Introductory Info

Date introduced: 12 November 2020

House: House of Representatives

Portfolio: Social Services

Commencement: Division 1 of Part 1, Division 1 of Part 2 and Part 3 of Schedule 1 on 1 January 2021; Division 2 of Part 1 and Division 2 of Part 2 of Schedule 1 on 1 April 2021; Parts 4–6 on the day after Royal Assent.

The

Bills Digest at a glance

The Social Services and Other Legislation Amendment

(Extension of Coronavirus Support) Bill 2020 (the Bill) amends the Social

Security Act 1991, the Farm Household Support Act 2014 and the Veterans’

Entitlement Act 1986, and extends the operation of

parts of the Social Security (Coronavirus Economic Response—2020 Measures

No. 5) Determination 2020 to:

- provide

for the extension of the Coronavirus Supplement for Youth Allowance (Student

and Apprentice) recipients from 1 January 2021 to 31 March 2021

- prevent

any extension of the Coronavirus Supplement and the temporary COVID-19-related

waivers from the ordinary waiting period, newly arrived resident’s waiting

period and seasonal work preclusion period beyond 31 March 2021

- provide

for the extension of the temporary COVID-19-related qualification rules for

Youth Allowance (Student and Apprentice) to 31 March 2021

- permanently

remove provisions relating to the COVID-19-related liquid assets test waiting

period and assets test waivers (these waivers ended on 25 September 2020)

- allow

for specific provisions of social security law to be temporarily modified by

the Minister by legislative instrument in response to the economic and social

impacts of COVID-19 until 31 March 2021 (or 16 April 2021 for one of

the measures)

- introduce

a discretionary power under the social security and veterans’ entitlements

assets tests to extend temporary absence provisions used to determine a

person’s principal home where an individual is unable to return to Australia

for reasons beyond their control and

- allow

for JobKeeper Payment information provided by the Australian Taxation Office to

Services Australia on or before 28 March 2021 to be used after that date.

The extension of certain COVID-19 social security measures

including the Coronavirus Supplement, waiting period waivers and eligibility

requirements for JobSeeker Payment and Youth Allowance were announced by the

Prime Minister and Minister for Families and Social Services on 10 November

2020. The Government also announced the Coronavirus Supplement would be reduced

from $250 to $150 per fortnight for the extension period—1 January to 31 March

2021.

The Bill only provides for the extension of the

Coronavirus Supplement for Youth Allowance (Student and Apprentice). The

Minister for Families and Social Services already has the power to extend the

supplement period for other payment categories by three-months at a time via

legislative instrument. The Minister can also change the rate of the supplement

via a legislative instrument.

Most stakeholder comments on the Bill have focused on the

proposed reduction in the rate of the Coronavirus Supplement, although this

specific change is not made via the Bill. These stakeholders are concerned

about the impact of lower levels of support on payment recipients and that

JobSeeker Payment and Youth Allowance rates are set to return to their

pre-COVID-19 levels from 1 April 2021. Community sector organisations,

academics and business groups have long considered these levels inadequate.

The Government has suggested that the level of support

offered through current Coronavirus Supplement rates offers a disincentive for

recipients to take-up paid work. This is disputed by social security experts

and economists. The design of the supplement rather than the rate does offer a

disincentive for some individuals to increase their income.

Purpose of the Bill

The purpose of the Social Services and Other Legislation

Amendment (Extension of Coronavirus Support) Bill 2020 (the Bill) is to amend

the Social Security Act

1991 (the SS Act), the Farm Household

Support Act 2014 and the Veterans’

Entitlement Act 1986 (the VE Act), and extends the operation of

parts of the Social

Security (Coronavirus Economic Response—2020 Measures No. 5) Determination 2020

to:

- provide

for the extension of the Coronavirus Supplement[1]

for Youth Allowance (Student and Apprentice) recipients from 1 January

2021 to 31 March 2021 (Part 1 of Schedule 1)

- prevent

any extension of the Coronavirus Supplement and the temporary COVID-19-related

waivers from the ordinary waiting period, newly arrived resident’s waiting

period and seasonal work preclusion period beyond 31 March 2021 (Part 1 of

Schedule 1)

- provide

for the extension of the temporary COVID-19-related qualification rules for

Youth Allowance (Student and Apprentice) (Part 2 of Schedule 1)

- remove

provisions relating to the COVID-19-related liquid assets test waiting period

and assets test waivers (these waivers ended on 25 September 2020) (Part 3 of

Schedule 1)

- allow

for specific provisions of social security law to be temporarily modified by

the Minister by legislative instrument in response to the economic and social

impacts of COVID-19 until 31 March 2021 (or 16 April 2021 for some of

the provisions) (Part 4 of Schedule 1)

- introduce

a discretionary power under the SS Act and the VE Act assets

tests to extend the temporary absence provisions used in relation to

determining a person’s principal home where an individual is unable to return

to Australia, for reasons beyond their control, within the allowable absence

period (Part 5 of Schedule 1)

- allow

for JobKeeper Payment information provided by the Australian Tax Office to

Services Australia on or before 28 March 2021 to be used after that date (Part

6 of Schedule 1).

The main measures in the Bill—the extension of the

Coronavirus Supplement, waiting period waivers and eligibility requirements for

JobSeeker Payment and Youth Allowance—were announced by the Prime Minister and

Minister for Families and Social Services on 10 November 2020.[2]

The measures were not included in the 2020–21 Budget which was released on 6

October 2020. The Bill only provides for the extension of the supplement for

Youth Allowance (Student and Apprentice) recipients. No amendments are required

for the extension of the supplement for other payment categories as the

Minister already has the power to extend the supplement period for these

payment categories by three-months at time via legislative instrument.[3]

The Government also announced that the Coronavirus

Supplement would be reduced to $150 per fortnight for the period it was

extended—1 January to 31 March 2021.[4]

The Supplement amount was originally $550 per fortnight for the period 27 April

to 24 September 2020. It was reduced to $250 per fortnight for the period 25

September 2020 to 31 December 2020.[5]

The proposed reduction from 1 January 2021 is not part of the Bill as the

rate will be set in a legislative instrument.

Structure of the Bill and the Bills Digest

The Bill contains one schedule in six parts with a

discrete measure in each part. The Bills Digest provides general background to

the Government’s social security COVID-19 measures. The Bills Digest examines

issues relating to the extension of the Coronavirus Supplement and the proposed

amendments in detail in the ‘Key issues and provisions’ section.

Background

Initial COVID-19 social security measures

In March 2020, the Government announced two packages of

measures in response to the COVID‑19 pandemic to support those needing

assistance from the social security system.

The first package was announced on 12 March 2020 and

consisted of:

- a

$750 lump sum payment for most social security, family assistance, farm

household support and veterans’ affairs payment recipients and concession card

holders

- a

waiver of the one-week Ordinary Waiting Period for JobSeeker Payment, Youth

Allowance (Other) and Parenting Payment and

- a

waiver of the requirement for a medical certificate for those claiming Sickness

Allowance due to COVID-19.[6]

The second package was announced on 22 March 2020 and

consisted of:

- a

Coronavirus Supplement of $550 per fortnight to recipients of JobSeeker

Payment, Parenting Payment, Youth Allowance, Farm Household Allowance, Special

Benefit, Partner Allowance, Widow Allowance and student payments and

- a

second $750 lump sum payment, to be paid in July 2020, for those not eligible

for the Coronavirus Supplement

- improved

access to income support through changed eligibility criteria for JobSeeker

Payment and Youth Allowance; and the waiver of the assets tests and some

waiting periods for certain payments.[7]

The lump sum payments, Coronavirus Supplement and

eligibility changes were provided for by the Coronavirus

Economic Response Package Omnibus Act 2020 (the CER Act). The CER

Act also provided the Minister for Families and Social Services the broad

power to modify provisions in social security law that relate to qualification requirements

and payment rates via legislative instrument.[8]

The Minister could only make such an instrument where they were satisfied that

the changes were in response to COVID-19. This power expires on 31 December

2020 and any instrument made using the power has no operation after that date.

On 30 March 2020 the Government also announced a

relaxation of the partner income test for JobSeeker Payment, lowering the rate

at which payment rates are reduced due to partner income.[9]

The change was made using the instrument making power provided by the CER

Act. The rate at which an individual’s payment rate was reduced for each

dollar of partner income over a certain threshold was reduced from 60 cents to

25 cents.[10]

In response to the pandemic, the Government suspended

mutual obligation requirements, such as job search requirements, for certain

payment recipients until 8 June 2020.[11]

These requirements were gradually reintroduced in most jurisdictions from June.

However, the second stage of the reintroduction was delayed in Victoria in

August 2020.[12]

Similar requirements apply across all jurisdictions other than South Australia

from 23 November 2020.[13]

Mutual obligation requirements were lifted in South Australia from 18 November

2020 to 29 November 2020.[14]

Coronavirus

Supplement

Prime Minister Scott Morrison described the Coronavirus

Supplement as ‘supercharging the safety net’ by effectively doubling the income

support available to those in receipt of JobSeeker Payment.[15]

The Prime Minister stated that the second package of measures was focused on

those in the ‘frontline’ of COVID-19’s economic impact: ‘We'll be supporting

the most vulnerable to the impacts of the crisis. Those who will feel those

first blows’.[16]

The $550 per fortnight supplement was initially targeted

at those receiving payments which support those looking for work. Recipients of

student payments such as Youth Allowance (Student and Apprentice) and Austudy

were initially ineligible for the supplement but this decision was reversed on

23 March.[17]

Recipients of pension payments such as Age Pension, Disability Support Pension

and Carer Payment were excluded. Minister for Families and Social Services

stated that the supplement was targeted at those expected to participate in the

labour market:

The Coronavirus Supplement is a temporary support in

recognition of the economic impact of the coronavirus pandemic, which will

directly impede people's ability to find employment. Accordingly, the Coronavirus

Supplement is payable to recipients of jobseeker payment and other related

allowances, as people on these payments are generally expected to participate

in the labour market.[18]

The Government originally announced that the Coronavirus

Supplement would be paid for six months.[19]

However, the CER Act provided the initial period of the payment would be

for around five months, from 27 April 2020 to 24 September 2020. The supplement

was later extended at a reduced rate (see below).

The Coronavirus Supplement is designed so that the full

amount is added to a person’s payment rate so long as their qualifying payment

is payable in a particular fortnight. This means that a person could have their

qualifying payment reduced under the income test (due to other income) to one

dollar or even zero dollars in some circumstances and still be eligible for the

entire $550 per fortnight amount.[20]

Eligibility

changes

The changed eligibility criteria for JobSeeker Payment and

Youth Allowance (Other) were to allow easier access to income support for

workers who, as a result of the economic impact of COVID-19:

- were

made unemployed

- were

stood down but not made redundant

- lost

hours of work

- were

sole traders/self-employed individuals and were force to suspend their business

or who had a downturn in revenue.[21]

The criteria also covered those people in quarantine or

self-isolation as a result of advice from a health professional or due to a

government requirement and who had their working hours reduced as a result.[22]

The eligibility criteria for these payments generally

require a person to be unemployed or be considered unemployed by Services

Australia for the purposes of these criteria—which can be used to allow someone

in part-time work to qualify for the payment where they are also meeting their

mutual obligation requirements to look for more work or for a full-time

position.[23]

The expanded eligibility criteria in response to COVID-19 were necessary to

ensure those who were still ‘employed’, but who had temporarily lost hours of

work and income, could qualify for income support.

The CER Act made amendments to the SS Act to

provide the Minister with the power to make a legislative instrument to

determine eligibility requirements for Youth Allowance (Other) and JobSeeker

Payment in response to circumstances relating to COVID-19.[24]

To be eligible, individuals still need to be considered Australian residents or

have an exemption from the residency requirements. The eligibility requirements

only apply for the period that the Coronavirus Supplement is paid. The

instrument providing for the eligibility requirements is the Social Security

(Coronavirus Economic Response—2020 Measures No. 2) Determination 2020.

The eligibility requirements only covered those who were

not entitled to or receiving a leave payment in respect of the relevant period

unless that leave payment, as a result of COVID-19 is lower than it would

otherwise have been, or it is paid at a lower rate than the rate of JobSeeker

Payment/Youth Allowance (Other) the person would receive if their claim was

granted.

Asset test

and waiting period waivers

Other temporary changes made in response to COVID-19 that

affected expanded payment eligibility and allowed some individuals to commence

receiving payments immediately were:

- the

waiver of the assets test for JobSeeker Payment, Parenting Payment, Youth

Allowance, Austudy and ABSTUDY Living Allowance—the assets test prevents

individuals with asset values over certain limits from qualifying for these

payments[25]

- the

waiver of the Liquid Assets Waiting Period for JobSeeker Payment, Youth

Allowance and Austudy—this waiting period applies to those with cash and easily

realisable assets over a certain value (with the value of the liquid assets

determining the waiting period)[26]

- waiver

of the one-week Ordinary Waiting Period for JobSeeker Payment, Youth Allowance

(Other) and Parenting Payment—applies to all claimants unless specifically

exempt[27]

- waiver

of the Newly Arrived Residents Waiting Period for JobSeeker Payment, Youth

Allowance, Austudy, Parenting Payment, Special Benefit and Farm Household

Allowance (the waiting period applies to new permanent residents and is usually

four years for these payments)[28]

and

- waiver

of the Seasonal Work Preclusion Period for JobSeeker Payment, Youth Allowance,

Parenting Payment, Special Benefit and Farm Household Allowance—applies to

those who undertake seasonal or intermittent work prior to claiming a payment

(waiting period depends on earnings and period of work undertaken).[29]

These changes applied for the initial period of the

Coronavirus Supplement—25 March to 24 September 2020. Most of these

waivers were implemented via the CER Act but waivers for some payments

were implemented via legislative instrument.[30]

Changes to

the COVID-19 social security measures

On 21 July 2020 Prime

Minister Scott Morrison and Treasurer Josh Frydenberg announced changes to the initial

social security measures introduced in response to COVID-19 and one new

measure.[31]

Table 1 sets out the changes to the initial measures.

Table 1: Changes to COVID-19

Economic Response social security measures

| COVID-19 Economic

Response social security measures |

Changes announced 21

July 2020 |

| $550 per fortnight

Coronavirus Supplement for selected payment recipients paid from 27 April to

24 September. |

Reduced to $250 per

fortnight from 25 September until 31 December 2020. |

| Expanded eligibility

criteria for JobSeeker Payment and Youth Allowance (Other) to allow

stood-down permanent employees and sole traders, casuals and contract workers

with reduced work to qualify. Criteria apply from 25 March to 24 September. |

Remains in place until 31

December 2020. |

| Waiver of the assets test for JobSeeker Payment, Parenting

Payment, Youth Allowance, Austudy and ABSTUDY Living Allowance from 25 March

to 24 September. |

Reinstated from 25 September 2020. |

| Waiver of the Liquid Assets Waiting Period for JobSeeker

Payment, Youth Allowance and Austudy from 25 March to 24 September. |

Reinstated from 25 September 2020. Those in receipt of a

payment prior to 25 September did not have to serve any potential waiting

period when it was reinstated—only new claimants from 25 September. |

| Waiver of the one-week Ordinary Waiting Period from 12

March to 24 September. |

Remains in place until 31 December 2020. |

| Reduction in the amount by which payment rates are reduced

(the taper rate) for partner income from 27 April to 24 September. |

Remains in place until 31 December 2020, but taper rate

increased from 25 September 2020: from 25 cents for each dollar of partner

income over $996 per fortnight, to 27 cents for each dollar of income over

$1,165 per fortnight. |

| Waiver of the Newly Arrived Residents Waiting Period for

JobSeeker Payment, Youth Allowance, Austudy, Parenting Payment, Special

Benefit and Farm Household Allowance (the waiting period is usually four

years for these payments) from 25 March to 24 September. |

Remains in place until 31 December 2020. |

| Waiver of the Seasonal Worker Preclusion Period from 25

March to 24 September. |

Remains in place until 31 December 2020. |

Sources: Department of Social Services (DSS), ‘Coronavirus

(COVID-19) information and support’, DSS website, last updated 27 November 2020;

Australian Government, Extension

of additional income support for individuals, fact sheet, The Treasury,

last updated 21 July 2020; S Morrison (Prime Minister), J Frydenberg

(Treasurer) and A Ruston (Minister for Families and Social Services), JobKeeper

payment and income support extended, media release, 21 July 2020.

Further to these changes, the Government announced a new

measure to allow recipients of JobSeeker Payment and Youth Allowance (Other) to

earn more private income before their payment rate is reduced under the income

test. From 25 September to 31 December 2020, the income-free area (the amount

of income a person can earn before their payment rate is reduced) has been

increased from $106 per fortnight for JobSeeker Payment and $143 for Youth

Allowance (Other) to $300 per fortnight. A person’s fortnightly payment rate

will be reduced by 60 cents for each dollar of income over $300.[32]

The change allows these payment recipients to earn more

income before having their payment rate reduced and increases the income

cut-off point at which a person’s JobSeeker Payment or Youth Allowance (Other)

rate reaches zero under the income test. This is significant because, as noted

above, the Coronavirus Supplement is not included in the income-tested rate—an

individual can receive the full supplement amount as long as they receive even

a small amount of the qualifying payment.

These changes, including the new income-free area, were

implemented by the Social Security

(Coronavirus Economic Response—2020 Measures No. 14) Determination 2020.

Most of the measures in the determination were made under the broad

instrument-making power provided to the Minister by item 40A of Schedule 11 of

the CER Act. However, the extension of the Coronavirus Supplement at the

reduced rate was made under separate powers provided by the CER Act

which allow the Minister to extend the supplement by up to three months at

time, to pay the supplement to additional payment categories, and to set a

different rate for the supplement.[33]

As the supplement could only be extended by three months from 25 September, a

separate instrument—the Social Security

(Coronavirus Economic Response—2020 Measures No. 15) Determination 2020—was

made to cover the period 19 December to 31 December 2020.

Cost of the

COVID-19 social security measures

In the Economic and Fiscal Update released on 23 July

2020, the Government set out the total cost of all the social security measures

announced in response to COVID-19, including the changes described in Table 1

and the new income test arrangements: $18.8 billion.[34]

The two lump-sum payments of $750 to certain payment recipients are estimated

to have cost an additional $9.4 billion.[35]

These measures, combined with an increase in the number of payment recipients

(see next section), have contributed to an estimated $46 billion in new

expenditure in the social security and welfare expense category in 2019–20 and

2020–21.[36]

Impact of

COVID-19 on social security recipient numbers

The economic impacts of COVID-19, and the measures to

expand access to social security described in the previous sections, have seen

a massive increase in the number of people receiving income support payments,

particularly those payments aimed at people of working age. Table 2 sets out

the number of recipients of the main social security income support payments at

different points in time from December 2019 onwards. The introduction of the

JobKeeper Payment from March 2020 will have reduced the number of people likely

to have claimed social security payments by providing income to eligible

individuals who have been stood down or who have had their working hours

reduced, as well as subsidising the wages of businesses facing a downturn in

revenue.[37]

On 20 March 2020 the main unemployment payment for those

aged 22 or above, Newstart Allowance, was merged with Sickness Allowance and

Bereavement Allowance to form a new payment: JobSeeker Payment.[38]

The introduction of the new payment was not related to COVID‑19 and had

been legislated in 2018.[39]

Between December 2019 and June 2020, the number of recipients of these payments

increased by 96.4 per cent. The number of recipients of the main unemployment

payment for people aged 16–21, Youth Allowance (Other), increased by 102.9 per cent

over the same period. Other payments such as student payments and Parenting

Payment Partnered have also seen a significant increase in recipient numbers as

a result of COVID‑19.

Table 2: Recipients

of the main income support payments, December 2019–October 2020

| Payment |

27/12/2019 |

27/03/2020 |

26/06/2020 |

25/09/2020 |

30/10/2020 |

| ABSTUDY Living Allowance* |

7 595 |

8 207 |

9 806 |

10 463 |

10 596 |

| Age Pension |

2

515 388 |

2 529 617 |

2 556 017 |

2 567 221 |

2 571 596 |

| Austudy* |

27

634 |

33 000 |

41 391 |

45 298 |

45 141 |

| Carer Payment |

284

252 |

290 121 |

294

272 |

294 465 |

295 372 |

| Disability Support Pension |

751

773 |

752 191 |

754 181 |

752 833 |

752 534 |

| Newstart Allowance

(combined)—JobSeeker Paymenta* |

733

704 |

797 941 |

1 441 293 |

1 399 858 |

1 346 890 |

| Parenting Payment

Partnered* |

68

087 |

67 552 |

92 022 |

94 171 |

95 413 |

| Parenting Payment Single* |

228

606 |

230 702 |

243 433 |

243 994 |

242 252 |

| Special Benefit* |

6 709 |

7 162 |

9 638 |

10 523 |

9 803 |

| Youth Allowance (Other)* |

85

316 |

93 399 |

173 125 |

166 416 |

151 874 |

| Youth Allowance (Student

and Apprentice)* |

134

456 |

168 997 |

225 483 |

234 288 |

231 177 |

* Qualifying payment for the

Coronavirus Supplement from 27 April 2020.

(a) Newstart Allowance, Sickness Allowance and

Bereavement Allowance were merged to form JobSeeker Payment from 20 March 2020.

The December data is the combined total of the three merged payments and

JobSeeker Payment data includes any recipients of Sickness Allowance and

Bereavement Allowance yet to transfer to the new payment.

Sources: DSS, ‘DSS Payment Demographic Data’, December 2019, March 2020 and June

2020, data.gov.au website, last updated 7 September 2020; DSS, ‘JobSeeker Payment and Youth Allowance

recipients monthly profile: September 2020’, data.gov.au website; DSS, ‘Income support payment data by state

and statistical area level 2 and by earnings and partner earnings as at 25 September

2020’, provided to

Senate Select Committee on COVID-19 on 7 October 2020 (Additional

information item no. 36); DSS, ‘Income support payment data by state

and statistical area level 2 and by earnings and partner earnings as at 30

October 2020’,

provided to Senate Select Committee on COVID-19 on 9 November 2020 (Additional

information item no. 36)

Impact of

the Coronavirus Supplement

The Coronavirus Supplement has significantly improved the

incomes of eligible recipients. The maximum rate of JobSeeker Payment for a

single person with no children increased from $574.50 per fortnight (including

Energy Supplement) to $1,124.50 per fortnight.[40]

This meant that JobSeeker Payment went from being the equivalent of 61 per cent

of the maximum pension rate ($944.30 per fortnight including Energy Supplement

and Pension Supplement) to 119 per cent.[41]

Modelling undertaken by Ben Phillips, Matthew Gray and

Nicholas Biddle at the Australian National University’s Centre for Social

Research and Methods examined the impact of the Government’s COVID-19 economic

response measures on poverty.[42]

They found that the social security measures, combined with the JobKeeper

Payment policy, significantly reduced the number of people in poverty and the

depth of poverty when compared with the pre-COVID-19 period.[43]

The researchers found that pre-COVID-19, around 67.3 per cent of households

whose main source of income was Newstart Allowance or Youth Allowance were in

poverty. The introduction of the Coronavirus Supplement and other social

security measures almost eliminated poverty for these households: only 6.8 per

cent of households with income from these unemployment payments were in poverty

in June 2020.[44]

Modelling commissioned by the Australia Institute think

tank also found that the Coronavirus Supplement had a dramatic impact on

poverty rates.[45]

The modelling estimated that around 425,000 people were no longer in poverty as

a result of the new supplement.[46]

A survey of recipients of the Coronavirus Supplement

conducted by the National Council of Single Mothers and their Children reported

many positive impacts of the supplement including reduced stress, the ability

to cover bills, the ability to purchase healthier food and reduced family

conflict.[47]

A similar survey by the Australian Council of Social Service (ACOSS) found that

80 per cent of respondents stated they were ‘eating better and more regularly’,

70.7 per cent said they were able to catch up on bill payments and 67.8 per

cent of people said they were able to pay for medicines or health treatments.[48]

The Australian Bureau of Statistics included some

questions on the Coronavirus Supplement in its survey of the household impacts

of COVID-19. In mid-September 2020, around 10 per cent of Australians reported

receiving the supplement. Of those receiving the payment, 32 per cent reported

mainly using the payment on household supplies such as groceries and 28 per

cent reported mainly using it for mortgage or rent payments. Of all uses of the

supplement (not only the main use), paying household bills was the most commonly

reported use (71 per cent of respondents) followed by household supplies (67

per cent).[49]

Extension of

COVID-19 social security measures to March 2021

On 10 November 2020, the Prime Minister and Minister for

Social Services announced the extension of the Coronavirus Supplement to the

end of March 2021, paid at a reduced rate of $150 per fortnight.[50]

The Government also announced that it would extend a range of other COVID-19

social security measures until the end of March 2021:

- the

expanded eligibility criteria for JobSeeker Payment and Youth Allowance

- the

waiver of the one-week Ordinary Waiting Period, Newly Arrived Resident’s

Waiting Period and the Seasonal Work Preclusion Period

- the

September 2020 changes to the income test for JobSeeker Payment and Youth

Allowance (Other)

- the

September 2020 changes to the partner income test for JobSeeker Payment and

- special

arrangements for pensioners temporarily absent from Australia, Mobility

Allowance transition arrangements and temporary self-declaration arrangements

for members of a couple assessments.[51]

The Government announced it would also extend the special

nil-rate period arrangements which allow social security recipients who have a

zero-rate of payment due to employment income to not have their payment

cancelled. Usually, a person can have a nil-rate period of up to six fortnights

before their payment is cancelled.[52]

The Government initially allowed for any nil-rate periods that ended after

22 June 2020 to end on 2 August 2020.[53]

This end date has been extended multiple times and is currently

31 December 2020.[54]

The Government has announced that it will extend the end-date of any nil-rate

periods that had reached their six-fortnight maximum after 22 June 2020 to

16 April 2021.[55]

Committee consideration

Senate

Community Affairs Legislation Committee

The Bill was referred to the Senate Community Affairs

Legislation Committee for inquiry and report by 27 November 2020. The Committee

received 35 public submissions. Some of the submissions are detailed in the ‘Position

of major interest groups’ section of this Bills Digest. Details of the inquiry

are available at the inquiry

homepage.

The Committee tabled its report on 27 November 2020.[56]

The Committee recommended the Bill be passed.[57]

Australian Labor Party senators made additional comments to the report and the

Australian Greens issued a dissenting report—see ‘Policy position of

non-government parties/independents’ section for details.

Senate

Standing Committee for the Scrutiny of Bills

At the time of writing, the Senate Standing Committee for

the Scrutiny of Bills had not yet considered the Bill.

Policy position of non-government parties/independents

In their Additional Comments to the Senate Community

Affairs Committee’s report on the Bill, Australian Labor Party senators stated:

‘It is a missed opportunity for the government to deliver a permanent increase

to the rate of JobSeeker Payment.’[58]

The Labor senators were concerned about the amendments in Part 1 of Schedule 1

of the Bill which will repeal provisions relating to the Coronavirus Supplement

from 1 April 2021. Their Additional Comments stated that ‘the government should

not be ending the Minister’s ability to provide additional Coronavirus support,

without at least legislating for a permanent increase to the base rate of

unemployment payments’.[59]

Labor called on the Government to deliver a permanent increase to the base rate

of unemployment support and ‘ensure continued beneficial support for people

impacted by the Coronavirus pandemic and the recession’.[60]

Previously, Shadow Minister for Families and Social

Services Linda Burney had stated that Labor wants the Coronavirus Supplement

rate to be maintained at the current rate of $250 per fortnight until the end

of March 2021 and that there should be a permanent increase in the rate of

JobSeeker Payment.[61]

The Australian Greens Dissenting Report to the Senate

Community Affairs Committee’s report on the Bill stated:

The Australian Greens reject the majority committee view that

this bill will adequately support people as they re-engage with the workforce.

The overwhelming evidence received by the committee clearly demonstrates this

bill will cause harm by further cutting the rate of the coronavirus supplement

and dropping people on income support payments further below the poverty line.[62]

The Greens recommended the Government announce ‘a

permanent and ongoing increase to JobSeeker Payment’; the reinstatement of the

$550 per fortnight rate of the Coronavirus Supplement; and, the reinstatement

of the waivers of the Liquid Assets Waiting Period and assets test.[63]

Greens Senator Rachel Siewert had previously criticised

the proposed reduction in the Coronavirus stating:

This decision is purely ideological. It is not fair and does

not make economic sense and it is extremely harmful for our communities.

Let’s be clear, the Government is making the decision to push

over a million people into poverty.

Short-term measures and cuts in the middle of a recession and

a pandemic leave people in limbo, increasing their anxiety and stress and

affecting their capacity to plan for the future.[64]

At the time of writing the position of other

non-government parties and independents on the Bill was unclear.

Position of major interest groups

In its submission to the Senate Community Affairs

Committee inquiry into the Bill the Australian Council of Social Service (ACOSS)

stated it was opposed to the proposed reduction in the Coronavirus Supplement

rate (not included in the Bill) and the Bill’s proposal to end the supplement

from 1 April 2021 without an increase in JobSeeker Payment and Youth

Allowance rates.[65]

The Council of the Ageing (COTA) Australia recommended the

Coronavirus Supplement be replaced with a permanent increase in the rate of

JobSeeker Payment:

The supplement has delivered a much-needed boost to both

individual hip pockets and the wider economy. Looking forward, there is a need

to replace the Coronavirus Supplement with permanent increases to the Jobseeker

rate and to the maximum rate of Commonwealth Rent Assistance (CRA), and to the

indexation of both.[66]

COTA Australia’s submission also recommended the

Government reverse its decision to reinstate the Liquid Assets Waiting Period

on 25 September 2020, at least for unemployed mature age workers.[67]

In its submission to the Senate Committee inquiry into the

Bill, the Australian Human Rights Commission stated: ‘while the measures in the

Bill are a step in the right direction, they are insufficient to protect our

most vulnerable communities, our children, and those people on temporary visas,

from poverty and associated harms’.[68]

The Commission was concerned at the proposed reduction in the Coronavirus

Supplement rate and a return to previous rates of income support from 1 April

2021. The Commission also recommended that eligibility for social security be

extended to certain groups currently excluded, particularly temporary visa

holders.[69]

A range of other submissions from community sector

organisations, peak bodies and groups representing social security payment

recipients also made submissions to the Senate Committee inquiry raising

concerns with the Government’s proposed reduction in the rate of the

Coronavirus Supplement and the return to pre-COVID-19 social security payment

rates from 1 April 2021.[70]

Financial implications

According to the Explanatory Memorandum, the Bill will allow

for the extension of certain temporary social security policies: ‘The

instrument making power will deliver the policies at a cost of

$3.2 billion to 2024–25’.[71]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the

Bill’s compatibility with the human rights and freedoms recognised or declared

in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[72]

Parliamentary

Joint Committee on Human Rights

The Parliamentary Joint Committee on Human Rights had no

comment in relation to the Bill.[73]

Key issues and provisions

The key issue being raised by stakeholders in relation to

the Bill is the extension to the period that the Coronavirus Supplement can be

paid to—from 31 December 2020 to 31 March 2021—and the Government’s

proposal to reduce the rate at which it will be paid during this period from

$250 to $150 per fortnight. The Bill does not actually provide for the

extension of the supplement or the rate reduction, however, some amendments are

proposed to ensure Youth Allowance (Students and Apprentice) recipients can

continue to receive the supplement during the period January to March 2021.

The Minister for Families and Social Services can extend

the supplement period for payments other than Youth Allowance (Student and

Apprentice) for three-months at a time via legislative instrument.[74]

This instrument can also set the rate of the supplement. The Department of

Social Services included a draft of the proposed instrument to extend and

reduce the supplement, and to extend various other COVID-19 social security

measures, with its submission to the Senate Community Affairs Legislation inquiry

into the Bill.[75]

Part 1 of Schedule 1 of the Bill does propose to repeal

all provisions relating to the Coronavirus Supplement from 1 April 2021. This

will mean that the supplement cannot be extended beyond 31 March 2021

without further legislation.

As the extension and reduction of the Coronavirus

Supplement is the key issue relating to the Bill, this section focuses on the

main issues relevant to public debate over the supplement before providing a

brief analysis of the key provisions of the Bill.

Rationale

for the Coronavirus Supplement

It is difficult to determine the specific rationale for

the Coronavirus Supplement but establishing the rationale is important to

assess the policy decision to both extend and reduce the rate of the payment.

The Prime Minister described the payment as ‘supercharging

the safety net’ and that it formed part of a package of measures to ‘cushion

the economic impact of the coronavirus and help build a bridge to recovery’.[76]

The payment was initially limited to payments related to unemployment such as

JobSeeker Payment, Youth Allowance (Other) and Parenting Payment (student

payments were not included in the package as announced). These are the ‘safety

net’ payments for those who lose work and act as an economic stabiliser, automatically

offering support for those whose income is affected by economic downturns. The

decision to ‘supercharge’ this safety net suggests some possible rationales:

- the

existing safety net offered inadequate support

- COVID-19

and/or the economic downturn was likely to significantly increase costs for

income support recipients

- additional

financial support provided to social security recipients was likely to act as

an economic stimulus and boost confidence in the economy

- new

claimants of unemployment payments required a different level of support

compared to existing recipients and/or

- the

nature of COVID-19 restrictions meant that any temporary additional support

would not act as a disincentive to labour market participation (but that this

would change with the easing of restrictions).

Appearing before the Senate Select Committee on COVID-19

in April 2020, Treasury Secretary Steven Kennedy suggested that the additional

support was intended to stabilise the economy following the shock of COVID-19

and to boost confidence:

In my view, it was important—as much as it is appropriate for

me to say; it was certainly my advice—to get the safety net in place first, the

COVID-19 supplement that the government announced in the enhanced safety net,

because, in this type of disturbance, with this type of shock, it's not just a

question of the economic stabiliser; there's a stabiliser that, in my view,

needs to go underneath the community for it to have confidence through a period

of really very significant disruption.[77]

This suggests the rationale focused less on the specific

needs of recipients or the adequacy of existing payment rates and more on the

need for fiscal stimulus and a desire to boost confidence in the economy. This

also matches with the rationale provided by the Minister for Families and

Social Services, Senator Anne Ruston, for the reduction of the supplement at

the end of September 2020:

The decision that was made in the July economic fiscal update

to extend the supplement past the end of September, which was the original

period of time in the decision made by the parliament back in March, was a

reflection of the lifting of restrictions that had taken place in the

intervening period. In the states and territories, with the exception of Victoria,

we were seeing restrictions lifting and jobs becoming available again. But we

also recognised that there was a shallowness in the jobs market. We remain in a

shallow jobs market, as you would concede. But, at the same time, we also

wanted to make sure that we were providing appropriate incentives for people to

seek to re-engage with the jobs market.[78]

Here, the improving labour market provides the reason for

a reduction in the rate of supplement suggesting the payment is intended

primarily as an economic stimulus, not as addressing any concerns regarding

costs of living or the adequacy of the payment rate.

Some of the criticisms of the reduction in the Coronavirus

Supplement directly relate to this rationale. For example, the Shadow Minister

for Families and Social Services has argued that the payment is helping to

stimulate economic activity and sustain jobs, and that a lower payment rate

will see job losses.[79]

Other criticisms of the reduction in the supplement have focused on the issue

of the adequacy of social security for job seekers—building on a long-running

campaign from community groups and others to have payment rates increased on an

ongoing basis (see next section).

The adequacy

of payments for job seekers

The Government’s decision to both reduce the Coronavirus

Supplement rate for the September–December 2020 period and again for the

January–March 2021 period has attracted criticism from the community sector,

the Australian Labor Party and the Australian Greens. These same groups have

been calling for an increase in the basic rates of the payments for job

seekers, including JobSeeker Payment and Youth Allowance. These criticisms

portray the Coronavirus Supplement as a relief from the inadequate level of

support offered to certain social security recipients and that the reduction in

the Coronavirus Supplement, and the eventual withdrawal of the supplement, will

mean these recipients are returned to an inadequate payment rate.[80]

For over a decade, policy experts, community sector

advocates and business groups have raised concern over the level of payments

for job seekers.[81]

These same groups applauded the introduction of the Coronavirus Supplement but

have expressed concern at the withdrawal of the support and that the Government

has not committed to any permanent increase in payment rates for job seekers.[82]

Ben Phillips, one of the ANU researchers who modelled the

impact of the COVID-19 response measures on poverty (see ‘Impact of the

Coronavirus Supplement’ section above), has estimated that the proposed $100

reduction in the rate of supplement in January 2021 will increase the number of

people below the poverty line by 330,000 to 3.82 million.[83]

Had the supplement remained at $550 per fortnight, Phillips estimated there

would be around 2.66 million people below the poverty line.[84]

Does the

rate of the Coronavirus Supplement offer a disincentive to work?

Another reason offered by the Government for reducing the

rate of the Coronavirus Supplement—linked to an improving economy—is that the

higher rate poses a disincentive for payment recipients to find employment.

Prime Minister Scott Morrison stated in an interview on 29 June 2020:

What we have to be worried about now is that we can't allow

the JobSeeker Payment to become an impediment to people out and going doing

work, getting extra shifts. And we are getting a lot of anecdotal feedback from

small businesses even large businesses where some of them are finding it hard

to get people to come and take the shifts because they're on these higher

levels of payment.[85]

Evidence for this disincentive is limited. In June 2020,

Minister for Employment Michaelia Cash cited a National Skills Commission

survey in which some businesses had reported a lack of applicants.[86]

However, a media report which examined the data found that only around six per

cent (139) of businesses surveyed reported difficulties in recruiting and just

over half of those (72) cited a lack of applicants as a reason.[87]

More recent data produced from a different survey conducted by the National

Skills Commission (covering a broader range of businesses than the earlier

survey cited by Minister Cash) found that around 43 per cent of employers who

were recruiting in the period 19 October to 13 November 2020 reported

difficulties. Of those with difficulties, just under 40 per cent cited one

reason was a lack of applicants. However, this translates to 110 businesses

reporting a lack of applicants out of 1,360 contacted for the survey (around

eight per cent).[88]

Supplement

design offers a disincentive

The Coronavirus Supplement has offered a significant

disincentive to earn more private income, but primarily for those close to the

point at which no JobSeeker Payment (or other qualifying payment) is payable.

As noted in the Parliamentary Library Research Paper, Changes to the

COVID-19 social security measures: a brief assessment, this is not due to

the high rate of the supplement, but the fact it is excluded from the income

test and does not gradually taper off as private income increases.[89]

For example, this means that a person who moves from qualifying for one dollar

of the basic JobSeeker Payment rate in a fortnight under the income test to

qualifying for zero dollars loses the entire Coronavirus Supplement amount

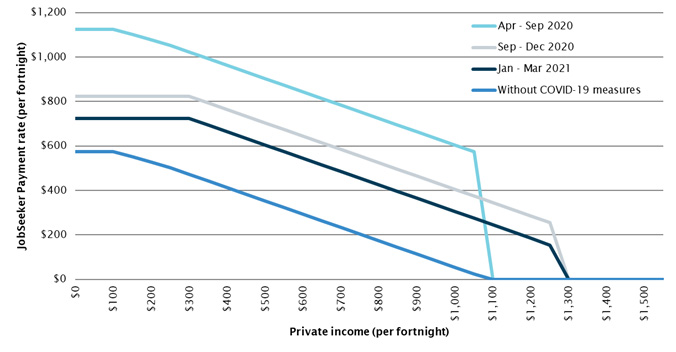

(currently $250 per fortnight). Figure 1 demonstrates this disincentive by

showing the dramatic drop to zero income support at the point where private

income means an individual is no longer eligible for the Coronavirus

Supplement. This is compared to the non-COVID-19 settings where income support

gradually tapers down to zero as other income increases.

Figure 1:

JobSeeker Payment rate under different Coronavirus Supplement and income test

settings (single, no dependent children)

Notes: JobSeeker Payment rate includes

Energy Supplement and the applicable Coronavirus Supplement rate (but excludes

Rent Assistance and other supplementary payments payable in some

circumstances). ‘Without COVID-19 measures’ excludes the Coronavirus Supplement

and the changes to the income test from 25 September 2020.

Source:

Parliamentary Library estimates.

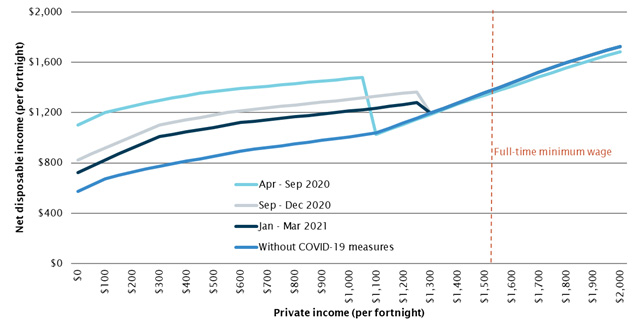

The effect of the sudden-death Coronavirus Supplement

cut-off means that some individuals can have a lower overall-income as they

earn more private income. Figure 2 shows how the design of the supplement

interacts with the JobSeeker Payment income test and income tax by comparing

net disposable income under the different COVID-19 settings. Figure 2 shows

that a disincentive to earn more private income applies at certain points under

each of the Coronavirus Supplement rate settings but the effect for the

proposed $150 per fortnight rate will not be as strong and will affect a more

limited income range compared to the April–September and September–December

settings.

Figure 2: Net

disposable income under different Coronavirus Supplement and income test

settings (JobSeeker Payment, single, no dependent children, no private health

cover)

Notes: JobSeeker Payment rate includes Energy

Supplement and the applicable Coronavirus Supplement rate (but excludes Rent

Assistance and other supplementary payments payable in some circumstances).

Disposable income is total private and social security income minus any income

tax or Medicare levy. ‘Without COVID-19 measures’ excludes the Coronavirus

Supplement and the changes to the income test from 25 September 2020. The

full-time minimum wage is $753.80 per week from 1 July 2020.

Source: Parliamentary Library

estimates; Fair Work Ombudsman, ‘Minimum wages’, Fair Work

Ombudsman website, n.d.

Does the

JobSeeker rate offer a disincentive?

Social security researchers Bruce Bradbury and Peter

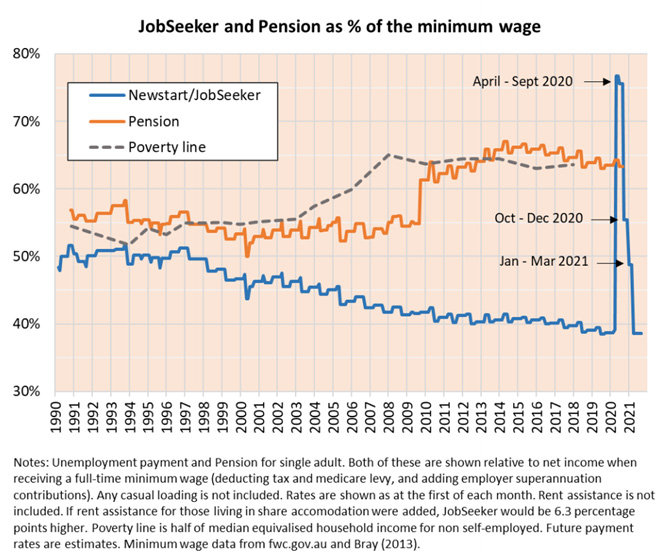

Whiteford have argued that ‘Australia is in no danger of creating a

disincentive for people to seek work because of higher JobSeeker payments’.[90]

Their analysis found that those on Newstart/JobSeeker Payment have experienced

a steady decline in their position relative to the minimum wage over the last

two decades: the rate of payment for a single adult with no children has fallen

from around 50 per cent of the minimum wage in the 1990s to under 40 per cent

at the start of 2020—well below the poverty line (half of median equivalised

household income for the non-self-employed). Bradbury and Whiteford found that

with the introduction of the Coronavirus Supplement, payment rates were still

well below the adult minimum wage (76 per cent, or 82 per cent if shared

accommodation Rent Assistance is included).[91]

Figure 3 is taken from Bradbury and Whiteford’s submission to the Senate

Community Affairs Committee inquiry into the Bill.

Figure 3:

Bradbury and Whiteford analysis of JobSeeker Payment and pension rates relative

to the minimum wage 1990–2021

Source: B Bradbury and P

Whiteford, Submission to

the Senate Community Affairs Legislation Committee, Inquiry into the Social

Services and Other Legislation Amendment (Extension of Coronavirus Support)

Bill 2020, [Submission no. 21], 19 November 2020, p. 3.

University of Melbourne economist Jeff Borland has also

published a paper setting out evidence that the Coronavirus Supplement, or an

increase in the JobSeeker Payment rate, does not offer a disincentive to search

for and take up paid work.[92]

Borland argued that payment recipients would gain a significant financial

advantage from taking up paid work even with an increase in the JobSeeker

Payment rate of $250 per fortnight.[93]

Borland also highlighted non-monetary benefits of moving from unemployment to

employment (such as health impacts) but did not factor in the loss of some

social security supplementary benefits such as concession cards. Borland’s

analysis suggested that the Coronavirus Supplement had not affected the speed

with which vacancies are being filled nor has it created labour shortages.

Borland argued that main drivers of labour supply in Australia since the onset

of the pandemic have not been social security payment rates but macroeconomic

conditions and the direct effects of COVID‐19.[94]

Key

provisions

Part

1—COVID-19 Supplement

Item 1 amends

subsection 557(1) of the Social Security Act 1991 with effect

from 1 January 2021 so that students and apprentices are not excluded from

eligibility for the Coronavirus Supplement for Youth Allowance. This exclusion

was included in the original CER Act but its operation was overridden by

the Social Security (Coronavirus Economic Response—2020 Measures No. 1)

Determination 2020.[95]

However, this determination will no longer operate after 31 December 2020 so

the amendment is required if the Coronavirus Supplement is to be extended for

Youth Allowance (Student and Apprentice).[96]

No amendments are

required to extend the Coronavirus Supplement for other payment recipients as

the CER Act did not place an end-date on the Minister’s power to extend

the supplement (but the Minister can only extend the supplement by three months

at a time).[97]

Items 3–29

remove all provisions relating to the Coronavirus Supplement from the SS Act

and the Farm Household Support Act 2014 with effect from 1 April 2021.

This has the effect that the supplement will not be payable to any payment

recipients after March 2021.

Part

2—Qualification for Youth Allowance or JobSeeker Payment—coronavirus

Item 30 repeals paragraph 540BA(1)(b) of the

SS Act so that students and apprentices are not excluded from the

special COVID-19 eligibility criteria for Youth Allowance (currently set out in

Social Security (Coronavirus Economic Response—2020 Measures No. 2)

Determination 2020).[98]

This exclusion was included in the original CER Act but its operation

was overridden by the Social Security (Coronavirus Economic Response—2020

Measures No. 1) Determination 2020.[99]

However, the No. 1 Determination will no longer operate after 31 December 2020

so the amendment is required if the special eligibility criteria are to

continue to apply for Youth Allowance (Student and Apprentice) claimants.[100]

Items 32–35 remove all provisions relating to the

special COVID-19 eligibility criteria for Youth Allowance and JobSeeker Payment

with effect from 1 April 2021. This has the effect that claimants will not be

eligible for these payments under these criteria after March 2021.

Part

3—Liquid assets test waiting period and assets test exemptions

Items 36–43 repeals all provisions in the SS Act

relating to the liquid assets test and asset test exemptions that applied to

Youth Allowance, JobSeeker Payment and Parenting Payment for the period 25

March to 24 September 2020. The Social Security (Coronavirus Economic

Response—2020 Measures No. 14) Determination 2020 and the Social Security

(Coronavirus Economic Response—2020 Measures No. 7) Determination 2020 ceased

the operation of these provisions from 25 September 2020.[101]

The proposed amendments in Part 3 will permanently remove the relevant

provisions from the SS Act.

Part

4—Modifications of social security law

Item 44 inserts sections 1261–1263 into the SS

Act to provide the Minister for Families and Social Services with the power

to amend specific provisions of the SS Act via legislative instrument.

Any amendment made by a legislative instrument made under proposed section

1262 cannot have effect after 31 March 2021 unless the amendments relate to

subsection 23(4A) or 23(4AA) of the SS Act, in which case they cannot

have effect after 16 April 2021. Subsections 23(4A) or 23(4AA) allow for ‘nil

rate periods’ to be determined which allow a person to be treated as a social

security payment recipient despite receiving a nil-rate due to the effect of

employment income under the income test.

The proposed instrument-making power is not as broad as

that provided under item 40A of the CER Act but still grants considerable

scope to the Minister to override the operation of the SS Act via a

legislative instrument. Such powers are referred to as Henry VIII clauses. The Senate

Scrutiny of Bills Committee generally draws attention to such clauses as

they ‘impact on the level of parliamentary scrutiny and may subvert the

appropriate relationship between the Parliament and the executive’.[102]

The powers provided under the CER Act were considered necessary given

the uncertain circumstances at the beginning of the pandemic, particularly

around parliamentary sittings and whether legislative amendments would be able

to made in response to unforeseen impacts of COVID-19. In the current

situation, the Government has made clear its intention to extend existing

policy settings for three months. Some of the provisions specified will not

require any further changes to extend the COVID-19 arrangements as they are

linked to the Coronavirus Supplement payment period (for example, the waiting

period waivers and COVID-19 qualification rules). It is unclear in this

instance why the relevant amendments cannot be made via legislation without the

need for a Henry VIII clause.

The specific provisions the instrument-making power will

apply to are:

- the

nil-rate period provisions (subsections 23(4A) and (4AA) of the SS Act)

- the

qualifying residency requirement for Parenting Payment—which has a similar

impact as the newly arrived resident’s waiting period that applies to other

payments (paragraph 500(1)(d) and subsections 500(3) and (4) of the SS Act)

- the

newly arrived resident’s waiting period and seasonal work preclusion periods

for JobSeeker Payment, Parenting Payment, Youth Allowance, Austudy and Special

Benefit, and the ordinary waiting period for JobSeeker Payment, Parenting

Payment and Youth Allowance (sections 500WA, 500WB, 500X, 500Y, 500Z, 549CA,

549CB, 549D, 549E, 553C, 575D, 575E, 575EA, 620, 621, 623A, 623B, 633, 739A and

745M of the SS Act)

- the

special COVID-19 qualification rules for Youth Allowance and JobSeeker Payment

(subsections 540BA(4) and 593(8) of the SS Act)

- provisions

relating to working out whether a JobSeeker Payment is a member of couple (in

Parts 2.12 and 3.6 of the SS Act)

- the

income free area and taper rate components of the rate calculators for Youth

Allowance (Other) and JobSeeker Payment (at sections 1067G and 1068)

- the

rules relating to pension eligibility while a recipient is absent from

Australia—known as pension portability (at section 1216, Division 3 of Part 4.2

and clause 128 of Schedule 1A of the SS Act)

- the

continuing qualification rules for Mobility Allowance (section 1046 of the SS

Act) and

- the

rate calculator for former Wife Pension recipients who have transitioned to

JobSeeker Payment (subsection 654(3) of the SS Act).

Proposed subsection 1262(3) provides that the

Minister ‘must be satisfied’ that any determination made to vary the above

provisions is ‘in response to circumstances relating to the coronavirus known

as COVID-19’.

Proposed subsection 1262(5) provides that the

determination may specify that a person is taken to have done a specified thing

before the determination commences—that is, any modification to the provisions

listed above could have a retrospective effect.

Item 45 is a transitional provision that provides

that any determination made under proposed subsection 1262 of the SS Act

modifying Module G of Benefit Rate Calculator B in section 1068, in relation to

working out the rate of Jobseeker Payment, is disregarded for the purposes of

working out if an individual meets the Health Care Card income test at section

1071A. The Health Care Card income test is linked to the JobSeeker Payment

income test and any modification of the income free area or taper rate for

JobSeeker Payment could affect Health Care Card eligibility.

Part

5—Extending the period a residence is the person’s principal home

The social security assets test excludes the value of a

person’s principal home.[103]

The definition of ‘principal home’ allows for temporary absences from that home

for up to 12 months. The home will be included in the assets test following an

absence of more than 12 months except where an extended exemption period is

granted. Extensions only apply in situations where the home has been lost or

damaged and specific criteria are met.[104]

Item 47 inserts proposed subsection 11A(9B)

into the SS Act to provide the Secretary of the Department of Social

Services with the discretionary power to extend the allowable absence period

where an individual:

- is

absent from Australia

- the

absence is temporary and

- the

person is unable to return to Australia before the end of the 12-month period

or an extension period granted under the existing provisions due to

circumstances beyond the person’s control.

No limit is placed on the length of the absence period the

Secretary can set.

International border closures and limits on overseas

travel resulting from COVID-19 are given as reasons for these amendments but

the discretionary power could be used in circumstances that are not related to

COVID-19.[105]

The application provision at item 48 enables the

amendments to apply on or after commencement; or, in situations where the

period of absence overseas commenced prior to commencement and the allowable

absence period (12 months or an extension granted under existing provisions)

ends on or after 11 March 2020.

Similar amendments are made by items 49–51 to the VE

Act in order to provide a discretionary power to the Repatriation

Commission to extend the allowable temporary absence period from a principal

home. This will enable recipients of asset-tested veterans’ payments such as

the Service Pension to have their absence period extended when they are

overseas and unable to return to Australia due to circumstances beyond their control.

Part

6—Continuation of Social Security (Coronavirus

Economic Response—2020 Measures No. 5) Determination 2020

The Social Security

(Coronavirus Economic Response—2020 Measures No. 5) Determination 2020 is

an instrument made under item 28 of Schedule 2 to the Coronavirus

Economic Response Package Omnibus (Measures No. 2) Act 2020 (CER

No. 2 Act). The determination amends section 204A of the Social Security

(Administration) Act 1999 (the SS Admin Act) to allow the

Secretary of the Department of Social Services to obtain information on

JobKeeper Payment and entitlements to JobKeeper Payment from the Commissioner

of Taxation.

The Social Security

(Coronavirus Economic Response—2020 Measures No. 12) Determination 2020 modified

the No. 5 Determination to also allow for the disclosure of protected

information under the SS Admin Act to taxation officers for the purposes of administering the Coronavirus

Economic Response Package (Payments and Benefits) Act 2020 or rules made

under that Act (the Act and Rules provide for the payment of JobKeeper

Payment). The No. 12 Determination also added additional purposes for the

sharing of JobKeeper Payment information with the Secretary of the Department

of Social Services including research, statistical analysis, policy

development, and service delivery to ensure correct payment entitlements.

Subitem 28(4) of Schedule 2 to the CER No. 2 Act

provides that any determination made under item 28 has no operation after 28

March 2021. Subitem 28(5) repeals the item at the end of

28 March 2021. Subitem 52(1) reverses the effect of these

subitems to allow item 1A of Schedule 1 to the No. 5 determination to

continue to operate after 28 March 2021. That item modifies section 202 of

the SS Admin Act, which sets out how protected information may be

obtained and dealt with, by providing that a person may disclose protected

information to a taxation officer for the purposes of administering the Coronavirus

Economic Response Package (Payments and Benefits) Act 2020 or rules made

under that Act. No time limit is placed on the continued operation of the modified

provision.

Subitem 52(2) allows the continued use of information

provided to the Secretary by the Commissioner of Taxation in relation to

entitlement to Jobkeeper, including tax file numbers, before 29 March 2021.

Subitem 52(3) allows the continued use, disclosure and

publication of aggregated information produced from information provided to the

Secretary by the Commissioner of Taxation in relation to entitlement to

Jobkeeper. The Department of Social Services has not published any detailed

statistics using this data to date.