29

The purpose as argued by Treasury is to:

[A]ddress potential techniques

for avoiding the annual cost rate, including:

- the imposition, under the credit contract, of relatively high

contingent fees that were in practice usually payable (particularly a deferred

establishment fee);

- varying the interest rate or increasing fees and charges to

exceed the 48% cap once the credit contract has been entered into; and

- the use of continuing credit contracts where costs were imposed

in a way that differed from the assumptions specified in relation to this class

of contracts.[28]

5.30

Treasury goes on to explain that:

- The formula used to calculate the annual cost rate averages the

cost of the term of the contract, and therefore the impact of a new fee or

charge will not usually be significant in itself.

- The formula allows a credit provider to determine the maximum

amount they can charge before the contract is entered into, and therefore to

ascertain a relative buffer of additional costs that they can charge.

- The impact of an individual fee or charge will be significant

where the fee is relatively large compared to the amount of credit being

provided (particularly therefore where the credit provider is arranging a

credit contract for a relatively small amount).

5.31

Treasury then canvasses four options in relation to implementation of

the amendment. These options are not considered in this report.

Features of the short-term loan industry

5.32

The committee understands that the short-term loan industry in Australia

commenced in the late 1990s, in response to ADIs withdrawing from the

short-term, small amount loans market.[29]

The Queensland University of Technology's March 2011 report into the industry

commented on the lack of statistical evidence regarding industry size. However,

the report notes industry estimates that there are 'approximately 500 000

active clients' and 'around 400 lenders nationwide.'[30]

Data forwarded by the National Financial Services Federation also provided an

indication of the size of the short-term lending industry. The committee was

advised that the Federation 'represents almost 300 ASIC licensed, small amount,

short-term credit providers who arrange more than $800 million of loans to over

500 000 consumers each year.'[31]

5.33

Evidence before the committee indicated that the industry is comprised

of lenders across the spectrum from small business operators to publicly listed

companies with substantial market share. As noted in the Queensland University

of Technology's report, the largest providers of short-term loans in Australia

are Cash Converters, Cash Stop and The Cash Store.[32]

The committee heard that Cash Converters issues in excess of 625 000 short-term

loans per year, with the total value of loans exceeding $250 million.[33]

The committee was also informed that the provider 'will lend a new customer a

maximum of 10 per cent of net income.'[34]

While not providing details of loan volume, The Cash Store informed the

committee that it operates 82 branches Australia-wide.[35]

Both companies are publicly listed.[36]

5.34

The committee also heard evidence of the turnover of short-term loan

providers with smaller market share. Money 3, also a publicly listed company,

advised that it provides a mixture of secured and unsecured loans that range

from $100 to $20 000 over a maximum 36 month period, for 25 000 consumers. For

the 2010-11 financial year the provider reportedly earned a net profit of $2.4

million.[37]

Can Do Credit Pty Ltd stated that it provides approximately 600 loans per year

to 600 customers. Self-identifying as a 'micro-lender', the provider reported

that the loans are, on average, for '$1000 for a period of 52 weeks'.[38]

The committee also heard evidence from several small businesses, including

Action Cash, Fundco, Action Finance and Moneyplus. Action Cash, a franchise

of 'nine "Mum and Dad" small business owners', reportedly provides

loans to 3000 consumers.[39]

Moneyplus reported issuing loans of $100 to $6000 with lending periods over one

to two years. For the 2010-11 financial year, Moneyplus reportedly issued loans

to 25 000 consumers. Moneyplus self-identified as a 'family business'.[40]

Emerging market – web-based

providers of credit

5.35

Evidence before the committee also indicated that there is a growing

web-based segment of the short-term loan industry. Web-based providers that

contributed to the inquiry included First Stop Money, Dollars Direct and the

Cash Doctors. First Stop Money advised that the company, founded in 2009,

conducted 300 000 loan transactions in the past 12 months. The committee was

informed that First Stop Money caps the repayments owed to 'a maximum...of 200%

of principal lent including any default fees and charges'.[41]

The committee was also informed that First Stop Money:

...will cap our instalment amount at a maximum of 30 per cent

of their income, minus all their other fixed outgoings—other loans, rent,

mortgage, bills. When we are working it out we will take into account the

instalment amount, which obviously includes fees and charges.[42]

5.36

The committee was further advised that, having assessed the applicant's

financial circumstances, First Stop Money refuses nine out of every ten

applications,[43]

and limits the availability of loan refinancing:

...we have restricted refinancing unless over 50% of the

principal has been repaid and we have for some time now provided a cooling off

period for all loans.[44]

5.37

Mr Daniel Shteyn, Managing Director, Dollars Direct, advised that the

multi–national online provider has issued approximately 50 000 short-term loans

to consumers in the Australian market, with the average loan ranging between

$280 to $450.[45]

Similar to First Stop Money, Mr Shteyn advised that the credit provider screens

applicants according to an income assessment:

Our issue rate, as we define it which is the number of people

we issue a loan to as a proportion of the people who apply, probably ranges

between one out of six to one out of three—in other words, somewhere between 15

per cent and 33 per cent. The reason I am unable to be more specific is that we

simply do not consider people who are not employed, but they still apply. We do

not even see them, given the fact that we are purely online and we have filters

set up. Those people who make it are already employed and out of those we

probably fund one out of three. The proportion is essentially half, to account

for the fact that many people who are not employed still apply.[46]

5.38

Cash Doctors provided the following overview of the company's approach

to short-term loans:

To date, Cash Doctors has provided more than 155,000 cash

advances under its continuing credit facility to some 23,000 customers. We

offer advances of between $100 to $600 for a maximum period of 45 days with no

roll-overs permitted. Repayments are typically over 1-3 pay cycles. The average

advance is $421 over a period of 21 days. We only offer loans to fully PAYG

employed customers, and as such, only 17% of total applications are approved.[47]

5.39

The committee was informed that the following lending philosophy underlies

the low application acceptance rate:

Cash Doctors is a growing national brand in Australia and is

the industry leader in responsible online small-amount short-term lending. In

2005, the founders, Greg Ellis and Sean Teahan, identified a need in the

small-amount short-term lending sector and saw an opportunity to provide a

responsible, transparent service to the Australian working community that was

neither available in the mainstream credit market nor the incumbent

fringe/short-term lending and pawn broking market[...]

The low approval rate is the result of an extremely rigorous

selection and approval process, which includes prudent credit checks and other

responsible lending checks, accompanied by technically sophisticated

data-driven underwriting measures to carefully assess capacity to repay and

maximise the chance of customer repayment and satisfaction.[48]

5.40

Mr Gregory Ellis, Co-Chief Executive Officer, Cash Doctors, and

Mr Sean Teahan, Co-Chief Executive Officer, Cash Doctors, further

explained that the lending criteria is designed to promote appropriate lending

and prudent business practice:

Mr Ellis: We are a little bit different, because we

have a very rigorous data driven underwriting method at the outset, approving

just 17 per cent of applicants. Eighty-three per cent repay fully on time. We

write off just two to three per cent of principle. Importantly, if someone does

go overdue they can only be overdue for a further 45 days. We have a different

fee structure. We have carefully tweaked it so that we make a loss on anybody

who goes overdue, so the organisation has incentive to lend correctly at the

outset. Obviously, we want positive and happy experiences. That is when we can

make money.

Mr Teahan: We only make money when people pay on time.

That is probably different from other options that customers would have if you

compare it to a credit card. If everybody paid their credit card on time, the

credit card companies would not make any money. We only make money when they

pay on time. That is why customers use us. Our customers are employed,

financially literate, earn $40,000 per annum net and 65 per cent have a credit

history. They choose to use us because they trust us to give them this product.

They will receive their money now when they need it and they will pay it off in

a few weeks. Then they can move on and forget about it.[49]

Small amount short-term loans or

micro-finance?

5.41

As noted above, evidence before the committee indicated that the total amount

lent under a short-term loan can substantially vary. It was put to the

committee that there is a distinction between 'pay-day lenders' and

'micro-lenders'. Super Nexus Pty Ltd argued that loans for a maximum of $1500

at 12 weeks fall within the category of a small amount short-term loans. It was

submitted that loans of $500 to $3000 for 26 to 104 weeks are more

appropriately termed 'micro-loans'. It appeared that the micro‑lending

category could cover a broad range of credit contracts, with Super Nexus

Pty Ltd arguing that micro-lenders can 'compete directly with banks...providing

loans up to $20 000 and more on terms up to 5 years or more.'[50]

5.42

It was also put to the committee that the cost of micro-finance is less

than that of small amount short-term loans:

Micro loans are generally recognised as $300 to $2000 for

terms of 25 to 52 weeks. Loan repayments start at $24. There is a massive

difference in the impact of the repayment compared to a payday loan repayment.[51]

5.43

While noting the categories and cost variations, the committee understands

that Schedules 3 and 4 would apply to loans classified as small amount

short-term loans as well as to micro-finance not provided by an ADI. Therefore,

the report has taken into account the full spectrum of the credit contracts

covered by Schedule 3 and 4. As noted above, the report uses the

terms 'short-term loan' to refer to credit contracts that would be affected by

the measures in Schedules 3 and 4.

Repeat lending

5.44

Industry data appeared to support claims that there is a high proportion

of repeat borrowing among consumers who access short-term loans. As noted,

industry estimates that there are 500 000 consumers entering into a short-term

loan credit contracts per year. Estimates received of total loans issued per

year included:

- Cash Converters: over 650 000[52]

- First Stop Finance: over 300 000[53]

- Dollars Direct: approximately 50 000[54]

-

Can Do Credit Pty Ltd: approximately 50 per month, therefore 600

per year, and[55]

- Action Finance: approximately 400.[56]

5.45

It is noted that estimates of total loans were provided by only one of

the three major lenders, and that estimates of five lenders is a minute

proportion of the approximately 400 credit providers operating in the

Australian market. None the less, on the basis of the figures provided it is

clear that repeat borrowing is required to generate the rate of loans that are

apparently issued per year. On the basis of this information it would appear that

either industry significantly underestimates the number of consumers accessing short-term

loans per year or there is extensive and substantial repeat borrowing by

consumers.

5.46

One lender provided details of the level of repeat borrowing by their

customers. Mr Daniel Shteyn from Dollars Direct informed the committee that

'our customers generally take approximately four-point-something loans

annually.'[57]

Further, the Financiers' Association of Australia advised that 28 per cent of

short-term, small amount credit contracts 'are dependent, in part....on some

form of rollover or refinancing opportunity.'[58]

Consumer profile – financial circumstances of short-term loan borrowers

5.47

The Regulation Impact Statement (the statement) accompanying the

Explanatory Memorandum contains an assessment of the predominant financial

background of consumers who access short-term loans. The statement submits that

the consumers typically have a high degree of financial exclusion:

The majority of consumers accessing short term credit have

low incomes, with possibly up to 25% of borrowers having incomes below the

Henderson Poverty Line ($401 a week for a single working person as at March

2010).

Borrowers largely have no access to other forms of credit

(with some surveys finding that this is the situation of over 70% of borrowers)

[....]

There is an element of self-selection in that consumers who

are price sensitive are more likely to be deterred from using short term loans

and seeking alternatives; that is, the more vulnerable the consumer the more

likely they are to use short-term loans.[59]

5.48

The statement also suggests that short-term loans are sought to cover

basic expenses rather than discretionary spending:

The most common uses of the funds advanced under short-term

loans are to meet living expenses, such as bills (including utilities), food,

rent, and car repairs and registration. There is minimal or negligible use of

short term loans for discretionary spending purposes.

The combination of low incomes and the use of loan proceeds

to meet basic expenses can result in significant levels of repeat borrowing.[60]

Research data

5.49

Research before the committee provided similar assessments of the

financial profile of short-term loan borrowers. However, as will be noted, the

extent to which the research took account of web-based lending was unclear. The

committee noted two recent research papers, one released in 2011 by RMIT and

the University of Queensland, the other in 2010 commissioned by the Consumer

Action Law Centre. Also noted was the National Australia Bank's report into its

2010 Small Loans Pilot.

5.50

As detailed at paragraphs 5.63 – 5.82, key research findings include the

following.

- A high proportion of borrowers are low income earners, including

Centrelink recipients. However, there is an increasing number of middle income

earners accessing the short-term loan market.

- Consumers on Centrelink benefits are likely to enter into loans

for smaller amounts than consumers not receiving Centrelink benefits.

- The data casts doubt on whether consumers understand the total

costs of the loan.

- Consumers access short-term loans as a mid-point between

government services and finance provided by ADIs.

Caught Short – interim report by RMIT/University

of Queensland

5.51

Released in August 2011, the interim report for a joint RMIT/University

of Queensland study provides the most up-to-date analysis of the circumstances

of consumers accessing the short-term loan industry.[61]

As part of the study, 160 interviews were conducted across Queensland, Victoria

and New South Wales; 112 with consumers 'who had borrowed between $50 and $1500

from non-bank lenders for short periods of time.'[62]

The following methodology was applied to source participants:

A range of methods were used to source borrowers willing to

be involved in the project. Approximately 4,000 cards were distributed, supplemented

by emailing electronic versions of the card to payday lending outlets, financial

counselling agencies, Neighbourhood Houses and other community organisations. A

$50 honorarium was offered to prospective interviewees in Victoria. NSW and

Queensland borrowers received $40.[63]

5.52

The report further explained:

Lenders interviewed for the study thought that a distorted

picture of the ‘average’ customer would emerge unless the study directly

sourced most participants from payday outlets. A majority (54 per cent) of

people interviewed found out about the study from cards displayed in payday

outlets or from talking to a researcher situated in an outlet. The rest saw a

card or heard about the project from financial counsellors (20 per cent), via

word of mouth (10 per cent), newspaper advertising (8 per cent), other

community organisations (6 per cent) and the source for three participants is

unknown.[64]

5.53

It is not clear whether interviewees included persons who obtained short-term

loans from web-based credit providers.

5.54

The researchers concluded that 'poverty pervades the lives of most

borrowers interviewed.' The study indicates that users of short-term loans are

commonly unemployed, receive Government assistance, have low rates of home

ownership and are likely to be in their 30s or 40s. Of the 112 borrowers

interviewed, 78 per cent received Centrelink benefits, less than 25 per cent

were in paid employment, and 75 per cent lived in rental accommodation. Only

nine persons interviewed owned their own homes, and eight were homeless.[65]

Of the 112 borrowers interviewed, only seven had credit cards and 68 had poor

credit history.[66]

5.55

There did not appear to be substantial difference in the number of

persons receiving Centrelink benefits among the interviewees sourced from short-term

loan outlets and those who heard of the research through other sources. 78 per

cent of borrowers sourced from short-term loan outlets received Centrelink

benefits compared to 83 per cent from community/financial counselling agencies.[67]

5.56

The research indicates that the short-term loan industry has a

disproportionately high client base of Disability Support Pensioners. The report

notes that while approximately 18 per cent of Centrelink recipients receive the

Disability Support Pension, 37 percent of interviewees receiving Centrelink

benefits were Disability Support Pensioners. Similarly, Newstart recipients

were overrepresented, with 30 per cent of the Centrelink recipients interviewed

receiving the allowance compared with 11 per cent of the general population

receiving Centrelink benefits. Of the 87 participants receiving Centrelink

benefits, 61 per cent were women.[68]

5.57

The research evidence suggests that persons receiving Centrelink payments

predominantly seek smaller amount loans. Those receiving Centrelink benefits

borrowed on average $300 or less per loan. For those not receiving Government

assistance, loans typically exceeded $300.[69]

5.58

The study shows that the primary reason for seeking a short-term loan is

to cover regular expenses such as food, bills and petrol.[70]

Of the regular expenses cited as reasons to obtain a short-term loan, the third

most common reason was 'to pay back another loan.'[71]

5.59

Borrowers reported being 'caught in a vicious cycle' and having limited

financial options outside short-term loans.[72]

The study also indicates that short-term loans are rarely entered into on a one-off

basis. Only 10 per cent of borrowers had entered into one loan. In contrast,

over 50 per cent had entered into at least 10, with some borrowers reporting

that they had entered into over 50 short-term loans.[73]

The majority of borrowers owed monies under one or more short-term loans for

substantial periods of time.[74]

5.60

The report provides the following overview of the data relating to

repeat borrowing:

Four themes provide a more complex understanding of a

participant’s borrowing practices: one-off, cycling, spiralling or parallel

loans. Forty two per cent of borrowers reported taking out one or more one-off

loans separated by periods of time. Forty four per cent of people discussed a

practice of cycling – how they had immediately taken out a new loan once the

previous loan had been paid out. Twenty three per cent became involved in the

spiralling process of refinancing the balance of a partially paid-out loan to

start a new loan, and a quarter of respondents described how they took out two

or more parallel loans from the same or different lenders simultaneously.[75]

5.61

The research also indicates that there is a higher probability that

borrowers receiving Centrelink benefits will enter into multiple loans.[76]

5.62

The report noted that the costs attached to short-term loans are not

commonly understood by consumers. Only 48 of the 112 consumers interviewed

commented on the terms of the loan, and, of these, half did not adequately

understand the conditions attached to the loan.[77]

5.63

The findings also provide indicative support for the proposition that consumers

with limited options outside short-term loans are supportive of the short-term

loan industry. Support for the industry was higher among frequent borrowers,

that is, those who had had at least 10 short-term loans, and consumers with

loans less than $300.[78]

The report also noted the comments of one participant that the short-term loan

industry responds to a 'gap' that would otherwise exist in the consumer credit

market:

I think, like in a perfect world it would be great if they

didn't exist because then people would have enough money – there wouldn't be

that desperation. I mean as long as there's that desperation and people aren't

earning enough to support themselves, there's always going to be those people

that are going to prey on that need. So, it's like a necessary evil...I think

that they are filling a gap that the welfare state isn't providing for. (Partnered

student in her 20s receiving Austudy)[79]

Payday loans: Helping hand or

quicksand? – Report by Zac Gillam and the Consumer Action Law Centre

5.64

The September 2010 report by Zac Gillam and the Consumer Action Law

Centre paints a similar picture of the circumstances of the average short-term

loan consumer.[80]

The report explains that the following methodology was applied to gather

evidence regarding the experience of consumers accessing payday loans.

- An online survey of 448 persons who had entered into a 'high-cost

short term loan', that is, a loan for under $2000 taken out for no more than

eight weeks from a registered institution. The survey was conducted in May

2008.

- A 'small scale qualitative study' that combined group

discussions, in-depth interviews and extended home interviews. The study aimed

to 'identify the sociological and psychological drivers of payday lending and

the impact on borrowers.' The study was conducted in October and November 2009.

- 11 case studies provided in September 2009 from financial

counsellors.

- Desktop research that included a literature review.[81]

5.65

It is not clear the extent to which the report considered consumers who

accessed short-term loans through web-based providers.

5.66

Of the consumers who participated in the research the majority (55 per

cent) were women; a high proportion of whom were single parents.[82]

60 per cent of respondents were aged between 26–45 years.[83]

While not providing data on the proportion of participants who received

Centrelink benefits, the research corroborates the view that consumers who

access loans are predominantly lower income earners. Of the borrowers

interviewed, 23.4 per cent were at or below the Henderson Poverty Line[84],

50 per cent earned less than $40 000 per annum, and 72.7 per cent received

below average weekly earnings. However, 14.5 per cent earned more than

$60 000 per annum, leading the researchers to conclude:

The data suggests high-cost short term loan providers no

longer serve strictly marginal income earners, although low and marginal income

earners clearly remain the overwhelming consumer base.[85]

5.67

The primary reason for the participants to seek a payday loan was to

'meet basic needs'. Of the borrowers interviewed, 22.1 per cent sought a

short-term, small amount credit contract to meet the costs of car repairs or

registration, 21 per cent to pay bills, 17.6 per cent for living expenses such

as groceries, 10.7 per cent for rent payments, and six per cent to repay debts.[86]

On this point, the report concluded:

Consumers do not generally take out high-cost short term

loans for discretionary purposes but instead borrow when they are struggling to

cope and have insufficient purchasing power to maintain a basic living

standard.[87]

5.68

The average cost to consumers of a $300 short-term loan was $100.

However, the report also found that consumers have a limited understanding of

the nature of short-term lending and therefore substantially underestimate the

overall costs. The report concluded:

A striking feature of the high-cost short term lending

industry is the degree of ignorance amongst consumer regarding interest rates

charged by lenders [...] it seems clear borrowers know how much they are borrowing

but not how much they are paying.[88]

National Australia Bank – Small

Loans Pilot

5.69

Data regarding consumers accessing small amount loans was also derived

from the report on the National Australia Bank's (NAB) Fast Money small loans pilot.

The pilot, which commenced in May 2008, provided $1000 to $5000 loans for 12

month terms. Applications were made via telephone or the internet.[89]

The pilot 'explored the feasibility of providing fair and affordable small

loans in an alternative credit environment to those who are not able to access

mainstream loan products.'[90]

5.70

The 2010 report into the pilot scheme notes that the consumers 'were not

low income and did not fit the stereotypical profile of a payday lender

client'. The consumers earned an average of $859 per fortnight, and only 19 per

cent received Centrelink benefits. However, financial exclusion seemed to be a

key reason why consumers sought credit under the pilot. Thirty eight per cent

of consumers had declared bankruptcy or otherwise defaulted on credit contracts.

As the report noted, '[m]any were financially excluded from mainstream loan

operations due to defaults on their credit record.'[91]

Industry views

5.71

Evidence received from industry seemed to concur with a number, but not

all, of the research findings.

Consumer profile

5.72

There appeared to be a notable divergence in the client profiles of

credit providers. Of the store-front operators, only three indicated providing short-term

loans to persons who receive Centrelink benefits. Cash Converters advised that

'over 40 per cent of our customers are on welfare payments.'[92]

Moneyplus advised that the provider does 'not lend to consumers receiving

Government benefits as their sole source of income.'[93]

Money 3 noted that at least 60 per cent of its customers are employed, and

advised that the credit provider has a diverse client base:

Money3 customers are drawn from most walks of life. Doctors,

bankers, painters, boiler makers, sales people, ministers, lawyers, dentists,

tradesmen, labourers and even the local court registrar are represented.[94]

5.73

Money Centre stated that 'prospective customers must be employed and

earn a minimum of $450 nett per week.'[95]

Fundco advised that the provider applies an income threshold, stating that

'[o]ur current policy is that we do not lend to any consumer with a gross

weekly income of less than $400.'[96]

5.74

In contrast, it was apparent that the web-based sector is tailored to

middle income earners, with lending criteria specifically excluding Centrelink

recipients. Mr Daniel Shteyn, representing Dollars Direct, advised:

Before talking about the bill itself, I first want to share a

few facts about our customer base, which includes many thousands of satisfied

Australian consumers. Just to dispel a few myths, we do not prey on the

desperate and vulnerable, nor are we simply a lender of last resort. On the

contrary, our customers are all employed and have bank accounts. On average,

our customers are in their mid-30s and earn over $40,000 gross per annum. One

out of every two customers has a dependant and approximately one out of three

owns their own home. Our customers tell us that they are extremely satisfied

with the quality of our customer service, which they say is as good or better

as that provided by mainstream financial institutions. Our record with COSL

supports this as we have not had any cases which have been adjudicated through

EDR during the whole time we have been a member.[97]

5.75

Cash Doctors provided a similar overview of its client base:

We are here to represent our clients, who are a growing

demographic of financially literate, credit averse and tech savvy people, so

they are accustomed to transacting on the internet and on their mobile phones.

They are fully employed and their net salary on average is $40,000 per annum.[98]

5.76

First Stop Money noted it has a similar client base:

We also only lend to people who are employed full time. We do

not lend through Centrelink. We do not lend to people who would potentially

turn financially vulnerable.[99]

5.77

The view that web-based providers have a predominantly 'middle class'

client base was shared by St Luke's Anglicare. However, this was attributed to

difficulties which lower income earners may have in accessing internet based

services:

...the fasted growing sector of pay day lending is on-line,

which means many low income households will not have access to this.

Consequently the growth in this sector is targeted at people who borrow to buy

discretionary purchases, the fasted growing pay day lending group[100]

An alternative source of finance

5.78

Evidence before the committee indicated that there is a need for

alternative sources of finance. Similar to the borrower's comment noted at

paragraph 5.69 and the findings of the NAB study, industry submitted that short-term

lenders fill the gap between government services and finance provided by ADIs. Reasons

put forward for accessing this alternative source of finance appeared to differ

according to the financial circumstances of the provider's client-base.

5.79

In relation to low income earners, Money 3 submitted that a short-term

loan can assist a vulnerable consumer to rebuild their financial security,

arguing that 'we do not sell money. We sell self-esteem.'[101]

Action Cash stated:

The capacity of your local LILS and NILS’ schemes, to lend

more than they are currently lending: nabs’ latest $34 million offering through

their community banking scheme are only able to approve lending to 6% of total

applicants. That is a lot of unsatisfied clients screaming for second chance

finance if they have in the last 5 years, a small blemish on their credit file

or are discriminated against because they don’t have any assets or savings. Who

will save these people – We’ll SAVE them! (your short term credit lender).[102]

5.80

The view that short-term lenders address the shortfall in the finances

of lower income earners was also noted by 'consumer advocates'. St Luke's

Anglicare commented that '[l]enders feel they are providing an important social

service.'[103]

While not commenting on the merits of short-term loans, St Luke's Anglicare

noted that additional finance is of critical importance to persons dependent on

Centrelink benefits:

The inadequacy of Centrelink incomes for some household

types, particularly those reliant on Newstart and Parenting payment, can be

illustrated by the percentage of income required for a variety of households to

buy the food they need to eat well. The purchase of basics such as food is a

common reason for borrowing from payday lenders. Compounded by other increasing

cost of living pressures, Centrelink recipients are increasingly vulnerable to

sourcing financial resources through short term loans as a common coping

strategy.[104]

5.81

However, providers with a client-base predominantly comprised of middle

income earners put forward other reasons for consumers accessing their credit

services. Views are reflected in Cash Doctor's statement that:

[a]bout 65 per cent of our clients have a perfect credit

history, so they are free to choose from among any financial products in the

mainstream industry. They choose Cash Doctors because they do not necessarily

want to be locked into a long-term commitment or to have more credit than they

need.[105]

The case for the short-term loan reforms

5.82

As noted at paragraphs 5.5-5.7, the key motivation for the short-term

loan reforms is to protect vulnerable consumers. The Regulation Impact

Statement commented that the reforms are necessary to address financial

vulnerability:

The higher the costs charged the greater the impact on a

consumer's income, default rates and level of social inclusion. This means that

the most financially vulnerable consumers are paying high costs relative to

their income when using short term, non-productive forms of finance, resulting

in financial harm through an inability to accumulate savings or personal

wealth, and a risk of continuing dependency on these products.[106]

5.83

Similar views were expressed by 'consumer advocates'. It was argued that

the reforms are essential to:

- rectify the increased indebtedness and financial vulnerability

that can result from the high-cost of short-term loans, and

- strengthen consumer protections across jurisdictional boundaries,

through applying national cost caps designed to foil avoidance practices.

High-cost finance

5.84

As noted above, it appeared that difficulties with accessing finance

from mainstream lenders are a primary reason for accessing short-term loans. The

financial disenfranchisement of short-term loan consumers was also noted in the

Regulation Impact Statement. The statement claimed that, as part of the

consultations on the Green Paper reforms, industry provided the

following insights into the financial circumstances of its clients:

In its submission Cash Stop quotes research undertaken by

Smiles Turner for the NFSF of 3408 consumers across Australia. Cash Stop states

that the research demonstrated that a large proportion of consumers reported

that they had no access to other forms of credit — 71.6 per cent (QLD), 72.1

per cent (SA), 76.7 per cent (NSW); 81.6 per cent WA.

The submission by the Financiers Association of Australia and

Minit-Software to the Green Paper lists poor credit history as one of the

reasons consumers access short term loans.

Cash Converters report that three in 10 of their clients

cannot get credit from other types of lenders.[107]

5.85

Evidence presented to the committee suggested that due to financial

exclusion the financially vulnerable seek finance from non-ADI lenders; finance

that is typically at a higher cost than 'mainstream' lending. St Luke's

Anglicare summarised the situation as follows:

Payday lending is undoubtedly the most expensive form of

credit. There is a real question mark over whether these loans alleviate

financial hardship or in fact exacerbate it.[108]

Examples of costs attached to short-term

loans

5.86

The committee was provided with evidence of costs calculated according to

an annual percentage rate (APR). The March 2011 report into the short-term

lending industry by the Queensland University of Technology noted research

findings that:

...the typical payday loan was in the range of $100 to $500

for a period of two to four weeks, involving a flat fee of $20 to $35 lent,

rather than an interest rate. As a result, the situation can arise where the

annual percentage rate (APR) for a two week loan can range from 390% to more

than 1000% for more money borrowed for only a few days.[109]

5.87

National Legal Aid noted, with disapproval, instances of interest rates

of 100 to 1500 per cent.[110]

Further details were provided at the hearing:

Payday lending diverts income. It goes in one hand and

straight back out by way of high repayment costs, where there is little or no

ability to reduce the balance owing. Who amongst us here could afford a credit

card with a 240 per cent interest rate? And yet, without a community norm, that

is the very rate that Legal Aid clients in Ipswich were frequently paying before

the state cap was implemented in 2008.[111]

5.88

Similarly, the Consumer Action Law Centre submitted that short-term

loans 'are extremely expensive', and advised the committee:

[t]hese loans typically attract effective annual percentage

interest rates (APR) of 400 per cent (and can be over 1000 per cent). Moreover,

repayments create a very large burden for borrowers on low income, particularly

due to the short term nature of many of the loans.[112]

5.89

Industry representatives disputed the accuracy and appropriateness of

representing costs with reference to the APR. The view put forward by the

National Financial Services Federation appeared to be indicative of the short-term

loan industry's position:

Annual Percentage Rates are not a useful guide on the cost of

small amount, short-term loans.

Small Amount Credit Contracts typically run for between a

couple of weeks and several months so an APR is misleading.

No consumer would take out a loan if they are quoted an APR

of 365% or 626%.

However, if they are told the dollar cost, they can then make

an informed decision, as they do.[113]

5.90

This argument notwithstanding, the committee also received estimates of

costs as a percentage of a consumer's income and in dollar terms. The Regulation

Impact Statement asserted:

There are significant variations in the level of costs

charged by short-term lenders. The impact on low income borrowers (defined as

those with an annual income of $24,000) of loans of between $300 and $1,000

over terms of 1 week to 1 year can be summarised as follows:

- The cost of a single loan can be between 2.59 and 50.05% of their

income during the period of the loan.

- The cost of two consecutive loans (where it is assumed the

borrower uses 25% of the proceeds of the second loan to repay the first loan)

can reduce the borrower's income by between 9.55 and 77.13%, during the period

of the two loans.[114]

5.91

The Consumer Action Law Centre held a similar view, providing two

scenarios to demonstrate the high cost of the loan as a proportion of a

consumer's income:

For example, assume a typical short term credit scenario

where the borrower earns $24,000 per annum after tax (that is, $923 per

fortnight), borrows $300 over a term of 28 days, and is required to repay a

total of $405. In this scenario, fortnightly repayments would be $202.50 per

fortnight, which is 22 per cent of this borrower's income.

Alternatively, assume the borrower's income was the maximum,

single adult rate of Disability Support Payment (this is also not uncommon, as

discussed below) which equates to an income of $748.80 per fortnight. Assuming

all other factors in the scenario above remain the same, repayments for this

person would be 27 per cent of income.

In both scenarios, repaying the loan creates what is without

doubt an enormous burden for a low income borrower whose entire income is

likely to be required to meet necessary living expenses.[115]

5.92

Commenting on the proposed 48 per cent cap on certain credit contracts,

the RMIT and the University of Queensland estimated that a 48 per cent

annualised cap would result in a cost to the borrower of $0.92 for a $50 short-term

loan taken out for a two-week period. The RMIT and the University of Queensland

contrasted this with an estimate of what consumers are currently paying for the

same loan. According to the researchers, borrowers would currently pay between

$15 to $17.50.[116]

5.93

Data provided by industry indicated that the terms on which credit is

offered, and therefore the costs to borrowers, can differ between credit

providers. Evidence presented to the committee indicated that consumers can be

charged:

- $35 per $100, which would result in a fee of $112 for a $320 loan

calculated as $320 x 0.35[117]

- $403.80 for a $250 loan comprising repayment of the principal,

$10.00 credit card fee, $7.00 ATM fee, $7.50 monthly card fee, $107.23

brokerage fee, $8.24 interest and $13.38 consumer protection insurance,[118]

and

- $110.84 for a $320 loan.[119]

Consumer awareness of costs

5.94

Reflecting research findings, submissions noted that there is limited

understanding among consumers of the total costs of short-term loans. The

Indigenous Money Mentor Network commented:

Many aboriginal people I deal with don’t understand the

interest rates or fees charged by Payday lenders. In fact when I sit down and

show them on paper the full cost of the money borrowed, they are ‘shamed and

frustrated’, thinking these people were there to help them. Instead, they feel

they were tricked![120]

5.95

Similarly, Sydney commented that consumers often fail to understand the

cost of the loan, and argued that greater disclosure is needed:

Our concerns are the hardship levels that are created from

the interest rates. They trap people into a cycle of financial exclusion, and

there is no option or alternative given to clients when they go in to payday

lenders. We find that they prey on the most vulnerable—people with mental

health issues, poor English skills or low levels of financial literacy. We

would just like to see, perhaps, a clearer display and disclosure of the actual

costs involved with these loans so that people understand, and we would like

there to be alternatives provided to them such as microfinance and financial

counselling.[121]

5.96

While acknowledging factors that may legitimately increase credit

providers' costs, Redfern Legal Centre argued that the level of costs were unsustainable

for lower-income earners:

We acknowledge that the payday lending market is

characterised by certain features that make small amount loans more expensive,

including the high risk of default and the high fees and the administrative

costs of short-term loans. However, there should be a limit on the amount of

fees and costs that can be charged under small amount credit contracts, to

protect vulnerable consumers. It is important to recognise the role that

payday-lending plays in indebtedness amongst socioeconomically disadvantaged

individuals.[122]

5.97

Similarly, the Consumer Action Law Centre reported:

In most cases, the high cost, short-term loans are required

because individuals have insufficient cash to meet their essential, daily needs

(such as utilities, car expenses, food and rent). They are already in financial

difficulty. The loan is repaid via direct debit from their bank account at the

same time their wages or benefits are credited into the account. Having such a

significant amount deducted from their next pay usually leads a borrower to

needing another loan within a short period of time to supplement their reduced

income.[123]

5.98

The Centre further argued that '[a]ccess to harmful financial products

does not amount to financial inclusion.'[124]

Fair Finance Australia took a similar view, submitting that:

Our experience would indicate that any loan made for the

purpose of payment of daily consumption or bills cannot by definition fit

within the responsible lending framework. This is because it is usually the

case that individuals do not have enough income to survive day to day and are

clearly in poverty. Any form of loan that has to be repaid will in effect

reduce their future income and is thus increasing their poverty levels. This

can be seen as just a short term fix to their financial problems.[125]

5.99

National Legal Aid submitted that a consumer's financial vulnerability

can be increased where the short-term loan is secured against the consumer's

property. The committee was provided with case examples of security attached to

short-term loans, which included the following:

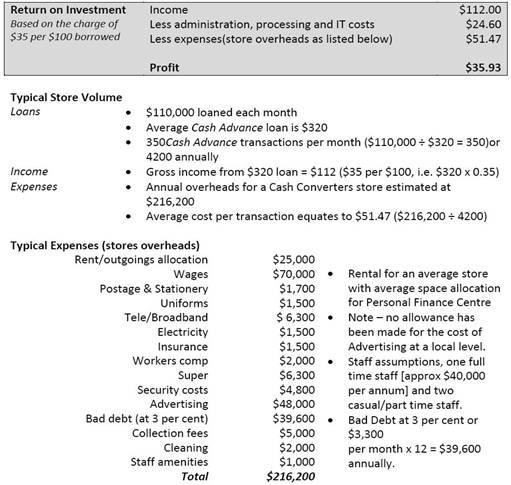

Table

5. 1 – Case examples of security taken for short-term loans[126]

|

Amount borrowed

|

Year loan contract signed

|

Length of loan

|

Asset over which security taken

|

|

$2189.13

|

2007

|

12 months

|

Car

|

|

$3300.00

|

2007

|

Unknown

|

Car, house

|

|

$2198.52

|

2008

|

36 weeks

|

Car

|

|

$7306.00

|

2008

|

46 fortnights

|

Dining suite, queen-sized bed, single

bed, stereo, sofa bed, microwave, 34cm TV, DVD player, lounge suite, laptop

|

|

$1000.00

|

2009

|

30 weeks

|

Car x 2

|

|

$1700.00

|

2009

|

29 weeks

|

Car, house

|

|

$1958.40

|

2009

|

52 weeks

|

Car

|

|

$3968.00

|

2009

|

31 weeks

|

Car

|

|

$1400.00

|

2010

|

17 fortnights

|

Car

|

Support for the proposed caps on the

costs of credit contracts

5.100

The committee gauged strong support among consumer advocates for the

introduction of caps on costs and the formula for calculating costs.[127]

Anglicare Victoria argued:

From our client experiences, the main destructive nature of

uncapped short term lending appears as two-fold; both the high cost of credit

and the overcommitment of borrowers through multiple or ‘rollover’ loans can

cause crippling effects. The proposed amendments seek to address exactly this,

and Anglicare Victoria wholeheartedly welcomes the new obligations placed on

such credit providers.[128]

5.101

Commenting on the effect of the Queensland cap, National Legal Aid

reported a 'diminution of clients coming for assistance after the state cap was

introduced'.[129]

National Legal Aid argued that a clearly defined, national costs cap would be

an appropriate and effective means of ensuring consumer protection:

We need something where it is a 'tick and flick', where there

is a definite rule where you are in breach of the cap so therefore you cannot

claim the interest.[130]

5.102

The Financial and Consumer Rights Council Inc stated:

We view the proposals as an improvement on the current

regulatory landscape in Victoria, where the soft 48% cap has proven largely

ineffectual.[131]

5.103

Redfern Legal Centre further submitted that loans with costs above a 48

per cent cap are contrary to prudent market practice:

Where the risk of lending is so high that a consumer loan

cannot be granted without charging an interest rate that breaches the 48% cap,

we submit that such a loan is irresponsible and predatory, and should not be

permissible.[132]

5.104

In relation to the proposed 10 per cent cap on establishment fees for

small amount loans, the Consumer Action Law Centre rejected the view that

consumers could be protected were the caps to increase:

If the establishment fee is increased to 20 per cent of the

amount borrowed (keeping the monthly rate the same), this will be equivalent to

an annual percentage rate of 264% for a one month loan. If it is increased to

25 per cent, this will be the equivalent to an annual percentage rate of 324%

on a one month loan. If the establishment fee is increased to 30 per cent, this

will be the equivalent to an annual percentage rate of 384%[...]

Leaving annual percentage rates aside, a 20 per cent, 25 per

cent, or 30 per cent establishment fee would allow a lender to obtain a return

of $66, $81, or $96 on a one month loan of $300. A fortnightly repayment on

such a loan would be between 22.5% and 24% of a single pensioner's fortnightly

income. A product that takes such a large proportion of a low-income earner's

regular income is designed to require them to come back to obtain another loan.[133]

5.105

In relation to a proposal to increase the cap for small amount loans,

the Consumer Action Law Centre further stated:

We do not doubt that there are costs involved in issuing a

loan, and we also acknowledge that the RIS suggested a return of "approximately $20-30 per $100 is required to generate a reasonable

return" on loans under around $300 (though costs would be lower on larger

loans). However, we would oppose a cap at the levels suggested by the NFSF, for

two main reasons.

The first is that the cap suggested by the NFSF would allow

lenders to charge very close to what they are charging now—for example, Cash

Converters' fee for their 'Cash Advance' product is $35 per $100 loaned. Given

the lack of price competition currently in this market, we do not accept that

the NFSF's proposed cap would bring fees down to a competitive level.

The second is that (even if the NFSF's suggestion represented

a competitive price) increasing the cap to allow continued provision of very

short term versions of these loans would be to profoundly miss the point of

this reform. The reason the proposed cap will protect consumers is that it will

make the shortest term loans less viable, encouraging lenders to offer longer

term loans. As discussed above, the short terms of these loans are one of the

key reasons they are so harmful. The object of any cap should be move the

market away from the shortest term loans.[134]

5.106

However, both Good Shepherd Youth and Family Services and Financial

Counselling Australia noted their preference for the 48 per cent cap to apply

to all short-term loans including those that would be defined as small amount

credit contracts. Good Shepherd Youth and Family Services stated:

Given an all inclusive cost rate cap of 48 per cent has been

tested previously and has already been in place in other states, we believe

this may be sufficient for loans both under and over $2,000.[135]

5.107

Financial Counselling Australia noted:

Our sector has long advocated for an all inclusive interest

rate cap of 48% (including fees and charges) along the lines of that already in

place in Queensland, New South Wales and the ACT. This Bill does not go this

far, instead proposing a two‐tier

structure. While this is not our preferred position, we support the legislation

as a reasonable compromise.[136]

Support for the formula for

calculating costs under the caps

5.108

There appeared to be general approval for including in the cost capping

formula a regulation-making power to address potential avoidance practices. The

committee received evidence from consumer advocates of examples that verified

the assertion in the Explanatory Memorandum and Regulation Impact Statement

that lenders had adopted tactics to generate income that falls outside of the

cap formula under state and territory consumer credit legislation.

5.109

Financial Counselling Australia provided the following example of

avoidance techniques:

Mr O on a Widows Pension, borrowed $1000, $200 went to pay

out her first loan. She had to borrow $900 to buy a money management DVD. She

already had the money management DVD from her first visit.[137]

5.110

A similar case was provided by the Consumer Credit Legal Centre (NSW)

Inc:

Our client wanted to borrow $1000. In order to do so she was

required to ―borrow a DVD set on money management for which an extra $400

was added to the contract. She was then charged 48% on $1400 instead of $1000.

When our client wanted to borrow more money at a later date, she was forced to

―borrow the same DVD set at a further cost of $400.[138]

5.111

It was also put the committee that the formula must address brokerage

fees. The Consumer Action Law Centre submitted that the cap should 'prohibit

fees incurred with third parties (such as introducers, brokers or processors)

whether associated with the credit provider or not).'[139]

Debt spirals – support for the

proposed restrictions on multiple concurrent small credit contracts,

refinancing and increased credit limits

5.112

Rather than alleviate financial pressures, it was argued that short-term

loans can increase financial hardship for the consumer. Financial Counselling

Australia submitted that:

The overwhelming experience of financial counsellors is that

payday loans are harmful and leaves the majority of consumers worse off. As a

general principle, more credit, particularly at such high cost, is not the

answer to financial difficulty.[140]

5.113

Drawing on a survey of over 300 financial counsellors, Financial

Counselling Australia reported that it was the view of the financial

counsellors interviewed that access to short-term finance did not improve the

consumer's financial situation:

The majority of financial counsellors (269 or 79%) said that

payday lending “never” improved their client’s financial situation. No

financial counsellor said that payday lending either “often” or “always”

improved their client’s financial situation.[141]

5.114

The committee was informed that financial difficulty linked to short-term

borrowing is a significant proportion of consumer advocates' work. Drawing on

the findings of a survey, conducted in September and October 2011 of financial

counsellors across Australia, Financial Counselling Australia estimated that in

a 12 month period the 341 financial counsellors surveyed saw approximately

2777 clients with short-term loans.[142]

5.115

Good Shepherd Youth and Family Services reported that approximately 30 per

cent of their financial counselling clients have payday loans. However, it was

noted that this figure could be higher as 'many clients do not mention their

payday loans as they are ashamed to admit they have them'.[143]

5.116

Anglicare Victoria and Anglicare Sydney also provided data concerning the

proportion of clients seeking assistance for matters connected with short-term

lending. Anglicare Victoria advised:

We see about 10½-thousand people throughout our financial

counsellors ... As we indicated in our submission, 72½ per cent of the cases relate

to client debt problems and 50 per cent of that 72½ per cent are from creditor

harassment or creditors, most of those being payday lenders.[144]

5.117

Anglicare Sydney also provided the following data, noting the figure may

be a conservative estimate due to client under-reporting:

This figure is off the top of my head but I would say at

least 1,000 to 1,500 of those would present with payday lender issues. It is a

question of whether, through services like Emergency Relief, people will

actually disclose those issues to you, because quite often they can be quite

embarrassed that they have those problems.[145]

5.118

It was argued that the high cost of credit, combined with refinancing,

can lead to 'debt spirals'. Redfern Legal Centre provided the following

description of the short-term loan borrowing cycle:

Many people who enter into short-term, small amount credit

contracts...are people on low incomes who are unable to afford to repay their

loans even at the time of entering into the contract, and are susceptible to

unscrupulous or irresponsible practices of some payday lenders. Such practices

can include: credit contracts that do not provide for the due date of payment

to coincide with the borrower's payday, providing access to further finance in

order to meet repayment obligations, and "rolling over" one payday

loan into another. These practices lead to further indebtedness on the part of

the borrower and make it unlikely that the borrower will be able to repay their

debt.[146]

5.119

Similarly, the Indigenous Money Mentor Network commented:

I am seeing firsthand the financial hardship payday loans

often bring. I have clients who take out small loans to pay bills which quickly

grow as a result of defaulting on their payments, hefty penalties for

insufficient funds and letter writing to the offending person. Studies have

shown that people who take out these short small loans focus on the dollar

amounts without any understanding of the annual effective interest rates, fees

or charges.

The people that present to me, often have more than one loan

from a Payday lender, leaving little money for food and the basic needs of

their children. This then creates a situation where families are required to

attend welfare agencies for electricity/gas vouchers, food or other assistance.

This in turn drains the resources of the charity as they support people over

the long term.[147]

5.120

National Legal Aid provided a case example of subsequent loans being

used as a means to finance the initial loan:

Mr H suffers from a mental illness and is on a disability

pension working limited hours. Mr H took out his first payday loan to assist

him to pay for basic living expenses. Unable to meet these expenses he

approached the neighbouring payday lender and was granted a second payday loan

which he used to pay the first payday loan. By the time he sought legal advice,

Mr H had 3 payday loans, the second and third were being used to pay for

the earlier payday loans.[148]

5.121

Accordingly, it appeared that the restrictions on multiple concurrent

loans, refinancing and increased credit limits were supported by consumer

advocates. As Redfern Legal Centre commented:

It is our position that a prohibition on charging fees and

charges ([other] than those specified) and on the refinancing of small amount

credit contracts would assist consumers to better understand the cost of the

loan, and to avoid becoming entrapped in a dept spiral through the refinancing

of one credit contract to repay another. This is an all too common problem in

the payday loan market, and one that consumers are often unable to escape

without extreme hardship.[149]

Support for the proposed cap on

default charges for small credit contracts

5.122

The proposed cap on the fee payable in the event of default on a small

amount credit contract appeared to have general support.[150]

Treasury provided the following explanation of the proposed cap:

The bill draws a distinction between default charges, which

are essentially charges for the loss of use of the money due to it being not

paid on time, and enforcement expenses, which are the actual costs of chasing

down the debt—for example, debt collectors or court actions. The first set of

costs for not paying the money on time have been capped under the total cap of

200 per cent. Enforcement expenses are regulated already under the NCCP Act and

must be reasonable.[151]

5.123

Anglicare Victoria argued that the proposed limit on the maximum that

can be charged in the event of default will assist the financially vulnerable

to avoid debt traps:

Anglicare Victoria views this provision as most important in

restricting exploitative practices by some small credit providers. The current

concern is for those consumers who access a small credit amount and default in

payment, requiring them to refinance the original amount plus the interest and

or fees. This can quickly spiral out of control and lead to additional debt.

The current provision provides much needed protection from this scenario.[152]

5.124

It appeared that the default cap has some support from within the short-term

lending industry. Fundco advised that 'we welcome this approach as we believe

it will protect consumers against spiralling debt.'[153]

First Stop Money commented 'we already cap the total repayment including

default fees at the proposed 200% of principal.'[154]

Similarly, Money 3 argued:

The best part of this legislation that has come in—and we

actually urged that it happen—is that we cap all fees at the amount of

principal advanced. So, if someone were to borrow $200, under this

legislation—and please do not touch that—it is capped at 100 per cent of the loan.