Philip Hamilton, Politics

and Public Administration

Key issues

Enterprise bargaining continues.

The Australian Public Service (APS) Commissioner has outlined future directions for the APS.

The Department of Finance is developing a new Commonwealth Performance Framework.

Recommendations of the review of internal red tape are being implemented.

A government transformation agenda has been announced, but with few details at this stage. ICT projects are likely to have a prominent role.

APS workforce

Workforce size

Data produced by the Organisation for Economic

Co-operation and Development (OECD) indicates that for 2000, 2008 and 2013, employment

in the Australian public sector was around 15 per cent of the total labour force (including federal,

state and local levels). In 2013, the OECD average was 19.3 per cent.

The Australian

Public Service Commission (APSC) has reported that at 30 June 2015

there were 152,430 staff employed under the Public Service Act

1999—down 5,526 (or 3.5 per cent) from 157,956 in June 2014.

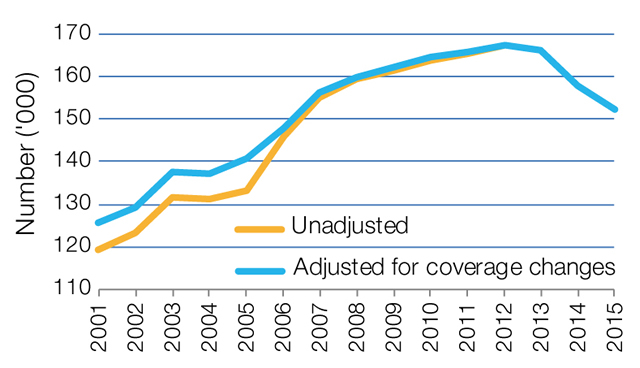

Figure 1 shows the change in total APS employee numbers over the past 15 years.

Figure 1: APS employee numbers, 2001–2015

Source: Australian Public Service Commission

(APSC), Australian

Public Service Statistical Bulletin 2014–15, APSC, Canberra, 2015.

The adjusted line takes account of coverage

changes in the APS each year, by adjusting total APS employee numbers by

the number of employees performing functions moving into or out of coverage of

the Public Service Act 1999.

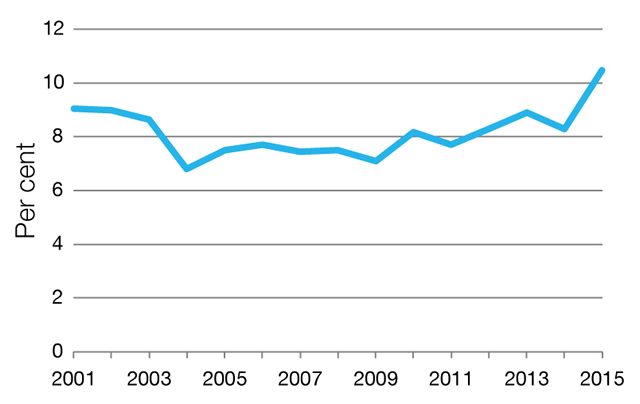

APS Commissioner John Lloyd PSM has observed

that ‘over the past 10 years the number of non-ongoing employees in the

APS has steadily increased. This is a healthy sign and reflects the changing

nature of public sector work’. Figure 2 shows non-ongoing APS employees as a

percentage of total APS employees from 2001 to 2015, including an apparent

longer-term trend since 2010 and a more pronounced increase since 2014.

Figure 2:

Percentage of non-ongoing APS employees in the APS, 2001–2015

Source: APSC, Australian

Public Service Statistical Bulletin 2014–15, APSC, Canberra, 2015.

Enterprise agreements

The salaries of most public servants are determined

in agency enterprise agreements, the majority of which expired on 30 June 2014.

Negotiations towards new agreements have been protracted, most recently because

the caretaker

conventions effectively precluded significant steps in the bargaining process

during the two-month election period.

A substantive point of contention is the position outlined

by the APS Commissioner: ‘Government policy for the current bargaining round is

to remove the more detailed policy and process content from enterprise

agreements, and place this material in agency documentation.’ The Community and Public

Sector Union considers that the use of agency policy documents rather than

agreements would reduce employees’ access to dispute resolution procedures in some

circumstances.

Future directions

In March 2016 the APS Commissioner outlined the

future direction of the APS. Priorities include:

- more effectively using employment types such as part-time, casual,

fixed-term, contractor and labour-hire

- reducing complexity and timeframes in recruitment

- facilitating mobility of staff between agencies, and between the APS

and the private sector

- using talent management to identify high potential people and

preparing them for business-critical roles

- improving performance management

- reducing the complexity and length of separation processes and

- moving HR management beyond a focus on transactions and toward

planning and strategy.

Budgeting for the APS

Program funds and running

costs

Most Budget appropriations for public service

agencies are classified as either administered

or departmental.

Administered funds are

administered by an agency on behalf of the government for the benefit of

parties who are external to the agency, generally through programs. For

example, the Department of Human Services (DHS) provides income support

payments. Agencies have no discretion in how administered funds are spent. For

example, DHS must make income support payments to applicants who fulfil eligibility

requirements. Other examples of administered program funds include grants,

subsidies, and other obligations arising from legislated eligibility rules and

conditions.

In contrast, departmental funds are generally

intended to cover agency running costs such as employee salaries and the purchase

or rental of equipment and property.

In 2014, the National Commission of Audit reported

that ‘of total Commonwealth spending in 2013‒14, some $360 billion

(or 88 per cent) comprised administered expenses with less than $50 billion

(or 12 per cent) categorised as departmental expenses’. As such, even

significant cuts to departmental expenses have only a minor impact on total

government expenditure.

Efficiency dividend

In place for over 25 years, the efficiency

dividend (ED) is an annual funding reduction for Australian government

agencies, in general applied only to departmental expenses. The ED has ranged

from 1 to 4 per cent over its life. The 2016–17

Budget provided that the ED will be maintained at 2.5 per cent

through 2016–18, before being reduced to 2 per cent in 2018–19 and

1.5 per cent in 2019–20.

In a first for the ED, the 2016–17 Budget indicated

that public sector agencies can anticipate the re-investment of a portion of

projected ED savings ($500.0 million) for ‘specific

initiatives to assist agencies to manage their transformation to a more modern

public sector’. This will mean a total estimated net ED saving of

$1.4 billion over 2017–20.

Managing the APS

Planning and reporting

The Department of Finance is leading a Public Management Reform

Agenda which, through a new Commonwealth Performance Framework

(CPF), will result in significant changes to Commonwealth

entities’ planning and reporting. In

the 44th Parliament, the Joint Committee of Public Accounts and Audit

(JCPAA) produced two reports on the CPF, the second of which recommended that Finance should produce an

incoming brief about the CPF for the JCPAA of the 45th Parliament.

Reducing red tape

The 2015 report of the Independent Review of

Whole-of-Government Internal Regulation (the Belcher Red Tape

review) made 134 recommendations, most of which can be implemented

administratively within the public service. However, full implementation of

some recommendations will require consideration by parliamentary

committees, the Senate or legislative

amendments.

Outsourcing

Notable agency-specific outsourcing projects in

progress include:

In a project

likely to be of relevance to all agencies, in early 2016 the Department of

Finance sought

‘the views of interested parties on the most effective and efficient way to

consolidate shared and common service delivery’, in particular ‘whether

opportunities may exist for partnering with the private sector to deliver

shared services’. The first tranche of shared services will focus on ‘core

transactional services’ considered

to be low risk, low to moderate complexity, and high volume of activity.

Examples include accounts payable/receivable and payroll administration.

ICT projects

During the 2013 election campaign, the Coalition undertook to‘improve the transparency of government ICT spending with the

establishment of a US-style online

dashboard so taxpayers can assess the performance and progress of major

projects’.

In the 2016 election campaign the Coalition

promised an expanded online dashboard enabling ‘public dashboard users ... to track the

performance of key government services, including: cost per transaction, user

satisfaction, and completion rates’. A performance dashboard of

this type is being developed by the Digital Transformation Office. A US-style projects/spending dashboard is yet to be

released, although an ICT dashboard is mentioned on the Department

of Finance website in the context of government investment in ICT.

The number of projects that would feature in a projects/spending

dashboard is likely to increase. One stated theme of the 2016‒17 Budget was transforming Government, including

by ‘maximising the opportunities of a digital dividend wherever possible’.

The ICT capability of Medicare received some

exposure in the 2016 election campaign, albeit in the context of a

highly-charged debate over the possible privatisation of Medicare.

In August 2014 the Government sought

‘Expressions of Interest from the private sector’ for handling the claim and

payment functions of both Medicare and the Pharmaceutical Benefits Scheme.

However, during the campaign the Prime Minister gave a commitment

that ‘every aspect of Medicare that is delivered by Government today will

continue to be delivered by Government in the future, full stop’. While that

statement aimed to address the privatisation issue, there appears to be a

broadly-held view that Medicare’s ICT capability still requires attention:

- During the election campaign, the Opposition health spokesperson stated

that ‘the IT system is going to have to be modernised at some point’, and it

was reported

that in 2009 the then Labor Government had sought to improve Medicare’s systems

in collaboration with the private sector.

- The incoming

president of the Australian Medical Association has described

Medicare’s ICT as ‘clunky, 30 years old’ and ‘not fit for purpose’.

- The Chief Information Officer of the Department of Human Services

has been quoted

as suggesting the Medicare system needs to be addressed within a four-year

period.

One industry analyst has observed

that a challenge will be bringing in sufficient external expertise without

compromising on ownership of the final delivered systems, as ‘the worst answer

would be for the pendulum to swing all the way back in the other direction and

for the government to start coding a whole new Medicare system from scratch’.

Further reading

P Hamilton, ‘Reducing Red Tape in the public service 1: committees and the Senate’, FlagPost, Parliamentary Library blog, 21 December 2015.

P Hamilton, ‘Reducing Red Tape in the public service 2: legislation’, FlagPost, Parliamentary Library blog, 21 December 2015.

P Hamilton, ‘

Selected government ICT projects’,

Budget Review 2016–17, Parliamentary Library, Canberra, May 2016.

Back to Parliamentary Library Briefing Book

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.