Introductory Info

Date introduced: 25 February 2021

House: House of Representatives

Portfolio: Social Services

Commencement: 1 April 2021

The Bills Digest at a glance

The purpose of the Social Services Legislation Amendment

(Strengthening Income Support) Bill 2021 (the Bill) is to amend the Social Security Act

1991 (the SS Act) to:

- increase

the maximum basic rates of JobSeeker Payment, Youth Allowance, Youth Disability

Support Pension, Parenting Payment and Austudy by $50 per fortnight from 1

April 2021

- increase

the ordinary income free area for JobSeeker Payment, Youth Allowance (Other),

Parenting Payment Partnered and Widow Allowance to $150 per fortnight from 1

April 2021 and cease indexation of the JobSeeker Payment income free area

- enable

a number of temporary COVID-19 measures to be extended.

The most significant measure in the Bill is the increase

in the basic rate of JobSeeker Payment and other payments. Over time the value

of payments to recipients of allowances such as JobSeeker Payment has fallen

relative to pensions and minimum wages.

The Government’s proposal to increase payment rates has

been criticised by non-government parties and by major interest groups on the

grounds that a $50 a fortnight increase is too low.

The digest explains how the Bill’s provisions operate and

provides details on the COVID-19 measures to be extended and the relevant provisions.

Purpose of

the Bill

The purpose of the Social Services Legislation Amendment

(Strengthening Income Support) Bill 2021 (the Bill) is to amend the Social Security Act

1991 (the SS Act) to:

- increase

the maximum basic rates of JobSeeker Payment, Youth Allowance, Youth Disability

Support Pension, Parenting Payment and Austudy by $50 per fortnight from 1

April 2021

- increase

the ordinary income free area for JobSeeker Payment, Youth Allowance (Other), Parenting

Payment Partnered and Widow Allowance to $150 per fortnight from 1 April 2021 and

cease indexation of the JobSeeker Payment income free area

- extend

special COVID-19 qualification criteria for Youth Allowance (Other) and

JobSeeker Payment until 30 June 2021—the criteria cover those in quarantine or

self-isolation or caring for a family member or household member in quarantine

or self-isolation due to COVID-19

- extend

until 30 June 2021 the waiver of the ordinary waiting period for JobSeeker

Payment and Youth Allowance (Other)—the waiver was introduced as part of the

Government’s COVID-19 response, and

- give

the Secretary of the Department of Social Services the discretionary power—until

30 June 2021—to extend the portability period for certain Age Pension

and Disability Support Pension recipients unable to return to, or depart from,

Australia within 26 weeks due to the impact of COVID-19—portability determines

a person’s eligibility for a pension and payment rate when they live

permanently outside Australia.

The measures were announced on 23 February 2021.[1]

Structure of

the Bill and the Bills Digest

The Bill has one Schedule divided into five parts

proposing discrete measures. The Bills Digest will provide background to the

issue of JobSeeker Payment adequacy and COVID-19 social security measures. The

‘Key issues and provisions’ will provide detail on each of the five parts but focuses

primarily on the changes to payment rates and the income free area.

Background

Over recent decades, payments such as JobSeeker Payment

and Youth Allowance have fallen behind pensions, minimum wages and living

standards in the broader community.

As the relative value of payments has declined, the Government

has faced increasing pressure to raise the rate. Initially this came from

community sector organisations like the Australian Council of Social Service

(ACOSS), but eventually expanded to others such as the Business Council of

Australia, the Governor of the Reserve Bank of Australia, and members of the

National Party.[2]

The coronavirus (COVID-19) pandemic shifted the debate.

Government actions to control the spread of the virus such as lockdowns, border

closures and social distancing requirements resulted in job losses. In response

the Australian Government introduced a number of measures including a temporary

Coronavirus Supplement of $550 a fortnight added to payments for recipients of

JobSeeker Payment, Youth Allowance and some other working age payments.[3]

On 23 February 2021, the Government announced a permanent

increase in ‘the rate of working-age payments by $50 a fortnight from 1 April

2021’.[4]

The rate increase will not apply to all payments those of working age can

receive—for example Disability Support Pension for those aged 21 years or more

and Carer Payment are excluded. Payments which will be increased include the

main benefit-type payments—JobSeeker Payment, Youth Allowance, Parenting

Payment, Disability Support Pension for those aged under 21 years, Austudy,

Special Benefit and ABSTUDY Living Allowance.

Payment adequacy

Why the value of unemployment

payments has fallen relative to pensions and minimum wages

Historically there has been a distinction between pensions

and benefits. Pensions were paid to claimants who were not expected to

work. This included the elderly, people with disabilities, and widows (later

extended to single parents). Benefits were paid to people who were

temporarily unable to work. This included people who were unemployed or sick.

Over time the distinction became more complicated.

Pensions were generally paid at a higher rate than

benefits. From the 1970s onwards, pensions rates began to be adjusted in a

different way from benefits.[5]

Pensions ended up being adjusted according to movements in the Consumer Price

Index (CPI) and benchmarked to a percentage of male total average weekly

earnings (MTAWE)—since 2009 pensions have been indexed to both the CPI and a

living cost index, the Pensioner and Beneficiary Living Cost Index (PBLCI). Benefits

have been indexed using the CPI alone.[6]

This meant that as living standards in the broader community rose as wages

increased, pensions also increased. Benefits, however, declined relative to

community living standards when wages rose.

The gap between pensions and benefits increased further in

2009 when the Government increased the single rate of payment by $32.49 per

week in response to the findings of the Pension Review led by departmental

secretary Jeff Harmer.[7]

The review was a response to community concerns that the rate of the pension

was inadequate.[8]

The single rate of unemployment benefit fell from around

93 per cent of the single rate of the pension in 1997 to around 66 per cent in

2020.[9]

According to researchers Peter Whiteford and Bruce Bradbury, unemployment benefits

fell from around 50 per cent of the minimum wage in 1997 to under 40 per cent in

the period before the addition of the Coronavirus Supplement.[10]

Current indexation arrangements mean that Parliament must

periodically pass legislation to increase benefits if it aims to prevent them

falling further behind pensions and wages (assuming wages increase).

Policy principles

The 2009 report of the Australia’s Future Tax System

Review (Henry Review) found that indexing payments ‘solely to prices can reduce

adequacy relative to members of the community who work’ and argued that benefit

type payments should be indexed to some measure of community standards rather

than CPI alone.[11]

Advocates of an increase argue that payments such as

JobSeeker Payment should be maintained at a rate that is adequate for a

recipient to meet basic needs.[12]

Poverty lines are sometimes used as a benchmark.[13]

However, the Department of Social Services (DSS) does not include reductions in

poverty as a performance criterion for income support payments.[14]

Even if policymakers accept adequacy as an objective, policymakers

may decide to balance it against other objectives. According to the Henry Review’s

report:

The primary focus of the income support system has been and

should continue to be the provision of a minimum adequate level of income to

people who are unable to support themselves through work or their savings. This

focus on payment adequacy, however, has to be balanced with incentives to work.

And payments need to be seen as affordable, sustainable and fair by the

community at large.[15]

Minister for Families and Social Services Anne Ruston has

taken a similar position saying that in making the decision to increase benefit

rates, the Government considered: ‘three key principles – our responsibility to

support unemployed Australians, to incentivise people to take up work and to

keep the welfare budget sustainable into the future’.[16]

Raise the Rate for Good campaign

For more than a decade ACOSS has been leading a campaign

to raise the rate of payments. In 2009, ACOSS called on the Government to

increase allowance payments for single people by $30 a week.[17]

Over time ACOSS adjusted this figure. In March 2020 they called for an increase

of $95 per week.[18]

In setting the most recent figure, ACOSS drew on budget

standards research conducted at the Social Policy Research Centre at the

University of New South Wales. According to researchers Peter Saunders and

Megan Bedford:

A budget standard indicates how much a particular family

living in a particular place at a particular time needs in order to achieve a

particular standard of living. It is derived by specifying every item that is

needed by the family and each of its members, pricing each item and summing to

produce the overall budget. The items included, how much they cost and how long

they last will vary according to the standard of living that the budget is designed

to support. Any budget is thus only relevant to a particular standard - hence

the term budget standard. The standard itself can (in principle at least) be

set at any level, although budget standards have traditionally been designed to

represent minimum standards by estimating how much is needed to achieve an

acceptable but minimal standard of living.[19]

The campaign’s approach shifted after the Government

introduced the $550 per fortnight Coronavirus Supplement in March 2020. The campaign’s

‘ask’ then became:

We can’t turn back to $40 a day. We need a permanent and

adequate increase that ensures people on JobSeeker, Youth Allowance and other

income support payments can cover the basics they need, including housing.[20]

A wide range of organisations have joined the Raise the

Rate for Good campaign. Supporters include community organisations, church

welfare organisations, unions and business groups. The campaign has also

attracted financial support from philanthropic trusts.[21]

The Government’s response to

COVID-19

By the end of February it was clear that measures to slow

the spread of COVID-19 would result in job losses and an economic slowdown. In

response, the Government initially developed two stimulus packages. In an

interview for Sky News, Minister for Families and Social Services Anne Ruston

did not rule out a permanent increase in unemployment payments but made it

clear that it would not be part of the stimulus. As she explained to journalist

Kieran Gilbert, the stimulus would be:

… a short term measured and proportionate response to the

economic conditions that we are encountering right now. And any long term

structural changes to anything that we're doing in this space will be the

subject of a separate conversation.[22]

The first stimulus package, announced on 12 March 2020,

included a one-off payment of $750 to recipients of income support payments (both

pensions and benefits), Family Tax Benefit recipients and Commonwealth Senior

Health Card holders.[23]

The second stimulus package, announced on 22 March, included the

Coronavirus Supplement and a second one-off payment of $750 to the same groups

as the first payment but excluding those eligible for the Coronavirus

Supplement. [24] The Government also

made a number of other temporary changes to payment eligibility and conditions.

The Coronavirus Supplement

Initially set at $550 per fortnight, the Coronavirus

Supplement was paid to recipients of JobSeeker Payment, Youth Allowance,

Parenting Payment, Austudy, ABSTUDY Living Allowance, Farm Household Allowance

and Special Benefit.[25]

Unlike an increase to the base rate of payment it was not income tested; if a

person was eligible for the supplement, they received the full amount.[26]

The Government announced that the supplement would be paid

for six months.[27]

However, the legislation implementing the payment provided that the initial

period would be for around five months, from 27 April 2020 to 24 September

2020.[28]

The supplement was later extended at a reduced rate of $250 per fortnight until

December 2020 and then extended again at a reduced rate of $150 per fortnight

until 31 March 2021.[29]

The supplement is legislated to cease from that date.[30]

Income test changes

In July 2020 the Government announced changes allowing

recipients of JobSeeker Payment and Youth Allowance (Other) to earn more

private income before their payments were reduced by the income test.[31]

The changes increased the amount of income an individual could receive before

the payment was affected—the income free area—from $106 per fortnight to $300

per fortnight for JobSeeker Payment and from $143 per fortnight to $300 per

fortnight for Youth Allowance (Other). The rate at which payment rates were

reduced (the taper rate) was changed from 50 cents for each dollar over

the free area and 60 cents for each dollar over the upper income test threshold

($256 for JobSeeker Payment and $250 for Youth Allowance (Other)), to a single

taper rate of 60 cents for each dollar of income over the free area.[32]

These changes applied initially from 25 September 2020 to

31 December 2020 but were extended until 31 March 2020.[33]

Separate income test changes were made to the way a

payment recipient’s partner’s income was assessed for JobSeeker Payment.

Initially, from 27 April to 24 September 2020, the taper rate for partner

income was reduced from 60 cents to 25 cents for each dollar of income over the

partner income free area ($996 per fortnight).[34]

From 25 September this was changed to a taper rate of 27 cents for each

dollar of income over a partner income free area of $1,165 per fortnight. The

partner income test changes were initially extended to 31 December 2020 but

will now cease on 31 March 2021.[35]

Expanding eligibility

From 25 March 2020, the Government temporarily expanded

eligibility for JobSeeker Payment and Youth Allowance (Other) to include:

- sole

traders and self-employed people who had lost revenue due to COVID-19—enabling

them to meet mutual obligation requirements by continuing to operate their

businesses

- permanent

employees who have been stood down or lost their job

- people

in quarantine or self-isolation as a result of advice from a health

professional or a requirement by a government (Commonwealth, state or

territory)

- people

caring for someone infected or in isolation as a result of contact with

Coronavirus.[36]

From 25 March the Government also waived a number of waiting

periods that usually apply to those claiming social security payments. This

included the Ordinary Waiting Period for JobSeeker Payment, Youth Allowance

(Other) and Parenting Payment and the Newly Arrived Residents Waiting Period

for JobSeeker Payment, Youth Allowance, Austudy, Parenting Payment, Special

Benefit and Farm Household Allowance.[37]

The Ordinary Waiting Period is a one-week period claimants

have to wait before their payment starts. In some circumstances the waiting

period can be waived.[38]

The Newly Arrived Residents Waiting Period, which applies to new migrants, is

usually four years for the payments listed above.[39]

Some groups are exempt from this waiting period.[40]

Both the expanded eligibility criteria and the waiting

period waivers were due to end on 24 September 2021 but were later

extended: firstly to 31 December 2020 and then to 31 March 2021.[41]

Separate waivers of the assets test for JobSeeker Payment,

Parenting Payment, Youth Allowance, Austudy and ABSTUDY Living Allowance; and

the Liquid Assets Waiting Period for JobSeeker Payment, Youth Allowance and

Austudy were in place for the 25 March to 24 September 2020 period but were not

extended.[42]

Extending the portability period

Portability refers to the eligibility conditions for a

social security payment while an individual is overseas.[43]

As part of the response to COVID-19 the Government allowed Age Pension

recipients and certain Disability Support Pension recipients who are

temporarily overseas to apply for a portability extension if they are unable to

return to Australia within 26 weeks because of COVID-19.[44]

Absences outside Australia for longer than 26 weeks can affect a person’s

payment rate (see ‘Key issues and provisions’ section below). Some pensioners

who normally reside overseas and were unable to leave Australia and return home

were also granted an extension to the period they could remain in Australia

before certain grandfathering provisions protecting them from previous

portability changes would no longer apply.

Changes were made to the portability provisions in the SS

Act via the Social

Security (Coronavirus Economic Response—2020 Measures No. 10)

Determination 2020 and the Social Security

(Coronavirus Economic Response—2020 Measures No. 16) Determination 2020.

The changes in the latter determination will expire on 31 March 2021.

Committee

consideration

The Bill was referred to the Senate Community Affairs

Legislation Committee for inquiry and report by 12 March 2021. The Committee

tabled its report on 12 March 2021. Details of the inquiry are available at the

inquiry

homepage.

Neither the Senate Standing Committee for the Scrutiny

of Bills nor the Parliamentary Joint Committee on Human Rights had

reported on their consideration of the bill at the time this digest was

prepared.

Senate Community Affairs

Legislation Committee

Committee report

The Committee recommended that the Bill be passed.

Commenting on the Bill’s proposed increase to payment rates and changes to the

income free threshold, the Committee’s report stated:

… the committee is of the view that the taxpayer-funded

increase of $50 to income support payments balances the need to ensure payments

encourage and enable workforce participation with the need for the welfare

system to be fiscally sustainable for future generations. In addition, the Bill

will raise the threshold before benefits start to taper off, enabling

recipients to earn more before their payments are decreased. This provides the

right balance of supports and encouraged people to engage in the workforce.[45]

Labor Senator’s additional comments

Drawing on evidence provided to the Committee during the

inquiry, Labor Senators highlighted concerns about the adequacy of payments,

the income free area, indexation, and changes to mutual obligation

requirements. However, the Senators noted that if the ‘Bill does not pass the

Parliament in the next sitting week, current legislative settings mean that

payment rates will revert to pre-pandemic levels by the end of March’.[46]

Labour Senators recommended:

- the

Senate does not stand in the way of the modest increase in payments contained

in this Bill

- the

Senate notes the strong concerns of the community, businesses, experts and

service delivery organisations that:

- the

income Free Area proposed in the Bill does not allow people to keep enough of

their earnings from part-time, casual, or seasonal work, to effectively help

people move into employment; and

- the

Bill does not do enough to support Australians facing poverty and hardship –

including in the areas of adequate payments to those who need them, housing,

addressing child poverty, and better health and education services.

- the

Government abandon its counterproductive and punitive plans for a hotline for

employers to report people who haven’t agreed to a job – regardless of the

reason – that will inevitably see the Government

hound people, rather than help the 2 million Australians currently

looking for work.[47]

The last recommendation refers to the Government’s

announcement of a hotline that will allow employers to report income support

recipients who have refused an offer of suitable employment.[48]

Dissenting report by the Australian

Greens

In their dissenting report the Australian Greens argued

that income support payments should be set at a level that lifts recipients

above the poverty line. The report made four recommendations:

- the

Bill be amended to increase all income support payments to $1,115 a fortnight,

which is in line with the Henderson Poverty Line

- the

Bill be amended to retain the current income free threshold of $300 a fortnight

- that

compulsory income management be abolished

- that

mutual obligations be abolished.[49]

The last two recommendations deal with matters outside the

scope of this Bill.

Policy

position of non-government parties/independents

In their public comments, non-government parties and

independents have focused on the Bill’s increase to the rate of Jobseeker

Payment.

Both Labor and the Australian Greens support an increase

to the rate of Jobseeker Payment but argue that the increase is not enough.

Labor’s Shadow Treasurer Jim Chalmers said ‘Any increase

is better than no increase’ and indicated that Labor was ‘not going to stand in

the way of an increase in the JobSeeker payment’.[50]

Greens Senator Rachel Siewert described the increase as ‘mean-spirited, cruel

and in fact insulting to jobseekers’.[51]

Position of

major interest groups

As with comments by non-government parties and

independents commentary by major interest groups focused on the rate of

Jobseeker Payment, however some groups have also commented on other parts of

the Bill.

The adequacy of the increase to

payments

ACOSS has described the increase in JobSeeker Payment as

‘measly’. According to a 23 February 2021 media release, ACOSS Chief

Executive Officer Cassandra Goldie said:

This is a heartless betrayal of millions of people with the

least, including hundreds of thousands of children, single parents, people with

disability, older people, students, people dealing with illness and injury, and

others relying on income support.

Today, the Government has turned its back on those with the

least, plunging people further into poverty. It’s a cruel decision that shows a

complete lack of humanity and empathy. It comes as devastating news for so many

and will have serious consequences for people’s lives, including homelessness

and crushing debt.[52]

Beyond the community sector, a number of other

organisations have also argued for a higher rate of JobSeeker Payment. In a

September 2020 budget submission the Business Council of Australia (BCA)

recommended that the ‘permanent rate of JobSeeker should be set at levels more

consistent with historical relativities with the Age Pension’. The submission

argued:

While the rate of JobSeeker will need to return to long run

levels, the longer-term rate should be reconsidered. The Newstart rate for

single people that applied pre-crisis had fallen in relative terms over time,

from around 90 per cent of the Age Pension to around 60 per cent, with

indexation arrangements that would ensure it continued to fall in relative

terms over time.

To support unemployed Australians and ensure nobody gets left

behind, the rate of JobSeeker should be set at levels more consistent with

historical relativities with the Age Pension (in the 75–90 per cent range). A

JobSeeker rate in this range (which is around 50 per cent of the minimum wage)

would address the need to preserve incentives to work while improving the

adequacy of the payment.[53]

In contrast, in July 2020 Robert Carling of the Centre for

Independent Studies argued that ‘Nothing has fallen apart because there have

not been real increases’ in unemployment payments and that a permanent increase

in the payment rate would ‘go against the government’s mantra that all extra

spending in this crisis is “temporary and targeted”.’[54]

Alternative proposals

In its submission to the Senate inquiry on the Bill, ACOSS

argued that income support payments should be set at at least $65 a day with

supplementary payments for additional costs. These payments include JobSeeker

Payment, Youth Allowance, Parenting Payment, Austudy, Abstudy, Special Benefit

and Crisis Payment:

People on JobSeeker need at least $65 a day to feed and

clothe themselves, as well as keep a roof over their heads. In addition,

supplementary payments must be available to meet additional costs faced by

people in private rental, people with an illness or disability and single

parents.[55]

ACOSS propose a 50 per cent increase in Commonwealth Rent

Assistance, a Disability and Illness Supplement (set at at least $50 per week)

and a Single Parent Supplement (set at least $200 per week). [56]

The Grattan Institute propose an increase of $100 per

week:

The Government should increase the permanent rate of

JobSeeker not by $25 a week as it has announced, but by at least $100 a week

for singles. An increase of $100 a week would restore the unemployment benefit

to a similar level, relative to full-time wages, as 1994. It would be a little

higher, relative to full-time wages, as in July 2000, when the benefit was

increased as part of GST compensation.[57]

The Council for Single Mothers and their Children stressed

the importance of support for parents:

If the rate of JobSeeker cannot be raised overall, we implore

Senators and Members to ensure that this Bill is amended such that all

JobSeeker and other payments to parents lift families well above the poverty

line so both the parents and children have a chance to find a better life.[58]

Indexation

A number of submissions argued that payments such as

JobSeeker needed to be indexed in a way that prevents them from falling behind

community living standards in the future. For example, ACOSS argued it is

‘crucial that wage indexation is applied to working-age payments so that they

do not fall so far behind community living standards again.[59]

The Grattan Institute argued against the Government’s approach of indexing

JobSeeker Payment to the Consumer Price Index:

The first problem with CPI indexation is that the CPI

understates the change in the cost of living for allowance recipients. The

second, more important, problem is that CPI indexation means that a person on

the unemployment benefit falls further and further behind other members of the

community, including pensioners. This also creates incentives for people to

seek to claim higher-paying disability pensions.

The Government’s plan to increase JobSeeker does nothing to

fix these problems. JobSeeker will still be benchmarked to inflation, rather

than wages. This means that over time, people on JobSeeker will again fall

further behind the living standards of other Australians.[60]

Grattan proposed setting JobSeeker Payment in the same way

as the Age Pension.[61]

Incentives to work

A number of organisations took issue with claims that a

significant increase to JobSeeker Payment would discourage recipients from

finding employment. For example, in their submission, Mission Australia stated:

The Government … argued that higher income support rates can

act as a disincentive for people to find employment. This is not the case.

Economic modelling has found that increasing income support payments will not

act as a disincentive to work, and did not do so even during the time the

highest level of Coronavirus Supplement was applied. On the contrary, higher

income support levels facilitate job seeking as they provide resources for

people to pay associated costs including transport and clothing for interviews.[62]

The St Vincent de Paul Society and the Grattan Institute

also rejected the argument that increasing payments would significantly reduce

work incentives.[63]

The best form of welfare is a job?

Critics of increases in the rate of unemployment payments

sometimes argue that a better way to improve the wellbeing of unemployed income

support recipients is to help them find work. Some organisations argued that

there are not enough jobs available to make this approach work. For example,

the St Vincent de Paul Society argue:

The rhetoric that ‘the best form of income support is a job’

is not palatable when there remain nine people either applying or looking to

increase their hours for every job advertised; when the increase in the labour

market has been in casual and part-time work; and when the income of

Australia’s youth has stagnated during this century.[64]

Similarly, the Financial Counselling Network argued that

if ‘full employment’ means unemployment does not fall below 4 or 5 per cent, a

large number of Australians will need to rely on income support. [65]

Waiting period and income taper

rates

ACOSS welcomed the Government’s waiver of the one-week

waiting period for JobSeeker Payment and Youth Allowance but argued that the

Bill’s temporary extension of the waiver should be permanent. [66]

On changes to the income free area, ACOSS’ submission

registered concern:

… many will be worse off as a result of the reduction in the

current $300 a fortnight income free-area. ACOSS has previously recommended

that people on JobSeeker Payment be able to earn more than $52pw before their

income support tapers off, and has proposed an income bank model similar to

that available for people receiving Youth Allowance (Student/Apprentice) to

better support people who have some paid work.

[67]

Financial

implications

According to the Minister’s second reading speech, the

‘policy delivered by this bill carries a cost of approximately $9 billion to

2024–25, including approximately $700 million in 2020–21.’[68]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the

Bill’s compatibility with the human rights and freedoms recognised or declared

in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[69]

Key issues

and provisions

Part 1—Increasing working age

payments

Is adequacy an objective?

Much of the advocacy for an increased rate of JobSeeker

Payment and other working age payments assumes that considerations such as work

incentives and financial sustainability should not trump adequacy. However,

official statements of program objectives suggest the Government places greater

relative weight on objectives such as financial sustainability than on adequacy.

In 1998 one of the objectives listed in the Department of

Social Security’s annual report was ‘unemployed people receive adequate levels

of income to support themselves’.[70]

This no longer appears as an objective in the most recent Department of Social

Services annual reports.

The current set of objectives place more emphasis on

containing the cost of payments. An objective of the payments system as a whole

is ‘sustainability’ measured in terms of the future lifetime cost of payments

to individuals. An objective for working age payments is the extent to which

payment recipients have improved financial self-reliance.[71]

The minimum wage as a benchmark

While there is no officially recognised benchmark for

measuring changes in the adequacy of income support payments, ministers have

compared payments to the minimum wage. For example, the Prime Minister recently

noted that the increased rate of JobSeeker Payment brings it to 41.2 per cent

of the national minimum wage:

… which puts us back in the realm of where we had been

previously. The indexation had been different to other payments and, as a

result, it had fallen down to 37.5%. We had obviously taken advice about the

level of the payment and this puts it back, comfortably, within the middle of

the range that had previously been in place.[72]

However, since the Bill does not change the way payments

are indexed, over time payments such as JobSeeker Payment can be expected to

again fall behind minimum wages.

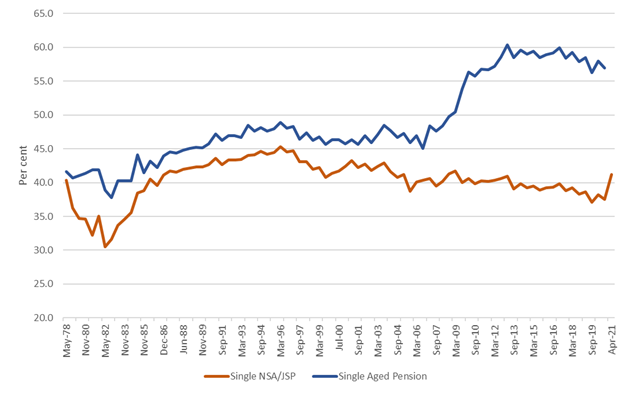

Figure 1 (below) shows the single rate of Newstart

Allowance/JobSeeker Payment and the Age Pension as a proportion of the minimum

wage. The large increase in the rate of the Age Pension as a proportion of the

minimum wage in 2009 is the result of a one-off increase in the single rate of

the pension by $32.49 per week in response to the findings of the Pension

Review.[73]

Figure 1: single JobSeeker Payment/Newstart

Allowance and Age Pension rates as a share of the National Minimum Wage

Sources: DSS, ‘5.2 Historical

rates’, Social security guide, DSS website, last reviewed 9 November

2020; Fair Work Commission (FWC), ‘The

Australian Minimum Wage from 1906’, FWC

website, last updated 12 July 2019; R Bray, Reflections

on the Evolution of the Minimum Wage in Australia: Options for the Future,

Working paper, Crawford School Social Policy Institute, 1, 2013, October 2013.

Note: chart uses the base rate of the unemployment benefit/Newstart

Allowance/JobSeeker Payment and Age Pension and does not include supplementary

payments.

Key provisions

Items 1–10 amend payment rates set out in the SS

Act rate calculators for Youth Disability Support Pension, Youth Allowance,

Austudy, JobSeeker Payment (as well as Partner Allowance and Widow Allowance)

and Parenting Payment. The proposed increase to all rates is $50 per fortnight.

A number of other payments have their rates linked to the

JobSeeker Payment and Youth Allowance rates and will also benefit from the $50

per fortnight increase: Farm Household Allowance, Disaster Recovery Allowance

and education allowances paid as part of the veterans’ education schemes.[74]

The Explanatory Memorandum notes that equivalent increases will be made to the

rate of ABSTUDY Living Allowance and to Special Benefit.[75]

ABSTUDY payment rates are set out in the ABSTUDY Policy Manual while Special

Benefit is paid at a discretionary rate but cannot be more than the rate of

JobSeeker Payment, Youth Allowance or Austudy the person would otherwise

receive.[76]

Table 1 sets out a selection of the current and proposed

payment rates.

Table 1: current payment rate and

proposed payment rates from 1 April 2021

| Payment |

Current per fortnight |

1 April 2021 per fortnight |

| JobSeeker Payment, single |

$565.70 |

$620.80 |

| JobSeeker Payment, single with dependent child |

$612.00 |

$667.50 |

| JobSeeker Payment, partnered |

$510.80 |

$565.40 |

| Parenting Payment Single |

$768.90 |

$825.80 |

| Parenting Payment Partnered |

$510.80 |

$565.40 |

| Youth Allowance, under 18 at home |

$253.20 |

$303.20 |

| Youth Allowance, under 18–21 at home |

$304.60 |

$354.60 |

| Youth Allowance, away from home |

$462.50 |

$512.50 |

| Youth Allowance, single with dependent child |

$606.00 |

$656.00 |

| Youth Allowance, partnered |

$462.50 |

$512.50 |

| Youth Allowance, partnered with dependent child |

$507.90 |

$557.90 |

| Austudy, single |

$462.50 |

$512.50 |

| Austudy, single with dependent child |

$606.00 |

$656.00 |

| Austudy, partnered |

$462.50 |

$512.50 |

| Austudy, partnered with dependent child |

$507.90 |

$557.90 |

| Long term student: Austudy single or Youth Allowance

single away from home |

$561.90 |

$611.90 |

| Long term student: Austudy or Youth Allowance partnered |

$507.90 |

$557.90 |

| Disability Support Pension, not independent, living at

home, aged under 18 |

$385.10 |

$435.10 |

| Disability Support Pension, living at home, aged 18–20 |

$436.50 |

$486.50 |

| Disability Support Pension, under 21, independent or

partnered |

$594.40 |

$644.40 |

Notes: Rates are maximum basic rates excluding any

supplementary amounts. JobSeeker Payment and Parenting Payment rates include

indexation increase to occur on 20 March 2020. Disability Support Pension rates

include the Youth Disability Supplement.

Sources: DSS, Enhanced

social security safety net, DSS, Canberra, 24 February 2021; DSS, Indexation

rates March 2021, DSS, Canberra, 8 March 2021.

Items 1–2 replace the tables setting out the rates

of Disability Support Pension paid to those under 21 years in various

circumstances at Point 1066A-B1 (table B) and Point 1066B-B1 (table

B) of the SS Act.

Items 3–5 replace the tables setting out the rates

of Youth Allowance paid to those in various circumstances at Point 1067G-B2

(table BA), Point 1067G-B3 (table BB) and Point 1067G-B4 (table BC).

Items 6–7 replace the tables setting out the rates

of Austudy paid to those in various circumstances at Subpoint 1067L-B2(1)

(table BA) and Point 1067L-B3 (table BB).

Item 8 replaces the table setting out the rates of

JobSeeker Payment, Widow Allowance and Partner Allowance paid to those in

various circumstances at Point 1068-B1 (table B). The new rates include

the rate increase occurring on 20 March 2021 due to automatic indexation

to movements in the Consumer Price Index.

Item 9 replaces the provision setting the rate of

Parenting Payment Single at Point 1068A-B1. The new rates include the

rate increase occurring on 20 March 2021 due to automatic indexation to

movements in the Consumer Price Index.

Item 10 replaces the provision setting out the

rates of Parenting Payment Partnered paid to those in various circumstances at Point

1068B-C2 (table C). The new rates include the rate increase occurring on

20 March 2021 due to automatic indexation to movements in the Consumer

Price Index.

Part 2—Qualification for Youth Allowance

or JobSeeker Payment—coronavirus

The amendments in Part 2 of Schedule 1 add new, temporary,

COVID-19-related qualification criteria for Youth Allowance (Other) and

JobSeeker Payment to the SS Act. The amendments are a more limited

version of criteria introduced as part of the Government’s COVID-19 response

and set out in a legislative instrument which will expire on 31 March 2021.

The Coronavirus

Economic Response Package Omnibus Act 2020 gave the Minister for

Families and Social Services the power to make a legislative instrument to

determine eligibility requirements for Youth Allowance (Other) and JobSeeker

Payment in response to circumstances relating to COVID-19.[77]

The eligibility requirements could only apply for the period that the

Coronavirus Supplement is paid. The instrument providing for the

COVID-19-related eligibility requirements is the Social Security

(Coronavirus Economic Response—2020 Measures No. 2) Determination 2020.

The Social Services

and Other Legislation Amendment (Extension of Coronavirus Support) Act 2020

repeals all provisions relating to the Coronavirus Supplement from 1 April

2021, including the Minister’s power to determine eligibility criteria relating

to COVID-19.[78]

The eligibility

criteria for JobSeeker Payment and Youth Allowance (Other) generally require a

person to be unemployed or be considered unemployed by Services Australia for

the purposes of these criteria—this discretion can be used to allow someone in

part-time work to qualify for the payment where they are also meeting their

mutual obligation requirements to look for more work or for a full-time

position.[79]

The expanded eligibility criteria in response to COVID-19 were necessary to

ensure those who were still ‘employed’ or were previously self-employed, but

who had temporarily lost hours of work and income, could qualify for income

support.

The proposed criteria to be included in the SS Act

are different from those in the Social Security

(Coronavirus Economic Response—2020 Measures No. 2) Determination 2020 as

they do not cover those who, as a result of the adverse economic effects of

COVID-19:

- were

made unemployed

- were

stood down but not made redundant

- lost

hours of work or

- were

sole traders/self employed individuals forced to suspend their business or who

had a downturn in revenue.

The proposed criteria only cover those affected by a

self-isolation or quarantine requirement issued by the Commonwealth, a state or

territory government, or a health professional in relation to COVID-19. The

previous criteria included those affected by the economic impacts of COVID-19

and those affected by health orders to self-isolate or quarantine, while the

criteria from 1 April 2021 is targeted at those affected by COVID-19

health orders. Those unemployed may still qualify for JobSeeker Payment or

Youth Allowance (Other) under the normal qualification criteria for these

payments.

Key provisions

Item 13

inserts new section 540BA and item 14 inserts new subsection

593(5) which set out the temporary COVID-19 qualification criteria for

Youth Allowance (Other) and JobSeeker Payment, respectively. The eligibility

criteria apply for the period 1 April 2021 to 30 June 2021 and cover those

required to self-isolate or quarantine due to COVID-19; or those caring for an

immediate family member or member of their household who is required to

self-isolate or quarantine where:

- the

Secretary of the Department of Social Services is satisfied that the person has

had their working hours reduced due to quarantining, self-isolation or caring

for someone who is

- the

person satisfies the activity test or is not required to satisfy the activity

test

- the

Secretary of the Department of Social Services is satisfied that the person:

- is

not entitled to receive a leave payment in respect of the period for which the

payment is claimed

- has

taken reasonable steps to claim any leave payment

- is

receiving a leave payment but it is less that it would have otherwise been due

to the economic effects of COVID-19 or

- the

total leave payment is less than the amount of Youth Allowance/JobSeeker

Payment the person would receive if their claim was granted; and

- the

person is an Australian resident or is exempt from the residency requirements.

Age requirements determine whether the person is eligible

for Youth Allowance or JobSeeker Payment in these circumstances: those aged at

least 22 years but under Age Pension age are eligible for JobSeeker Payment

while those aged 16–21 years are eligible for Youth Allowance (individuals aged

15 years may be eligible in special circumstances).[80]

Part 3—Ordinary waiting period

The amendments in Part 3 of Schedule 1 extend the waiver

of the ordinary waiting period for JobSeeker Payment, Youth Allowance (Other)

and Parenting Payment to 30 June 2021. The ordinary waiting period delays the

start date for these payments by one week (other waiting periods can also

apply).[81]

The Coronavirus

Economic Response Package Omnibus Act 2020 waived the one-week

‘ordinary waiting period’ that applies to JobSeeker Payment, Youth Allowance

(Other) and Parenting Payment for the period that the Coronavirus Supplement is

paid. The waiver of this waiting period was extended with the Coronavirus

Supplement, apart from the extension that applied from 1 January 2021 to

31 March 2021. The extension of the ordinary waiting period waiver in 2021 was

made using the instrument making power under section 1262 of the SS Act

inserted by the Social

Services and Other Legislation Amendment (Extension of Coronavirus Support) Act

2020—the instrument is the Social Security

(Coronavirus Economic Response—2020 Measures No. 16) Determination 2020.

Section 1262 allows the Minister for Families and Social Services to amend specific

provisions of the SS Act via legislative instrument. However, any amendment

made using this power ceases to have effect after 31 March 2021.

Key provisions

Items 15–20 provide for the ordinary waiting period

to not apply to any claimants for Parenting Payment, Youth Allowance (Other) or

JobSeeker Payment for the period 1 April 2021 to 30 June 2021.

Part 4—Income free areas and taper

rates

The amendments in Part 4 of Schedule 1 permanently

increase the income free area for Youth Allowance (Other), JobSeeker Payment

(except principal carer parents), Parenting Payment Partnered, Partner

Allowance and Widow Allowance to $150 per fortnight from 1 April 2021. The

amendments also cease indexation of the free area for JobSeeker Payment,

Parenting Payment Partnered, Widow Allowance and Partner Allowance.

The income free area is the amount of income an individual

can receive per fortnight before their payment is reduced under the income

test. Income over the free area reduces the rate of these payments by 50 cents per

dollar (this rate of reduction is known as the taper rate). There is also a

higher threshold over which a taper rate of 60 cents for each dollar applies.[82]

The higher threshold from 1 April 2021 will be $256 per fortnight for all the

listed payments except for Youth Allowance (Other) which will be $250 per

fortnight.

Prior to 25 September 2020 the income free area for the

payments other than Youth Allowance (Other) was $106 per fortnight. Youth

Allowance (Other) had a higher free area of $143 per fortnight. On 21 July

2020, the Government announced a temporary increase in the free area for

JobSeeker Payment and Youth Allowance (Other) to $300 per fortnight.[83]

The increase was to apply from 25 September to 31 December 2020 but was later

extended to 31 March 2021.[84]

History

The income free area for JobSeeker Payment (and related

payments) has rarely changed since the unemployment benefit was introduced in

1945. When it has changed it has been with the intention of encouraging

jobseekers to take up part-time work and to help recipients avoid poverty traps

(where the income test combined with income tax result in very little return

from work).[85]

In 2014, the income free area for JobSeeker Payment’s predecessor Newstart

Allowance (together with Parenting Payment Partnered, Widow Allowance and

Partner Allowance) was increased from $62 to $100 per fortnight. This was the

first increase since 2000, when it was increased from $60 to $62 as part of the

GST compensation package.[86]

The $60 free area had been in place since May 1986.

Also in 2014, the

income free area began to be annually adjusted in line with movements in the

Consumer Price Index. Indexation was paused for three years from 1 July 2017 as

part of a savings measure included in the Social Services

Legislation Amendment Act 2017.

Comparison of pre- and

post-COVID-19 income test settings with proposed changes

Table 2 sets out previous income test settings, the

temporary increase as part of the Government’s COVID-19 response, and the

changes proposed in Part 4 of Schedule 1 to the Bill.

Table 2: income test settings for

JobSeeker Payment and Youth Allowance (Other)

| Payment |

July–September 2020 |

September 2020–March 2021 |

From 1 April 2021 |

|

JobSeeker Payment, Parenting Payment Partnered, Partner

Allowance and Widow Allowance

|

Free area of $106 per fortnight.

Taper rate of 50 cents per dollar of income between $106

and $256 per fortnight

Taper rate of 60 cents per dollar over $256 per fortnight.

Free area adjusted on 1 July each year in line with

movements in the CPI. Higher threshold set at $150 above the free area.

|

Free area of $300 per fortnight.

Taper rate of 60 cents per dollar of income over $300 per

fortnight.

|

Free area of $150 per fortnight.

Taper rate of 50 cents per dollar of income between $150

and $256 per fortnight.

Taper rate of 60 cents per dollar over $256 per fortnight.

No annual adjustment of the free area.

|

|

JobSeeker Payment for a single principal carer

|

Free area of $106 per fortnight. Taper rate of 40 cents

per dollar of income over $106 per fortnight.

Free area adjusted on 1 July each year in line with

movements in the CPI.

|

Free area of $106 per fortnight. Taper rate of 40 cents

per dollar of income over $106 per fortnight.

Free area adjusted on 1 July each year in line with

movements in the CPI.

|

Free area of $150 per fortnight. Taper rate of 40 cents

per dollar of income over $150 per fortnight.

No annual adjustment of the free area.

|

|

Youth Allowance (Other)

|

Free area of $143 per fortnight.

Taper rate of 50 cents per dollar of income between $143

and $250 per fortnight

Taper rate of 60 cents per dollar over $250 per fortnight.

No annual adjustment.

|

Free area of $300 per fortnight.

Taper rate of 60 cents per dollar of income over $300 per fortnight.

|

Free area of $150 per fortnight.

Taper rate of 50 cents per dollar of income between $150

and $250 per fortnight.

Taper rate of 60 cents per dollar over $250 per fortnight.

No annual adjustment.

|

Source: DSS, ‘4.10.2

Historical unemployment & sickness benefit income test’, Social

security guide, DSS website, last reviewed 1 July 2020; SA, A

guide to Australian Government payments: 1 July–19 September 2020, SA,

Canberra, 2020, pp. 38–40; SA, A

guide to Australian Government payments: 1 January to 19 March 2021,

SA, Canberra, 2021, pp. 39–41.

Lack of indexation for the income

free area

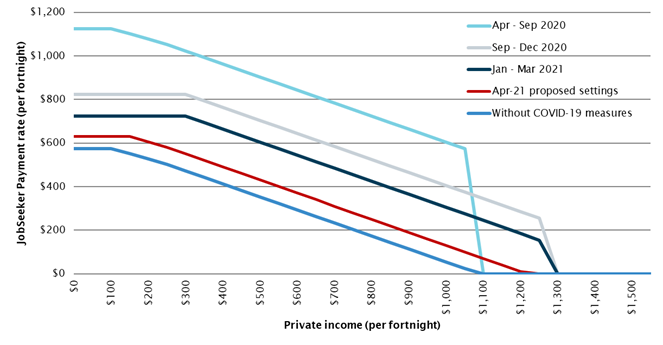

Figure 2 (below) shows how earnings affect the rate of

payment under the temporary COVID-19 response measures, the proposed settings

under the Bill and the situation without the COVID-19 measures.

Changes to the income free area and the increase in the

maximum rate mean that recipients with earnings will be better off than under

the pre-COVID-19 settings, but will receive lower levels of support compared to

the COVID-19 settings.

The removal of indexation means that the increased support

and work incentive offered by the higher free area will erode over time as its

real value is not maintained.

Figure 2: JobSeeker Payment rate

under different COVID-19 settings and proposed settings from April 2021

(single, no dependent children)

Notes: JobSeeker Payment rate

includes Energy Supplement and any applicable Coronavirus Supplement rate (but

excludes Rent Assistance and other supplementary payments payable in some

circumstances). ‘Without COVID-19 measures’ is an estimate for the period

20 March 2020 to 19 March 2021 excluding the Coronavirus

Supplement and the changes to the income test from 25 September 2020 to 31

March 2021.

Source: Parliamentary Library estimates.

Key provisions

Item 21 changes the ordinary income free area for

Youth Allowance (Other) at point 1067G-H29 of the SS Act from

$143 to $150.

Item 22 changes the amount of excess income allowed

before the higher taper rate of 60 per cent applies to Youth Allowance (Other),

at paragraph 1067G-H32(c) and 1067G-H33(c), from $107 to $100.

This maintains the current upper income test threshold at $250 for Youth

Allowance (Other).

Item 23 changes the ordinary income free area for

JobSeeker Payment at point 1068-G12 to $150.

Item 24 repeals the note at point 1068-G12

which states that the free area is indexed in line with CPI increases.

Item 26 changes the amount of excess income allowed

before the higher taper rate of 60 per cent applies to JobSeeker Payment, at points

1068-G15 and 1068-G16 to $106. This maintains the upper income test

threshold at the current rate of $256.

Items 27–30 make similar amendments to the

Parenting Payment Partnered free area and upper income test threshold.

Items 31 and 32 repeal the indexation provisions

for the JobSeeker Payment, Parenting Payment Partnered, Widow Allowance and

Partner Allowance income test free area at section 1190 (table item 20AAA)

and subsection 1191(1) (table item 14AAA).

Part 5—Portability

The amendments in Part 5 of Schedule 1 provide the

Secretary of the Department of Social Services with a temporary discretionary

power to extend the portability period for certain Age Pension and Disability

Support Pension recipients who are unable to return to, or depart from,

Australia within 26 weeks because of the impact of COVID-19. The Secretary’s

power will expire on 30 June 2021.

Portability refers to the eligibility conditions for a

social security payment while an individual is overseas.[87]

Some social security payments have limited portability and can only be receive

for short periods while a person is temporarily overseas and some may only

provide portability in special circumstances. Other payments, such as the Age

Pension, have unlimited portability and a person can continue to receive the

Age Pension while living permanently outside Australia. The Disability Support

Pension has different portability conditions depending on an individual’s

circumstances:

- people

who are permanently and severely impaired and have no future work capacity may

be eligible for unlimited portability

- people

with terminal illnesses who return to their country of origin to be near or

with a family member may be eligible for unlimited portability

- other

DSP recipients generally have a portability period of up to four weeks in any

12-month period (four week periods separate from this general period can be

granted for specific purposes such as medical treatment or family crises).[88]

While a person may be eligible for a payment under the

portability rules, their pension rate can be affected after a certain period of

time outside of Australia depending on the time they spent residing in

Australia during their working life (between the age of 16 and Age Pension

age). This period of residence in Australia is known as their Australian

Working Life Residence (AWLR). Those with less than 35 years AWLR will, after

26 weeks overseas, have their payment reduced to a rate equivalent to the

proportion of 35 years their AWLR represents.[89]

For example, a person with 16 years of AWLR will receive around 46 per

cent of the rate otherwise payable if they resided in Australia. Those with 35

years or more AWLR residence will not have their payment reduced.

Some Disability Support Pension recipients with unlimited

portability may be exempt from the AWLR rate reduction.[90]

In response to COVID-19-related overseas travel

restrictions, the Australian Government provided extended portability periods

to those pensioners unable to return to or depart from Australia within 26

weeks. Some pensioners face issues with being unable to depart because they are

part of groups grandfathered from previous changes to portability.[91]

These groups only remain covered by the grandfathering provisions if they have

not returned to Australia since that date for a continuous period of 26 weeks

or more.[92]

Changes were made to the portability provisions in the SS Act for those

outside Australia unable to return and those in Australia unable to depart via

the Social Security

(Coronavirus Economic Response—2020 Measures No. 10) Determination 2020

and the Social

Security (Coronavirus Economic Response—2020 Measures No. 16)

Determination 2020. The changes in the latter determination will expire on

31 March 2021.

The amendments proposed in items 35–37 will enable

the Secretary to determine a different portability period where the relevant

26-week period ends on or after 11 March 2020 and:

- the

Secretary is satisfied the person’s absence from Australia is temporary and

- the

Secretary is satisfied the person in unable to return to Australia before the

end of the 26‑week period because of the impact of COVID-19.

The different period set by the Secretary cannot end after

30 June 2021.

Similar amendments are made for those in Australia at risk

of losing their grandfathered status by items 38 and 39—the Secretary

can determine a different period the person can remain in Australia before they

lose their grandfathered status. The Secretary must be satisfied of the same

conditions listed above and cannot set a period that ends after 30 June 2021.

Concluding comments

The end of the $150 per fortnight Coronavirus Supplement

on 31 March 2021 will have an immediate impact on recipients of the affected

payments. This will only be partially cushioned by the $50 per fortnight

permanent increase proposed by the Bill. If the Bill passes it is likely that

advocacy groups will continue to campaign for further increases in the base

rate of payment.

The Bill does not address the reason payments such as

JobSeeker Payment have fallen in value relative to pensions and the minimum

wage—the way payments are indexed. If wages increase over time, payments

indexed to the CPI are likely to fall behind pensions and the minimum wage.