Introductory Info

Date introduced: 23 June 2021

House: House of Representatives

Portfolio: Home Affairs

Commencement: The operative provisions of both Bills will commence 1 January 2022.

Purpose of the Bill

This Bills Digest relates to two Bills comprising:

The purpose of the two Customs Bills is to amend the Customs Act 1901

(Cth) and the Customs

Tariff Act 1995 (Cth) to fulfill Australia’s international obligation to

implement changes to the Harmonized Commodity Description and Coding System.

Two separate Customs Bills

are needed for this in order to comply with the constitutional requirement that

‘laws imposing duties of customs shall deal with duties of customs only’[1] and provisions regarding other matters need to be

dealt with separately.[2] As such, the Customs

Act sets out the broad administrative

rules and the offence provisions for the importing of prohibited goods into

Australia, while the Customs Tariff Act focuses exclusively on the customs duty rates

applicable to imported goods.

Background

Overview of

the Australian tariff classification system

All goods (above a set minimum

value) imported into Australia, whether by air, sea or post, must be cleared

through Australian Customs/Border Force.[3]

The typical duties and taxes paid on imported goods include import processing charge,

GST, and customs duty (also known as tariff or import duty).

Customs duty is payable as a rate/percentage of the total

value of the imported goods.[4]

Customs duty rate typically ranges from 0% to 10%. Different goods are taxed at

different customs duty rates (for example, 5%, 10%) according to the Australian

tariff classification system.

The Australian tariff classification system is based on

the Harmonized

Commodity Description and Coding System (commonly referred to as the

Harmonized System or the HS).[5]

The Harmonized System is an internationally standardised system of names and

codes to classify traded goods.

The HS entered into force in 1988 and it is monitored by

the World Customs Organization (WCO).[6]

Australia is a member of the WCO and a signatory to the International

Convention on the Harmonized Commodity Description and Coding System (HS Convention), therefore Australia has an international

obligation to adopt the HS into domestic law.

Harmonized

System codes

The HS is enforced in Australian law via the Customs

Tariff Act. The Customs Tariff Act contains thousands of HS codes.

The HS codes are typically six to 10 digits long and they describe specific

products.[7]

Each HS code has a corresponding rate of applicable customs duty – free, 5%,

10% et cetera.

For example:

- Chapter

08 of the HS codes is a broad description, titled ‘Edible fruit and nuts, peel

of citrus fruit or melons’

- Heading

06 of Chapter 08 is more specific, titled ‘Grapes, Fresh or Dried’

- Subheading

10.00 of Heading 06 of Chapter 08 is very specifically called ‘Fresh’.[8]

The HS code given to fresh grapes is 0806.10.00,

indicating the product’s classification chapter, heading, and subheading.

Businesses that wish to import fresh grapes into Australia must pay the customs

duty rate prescribed by the HS code 0806.10.00, which is currently held at 5%

of the value of the import.[9]

For example, if a business decides to import $10,000 worth

of fresh grapes into Australia, then it must pay $500 customs duty to the

Government, unless the grapes are imported from a free trade partner country

and eligible for the free trade agreement’s preferential duty rates.[10] Low value goods (that is, goods with a value of $1,000 or

less), imported into Australia by post, are generally exempt from customs duty,

however, some exceptions and limitations apply.[11]

The HS codes are used by more than 200 countries and

economies.[12]

This allows customs authorities around the world to identify goods on a

consistent basis and apply the relevant customs regulations.

The WCO describes the HS as ‘a universal language for

international trade’.[13]

Jason Wood, the Assistant Minister for Customs, Community Safety and

Multicultural Affairs, explains:

The Harmonized System provides means for identifying a good

as it moves from one country to another, ensuring that what Australia calls a

‘tomato’ is the same as what every other user of the Harmonized System calls a

‘tomato’.[14]

World

Customs Organization’s reviews of the HS

New products are being invented and traded every day. For

example, electronic cigarettes are a relatively new invention and there are

debates around whether they are ‘tobacco products’ because most electronic

cigarettes do not contain tobacco.[15]

As such, the WCO periodically reviews and updates the HS to recognise new

products and improve the uniformity in the global classification of traded

goods.

The HS entered into force in 1988 and it has undergone

several major changes or reviews.[16]

Table 1 below outlines the amendments to the HS and the

corresponding Australian legislation.

Table 1: amendments

to the HS and the corresponding Australian legislation

Source: As per footnotes 17 to 25.

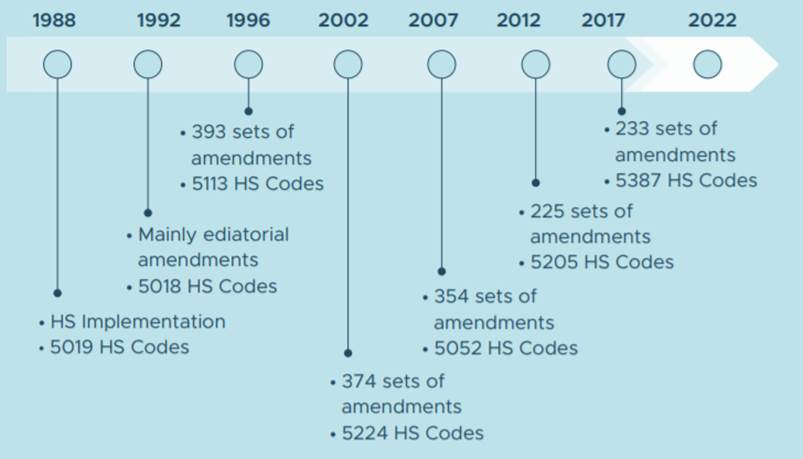

Figure 1 below shows the scope of previous

amendments to the HS.

Figure 1: scope of previous amendments to the HS

Source: World Customs

Organization, The harmonized system: a universal language for

international trade, 2018,

p. 37.

Sixth major review

of the Harmonized System

The WCO began its sixth major review of the HS in November

2014 and invited member countries to submit proposals for changes to the HS.[26]

In January 2020, the WCO published amendments to the HS accepted by all member

countries (including Australia).[27]

The accepted amendments to the HS are known as ‘HS 2022

amendments’ or ‘2022 Harmonized System changes’. The WCO emphasises:

the importance of ensuring that the HS is kept up to date in

light of changes in technology and patterns of international trade. Adaptation

to current trade through the recognition of new product streams and addressing

environmental and social issues of global concern are the major features of the

HS 2022 amendments.[28]

[emphasis added]

Member

countries (including Australia) are obligated to implement the agreed changes

to the HS in their national tariff schedules. Jason Wood said:

Australia was an active participant in the World Customs

Organization’s sixth review of the Harmonized System … Australia is

committed to fulfilling its international obligation to implement these changes

by 1 January 2022.[29]

[emphasis added]

Consequently, the two Customs Bills arise from Australia’s

commitment to fulfil its international obligation under the HS Convention.

Committee

consideration

Senate

Selection of Bills Committee

At its meeting of 24 June 2021, the Senate Selection of

Bills Committee deferred consideration of the Bills until its next meeting.[30]

Senate

Standing Committee for the Scrutiny of Bills

The Scrutiny of Bills Committee had no comment on the

Bills.[31]

Policy

position of non-government parties/independents

At the time of writing, no comments in relation to the

Bills by non-government parties or independent Members and Senators have been identified.

Financial

implications

The Customs Amendment Bill is not expected to result in

any financial impact.[32]

The Customs Tariff Amendment Bill will preserve the

current customs duty treatment for all goods with the exception of three categories

of goods (that is, flat-panel display modules, semiconductor based transducers

and electronic waste and scrap). The Explanatory Memorandum states that it is

not possible to quantify the financial impact of these amendments.[33]

Statement of Compatibility

with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the

Bills’ compatibility with the human rights and freedoms recognised or declared

in the international instruments listed in section 3 of that Act. The

Government considers that the Bills are compatible.[34]

Parliamentary

Joint Committee on Human Rights

The Parliamentary Joint Committee on Human Rights had no

comment on the Bills.[35]

Key issues

and provisions

Schedule 1

of Customs Amendment Bill

Item 1 of Schedule 1 of the Customs Amendment Bill

amends the definition of ‘tobacco products’ to include a new HS code 2404.11.00.

The new HS code is created to better classify ‘products containing tobacco or

reconstituted tobacco and intended for inhalation without combustion’, products

commonly known as electronic cigarettes or e‑cigarettes.

If passed, this means that e-cigarettes will be classified

under the new HS code 2404.11,[36]

in the same classification chapter as ‘tobacco and manufactured tobacco

substitutes’. Furthermore, this indicates the chemicals used for e‑cigarettes

(known as e-liquids or vape juice) will be classified under a similar HS code.

As such, e-cigarettes or e-liquids will be subject to the same regulatory

requirements as existing categories of tobacco products for customs purposes.[37]

Item 2 of Schedule 1 of the Customs Amendment Bill is

an application provision and provides for the continued operation of subsection

82(2), subsection 206(2A) and section 233BABAD of the Customs Act, these

provisions being affected by the new classification 2404.11.00.

Subsection 82(2) provides:

A warehouse

licence is subject to the condition that no tobacco products will be warehoused

in the warehouse.[42]

Item 2 will have the effect that from the date of

commencement, this section will apply to products (for example, e-cigarettes)

covered by the new subheading 2404.11.00.[43]

Similarly:

- the

disposal power for prohibited imports (subsection 206(2A)) will apply to

products (for example, e-cigarettes) covered by the new subheading 2404.11.00 seized

on or after the commencement of the Bill and

- the

criminal offence provision for illegally importing, possessing, or conveying

tobacco products (section 233BABAD) will apply to products (for example, e-cigarettes)

covered by the new subheading 2404.11.00 imported on or after the commencement

of the Bill.[44]

The amendments ensure that the Australian Border Force

will be able to seize and dispose of e‑cigarettes (covered by the new

subheading 2404.11.00) that arrive in Australia illegally on, and after, the

commencement of the Bill. Figure 2 below is a visual representation of a

sample of the products commonly known as e-cigarettes.

Figure 2: visual representation of e-cigarettes

Source: Queensland

Department of Health, The known harms of e-cigarettes and vaping, 2021.

Schedule 1

of Customs Tariff Amendment Bill

Schedule 1 of the Customs Tariff Amendment Bill

contains more than 400 items, almost all of which repeal or substitute new

classifications of goods for the purposes described in the background to this

Digest.

As described by Jason Wood, Assistant Minister for

Customs, Community Safety and Multicultural Affairs, in his second reading

speech for the Customs Tariff Amendment Bill:

The amendments proposed under

this Bill will preserve existing rates of customs duty for the majority of

goods. There are exceptions to this general approach for three categories of

goods: flat-panel display modules, semiconductor based transducers and

electronic waste and scrap … each of these categories of goods will have new

dedicated tariff subheadings and will apply a 'free' rate of customs duty.[45]

Concluding comments

The two Customs Bills amend Australian law to implement

changes that emanated from the most recent review of the HS. The changes have

been endorsed by the WCO and will preserve existing rates of customs duty for

the majority of goods. As such, the Bills do not introduce controversial policy

issues.