APPROPRIATION (NATION BUILDING AND JOBS) BILL (No.2) 2008-2009

THE INQUIRY

1.1

The Appropriation (Nation Building and Jobs) Bill (No.2) 2008-2009 (the Bill)

was introduced on 4 February 2009 as part of a package of six bills

to give effect to the Government’s Nation Building and Jobs Plan.

1.2

On 5 February 2009, the Senate referred the provisions of the Bill

relating to the social housing program to the Community Affairs Committee (the

Committee) and the package of bills to the Finance and Public Administration Committee

(F&PA). The presentation of the Committee's report was made an order of the

day for 12.31pm on Tuesday 10 February 2009. In taking evidence in

relation to the Bill the Committee could not meet to consider the Bill at the

same time as the F&PA Committee was meeting to consider the Bill and

related bills. On 9 February the presentation time for the report was

moved to 7.31pm on 10 February.

1.3

The Committee's inquiry concerned only the social housing program. The

broader economic and fiscal issues underpinning the Nation Building and Jobs

Plan were considered during the Finance and Public Administration Committee's inquiry

1.4

The Committee received 2 submissions relating to the Bill and these are

listed at Appendix 1. The Committee considered the Bill at a public hearing in Canberra

on 10 February 2009. Details of the public hearing are referred to in

Appendix 2. The submissions and Hansard transcript of evidence may be

accessed through the Committee’s website at https://www.aph.gov.au/senate_ca .

THE BILL

1.5

The main purpose of the Bill is to propose appropriations from the

Consolidated Revenue Fund for services that are not the ordinary annual

services of the Government in relation to the Nation Building and Job Plan.[1]

During the Second Reading speech of the Bill in the House of Representatives,

the Treasurer, the Hon Wayne Swan MP, noted that the Commonwealth Social

Housing Initiative will provide up to $6 billion to the states and territories

to fund the construction of approximately 20,000 new dwellings. The

Commonwealth will also provide $400 million for repairs and maintenance of

existing public housing stock over two years.[2]

1.6

The initiative is intended to boost the supply of public and community

housing for people who are homeless, at risk of homelessness, or who are paying

very high rental costs. Details released as part of the Updated Economic and

Fiscal Outlook (UEFO) indicated the funding will be provided over three and

a half years from 2008-2009 to 2011-2012. The UEFO stated:

The first stage of this program is to fund some 2,300 new

dwellings by bringing forward construction already approved. The remainder of

the funding will be allocated to address areas of most urgent need. State

governments will be responsible for conducting Commonwealth approved tender

processes for the construction of the additional dwellings. Tenders will be

structured to include spot purchases of new house and land packages to ensure

both large and small builders benefit from increased construction activity.[3]

1.7

The funding for social housing will begin immediately and new houses

should be largely completed by 2010. $200 million will be provided this

financial year for repairs and maintenance and $60 million for new

construction. The funding will be allocated to state and territory governments

on a per capita basis through a new Economic Stimulus National Partnership

Agreement signed on 5 February 2009 at a special COAG meeting held to

ensure rapid delivery of economic stimulus measures to support employment and

growth and to foster a more resilient Australia. See Table 1 for funding

by jurisdiction. The actual number of new dwellings will depend on a range of

factors, such as their size, type and location and the capacity of States and

Territories and the not-for-profit sector to leverage additional funds from

other sources.[4]

1.8

The allocation of funding will be over two stages:

- Stage One - States will initially be allocated funding (up to

$692 million) for suitable projects already in their development pipelines that

can be brought forward and built in the time frame (2008-09 and 2009-10).

States have agreed to submit proposals by 15 March 2009 and the Commonwealth will make allocations for stage one construction projects by 1 April 2009; and

- Stage Two - Funds from 2009-10 to 2011-12 (around $5,296 million)

will be allocated to States on the basis of an assessment of suitable

proposals. States have agreed to submit proposals by 30 June 2009 and the Commonwealth will make allocations for stage two construction projects by 30 August 2009.[5]

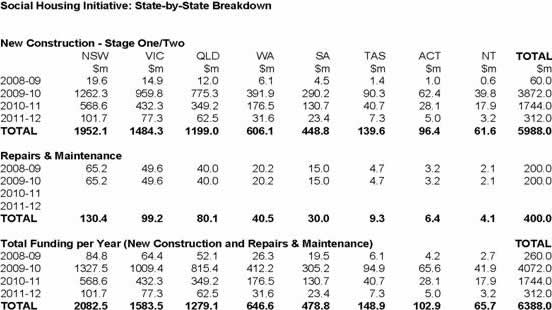

Table 1:

Funding by jurisdiction

Source: Additional

information tabled at hearing 10 February

2009 (Department of Families, Housing,

Community Services and Indigenous Affairs).

1.9

In addition to the funding commitments by the Commonwealth, it was

agreed at the COAG meeting on 5 February that the states would:

- identify, manage and report on Commonwealth approved construction

projects and repair/maintenance programs in their jurisdiction;

- manage funding for successful proposals, with project payments

made on achievement of project milestones with 75 per cent of these new homes

to be completed by December 2010;

- ensure recurrent costs of new housing are met, with completed

dwellings to be owned by State governments or community housing providers; and

- progress reforms in the sector and report to COAG by December

2009 on these. Further details were outlined in Schedule C to the National

Partnership Agreement (see Appendix 3).

1.10

The initiative is also intended to stimulate the building and

construction industry, through funding the building of additional dwellings and

increased expenditure on repairs and maintenance. This stimulus to the housing

construction sector 'will translate into about 15,000 jobs over the next two years'.[6]

BACKGROUND

1.11

Housing assistance is an important part of the social and welfare

policies of the Australian and state and territory governments. In the past,

the Commonwealth, state and territory governments provided funding for public

housing and other housing measures through the Commonwealth-State Housing

Agreement (CSHA). The Commonwealth Rent Assistance program (CRA) also provides

an income supplement paid to eligible individuals who rent accommodation in the

private rental market.

1.12

On 29 November 2008 the Council of Australian Governments

announced a National Affordable Housing Agreement (NAHA) which brought together

existing Commonwealth housing and homelessness assistance programs. The NAHA

will provide $6.2 billion over five years from 2008-09. Under the Social

Housing National Partnership of the NAHA, the Commonwealth will provide $400

million over 2008-09 and 2009-10 for capital investment in social housing and

homelessness. This will increase the supply of social housing through new

construction, providing approximately 1600 to 2100 additional dwellings by

2009-10.[7]

1.13

Also recently established was the National Rental Affordability Scheme

(NRAS). NRAS is a Commonwealth Government initiative to stimulate the supply of

up to 50,000 new affordable rental dwellings by 2012. Under NRAS successful

applicants will be eligible to receive a National Rental Incentive for each

approved dwelling, on the condition that they are rented to eligible low and

moderate income households at 20 per cent below market rates.

ISSUES

Public and community housing

demand

1.14

Witnesses generally agreed on the need for additional public and

community housing units. Mr Frank Quinlan of Catholic Social Services noted

that there was 'enormous pent-up demand in the community and social housing

area' and noted that the '20,000 stock that is anticipated by this project only

goes some way to meeting the anticipated demand and the anticipated need'.[8]

1.15

Mr Simon Smith Executive Officer of Homelessness Australia emphasised

that timely access to housing is critical in responding to homelessness and

noted that currently half of all people with an urgent need for housing

assistance, including people experiencing domestic violence, must wait three

months before they are allocated housing. He also noted that the measures in

the Bill would support the Government's objectives, outlined in the White Paper

on Homelessness, to halve homelessness by 2020.[9]

1.16

The joint submission from the major church providers noted that an

estimated 100,000 Australians are homeless, including 14,000 who rely on

emergency accommodation. They suggested that while the cost of housing may be

easing for some, such as mortgage holders, others would suffer if economic

conditions worsened. They stated:

With physical constraints in rental markets expected to persist

over the next two to three years (that is, vacancy rates will remain at record

lows), there is likely to be little easing of rent prices in the short-term.

The greatest source of increased demand for housing services, however, is

likely to be increased risk of unemployment, which will leave some individuals and

families unable to meet their housing costs.[10]

1.17

Estimates in the UEFO project that the unemployment rate in Australia will

rise to seven per cent by June 2010. Mr Simon Smith of Homelessness Australia

noted that while the relationship between homelessness and unemployment was

complex it was important that a robust social safety net existed in a 'deteriorating

economic environment'. He stated:

It is always important, but with unemployment increasing and

with homelessness invariably increasing at the same time, an increase in public

and community housing will be very important to help us to address the fallout

that comes from that.[11]

1.18

The Australian Institute of Health and Welfare (AIHW) has indicated that

there has been a drop in the level of public housing stock, 'decreasing

nationally from around 372,000 dwellings in 1996 to 340,000 dwellings in 2007'.

The availability of low-rent housing in the private rental market has also not

kept pace with the increased demand by low-income households.[12]

1.19

The AIHW has highlighted a trend in government expenditure over the

period from 1994-1995 to 2003-2004. While CRA expenditure increased 9 per cent

over this period CSHA expenditure decreased 31 per cent. However the AIHW also

noted that these trends should be viewed with caution as the CRA is a recurrent

expenditure program driven by demand whereas the CSHA includes a capital

component that has resulted in public housing assets that are continually used

for housing assistance.[13]

Implementation

1.20

Implementation issues were highlighted by a number of witnesses and in

particular the role and capacity of state and territory housing authorities. Ms

Carol Croce of the Community Housing Federation of Australia noted the need

for clear public criteria so that the use of funds in the initiative could be

assessed. She also highlighted the need for strong accountability and

enforcement measures, 'something with teeth', to ensure that funds were used appropriately.

She stated:

The Prime Minister said that the government would be watching to

ensure that the stimulus funds do not replace existing state money and

programs. I think the states and territories must be accountable for how the

funds are spent in line with the Commonwealth targets and there must be a

strong enforcement component in any agreement that is signed. [14]

1.21

Similarly Ms Susan Helyar of UnitingCare noted that:

The other issue, I think, is to make sure that the systems in

place for rolling out the money are accountable and transparent, but also

simple. There are a range of legislative changes underway in states and

territories. I think making sure that the reform process going through the COAG

agenda continues to operate to reduce the red tape, administrative compliance

and burden on providers is important because that is one of the things that

slows down projects and diverts resources from delivering projects to reporting

on administering funding sources.[15]

1.22

FaHCSIA officers advised that scrutiny around the whole of the economic

stimulus package 'will be fairly vigorous'. Ms Peta Winzar stated:

We have provision in our agreement with the states to withdraw,

withhold or reallocate funding if they fall behind on their delivery

milestones. We will be monitoring their progress in terms of development

applications, development approvals, commencements, completions and tenanting

quite diligently, and we will be providing reports to our ministers on a very

regular basis. I think that at this stage it is proposed to have monthly

reports at headline level and then much more detailed reports at quarterly

intervals.[16]

1.23

The ACOSS submission also highlighted a number of areas which they

considered required clarification, including the definition of 'social housing'

and how social mix targets will be achieved.[17]

In relation to the social inclusion objectives of the initiative Mr Geoff Leeper

of FaHCSIA stated:

The guidance we have given in the national partnership agreement

certainly leads to a view that, if I can use the term salt and pepper

arrangements will be preferred rather than broadacre. We are not interested in

this package resulting in 200 social housing dwellings being put in a single

location. We are much more interested in buying 10, 15 or 20 per cent of a

larger development, be that multiunit or detached housing, which are for social

housing purposes, to sprinkle, so to speak, the social housing more

appropriately and equally.[18]

1.24

Professor Julian Disney stressed the importance of 'this additional

support for growth interacts effectively with other parts of the package that

the government has developed, especially the National Rental Affordability

Scheme' and the other housing initiatives and suggested an advisory panel on

the program as a whole be established.[19]

1.25

Mr Adrian Pisarski of National Shelter highlighted that when 'much of Australia’s

public housing stock was built, it was built for a different kind of family

structure than the ones we have now'. He stated:

Traditionally there are a lot of three-bedroom houses in that

stock. The demand these days is much more for four-bedroom-plus properties for

large families and for two-bedroom units, by and large. The stock has not

really been matching the demand.[20]

1.26

FaHCSIA noted that the Commonwealth did not intend to be prescriptive

with the states about types of dwellings and that the mix will depend very much

on the profile of clients on the waiting lists in each jurisdiction.[21]

1.27

Ms Croce also noted that the opportunities which existed in the

not-for-profit and community housing sector 'to leverage additional dollars

from the private sector maximising the stimulus funds and increasing the amount

of new, affordable housing stock for low and moderate incomes'.[22]

FaHCSIA officers stated that while there was not a specific target their hope

was that 'perhaps 75 per cent of the stock will eventually transfer to

community housing ownership'. Mr Leeper commented on the rationale for the

shift to community housing:

Initially we would like to diversify the provider base... A number

of the community housing organisations and not-for-profit housing organisations

of which we are aware are prepared to use the value of their balance sheets as

debt equity, subject to financial approvals, to further boost the supply of

social housing. So it is a way of leveraging the Commonwealth’s investment.[23]

1.28

A number of concerns were raised regarding the possibilities for state

housing agencies to sell down housing stock in response to additional

Commonwealth funding. For example Dr Silberberg of the Housing Industry

Association stated that there was an incentive for state housing authorities to

transfer public housing stock to the not-for-profit sector. He continued:

That relates to the eligibility for Commonwealth Rent

Assistance. Public housing tenants are not eligible for CRA, but those tenants

under the management of a community housing entity would be eligible. In

addition, public housing authorities are not GST free. Charitable organisations

can get approval for GST-free status, which means that those GST-free entities

can acquire social housing at a lower cost.[24]

1.29

However FaHCSIA officers noted that under the National Affordable

Housing Agreement the Commonwealth purchases housing outcomes and seeks to

measure 'access by Australians, particularly those in the lower two income

quintiles, to affordable, safe and sustainable housing'. Thus the Commonwealth

would not wish to prevent state and territory housing agencies from selling

some of their legacy stock which costs more to maintain and no longer meets the

needs of people who are seeking accommodation with the intent of using revenue

to increase appropriate housing stock.[25]

House construction sector stimulus

and job creation

1.30

Both the Housing Industry Association (HIA) and the Master Builders

Association (MBA) noted that the housing construction sector was slowing. Dr Silberberg

outlined that:

There are 25,000 private sector dwellings that have been

approved but not yet commenced. Most of those dwellings are multi-unit and

medium-density housing projects that have stalled, due in part to a lack of

investor confidence and interest but also due in part to a lack of working

capital. The stalling of those projects is placing jobs at risk in the

industry.[26]

1.31

Dr Silberberg highlighted that spot purchasing by state housing agencies

in some of the 'stalled' private sector housing developments could reduce risk

for providers of finance and allow projects to be implemented quickly. These

developments could generate an additional 85,000 jobs. The multiplier effect of

the funding for social housing was highlighted by Mr Wilhelm Harnisch of Master

Builders Australia noting that:

...as part of the economic stimulus package, this will very much

generate economic activity, particularly through the multiplier effects, through

manufacturing, obviously through the construction phase and then through the

retail phase. All this will provide much-needed jobs in this industry. We agree

with the HIA that the housing sector is very sluggish at the moment, so this

stimulus package will certainly be a welcome boost—not only, obviously, to the

social housing sector but, more importantly, to the economy and therefore to

jobs, which is very important in the current economic climate.[27]

1.32

Mr Frank Quinlan of Catholic Social Services stated that the downturn in

the construction sector meant there was likely to be available resources and

capacity to implement projects despite the 'ambitious target'.[28]

1.33

ACOSS reinforced the point that social housing investment makes economic

and social sense:

Investment in public and community housing will provide a direct

stimulus to the housing and construction industry while also responding to the

acute need for more affordable housing.

Investment in construction has clear flow on effects to other

parts of the economy, as the construction industry uses mostly local materials

and has a very large labour component.[29]

Environmental building standards

1.34

Concerns were raised regarding the energy efficiency standards of any

new social housing constructed. For example ACOSS noted that new housing should

be energy efficient 'to reduce the costs to tenants and minimise the

environmental impact'. [30]

However the HIA defended the current energy efficiency targets of new houses

being constructed and noted that most public housing stock was below the 5 star

rating for energy efficiency and that new buildings would meet these

requirements. Mr Chris Lamont argued that there is a bigger efficiency dividend

with respect to energy use to build five star rated houses and that

'[d]iminishing marginal returns set in with respect to going from five to six'.[31]

1.35

The HIA also noted that there was a lack of uniformity between states

and territories in relation to environmental building standards and this

complexity was a disincentive to development. Dr Ron Silberberg stated:

We have a plethora of regulation relating to the way in which

dwellings are to be prepared for the market. In some cases we have

manufacturers that have been so confounded by the differences in regulatory

requirements they have given up manufacturing and supplying in some states....Each

state and territory is operating on five-star energy efficiency, except in the

case of Queensland and Tasmania, which have agreed to move to five star—in the

case of Queensland, by next month.[32]

Ongoing obstacles to development

1.36

The MBA and the HIA both noted a number of ongoing obstacles to the

construction of residential developments which largely originated from state,

territory and local government. These included stamp duty charges, development

fees, planning approvals and consultation processes.[33]

The issue of waiving such fees and charges was raised with the Department:

Senator HUMPHRIES—Will any of the planning and

development processes be waived, fast-tracked or otherwise altered to make

these projects happen?

Mr Leeper—That would be a matter for the

states to decide. We certainly would be interested in raising with the states

whatever possibilities they could pursue to make sure that potential

construction that does not yet have development approval gets that as fast as

possible, but that is a matter for the states to determine.

Senator HUMPHRIES—So you are interested in asking

them but have not actually done that as yet.

Mr Leeper—Having executed the national

partnership agreement at COAG last week, we now need to do bilateral

implementation plans. We could potentially raise with the states in those plans

what they would be able to do or be prepared to do to get their governments’

support for fast-tracking development approvals, noting that that actually

involves the local government level, not the state government level.[34]

1.37

Departmental officers confirmed that the projects to be funded in the

first round of this scheme are ready for development.[35]

The term 'shovel ready' was used in evidence to describe this level of

readiness.

Charitable tax status

1.38

The Community Housing Federation of Australia (CHF) emphasised the

importance of understanding that the funding that goes into public and

community housing is spent entirely on housing. Due to the charitable status

that the community housing sector enjoys, and government status, funding is not

diverted towards stamp duty or transaction fees; it goes strictly into housing.

However, concern was expressed that uncertainty still exists about their

charitable tax status which needs to be addressed urgently. Ms Croce from the

Community Housing Federation of Australia commented that:

We took care of it for NRAS, at least in a stopgap manner, so

that the people participating will not have their charitable status challenged,

but I think, even though it is being examined as part of the Henry review, it

needs to be moved forward and dealt with more urgently so that the people who

are providing housing at a non-commercial rate do not feel that their

charitable status is in jeopardy if they are trying to provide housing through

this stimulus package.[36]

1.39

The Department reassured the Committee in respect of those who

participate in some of the housing measures from the stimulus package:

Our expectation is that most, if not all, of these 20,000 extra

dwellings funded under this package would go to people who are currently on the

public housing waiting list. We would therefore expect that they would be at

the very lower end of the income spectrum. I think, therefore, that that poses

much less of a problem for community housing organisations in terms of their

charitable status—because there is no question of them drawing a large

proportion of their income from people who the tax office might regard as not

being a charitable objective.[37]

1.40

The Department also noted that 'the broader issue of the existence of

charitable status organisations and their ability to play in a space, as it

were, where they might be seen to be delivering quasi-commercial services—for

example, housing—is a matter, I understand, which is likely to be considered by

the Henry tax review that is running through the course of this year'.[38]

CONCLUSION

1.41

While the Committee was asked to examine only the social housing aspects

of the Bill it is clearly a significant component of the Nation Building and

Jobs Plan – both in terms of the sizeable funding being allocated and the

significant housing needs being addressed. The social housing provisions in the

Bill received strong support from all witnesses to the inquiry. The evidence

which the Committee received highlighted that the stock of available public and

community housing has declined while the demand for these services has

increased, and is expected to increase further if economic conditions

deteriorate.

1.42

The provisions in the Bill will clearly benefit the housing construction

industry and will have a multiplier effect from additional purchases,

employment and other business activity.

1.43

While concerns were raised regarding the implementation of housing

projects and the efficiency of state and territory housing authorities, the

Committee notes that the Plan does contain significant monitoring and

compliance mechanisms.

Acknowledgements

1.44

The Committee would like to thank the witnesses for their cooperation

and willingness to speak at the hearing despite the tight timeframe of the

inquiry and a late scheduling change.

1.45

The Committee also records its thanks to the Parliamentary Reporting Staff

for their efforts in having a Hansard transcript of the hearing available

within a few hours of the hearing.

Recommendation

The Committee recommends that the provisions of the Appropriation

(Nation Building and Jobs) Bill (No.2) 2008-2009 relating to the social housing

program be passed.

Senator Claire

Moore

Chair

February 2009

Navigation: Previous Page | Contents | Next Page