Introductory Info

Date introduced: 13 May 2020

House: House of Representatives

Portfolio: Agriculture, Water and the Environment

Commencement: Sections 1-3 on Royal Assent; all remaining provisions on the earlier of a day to be fixed by Proclamation or six months after Royal Assent

Purpose of

the Bill

The purpose of the Primary Industries (Customs) Charges

Amendment (Dairy Cattle Export Charge) Bill 2020 (the Bill) is to amend the Primary Industries

(Customs) Charges Act 1999 (the Customs Charges Act) to:

- provide

for the imposition of an export charge on the export of dairy cattle and

- amend

the rate provision to provide for two different rates of charges—a per head

charge on dairy cattle and a per kilogram charge on cattle other than dairy

cattle.[1]

Background

LiveCorp (the Australian Livestock Export Corporation

Limited) is fully owned by Australian livestock exporters through the Australian

Livestock Exporters’ Council (ALEC). It is responsible for identifying and

supporting research and development initiatives in the interests of livestock

exporters, developing and administering industry standards, accrediting

livestock exporters against those standards, and providing training for people

in the industry.[2]

In 2006, LiveCorp established a Dairy Cattle Export

Program which was funded by voluntary levies on exported dairy cattle.[3]

At the time of introduction, the charge amounted to $3 per head, although this

was increased to $6 per head in 2014.[4]

The Dairy Cattle Export Program provides advice and

support for market

access,[5]

conducts research

and development[6]

for dairy cattle exports and participates on and provides funding to the National

Arbovirus Monitoring Program[7]

to underpin market access opportunities.[8]

The Dairy Cattle Export Program priorities include animal health and welfare,

supply chain efficiency and regulatory performance and market access.[9]

Problems

with the voluntary levy

In a written submission to the Senate Standing Committee on

Rural and Regional Affairs and Transport Inquiry into industry structures and

systems governing the imposition of and disbursement of marketing and research

and development (R&D) levies in the agricultural sector,[10]

LiveCorp stated:

LiveCorp’s experience in maintaining a voluntary levy based

program has provided some insights into the challenges it presents for the

management of the program and the industry, including:

- The fluctuating and unreliable

funding and cash flow, which limits effective budgeting and resource

allocation;

- The limitations on long term

corporate engagements, such as recruitment and contracting;

- The efficiency losses through monitoring,

identifying and chasing payments;

- The inability to enter into

long-term, strategic or higher cost projects;

- Managing the risks of

over-servicing the program or the levy payers beyond the levy payments

received;

- Managing the expectations from

levy payers and stakeholders that exceed the capacity of the program; and

- Under a voluntary contribution

arrangement, it is more difficult to get consistent payment across a group of

levy payers for industry good functions, as potential levy payers often have

expectations linked to the service or benefits received by their individual

businesses.

These challenges have constrained LiveCorp from successfully

integrating the dairy program into its routine operations or meeting the

expectations of stakeholders...[11]

These comments essentially foreshadowed the need for the

levy to be made mandatory, rather than voluntary. During 2019 the industry

exported just over 90,000 head of live dairy cattle with a value of over $100

million. The revenue collected in 2019 through the voluntary charge was just

over $15,000, while the potential revenue collection would have been over

$550,000 if a Dairy Cattle Export Charge set at $6 per head was mandatory. As a

result, a stand-alone dairy cattle export program has become unfeasible and

cannot be continued into the future under current arrangements.[12]

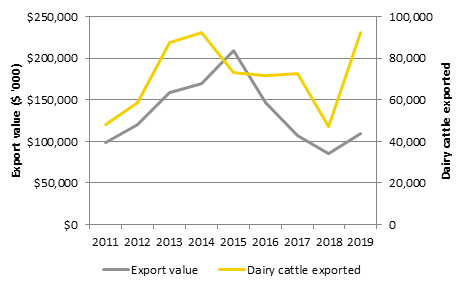

Graph 1 below shows the number of live dairy cattle exported between 2011 and

2019, and the value of those exports.

Graph 1:

Live dairy cattle exports and value: 2011 to 2019

Source: The number of dairy cattle exported was supplied by the

Australian Livestock Export Corporation Limited and the export value is based

on DFAT, Trade

Statistical Pivot Tables, Australia AHECC export pivot table.

The collection of voluntary charges as a percentage of

potential revenue from a mandatory levy has declined from 92 per cent in 2011

to three per cent in 2019. This is shown in Table 1 below.

Table 1:

Cattle exported, revenue collected and potential revenue: 2011 to 2019

|

Cattle exported (head)

|

Charge rate

($ per head)

|

Collected revenue ($)

(voluntary charge)

|

Potential revenue ($)

(mandatory levy)

|

Collected revenue

potential revenue

(per cent)

|

|

2011

|

48,253

|

$3

|

$133,014

|

$144,759

|

92%

|

|

2012

|

58,773

|

$3

|

$95,796

|

$176,319

|

54%

|

|

2013

|

87,422

|

$3

|

$133,324

|

$262,266

|

51%

|

|

2014

|

92,340

|

$6

|

$149,578

|

$554,040

|

27%

|

|

2015

|

73,217

|

$6

|

$176,436

|

$439,302

|

40%

|

|

2016

|

71,907

|

$6

|

$164,358

|

$431,442

|

38%

|

|

2017

|

72,811

|

$6

|

$78,942

|

$436,866

|

18%

|

|

2018

|

47,017

|

$6

|

$38,892

|

$282,102

|

14%

|

|

2019

|

92,347

|

$6

|

$15,132

|

$554,082

|

3%

|

Source: Data supplied by the Australian Livestock Export

Corporation Limited

Consultation

In May 2018, ALEC recommended that a statutory Dairy

Cattle Export Charge be implemented at a rate of $6 per head, payable at the

point of export and collected monthly.[13]

The rationale for the proposal was that ‘[d]ue to the nature of the voluntary

arrangement, the Dairy Cattle Export Charge is significantly (and historically)

under-collected and is not sufficient to meet the R&D and marketing needs

of the dairy cattle export sector’.[14]

According to the Explanatory Memorandum to the Bill, ALEC

undertook stakeholder consultation about a statutory Dairy Cattle Export Charge

of $6 per head from 31 May to 13 October 2017.[15]

In a ballot held in December 2017, ‘the majority of eligible registered voters’

supported the proposed mandatory charge.[16]

Eligible voters were those that held a current Australian Government-issued

livestock export license.[17]

The result was that 80 per cent of voters supported the imposition of the levy.[18]

A further six-week objection period from 5 October to 16

November 2018 provided stakeholders with an additional opportunity to express

their views on the proposal. The Explanatory Memorandum advises that ‘[t]here

were no objections received’.[19]

The imposition of the Dairy Cattle Export Charge will

enable the stand-alone Dairy Cattle Export Program to continue into the future.

Committee

consideration

At its meeting of 13 May 2020, the Senate Standing

Committee for the Selection of Bills deferred consideration of the Bill.[20]

Senate

Standing Committee for the Scrutiny of Bills

At the time of writing this Bills Digest, the Senate

Standing Committee on the Scrutiny of Bills had not commented on the Bill.

Policy

position of non-government parties/independents

At the time of writing this Bills Digest no comments on

the Bill by non-government parties or independent Members and Senators have

been identified.

Position of

major interest groups

During its stakeholder consultation period, ALEC consulted

with its licenced livestock exporter members and its state chapter members.

During the course of their consultations two objections were raised by dairy

cattle exporters, namely:

- the

proposed $6 export charge should be applied to all cattle exported as ‘breeder’

animals and

- the

levy rate of $6 per head is too high and that it should be implemented at a

rate of $4 per head.[21]

Despite these concerns, the result of the final vote was,

as stated above, 80 per cent support for the imposition of the levy.[22]

Financial

implications

The Explanatory Memorandum to the Bill states:

This measure is estimated to have a nil net financial impact

over the forward estimates period.

Costs associated with the collection and administration of

the Dairy Cattle Export Charge are to be cost-recovered from industry by the

Department of Agriculture, Water and the Environment.[23]

However, the ALEC estimated that the Australian Government

will match R&D funding with $1 for every head of dairy cattle exported.[24]

Based on the data in the background section, this could have an impact over the

forward estimates of between $50,000 to $90,000 per year.

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed

the Bill’s compatibility with the human rights and freedoms recognised or

declared in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[25]

Parliamentary Joint Committee on Human Rights

The Parliamentary Joint Committee on Human Rights had no

comment on the Bill.[26]

Key issues

and provisions

The Customs Charges Act authorises the imposition

of primary industries charges that are duties of customs. The Act provides for

the operative rates of charges to be set through Regulations.[27]

Each of the Schedules to the Customs Charges Act

imposes a particular charge and makes provision for:

(a) the operative rate of

the charge

(b) the person who is

liable to pay the charge and

(c) any exemptions

from the charge.

Schedule 2 to the Customs Charges Act is about

cattle exporters. Schedule 2 specifies:

- the

term cattle means bovine animals other than buffalo and

- the

term dairy cattle means bovine animals that are,

or, if they were not exported from Australia, would be likely to be, held on

licensed dairy premises for a purpose related to commercial milk production,

including but without limiting the generality of the above, bulls, calves and

replacement heifers.

Imposition

of charge

Currently subclause 2(1) of Schedule 2 imposes a charge on

the export of cattle (other than dairy cattle) from Australia. Item 1 of

the Bill inserts proposed subclause 2(1A) into Schedule 2 so that a

charge is imposed on the export of dairy cattle from Australia.

Rate of

charge

Under existing clause 3 of Schedule 2 the rate of the

charge is calculated by reference to amounts per kilogram of cattle that are

exported.

Items 2 and 3 of the Bill amend clause 3 to

differentiate the manner in which the rate is calculated for export of cattle

and export of dairy cattle. Proposed paragraphs 3(1)(a) and 3(1)(b)

provide that the rate of charge imposed on the export of cattle is the sum of:

- for

cattle other than dairy cattle—the amounts prescribed by kilogram of cattle

exported and

- for

dairy cattle—the amounts prescribed per head of cattle exported.

The notes to clause 3 are unchanged. They state that,

under the Australian

Meat and Live-stock Industry Act 1997, the amounts paid under paragraph

3(1)(a) are destined for the live-stock export marketing body whilst the

amounts paid under paragraph 3(1)(b) are destined for the live-stock

export research body.[28]

LiveCorp is the declared livestock export and marketing body.[29]

Regulations

Clause 5 of Schedule 2 to the Customs Charges Act

provides for the making of Regulations about customs charges for cattle exporters.

Items 4–10 of the Bill amend clause 5 to:

- allow

the Regulations to prescribe amounts for charges in respect of the export of

cattle (other than dairy cattle) and dairy cattle

- require

the Minister to take into account recommendations from the declared livestock

export marketing body and the declared livestock export research body about the

prescribed rate of marketing and R&D charges on exported cattle (including

dairy cattle) and

- prevent

Regulations from prescribing a charge rate that is higher than the rate

recommended above.