Family and

Community Services and

Veterans' Affairs Legislation Amendment (Income Streams) Bill 2004

June

2004

Parliament of the

Commonwealth of Australia 2004

ISBN 0 642 71417 7

Table of Contents

Membership of the Committee

Report

- The Inquiry

- The Bill

- Issues

- Recommendation

Additional Comments from Labour Senators

Appendix 1 Submissions received by the Committee

Appendix 2 Public Hearing

Senate Community Affairs Legislation Committee Secretariat

Mr Elton

Humphery Secretary

Ms Christine

McDonald Principal Research Officer

Ms Leonie

Peake Research Officer

Ms Ingrid

Zappe Executive Assistant

The Senate

Parliament House

Canberra ACT

2600

Phone: 02 6277 3515

Fax: 02 6277 5829

E-mail: community.affairs.sen@aph.gov.au

Internet: https://www.aph.gov.au/senate_ca

Membership of the Committee

Members

|

Senator Sue

Knowles, Chairman

|

LP, Western Australia

|

|

Senator Brian

Greig, Deputy Chairman

|

AD, Western Australia

|

|

Senator Guy

Barnett

|

LP, Tasmania

|

|

Senator Kay

Denman

|

ALP, Tasmania

|

|

Senator Gary

Humphries

|

LP, Australian Capital Territory

|

|

Senator Jan

McLucas

|

ALP, Queensland

|

Substitute member

|

Senator Nick

Sherry to replace Senator Denman

for the committee's inquiry into the Family and Community Services and

Veterans' Affairs Legislation Amendment (Income Streams) Bill 2004

|

ALP, Tasmania

|

Family and communtiy services and veterans' affairs legislation amendment (Income Strams) Bill 2004

The Inquiry

99.1

The Family

and Community Services and Veterans' Affairs Legislation Amendment (Income

Streams) Bill 2004 (the Bill) was introduced into the House of

Representatives on 26 May 2004 and in the Senate on 15 June 2004. On 16 June 2004, the Senate, on the

recommendation of the Selection of Bills Committee (Report No. 8 of 2004),

referred the Bill to the Committee for report.

99.2

The Committee considered the Bill

at a public hearing on 18 June 2004.

Details of the public hearing are referred to in Appendix 2. The Committee

received six submissions relating to the Bill and these are listed at Appendix

1. The submissions and Hansard transcript of evidence may be accessed through

the Committees website at https://www.aph.gov.au/senate_ca

The Bill

99.3

The purpose of the Bill is to change the social security and

veterans' affairs means test assessment for certain income streams.

99.4

Currently, income streams that meet certain criteria

are 'asset-test exempt' for the purposes of the means test for social security

and veterans' affairs payments. This means that the asset value of the income

stream is not taken into account when determining a person's eligibility for a

social security payment. The proposed legislation seeks to change entitlements

means test assessments of income streams to:

-

extend asset-test exempt status for a new

product, 'market-linked income streams' from 20 September 2004. This product

will offer market returns but the purchaser will not be able to withdraw his or

her capital before the term of the product has been ended (ie it is

non-commutable); and

-

change the social security assets test exemption

from 100 per cent to 50 per cent for non-commutable income streams that are

purchased from 20 September 2004 and meet the requirements for exemption

from the assets test.[1]

99.5

The Bill also contains provisions to align the

characteristics of life expectancy income stream products with those of the new

market-linked income stream products. This will ensure that the products are

treated in a consistent manner under the means test.

99.6

Under present arrangements, life expectancy income

streams only retain assets test exempt status on reversion to a reversionary

beneficiary where the remaining term of the income stream matches the

beneficiary's life expectancy at the time of death. As a consequence, for most

life expectancy income streams, assets test exempt status is lost when the

income stream reverts. Under the proposed legislation individuals, who purchase

life expectancy and market-linked income streams on or after 20

September 2004, will have 'greater confidence that the

income stream will retain its asset test exempt status on reversion to a

partner'.[2]

99.7

The Bill also proposes to extend the guarantee period

for asset-test exempt lifetime income streams. The current means test rules

stipulate that an asset test exempt lifetime income stream may only be commuted

if the primary beneficiary dies within a 10-year period of purchasing the

income stream. The Bill will extend this period to allow a lifetime

income stream to be commuted provided that the primary beneficiary dies within

a period equal to his or her expectancy or within 20 years of purchasing the

income stream, whichever is the lesser.

99.8

Table 1.1 provided by the Department of Family and

Community Services gives a pictorial representation of the different categories

of income streams products.

Issues

Market-linked income streams

99.9

Market-linked income streams will offer market returns

but the purchaser will not be able to withdraw his or her capital before the

term of the product has ended (that is, it is non-commutable). Presently,

consumers can only select insurance-based income streams which offer a

guaranteed income but at generally low return.[3] According to evidence provided, the

availability of many other products will be a consequence of this legislation.

99.10

The Investment and Financial Services Association

(IFSA) stated that the new product would enable retirees to 'invest in a

balanced portfolio of investments and that will improve both the amount and the

quality of their returns over their retirement'. In addition, because market-linked

income streams do not involve any income guarantees, a broader range of funds,

both in the for-profit sector and elsewhere, will be able to offer products.[4]

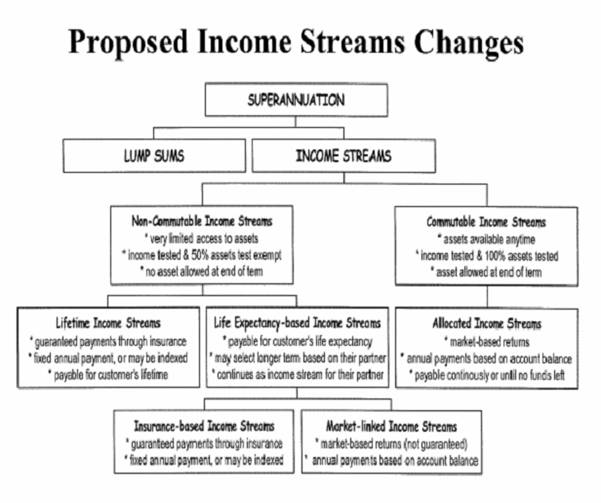

Table 1.1

Source: Submission No.1 (Department of

Family and Community Services).

99.11

IFSA also noted that the changes to life expectancy provisions

will result in 'a significant lengthening, we believe, in the terms that people

can choose and, importantly, a choice in the length of term between life

expectancy and the life expectancy of somebody five years younger than you'.

There are also changes to the provisions concerning who can purchase a market-linked

income stream with either a couple or an individual now being able to purchase

the product.[5]

99.12

IFSA concluded that the changes will result in 'quite

significant competition amongst product providers'. In addition a strong demand

from consumers was expected as there is a need for retirees to invest in growth

assets to fund their retirement.[6] The market-linked

income streams 'will be a better product by the measures that consumers bring

to the marketplace than the preceding offers'.[7]

99.13

The Securities Institute also noted that market-linked

income streams provide better returns, higher levels of income over time for

retirees and allow retirees to control their capital.[8]

99.14

The Department of Family and Community Services (FaCS)

noted that the proposed changes to extend assets test exempt status to the new

'market-linked income streams' will increase competition in the income streams

market and provide retirees with more choice and flexibility by making

available a wider range of products that best meets their retirement needs.[9]

99.15

The Department stated that features which will allow more

flexibility include:

-

life expectancy provisions which allow for a

choice of the individual's life expectancy or life expectancy at an age five

years younger than that persons current age. Individuals who are members of a

couple will also have the choice of selecting the term based on their spouses

life expectancy and life expectancy of that partner at an age five years

younger;

-

allowing retention of the assets test exemption

on reversion to a spouse, if the primary beneficiary dies, provides couples with

greater choice in purchasing income streams that provide income for the greater

part of both partners' lives.

-

payments being made to the recipient annually

and are based on payment factors contained in the Superannuation Industry

(Supervision) Regulations;

-

the product will be non-commutable except in

limited circumstances, such as hardship or divorce; and

-

purchase of market-linked income stream products

by an individual from any age and obtain the 50 per cent asset test concession

from purchase.[10]

Changing the asset test exemption to 50 per cent

99.16

The Association of Superannuation Funds of Australia (ASFA)

stated that it supported the measures 'particularly the reduction from 100 per

cent to 50 per cent, if they better target the public pension'.[11]

99.17

FaCS also stated that the change in the assets test

exemption from 100 per cent to 50 per cent for asset test exempt income streams

purchases after 20 September 2004

is aimed at ensuring that social security payments are paid to those who need

it most. FaCS noted that even after the change, it will be possible for home

owner couples to invest $900,000 in a complying income stream and still receive

some age pension if they have no other assessable assets. FaCS concluded that,

while providing some concessions:

These changes will make the retirement income system fairer by

better targeting the age pension to those in need.[12]

Recommendation

99.18

The Committee reports to the Senate that it has

considered the Family and Community Services and Veterans' Affairs Legislation

Amendment (Income Streams) Bill 2004 and recommends

that the Bill proceed.

Senator Sue Knowles

Chairman

June 2004

Family and

Community Services and Veterans' Affairs Legislation Amendment (Income Streams)

Bill 2004

Additional

Comments from Labor Senators

The tightening of the assets test, which

reduces the level of tax exemption for certain complying pensions from 100%

down to 50%, will have a significant impact over time on those entitled to

claim the age pension.

It will lead over time to either the loss,

or a reduction, in the level of the age pension that many low and middle income

Australians would otherwise have been entitled to on retirement and not just

millionaires as was inferred by the Department, IFSA and ASFA.

The number of persons estimated to be

affected in the first year is 19,000 to 20,000.

This number will continue to grow at a similar rate in the following

years as reflected in the projected savings.

|

Year

|

2005/06

|

2006/07

|

2007/08

|

|

Amount

|

$28 million

|

$60million

|

$97 million

|

In addition, the effect of superannuation

balances, which will increase significantly as a result of compulsory

superannuation which was introduced in 1987, and are included in the means

test, means that there will be a significant average increase in assets for many

individuals in futures years.

Taking into account the fact that the asset

test for single persons cuts in at approximately $150,000, increasing numbers

of low and middle income Australians will be caught by this measure.

Senator

Jan McLucas

(ALP, Queensland)

Senator

Nick Sherry

(ALP, Tasmania)

Appendix 1 - Submissions received by the Committee

|

1

|

Department of Family and Community

Services

|

|

2

|

Industry Fund Services Pty Ltd (IFS)

|

|

3

|

Investment & Financial Services

Association Ltd (IFSA)

|

|

4

|

Small Independent Superannuation Funds

Association Ltd (SISFA)

|

|

5

|

Securities Institute

|

|

6

|

The Association of Superannuation Funds of

Australia Limited (ASFA)

|

Appendix 2 - Public Hearing

A public hearing was held on the Bill

on 18 June 2004 in House of

Representatives Committee Room 2R1, Parliament House, Canberra.

Committee Members in attendance

Senator Knowles

Senator Humphries

Senator McLucas

Senator Sherry

Witnesses

Investment &

Financial Services Association Limited (IFSA)

Mr Bill

Stanhope, Senior

Policy Manager

Ms Nicolette Rubinsztein, General Manager, Colonial First

State Investments Ltd

Association of

Superannuation Funds Australia (ASFA)

Dr Michaela

Anderson, Director, Policy

Mr Robert

Hodge, Senior

Policy Adviser

Department of Family

and Community Services

Mr Alex

Dolan, Assistant Secretary, Seniors and

Means Test Branch

Mr Sam

Cavalli, Director, Seniors and Means Test

Branch

Department of the

Treasury

Mr Patrick

Boneham, Senior

Adviser, Superannuation, Retirement and Savings Division