1.1

While signing the committee's majority report in my capacity as Chair, I

and other government members on the committee do not agree with all of the

conclusions and recommendations contained in the majority report. This

dissenting report broadly outlines the views of government members, where these

differ from the views found in the majority report.

Introduction

1.2

Rolling out the next-generation NBN to all Australians as quickly as

possible is a priority for the Coalition Government. But national objectives

must always be tempered by economic reality, and tested by thorough public

scrutiny.

1.3

In the eight years since the National Broadband Network (NBN) was

conceived, there have been a multitude of parliamentary inquiries and hearings

to examine NBN Co Limited's (nbn's) performance in delivering on its purpose,

as expressed in the Government's Statement of Expectations, to ensure all

Australians have access to fast, affordable broadband as soon as possible, and

at least cost. Almost all of these reviews have occurred during the term of

the Coalition Government.

1.4

On all measures, Bill Morrow and the rest of the executive team at nbn

have done a phenomenal job in turning the company around. The NBN is

Australia's largest and most complex infrastructure project. It will be a key

facilitator for innovation in the nation. In a sense it will be the sinews of

the Australian economy in the 21st Century, especially for

households and small business. Critical to this is how fast the network can be

rolled out, and what prices householders and businesses pay for access to the

network.

Performance measurement

1.5

When judging nbn's performance it is reasonable to assess the

management's record in meeting business plan targets as set out in annual

corporate plans, as required of Commonwealth companies by the Public

Governance, Performance and Accountability Act 2013.

1.6

nbn's record in meeting or exceeding its financial and rollout targets

for three consecutive financial years stems from the Coalition Government's

reforms which gave nbn the flexibility to choose the right broadband technology

for each location. This approach aims to reduce costs, save time and limit

inconvenience to households and businesses during the transition to the new

network.

1.7

Under the Coalition Government, this important infrastructure project is

continuing at a more manageable cost and is on track to deliver all households

access to better broadband by 2020. An important point is that someone must in

the end pay for the network. This means that if the cost of the network

increases, the increase must either be paid for by consumers through higher

retail prices, or tax payers through more funding. Figure 1 represents the

difference in financial profiles between the MTM approach and the all-FTTP

approach.

1.8

The committee majority report implies at several points that there is a

risk nbn will fall short of the Statement of Expectations regarding the speed

of services provided to the fixed line footprint.

1.9

In fact, elsewhere in public statements, responses to Questions on

Notice and evidence presented to parliamentary committees, nbn has indicated

that the average speed attainable on nbn's fibre to the node (FTTN) network is

67.7 megabits per second (Mbps) and 101.6 Mbps on the fibre to the basement

(FTTB) network. The average attainable rate across both networks is 70.4 Mbps

(page 101).

1.10

While the network speed baseline is nominally set at the universal

minimum 25 Mbps, at least 9 in 10 premises in the fixed line footprint will

have wholesale speeds of at least 50 Mbps at rollout completion under the

direction set by the Statement of Expectations. Furthermore, an upgrade path

will provide close to half of all premises on the network access to speeds of

up to 500 Mbps as demand emerges.

Source: nbn quarterly

report.

1.11

Paragraph 1.28 of the committee majority report also misrepresents the

findings and purpose of the 2013 NBN Strategic Review. The objectives of the

review were to assess the progress and cost of the rollout at that time, as

well as the economic viability of nbn under alternative rollout scenarios. The

Strategic Review also evaluated the likely operational and financial position

of nbn based on the continuation of the fibre-to-the-premises rollout targeting

93 per cent of premises.

1.12

The strategic direction recommended by the review was that NBN Co should

develop an 'optimised multi-technology approach' to rollout out the network

that balanced fast broadband deployment to the highest number of Australians

with better economics.

1.13

Far from being an outlier, nbn's 'incremental upgrade' approach has been

adopted in other countries such as Austria, Germany and the UK, to enable

further investment to be staged as demand emerges, in parallel with technology

advances.

Rollout progress

1.14

By mid-2017 nbn had exceeded its rollout targets and financial forecasts

across three full financial years. The cost overruns and connection delays that

plagued the early rollout under the former Labor Government have been resolved.

1.15

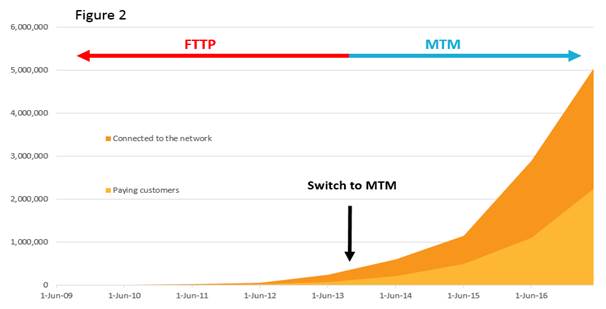

Over little more than three years, the number of premises able to access

the NBN network has grown from 504,000 premises reached, to more than six

million in the NBN's national footprint.[1]

Similarly, customers connected to the built network stood at 51,000 in

September 2013. In September 2017 there are more than 2.8 million services in

operation and nbn's wholesale revenues have exceeded $1 billion annually and

continue to grow.

1.16

Figure 2 demonstrates the rapid rollout since switching to an MTM model.

1.17

nbn's Corporate Plan 2018-21, released in August 2017, shows the

NBN rollout remains firmly on track to deliver fast broadband to all Australian

homes and businesses by its target of 2020, having achieved two consecutive

years during which the network footprint was nearly doubled.[2]

1.18

The plan will see three-quarters of Australian premises able to access a

service over the nbn network by mid-2018, with 4.4 million active services by

that time. These forecasts are in line with targets the company set more than

two years ago.

1.19

The Corporate Plan reports that network construction and activation is

nearing peak with more than 6,000 direct nbn employees and an external field

workforce of 24,000 contractors working to build the network and connect homes

and businesses across every square kilometre of Australia.

1.20

Capital expenditure reached $5.8 billion in FY2017. More than 70 per

cent of nbn's procurement spend to date has been on local content – that is,

Australian manufacturing, construction, installation and support activities.[3]

1.21

End-user activations were higher than forecast in 2016-17 and the NBN is

now being switched on at 1,000 Australian premises every working hour. There

are more than five times as many users on the network today compared to just

two years ago.

1.22

The committee majority report at paragraph 2.29 argues that nbn has no

capacity to upgrade the network. This is in stark contrast to both the

Statement of Expectations (which requires nbn to ensure that upgrade paths are

available as required) and the facts. In the past year nbn has:

-

introduced new fibre-to-the-curb technology that will be

available from 2018 to around one million premises;

-

announced Sky Muster satellite users will gain access to 50 per

cent more peak data and twice as much off-peak data; and

-

trialled speeds up to 100 Mbps delivered over the fixed wireless

service.

1.23

That nbn has been given the flexibility to choose the best technology

for each part of Australia is the very reason that these upgrades have been

possible, in contrast to the technological ideology of the previous Government.

1.24

Of course, even though these factors were brought to the committee's

attention, nonetheless the committee majority has formed the view that upgrades

across the nbn network are required (although not costed). In paragraph 2.88

the committee majority appears ignorant of the costs of wholesale upgrade, and

in paragraph 2.89 appears to confuse speed with capacity.

1.25

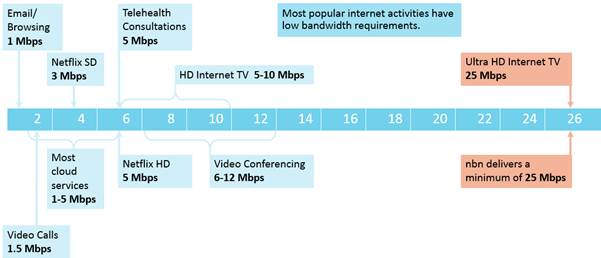

As figure 3 clearly shows, most user applications require far less speed

than what will be delivered over the NBN. The reality is that, aside from a

few niche products (that are largely focused on video streaming and related

entertainment applications) there are currently few products or applications

that require speeds higher than 25 Mbps. It is the case that under current

technology specifications (including compression technology) multiple ultra

high definition video streams might require speeds of 75 Mbps or more (on the

basis that households have access to ultra high definition televisions and

content), although it is questionable whether the Australian taxpayer should be

subsidising such uses.

Figure 3. Speeds required to

support typical household and office applications (Mbps)

1.26

The argument cited at paragraph 2.81 of the committee majority report,

that Australia has been dropping in internet speeds, fundamentally

misunderstands the Akamai index upon which those claims are based. Akamai

measures the total speed achieved or requested though its global services (i.e.

demand, not supply). Consequently, countries with high concentrations of a

small number of high usage consumers achieve a relatively higher ranking.

1.27

The strength of the Government's rollout is affordability and ubiquity –

all Australians, regardless of where they live, will have access to high speed

broadband of 25 Mbps or more by 2020, at affordable prices. Demand for speed in

Australia is also depressed compared to some other countries because of the

compression technologies being used (the ABC, for example, asks that users have

an internet speed of 1.5 Mbps or more for best results).[4]

1.28

Ironically, an all FTTP rollout would have meant a lower ranking

for longer because of the much slower pace of the rollout and consequent

delayed switch over from slower ADSL-based broadband.

Meeting financial forecasts

1.29

The estimated peak funding is forecast to reach $48.8 billion in

financial year 2020. This remains unchanged from nbn's forecast in the two

previous corporate plans. nbn forecasts that its revenue will almost double in

the coming financial year, from $1 billion in 2016-17 to $1.9 billion in

2017-18. The internal rate of return for the project is forecast to be within

the range of 3.2 to 3.7 per cent based on peak funding of approximately $49

billion and a terminal value calculated at six times EBITDA.

Activations and service take-up

1.30

At the end of each of the last three financial years, nbn's activations

have been ahead of forecast. Further, nbn's public statements on take-up rates

by the end of the 18-month migration period—and 2018 Corporate Plan forecasts

of RFS and activations—suggest the proportion of activated services at the end

of FY2021 will be 73.5 per cent, across all technologies.

1.31

The committee majority report at paragraphs 2.17 and 2.6 suggests there

is doubt around nbn's take-up forecast because the proportion of services

activated is currently less than 70 per cent. However, the clear trend from

service activation rates over the past three years indicates nbn's forecasts

have been on the conservative side. A closer analysis of the data would reveal

that the proportion of premises in serving area modules that are live increases

as time goes on. It is obvious that the activation rates will lag the ready for

service progress because nbn has been expanding the network footprint at a

faster rate than the connection runrate. For example, in FY2018 nbn plans to

deliver nbn access to a further three million premises but during the same

period the company will connect two million premises. Therefore the proportion

of connected premises in the total footprint in a year's time will remain

relatively steady at 50 per cent.

Upgrade paths

1.32

The Statement of Expectations which sets the overarching objectives and

direction for nbn makes explicit the requirement for nbn to design and build

the network with upgrade paths available for future development. On several

occasions and in various forums, including hearings of this committee, nbn has

confirmed that the multi-technology mix is delivering an upgrade path for FTTN

and its variants, as well as HFC.

1.33

In his evidence at the committee's Sydney public hearing, nbn Chief

Financial Officer Stephen Rue explained the underlying business rationale for

selectively investing in speed increases via technology upgrades:

[T]he typical way you do long-term planning is...apply

parameters of CPI for both revenue and costs and we apply a ratio of CAPEX to

revenue, which, in our case, are around about 15 per cent. It is true some of

that 15 per cent could be applied to upgrades, but...it's not locked in... So

what we would do is we would look at business cases for upgrades as and when

they come and we would apply capital where it made business sense to do so.

There would be an overlay, if you like, to our corporate plan, and you would

only do it when it improved the corporate plan.[5]

The committee majority report conclusion of paragraph 2.90 is

at odds with the usage patterns, speed tier take-up, and choice of plan

indicated in Table 2.4 of the same report. Relying on a sample size of 2.8

million connected customers, the speed tier data indicates the prevalent trend

is for users to move from the lowest tier (12/1) to the next highest tier

(25/5). The proportion of users selecting a speed tier of 50 mbps or more has

remained largely unchanged during the past two years.

Sky Muster satellite services

1.34

Describing the Sky Muster service as a 'technology of last resort' (committee

majority report paragraph 4.87) significantly undervalues the step-change that

has occurred in the experience of internet users living in regional and remote

areas.

1.35

The Australian Government has invested $2 billion in two advanced

Ka-band satellites and a network of ground stations that make up the Sky Muster

service.

1.36

Until the Sky Muster service became available many homes and businesses

in regional and rural Australia were still dependent on very basic internet

access which made even online banking or emailing difficult. Sky Muster has

change all that for many thousands of Australians.

1.37

As the committee majority report acknowledges, satellite has always been

intended to be part of the rollout. Indeed, since the beginning of the rollout,

satellite has been used to provide broadband to Australians living in regional

and remote areas. nbn first began providing satellite services through the

Interim Satellite Service (ISS). Spending approximately $351 million, the then

Labor Government had promised 250,000 Australians would be eligible but

capacity was only available for 48,000. The service was abysmal, with speeds

often no faster than dial up. Part of this stemmed from poor design – the lack

of an enforced fair use policy meant that some heavy use consumers were able to

consume more than their fair share of data, whilst thousands of normal users

could not get an adequate service.

1.38

Under the current Government, the nbn has a record of being able to

deliver satellite to some of the most remote parts of the world, and deliver

upgrades along the way.

1.39

The Fixed Wireless and Satellite review undertaken by nbn under the

Coalition Government was able to diagnose some of the systemic issues that

plagued the ISS at the time. In 2014, nbn upgraded the capacity of the ISS by

one third, at a cost of $18.4 million. Secondly, a fair use policy was

introduced to ensure that a minority of very heavy users could not crowd out

the majority.

1.40

Following the work undertaken in the Fixed Wireless and Satellite Review,

both satellites were launched successfully into orbit by nbn, and have begun

providing services. Whilst there have been some initial problems in

installation and stability, nbn has now resolved these issues, and the

reliability of Sky Muster has been consistent with other technologies on the

network for some months. At the same time, the rollout of Sky Muster services

has been proceeding at a rapid pace, with over 79,000 active customers now

using the service.

1.41

Last year, telecommunications research firm Ovum found that when

measured in terms of data allowance, download speed, upload speed and

affordability selected plans on the nbn Sky Muster service are world leading

for satellite broadband services.[6]

1.42

Ovum examined eighteen retail service providers internationally that

offer satellite broadband services and found that selected plans based on nbn's

Sky Muster service delivered outstanding results across all service

requirements, establishing itself as a world leader that will deliver a great

service for regional and remote Australians.

1.43

Notwithstanding the substantial achievement in launching two of the most

sophisticated telecommunications satellites to provide services to some of the

most remote places in the world, nbn has also delivered a series of upgrades to

the service, over and above what they were originally designed to do under the

former Government. In particular, nbn has been able to fully utilise the second

satellite to provide services, rather than leaving it for redundancy. Secondly,

through more sophisticated demand modelling, nbn has been able to adjust

upwards the fair use policy to enable nbn to provide an extra 50 per cent of

data during peak times, and double the data available at off peak time, whilst

still ensuring that all users are able to get an adequate service. It is clear

that less data would have been available under the former Government as it had

only planned to make use of one satellite. Due to its revised forecasts of Sky

Muster capacity and through optimising the conversion of available satellite

spectrum (megahertz) to usable bandwidth (megabits), nbn has been able to

increase data caps from 150GB to 300GB, or from an average of 30GB of peak data

per customer to an average of 45GB of peak data per customer.

Global comparisons

1.44

The committee majority report focuses on limited and at times,

misleading comparisons between rollouts in other countries. In particular, to

compare the rollout of broadband in New Zealand with the rollout in Australia

fundamentally misunderstands the basic geographies of the two different

countries, and the economics of each rollout.

1.45

Figure 4 seeks to demonstrate the difference in land mass size between

Australia and New Zealand. Put simply, Australia is more than 27 times larger

than New Zealand.

Figure 4

1.46

Furthermore, there are important facts about the New Zealand rollout

that the committee majority has not acknowledged. In particular, there is no

commitment in New Zealand for 100 per cent coverage – premises can be chosen on

the basis of how easy or profitable it is to rollout services to them.

1.47

Fixed line high speed broadband is expected to be provided to 85 per

cent of premises. Even the former Labor Government's deeply flawed NBN Implementation

Study acknowledged that there was substantial additional cost beyond the 85 per

cent mark:

Source: National Broadband

Network Implementation Study, May 2010, p. 14.

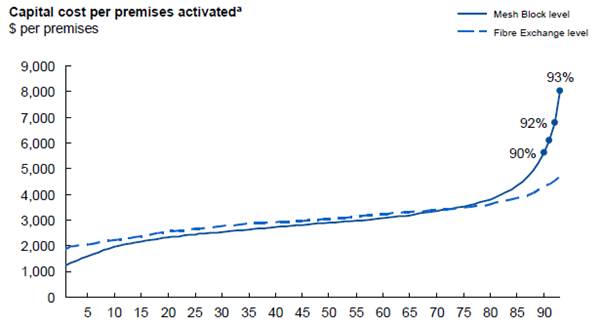

1.48

With the continuation of the rollout, these forecasts have proved overly

optimistic, as nbn has gained experience in a real-world environment, and not

the theoretical model of consultants.

1.49

New Zealand has not needed to make use of satellite technology in its

rollout and is able to rely on terrestrial wireless and mobile technologies for

providing services beyond the fixed line footprint.

1.50

For Australia, satellite has been necessary as this is the most cost

effective technology to serve remote premises to ensure that all premises can

access minimum broadband speeds of 25 Mbps.

1.51

nbn is expected to spend around $4.5 billion in capital on the fixed

wireless and satellite networks to provide affordable broadband to regional,

rural and remote Australia. Of course, the Government has done this because it

believes that there must be equivalent broadband services in regional

Australia. This commitment is demonstrated by the Government’s regular reviews

of regional telecommunications via the Regional Telecommunications Independent

Review Committee (RTIRC).

1.52

The new broadband networks being rolled out in Australia and New Zealand

are vastly different and it does neither rollout justice to compare them using

simple metrics such as the cost per premises to build FTTP.

1.53

While the cost of building FTTP in New Zealand may be less than what nbn

has experienced, the NBN is achieving better outcomes than New Zealand in many

other areas, including:

-

The fixed line footprint in Australia will extend to around 92

per cent of premises, whereas the fibre rollout is only around 85 per cent in

New Zealand.

-

The minimum broadband speed being provided in Australia is 25

Mbps, whereas New Zealand is only guaranteeing 10 Mbps.

1.54

And while the committee majority report at paragraph 2.82 suggests the ACT Government

found Australia compared unfavourably to South Korea and Hong Kong which have

rolled out FTTP networks, there is no acknowledgement of evidence given at two

hearings that demonstrated that the beneficiaries of FTTP are unwilling to pay the

incremental costs of upgrade. Both the ACT Government and the South Australian

Government expressed a desire for FTTP to be rolled out in those States. When

asked whether they would be will to contribute to the cost, these jurisdictions

declined. This is a real world example of the willingness to pay for FTTP over

MTM – when asked whether they would contribute to the sometimes substantial

costs of using FTTP over MTM, both jurisdictions declined even though the

supposed benefits would largely accrue in their jurisdictions.

1.55

The reality is that access to high speed broadband (regardless of the

technology) is just one factor to determine whether the economic and social

benefits flow from access to high speed broadband. For example, Tasmania has

the highest proportion of FTTP of any state, and has had access to the network

the earliest. Nonetheless, Tasmania ranks the lowest on Telstra's Digital

Inclusion index compared to other States.

Serviceability of premises

1.56

At paragraph 3.24, the majority committee argues that premises classed

as service class zero (SC0) have resulted in delays of months or more. However,

the committee majority report fails to acknowledge the fact that under the FTTP

rollout SC0 was a substantially bigger problem. The public reporting that nbn

was required to undertake following the 2013 election clearly shows that the

percentage of SC0 premises has fallen significantly since nbn switched to a more

efficient MTM rollout model:

-

14 September 2017: Total percentage of brownfields premises at

SC0: 5.9 per cent.

-

9 September 2013 (at time of 2013 election): Total percentage of

brownfields premises at SC0: 31 per cent.

1.57

The committee majority report at paragraph 1.50 refers to research

undertaken by the Australian Communications and Media Authority (ACMA) in 2016

and implies the research found that very early and high migration rates were a

feature of the FTTP footprint. In fact, the ACMA research found that, of 900

premises in FTTP ready for service areas, 400 (or 44 per cent) had not switched

over to the NBN at all at the time the survey was undertaken.

Consumer experience

1.58

Several recent announcements indicate the Coalition Government is

working closely with nbn and retailers to ensure the processes for switching to

the NBN are being refined and enhanced to meet consumers' needs. Over the past

year the Government announced it is:

-

helping Australians get what they pay for under their internet

plan by introducing Australian Competition and Consumer Commission (ACCC)

monitoring of broadband performance at the retailer level;

-

having the ACMA gather objective data on the consumer experience

to help target industry improvements;

-

increasing understanding of consumer experiences before, during

and after migration to the NBN through research being commissioned and

undertaken by the ACMA; and

-

setting out the roles and responsibilities of all parties in

delivering a smooth transition to an NBN-based service through a revised

telecommunications industry guide.

1.59

In addition, the ACCC has released detailed guidance for retailers on

how to advertise broadband speeds to customers, including clearly identifying

typical minimum speeds during peak periods.

1.60

The committee majority report finds that these measures are untimely or

inadequate, despite most of them being at just the earliest stage of

implementation. For example, paragraph 5.62 declares the committee's view that

industry guidance from the ACCC will be insufficient and heavy regulatory

intervention is required.

1.61

The ACCC is to be applauded for taking the measured and prudent approach

of developing comprehensive industry guidance on the information to be provided

to consumers about broadband services supplied over the NBN. While great

progress has been made in the rollout of the NBN over the past several years,

it remains a fact that the majority of residential broadband connections still

operate over pre-NBN infrastructure.

The telecommunications sector is undergoing a period of

adjustment as the nbn progressively replaces legacy broadband infrastructure.

Broadband consumers do need more detailed information concerning the new

choices available to them in the post-nbn world. The ACCC's guidance is well

researched and informed by typical usage and user needs. Given the guidance has

only been provided to retailers in recent weeks—and there remain more than five

million Australian premises to be migrated to the nbn—it would appear premature

to be declaring that the guidance will be inadequate.

Hon Sussan Ley MP

Chair

Mr Luke Howarth MP Senator

Jane Hume

Senator Dean Smith Mrs

Lucy Wicks MP

Navigation: Previous Page | Contents | Next Page