Manufacturing and value-chain activities—opportunities and challenges

Introduction

4.1

This chapter focuses on the opportunities and challenges associated with

electric vehicle (EV) manufacturing and value-chain activities including:

-

EV and EV component manufacturing;

-

Battery manufacturing and commodity value-adding; and

-

Charging infrastructure.

EV and EV component manufacturing

4.2

The Committee has heard about the future opportunities for manufacturing

in the industries related to EVs. A number of companies the Committee has

spoken to and visited are already on the front foot seeking to take advantage

of the commercial opportunities presented by the rising consumer demand for

EVs.

4.3

In its submission, Deakin University shared its positive outlook for manufacturing

in this area:

No component, nor assembly of a complete electric vehicle, is

beyond the capability of Australian industry.

The opportunities for local manufacture will, therefore, be

determined on price, production volumes and access to requisite designs, which

may otherwise be constrained by intellectual property protections.

Volume can be enhanced by exports and intellectual property

issues addressed through partnerships. A comprehensive analysis of supply chain

requirements and opportunities should be undertaken by an industry capability

network or similar agency.[1]

4.4

One of the inherent benefits to EVs is that they are less complex than

internal combustion engine vehicles and hence have 'thousands of fewer

components per vehicle'.[2]

Not only does this lead to potentially lower costs per vehicle (excluding the

batteries) for the consumer (and cheaper servicing), but it also reduces the capital

cost and complexity of manufacturing including logistics.[3]

4.5

There will also be changes to how motor vehicles are made and how much

they cost to build. Uniti Australia has stated that 'new advanced manufacturing

processes, light-weight materials and new vehicle designs have led to a

dramatic reduction in the costs of assembling vehicles'.[4]

Dr Brett Dale, Chief Executive Officer of the Motor Trades Association of

Queensland (MTAQ) made his views clear on the future of manufacturing,

including custom order motor vehicles:

I [spoke about] the concept of 3D printing. With the way in

which that's developing and the rate at which it's developing, there's a real

possibility that, in the next five to 10 years, you'll custom print the car that

you want. When you look at the components associated with electric vehicles,

there are way fewer than the existing fleets on the road. Printing a fully

electric vehicle, which will be autonomous by then, could be done custom; you

would get a product comparative to an architecturally designed home or a spec

home. So, manufacturing is the key, and governments need to support the

investment into that, because it will be the technology that determines whether

we are a competitive nation.[5]

4.6

The advent of automated vehicles will also likely present changes to structural

and material requirements, and vehicle design, 'which might create further

opportunities to utilise Australian resources'.[6]

4.7

Although the majority of submitters and witnesses expressed support for

local manufacturing associated with EVs, others, such as Mr Tony Weber, Chief

Executive Officer of the Federal Chamber of Automotive Industries were more

circumspect:

On the question of manufacturing in the future, obviously we

ceased [vehicle] manufacturing late last year [2017]. In the future, if we were

to look at manufacturing being realistic, we'd have to examine the fact that,

despite Australia having a market of 1.2 million vehicles a year, no vehicle

sells at 50,000 units per year in Australia. Fifty thousand units is not

considered to be the scale required for a factory anywhere in the world, and

therefore you would need extensive export markets, in conjunction with a very

successful product in the domestic market, before it was viable. One of the

substantial issues with manufacturing in Australia is lack of real access to

markets outside of Australia, especially in the Asian region, because of

tariffs and non-tariff barriers.[7]

Residual car-making skills and

experience

4.8

In October 2017, the General Motors (GM) Holden automotive manufacturing

facility in Elizabeth, South Australia was closed. As the last car making plant

in Australia at the time, it also signified the end of passenger vehicle manufacturing

in Australia at that time.[8]

This left not only hundreds of highly skilled automotive workers unemployed,

but many thousands more who worked in businesses supplying components to GM

Holden. This effect has been mirrored across the country in the wake of other

high profile car plant closures in recent years with estimates suggesting that

up to 50 000 workers could have been impacted as a result.[9]

The Committee notes that Iveco manufactures trucks at its Dandenong plant.[10]

4.9

Notwithstanding the closure of Toyota's Altona plant in western

Melbourne, the Hobsons Bay Council observed that 'there remains capacity and

expertise in the areas of vehicle design, heavy vehicle manufacturing,

conversions, component manufacturing and servicing'. This capacity stands ready

to take advantage of the growth in EVs.[11]

The South Australian Government put forward a similar view:

The state also retains an automotive sector following the

closure of Holden with many component suppliers, a strong research base and a

remnant pool of skilled workers.[12]

4.10

The Victorian Automobile Chamber of Commerce (VACC) expressed its view

that opportunities exist for Australian industry stemming from a ready skilled

workforce and the introduction of automated manufacturing techniques:

Whilst passenger car manufacturing has now ceased, it is not

beyond possibility that the assembly of EVs may become a viable business

option. EVs have fewer components than traditional ICE vehicles, thus

eliminating the need for many costly manufacturing processes such as engine

casting, tooling and the creation of component parts. Given the inherent

residual engineering capacity that is available in Victoria and other states,

business models involving the importation of electric motors and the assembly

of EVs from Completely Knocked Down packs (CKDs) using robotics and other

automated processes may be viable.[13]

4.11

The Australian Council of Trade Unions (ACTU) has argued that it would

make sense to take advantage of such a large skilled workforce and existing

supplier capacity, and situate any new industry in areas where skilled

automotive workers and associated businesses are located:

EV manufacturing could be centred in precisely the

communities and area, such as Elizabeth in SA and Geelong in Victoria, that

have been most affected by the destruction of the Australian car industry. The

return of vehicle production to these areas would revitalise these communities,

bringing jobs, allowing families to escape and poverty and would encourage the

engagement of young people with education and training.[14]

4.12

The Australian Manufacturers Workers Union (AMWU) echoed these

sentiments:

Australia is uniquely placed as a country with a ready supply

of skilled workers capable of building a world-class EV manufacturing facility.

As a result of the closure of Australia's conventional automotive manufacturing

industry, there are many workers capable of supporting the development of an

electric vehicle industry in Australia.

In addition, there is also a significant infrastructure to

support the development of such an industry in Australia, particularly in the

former regions that hosted automotive manufacturing facilities until recently.

These areas have vocational education providers that specialise in the skills

required, they have connections for import and export and are close to

established supply chains.[15]

Automotive Transformation Scheme

4.13

As car manufacturers signalled their intention to close Australian

manufacturing facilities, the Australian Government established a $2 billion

industry adjustment scheme called the Automotive Transformation Scheme (ATS).

The ATS, started in 2011 will run until the end of 2020, and provides:

businesses

involved in the Australian automotive industry with cash payments to cover up

to 15% of the cost of investing in plant and equipment, and 50% of the cost of

investing in research and development, to encourage investment and innovation

in the Australian automotive industry.[16]

4.14

The ATS has been taken up by firms such as Precision Components to

reshape their businesses for the opportunities of the future. Mr Christian Reynolds,

Director of Precision Buses, a South Australian bus manufacturer, explained his

company's journey from 'metal stamping component manufacturer' to an 'advanced

manufacturing group'.[17]

Precision Buses is a genesis from Precision Components.

Precision Components was a component manufacturer at tier 1 level to Holden and

Ford, which, through the Automotive Transformation Scheme, took the opportunity

to transition into vehicle manufacturing. We've set up an advanced

manufacturing facility in Edinburgh Parks [South Australia], where we have a

level of collaboration between four business entities. We're looking at

co-locating to advance the knowledge share and the engineering detail around

how we progress autonomous and electric vehicles.[18]

4.15

The Committee heard that there were a number of limitations with the ATS and

its eligibility requirements. For example, many companies do not meet the

minimum throughput of 30 000 vehicles per annum. However, there is an

exemption in the form of a national interest test. The Department of Industry,

Innovation and Science's (DIIS) submission explained how the ATS was being

expanded:

Businesses that have made a financial commitment to carry on

business in Australia as a motor vehicle producer or supplier to the automotive

industry, for the first time can also participate in the scheme. Businesses

that do not satisfy certain registration requirements may seek the Minister's

permission to apply for registration on national interest grounds.[19]

4.16

Prospective EV manufacturer, Australian Clean Energy Electric Vehicle

Group (ACE-EV) suggested that this test was difficult to meet for start-up manufacturers.[20]

Ms Claire Johnson, Chief Executive Officer from Hydrogen Mobility Australia suggested

that the ATS should be reframed 'around zero- and ultra-low emission vehicles'.[21]

Ms Johnson continued:

When [the ATS] is set to cease with, at this point, no future

assistance available in the form of an automotive scheme, we think that can

send a strong signal to international companies who are looking to invest in

Australia.[22]

4.17

Hyundai's submission said that funding is available for research and

development (R&D) under the ATS and that this should be further prioritised.[23]

Tritium suggested that the ATS be extended to component manufacturing, noting

that 'grant programs are vital in supporting entrepreneurs who may be building

or seeking to build a business in the EV industry'.[24]

Assembly of imported parts

4.18

Some submitters and witnesses have expressed their support for EV manufacturing

based on the local assembly of imported pre-built parts. Volvo confirmed that it

is currently contemplating such an approach in relation to buses:

Volvo Bus also sees a future where we will be able to provide

local manufacturers in Australia with a chassis product that can be bodied

locally here in Australia. This will allow the same high standards of body

building to deliver safe, reliable and [Australian Design Rules] compliant

vehicles manufactured here in Australia, sustaining a vibrant and specialised

body manufacturing industry.[25]

4.19

In its submission, Uniti Australia said that it 'is designing a vehicle

to be assembled in Australia by Australians and for Australians' from imported

parts.[26]

Dr Michael Molitor, Chairman of Uniti Sweden AB (parent company of Uniti

Australia) explained that his company expected to be manufacturing 'up to

100 000 units within three to five years' in Australia.[27]

Mr Greg McGarvie, Managing Director of the ACE-EV provided details about his

company's two-stage approach for its Australian EV manufacturing plant:

We're taking a low-risk approach. Initially we were looking

at $5 million to get the assembly plant. We've got an assembly facility

available to get that set up and get their components in CKD and then, as soon

as it looked like there was interest and appetite for more vehicles, to the

second stage, which is full manufacturing here. In other words, we'd be doing

carbon fibre structures here, their panels here, supply chain—we've been

contacted by various lithium suppliers. We've got quite a few different supply

chains wanting to link in with us. We've got research facilities wanting to

link in with us. As you know, the carbon fibre research in Australia is quite

advanced.[28]

Retrofitting electric drive trains

4.20

As part of this inquiry, the Committee visited the SEA Electric

manufacturing facility in Dandenong, Victoria (see Appendix 3). SEA Electric is

an Australian-based company that initially retrofitted electric powertrains and

batteries to a wide range of commercial buses and trucks. SEA Electric now

supports the importation of gliders—a manufactured vehicle without a

powertrain—to which SEA Electric fits a powertrain and batteries providing a

fully electric vehicle to their clients. The Group Managing Director of SEA

Electric, Mr Tony Fairweather, described a future scenario where local

manufacturing may form part of the light truck manufacturing process:

The chief engineer from Isuzu Australia visited yesterday. He

explained how the pilot process at the moment in their particular case involves

substantial testing and evaluation of half a dozen vehicles, which are going

into service with some of Australia's largest operators of trucks later this

year. Their hope and intention is to potentially be producing their glider

vehicles, assembled in Australia with our driveline technology in them, early

next year or sometime next year. At the moment, everything they do right now,

which is up to 10,000 units a year, is 100 per cent imported internal

combustion engine product. Isuzu is an example of a company that is very

progressive and working towards an electrification option with, hopefully, some

local content. That opportunity for others is there. Our intention is in

licensing our technology but also very much in having a local assembly element

for our products and for end users. It's kind of a hybrid approach.[29]

4.21

Mr Fairweather noted that it was not only the new segment of the truck

market that is looking to convert to fully-electric, there are also those who

may seek to retrofit existing trucks with end of life conventional powertrains.[30]

Mr Fairweather asserted that SEA's all-electric commercial trucks now 'had

payback periods of three or four years based on the total-cost-of-ownership

model'.[31]

4.22

In October 2018, the Victorian Government announced it had signed an

agreement that would result in SEA Electric establishing an additional factory

in the regional town of Morwell in Victoria's Latrobe Valley. Mr Fairweather

estimated that the Morwell plant could build 2 400 four-tonne vans and commuter

buses, and employ up to 500 workers over the next five years. The plant is

expected to be up and running in less than a year and generate about $200

million in economic activity.[32]

4.23

The Australian Productivity Council put forward its views on a more

cost-competitive manufacturing approach that would be better suited to a lower

volume producer such as Australia:

The business concept had three main features.

Firstly, it proposed a way of building cars on a common

flexible platform (CFP) to substantially reduce initial development and tooling

cost per model at the expense of a higher base unit cost. Trading up-front

costs against unit costs in this way would provide better production economies,

more variety and shorter model cycle times at all volumes below 40,000 annual

units than the conventional manufacturing methods.

Secondly, the business proposed a different plant format,

similar to production concepts developed by Volvo at Uddevalla in Sweden, as an

alternative to the Toyota Production System (TPS). The proposed plant design

had fixed assembly stations as distinct from a moving assembly line with part

sets delivered sequentially to the workspace for assembly by a skilled

two-person team completing one vehicle per shift. Such a plant is much less

expensive to build, is more flexible, offers higher worker morale and a

flatter, less expensive, management structure than a conventional plant.

Thirdly, the business proposed a direct-selling model from a

digital platform supported by company-owned sites in shopping centres, a model

subsequently demonstrated by Tesla in Australia. This would collapse the dealer

margin into the producing business and enable solid profit margins, budgeted at

30%, providing rapid growth through retained earnings while offering customers

an ultra high quality product at a reasonable price.[33]

4.24

Mr Reynolds described how Precision Buses has used existing local

Australian engineering and design capability, previously harnessed for car

manufacturing to reimagine how buses are built. Instead of importing chassis

and fitting a coach body and other fittings as has been done in the past,

Precision Buses is looking at how it can bring together bus components from a

range of local and imported suppliers to build a product that meets their

client's requirements:

We've manufactured two electric buses to date that are being

prepared to go into trial. The aim of those buses is to look at how electric

drive line is affected by mass transport patronage, topography, traffic

structure in terms of time and delay, and also weather conditions. We also

manufacture an architecture which [has] moved away from the traditional chassis

and coach into an integrated model which allows us to become an [Original

Equipment Manufacturer (OEM)] in the bus manufacturing space. This allows us to

integrate various technologies from partners, whether that be drive line from

other OEMs or autonomous technologies from other companies, which allows us to

try and connect mass transport artery with last mile solution so that we have

an integrated solution. By setting that up in a local condition, we're able to

bring economic benefit to suppliers and manufacturers locally. We use the

existing capability that was available with OEM manufacturers in the passenger

car space to engineer for us today.[34]

4.25

One of the benefits to manufacturing locally are the synergies that could

be generated by having collaborators co-located, particularly in regard to

emerging technologies such as automation. Two companies, EasyMile and Transit Australia

Group, have announced plans to manufacture autonomous vehicles in South

Australia.[35]

Mr Simon Pearce, Head of EasyMile Asia-Pacific described EasyMile's

relationship with Precision Buses as 'seamless' when integrating their

technology. Mr Pearce suggested that automated vehicles are a parallel

technology that would develop side by side with electric and that it made sense

to co-locate where synergies might be gained for both parties.[36]

EV component manufacturing

4.26

The Committee heard that 'Australia has the skills needed to manufacture

EVs and components like battery cells, motors and power electronics'.[37]

The MTAQ noted that 'Australia has always been an effective supplier of

components'.[38]

4.27

Monash University submitted that Australia would need to be 'selective'

in deciding where to focus in regards to manufacturing EVs or components. The

submission suggested that:

Areas of strength lie in development of [Intellectual

Property], protection and nurturing of emerging energy storage technologies and

integrated systems for electric vehicles developed in our innovation system so

that we are better prepared for the next-generation of technologies required

for the EV market.[39]

4.28

Associate Professor Nesimi Ertugrul from the School of Electrical and

Electronic Engineering at the University of Adelaide put forward a similar

view:

My view is: why don't we focus on some value-added part of

these electronics—from the battery level, motor control level, similar

topology, similar developers. If this continues happening, we can become an

electronic nation. We can compete, with electronics all produced in automated

manner without touching a single hand. That's how I see it.[40]

4.29

During the inquiry, the Committee visited the Nissan Casting Plant

Australia (NCAP) in Dandenong, Victoria (see Appendix 3). The plant casts,

machines and assembles components for motor vehicles in the Nissan range with

parts exported to Japan, Thailand, Mexico and the United States. The plant

employs nearly 150 people and operates six days per week.[41]

NCAP's submission stated:

NCAP produces six key components for Nissan EV and hybrid

vehicles that are sold globally. The growth of EVs globally is allowing us to

not only expand our workforce, but also develop talents in areas such as

engineering, manufacturing, logistics and more.[42]

4.30

Pilbara Metals Group (PMG) commented that Australia's large reserves of

raw materials required for battery manufacturing 'has allowed companies to

[proceed] with planning and engineering studies to produce various components

of batteries in Australia'. PMG suggested that production of battery cathodes

could be a logical starting point.[43]

4.31

MTAQ submitted that the manufacture of a key component such as a battery

pack in Australia could lead to other parts of the EV manufacturing chain also

being based in Australia:

The economics of vehicle manufacture tends to indicate the

most important component is the battery pack. The geographic sourcing of these

items can be expected in large part to determine the architecture of the future

electric vehicle manufacturing. Tesla has demonstrated the economic power that

battery manufacturing confers on an OEM electric vehicle producer.[44]

4.32

The Committee has also heard that Australia has significant,

high-quality deposits of rare earth elements (REE) that are used to manufacture

permanent magnets for EVs and 'for electric generators that power wind

turbines'.[45]

China currently dominates the mining of REE and the manufacture of permanent

magnets. Deakin University argued that there is an opportunity for Australia to

take advantage of its reserves, to build local manufacture of value-added

products and to do so in an environmentally responsible way.[46]

The University of Adelaide submitted a similar proposition:

Australia can also develop high quality brushless permanent

magnet motor manufacturing facilities used in EVs which rely on two critical

value added materials: copper and rare earth magnets.[47]

Research and development

4.33

Many witnesses and submitters highlighted the key role that R&D has,

and could, continue to play in underpinning Australia's future automotive

manufacturing capacity. This R&D runs the spectrum from academia through to

in-house OEM R&D centres.

4.34

The Committee has heard that Australia is an R&D hub for major OEMs

such as Ford, GM Holden and Toyota in the Asia-Pacific:

Currently, Ford has a design/styling, engineering and

homologation/testing team in Australia, and General Motors and Toyota have

their design/styling and small engineering teams in Australia.[48]

4.35

Mr David Magill, Director, Government Relations and Public Policy, GM

Holden explained that GM Holden 'are now doing over $120 million worth of

R&D annually in Australia each year and our engineering program in advanced

vehicle development is going to be working on electrification projects for GM'.[49]

The Committee also heard that GM Holden is expanding this capacity in advanced

vehicle development—the 'area between pure research and development and

establishing programs that are technically feasible and business case feasible

and can be produced'.[50]

4.36

In its submission, Hyundai noted that it invests in Australian R&D

and the value of this work:

This is valuable, highly skilled work that both secures and

develops automotive engineering expertise in Australia and should continue to

be supported through a dedicated program if the country is to recognise the

sector as having strategic importance to the economy.[51]

4.37

Noting the importance of batteries not just in motor vehicles, but also

for stationary energy storage, the CSIRO is contemplating establishing a new

future science platform focusing on the lithium value-chain. This would place

it as one of the CSIRO's six priority areas for future scientific research.[52]

The CSIRO has also reiterated to the Committee the importance of its

partnerships with industry as a means to commercialise research outcomes with

benefits for both industry and CSIRO.[53]

4.38

Associate Professor Patrick Howlett from Deakin University told the Committee

that research in the automotive sector is constantly evolving as a result of

changing priorities and scientific breakthroughs. Associate Professor Howlett

raised the example of advances in lithium metal electrodes in high-energy

batteries:

The [United States Department of Defence] made a directive to

essentially investigate the lithium-metal electrode for high-energy batteries

for electric vehicles, and they have the target of 500 watt-hours per kilo.

There were a lot of slogans that went around that. What that has driven is

research in the US on the lithium metal electrode, and then that has further

driven worldwide research to the point where now there have been rapid advances

in that technology. Where not so long ago that was essentially ignored as a

potential technology, now it's probably the most likely next technology. That's

the metal electrode; that's only the bottom half of the battery, if you like.

The cathode remains a problem, and there are a range of technologies that can

be addressed there.[54]

4.39

In its submission, Deakin University flagged a number of constraints to

research in the automotive sector. The most significant of these is the lack of

students available to undertake post-graduate study and the difficulty in

recruiting automotive engineering researchers. This difficulty stems from the

perceived lack of employment opportunities in the automotive sector and complications

accessing student visas.[55]

During the Adelaide hearing, Professor Rocco Zito, Head of Civil Engineering,

College of Science and Engineering at Flinders University noted the current

professional development and employment pathways that exist, but flagged that more

could be done to ensure that employment opportunities exist for these students

at the conclusion of their studies:

I think there is a need to bring some coherence to this

debate in the form of an industry roadmap for EV and AV in Australia to provide

short- and medium-term guidance to how we can maximise our participation in the

value chain in both inputs like batteries and taking on that larger challenge

and opportunity of being part of a global EV-AV industry into the future. We

should never rule that out in the great sweep of history. Even in the wake of

the closure of the auto industry, which hurt us in South Australia so badly,

there are plenty of skills and capabilities available to be redeployed cleverly

in a very high value industry at its best, EV and AV.[56]

Industry 4.0

4.40

A key opportunity for the manufacturing of EVs and associated

componentry in Australia is the worldwide phenomenon of 'Industry 4.0'. This

refers to what is being termed as the fourth industrial revolution—that is,

technological developments such as the improvement of artificial intelligence

and machine-to-machine integration across 'almost every industry worldwide'.[57]

In a recent article, Dr Jens Goennemann, Managing Director, Advanced

Manufacturing Growth Centre described the benefits of Industry 4.0:

Industry 4.0 can start with as little as sticking a sensor on

a piece of equipment so that one can monitor where it is or what it does. In

the longer perspective though, it is about establishing a relationship with

embedded intelligence across the entire manufacturing process from research and

design through to the final customer engagement. If we get this right, then customer

feedback loops back into the R&D process and starts the next iterative step

in delivering high-quality outcomes and rich customer experiences.[58]

4.41

Of most relevance to this Committee is the increase in manufacturing

automation. The Boston Consulting Group explained how increased automation will

also lead to significant decrease in battery price:

By transitioning to the factory of the future [Industry 4.0],

producers can reduce total battery cell costs per kilowatt-hour (kWh) of

capacity by up to 20%. The savings result from lower capex and utility costs

and higher yield rates. The production-related costs (excluding materials) can

be reduced by 20% to 35% in each of the major steps of battery cell production:

electrode production, cell assembly, and cell finishing. Electrode production

benefits from faster drying times that increase yield rates and reduce capex

for equipment. In cell assembly, data-driven automated adjustment of parameter

settings increases accuracy and reduces production times. Cell finishing is

enhanced by shorter times for formation and aging, which significantly reduces

capex requirements.[59]

4.42

Professor Peter Newman highlighted the opportunities that Western

Australia has in taking advantage of Industry 4.0 developments:

Fourth stage technologies offer WA the opportunity to develop

a much larger industrial base that is complementary to its world-leading

resource extraction sector. These technologies shift the competitive advantage

of early stage value adding away from low cost labour countries to the earliest

point in the value chain where all the input materials can be brought together

for highly automated manufacturing processes. Components are then shipped to

the major global manufacturing centres for later stage manufacturing where proximity

to markets or low-cost labour still afford an advantage. WA is in the unique

position of having abundant quantities of almost all the New Energy metals,

giving it a large advantage in electro-chemical processing.[60]

4.43

Automated manufacturing will have a lower labour requirement and allow

Australian firms to compete globally. Deakin University's submission indicated

the need for Australia to adopt and develop Industry 4.0 frameworks and

technologies to be competitive in EV manufacturing:

The competitive manufacture of electric vehicles in Australia

will need to leverage Australia's research and development capabilities to

deliver future integrated factories. These Industry 4.0 facilities will operate

as a 'system of systems' through intelligent machines, human factor

integration, and integrated supply chains.[61]

4.44

Deakin University also anticipated the benefits that would eventuate

from adopting Industry 4.0 framework in electric vehicle manufacturing through

the ability to 'participate in the global supply chain' without having to

commit to a full-scale 'end-to-end vehicle manufacturing industry'.[62]

4.45

The concept of Industry 4.0 was discussed in a November 2015 report of

the intergovernmental Australia-Germany Advisory Group, Collaboration,

Innovation and Opportunity.[63]

Recommendation 10 of this report called for 'initiating a collaborative

approach to the development of global Industry 4.0 standards'.[64]

4.46

The report of the Australia-Germany Advisory Group resulted in the

creation of the Prime Minister's Industry 4.0 Taskforce (now the Industry 4.0

Advanced Manufacturing Forum).[65]

The Taskforce and its successor have fostered an industry relationship with the

German Plattform Industrie 4.0, and supported Industry 4.0 test laboratories in

Australian universities.[66]

Battery manufacturing and commodity value-adding

4.47

Earlier in the report, the Committee discussed the benefits for the

mining sector from an increased use of EVs both here and in Australia.[67]

The future of EV manufacturing will lead to an increase in demand for a number

of key resources including copper, nickel, cobalt and lithium. Given the

anticipated increase in demand for EV manufacturing in the coming decades,

there could be a significant upsurge in the value of these minerals.[68]

The Electrical Trades Union highlighted Australia's natural advantages:

Australia has some of the highest grade, and largest,

deposits of Lithium and Vanadium in the world, particularly in Western

Australia. Western Australia is also currently the largest producer of lithium,

which is necessary to supply batteries for the emerging EV market.[69]

4.48

Bloomberg NEF projected that 'global demand for metals and materials

used to produce lithium ion batteries will increase 25-fold by 2030'.[70]

Dr Howard Lovatt, Team Leader, Electrical Machines at the CSIRO made the point

that Australia's diversity of mineral resources makes it well placed to take

advantage of any changes to battery chemistry and composition:

Generally in terms of batteries it most definitely is an area

that's changing rapidly, and new developments are occurring, and that will mean

that some minerals that were important suddenly become not important and vice

versa. Particularly when you get a big growth in an industry like lithium

batteries, it does put stress on the supply of some minerals, so then

everyone's motivated to change the composition of the batteries to avoid those

minerals. So this is very much a moving target. But I guess the good news for

Australia is that we're well supplied with lots of different minerals, so it's

likely to benefit Australia regardless of the final commercial outcome.[71]

Commodity value-add

4.49

Mr Warren Pearce, Chief Executive Officer of the Association of Mining

and Exploration Companies explained the lithium value chain from mining to

battery manufacture:

we've broken the value chain into the five steps toward the

creation of manufacturing of batteries: the first step being mining

concentrate; the second step being refining and processing; the third step

being electrochemical processing; the fourth step being the production of

battery cells; and the final step being the assembly of batteries.[72]

4.50

Mr Pearce noted that Australia currently only participated in the first

step—mining the raw materials—but that involvement in the subsequent stages could

bring huge economic returns to Australia saying that many Australian companies

'are now quite legitimately looking to process or value-add their materials to

see if they can get into a greater part of the value chain.[73]

4.51

Currently, it is estimated that Australian mining companies capture less

than 0.5 per cent of the lithium chain.[74]

Deakin University agreed with this estimation stating that 'there is a great

opportunity for Australia to capture a larger part of the value chain of

lithium ion batteries, by not only exporting the lithium minerals, but also by

designing and manufacturing batteries'.[75]

4.52

Mr Pearce provided the Committee with examples of a number of Western

Australian mining and exploration companies where Australian mining and

exploration companies have partnered with larger international companies with

capital and expertise in processing in order to build processing facilities for

lithium and other commodities.[76]

4.53

Mr Pearce discussed the need for linkages to be facilitated between

Australian mining and exploration companies with international processing

companies in order to import much needed expertise and capital. This expertise

would enable Australian businesses to value-add our mineral resources on-shore

for export or domestic use:

In order to achieve that, there are some barriers that our

report has tried to identify, primarily being that our member companies are

mid-tier or small-cap mining companies. They don't have large balance sheets

and they require support to find investment to build these types of facilities.

Also, in order to move into that space, we're capable explorers and miners but

we are not processers or refiners. We need to access the proprietary knowledge

and technical expertise to undertake that successfully. To make that

possibility a reality, our organisation has been promoting the opportunity for

partnerships between international companies that hold this knowledge and

Australian mining companies.[77]

4.54

The 2018 report titled Lithium Valley: Establishing the Case for

Energy Metals and Battery Manufacturing in Western Australia observed how

trends such as automation are changing the economic paradigm of value-adding

raw minerals:

Historically, it was more cost effective to value add closer

to large markets or in countries with large, low cost workforces. This is no

longer the case. Information technologies, artificial intelligence, automation

and new energy systems now favour manufacturing at the earliest point in the

value chain where all the input materials can be brought together in a low, cost

effective way.[78]

4.55

This same report quantified the projected economic importance of

value-adding. An integrated approach that focused on mining, refining with 10

per cent electro-processing (the first three steps that Mr Pearce outlined) is

projected to result in over 100 000 jobs, economic investment of over $34

billion and an economic contribution of $56 billion per annum by 2025. This

compares to a mining only scenario whereby less than 30 000 jobs are

created and total investment of nearly $14 billion.[79]

Battery manufacturing

4.56

In addition to processing and advanced refining of minerals, there is an

opportunity for Australian companies to value-add refined minerals into battery

cells and then assemble into batteries. The University of Adelaide stated that

Australia could play a part in the 'automated production of batteries and

battery management systems in [the] EV supply chain'.[80]

4.57

Mr Brian Craighead, Director of Renaissance Energy told the Committee

about his company's intention to construct a lithium-ion battery factory in the

Northern Territory. [81]

Mr Craighead explained the benefits to his company of building tailored

products in Australia:

We are manufacturing a particular type of battery cell that

works better in hot climates. That's South-East Asia and Australia. Part of the

reason we're up in Darwin is that the export capability is very good for us

when it comes to South-East Asian markets. Ours is, we think, about 70 per cent

an export business, but Australia is an important market for us in both the grid

market and the electronic vehicle market. We've met a few folks who seem to be

quite ambitious with plans for electronic vehicle manufacturing. An EV,

fundamentally, is a battery on wheels. So for us it's a very attractive market.

We can customise batteries and stick them in EVs. For hot-climate [EVs], we

think that there will be a very clear market.[82]

4.58

Mr Craighead also noted that the capital expense of building an

automated factory is 'not what it once used to be', and explained the

counterintuitive proposition that Australia could find itself as a leader in

extracting the raw materials required in batteries and manufacturing the

batteries themselves but not having the capacity in Australia to process and

refine the raw material to battery manufacturing grade:

The great sadness of Australia—the kind of twist here—is

that, although we have all the raw materials we need to manufacture

competitively lithium-ion batteries in Australia, the reality is that all those

raw materials without exception are mined and shipped overseas to be processed

to battery grade and then reimported; we have to re-import. Most of the margin

is given overseas because there aren't processing facilities locally for

battery-grade raw material.[83]

4.59

Mr Craighead was confident that the establishment of a battery

manufacturing sector in Australia could provide the critical mass to encourage

local miners to develop processing and refining capabilities:

What they need is security in offtake. If there is enough

confidence in forward orders, people can justify and bank the capital

investment to do the processing locally. In some cases—lithium, less so—it's

quite expensive to bring a processing facility on shore. And it's the process

as well, because some of them are power hungry and with some of them you have

to be very careful that you're not hurting the environment. So because of the

cost involved all of them need security in forward orders. Basically, they need

to know if they have enough orders for the next three years to justify the capital

investment.

And here's how you get that: we will bring some level of

security in forward orders to these folks locally, because, obviously, the

reason you exist is to buy Australian. But if another factory comes up—if the

Townsville comes up—it will be much bigger than ours; it's a very differently

sized facility. If that goes up it would bring even more security in forward

orders. So, really, it's just like any bankable project: the more forward

orders you've got then the more comfortable the lenders are and the more

comfortable the investors are. That's what will suit our local processing. For

every dollar of benefit and economic benefit that our little factory brings

there's about six that go to the raw material producers so that they can get

processing. There's much more in it for Australia if we can have them

processing to battery grade, rather than our little factory.[84]

4.60

Two battery manufacturers, Sonnen and Aplha ESS, have recently announced

that they will manufacture lithium-ion home batteries in Adelaide.[85]

4.61

Professor Mainak Majumder of Monash University was more cautious in his

advice to the Committee:

My view is that because battery manufacturing is so well

established in South-East Asia and in Japan and that they're so good at that we

might not be able to compete with them in battery manufacturing. But we could

possibly think about the resources that go into battery manufacturing, and that

could be a much better approach for us to invest in.[86]

4.62

Mr Pearce observed that the establishment of a local battery

manufacturing sector would be beneficial for mining and processing companies

'as a local market to sell their product into'.[87]

An Australian-based battery manufacturing sector would also have flow-on benefits

to other industries 'such as the manufacture of new submarines in South

Australia which is expected to involve battery technology'.[88]

Battery technology and developments

4.63

At its Melbourne hearing, the Committee heard from a panel of academics

specialising in battery chemistry research who spoke about their research areas

and the implications this work would have on battery use into the future.

Associate Professor Patrick Howlett from Deakin University stated that his

focus was on 'next generation prototype batteries with new materials that have

superior properties, for example, lighter weight'.[89]

Associate Professor Howlett also described the industry's move to lithium-ion

batteries with higher levels of cobalt:

The main attractiveness there is their higher theoretical

energy density or specific capacity, which is the amount of charge they can

store per gram, as well as their higher voltage.[90]

4.64

Mr Ali Asghar, Senior Associate for Power, Energy Storage and EVs at

Bloomberg New Energy Finance explained that as demand for particular minerals

increases with battery demand, this will drive innovation and amongst the

battery industry to modify the chemical composition of batteries to reduce

battery input costs:

We do look at battery chemistry changes in the chemical composition

of batteries—the amount of cobalt, lithium, nickel, manganese composition

within batteries. We do expect a change towards chemistries with a lower

composition of cobalt, mainly because that is a metal that we expect to be a

bottleneck in lithium-ion battery manufacturing. It is basically a road block

in putting pressure down on lithium-ion battery pricing.[91]

4.65

Associate Professor Howlett noted that higher energy density can pose

difficulties from an operating perspective as they are restricted in how

quickly the batteries can be charged.[92]

4.66

Professor Baohua Jia, Research Leader at the Swinburne University of

Technology highlighted her team's work on supercapacitors, which are 'a very

good alternative for the current batteries in terms of safety issues, lifetime,

cost and also environmental concerns'.[93]

4.67

The University of Adelaide has projected that by 2030 'silicon carbide

and gallium nitride based switching devices will drastically change the power

electronics systems used in EVs (including battery chargers and motor drives)'.

The use of such devices will 'improve efficiency, operating temperature,

reliability while significantly reducing system size and weight'.[94]

4.68

Nonetheless, many witnesses argued that despite these advances lithium-based

batteries would remain the dominant underlying chemistry in batteries well into

the future.[95]

Mr Asghar affirmed this view:

Absolutely, lithium-ion batteries have an incumbency

advantage. They have governments that are supporting the technology,

governments that are supporting the manufacturing—for the electric vehicle

industry and lithium-ion battery manufacturing. That gives me a little bit of

confidence that, at least in the next five to seven years, lithium-ion

batteries will likely be the major source for electric vehicles.[96]

4.69

Associate Professor Howlett added to this noting that 'there are a

number of fundamental barriers to making [lithium-ion batteries] work well,

particularly when we try to achieve long cycle lives or the high rates that we

need for acceleration'.[97]

4.70

Importantly, this dominance of lithium-ion is likely to underpin the

continued fall in battery pricing and, in turn, the improved affordability of

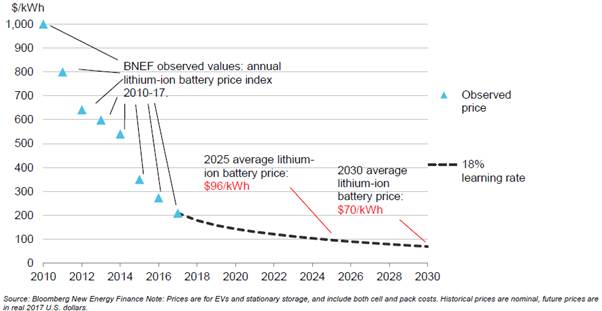

EVs. The Committee heard that the average pricing of lithium-ion battery pack

is expected to fall from its current pricing of $209/kilowatt (kW) to $70/kW by

2030.[98]

Mr Asghar explained the reasons for this projected trend:

It's a story of mass manufacturing—so economies of

scale—technology development and a major push towards electric vehicles.

Electric vehicles are currently the biggest consumer of lithium-ion batteries.

They've surpassed consumer electronics or stationary storage. Because of that

demand for lithium-ion batteries there's been a lot of R&D into the

technology and there's been a lot of investment into manufacturing capacity,

specifically in Asia—in China, South Korea and Japan. Economies of scale have a

big role in this. We've seen this in solar panels, where the Chinese started

entering the solar PV manufacturing sector and brought the cost down

considerably over the last decade. It's a similar trend that we see in

lithium-ion batteries. I would say: technology improvement and economies of

scale.[99]

Figure 4.1:

Lithium-ion battery prices, historical and forecast[100]

4.71

Mr Fairweather also noted:

With the technology developing and density increasing in

batteries at the scale and rate that they currently are, in the very short

term—maybe 12 months to two years—the battery sizes will start to be reduced

with range still being retained.[101]

4.72

The International Energy Agency's (IEA) Global EV Outlook 2017,

noted that '[r]esearch, development and deployment...and mass production

prospects are leading to rapid battery cost declines and increases in energy

density'.[102]

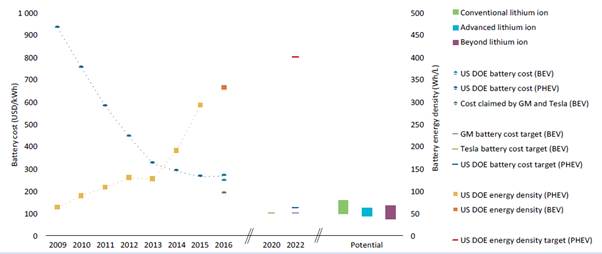

Figure 4.2 is taken from the IEA's report and shows the evolution of battery

energy density and cost.

Figure 4.2:

Evolution of battery energy density and cost[103]

Battery recycling and repurposing

4.73

As the number of EVs rises and the batteries reach end-of-life, a number

of witnesses have identified the recycling and repurposing of EV lithium-ion

batteries as both a significant challenge and opportunity. The Queensland

Department of Transport and Main Roads (DTMR) claimed that significant prospects

exist for Australian businesses in relation to battery recycling:

As a greater number of EVs are brought into the vehicle

fleet, there will be opportunities to create industries around recycling and

reusing EV batteries. EV batteries can be used for stationary storage, and

following this, the raw materials can be recycled to create new batteries.[104]

4.74

According to the CSIRO only about three per cent of lithium batteries

currently sold in Australia 'are being captured and sent for recycling

off-shore'.[105]

In its submission, MTAQ referred to a CSIRO report projecting between

100 000 and 188 000 tonnes of lithium battery waste by 2036, noting

that 95 per cent of this waste could be recycled into 'new batteries or used in

other industries' and yield an economic benefit of between $813 million and $3

billion by 2036.[106]

4.75

However, Dr David Harris, Research Director for Low Emissions

Technologies and Energy at the CSIRO acknowledged that there are serious

challenges in the recycling space, but that these are not insurmountable:

We have projects underway now looking at how we can help

companies who currently recycle some components of batteries adapt their

processes to accommodate the changing composition of batteries, the higher

metal contents, the different metals that are coming on—so, how we fit into

existing processes and add new capability as the batteries change. We're

helping to do that. In some cases the materials get recycled either back to the

manufacturer or for different purposes altogether in Australia. We're now working

with groups looking at different applications and separating those safely,

because just recycling them itself is not a trivial process; that's a process

that requires safety procedures. Batteries still have some charge and can still

catch fire in those processes. We are doing work with people to try to develop

efficient processes for battery recycling.[107]

4.76

Some manufacturers such as Tesla and Toyota are already taking

responsibility for 'whole of the battery life'.[108]

Toyota has established a hybrid EV Battery Recycling Program with cash rebates

and discounts for the return of EV batteries.[109]

Whilst a recent media article claimed that 60 per cent of Tesla batteries are

recycled with a further 10 per cent being reused in some form. Tesla is working

towards a closed manufacturing loop that 'reuses the same recycled materials'.[110]

4.77

Dr Dale of the MTAQtold the Committee that there were many businesses excited

by the commercial opportunities presented by battery recycling and ready to

take up the challenge. Notwithstanding this confidence, many of these

businesses need support to understand some of the technological issues

associated with this industry. Dr Dale stated:

If we can develop the technology to support businesses with

that interest then that's where Australia will win in the longer term.[111]

4.78

In this context, the Committee notes the recent grants from ARENA and

the CEFC to Melbourne-based company Reelectrify who are seeking to

commercialise battery recycling technology.[112]

4.79

Dr Matthew Stocks, Research Fellow at the College of Engineering and

Computer Science at the Australian National University provided a practical example

of how a used EV battery might be repurposed:

Electric vehicle range is important. Electric vehicles have a

more limited battery life than stationary energy. As battery capacity

decreases, you are likely to say: 'I don't want this battery anymore; I want a

new one.' That battery still has a significant life potentially for other

applications like replacing a Tesla Powerwall in stationary energy, where I

don't actually care if I put in another three batteries—instead of putting in

10, I put in 13—because there is no real space cost. So I suspect that a lot

will go into re-use rather than recycling, to begin with.[113]

4.80

Dr Howard Lovatt, Team Leader, Electrical Machines, CSIRO noted that

recycling car batteries may in fact be a more straightforward process than

recycling batteries associated with smaller, personal devices:

To make one observation on that, with a vehicle it is a lot

easier to capture the battery at the end of life because there is already

significant infrastructure for recycling the vehicle as a whole and the

batteries could be an add-on to that, whereas, like your phone or your laptop

batteries, it is much harder to actually capture the battery at the end of

life.[114]

Manufacturing and installation of charging infrastructure

4.81

The lack of charging infrastructure is a barrier to increased uptake of

EVs. The Royal Automobile Club of Victoria (RACV) cited a recent survey that

found 80 per cent of 'respondents consider the availability of public fast

charging (ie. 15 minutes to full charge) to be an important factor in

influencing their decision to buy/own an electric vehicle'.[115]

Furthermore, over half of respondents to the survey 'believe government should

implement subsidies to reduce the cost of installing home charging, and provide

public charging infrastructure'.[116]

4.82

Although Australia currently has a relatively high ratio of public

chargers to EVs—about one charger to every six EVs—the low number of EVs and

the large geographical area of Australia mean that this number will need to

continue to grow to maintain this ratio and public confidence in using EVs

across the country.

4.83

In its submission, the Australian Logistics Council (ALC) described the

three types of charging infrastructure—'home charging, public charging and

rapid/fast charging' and noted that :

Home charging and public charging can further be grouped as destination charging – a slow charge

designed to help motorists travel in metropolitan centres.

Rapid/fast charging is analogous to highway petrol stations

and is known as journey

charging. As its name implies, it is designed to rapidly charge an

electric vehicle for longer journeys.[117]

4.84

There are currently considerable opportunities for local companies to

take advantage of the forecast increased demand for manufacture and

installation of charging infrastructure for residential, commercial and

government applications.

Home charging

4.85

The vast majority of EV charging is expected to occur at home, with

about 70 per cent of EVs having a dedicated charging unit either at home

or work.[118]

Home charging at its simplest is connecting the EV to a regular household power

outlet which provides the equivalent of 100 kilometres of charge in 17 hours.

This can be upgraded to a basic AC charger known as a "slow" or

"trickle" charger which can fully charge a vehicle overnight.[119]

4.86

About 85 per cent of kilometres travelled in Australian passenger cars

are classified as short range driving, that is generally less than 100 kilometres

from home.[120]

Another survey showed that 'more than 99% of daily trips were under 50

kilometres, implying a round trip of 100 kilometres.[121]

Most of this driving is commuting to work, study and recreation; visiting

friends; and shopping. With newer EV models having a range of over 350 kilometres,[122]

a home charger will meet the average day-to-day needs of most Australians. The

Tesla Owners Club of Australia (TOC) confirmed this and made the point that

most owners will not require public charging the majority of the time.

The day to day requirement does not require high speed

charging, with vehicles typically sitting idle for ten or more hours overnight

or for a similar period during the day whilst the owner is at work.[123]

4.87

Even so, people for whom most charging is undertaken at home will still

have a public charging requirement for long-haul trips.[124]

4.88

TOC noted that the limitation to home charging, particularly those who

live in apartments is the availability of charging points:

The key is availability, particularly for those who live in

apartments. This can be addressed through building codes for new residential

and commercial properties. As long as the electricity supply to the premises is

appropriate the charging facilities do not need to be anything more complex

than a standard 15A or 3 phase outlet which can be used with a suitable lead or

adaptor.

This will not immediately address the demand in existing

buildings and it may be appropriate to make grants available to local councils

or other authorities to provide publicly accessible charging points on street,

in car parks and places of work.[125]

4.89

In its submission, the vehicle manufacturer Tesla confirmed the difficulties

for apartment owners and observed that another barrier to home charging is for

those who rent homes:

Customers who are keen to purchase electric vehicles in

Australia are often unable to do so if they live in apartments or are renting

their home. Some are able to install charging quickly. However, others can be

delayed because strata meetings for their building are very infrequent or have

no clear process to follow for charging installations. Customers can also be

faced with unreasonable demands or objections from landlords or strata Committees.[126]

4.90

An Energeia report also noted that EV 'drivers without access to home

charging must rely entirely on public charging'.[127]

The next section explores public charging stations.

Public charging stations

4.91

As noted earlier, 'two thirds of motorists indicate that a lack of

adequate charging infrastructure is the greatest barrier to purchasing an [EV]'.[128]

A small proportion of total Australian passenger vehicle kilometres are

classified as long-range driving—about 15 per cent. Public chargers are

primarily used for convenience but will also be used by drivers undertaking

long-range trips and for those who do not have access to a charger at home or

work. The Committee heard that public chargers form an 'important part of the

electric vehicle ecosystem'.[129]

4.92

During the inquiry, the Committee heard about some of the businesses

that are benefiting from the growing demand for public charging infrastructure.

Mr Nathan Dunlop, the New Markets and Sales Analyst at Tritium, a

Brisbane-based company, provided a background on his company:

we're almost 250 staff now at Tritium. Those staff are in

engineering, automotive and high-tech roles, working on exporting our product

overseas. I guess the thing to note here is that those jobs also create

downstream jobs throughout the supply chain. We create installation,

maintenance and field service opportunities for installers that are putting our

product in the ground. That's worldwide and in Australia. We also create jobs

in regard to the supply chain. As you saw, our product has very many components

in it, and 40 per cent of that procurement spending goes to Australian

businesses at the moment. So those jobs are coming to Tritium but are also

creating downstream job impacts.[130]

4.93

Chapter 2 of the report described the different types of public charging

infrastructure. Level 2 chargers (slow chargers) can charge an average car in

4–6 hours; whereas level 3 chargers (fast/ultra-fast chargers) can charge a car

in as little as 20 minutes (even less for ultra-fast chargers currently under

development).[131]

A recent Energeia report estimated that up to 30 per cent of EV drivers will

rely on public chargers for 100 per cent of their EV charging needs.[132]

Level 2 public chargers are primarily used 'for public destination-based

charging locations to attract drivers' such as supermarkets or shopping centres.[133]

Level 3 chargers are mainly used for long-distance charging where an EV needs

to quickly recharge in order to continue its journey.

Highway charging

4.94

In its submission, Fast Cities Australia estimated that the optimal

spacing for an ultra-fast charging network would be 150 kilometres, and that a

network of this type would cost a minimum of $100 million.[134]

Fast Cities Australia also stated that 'ultrafast highway charging networks are

capital-intensive but cannot attract conventional equity and debt in medium

term due to revenue uncertainty'.[135]

4.95

A number of state governments and other organisations are establishing,

or planning to establish, new public charging infrastructure. Mr Paul Fox,

Head, Corporate Development at Fast Cities Australia told the Committee of

their intention to complete a network of fast chargers along the major

federally funded highways:

My colleague tells me that he could knock out 42 sites very

quickly. It's really a matter of the timing of funding. But our intention is to

have the Melbourne to Brisbane completed by the end of next year, and then we

would roll out the remaining 42 sites in the following year and six months. So

it's about a two and a half year process in total. We could go faster; we have

to be careful about going faster, because we need to match it to the growth in

demand. We're already going ahead of ourselves; we don't want to go too far

ahead of ourselves.[136]

4.96

The DTMR described the Queensland Government's Electric Super Highway

(QESH), which stretches from Coolangatta to Cairns and Brisbane to Toowoomba.

DTMR explained:

Fast charging stations have been built in Cairns, Tully,

Townsville, Bowen, Mackay, Carmila, Marlborough, Rockhampton, Miriam Vale,

Childers, Maryborough, Cooroy, Brisbane, Coolangatta, Springfield, Gatton and

Toowoomba. An additional charging site will be built at the Helensvale

Queensland Rail carpark now that the Commonwealth Games have finished, once the

carpark upgrade is complete.

Each site is no more than 200km apart and was chosen

considering the driving range of EVs, local amenities, and the local energy

network capacity. Sites are located close to amenities, such as cafes, shopping

centres and restrooms, allowing drivers to take a break to stop, revive and

survive while they recharge their vehicle.[137]

4.97

DTMR stated that the large rollout of charging stations has resulted in

a reduction in the ratio of EVs to public chargers from 10.5 to 4.9. This is

despite a 70 per cent increase in the EV fleet over the last two years.[138]

Ms Sally Noonan, Chief Economist at DTMR stated that the Queensland

Government's reasons for building the QESH was not just about refuelling

vehicles but also encouraging people to spend time in various locations around

Queensland:

It's quite a different experience. The Queensland

government's Electric Super Highway is not about just filling up in 10 minutes

and then you're gone. It's actually trying to, in particular, look at that

range anxiety around tourists, for example. That is where we see there's a real

opportunity, where people are going to spend some time in the location where

their vehicle is charging. It's quite a different proposition to the petrol

station kind of scenario that I understand.[139]

4.98

The Royal Automobile Club of Western Australia (RACWA) also described

the RAC Super Highway, 'a network of 11 publicly accessible EV fast charging DC

stations located between Perth and Augusta' (520 kilometres) in south-west

Western Australia.[140]

The NRMA stated that it intends to build 'Australia's largest charging [EV]

fast charging network' in NSW at a cost of $10 million.[141]

4.99

Mr Tim Washington, Chief Executive Officer at Jetcharge, a

Melbourne-based business explained how his business is benefitting:

JET Charge is what I would call a small business, one of the

beneficiaries of the downstream jobs that Tritium are talking about. We started

about five years ago, and we're now the leading installer of electric vehicle

charging stations in Australia, being the recommended installer for nine

vehicle brands nationwide. If you think of us as, basically, the people on the

ground actually making sure the infrastructure gets installed, we're those

people. We're the largest hardware distributor of charging stations in the

Australian market. We've seen a large growth period over the last two years in

the market. We currently employ 14 people in the head office and have a large

contractor network of electricians who perform installations for us. That comes

from a base of only two to three people, two years ago, and so we've seen some

good growth in the market. From my perspective, it's really important that

small businesses like ours have the room to grow into this new industry.[142]

4.100

Mr Washington also described an associated business called Chargefox:

Chargefox is basically a software business that controls the

charging stations. You need software to control the charging stations, and

Chargefox was born out of a joint venture between us and a software business.

It is another example of the new age of automotive, in terms of the

technologies that are required, and is another Australian-born business, which

currently employs four people.[143]

Metropolitan charging

4.101

A number of local governments have also declared their interest in

establishing public charging infrastructure within their local areas.[144]

4.102

The Committee heard that the ACT Government is funding '50 new EV public

charging stations in Canberra' at a cost of about $450 000.[145]

That works out to be $9 500 per charger.

4.103

Ms Michelle English, Associate Director at the City of Adelaide spoke

about the how the City of Adelaide was seeking to leverage private sector

capital to build charging infrastructure:

At a local level, we have several initiatives that

demonstrate our commitment and our leadership. In the last 12 months we have

co-funded with the state government, Esso power networks and Mitsubishi Motors

the installation of 30 off-street electric vehicle charging stations in our

council owned UPark stations and an additional 10 on-street electric vehicle

charging stations. We've also partnered with Tesla and our eight-bay electric

vehicle charging hub in Franklin Street to enable them to install four

120-kilowatt superchargers. We offer two hours free parking in selected high-profile

locations, such as the Franklin Street EV charging hub.[146]

4.104

Ms English continued describing incentives for local businesses and

community members:

In addition to infrastructure, our Sustainability Incentives

Scheme provides financial rebates to our businesses, property owners and

community for rebates of up to $1,000 for each fast charger less than 20

kilowatts, $5,000 for each superfast charger over 20 kilowatts, and $250 for

each electric bike charging station installed in the city.[147]

4.105

In its submission to the Committee, Jolt explained that it is building a

network of public chargers, 'providing free charging for users and free

installation for cities, funded by the billion dollar digital out-of-home

advertising market'.[148]

4.106

The UK Government, in its Road to Zero Strategy, noted that in addition

to charging at home overnight, charging at workplaces during the day will be

one of the 'most attractive options' as 'EVs go mainstream'.[149]

The UK Government has made funding available to private businesses and public

bodies through a Workplace Charging Scheme and recently announced an increase

in the levels of the scheme to provide up to £500

off installation costs of charging sockets deployed at workplaces.[150]

Rural charging

4.107

The Victorian Government Department of Environment, Land, Water and

Planning identified that some gaps may emerge in the deployment of public

charging infrastructure particularly in rural and regional parts of the country:

Research has found that the private sector will develop

charging infrastructure at destinations such as shopping centres as there is an

economic benefit. However, the areas less enticing for private investment are

regional areas. A charging network along key regional routes could unlock

tourism and economic development opportunities.

Tourists and residents are more likely to rely on public

charging stations in regional and rural areas. Those living in rural areas

travel further to access services than metropolitan residents, including

education and employment precincts, and do not have as many public transport

options. Vehicle ownership is perceived as more of a necessity for those living

in regional Victoria. Similarly, tourists driving through regional Victoria

need easy access to public charging infrastructure along popular tourist

routes. Fast charging is particularly beneficial for long trips.[151]

Concluding comments

4.108

With increasing global demand for EVs, the Committee has heard that

there are tremendous opportunities for Australian manufacturers. The Committee

notes evidence suggesting that increasing automation will lead to fundamental

changes to the processes and costs of manufacturing opening niches for

Australian industry. The Committee has also heard that the Australian

automotive sector might look differently to the mass manufacturing model of the

past. The sector may choose to identify and play to its strengths, building

specialist componentry, or assembling imported and locally made parts.

4.109

The Committee is encouraged by the companies that it has had heard from

and visited who are at the forefront of the transition to EVs. For example,

Nissan Casting Australia is already making components for EVs that are then

assembled overseas; SEA Electric is fitting EV technology to truck gliders and

has recently announced an expansion into EV bus manufacturing. In addition to

these companies, there is a significant skilled workforce available to migrate

from conventional automotive manufacturing to EVs; and a substantial and

growing automotive research and development capacity.

4.110

Australia has significant reserves of a range of minerals essential to the

production of lithium-ion batteries, the preferred battery type for EVs

currently and into the foreseeable future. A number of large lithium deposits

have been developed with more on the way. The Committee is concerned that

Australia is primarily engaged in the raw material extraction and export which

only captures 0.5 per cent of the lithium value chain. Clearly more of this

value chain can and should be captured by Australian companies.

4.111

Some mining and exploration companies are partnering with international

companies with processing experience as a means to build processing capability.

The Committee has heard that there are currently four lithium battery factories

under development in Darwin, Townsville and Adelaide. These and other similar

developments may provide the catalyst for an increased refining and processing

presence for lithium and other minerals used in battery manufacture. The Committee

is concerned about the likelihood of a surge in end-of-life EV batteries

requiring recycling or repurposing. There is a need to ensure that companies

interested in battery recycling are guided by comprehensive regulatory

frameworks and the latest R&D to minimise any environmental and safety

risks.

4.112

It is clear that the demand for charging infrastructure will continue to

grow in line with EV numbers. Production of charging units and componentry for

both home and public use, and the installation of such equipment is already

providing economic benefits in states such as Queensland and Western Australia.

This is being led by both the private sector and government. Although it is

likely that the private sector will primarily fund public charging

infrastructure in cities, public funding and planning will be required for

highways and regional areas. Government has a role to play in enabling the

private sector to rollout public charging infrastructure to all parts of the

country.

4.113

A targeted approach will ensure that Australian industry optimises its

economic participation in the transition to EVs. The next chapter will examine

a range of possible federal and state government policies that could support

the Australian industry to seize the opportunities associated with

manufacturing EVs.

Navigation: Previous Page | Contents | Next Page