Introductory Info

Date introduced: 28 November 2018

House: House of Representatives

Portfolio: Finance

Commencement: Future Drought Fund Act 2018 on proclamation or six months after Royal Assent, whichever occurs first; Future Drought Fund (Consequential Amendments) Act 2018 on various dates as set out in the body of this Bills Digest.The Bills Digest at a glance

Purpose of the Future Drought Fund

Bill

The Future Drought Fund Bill 2018 (the Fund Bill)

establishes:

- the

Future Drought Fund

- the

Future Drought Fund Special Account and

- Agriculture

Future Drought Resilience Special Account.

Investing the Future Drought Fund

The Future Fund Board, which is established under the Future Fund Act

2006 is responsible for deciding

how to invest the Future Drought Fund. Investments of the Future Drought Fund

will be held in the name of the Future Fund Board.

In making investment decisions, the Future Fund Board is

bound by the Future Drought Fund Investment Mandate given to it by the

Treasurer and the Minister for Finance.

Payments into and out of the Future Drought Fund

Special Account

The Future Drought Fund Special Account (FDF Special

Account) is a special account established in accordance with section 80 of the Public Governance,

Performance and Accountability Act 2013 (PGPA

Act). The statute that establishes a special account must specify both the

purposes for which the special account may be debited and the types of

receipts that may be credited to increase the balance of the special

account.

The initial credit to the FDF Special Account will

come from the transfer of the balance of the Building Australia Fund, which is

estimated to be $3.9 billion. The Future Drought Fund is expected to grow to $5

billion over time.

There are only three purposes for which an amount may be debited

from the FDF Special Account:

- transferring

amounts to the Agriculture Future Drought Resilience Special Account (AFDR

Special Account)

- paying

amounts which are exclusively related to the investments of the Future Drought

Fund—for example, paying the costs of, or incidental to the acquisition of

financial assets by the Future Fund Board and

- paying

amounts which are not exclusively related to the investments of the Future

Drought Fund—for example paying part of the remuneration and allowances of the

Future Fund Board members.

Payments into and out of the Agriculture Future Drought

Resilience Special Account

The Agriculture Future Drought Resilience Special Account

(AFDR Special Account) is also a special account established in accordance with

the PGPA Act. From 1 July 2020, $100 million annually will be debited

from the FDF Special Account and credited to the AFDR Special Account.

The Agriculture Minister, on behalf of the Commonwealth,

may pay amounts from the AFDR Special Account under an arrangement with a

person or body, or pay amounts by way of a grant to a person or body in

relation to drought resilience. Neither the arrangements nor the

grants may be loans. Arrangements or grants to a person or body must be

consistent with the Drought Resilience Funding Plan.

Before making such an arrangement, or grant, the

Agriculture Minister must request the advice of the Regional Investment

Corporation Board, which is established by the Regional Investment

Corporation Act 2018.

Purpose of the

Bills

The purpose of the Future Drought Fund Bill 2018 (the Fund Bill)

is to establish the Future Drought Fund which includes the Future Drought Fund Special

Account, and the Agriculture Future Drought Resilience Special Account to fund

initiatives that enhance future drought resilience, preparedness and response

across Australia.

The purpose of the Future Drought Fund (Consequential

Amendments) Bill 2018 (the Consequential Amendments Bill) is to make

consequential amendments to a number of existing statutes to:

- extend

the Future Fund Board’s duties to include managing the Future Drought Fund and

- allow

for amounts to be transferred between the Future Drought Fund and the Future

Fund.

Structure of

the Fund Bill

The Fund Bill comprises six Parts:

- Part

1 sets out preliminary matters including relevant definitions

- Part

2 establishes the Future Drought Fund. It also sets out matters relating to the

credit of amounts to the Future Drought Fund Special Account and those relating

to the debit of funds from the Future Drought Fund

- Part

3 concerns arrangements and grants relating to drought resilience

- Part

4 relates to the investment of the Future Drought Fund

- Part

5 contains relevant reporting obligations and

- Part

6 sets out miscellaneous matters including the delegation of powers of the

Treasurer, the Minister for Finance and the Agriculture Minister.

Commencement

The Fund Bill commences on the earlier of a single day to be

fixed by Proclamation or six months after Royal Assent.

Structure of

the Consequential Amendments Bill

The Consequential Amendments Bill comprises three Schedules.

Schedule 1 contains general amendments to the

following:

Schedule 2 amends the following statutes to bring about

the abolition of the Building Australia Fund

- the COAG Reform Fund

Act 2008

- the DisabilityCare Australia Fund Act

- the Future Fund Act

- the

Medical Research Future Fund Act and

- the Nation-building Funds Act.

Schedule 3 contains

amendments to the Aboriginal

and Torres Strait Islander Land and Sea Future Fund Act 2018 (ATSI

Land and Sea Future Fund Act) and the Future Drought Fund Act (when

enacted) which are contingent on the commencement of the ATSI Land and Sea

Future Fund Act on 1 February 2019.[1]

Commencement

Schedules 1 and 2 of the Consequential Amendments Bill

commence at the same time as the Future Drought Fund Act commences.

Schedule 3 of the Consequential Amendments Bill commences

on the later of:

- immediately

after the commencement of the Future Drought Fund Act and

- immediately

after the commencement of the ATSI Land and Sea Future Fund Act—that is,

1 February 2019.

However, the provisions do not commence at all unless both

of those statutes commence.

Background

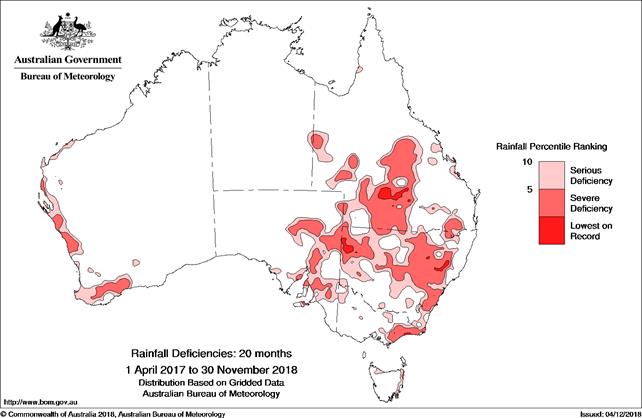

The Bureau of Meteorology stated in December 2018:

The year to date has

been exceptionally dry for New South Wales, Victoria, eastern South Australia,

and the southern half of Queensland. Significant rainfall deficiencies continue

to affect large areas of eastern Australia at timescales out to around two

years' duration. This has been the seventh-lowest January to November rainfall

since 1900 for the Murray-Darling Basin, eighth-lowest for New South Wales, and

ninth-lowest for Victoria.[2]

The position in NSW in particular is particularly dire. In

August 2018, the Berejiklian Government declared all of NSW to be in drought.[3]

Australia’s evolving

drought policies

1980s

Up until the late-1980s, drought was thought to be a

climatic abnormality and, as such, was treated with disaster relief policies

and Exceptional Circumstances (EC) payments in a similar way to floods,

earthquakes and cyclones.[4]

However, during the late-1980s, the view of drought as a

one-off, unpredictable and unmanageable natural disaster began to be

questioned.[5]

Drought was subsequently removed from national disaster relief arrangements,[6]

and a task force was initiated to shape the most appropriate response to

drought.[7]

1990s—National

Drought Policy

The National Drought Policy (NDP) was established in 1992

through collaboration between state and Commonwealth governments.[8]

The NDP was based on principles of self-reliance, risk management and an

understanding that drought is an inherent feature of the Australian environment.[9]

The primary avenues for government assistance were:

- the

Rural Adjustment Scheme (RAS) which adopted structural adjustment initiatives

to improve farm productivity, profitability and sustainability[10]

and

- the

Farm Household Support Scheme (FHSS) which provided finance with no repayments

required until the family came off the scheme and with scope to repay over five

or ten years.[11]

In 1997, following the change of Federal government in the

previous year, the ‘RAS was scrapped but the exceptional circumstances concept

was retained’.[12]

Unfortunately, the Government was faced with a number of challenges including:

- prolonged,

expanding and worsening drought conditions across significant agricultural

producing regions—which became known as the ‘Millennium Drought’[13]

- increasing

focus on government intervention rather than self-management and sustainability

and

- the

situation where EC payments artificially kept unviable and/or poorly managed

farm businesses afloat.[14]

Productivity

Commission report

The 2008 review of government assistance for drought

events by the Productivity Commission opined:

There is a mismatch between the NDP’s policy objectives

and its programs. From its inception, policy has ostensibly centred on

helping farmers build their self-reliance to manage climate variability and

preparedness for droughts. Program expenditures, however, have not been directed

to this end but have mainly flowed as emergency payments to a minority of

farmers in hardship and to stressed farm businesses.[15]

[emphasis added]

The Productivity Commission argued for the termination of

the EC declaration process and the various programs that it triggered and

recommended a policy which would:

- assist

primary producers to adapt and adjust to the impacts of climate variability and

climate change

- encourage

primary producers to adopt self-reliant approaches to managing risks

- assist

primary producers to manage greenhouse gas emissions and other adverse impacts

on the environment and

- ensure

that farming families in hardship have temporary access to an income support

scheme that recognises the special circumstances of farmers.[16]

2016 election

commitment

Since that time, Australia’s drought policy has continued

to evolve. Governments have sought to:

... provide the tools to facilitate more effective risk

management by farmers and a long-term approach to drought that incorporates

provision of enhanced social and community support for farming families and

rural communities, and business initiatives for preparedness and in-drought

support.[17]

In accordance with its 2016 Election commitment, the

Government enacted the Regional Investment

Corporation Act 2018.[18]

Then Minister for Agriculture and Water Resources, Barnaby Joyce stated:

A re-elected Coalition Government will establish a Regional

Investment Corporation to fast-track the delivery of $4.5 billion in

Commonwealth drought and water infrastructure loans...

The Coalition is committed to streamlining Commonwealth

financing and concessional loan processing to enable new dams to be financed

quickly and ensure drought loans are speedily approved to help farmers

in need.

The Regional Investment Corporation will be established as

the single administrator for the $4.5 billion in Agriculture and Water

Resources portfolio financing and concessional loans initiatives.

No longer will the Commonwealth have to barter with state

governments to process drought and dairy concessional loans to help farmers. Under

a re-elected Coalition Government we will be able to deliver this support

direct to farmers in need.[19]

[emphasis added]

Background to

the Fund Bill

When Scott Morrison became Prime Minister on 24 August

2018, he made it clear that one of his first priorities was to deal with the

ongoing drought.[20]

At the Drought Summit held in Canberra on 26 October 2018, the Prime Minister

announced a package of new initiatives for drought relief, recovery and

resilience, including the Future Drought Fund.

A comprehensive drought response needs to meet not only the

immediate needs of those affected but to look to the future to ensure our

agriculture sector is prepared and resilient. So we can do this, our Government

is establishing a Future Drought Fund with an initial allocation of $3.9

billion in 2019. In time, this fund will grow to $5 billion. The Future Drought

Fund will provide a sustainable source of funding for drought resilience works,

preparedness and recovery. It's about helping farmers and their communities to

prepare and adapt to the impact of drought. Through the fund, the Government

will drawdown $100 million a year for projects, research and infrastructure to

support long-term sustainability.[21]

In a radio interview conducted on the same day Mr Morrison

confirmed that the initial allocation of $3.9 million into the Future Drought

Fund would arise from the transfer of that amount from the Building Australia

Fund, which had previously been nominated as a source of funding for the

National Disability Insurance Scheme (NDIS).[22]

The Fund Bill establishes the Future Drought Fund. It

represents the latest in a long line of efforts by governments of all political

persuasions to address the complex problems of ongoing drought and its social

and economic effects.

Committee

consideration

Finance and

Public Administration Committee

The Bills have been referred to the Finance and Public

Administration Committee (FPA Committee) for inquiry and report by 8 February

2019.[23]

The FPA Committee received six submissions from stakeholders.

Senate

Standing Committee for the Scrutiny of Bills

The Senate Standing Committee for the Scrutiny of Bills has

commented on a number of aspects of the Fund Bill.[24]

These comments are canvassed under the discussion of the provisions of the Fund

Bill below.

Policy

position of non-government parties/independents

Australian

Greens

Australian Greens (the Greens) Senator Steele-John has

expressed concern that the Prime Minister ‘is considering taking funds from the

NDIS to provide relief to drought-stricken farmers’.[25]

And further:

This government needs to prove that the NDIS will be fully

funded before it considers repurposing any funds that might be made available

to disabled Australians. Taking money from one disadvantaged community to give

to another is just bad policy, and in a wealthy country like Australia

shouldn’t even be on the table ...[26]

Position of major

interest groups

Farmers

Speaking on the day after the drought summit, the National

Farmers Federation President Fiona Simson stated:

The Future Drought Fund and further new initiatives focus on

building the resilience of not only our farmers but also our regional

communities, which we know bear much of the social and economic hardship during

drought.

... the Government should be commended for the highly

significant and holistic measures extended to drought support today and in the

months previous.[27]

Disability

advocates

On the other hand, disability advocates are reported to

have ‘slammed’ the plan on the grounds that ‘the first $3.9 billion of the

scheme ... is to be paid for out of a pool of money originally intended for the

National Disability Insurance Scheme’.[28]

Physical Disability Council of NSW chief executive Serena

Ovens is reported as stating:

... the funds should instead be used to ensure the NDIS would

be sustainable in the long term and that Australians with disability were given

“what is required to have a normal, reasonable life” ... while helping farmers

was a worthy aim, it should not be done “at the cost of an equally important

scheme for some very vulnerable people”.[29]

Financial

implications

Fund Bill

According to the Explanatory Memorandum for the Fund Bill:

The initial credit of the balance of the funds from the

Building Australia Fund to the Future Drought Fund will not have a direct

impact on underlying cash and fiscal balances, as these represent the transfer

of financial assets between funds.

Positive interest earnings of the Future Drought Fund will

have a positive impact on the underlying cash and fiscal balances. Costs

incurred by the Future Fund Board have a negative impact on the underlying cash

and fiscal balances. Payments for initiatives to enhance future drought

resilience will have a negative impact on the underlying cash and fiscal

balance.[30]

Consequential

Amendments Bill

The Explanatory Memorandum for the Consequential

Amendments Bill states that the Bill ‘has no financial impact’.[31]

Special appropriations

Speaking about the Fund Bill, Minister for Finance and

Public Service Mathias Cormann, said:

... the [Future Drought] Fund would start with $3.9 billion, growing

to $5 billion over the next decade. From 1 July 2020, $100 million will be

directed annually to fund a wide range of drought resilience projects, while

the balance is reinvested the Fund.[32]

Key issue—effect

on NDIS funding

The 2017–18 Budget indicated the Government’s commitment

to Australians with permanent and significant

disability having access to vital care and support, with the Government fully

funding the National Disability Insurance Scheme. The graphic below

demonstrates the proposed sources of that funding at that time.[33]

Graphic 1:

funding the NDIS

Note:

The NDIS Savings Fund includes one-fifth of the Medicare levy from 1 July 2019,

underspends and realised saves redirected to the NDIS Savings Fund, and

uncommitted funds from the Building Australia Fund and Education Investment

Fund.

However, Finance Minister Mathias Cormann has since stated

that the NDIS ‘is now fully funded from consolidated revenue on the back of a

stronger economy and, because of our successful budget repair efforts, a

stronger and improving budget position’.[34]

He argues that ‘our sound economic and fiscal management

has enabled us to fully fund the NDIS from consolidated revenue without

increasing the Medicare Levy as originally proposed and without transferring

the Building Australia Funds into the NDIS Savings Special Account’.[35]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed

the Bill’s compatibility with the human rights and freedoms recognised or

declared in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[36]

Parliamentary

Joint Committee on Human Rights

The Parliamentary Joint Committee on Human Rights considered

that the Bills did not raise human rights concerns—either because they do not

engage or promote human rights, and/or permissibly limit human rights.[37]

Future Drought

Fund

Establishing

the Fund

Clause 10 of the Fund Bill establishes the Future

Drought Fund. It consists of:

- the

Future Drought Fund Special Account and

- the

investments of the Future Drought Fund.

At the time of its establishment the balance of the Building

Australia Fund Special Account will be credited to the Future Drought Fund

Special Account.[38]

The financial assets of the Building

Australia Fund will become an investment of the Future Drought Fund.[40]

The Fund Bill incorporates the definition of the term financial asset

from the Future Fund Act.[41]

Credits to the

FDF Special Account

In addition to those amounts which will be credited to the

FDF Special Account on its establishment, clause 14 of the Fund Bill

provides that the responsible Ministers—being the Treasurer and

the Minister for Finance[42]—may

determine in writing that an amount is to be credited to the FDF Special

Account on a specified day or in specified instalments on specified days.[43]

Delegation of

power

However, under clause 61 of the Fund Bill, the

Finance Minister may delegate any or all of his, or her, powers under clause 14

to the Secretary of the Department of Finance or a Senior Executive Service

(SES) employee (or acting SES employee) of that Department. Similarly, under clause

62 of the Fund Bill, the Treasurer may delegate any or all of his, or her,

powers under clause 14 to the Secretary of the Treasury Department or an SES

employee (or acting SES employee) of that Department.

Investments of

the Fund

The Future Fund Board[44]

is responsible for deciding how to invest the Future Drought Fund.[45]

The Fund Bill empowers the Future Fund Board to invest amounts standing to the

credit of the FDF Special Account in any financial assets.[46]

Any income derived from an investment of the Future Drought Fund is to be

credited to the FDF Special Account.[47]

Future Drought

Fund Investment Mandate

Establishing

the Investment Mandate

Clause 41 of the Fund Bill empowers the responsible

Ministers to give the Future Fund Board written directions about the

performance of its Future Drought Fund investment functions, and provides that

they must give at least one such direction. These directions are known as the Future

Drought Fund Investment Mandate.[48]

In giving such a direction the responsible Ministers must

have regard to:

- the

need to maximise the return earned on the Future Drought Fund over the long

term

- the

need to enhance the Commonwealth’s ability to make payments under arrangements

and grants for drought resilience (see the discussion below under the heading ‘Debiting

the FDF Special Account’) and

- such

other matters as the responsible Ministers consider relevant.[49]

Key

issue—non-disallowable instrument

Although the Future Drought Fund Investment Mandate

is a legislative instrument, the notes to clause 41 specify that it is neither

disallowable nor subject to sunsetting in accordance with the Legislation Act

2003. This is because the directions will be covered by an exemption

under the Legislation

(Exemptions and Other Matters) Regulation 2015.

According to the Explanatory Memorandum to the Fund Bill:

The Government considers it is appropriate that a direction

under subclause 41(1) of the Bill is not subject to disallowance. The Bill

would provide adequate scrutiny of directions comprising the Future Drought

Fund Investment Mandate through mandated consultation with the Future Fund

Board (clause 44). Exemption from disallowance together with consultation would

give the Future Fund Board necessary certainty when investing through the

Future Drought Fund. While it would be possible to provide that a direction

under subclause 41(1) does not come into effect until disallowance periods have

expired, this approach would significantly impede the ability of Government to

make urgent changes to the Future Drought Fund Investment Mandate in the

national interest. [50]

The Scrutiny of Bills Committee acknowledged the

explanation but did not consider that it provided sufficient justification ‘for

leaving significant elements of the drought resilience funding scheme in the Bill

to non-disallowable instruments’.[51]

The Committee has asked the Minister for advice:

... as to the appropriateness of amending the Bill to provide

that the directions are subject to disallowance but only come into force once

the disallowance period has expired, unless the minister certifies that there

is an urgent need to make changes and it is in the national interest that a

specified direction not be subject to disallowance.[52]

Limitations on

the Investment Mandate

As noted by the Scrutiny of Bills Committee, the Bill

inserts a limitation on the powers of the responsible Ministers in making the Future

Drought Fund Investment Mandate (Investment Mandate). The responsible

Ministers must not give a direction under subclause 41(1) that has the

purpose, or has or is likely to have the effect, of directly or indirectly

requiring the Future Fund Board to:

- invest

an amount standing to the credit of the FDF Special Account in a particular

financial asset

- acquire

a particular derivative[53]

or

- allocate

financial assets to a particular business entity, a particular activity or a

particular business.[54]

Obligation to

comply with Investment Mandate

Clause 45 of the Fund Bill requires the Future Fund

Board to take all reasonable steps to comply with the Investment Mandate. If

the Future Fund Board becomes aware that it has not done so it must, as soon as

practicable after becoming so aware, give the responsible Ministers a written

statement:

- advising

of the failure to comply with the Investment Mandate and

- setting

out the action that it proposes to take in order to comply with the Investment

Mandate.[55]

Alternatively, if the responsible Ministers are satisfied

that the Future Fund Board has failed to comply with the Investment Mandate,

they may direct the Board, in writing:

- to

give the responsible Ministers, within a specified period, a written

explanation for the failure to comply with the Investment Mandate and

- to

take action in the time specified in the notice, in order to comply with the

Investment Mandate.[56]

Formulating

investment policies

Consistent with the requirement to comply with the Investment

Mandate, clause 48 of the Fund Bill requires the Future Fund Board to formulate

and periodically review written policies in relation to the Future Drought Fund

including the relevant investment strategy, benchmarks and standards for

assessing the performance and risk management for the Fund.

The Future Fund Board must publish those polices on the

internet.[57]

About special

accounts

A special account is a limited special appropriation that

notionally sets aside an amount that can only be expended for listed

purposes. The amount of appropriation that may be drawn from the Consolidated

Revenue Fund (CRF) by means of a special account is limited to the balance of

each special account at any given time. Special accounts are not bank accounts.

Amounts forming part of the balance of a special account may be held in various

ways, such as in the Official Public Account, an entity's official bank

account, or partly in both.[58]

Establishing

the special accounts

A special account can be established either by the Finance

Minister making a determination under section 78 of the Public Governance,

Performance and Accountability Act 2013 (PGPA Act), or by

legislation as recognised under section 80 of the PGPA Act. The

appropriation authority to draw money from the CRF is section 78 or 80 of the PGPA

Act, as relevant—rather than the determination or the legislation.[59]

The Fund Bill establishes two special accounts in

accordance with section 80 of the PGPA Act:

- clause

13 of the Fund Bill establishes the Future Drought Fund Special Account

(FDF Special Account) and

- clause

33 of the Fund Bill establishes the Agriculture Future Drought Resilience

Special Account (AFDR Special Account).

Requirements

of a special account

Special accounts may be established when it is clear that

other types of appropriations are not suitable. For example, there may be a

need for specific transparency. The Act that establishes a special account

specifies both the purposes for which the special account may be debited

and the types of receipts that may be credited to increase the balance of

the special account.[60]

Accordingly, the Fund Bill specifies the main purposes of each

of the special accounts. Amounts credited to a special account can only be

spent for the specified purposes.

Debiting the

FDF Special Account

Main purpose—FDF

Special Account

The main purpose of the FDF Special Account is to transfer

amounts to the AFDR Special Account so that the Agriculture Minister, on behalf

of the Commonwealth, may pay amounts under an arrangement with a

person or body, or pay amounts by way of a grant to a person or body in

relation to drought resilience.[61]

For the purposes of the Fund Bill an arrangement

includes a contract, agreement or deed—but does not include a ‘securities

lending arrangement’.[62]

The term drought resilience[63]

is defined as:

- resilience

to drought[64]

- preparedness

for drought

- responsiveness

to drought

- management

of exposure to drought

- adaptation

to the impact of drought

- recovery

from drought or

- long‑term

drought‑related sustainability of farms and communities that:

- have

been affected by drought

- are

being affected by drought or

- are at significant risk of being affected by drought.

According to the Explanatory Memorandum to the Fund Bill:

The words ‘at significant risk’ in the definition of drought

resilience would require a higher threshold test than a farm or community that

merely might be or could be affected by drought at some point in the future.

The risk of being affected by drought would need to be ‘significant’ to attract

this element of the definition of drought resilience.[65]

Other purposes—FDF

Special Account

Clause 16 sets out additional approved

purposes of the FDF Special Account, being:

- paying

the costs of, or incidental to, the acquisition of financial assets

- paying

expenses of an investment of the Future Drought Fund

- paying

the costs of, or incidental to, the acquisition of derivatives

- paying

or discharging the costs, expenses and other obligations incurred by the Future

Fund Board under a contract between the Board and an investment manager

- paying

or discharging the costs, expenses and other obligations incurred in connection

with the establishment, maintenance or operation of a bank account of the

Future Fund Board, if the bank account relates exclusively to the Future

Drought Fund

- paying

a premium in respect of a contract of insurance entered into by the Future Fund

Board exclusively in connection with the Future Drought Fund

- paying

or discharging any other costs, expenses, obligations or liabilities incurred

by the Future Fund Board exclusively in connection with the Future Drought

Fund.

Clause 17 of the Bill lists other purposes

for which the funds in the FDF Special Account may be expended. These relate to

expenses incurred by the Future Fund Board in its management of the Future

Drought Fund.

The amounts specified under clauses 16 and 17 may be

transferred to the Future Fund Special Account in accordance with clause 19

of the Fund Bill. Importantly, subclause 61(2) of the Fund Bill allows

the Finance Minister to delegate any or all of his, or her, powers under clause

19 to the Secretary or an SES employee of the Department of Finance, to the

Chair of the Future Fund Board or to an SES employee of the Future Fund

Management Agency.[66]

AFDR Special

Account

Establishing

the special account

As stated above, clause 33 of the Fund Bill

establishes the AFDR Special Account under section 80 of the PGPA Act.

Credits to the

AFDR Special Account

Each financial year, commencing with the financial year

beginning on 1 July 2020, the Finance Minister must direct, in writing,

that $100 million is to be debited from the FDF Special Account and credited to

the AFDR Special Account. This may be by way of a lump sum on a specified day

or by instalments on specified days.[67]

In addition, certain amounts paid to the Commonwealth in

accordance with clause 21 (see discussion below) may be credited to the AFDR

Special Account.

Debiting the AFDR

Special Account

Amounts may only be debited from a special account to meet

the purposes of the account as stipulated in the establishing legislation. In

this case, the relevant purposes of the AFDR Special Account are set out in clause

36 of the Fund Bill—that is, to pay amounts under an arrangement or to make

grants. Both of these matters are explained in clause 21 of the Fund

Bill.

Arrangements

and grants

Under clause

21, the Agriculture Minister may, on behalf of the Commonwealth make

an arrangement with, or make a grant of financial assistance to, a person or

body for the following:

- the

carrying out of a project that is directed towards achieving drought resilience

- the

carrying out of research that is directed towards achieving drought resilience

- the

provision of advice that is directed towards achieving drought resilience

- the

provision of a service that is directed towards achieving drought resilience

- the

adoption of technology that is directed towards achieving drought resilience or

- a

matter that is incidental or ancillary to those matters.[68]

For the purposes of the Fund Bill, an arrangement or a

grant may be made by way of the reimbursement, or partial reimbursement, of

costs or expenses.[69]

Importantly, however, clause 21 does not does not authorise the acquisition of

shares in a company or the making of a loan.[70]

The Explanatory Memorandum to the Fund Bill provides

examples of activities that could be funded under this provision including:

-

the creation or development of

water infrastructure

- financial and business planning

for primary producers to improve ability to manage through lower income periods

caused by drought

- restoring native vegetation for

soil or water regeneration

- pest control

- fire mitigation

- training and information for

primary producers on sustainable stock management during drought

- training and information on local

climate variability and advice on climate risk applied to specific locations

- blue-sky research in drought

resilience or

- improving data on fodder and

impacts from drought, including market trends.[71]

Scrutiny of

Bills Committee comments

The Scrutiny of Bills Committee drew attention to the

absence of guidance in the Bill as to the terms and conditions that would

attach to the financial assistance granted in accordance with clause 21—beyond

requiring that any such terms and conditions are to be set out in a written

agreement between the Commonwealth and the relevant grant recipient.[72]

Of particular concern to the Committee was that the Explanatory Memorandum to

the Fund Bill:

... provides no explanation as to why it is considered

necessary and appropriate to confer on the Minister a broad power to provide

financial assistance with regard to drought resilience, without specifying any

terms and conditions to which the provision of assistance would be subject.[73]

About making

grants

Clause 22 of the Fund Bill is ancillary to clause

21. Where financial assistance has been provided by way of grant (rather than

under an arrangement), the terms and conditions of the grant must be contained in

a written agreement between the Commonwealth and the grant recipient. Section

105C of the PGPA Act empowers the Finance Minister, by written

instrument, to make provision about grants by the Commonwealth.

Accordingly, the Commonwealth

Grants Rules and Guidelines 2017 (CGRGs) establish the Commonwealth grants policy

framework. The CGRGs contain the key legislative and policy

requirements—including how they apply to Ministers.[74] According to the CGRGs:

Achieving value with relevant money should be a prime

consideration in all phases of grants administration. Grants administration

should provide value, as should the grantees in delivering grant activities.

This requires the careful comparison of the costs and benefits of feasible

options in all phases of grants administration, particularly when planning and

designing grant opportunities and when selecting grantees. It is also a means

by which officials can assure the entity’s accountable authority, Ministers and

the Parliament that resources are deployed in an efficient, effective,

economical and ethical manner, while not imposing overly burdensome

requirements on grantees.[75]

However, the Explanatory Memorandum does not make a

connection between the Fund Bill and the CGRGs. That being the case, it is

unclear whether there is an intention that the relevant grants will be

administered in accordance with CGRGs.

The Scrutiny of Bills Committee has requested advice from the

Minister about ‘the appropriateness of amending the bill to include (at least

high-level) guidance as to the terms and conditions on which financial

assistance may be granted’.[76]

Delegation of

power

Importantly, under clause 63 of the Fund Bill, the

Agriculture Minister may delegate any or all of his, or her, powers under

clauses 21 and 22 to the Secretary of the Agriculture Department, an SES

employee (or acting SES employee) of that Department or to a person who is an

official of a Commonwealth entity who is not employed by the Agriculture

Department.

According to the Explanatory Memorandum to the Fund Bill:

This broad delegation power is required to enable grants made

under clause 21 to be administered by Commonwealth officials employed in the

Australian Government Community Grants Hub, managed by the Commonwealth

Department of Social Services.[77]

Key issue—right

of review

Given the apparent opacity of the process for which the

Fund Bill provides only a skeletal outline, the question arises as to whether a

review process will be available to unsuccessful applicants.[78]

Currently the Fund Bill is silent on the access to such a process.

Noting the absence of relevant information, the Scrutiny

of Bills Committee has requested the Minister’s advice about:

- the processes by which grants

would be provided, and arrangements would be entered into, in accordance with

clause 21 of the Bill

- whether decisions in relation to

the provision of grants and entering into arrangements would be subject to

independent merits review and

- if not, the characteristics of

those decisions that would justify excluding merits review.[79]

Limits on the

exercise of power

Constitutional

limits

The Fund Bill empowers the Agriculture Minister, on behalf

of the Commonwealth, to make an arrangement with, or make a grant of financial

assistance to, a person or body in relation to drought resilience. In order to

be constitutionally valid, such an arrangement or grant must be consistent with

one or more of the powers which are set out in the Australian

Constitution. For that reason the Fund Bill lists each and every power

on which the Minister may rely when making an arrangement or grant.[80]

Essentially the powers that are relied on either

individually, or in combination, are:

- the

external affairs power under section 51(xxix) of the Constitution[81]

- the

grants power under section 96[82]

- the

corporations power which relates to foreign corporations, and trading and

financial corporations formed within the limits of the Commonwealth under

section 51(xx)[83]

- the

Territories power under section 122[84]

- the

power to make laws in respect of a Commonwealth Place in accordance with the Commonwealth Places

(Application of Laws) Act 1970[85]

- the

power to make laws with respect to trade and commerce with other countries, and

among the states under section 51(i) of the Constitution[86]

- the

postal, telegraphic, telephonic powers under section 51(v)[87]

- the

power relating to the development of patents of inventions under section 51(xviii)[88]

- the

statistics power under section 51(xi)[89]

- powers with

respect to meteorological observations under section 51(viii)[90]

- the

insurance power under section 51(xiv)[91]

- the

implied power of the Parliament to make laws with respect to nationhood[92]

and

- powers

in relation to incidental matters under section 51(xxxix).[93]

Compliance

with the Drought Resilience Funding Plan

The Fund Bill requires the Agriculture Minister to make a Drought

Resilience Funding Plan (the Funding Plan) and publish it

on the Department’s website.[94]

The purpose of the Funding Plan is to ensure that the Agriculture Minister has

a consistent and coherent approach to the making of arrangements and grants;

and to the setting of the terms and conditions of a grant which are detailed in

a formal agreement.

Clause 32 of the Fund Bill requires the Agriculture

Minister to publicly consult about the Funding Plan before it is finalised.

The Agriculture Minister must take all reasonable steps to

ensure that the first Funding Plan comes into force before 1 July 2020. It

will remain in force for four years from the date on which it is registered

under the Legislation Act[95]—unless

it is repealed and replaced on an earlier date.[96]

Although the Funding Plan is a legislative instrument, it is not subject to

disallowance by the Parliament.[97]

The Agriculture Minister must comply with a Funding Plan

that is in force when exercising a power under clauses 21 and 22.[98]

Requesting advice from the RIC Board

In

addition, the Agriculture Minister must request advice from the Regional

Investment Corporation Board (RIC Board) about whether he, or she, should

make an arrangement or grant, or enter an agreement, prior to exercising the

relevant power under clauses 21 and 22.[99]

In that case, the RIC Board must comply with the Minister’s request and, in

providing such advice,[100]

must comply with the Drought Resilience Funding Plan that is in force at that

time.[101]

The Agriculture Minister must, in exercising a power under

clauses 21 and 22, have regard to any advice that the RIC Board has provided.[102]

Comment

On its face, requiring the Minister to obtain the advice of

the RIC Board before exercising a power under clauses 21 and 22 will

operate to moderate the power of the Minister. However, it must be noted that

the RIC Board consists of the Chair; and at least two, and no more than four

persons.[103]

Each of those persons is appointed by the responsible Ministers.[104]

For the purposes of the Regional Investment Corporation Act, the responsible

Ministers are the Agriculture Minister and the Finance Minister.[105]

Essentially then, the power to determine who is to receive

farm business loans from the Regional Investment Corporation and who is to

receive monies under an arrangement or grant under the Fund Bill lies in the

hands of the Agriculture Minister and no more than five other persons who have

been appointed by the Agriculture Minister. Although the arrangements and

grants under the Fund Bill are to be made in accordance with the Drought

Resilience Funding Plan it is for the Agriculture Minister to make that

Plan.

It may, therefore, be prudent to consider further specific

checks and balances on the payments of arrangements and grants.

Statutory

review

Clause 65 of the Fund Bill requires the responsible

Ministers to conduct a review of the operation of the Act after ten years.

However, there is no requirement to table the outcome of the review in the

Parliament.

Concluding comments

The Australian Bureau of Agricultural and Resource

Economics and Sciences (ABARES) published an analysis of the 2018 drought in

which it opined:

While attention is focused on responding to the current

situation, it is important to understand the wider context—and tensions—around

drought policy and climate change. Most importantly, while supporting those in

need is appropriate, there is a risk that some interventions intended to assist

farmers during droughts can have negative consequences in the longer term ... Policies

that impede structural adjustment have the potential to weaken overall

productivity growth and hence competitiveness in international markets.[106]

[emphasis added]

The Prime Minister has stated that the Future Drought Fund

will provide a sustainable source of funding for drought resilience works,

preparedness and recovery. However, the breadth of the activities that could be

funded is such that care will need to be taken to ensure that structural

adjustment is not impeded.