Introductory Info

Date introduced: 07/10/2020

House: House of Representatives

Portfolio: Infrastructure, Transport, Regional Development and Communications

Commencement: Various dates as set out in the body of this Bills Digest.

The Bills Digest at a glance

Purpose of the Bill

The Territories

Legislation Amendment Bill 2020 primarily amends the legislation relating

to Australia’s external territories of Christmas Island, Cocos (Keeling)

Islands and Norfolk Island. There are consequential impacts for other

Commonwealth legislation.

The Bill amends the Christmas Island

Act 1958, the Cocos (Keeling)

Islands Act 1955 and the Norfolk Island Act

1979 to streamline the operation of applied laws and delegation and

vesting of powers. According to the Explanatory

Memorandum, the Bill addresses

the risk of delegation instruments becoming outdated when

applied laws in force in the territories are amended or new laws are made by

the relevant state or territory government. This will address any concerns that

the delegation instruments cannot encompass powers that do not exist at the

time they are made.

Amendments are also proposed in the Bill to the Norfolk

Island Act to allow the Commonwealth Government to enter into agreements

for the provision of state-type services for Norfolk Island with applied law

jurisdictions.

These arrangements are intended to operate in the same way

as the existing arrangements that allow for the application of NSW laws and

provide a broader and more flexible legal mechanism with respect to the future

provision of state-type services in Norfolk Island. The amendments allow for

the laws of a state or territory, prescribed by Regulations as an ‘applied law

jurisdiction’, to be applied in Norfolk Island.

The Bill also changes the jurisdiction of Norfolk Island

courts and provides for the future abolition of the Norfolk Island Supreme

Court after a lengthy transitional period.

The Bill, if passed, will continue the extension of

Commonwealth legislation to Norfolk Island.

Stakeholder comments

There has been little or no comment about the effect of the

Bill from stakeholders or from non‑government and independent Senators

and members.

Provisions of the Bill

The Bill applies certain Commonwealth laws—particularly from

the Treasury portfolio and the Attorney-General’s portfolio—to Norfolk Island.

Once that has occurred, any changes to the relevant statutes by the

Commonwealth will also apply in Norfolk Island.

Purpose of

the Bill

The purpose of the Territories

Legislation Amendment Bill 2020 (the Bill) is to amend a range of

Commonwealth legislation applicable to the external territories of Christmas

Island, Cocos (Keeling) Islands and Norfolk Island. This includes:

-

amend the Norfolk Island Act

1979 (NI Act), Christmas Island

Act 1958 (CI Act) and Cocos (Keeling)

Islands Act 1955 (CKI Act) to ensure the effective operation of

the laws of other states and territories which have been applied in these

territories. Together these three statutes are referred to as the Territory

Acts

-

amend the NI Act to allow the Australian Government to

enter into arrangements with any state or territory government to support

state-type service delivery in Norfolk Island and provide for the possible

future conferral upon the courts of a state or territory jurisdiction

(including appellate jurisdiction) in relation to Norfolk Island

-

amend the Corporations Act

2001, Australian

Securities and Investments Commission Act 2001 (ASIC

Act) and associated Treasury Acts to fully extend their application to the

external territories and ensure all Australian companies operate under the same

legislative framework

-

amend the Bankruptcy Act 1966

to allow the Australian Financial Security Authority (AFSA) to provide

bankruptcy and personal property security services to Norfolk Island. The Bankruptcy

(Estate Charges) Amendment (Norfolk Island) Bill 2020 (Bankruptcy Estate

Charges Bill) is consequential to this measure and extends the Bankruptcy (Estate

Charges) Act 1997 to Norfolk Island

-

amend the Freedom of

Information Act 1982 (FOI Act) to clarify its application to

bodies established under a law in force in Norfolk Island

-

amend the Privacy Act 1988

to clarify its application to statutory bodies in the external territories and

clarify the application of the Australian Privacy Principles (APPs) to state

and territory laws which have been applied in the external territories and the

Jervis Bay Territory

-

amend the Administrative

Decisions (Judicial Review) Act 1977 (ADJR Act) to extend its

coverage to decisions made by Commonwealth officials under applied laws in the

external territories and the Jervis Bay Territory and extend the right to

judicial review to decisions made under laws made by the former Norfolk Island

Legislative Assembly and continued pre-self-government ordinances

-

amend the Criminal Code Act

1995 (Criminal Code) to update the definition of ‘Commonwealth

public official’ to include people exercising powers or functions under a law

in force in Norfolk Island

-

amend the Broadcasting

Services Act 1992 to allow the Australian Communications and Media

Authority (ACMA) to issue licences and undertake future broadcasting planning

in Norfolk Island

-

amend the Copyright Act 1968

to ensure Norfolk Island is treated as a territory instead of a state for the

purposes of the Act

-

extend the application of the Education Services

for Overseas Students Act 2000 (ESOS Act) to Norfolk Island to

allow for the potential regulation of services to overseas students attending

Norfolk Island Central School.[1]

Structure of the Bills

The Bill is divided into four Schedules which broadly set

out the following:

-

Schedule 1 contains amendments to the Territory Acts relating to

applied laws and delegations operating in the external territories as well as

amendments relating to Norfolk Island courts

-

Schedule 2 amends various statutes within the Treasury portfolio

and in particular Acts which are administered by the Australian Securities and

Investments Commission (ASIC)

-

Schedule 3 amends Acts within the Attorney-General’s portfolio

such as the Bankruptcy Act and various statutes relating to

administrative law and

-

Schedule 4 amends three other Commonwealth Acts including the Broadcasting

Services Act.

The Bankruptcy Estate Charges Bill contains a single

Schedule.

Background

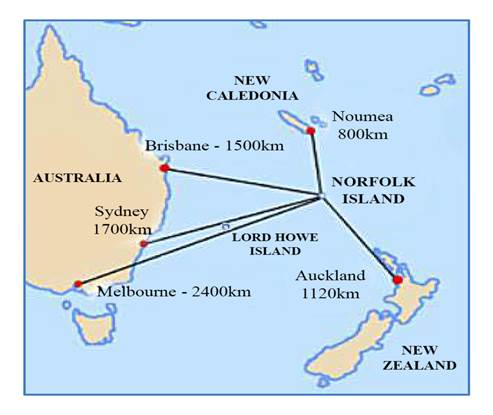

Norfolk Island is an external territory of the Commonwealth

of Australia located 1,676 kilometres northeast of Sydney.[2]

Norfolk Island has a population of

1,748 (ABS 2016), with approximately 20 per cent identifying as having Pitcairn

ancestry. This compares with a population of 1,796 in 2011 (Norfolk Island

Government Census) and 2,601 in 2001.[3]

The Australian Government, through the Department

of Infrastructure, Transport, Regional Development and Communications,

administers the Indian Ocean Territories of Christmas Island and the Cocos

(Keeling) Islands as well as Norfolk Island. Through the Territories Law Reform Act 1992 the Commonwealth Parliament

amended the Christmas Island Act and the Cocos (Keeling) Islands Act to

apply most of the Western Australian law in those territories.[4]

Since 1 July 2016, following the passage of the Norfolk Island

Legislation Amendment Act 2015[5]

and the Territories

Legislation Amendment Act 2016,[6]

the Commonwealth has taken over the administration of Norfolk Island including

taking responsibility for all levels of government services and their delivery

arrangements. Since that time the Government has been extending Commonwealth

legislation to Norfolk Island. These Bills continue this iterative process.

A number of the measures contained in the Bill allow for

transition periods so that there will be an efficient transfer of

responsibilities such as the registration of business names, bankruptcy records,

and television and radio services.

The abolition of self-government for Norfolk Island remains

controversial on Norfolk Island and

has led to the filing of two applications with the United Nations.[7] The Commonwealth

Government has a consultation process on reforms to Norfolk Island laws.[8]

Applied laws

and state-type services

Commonwealth legislation allows for the laws of another

jurisdiction to be applied in certain territories to enable the regulation and

delivery of services usually provided by state or territory governments.

Section 18A of the NI Act provides

that the laws of New South Wales are in force on Norfolk Island, but that such

laws may be amended, repealed or suspended by an ordinance made under section 19A

of that Act. The Norfolk

Island Applied Laws Ordinance 2016, made under section 19A, amends,

repeals and suspends applied laws as set out in the items in the Schedules to

the Ordinance. The Ordinance is to be read together with the NSW laws in order

to understand the operation of the applied laws in the Territory.

ANAO report

In 2016 the Commonwealth entered an agreement with the NSW

government for the delivery of some state-type services such as education,

health and local government.[9]

The 2019 report by the Australian National Audit Office

(ANAO) considered the design and implementation of the Norfolk Island reform

process.

The department’s advice to the Australian Government on the

need for comprehensive reform was informed by a body of evidence showing the

existing arrangements on Norfolk Island were not sustainable. There was an

appropriate community consultation process. Advice on the extension of

Australian Government arrangements to Norfolk Island was informed by economic

analysis and input from relevant Australian Government entities. Advice

relating to the delivery of state-type services was not informed by appropriate

engagement with the State Government of NSW (NSW Government) on the

development, implementation and monitoring of service delivery.[10] [emphasis added]

And further:

The department did not secure the NSW Government’s commitment

to deliver state-type services during the design phase. The Assistant Minister

for Infrastructure and Regional Development (Minister) announced the reforms on

19 March 2015, prior to receiving a formal response from the NSW Government

confirming its in-principle agreement. Consequently, the department did not

obtain the NSW Government’s advice on state-type service priorities, delivery

risks, timeframes and anticipated costs before the reforms were announced. The

department, in its advice to the Australian Government, did not adequately

outline the risks or likelihood of being able to secure NSW Government as a

partner or alternative plans should NSW not agree in whole or in part.[11] [emphasis added]

In 2018–19 state-type services were delivered to Norfolk

Island residents through agreements with the NSW Government, the Australian

Federal Police, the Norfolk Island Regional Council and private sector

service providers.[12]

However, in response to a question posed in 2019, the Minister for

Infrastructure stated:

The NSW Government has confirmed it will not deliver services

to Norfolk Island beyond the end of its current agreement in mid-2021. The

Department is currently undertaking work to develop options for the future

delivery of services to the Island. [13]

The matter had not been resolved by August 2020.[14] According to the

ANAO report, in July 2018 the Prime Minister wrote to the ‘ACT Chief Minister

seeking interest in delivering services on Norfolk Island’.[15]

Norfolk

Island courts

This Bill will lead to the future abolition of the Norfolk

Island Supreme Court, the Court of Petty Sessions and the Coroners Court. This

will bring Norfolk Island into line with the arrangements existing on Christmas

Island and the Cocos (Keeling) Islands. The Norfolk Island Supreme Court will

not cease to operate until no person holds the office of judge of the Supreme

Court of Norfolk Island. The Explanatory Memorandum notes that ‘it is likely to

be a number of years before these provisions are utilised’.[16]

The Supreme Court of Norfolk Island was established

in 1957 under the Norfolk Island Act

1957 (NI) and details of its jurisdiction, administration and procedure

are set out in the Supreme Court Act

1960 (NI).[17]

It was continued in existence by the NI Act as the superior court of

record of Norfolk Island and the application of the Supreme Court Act 1960

amended by the Norfolk Island

Continued Laws Ordinance No. 2 of 2015.[18]

The Supreme Court is also the court of

appeal from the Court of Petty Sessions (established under the Court of Petty

Sessions Act 1960 (NI)), and the Federal Court of

Australia is the court of appeal from the Supreme Court of Norfolk Island.[19]

The Supreme Court consists of the Chief Justice, appointed by the

Governor-General of Australia, and such other judges as the Governor-General

sees fit to appoint.[20]

Recent amendments to the operation

of the Norfolk Island Supreme Court by the Investigation

and Prosecution Measures Act 2018 (IAPMA) included provisions

allowing the Norfolk Supreme Court to exercise its civil and criminal

jurisdiction in ‘host-jurisdictions’ and empanel juries in those jurisdictions.[21] Further amendments

made by the Norfolk

Island Amendment (Supreme Court) Act 2020 serve to ‘remove any

doubt’ that the Norfolk Island Supreme Court may sit in state jurisdictions,

among other measures.[22]

The Court of Petty Sessions hears

criminal matters punishable by fine or summary conviction and may hear minor

civil matters.[23]

The jurisdiction of the Court is exercised by the Chief Magistrate or by any three

magistrates.[24]

Norfolk Island’s courts also have

jurisdiction in the Coral Sea Islands Territory.[25]

Committee consideration

Senate

Standing Committee for Selection of Bills

In its report of 12 November 2020, the Senate Standing

Committee for the Selection of Bills determined that the Bills not be referred

to committee for inquiry and report.[26]

Senate

Standing Committee for the Scrutiny of Bills

The Standing Committee for the Scrutiny of Bills commented

on the Bills in its report of

11 November 2020.[27]

It had no specific comment to make in relation to the Bankruptcy Estate Charges

Bill.[28]

However, it expressed a number of concerns in relation to the Territories

Bill—in particular:

- the

broad delegation of administrative powers[29]

- that

significant matters—for example, the determination of which laws will be in

force in Norfolk Island—are contained in delegated legislation[30]

- that

instruments made under the Bill are not subject to Parliamentary disallowance[31]and

- the

potential for certain provisions of the Bill to limit access to justice on

Norfolk Island for accused persons.[32]

These matters are canvassed under the relevant Schedule

heading in the body of this Bills Digest.

Policy position of non-government parties/independents

At the time of writing this Bills Digest, neither non-government

parties nor independent members and Senators had commented on the Bills.

Position of major interest groups

In the October 2020 Mayors Update, the Mayor of the

Norfolk Island Regional Council provided an outline of the Territories

Legislation Amendment Bill 2020 and a link to the Department of Infrastructure,

Transport, Regional Development and Communications website. He thought it may

be of interest to the community.[33]

The only comment in regard to the Bill was a reference the

Norfolk Island Regional Council passing a resolution opposing the extension of

the Broadcasting Act 1966 (Cth) to Norfolk Island on

21 August 2019.[34]

Mayor Robin Adams indicated the Council’s disappointment with the

Commonwealth’s continued intention to bring Norfolk Island under that Act.[35]

Financial implications

The Explanatory Memorandum to the Bills states that the

amendments in the Territories Bill) ‘do not have any additional impact on the

budget’.[36]

In relation to the Bankruptcy Estate Charges Bill, the Explanatory Memorandum

states that ‘it will have no significant financial implications for the

Commonwealth’.[37]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed

the Bills’ compatibility with the human rights and freedoms recognised or

declared in the international instruments listed in section 3 of that Act. The

Government considers that the Bills are compatible.[38]

Parliamentary Joint Committee on Human Rights

At its meeting of 15 October 2020, the Parliamentary Joint

Committee on Human Rights (Human Rights Committee) deferred consideration of

the Bill.[39]

It had no comment on the Bankruptcy Estate Charges Bill.[40]

The Human Rights Committee subsequently expressed concern

that the Bill amends the NI Act:

... to allow criminal proceedings to be relocated from Norfolk

Island to a prescribed state or territory if it is not contrary to the interests

of justice. This would have the effect of relocating a criminal trial to a

place other than where the alleged conduct occurred and authorising the

detention of an accused person from Norfolk Island in a prison in the

prescribed state or territory.[41]

The Human Rights Committee formed the view that the Bill

‘engages and may limit the rights to a fair trial and liberty to the extent

that relocating criminal proceedings may impose hardship on the accused person,

such as reduced access to evidence and witnesses to prepare a defence’.[42]

Accordingly the Human Rights Committee has requested

further advice in relation to the Bill which would allow it to form a concluded

view on the human rights implications of the Bill. At the time of writing this

Bills Digest, the Committee had received a response from the Assistant Minister,

but it had not been published.[43]

Schedule 1—amendment of Territory Acts

Commencement

The amendments in Parts 1 and 2 of Schedule 1 to the Bill

commence on the day after Royal Assent.

The amendments in Part 3 of Schedule 1 to the Bill commence

on a single day to be fixed by Proclamation. That day must not be before the

later of either:

- the

first day on which no person holds office as a Judge of the Supreme Court of

Norfolk Island and

- the

day a State or Territory is prescribed by the Regulations for the purposes of

subsection 60AA(1) of the NI Act to have jurisdiction to hear and

determine matters arising under laws in force in Norfolk Island as if Norfolk

Island were part of the prescribed State or Territory.[44]

Application

of applied laws

The provisions in Schedule 1 to the Bill propose changes to

the Australian laws applying in Christmas Island, Cocos (Keeling) Islands and

Norfolk Island. The changes to the laws of the three Territories are in near

equivalent terms.

According to the Department of

Infrastructure, Transport, Regional Development and Communication:

The Bill will amend the [NI Act],

the [CI Act] and the [CKI Act] to ensure the effective operation

of applied state or territory laws. The amendments will automatically vest

relevant powers and functions in the police and local government officials in

those territories and address the risk of other delegations becoming outdated

when applied laws are amended or new laws are made by the relevant state or

territory government.[45]

Christmas

Island and Cocos (Keeling) Island

Section 8A of both the CI Act and CKI Act

provide that the provisions of the law of Western Australia, as in force from

time to time, apply in the territory of Christmas Island and the Cocos

(Keeling) Islands, respectively. An Ordinance made under these provisions may

suspend or amend the operation of a law in force in the relevant Territory. The

term provision of the law of Western Australia

is defined as:

- including

a principle or rule of common law or equity that is part of the law of Western

Australia and

- not

including an Act or a provision of an Act.[46]

Schedule 1 of the Christmas Island

Applied Laws Ordinance 1992, made under section 8A of the

CI Act, and Schedule 1 of the Cocos (Keeling) Island

Applied Laws Ordinance 1992, made under section 8A of the CKI Act, amend

specific Western Australian laws which are applied and operating in each of

those territories.

Applying the

Western Australian law

Item 9 in Schedule 1 to the Bill amends section 8A of

the CI Act to repeal the definition of provision of the law of

Western Australia and replace it with a definition of Western

Australian law. Under proposed subsection 8A(6) of the CI Act

a Western Australian law:

- is

a law in force in Western Australia from time to time and

- includes

a principle or rule of common law or equity that is part of the law of Western

Australia and

- does

not include a Commonwealth Act or a provision of a Commonwealth Act or an

instrument (however described) made under a Commonwealth Act, or a provision of

such an instrument.[47]

Vesting

power in the Minister

Subsections 8G(1) and (2) of

the CI Act deal with vesting power in the Minister. Essentially they

provide that where a power is vested in a Minister of Western Australia, the

Governor of Western Australia, the Governor-in-Council of Western Australia, a

person (other than a court officer of WA), or an authority (other than a court

of WA) by a Western Australian law in force on Christmas Island,

the power is (in relation to Christmas Island) vested instead in the relevant

Commonwealth Minister.[48]

Item 11 updates the language in subsections 8G(1) and (2) and

inserts proposed subsection 8G(2A), which clarifies that the

vesting provisions do not apply to a power vested because of an Ordinance made

under subsection 8A(2) (which provides for the incorporation, amendment or

repeal of an applied Western Australian law). For the purposes of the CI Act,

power includes a function or duty, and, in that context exercise

means perform.[49]

Currently subsection 8G(3) of the CI Act provides

that if powers are vested in the Minister as a result of subsections 8G(1) or

(2), he or she may direct that the powers are also vested in a specified person

or authority, or delegate those powers in writing to a specified person.[50] Subsection 8G(4)

provides that a person or authority in whom a power is vested may, if so

empowered by the Minister, delegate the power in writing to a specified person.

Subsection 8G(5) currently applies where a power is vested in the Minister

under subsection 8G(2) and that power corresponds to a power that an officer,

employee or authority of WA is authorised to exercise. If that officer,

employee or authority is subject to an arrangement between the Commonwealth and

Western Australia for the effective application and administration of the laws

in force in Christmas Island, the Minister is deemed to have vested the

relevant power in that person or authority. However, the Minister may direct

that this does not apply to a specified power.[51]

Item 14 repeals subsections 8G(4)–(6) of the CI

Act, and replaces them with proposed subsections 8G(4), (5), (5A), (5B)

and (6). Proposed subsection 8G(4) provides that a direction or delegation

by the Minister under subsection 8G(3) is subject to any conditions specified

in writing by the Minister. Proposed subsections 8G(5A) and (5B) provide

that the Minister is deemed to have vested powers in certain circumstances.[52] Proposed

subsection 8G(5A) is largely the same as existing subsection 8G(5).

Under proposed subsection 8G(5B), where powers

correspond with police or local government powers vested by a Western

Australian law, the Minister is taken to have directed that these powers are also

vested in the Australian Federal Police (AFP), AFP members or special members,

the Christmas Island Shire or Shire officials as the case may be.

Item 18 inserts proposed section 8GA into

the CI Act. Item 44 inserts proposed section 8GA into the CKI

Act in equivalent terms. Proposed subsection 8GA(1) deals with the

application of proposed section 8GA to the directions and delegations

made under section 8G as discussed above. Proposed subsection 8GA(2)

provides that a direction or delegation that is expressed to include all the

powers, functions or duties of a person or authority under an applied Western

Australian law extends to include any additional power, function or duty of

that person or authority that arises from subsequent amendments to the applied

Western Australian law. The amendments address the risk of other delegations

becoming outdated when applied laws are amended or new laws are made by the

relevant state or territory government.[53]

Scrutiny of

Bills Committee comments

The Scrutiny of Bills Committee drew attention to proposed

subsection 8G(5) on the grounds that it ‘allows the delegation of

administrative powers to a relatively large class of persons, with little or no

specificity as to their qualifications or attributes’.[54]

Of particular concern was that the Explanatory Memorandum

to the Bill does not specify whether there are any limits as to who a person or

authority in whom a power is vested by the Minister under subsection 8G(3) may further

delegate power to under proposed subsection 8G(5).

While the Committee noted that such delegations would be

subject to any conditions set by the direction or the Minister, these

conditions have not been specified on the face of the Bill or clarified in the

Explanatory Memorandum.[55]Accordingly,

the Committee has requested clarification in relation to this matter from the

Minister.[56]

The Minster’s response states that, in light of the ‘potential

breadth and scope of the powers and duties conferred by the applied laws’... ‘it

is necessary and appropriate for the Minister to have a broad delegation power

to ensure that these powers are exercised effectively at an appropriate level’.[57]

The Scrutiny of Bills Committee noted:

... the Minister’s advice that in circumstances where there is

an arrangement between the Commonwealth and a state or territory to administer

the laws in force in the external territory, that the state or territory

official, with the corresponding power in the relevant state or territory, will

ordinarily exercise the delegated powers of the Minister, and that the

circumstances for which it may be appropriate for the Minister to delegate

powers under the applied laws are not certain and cannot necessarily be

foreseen.[58]

The Committee has asked that an addendum to the

Explanatory Memorandum containing the relevant key information be tabled in the

Parliament as soon as practicable.[59]

Norfolk

Island

Items 53–74 apply to the NI Act. Items

59–60, 63–67 and 73 in Schedule 1 to the Bill apply near equivalent

provisions to those inserted into the CI Act and the CKI Act as

discussed above—except that currently it is not the Western Australian law that

is applied but the New South Wales law.

As the arrangements with the Government of New South Wales

are not expected to continue, the NI Act is amended to remove specific references

to the application of New South Wales laws, powers and functions. This allows

the Commonwealth to enter into arrangements with New South Wales or any other

state or territory to provide state-type services to Norfolk Island.

Item 57 in Schedule 1 to the Bill inserts proposed

section 5 into the NI Act to set out the meaning of the term applied

law jurisdiction. Within that new definition, proposed subsections

5(1) and (2) provide that either New South Wales or a state or territory

prescribed by regulation can be an applied law jurisdiction or stop being an

applied law jurisdiction in respect of Norfolk Island.

Items 61 repeals and replaces section 18A of the NI

Act. Under proposed section 18A, the laws of an applied law jurisdiction

are in force in Norfolk Island. Importantly an applied law in force under this

section may be incorporated, amended or repealed by a section 19A Ordinance.[60] Further, an

applied law may be suspended for a specified period of time by a section 19A

Ordinance.[61]

Item 68 amends the heading to section 18C to remove a reference to New

South Wales and refer to ‘arrangements with the Government of a State’.

Items 63 to 67 amend section 18B of the NI Act,

which deals with the vesting and delegation of powers. These replace references

to New South Wales law with references to an ‘applied State law’, as well as

making changes to the vesting of powers in equivalent terms to the amendments

made to the CI Act and CKI Act, discussed above.

Scrutiny of

Bills Committee comments

The Scrutiny of Bills Committee expressed significant

concerns about the effect of item 57 (which, as set out above, allows

Regulations to prescribe states or territories whose laws will be applied in

Norfolk Island) of the Bill stating:

The committee's view is that significant matters, such as the

determination of which laws will be in force on Norfolk Island and which state

or territory courts will have jurisdiction for Norfolk Island, should be

included in primary legislation unless a sound justification for the use of

delegated legislation is provided. In this instance, the explanatory memorandum

does not address why it is necessary or appropriate to set out either of these

matters in delegated legislation.

The committee notes that this approach means that changes to

the 'applied law jurisdiction' or the state or territory courts with

jurisdiction for Norfolk Island will not be subject to the full range of parliamentary

scrutiny inherent in bringing proposed changes in the form of an amending bill.

The committee considers that if it is envisaged that the law

of a specific state or territory may become the applied law for Norfolk Island

or the courts of a specific state or territory will be conferred with

jurisdiction for Norfolk Island then this specific state or territory should be

set out on the face of the bill. Alternatively, if the specific state or

territory is not yet known, the committee considers that a new bill to set out

the 'applied law jurisdiction' and the state or territory whose courts will be

conferred with jurisdiction in relation to Norfolk Island should be introduced

into the Parliament in the future.[62]

The Scrutiny of Bills Committee therefore asked the

Minister’s advice about why it is considered necessary and appropriate to allow

Regulations to determine:

- which

state of territory laws will be in force on Norfolk Island and

- which

state and territory courts will have jurisdiction to hear and determine matters

in relation to Norfolk Island.[63]

In addition, the Scrutiny of Bills Committee asked the

Minister for more detailed advice about why it is appropriate to specify that

instruments made under proposed sections 18B and 18D are not legislative

instruments—and whether it would be possible to amend the Bill so that these

instruments could be subject to Parliamentary oversight.[64]

The Minister provided a detailed response in relation to

the use of regulations in the Bill stating:

New South Wales (NSW) has announced that the existing

arrangements in Norfolk Island, under which it provides some state-type

education and health support services, will cease by the end of 2021. In light

of this, the Australian Government is considering its options with respect to

the future provision of state-type services in Norfolk Island and is currently

involved in confidential government-to-government negotiations with a number of

jurisdictions about possible future state-type service delivery options in

Norfolk Island.

Accordingly, the applied laws amendments are intended to

provide a flexible legal mechanism under which the laws of a state or territory

may be applied as Commonwealth law in Norfolk Island and will enable state-type

service arrangements to be entered into with a state or territory. These

applied laws arrangements are intended to operate in a similar way to the

existing applied NSW laws arrangements. An ‘applied law jurisdiction’, being

NSW or another state or territory, may be prescribed by regulations made under

the Act. The laws of a jurisdiction would only be applied when there is an

agreement in place between the relevant state or territory and the Government.

Amendments in relation to the jurisdiction of Norfolk Island

courts complement the proposed amendments to the NI Act which allow state or

territory laws to be applied in Norfolk Island...

In light of the present circumstances regarding the provision

of state-type services in Norfolk Island, it is considered necessary and appropriate

to allow regulations to determine which state or territory laws will be in

force in Norfolk Island. [65]

The Committee has asked that an addendum to the

Explanatory Memorandum containing the relevant key information be tabled in the

Parliament as soon as practicable.[66]

In relation to proposed sections 18B and 18D the

Minister advised the Scrutiny of Bills Committee:

Proposed subsections 18B(13) and 18D(13) respectively provide

that an instrument made under section 18B or 18D is not a legislative instrument.

These provisions are based on existing subsection 18B(11) of the NI Act

which similarly provides that an instrument made under this section is not a

legislative instrument.

I note that subsections 8(1) and (4) of the Legislation

Act 2003 have the combined effect that an instrument that is made under a

power delegated by Parliament and has one or more provisions that have

legislative character (rather than administrative character) will be a

legislative instrument: unless the relevant Act expressly exempts the

instrument from being a legislative instrument.

In Visa International Services Association v Reserve Bank

of Australia (2003) 131 FCR 300 at 424 (Visa International), the Federal

Court identified a number of factors that are likely to have bearing on whether

a decision is to be characterised as being of administrative or legislative

character. The list included (at paragraph 592):

-

whether the decision determined

rules of general application, or whether there was an application of rules to

particular cases

-

whether there was Parliamentary

control of the decision

-

whether there was public

notification of the making of the decision

-

whether there was public

consultation

-

whether there were broad policy

considerations imposed

-

whether the regulations (or other

instrument) could be varied

-

whether there was power of

executive variation or control

-

whether there was provision for

merits review and

-

whether there was binding effect.

The case law makes it clear that not one of these factors

will determine whether the decision is of an administrative or legislative

character. Rather, it is necessary to consider the decision in light of all

these factors ...

Applying these factors to the instruments made under sections

18B and 18D, I am satisfied that none of these instruments determine the

content of the law. Notably, these instruments deal with the vesting,

delegating or directing of powers otherwise vested in the minister and other

persons under applied state or territory laws. In this respect, the instruments

are of an administrative character, dealing with the application or carrying

out of these powers, and do not determine or alter the content of these

delegated, vested or otherwise directed powers.[67]

The Scrutiny of Bills Committee has asked that an addendum

to the Explanatory Memorandum containing the relevant key information be tabled

in the Parliament as soon as practicable.[68]

Jurisdiction

of Norfolk Island Courts

Item 81 inserts proposed Division 3 into

Part VII of the NI Act about the conferral of jurisdiction on prescribed

State or Territory courts.

These amendments allow for courts of a prescribed state or

territory to have jurisdiction in relation to Norfolk Island as though it were

part of that state or territory. Proposed section 60AA of the NI Act

provides for conferral of jurisdiction on a prescribed State or Territory.

Under proposed subsection 60AA(4) of the NI Act,

section 68 of the Judiciary

Act 1903 (which deals with the jurisdiction of state and territory

courts in criminal cases, including by providing that state and territory

courts have jurisdiction to hear and determine matters involving Commonwealth

offences), applies to a court under this section. Further, the practice and

procedure of the courts of the prescribed state or territory in relation to

Norfolk Island would be the same as they exercise with respect to their home

jurisdiction.

Consequential

amendments

The Coral Sea Islands

Act 1969 (CSI Act) is amended consequential to the changes to

Norfolk Island jurisdiction. The Supreme Court and the Court of Petty Sessions

of Norfolk Island have criminal jurisdiction in relation to the Coral Sea

Islands.[69]

These courts are permitted to sit in the Territory, in Norfolk Island or in

Australia for the dispatch of business concerning the Coral Sea Islands

Territory.[70]

Item 83 inserts proposed subsection 8(1A) into the CSI Act

which provides that the courts of a prescribed Australian State or Territory in

respect of Norfolk Island also have jurisdiction in, and in relation to, the

Coral Sea Islands.

Item 86 amends the Criminal Code Act

1995 to change the definition of Commonwealth judicial officer

a by omitting reference to Norfolk Island Territory in the Dictionary

paragraphs (h) and (i). The Explanatory Memorandum states:

The effect of this amendment will be to provide state or

territory judicial officers who exercise jurisdiction or powers under laws in

force in Norfolk Island with the equivalent status to state or territory

judicial officers who exercise jurisdiction or powers under laws in force in

the other external territories and the Jervis Bay Territory.[71]

Six Commonwealth Acts are amended to provide that the

jurisdiction of the Norfolk Island Supreme Court is subject to proposed

section 60AA of the NI Act (discussed above), thus ensuring that jurisdiction

of the courts of a prescribed state or territory in respect of Norfolk Island

is recognised under the amended Acts.[72]

Supreme

Court of Norfolk Island

The amendments to the NI Act in Part 3 of Schedule

1 to the Bill provide for the Supreme Court to cease operation after its

jurisdiction is conferred on a court of a prescribed state or territory. As

noted above, these amendments commence only after no person holds office as a

Judge of the Supreme Court, and the Supreme Court’s jurisdiction has been

conferred on a prescribed State or Territory under proposed section 60AA.

Item 108 repeals Divisions 1 and 2 of Part VII of

the NI Act (as amended by Part 2 of Schedule 1 to this Bill), providing

for the establishment and operation of the Supreme Court of Norfolk Island and

the establishment of other courts and tribunals for Norfolk Island under

enactment (sections 52 to 60 of the NI Act). The repeal of these

provisions will effectively abolish the Supreme Court of Norfolk Island. The

Explanatory Memorandum to the Bill provides that other Norfolk Island courts

and tribunals, which are established under laws continued by section 16 or 16A

of the NI Act, may be abolished by a section 19A ordinance.[73]

A number of other provisions are consequential to repealing

Divisions 1 and 2 of Part VII, such as changing the headings and the repeal of

redundant provisions.

Sections 60B and 60C of the NI Act relating to the

hearing of criminal proceedings in a host jurisdiction are repealed by items

111 and 112, respectively. Proposed section 60C deals with

criminal trials in a court of a prescribed state or territory. It provides,

amongst other things, that in exercising its jurisdiction under the NI Act,

the court may sit in the prescribed State or Territory if doing so would not be

contrary to the interests of justice.

Sections 60D and 60E, which relate to juries outside the

territory, are repealed by item 113. The Explanatory Memorandum notes

that ‘[n]ew subsection 60AA(4) of the NI Act, which applies section 68

of the Judiciary Act 1903, with appropriate modifications, will instead

apply the criminal procedure laws, including the relevant arrest, custody and

bail laws, of the prescribed state or territory to a court of the prescribed

state or territory exercising criminal jurisdiction under the NI Act’.[74]

Minor technical amendments are made to substitute

references to ‘the Territory’, ‘the Supreme Court’, ‘host jurisdiction’ or

‘jurisdiction’ with references to ‘Norfolk Island’, ‘the prescribed State or

Territory’ or ‘State or Territory’, as appropriate (see items 123– 126).

Item 128 repeals Division 2 of Part VIIA of the NI

Act which deals with the civil jurisdiction of the Supreme Court of Norfolk

Island in a state or territory (other than Norfolk Island).

Scrutiny of

Bills Committee comments

The Scrutiny of Bills Committee noted that proposed

section 60C may have the effect of ‘reducing the number of criminal trials held

on Norfolk Island’.

While the committee welcomes the requirement that a court may

only make an order that a trial be held in the prescribed state or territory if

it is satisfied that the interests of justice require it, the committee

considers that further safeguards may be required to ensure fair trial rights

and procedural fairness, given the difficulty that accused persons may face if

their trial is held in a prescribed state or territory, rather than on Norfolk

Island. The proposed section may affect access to justice by creating barriers

to accessing legal representation, evidence and trial support.[75]

The Scrutiny of Bills Committee has requested further

advice from the Minister as to whether the Bill can be amended to include

additional protections for the rights of an accused person whose trial is held

in a prescribed state or territory, rather than on Norfolk Island.[76]

According to the Minister:

... these provisions dealing with the criminal jurisdiction of

the courts of a prescribed state or territory with respect to Norfolk Island

are modelled on 2018 amendments to the NI Act, contained in the Investigation

and Prosecution Measures Act 2018, which similarly authorise the Supreme

Court of Norfolk Island to hear criminal trials outside Norfolk Island in its

criminal jurisdiction if the court is satisfied that the interests of justice

require it...

It should be noted that the proposed provisions to permit the

courts of a prescribed state or territory to have jurisdiction in relation to

Norfolk Island would only be utilised if the Government entered into an

agreement with a state or territory government for the delivery of state-type

services and it was considered appropriate for the courts of that jurisdiction

to also operate in Norfolk Island. Where a state or territory government was

delivering most or all state-type services in Norfolk Island under the laws of

that state or territory, it may be appropriate for the courts of that state or

territory to adjudicate on matters arising under those laws.

This is the same as the situation in Christmas Island and the

Cocos (Keeling) Islands where the courts of Western Australia have jurisdiction

as if these external territories were part of Western Australia. Similar to the

proposed provisions of the NI Act, provisions in the CI Act and

the CKI Act provide that the Supreme Court of Western Australia may,

when exercising its criminal jurisdiction with respect to these external

territories, conduct criminal trials in Western Australia if the court is

satisfied that the interests of justice require it.

If these provisions were ever utilised in the future, I do

not consider that they would substantially change the manner in which the

courts presently exercise their criminal jurisdiction in Norfolk Island or

limit access to justice in Norfolk Island for accused persons. As is presently

the case, serious criminal trials would only take place outside Norfolk Island

in circumstances where the interests of justice require it, for instance where

there are concerns about the ability to empanel an impartial local jury. Many

of the existing services of the Norfolk Island courts are already delivered

remotely by judicial officers sitting on the mainland and it is expected that

these arrangements would continue. [77]

The Scrutiny of Bills Committee has

asked that an addendum to the Explanatory Memorandum containing the relevant

key information be tabled in the Parliament as soon as practicable.[78]

Application, savings and transition

provisions

Items 96–104 are transitional provisions which

relate to the transfer of proceedings before the future abolition of the

Norfolk Island Supreme Court, the Court of Petty Sessions and Coroner’s Court.

In particular, item 97 will enable the Supreme Court of Norfolk Island,

after the judicial transition time, to transfer proceedings where it has

retained jurisdiction, for instance in pending matters, to the Supreme Court of

the prescribed state or territory or a prescribed court of the prescribed state

or territory.[79]

Item 98 provides for the transfer to the Supreme

Court of the prescribed state or territory, or any other court prescribed for

the purposes of sub-item 96(4), as appropriate, of all the remaining

proceedings of the Supreme Court of Norfolk Island (not already transferred

under item 97) as soon as practicable once there is no longer a serving

judge of the Court.

Items 99–101 are transitional provisions relating

to the transfer of proceedings from the Court of Petty Sessions. These are

equivalent to those which apply to the Norfolk Island Supreme Court.

Items 133 and 134 provide for savings measures for

ongoing criminal and civil matters by the Norfolk Island Supreme Court sitting

in a host jurisdiction a state or territory.

Schedule 2—amendments to Treasury Acts

Commencement

Division 1 of Part 1 of Schedule 2 to the Bill commences

on the first Monday to occur after the end of the period of six months after

Royal Assent or on 2 August 2021—whichever is the later. Division 2 of

Part 1 and Part 2 of Schedule 2 commence on the day after Royal Assent.

Part 3 of Schedule 2 commences immediately after

commencement of Division 1, Part 1 of Schedule 2 or commencement of Schedule 2

to the Federal Circuit and Family Court of Australia (Consequential

Amendments and Transitional Provisions) Act 2020—whichever is the later.

However, Part 3 will not commence at all if that Act (the Bill for which is

before the Senate at the time of writing)[80]

does not commence.

Current

position

Under section 18 of the NI Act, Commonwealth Acts are

in force in Norfolk Island unless expressly excluded. The following

Commonwealth statutes do not operate in full on Norfolk Island:

- the

Corporations Act which regulates the formation of companies and imposes

requirements for certain conduct and activities of corporations and their

directors and officers[81]

- the

ASIC Act which establishes the corporations regulator, the Australian

Securities and Investments Commission (ASIC)[82]

and

- the

National

Consumer Credit Protection Act 2009 (Consumer Credit Act) which

contains the consumer credit framework (set out in the National Credit Code)

and includes the responsible lending obligations.[83]

Schedule 2 to the Bill operates so that those Acts will

apply more fully Norfolk Island.

Importantly from 1 July 2016, ASIC and Australian Taxation

Office (ATO) assumed responsibility for specific services.[84] Relevant

to this Bills Digest, from that date ASIC has been responsible for providing

business registration services for Norfolk Island.[85] From 5 September 2016, all

registered Norfolk Island business names have been displayed on the Business

Names Register.[86]

As of 4 June 2020, there are 468 businesses on Norfolk

Island.[87]

ASIC Act

Items 3–8 of Part 1 in Schedule 2 to the Bill

extend the ASIC Act to Norfolk Island. Item 3 repeals subsections

4(1A) and 4(1B) which specifically provide that the ASIC Act does not

apply to Norfolk Island, Christmas Island and Cocos (Keeling) Islands unless

those territories are prescribed in Regulations.[88]

The remaining items update definitions in subsection 5(1) of the ASIC Act

so that references to the terms Australia, Commonwealth

and this jurisdiction include references to Norfolk Island.

Further, references to Territory include Norfolk Island.

Items 1 and 2 of Part 1 in Schedule 2 to the Bill remove

references to ‘the Crown in right of Norfolk Island’ in the ASIC Supervisory

Cost Recovery Levy Act 2017 and the ASIC Supervisory

Cost Recovery Levy (Collection) Act 2017 respectively, as such an

entity has not existed following the commencement of amendments to the NI

Act made by the Norfolk

Island Legislation Amendment Act 2015, which commenced on 1 July 2016.

These ASIC Acts already extend to each external Territory.[89]

Transitional

provisions

Item 64 inserts proposed Part 35—Transitional

provisions relating to the Territories Legislation Amendment Act 2020 into

the ASIC Act. Within new Part 35, proposed section 334

empowers ASIC to make rules about transitional matters arising from the

amendments above.

Corporations

Act

As stated above, the Corporations Act does not

currently apply in full to Norfolk Island. This is because subsection 5(3) of

the Corporations

Act 2001 provides that the Act applies ‘in this jurisdiction’. The

definition of ‘this jurisdiction’ in section 9 does not currently include

Norfolk Island, Christmas Island or the Cocos (Keeling) Islands, except to the

extent that the Regulations prescribe that a specified provision applies in the

territory. Regulation 1.0.22 of the Corporations

Regulations 2001 applies elements of Part 7 of the Act (which deals with

Financial services and markets) to the external territories.

Items 18 and 20 insert definitions of Australia

and Commonwealth respectively into section 9 of the Corporations

Act in equivalent terms to those which are inserted into the ASIC Act

whilst item 31 repeals and replaces the definition of Territory

in section 9 to include Norfolk Island, Christmas Island and Cocos (Keeling)

Islands. Item 32 repeals and replaces part of the definition of this

jurisdiction so that each Territory is included.

In practical terms, the amendments will extend all of

the provisions of the Corporations Act to Norfolk Island. These include

but are not limited to:

- the

formation and registration of a company[90]

- the

circumstances under which ASIC may disqualify a person from running a company

- the

duties and powers of officers and employees[91]

- rights

of and remedies for shareholders[92]

- external

administration[93]

and

- regulation

of financial services and markets.[94]

In addition, the criminal offences and civil penalties which

are set out in the Corporations Act along with remedies such as

infringement notices and enforceable undertakings will apply to corporations

which have been formed in Norfolk Island and to their directors and employees

where a breach the provisions of the Corporations Act has occurred.[95]

Transitional

provisions

Registration

of Norfolk Island companies

Item 65 inserts proposed Part 10.51—Transitional

provisions relating to the Territories Legislation Amendment Act 2020. The

new Part 10.51 applies to an eligible corporation—that is:

- a

company that is a registered company under the Norfolk Island Companies Act 1985

- the

corporation is not a body corporate which is under external administration in

accordance with Chapter 5 of the Corporations Act[96]

- no

application to wind up the corporation has been made to the Supreme Court of

Norfolk Island that has not been dealt with and

- no

application to approve a compromise or arrangement between the corporation and

another person has been made to the Supreme Court of Norfolk Island that has

not been dealt with.

Proposed section 1678A requires ASIC to register an

eligible corporation as a company on the commencement day—that is

the later of the first Monday to occur after the end of the period of six

months after Royal Assent or on 2 August 2021. No formal application for

registration is required.[97]

Registration

process

The Bill requires ASIC to give the company an Australian

Company Number (ACN)[98]

and issue a certificate that states all of the following:

- the

company’s name

- the

company’s ACN

- the

company’s type (for instance, unlimited proprietary company, company limited by

guarantee, no liability company)

- that

the company is registered as a company under the Corporations Act

- that

the company is taken to be registered in Norfolk Island and

- the

date of the company’s registration.[99]

Company name

Currently, company names are regulated under the Business Names

Registration Act 2011 and the Business Names

Registration (Transitional and Consequential Provisions) Act 2011. The

main purpose of the national registration scheme is:

...to ensure that any business that does not operate under its

own entity name, registers its name and details on a national register to

enable those who engage or propose to engage with that particular business to

determine the identity of the entity behind the business name and its contact

details.[100]

The Bill requires ASIC to register a Norfolk Island

company with a name consisting of either the corporation’s name immediately

before commencement or, if that name is unacceptable,[101]

a name that consists of the expression ‘Australian Company Number’ followed by

the company’s ACN.[102]

The words Limited and/or Propriety are to be added as required by subsections

148(2) and (3) of the Corporations Act.

Proposed subsection 1678B(5) provides that if the

Norfolk Island company is registered with a name that is identical or nearly

identical to a name that is reserved or registered for another body or entity,

the Norfolk Island company will be able to continue to use that name.[103]

Company

Constitution

At the time that a Norfolk Island company is registered as

an Australian company its constitution will be the memorandum and articles of

association that were in force immediately before the commencement day. However

the company must, within three months of registration, update its constitution

to give effect to its registration under Part 5B.1 of the Corporations Act.[104]

Transitional

rules

The Bill empowers ASIC to make rules, by legislative

instrument, setting out transitional arrangements.[105] The rules may relate to any

of the following:

- the

amendments to the Corporations Act made by the Territories Legislation

Amendment Act 2020 (when enacted)

- the

repeal of the Norfolk Island Companies Act and

- the

amendments of the Corporations Act and any other Act made by the Treasury

Laws Amendment (Registries Modernisation and Other Measures) Act 2020

(Registries Modernisation Act) which has received Royal Assent but has not yet

formally commenced. Relevant to this Bills Digest, Schedule 2 to the Registries

Modernisation Act contains amendments to the Corporations Act which

require the directors of a company to have a director identification number.[106]

Importantly the Bill limits the period within which ASIC

can make transitional rules, so that the power ends on

the first Monday after one year, beginning on the commencement day, at which

time the transitional provisions will self-repeal.[107]

For the purposes of ASIC performing its functions or

duties, or exercising powers under new Part 10.51 and any relevant rules, proposed

section 1678C empowers the Registrar of Companies under the Norfolk Island Companies

Act to disclose to ASIC information (including personal information) and

for ASIC to disclose information in equivalent terms to the Norfolk Island

Registrar.

Consumer

Credit Act

As with the ASIC Act and the Corporations Act,

the amendments to the definitions of Territory in the Consumer

Credit Act by items 57 and 63 in Part 1 of Schedule 2 to the Bill

operate to ensure the extension of the Act to Norfolk Island, Christmas Island

and the Cocos (Keeling) Islands.

Transitional

provisions

Item 66 in Part 1 of Schedule 2 to the Bill inserts proposed

Schedule 18—Application and transitional provisions for the Territories

Legislation Amendment Act 2020 into the National Consumer

Credit Protection (Transitional and Consequential Provisions) Act 2009.

Within new Schedule 18, item 1 empowers ASIC to make rules, by legislative

instrument, setting out transitional arrangements. The power to make transitional

rules expires on the first Monday after one year, beginning on the commencement

day, at which time the transitional provisions will self-repeal.

Other

Treasury Acts

Competition

and Consumer Act

Currently some parts of the Competition and

Consumer Act 2010 (CCA) apply to Norfolk Island whilst others do

not. For instance, the Australian Consumer Law (which is located in Schedule 2

to the CCA) already applies in Norfolk Island[108]

but Part VIIA, about prices surveillance, does not.[109]

Item 67 in Part 2 of Schedule 2 to the Bill amends

the definition of authority at subsection 4(1) of the CCA so

that authority, in relation to a State or Territory and each external

Territory, means:

- a

body corporate established for a purpose of the State or the Territory by or

under a law of the State or Territory or

- an

incorporated company in which the State or the Territory, or a body corporate

referred to above has a controlling interest.

Items 70 and 71 insert definitions of external

Territory and Territory, respectively, into subsection

4(1) of the CCA.

The term external Territory:

- means

a Territory referred to in section 122 of the Constitution,

where an Act makes provision for the government of the Territory as a Territory[110]

- but

does not include a Territory covered by the definition of Territory.

The term Territory means the following:

- the

Australian Capital Territory

- the

Jervis Bay Territory

- the

Northern Territory

- Norfolk

Island

- the

Territory of Christmas Island and

- the

Territory of Cocos (Keeling) Islands.

These amendments are relevant to sections 2A and 2B of the CCA

which apply the provisions of the Act to the Commonwealth, States and

Territories and their authorities.[111]

Items 75–78 amend section 95C of the CCA so

that the provisions of Part VIIA relating to prices surveillance extend to

Norfolk Island.

Cross-Border

Insolvency Act

Currently section 4 of the Cross-Border

Insolvency Act 2008 provides that the Act does not apply to Norfolk

Island, Christmas Island and the Cocos (Keeling) Islands.

The Cross-Border Insolvency Act gives effect to the Model

Law on Cross-Border Insolvency of the United Nations Commission on

International Trade Law (UNCITRAL):

The Model Law is designed to assist States to equip their

insolvency laws with a modern legal framework to more effectively address

cross-border insolvency proceedings concerning debtors experiencing severe

financial distress or insolvency. It focuses on authorizing and encouraging

cooperation and coordination between jurisdictions, rather than attempting the

unification of substantive insolvency law, and respects the differences among

national procedural laws. For the purposes of the Model Law, a cross-border

insolvency is one where the insolvent debtor has assets in more than one State

or where some of the creditors of the debtor are not from the State where the

insolvency proceeding is taking place.[112]

The Model Law outlines a system of insolvency procedures

to be used in cases where the insolvent party has assets in more than one

country; or when there are foreign creditors present in a domestic insolvency

proceeding.

Items 80–85 in Part 2 of Schedule 2 to the Bill amend

the Cross-Border Insolvency Act so that it will apply in Norfolk Island,

Christmas Island and the Cocos (Keeling) Islands.

Schedule 3—amendments of Attorney-General’s Department Acts

Commencement

The amendments in Part 1 of Schedule 3 to the Bill

commence on the later of the first Monday to occur after the end of the period

of six months after Royal Assent and 2 August 2021.

The amendments in Parts 2 and 3 in Schedule 3 to the

Bill commence on the earlier of a day to be fixed by Proclamation or six months

after Royal Assent.

The amendments in Part 4 of Schedule 3 to the Bill

commence on the day after Royal Assent.

Bankruptcy

background

The Australian Financial Security Authority (AFSA) manages

the application of bankruptcy and personal property securities laws through the

delivery of high quality personal insolvency and trustee, regulation and

enforcement, and personal property securities services. AFSA:

- acts

as trustee for personal insolvency administrations

- provides

practical information about options to deal with unmanageable debt and

- preserves

the security and integrity of a large volume of personal insolvency records.[113]

For the quarter ending on 30 September 2020, there were

zero debtors in Norfolk Island who became bankrupt/entered a debt

agreement/entered a personal agreement.[114]

Bankruptcy is a legal process where a person is

declared unable to pay their debts. It can release the person from

unsecured debts such as credit and store cards; unsecured personal loans and

pay day loans; gas, electricity, telephone and internet bills; overdrawn bank

accounts and unpaid rent and medical, legal and accounting fees.[115]

However, it does not cover debts such as:

- court

imposed penalties and fines

- child

support and maintenance

- HECS

and HELP debts (government student loans)

- debts

incurred after the bankruptcy begins and

- unliquidated

debts—that is a debt where the person and their creditor have not yet

determined the amount owed.[116]

Bankruptcy normally lasts for three years and one day.[117]

Bankruptcy

Act

Currently section 9A of the Bankruptcy Act 1966

provides that it does not extend to Norfolk Island. Similarly, the definitions

of the terms Australia, Territory and Territory

of the Commonwealth in subsection 5(1) of the Bankruptcy Act are

expressed as not including Norfolk Island.

Extension to

Norfolk Island

Items 1, 3 and 5 in Part 1 of Schedule 3 to the Bill

repeal the definitions of Australia, Territory and Territory

of the Commonwealth and section 9A respectively.

In the absence of a formal definition of Australia

in the Bankruptcy Act, the definition which is at section 2B of the Acts Interpretation

Act 1901 will apply so that Australia means the

Commonwealth of Australia and, when used in a geographical sense, includes

Norfolk Island, the Territory of Christmas Island and the Territory of Cocos

(Keeling) Islands, but does not include any other external Territory. The

definition of Territory in the Acts Interpretation Act will also apply.

This definition encompasses a Territory referred to in section 122 of the Constitution

and therefore includes the ACT, NT, Norfolk Island and other external

territories.[118]

Item 2 in Part 1 of Schedule 3 to the Bill inserts

two new definitions:

- authority,

in relation to a Territory, means an authority established by or under a law of

the Territory, and includes the holder of an office established by or under a

law of the Territory

- law,

in relation to a Territory, means a law in force in the Territory.

According to the Explanatory Memorandum to the Bill:

By capturing the new definition of ‘law’ in relation to a

territory, this amendment is intended to ensure that references to ‘authority’

in the Bankruptcy Act capture authorities of external territories,

including those operating under applied laws.[119]

Items 7–12 make consequential amendments to the Bankruptcy

Act which are consistent with the above definitional changes.

Transitional

provisions

Transitional

bankrupts

Item 14 provides that Part 1 of Schedule 3 to the

Bill applies to a person (called a transitional bankrupt) in the

following circumstances:

-

a determination of bankruptcy was made against the person under

the Norfolk Island Bankruptcy

Act 2006 and

-

immediately before the transition time, (that is,

the later of the first Monday to occur six months after Royal Assent and

2 August 2021) the person had not obtained a certificate of discharge of

the bankruptcy and the bankruptcy determination had not been annulled.

In that case, certain actions taken by persons in Norfolk

Island (such as Judges, registrars or the official trustee) are taken to have

been done by equivalent persons in the Commonwealth. These are set out in table

form in subitem 15(2). In addition, the Commonwealth Bankruptcy Act

will apply to a determination of bankruptcy as if it were a sequestration order

made under that Act.[120]

Determination

of bankruptcy

The Commonwealth Bankruptcy Act applies to a

determination of bankruptcy under the Norfolk Island Bankruptcy Act in

relation to a transitional bankrupt.

As a result the Official Receiver must enter the following

information on the National

Personal Insolvency Index:[121]

- particulars

of the transitional bankrupt, to the extent that these are disclosed on the

determination

- the

date of the bankruptcy

- the

name of the petitioning creditor

- the

name of the transitional bankrupt’s trustee

- the

date the transitional bankrupt provided the statement required under paragraph

51(b) of the Norfolk Island Bankruptcy Act [122]and

- any

other available information required to be entered on that Index.[123]

Discharge

from bankruptcy

A transitional bankrupt is discharged from bankruptcy at

the transition time if the date of the determination of the

bankruptcy occurred three years or more before the transition time.[124]

Bankruptcy

(Estate Charges) Bill

The Bankruptcy (Estate Charges) Bill repeals section 3A of

the Bankruptcy (Estate Charges) Act which currently states that the Act

does not apply to Norfolk Island.

The effect of this amendment is to empower AFSA to collect

certain charges which arise when it administers a bankruptcy.[125] The charges under the Bankruptcy

(Estate Charges) Act include an interest charge[126] and a realisations charge.[127]

Freedom of

Information Act

Individuals have the right to access documents from

Australian Government ministers and most Australian Government agencies under

the Freedom of

Information Act 1982 (FOI Act).

The FOI Act also applies to Norfolk Island public

sector agencies and official documents of Norfolk Island ministers.[128]

Part 2 of Schedule 3 to the Bill repeals and replaces the

definition of Norfolk Island authority. Under the new definition

the term Norfolk Island authority means any of the following

bodies or persons:

- a

body (whether incorporated or not) established for a public purpose by a

Norfolk Island law, other than a law providing for the incorporation of

associations or companies and

- a

person holding or performing the duties of an office established by a Norfolk

Island law or an appointment made under a Norfolk Island law.[129]

Importantly, the Norfolk Island Regional Council which was

established under the Local

Government Act 1993 (NSW) (NI) is captured by this definition. However,

the definition does not include:

... a state or territory body or office, established or

appointed under a state or territory law as in force in that state or

territory, which may exercise powers in Norfolk Island under an applied state

or territory law.[130]

The term Norfolk Island law means a law in

force in the Territory of Norfolk Island that is not an Act or an instrument

made under an Act.[131]

The rationale for this change is set out in the Explanatory Memorandum to the

Bill:

This new definition will include an enactment within the

meaning of the Norfolk Island Act or an instrument made under such an enactment

(as amended) as well as any applied laws in force in Norfolk Island under

section 18A of the Norfolk Island Act. Acts and instruments made under Acts are

excluded from this definition to avoid overlapping with the existing definition

of ‘enactment’ in subsection 4(1) [of the FOI Act].[132]

Section 7 of the FOI Act sets out a range of

persons and bodies that are exempt from its operation. The Bill provides that a

body or person may be prescribed by the Regulations as exempt from the FOI

Act if: the body or person would otherwise be a Norfolk Island

authority and the Minister is satisfied that the body or person is

subject to a law that provides equivalent, or substantially similar,

requirements relating to freedom of information as those in the FOI Act.[133]

Application

provisions

The amendments of the FOI Act apply in relation to:

- the

publication of information under the agency information publication scheme

- requests

for access to documents and

- applications

for amendment or annotation of personal records

after the commencement time—that is, on the

earlier of a day to be fixed by Proclamation or six months after Royal Assent.[134]

Privacy Act

The Privacy Act 1988

was introduced to promote and protect the privacy of individuals and to

regulate how Australian Government agencies and organisations with an annual

turnover of more than $3 million handle personal information.

The Privacy Act includes 13 Australian Privacy

Principles (APPs) which apply to some private sector organisations, as well as

most Australian Government agencies.[135]

These are collectively referred to as APP entities.

In addition, the Privacy Act regulates the privacy

component of the consumer credit reporting system,[136] tax file numbers[137]

and health and medical research.[138]

The amendments to the Privacy Act in Part 3 of

Schedule 3 to the Bill—in particular the amendment to the definition of agency

in the Privacy Act—clarify that the Privacy Act applies to:

- a

body (whether incorporated or not), or a tribunal, established for a public

purpose by or under a law of a State or Territory as in force in an external

Territory[139]

or

- a

person holding or performing the duties of an office established by or

under, or an appointment made under, a law of a State or Territory as in force

in an external Territory.[140]

This will apply to the Norfolk Island Regional Council.[141]

Schedule 4—amendments of other Acts

Commencement

The amendments in Part 2 of Schedule 4 to the Bill commence

the day after Royal Assent. The amendments in Part 1 of Schedule 4 to the Bill

commence the day after the end of six months after Royal Assent.

What the

Bill does

Part 1 in Schedule 4 to the Bill amends the Broadcasting

Services Act to enable the ACMA to issue licences and undertake future

broadcasting planning in Norfolk Island.

Item 1 repeals section 10AA of the Broadcasting

Services Act which was inserted into that Act by Schedule 5 of the Territories

Legislation Amendment Act 2016 to prevent the Broadcasting Services

Act from applying wholly to Norfolk Island. As a result of the repeal, the Broadcasting

Services Act will apply in its entirety to Norfolk Island—subject to the

application, saving and transitional provisions.

Subitem 2(1) relates to the continued operation of

community radio service Norfolk Island VL2NI which was established under the

Norfolk Island Broadcasting

Act 2001. A community radio broadcasting licence is allocated to the

Norfolk Island Regional Council for broadcasting services immediately before

the commencement time—being six months after Royal Assent. The

licence is taken to be a broadcasting services bands licence allocated under

the Broadcasting Services Act.

Subitem 2(3) provides that the relevant licence

will remain in force for two years from the commencement and cannot be renewed

on an application by the Norfolk Island Regional Council.

However, the ACMA may extend the period of the licence by

a further period of no more than two years only if, before the end of the

initial two year period, the licence has been transferred to another person or

an application has been made for approval of such a transfer.[142]

Part 2 in Schedule 4 to the Bill:

- amends