Introductory Info

Date introduced: 26 February 2020

House: House of Representatives

Portfolio: Education

Commencement: Sections 1 to 3 on Royal Assent. Items 1–6 of Schedule 1 on 1 July 2021. Item 7 of Schedule 1 on 13 December 2019. Item 8 of Schedule 1 on 16 December 2019. Schedule 2 on the first Child Care Subsidy fortnight that begins after Royal Assent.

Purpose of

the Bill

The purpose of the Family

Assistance Legislation Amendment (Improving Assistance for Vulnerable and

Disadvantaged Families) Bill 2020 (the Bill) is to amend the A New Tax System

(Family Assistance) Act 1999 (the FA Act) and the A New Tax System

(Family Assistance) (Administration) Act 1999 (the FA Admin Act)

to:

- make

it easier for child care providers and families to access the Additional Child

Care Subsidy (child wellbeing) which assists with the costs of child care for

children at risk of serious abuse or neglect

- change

how an individual whose relationship status changes during a financial year has

their adjusted taxable income assessed for the Child Care Subsidy (CCS)

reconciliation process which occurs at the end of the financial year and

- make

other technical amendments and corrections.

The amendments were not announced prior to the Bill being

introduced. The main changes affecting Additional Child Care Subsidy (child

wellbeing) will commence 1 July 2021. The changes to the CCS reconciliation

process will affect reviews of CCS entitlements paid in the 2019–20 financial

year onwards.

The amendments will result in a small net saving to the

government with costs to Services Australia to implement the changes estimated

at $22.3 million and changes to the CCS reconciliation process providing

savings of $24.0 million.[1]

Coronavirus

Economic Response Package Omnibus (Measures No. 2) Act 2020

The amendments proposed in Schedule 2 of the Bill, relating

to the reconciliation process for individuals whose relationship status changes

during a financial year, have subsequently been legislated under the Coronavirus

Economic Response Package Omnibus (Measures No. 2) Act 2020.[2]

The Coronavirus

Economic Response Package Omnibus (Measures No. 2) Bill 2020 was introduced

and passed by the Parliament on 8 April 2020.[3]

Accordingly the Bill will need to be amended to remove Schedule 2.

Structure of

the Bill and the Bills Digest

The Bill contains two schedules providing for distinct

changes to different components of the child care fee assistance system. The

Bills Digest provides general background to Australian Government funding of

child care and addresses the key issues and provisions of each schedule separately.

The Bills Digest contains analysis of the amendments in Schedule 2 despite the

amendments being subsequently enacted via the Coronavirus

Economic Response Package Omnibus (Measures No. 2) Act 2020.

Background

Australian Government funding for child care

The Australian Government provides child care fee

assistance to families and direct assistance to services to improve equity of

access to child care services, encourage and support the participation of women

in the workforce and improve the quality of early childhood education and care

(ECEC) in order to assist with children’s development.[4]

Pre-July 2018 fee assistance: Child Care Benefit and Child

Care Rebate

Prior to July 2018, the two main forms of fee assistance

were the Child Care Benefit and Child Care Rebate. These payments were paid to

families using approved child care services (services which met certain

eligibility requirements such as compliance with state and territory regulatory

requirements under the National Quality Framework).[5]

Child Care Benefit was means tested and rates were based on family income,

hours of care used, type of care used, and whether parents met the work,

training or study test.[6]

Child Care Benefit could be paid via a family’s child care provider as a fee

reduction, or as a lump sum paid to the family at the end of the financial

year.

Child Care Rebate was not means tested and covered 50 per

cent of out-of-pocket costs (after deducting Child Care Benefit) up to a

maximum amount per child per financial year. Child Care Rebate could also be

paid via providers as a fee reduction or directly to families (either

fortnightly or as an annual lump sum).[7]

Post-July 2018 fee assistance: Child Care Subsidy

From 2 July 2018, these two payments were merged into a

new payment known as the Child Care Subsidy (CCS).[8]

The CCS is means tested with rates of payment based on family income, hours of

care used, type of care used, and parents’ level of work, training or study. A

maximum hourly amount payable via the subsidy is set by the Government with

families receiving a percentage of this rate or a percentage of their child

care fees, based on the factors listed above. The payment is paid directly to

providers to be delivered to families in the form of a fee reduction.

The CCS can be paid for Centre Based Day Care, Outside

School Hours Care, Family Day Care and In Home Care but different rates of

assistance are offered depending on the kind(s) of care used.[9]

Child care services must meet certain conditions to be approved to pass on the

CCS; this includes any regulatory requirements set by state and territory

authorities under the National Quality Framework.

Additional Child Care Subsidy is a top-up payment

available to families in special circumstances (see section below).[10]

Direct support to providers

The Australian Government also provides direct support to

child care services to assist with the establishment and running costs of

services in areas where they may otherwise be unviable, for delivering services

to children with disability or other special needs, and to assist with

professional development.[11]

These supports are provided under the Department of Education’s

Community Child Care Fund program. The fund consists of different grant

categories—open competitive grants, restricted non-competitive grants (for

specified services, primarily those previously funded under the Budget Based

Funded program which provided assistance to Indigenous, regional and remote

services), the Connected Beginnings Program and special circumstances grants

(for services that have experienced a natural disaster or other unexpected

event).[12]

Temporary

funding changes in response to the COVID-19 pandemic

In response to the COVID-19 pandemic, the Government

temporarily suspended the CCS funding arrangements from 6 April 2020.[13]

Under the new funding arrangements child care services will receive a weekly

‘business continuity payment’ equivalent to 50 per cent of fees charged (up to

the CCS hourly fee cap) for sessions of care in the fortnight proceeding 2

March 2020 (17 February 2020 to 28 February 2020). The

payment for vacation care services will be based on the first fortnight of

revenue in the school holidays between Term 3 and 4 of 2019.[14]

This will mean services can receive a payment worth up to half of their

pre-pandemic fee revenue.

The new system will be reviewed after one month and an

extension will be considered after three months.[15]

In order to be eligible for this new payment, a child

care service must:

- stay

open with at least one child actively enrolled (except where the service is

made to close on public health advice or for other health and safety reasons)

- not

charge families any fees

- continue

and prioritise care for children of essential workers, vulnerable and

disadvantaged children and previously enrolled children

- comply

with other regulatory requirements under the National Quality Framework and the

conditions for approval for the CCS.[16]

Some providers and their employees may be eligible for

JobKeeper Payment.[17]

In exceptional circumstances, providers may be able to apply for additional

funding under the new child care funding arrangements but this would be decided

on a case by case basis.[18]

Detailed information on the Child Care Subsidy

Child Care Subsidy

CCS eligibility

For a person to be eligible for the CCS, their child must:

- be

a ‘Family Tax

Benefit child’[19]

or ‘regular

care child’[20]—this

essentially means that the child must an Australian resident and in the adult’s

care for at least 14 per cent of the time

- be

13 or under and not attending secondary school and

- meet

immunisation requirements.[21]

The claimant, and/or their partner, must:

- meet

residency requirements and

- be

liable to pay for the child care provided by an approved provider.[22]

Some exemptions from these requirements can apply in

special circumstances. For example, Services Australia can waive the residency

requirements in certain circumstances.[23]

Activity test

The activity test determines how many hours of child care

a claimant can receive CCS for. This depends on how much time a single parent

or both partners in a couple/two-parent family undertake recognised activities:

these include paid work, study, training or volunteering.[24]

For couple/two-parent families, the maximum number of hours of subsidised care

a person can receive is calculated using the person with the lowest level of

activity. See Table 1 for a breakdown.

Table 1: Child Care Subsidy Activity test

| Hours of recognised activity (per fortnight) |

Maximum number of hours of CCS (per fortnight) |

| 8 hours to 16 hours |

36 hours |

| More than 16 hours to 48 hours |

72 hours |

| More than 48 hours |

100 hours |

Source: Department of Social Services (DSS), ‘3.5.2.10 CCS

– activity test – general’, Family assistance guide, DSS website, last

reviewed 20 March 2020.

Families that earn $68,163 or less in 2019–20 and do fewer

than eight hours of recognised activities in a fortnight are able to access 24

hours of subsidised care per fortnight.[25]

Families that do not meet the activity test and have a child/children attending

a preschool program provided by a centre-based Long Day Care centre are able to

access 36 hours of subsidised care (however, this only applies to the child

attending the preschool program).[26]

A range of other exemptions are available for families in

certain circumstances (such as disability or care requirements).[27]

Income test

The activity test determines for how many hours of care a

person is eligible to receive the CCS. The income test determines the rate of

CCS a person will receive for the hours they are eligible under the activity

test. The CCS will pay a percentage of the child care fee or a percentage of

the hourly ‘rate cap’, whichever is lower. The income test determines the

percentage paid. The current hourly rate caps are set out in Table 2.

Table 2: Child Care Subsidy hourly rate caps

| Type of child care |

Hourly rate cap |

| Centre Based Day Care—long

day care and occasional care |

$11.98 (for below

school-aged children) |

| Family Day Care |

$11.10 |

| Outside School Hours Care—before

and after school, and vacation care |

$10.48 (for school-aged

children) |

| In Home Care - per family |

$32.58 |

Source: DSS, ‘3.5.3 CCS –

hourly rate caps’, Family assistance guide, DSS website, last

reviewed 1 July 2019.

The income test assesses the combined adjusted taxable

income of the family. Adjusted taxable income is the sum of taxable income,

adjusted fringe benefits, target foreign income, net investment losses, tax

free pensions or benefits and reportable superannuation contributions less any

child maintenance expenditure.[28]

Table 3 shows the applicable percentage by income range for 2019–20. These

amounts are adjusted based on movements in the Consumer Price Index on 1 July

of each year.[29]

Table 3: Child Care Subsidy income test

| Combined annual adjusted taxable income |

Applicable CCS percentage of the actual fee charged or

the relevant hourly rate cap (whichever is lower) |

| Equal to or below $68,163 |

85% |

| Above $68,163 and below $173,163 |

Decreasing from 85% to 50% Subsidy decreases by 1% for each $3,000 of family income |

| Equal to or above $173,163 and below $252,453 |

50% |

| Equal to or above $252,453 and below $342,453 |

Decreasing from 50% to 20% Subsidy decreases by 1% for each $3,000 of family income |

| Equal to or above $342,453 and below $352,453 |

20% |

| Equal to or above $352,453 |

0% |

Source: DSS, ‘3.5.1 CCS – combined annual ATI’, Family assistance guide, DSS website,

last reviewed 1 July 2019.

Annual cap

If a family earns more than $188,163 per year (and less

than $352,453) then the total amount of CCS they can receive in 2019–20 is $10,373

per child.[30]

Families earning less than $188,163 per year do not face a cap. Families

earning over $352,453 cannot receive any CCS under the income test.

Additional

Child Care Subsidy

Additional Child Care Subsidy (ACCS) provides targeted

assistance to families/children facing barriers to accessing child care.[31]

There are four categories of the ACCS:

- child

wellbeing—aimed primarily at children at risk of abuse or neglect

- grandparent—for

grandparent carers who receive income support (such as a pension) and who are

the principal carer of children

- temporary

financial hardship—for those experiencing significant financial stress due to

exceptional circumstances and

- transition

to work—for those receiving certain income support payments such as Parenting

Payment, Newstart Allowance or Disability Support Pension and who have a Job

Plan (employment pathway plan) in effect.[32]

The child wellbeing, grandparent and temporary financial

hardship categories of ACCS allow eligible families to receive a subsidy equal

to the actual fee charged by their child care service (up to 120 per cent of

the hourly rate cap—see Table 1 above) for up to 100 hours per fortnight and be

exempt from the activity test. The transition to work category provides a

subsidy equal to 95 per cent of the actual fee charged (up to 95 per cent

of the hourly rate cap) with subsidised hours determined by the activity test.[33]

Committee

consideration

Senate

Standing Committee for the Selection of Bills

The Senate Standing Committee for the Selection of Bills recommended

the Bill not be referred to a committee.[34]

Senate

Standing Committee for the Scrutiny of Bills

The Senate Standing Committee for the Scrutiny of Bills

raised concerns with the retrospective application of certain amendments in

Schedules 1 and 2.[35]

The Committee sought further advice from the Minister for Education as to why

the retrospective application was necessary and justified. At the time of

writing, the Committee does not appear to have received a response from the

Minister.[36]

Policy

position of non-government parties/independents

At the time of writing, non-government parties and independents

had not commented on the Bill.

Position of

major interest groups

At the time of writing, major stakeholder groups had not

commented on the Bill.

Financial

implications

According to the Explanatory Memorandum, information

technology implementation of the proposed amendments will cost $22.3 million

over the period 2019–20 to 2023–24. The amendments in Schedule 2 will provide

savings of $24.0 million over the forward estimates (2019–20 to 2022–23). The

Explanatory Memorandum does not provide an estimate for the net fiscal impact

of the proposed amendments over the forward estimates.[37]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights (Parliamentary

Scrutiny) Act 2011 (Cth), the Government has assessed the Bill’s

compatibility with the human rights and freedoms recognised or declared in the

international instruments listed in section 3 of that Act. The Government

considers that the Bill is compatible.[38]

Parliamentary

Joint Committee on Human Rights

The Parliamentary Joint Committee on Human Rights had no

comment on the Bill.[39]

Key issues

and provisions

Schedule 1—ACCS

(child wellbeing) and technical amendments

Schedule 1 of the Bill proposes a number of amendments to

improve access to ACCS (child wellbeing) for providers and families.

ACCS (child wellbeing) is paid in respect of children

considered at risk of serious abuse or neglect and provides a subsidy equal to

the actual fee charged by a child care service (up to 120 per cent of the

hourly rate cap) for up to 100 hours per fortnight. Individuals eligible for

ACCS—child wellbeing are exempt from the activity test.[40]

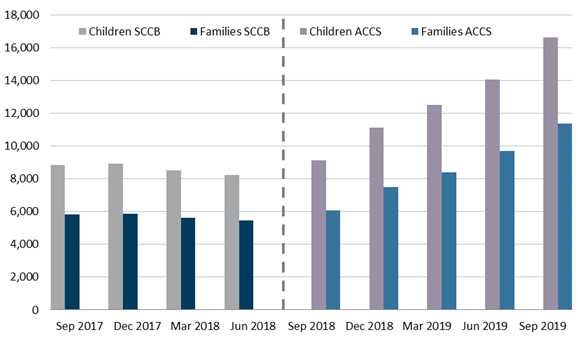

There was a marked increase in the number of children for

whom ACCS (child wellbeing) was paid over the first year of the new child care fee

assistance system (Table 4 and Figure 1). This is also a significant increase

compared to the number of children accessing the previous fee assistance

payment aimed at children at risk of abuse and neglect: Special Child Care

Benefit—child at risk (note that the payments are not directly comparable due

to different policy settings). In response to questions on the reason for the

increase in recipients, the Department of Education cited its promotion of ACCS

(child wellbeing) and specific eligibility criteria allowing for foster carers

to access the payment.[41]

Table 4:

Special Child Care Benefit-child at risk and Additional Child Care Subsidy

(child wellbeing) recipients, September 2017–September 2019

|

Special Child Care Benefit—child at risk

|

|

Date

|

Children

|

Families

|

|

September 2017

|

8,820

|

5,800

|

|

December 2017

|

8,920

|

5,870

|

|

March 2018

|

8,530

|

5,600

|

|

June 2018

|

8,220

|

5,460

|

|

Additional Child

Care Subsidy (child wellbeing)

|

|

Date

|

Children

|

Families

|

|

September 2018

|

9,140

|

6,070

|

|

December 2018

|

11,140

|

7,490

|

|

March 2019

|

12,510

|

8,390

|

|

June 2019

|

14,070

|

9,710

|

|

September 2019

|

16,610

|

11,360

|

Sources: September 2017–June 2018 data from Senate Education

and Employment Legislation Committee, Answers to Questions on Notice, Education

Portfolio, Supplementary Budget Estimates 2019–20, 24 October 2019, Question

no. SQ19-000478; September 2018–September 2019 from Department of

Education, Skills and Employment (DESE), ‘Child

care data for September quarter 2019’ DESE, Canberra, December 2019.

Figure 1:

Special Child Care Benefit (SCCB)—child at risk and Additional Child Care

Subsidy (ACCS) (child wellbeing) recipients, September 2017–September 2019

Sources: September 2017–June 2018 data from Senate Education

and Employment Legislation Committee, Answers to Questions on Notice, Education

Portfolio, Supplementary Budget Estimates 2019–20, 24 October 2019, Question

no. SQ19-000478; September 2018–September 2019 from Department of

Education, Skills and Employment (DESE), ‘Child care in

Australia’ quarterly reports, DESE website.

Eligibility for ACCS (child wellbeing)

Individual

eligibility

An individual (such as a parent or carer) is eligible for

ACCS (child wellbeing) where they are eligible for CCS for that session of care

and:

- either

a certificate has been given under section 85CB of the FA Act, or a

determination made by the Secretary under section 85CE is in effect and

- none

of the limitations to eligibility for the ACCS (child wellbeing) under Division

5 of Part 4A of the FA Act applies.[42]

A certificate under section 85CB of the FA Act is

made by a child care provider where it considers that a child is at serious

risk of abuse or neglect. Currently, a provider cannot issue a certificate

where it would mean that:

- in

any period of 12 months, certificates given by the provider for the same child

at the same service would be in effect for more than six weeks[43]

or

- during

the first week the certificate applies, the total number of children accessing

ACCS (child wellbeing) at the child care service is more than 50 per cent of

the total number of children being cared for by the service (known as the ‘50

per cent rule’).[44]

Where a provider is unable to issue a certificate because

of the time limit or the 50 per cent rule, the provider may apply to Services

Australia to make a determination under section 85CE that a child is at risk of

serious abuse or neglect so that ACCS (child wellbeing) is therefore payable in

respect of that child’s sessions of care.[45]

Applications for an ongoing increase in the percentage (above 50 per cent) can

also be made by a child care provider—such applications are made to the

Department of Education, Skills and Employment.[46]

The Department of Education, Skills and Employment may, at

any time, increase or decrease the percentage limit that applies to a

particular service, based on evidence previously submitted by the provider or

compliance data analysis.[47]

The Secretary may also prescribe a different percentage to apply across the

board.[48]

Certificates issued by a provider under section 85CB must

specify the day that it takes effect. Paragraph 85CB(2)(c) specifies that this

must be a Monday of a week that includes a day where the child was considered

at risk of serious abuse or neglect, and that the commencement day cannot be

more than 28 days before the day the certificate is issued.

As a result of amendments made by the Family Assistance

Legislation Amendment (Building on the Child Care Package) Act 2019,

commencing on 13 July 2020, the 50 per cent rule will no longer apply.[49]

The amendments will only limit the number of certificates that can be issued by

a provider when the Secretary of the Department of Education, Skills and

Employment has determined a particular percentage should apply to a particular

service. If the Secretary has not made such a determination, then providers are

not limited in the percentage of ACCS (child wellbeing) certificates they can

issue.

Provider

eligibility

A provider is eligible for ACCS (child wellbeing) for a

session of care which is delivered by the provider where:

- a

certificate has been given under section 85CB of the FA Act, or a

determination made by the Secretary under section 85CE is in effect—that is, the

provider has given the Secretary a certificate stating the child is or was at

risk of serious abuse or neglect or the Secretary has otherwise determined this

to be the case

- the

provider is not able to identify an individual who is eligible for CCS for the

session of care

- the

child meets the age and immunisation requirements for CCS and

- none

of the limitations to eligibility for the ACCS (child wellbeing) under Division

5 of Part 4A of the FA Act applies.[50]

Proposed

changes

Schedule 1 of the Bill makes a number of amendments to

make the ACCS (child wellbeing) easier to access. The Explanatory Memorandum

states that these amendments are intended to ‘address feedback’ from the child

care sector.[51]

The proposed changes include:

- allowing

providers to be considered eligible for ACCS (child wellbeing) in respect of a

child who is considered part of a class prescribed in the Minister’s Rules,

including children in foster care arrangements

- extending

the period that ACCS (child wellbeing) certificates can be backdated from a

maximum of 28 days to 13 weeks as prescribed by the Minister’s Rules and

- extending

the maximum period for an ACCS (child wellbeing) determination from 13 weeks to

up to 12 months for classes of children prescribed in the Minister’s Rules.[52]

The changes will commence from 1 July 2021.[53]

Provider

eligibility for ACCS (child wellbeing)

This measure will allow for a provider to be considered

eligible for ACCS (child wellbeing) in respect of a child who is considered

part of a class prescribed in the Minister’s Rules. The Explanatory Memorandum

states that it is expected that this class will include children in formal

foster care arrangements.[54]

As described above, currently, in order to be eligible to

claim ACCS (child wellbeing) in respect of a child, the provider must not be

able identify an individual who is eligible for CCS in respect of that session

of care. The proposed amendments will remove this requirement where the child

is a member of a class prescribed by the Minister’s Rules.

The intent of the amendment is to ensure providers can

care for a child at risk of abuse or neglect while a foster family determines

its eligibility for CCS (and potentially ACCS).[55]

That is, currently providers might be able to identify a foster family as

eligible for CCS but the foster family may not have had time to establish or

claim its entitlement. The amendment will enable a continuity of care for these

children where they may be transitioning to or between different out of home

care arrangements.

Item 1 of Schedule 1 repeals paragraph 85CA(2)(b)

and inserts new paragraphs 85CA(2)(b) and (ba) to provide that in order

for a child care provider to be eligible for ACCS (child wellbeing) in respect

of a session of care for a child, the provider:

- must

be not able to identify an individual who is eligible for CCS for the session

of care or

- the

child must be a member of class prescribed by the Minister’s Rules.

The existing age and immunisation requirements will

continue to apply to the child but will be set out in new paragraph

85CA(2)(ba).

Backdating

of ACCS (child wellbeing) certificates/determinations

These amendments will allow for the backdating of ACCS

(child wellbeing) certificates and determinations from the current maximum of

28 days to up to 13 weeks in certain circumstances. The circumstances are to be

set out in the Minister’s Rules. The amendments will enable backdating of

payments in situations where a provider has identified a child as at risk but

it takes longer than 28 days to provide a certificate.

Item 3 of Schedule 1 inserts new subsection

85CB(2A) which allows for the Secretary to extend the 28 day period

backdating limit for a certificate given under section 85CB if the Secretary is

satisfied that exceptional circumstances prescribed by the Minister’s Rules

exist. The extension can be to a maximum period of 13 weeks.

Item 5 inserts new subsections 85CE(5A), (5B)

and (5C)—section 85CE deals with determinations for ACCS (child wellbeing) made

by Services Australia or the Secretary of the Department of Education, Skills

and Employment because of the 12 month or 50 per cent rule.[56]

New subsection 5B provides for the Secretary to extend the 28 day

backdating limit for a determination made under section 85CE to a period of no

more than 13 weeks where the Secretary is satisfied that exceptional

circumstances set out in the Minister’s Rules exist.

The Explanatory Memorandum states that ‘the exceptional

circumstances are anticipated to be circumstances which are outside the

provider’s control and made it impractical for the provider to provide the

certificate or apply for a determination within the required timeframes’.[57]

Extension of

maximum ACCS (child wellbeing) determination period

These amendments will extend the maximum period for an

ACCS (child wellbeing) determination period from 13 weeks to up to 12 months

for classes of children to be prescribed in the Minister’s Rules. The

Explanatory Memorandum states that it is expected that this class will include

children on long term child protection orders and those in formal foster care.[58]

This is intended to reduce the administrative burden on families, providers and

state and territory child protection agencies which currently have to apply for

an extension to a determination every 13 weeks.

New subsection 85CE(5C) inserted by item 5,

provides for the Secretary to extend an ACCS (child wellbeing) determination

made under section 85CE from 13 weeks duration to up to 12 months, if the

Secretary is satisfied that circumstances prescribed by the Minister’s Rules

apply in relation to the child.

Other

amendments

Items 7 and 8 clarify and correct two amendments to

the FA Admin Act made by the Family Assistance

Legislation Amendment (Building on the Child Care Package) Act 2019.

Schedule 2—Review

of certain CCS decisions

Background

Schedule 2 proposes to amend the FA Admin Act to

change how adjusted taxable income is assessed during the CCS reconciliation

process at the end of the financial year. However, the amendments proposed in

Schedule 2 of the Bill have already been enacted under the Coronavirus

Economic Response Package Omnibus (Measures No. 2) Act 2020 and the

Bill will need to be amended to remove Schedule 2.[59]

The Coronavirus

Economic Response Package Omnibus (Measures No. 2) Bill 2020 was introduced

and passed by the Parliament on 8 April 2020.[60]

For completeness, this Bills Digest provides an analysis

of Schedule 2 to the Bill.

Income test

treatment of couples

The basic components of the CCS income test are described

in the ‘Background’ section.

Under clause 3AA of Schedule 3 of the FA Act, both

members of a couple’s adjusted taxable income are assessed for the purposes of

working out a CCS entitlement. Where an individual is considered to be a member

of a couple for only part of a year, the partner’s income that is added to the

CCS claimant’s adjusted taxable income is equivalent to the proportion of the

fortnights in the financial year where they were both a couple and entitled to

CCS or ACCS.

For example, if an individual claiming CCS (P1) was in a relationship

with another person (P2) for 12 weeks in a particular financial year, and CCS

was claimed for 10 of those weeks, then 19.2% of P2’s annual income would be

included in the calculation of the CCS entitlement (which is worked out on an

annual basis but converted to a fortnightly amount).

Prior to amendments made by the Family Assistance

Legislation Amendment (Building on the Child Care Package) Act 2019,

the income test apportioned income for all the fortnights in a financial year

in which P1 and P2 were a member of a couple, irrespective of whether CCS was

being claimed for those fortnights.[61]

Reconciliation

The reconciliation process is a review of a person’s CCS

entitlement undertaken by the Secretary of the Department of Education, Skills

and Employment through Services Australia.[62]

At the end of the financial year, a person’s CCS

entitlement is reconciled through a process that compares the estimates of

their adjusted taxable income during the financial year with their actual

adjusted taxable income as assessed using the information submitted in their

tax return.[63]

Where a person is not required to submit a tax return then they must notify

Services Australia of their actual adjusted taxable income for the year

(Services Australia will be able to verify data on any income support received—such

as a pension or allowance).[64]

The reconciliation process also assesses the session reports provided by child

care providers.[65]

The reconciliation process determines whether the

individual received an accurate CCS payment, an overpayment or an underpayment.

In cases of an overpayment, a debt will be raised (which can be recovered

through reductions in future CCS payment). In cases of underpayment, a person

will receive a lump sum payment to correct the entitlement.[66]

During the financial year, an individual’s fortnightly CCS

payment will have five per cent withheld. This amount can be used to offset any

debts that arise from the reconciliation process at the end of the year or will

be paid as a lump sum to the individual.[67]

Proposed

changes

The Bill does not propose amendments to the way

entitlements are assessed and calculated during the financial year, only for

the reconciliation process at the end of the year.[68]

Schedule 2 makes the following changes to how CCS rates

are to be calculated in the reconciliation process for those who are a member

of a couple for only part of a financial year:

- the

current process for assessing partner income under clause 3AA of Schedule 3 to

the FA Act will be ignored for the purposes of the reconciliation

process

- CCS

entitlements in the financial year under review will be assessed for each

fortnight. Where a person is a member of a couple at the beginning of that

fortnight then the partner’s adjusted taxable income will be included for the

purposes of calculating the CCS rate for that fortnight (annual rate is

calculated and converted to a fortnightly rate)

- where

the annual cap is determined to apply for a fortnight in which a person is a

member of a couple, then whether the annual cap has been reached will be worked

out by adding:

- the

CCS amounts the individual has been entitled to for a particular child in the

fortnights starting that financial year and

- any

CCS their partner has been entitled to for the same child in the fortnights in

that financial year they have been members of a couple.

Currently, under paragraph 1(3)(b) of Schedule 2 to the FA

Act, CCS paid to the person’s partner is only included in determining

whether the CCS rate cap has been reached where they have been a member of a

couple for the whole of the financial year.

Impact of

the changes

The effect of these amendments is that the CCS rate

calculation process in Schedule 3 of the FA Act will assess part-year partner

income in one way (the percentage of their income equivalent to the percentage

of CCS fortnights they are a member of the couple). This will be different from

the calculation used in the reconciliation process (each CCS fortnight they are

in a couple relationship will include the partner’s annual income to calculate

an annual rate that is then converted to a fortnightly rate). The

reconciliation process will determine the actual entitlement for the financial

year.

The proposed way of assessing income for the

reconciliation process is similar to that used normally for Family Tax Benefit.

The Family Tax Benefit income test (also set out in the FA Act) allows

for rates to be calculated based on the person’s circumstances in each relevant

fortnightly period.[69]

The CCS, despite using the same income test definitions, income estimates and

reconciliation processes as Family Tax Benefit, adopted a very different

approach to considering the income of partners where circumstances had changed

during the year. The Bills Digest for the legislation that introduced the CCS

flagged the design of this part of the CCS income test as an issue stating:

As CCS is to be worked out on a fortnightly basis, it appears

this provision has been included to allow for couple rates to be calculated

based on the fortnights a couple was together in a relationship. This is

different from other family assistance payments where rates are calculated on

an annual basis divided into a daily rate. For these payments, where

circumstances change during the year such as a person entering a couple

relationship, a different rate is calculated based on the relevant period where

the circumstances are changed (a new annual rate is calculated and a new daily

rate determined).[70]

The Bill shifts the assessment of income for CCS

reconciliations purposes more in line with Family Tax Benefit but does not change

the assessment of partner income for CCS instalments made throughout the year.

It is unclear why inconsistent assessment processes will apply and what impact

this will have on reconciliation outcomes.

The amendments relating to the CCS annual cap calculation

ensure more accurate assessments are made as to whether CCS paid in respect of

a particular child has reached any annual cap, regardless of which parent/carer

claimed the CCS.

The Explanatory Memorandum states the intended effect of

the proposed amendments primarily relate to how the annual cap is applied

during the reconciliation process.[71]

The annual cap will not apply in fortnights where the individual is single and

their own income is under the annual cap income threshold, regardless of

whether the annual cap applies in other fortnights as a result of a partner’s

income being included in those other fortnights.

No information has been provided in the explanatory

materials as to how many families are expected to be affected by the amendment.

Provisions

Section 105E of the FA Admin Act sets out the

conditions for the Secretary to undertake a review of an individual’s CCS

entitlement (the reconciliation process). Item 1 of Schedule 2 inserts new

subsections 105E(4)–(7) to the FA Admin Act.

New subsection 105E(4) provides for new subsections

105E(5) and (6) to apply to the review of an individual’s CCS entitlement where

the individual has been a member of couple on one or more, but not all, of the

first Mondays in any CCS fortnights in the financial year under review.

New subsection 105E(5) mandates that the Secretary

must review the individual’s CCS entitlement for each fortnight in the

financial year as if provisions for assessing the adjusted taxable income of

members of a couple set out in paragraph 3AA(2)(b) of Schedule 3 of the FA

Act had not been enacted. This paragraph sets out how the adjusted taxable

income of the partner of the CCS claimant, where they have not been a couple

for the entire year, should be apportioned to the fortnights they were both a

couple and CCS was claimed.

New subsection 105E(6) provides that for each

fortnight the individual is a member of a couple on the first Monday in a CCS

fortnight in the financial year, their CCS rate should be worked out:

- as

if the individual’s adjusted taxable income for the year included their

partner’s adjusted taxable income and

- in

determining whether the annual CCS cap has been reached, any CCS paid to their

partner in respect of the same child during fortnights they were a couple

should be added to any CCS previously paid to the individual for the same

child.

Item 2 is an application provision. The amendments

made by item 1 are to apply for reviews of CCS entitlements starting in the

2019–20 income year and later income years. While the review process occurs at

the end of the financial year, payments for the 2019–20 income year have

already been made and the amendments affect the reconciliation process for

those payments. As noted above, the Senate Standing Committee for the Scrutiny

of Bills raised concerns about the retrospective application of the amendments

in Schedule 2.[72]