Introductory Info

Date introduced: 18 September 2019

House: House of Representatives

Portfolio: Health

Commencement: Schedules 1 to 5 commence on 1 July 2020. Schedule 6 commences immediately after schedules 1–5. All other sections commence on Royal Assent.

Purpose of the Bill

The purpose of the Medical and Midwife Indemnity

Legislation Amendment Bill 2019 (the Bill) is to amend the Medical Indemnity

Act 2002 (MI Act), Medical Indemnity

(Prudential Supervision and Product Standards) Act 2003

(MI(PS&PS) Act) and the Midwife

Professional Indemnity (Commonwealth Contribution) Scheme Act 2010

(MPICCS Act) to:

- simplify the current legislative structure underpinning the

Government’s support for medical indemnity insurance

- repeal redundant legislation

- remove the existing contract requirements for the Premium Support

Scheme (PSS) and incorporate the necessary requirements in legislation

- require all medical indemnity insurers to provide universal cover

to medical practitioners

-

maintain support for high cost claims and exceptional claims made

against allied health professionals and enable exceptional cost claims to be

made, which is provided for in a separate scheme to medical practitioners

- support high cost claims and exceptional cost claims made against

private sector employee midwives not covered under the Midwife Professional

Indemnity Scheme (MPIS)

- clarify eligibility for the Run-off Cover Scheme (ROCS) and

permit access for medical practitioners and eligible midwives retiring before

the age of 65

- cause an actuarial assessment to report on the stability and

affordability of Australia’s medical indemnity market, with the report to be

laid before each House of Parliament and

- streamline reporting obligations and improve the capacity for

monitoring and information sharing.[1]

These amendments are designed to support the long-term

stability and affordability of medical indemnity premiums for medical

practitioners.

Structure of the Bill

The Bill contains six Schedules:

- Schedule 1 removes redundant legislation by repealing the Medical Indemnity

(Competitive Advantage Payment) Act 2005 (Competitive Advantage

Payment Act) and the Medical Indemnity

(UMP Support Payment) Act 2002 (UMP Support Payment Act) and

making associated consequential amendments to other legislation that refer to

those Acts

- Schedule 2 clarifies eligibility under existing claim schemes:

- Part

1 provides clarity for the claiming criteria under the High Cost Claims Scheme

(HCCS) relating to aggregation of claims (where the claim/s is/are against the

same medical practitioner or in relation to the same incident or series of

incidents)

- Part

2 amends relevant provisions in the MI Act to clarify that the HCCS and

the Exceptional Claims Scheme (ECS) are only intended to apply to medical

practitioners (as distinct from allied health professionals)

- Part

3 will allow greater access to the ROCS for medical practitioners and eligible

midwives who permanently retire before the age of 65 by removing the current

age restriction

- Part

4 provides that medical and midwife indemnity claims will only relate to

incidents that have occurred in connection with a health service

- Schedule 3 deals with administrative changes intended to

streamline and/or clarify the operation of the legislation, including more

efficient information sharing, the use of computerised decision-making by the

Chief Executive Medicare (CEM) and an actuarial evaluation of the affordability

and stability of the medical indemnity market by February 2021

-

Schedule 4 provides for the restructure and consolidation of

delegated legislation and creates the power of the Minister to make rules

required or permitted by the MI Act, or necessary or convenient for

carrying out or giving effect to that Act

- Schedule 5 sets out the requirements for universal cover and

- Schedule 6 creates high cost claim and exceptional claims schemes

for allied health professionals, including private sector midwives.

Background

Medical indemnity insurance provides financial protection ‘to

both medical practitioners and patients in circumstances where a patient

sustains an injury (or adverse outcome) caused by medical misadventure,

malpractice, negligence or an otherwise unlawful act’.[2]

In Australia, it is compulsory for all registered health professionals to hold medical

indemnity insurance under the Health

Practitioner Regulation National Law Act 2009 (National Law).[3]

Subsection 129(1) of the National Law provides:

A registered health practitioner must not practise the health

profession in which the practitioner is registered unless appropriate

professional indemnity insurance arrangements are in force in relation to the

practitioner’s practice of the profession.

Currently an exemption from this requirement applies under

section 284 of the National Law for privately practicing midwives who

provide intrapartum services (labour and delivery) for women having homebirths.

This exemption applies until 31 December 2019.[4]

Government

support for medical indemnity

Prior to 2002, medical indemnity insurance was

traditionally provided by medical defence organisations (MDOs), not-for-profit

mutual organisations that offered discretionary indemnity cover as a benefit to

members in return for an annual subscription.[5]

In May 2002, the largest MDO in Australia, United Medical Protection (UMP) and

its wholly owned subsidiary Australian Medical Protection Limited (AMIL), was

placed into provisional liquidation. It was estimated that the collapse of UMP

would leave up to 60 per cent of medical practitioners in Australia without

professional indemnity cover.[6]

At the same time, insurers were experiencing pressure due

to increased claim costs, a fall in investment returns and for some MDOs, a

failure to make sufficient provisions for ‘incurred but not reported claims’

(claims that may occur many years in the future). Further, medical

practitioners were facing increased premium costs (as high as one third of

their incomes) and considering leaving the profession or ceasing high-risk

procedures. [7]

As a result of these issues, between 2002 and 2010, the Australian

Government implemented a range of financial and regulatory measures designed to

support the medical indemnity insurance industry, including: premium subsidies;

government assistance for high-cost claims; and placing providers of medical indemnity

insurance under the regulatory supervision of the Australian Prudential

Regulatory Authority (APRA). These measures were underpinned by tort law

reform at the state and territory level.[8]

Indemnity

Insurance Fund

During the period 2003–10, seven discrete schemes to

provide medical and professional indemnity support for medical practitioners

and midwives were established (see Table 1). In 2011, these schemes were

consolidated under the Indemnity Insurance Fund (IIF), which is administered by

the Department of Health. The primary objective of the IIF is to streamline the

administration of the seven schemes with the following priorities:

- promote stability of the medical indemnity insurance market

- keep premiums affordable for doctors in private practice and

-

ensure availability of professional indemnity insurance for

eligible midwives.[9]

Table 1: schemes

within the Indemnity Insurance Fund

|

Scheme

|

Purpose and key features

|

|

Premium support scheme (PSS)a

|

The PSS assists eligible

doctors with the costs of their medical indemnity insurance through

reductions in the level of premiums charged to them by their medical

indemnity insurer. The PSS currently subsidises 60% of indemnity costs for

doctors whose premiums exceed 7.5% of their income from private practice.

The applicable subsidies under

the PSS have decreased since its introduction. Previous subsidies were:

-

80% from 2004 to 1 July 2012 and

- 70% from 1 July 2012 to before 1 July 2013.

Procedural

GPs working in rural areas (Rural, Remote and Metropolitan Areas 3-7b)

are eligible for PSS regardless of whether they meet other PSS eligibility

criteria. The PSS will cover 75% of the difference between premiums for these

doctors and those for non-procedural GPs in similar circumstances.

|

|

Run-off Cover Scheme (ROCS)c

|

The ROCS is designed to provide

secure ongoing insurance for doctors who have ceased private practice because

of retirement (after the age of 65), disability, maternity leave, death, or

if they discontinue working as a doctor in Australia.

The Australian Government pays

100% of the costs of valid claims (including the costs of managing claims) made

against eligible doctors.

The ongoing costs of the scheme

are met by the ROCS Support Payment, a levy on the premium income of medical

indemnity insurers.

Currently

a private medical practitioner who leaves the workforce for a reason other

than those outlined above, or who retires before the age of 65, will not be

eligible for ROCS for a period of three years. As such, those practitioners

must purchase run-off cover from their medical indemnity insurer for the

three year period if they wish to remain insured. This Bill seeks to permit

access to ROCS for medical practitioners and eligible midwives retiring

before the age of 65.

|

|

High Cost Claims Scheme (HCCS)d

|

The

HCCS is intended to place downward pressure on premiums, particularly for

doctors in high risk areas, by lowering the amount that insurers pay out and

reducing the amount of reinsurance medical indemnity insurers need to buy to

fund large claims.

Under

the HCCS, the Australian Government will reimburse medical indemnity insurers

50% of the insurance payout over $300,000 up to the limit of the

practitioner's cover, for claims notified on or after 1 January 2004.

From

1 July 2018, the threshold for claims under the HCCS was amended from

$300,000 to $500,000. The new threshold will be applied to claims notified to

insurers on or after 1 July 2018.

|

|

Exceptional Claims Scheme (ECS)e

|

The

ECS covers health practitioners for 100% of the cost of private practice

claims that are above the limit of their medical indemnity insurance

(generally $20 million), so that they are not personally liable for

exceptionally high claims. These claims can be either a single very large claim

or an aggregate of claims related to an incident that together exceed a

threshold for a contract's limit.

Health

practitioners are not required to make a contribution towards the ECS. It is

fully funded by the Government.

|

|

Incurred But Not Reported (IBNR)

Indemnity Schemef

|

The IBNR Indemnity Scheme

covers unfunded medical insurers’ liabilities that were incurred but not

reported as at 30 June 2002. The Government covers 100% of claims.

At present, only one insurer, United

Medical Protection Limited (now known as Avant Insurance Limited)

participates in the IBNR Scheme.

|

|

Midwife Professional Indemnity

(Commonwealth Contribution) Scheme (MPIS)g

|

The MPIS provides financial

assistance to eligible insurers who provide indemnity to eligible midwives. The

MPIS was introduced in 2010 to address concerns that privately practicing

midwives were unable to access professional indemnity insurance cover from

commercial insurers (see further information below).

Payment rates:

-

under the MPIS, the insurer pays the first $100,000 for each

claim

- Level 1 Commonwealth contribution payments – for each claim

over $100,000, the Government will pay, via the insurer, 80% of the cost that

exceeds the threshold, up to a ceiling of $2 million

- Level 2 Commonwealth contribution payments – for each claim

that exceeds $2 million, the Government will pay, via the insurer, at the

Level 1 rate for the first $2 million, plus 100% of the cost of the claim

above the threshold.

There is currently only one

provider of professional indemnity insurance for privately practising

midwives.

|

|

Midwife Professional Indemnity

Run-off Cover Scheme (Midwife ROCS)g

|

The Midwife ROCS provides

secure ongoing insurance for eligible midwives who have ceased private

practice because of retirement, disability, maternity leave, death or other

reasons, with 100% of costs covered by the Commonwealth.

|

Notes: (a) Further information on the PSS, including

eligibility criteria can be found at Department of Health (DoH), ‘ Premium

Support Scheme (PSS) – frequently asked questions’, DoH website, last

updated 1 March 2017;

(b) The Rural, Remote and Metropolitan Area (RRMA)

classification divides Australia into three zones and seven classes:

metropolitan zone (RRMA 1 and 2), rural zone (RRMA 3 to 5) and remote zone

(RRMA 6 and 7);

(c) Further information on the ROCS, including eligibility

criteria can be found at DoH, ‘Coverage

- doctors’, DoH website, last updated 4 April 2018;

(d) Further information

on the HCCS, can be found at Department of Human Services (DHS), ‘High

Cost Claim Indemnity Scheme’, DHS website, last updated 22 February 2019;

(e) Further information on the ECS, can be found at DoH, ‘Exceptional

Claims Scheme (ECS) – frequently asked questions’, DoH website, last

updated 31 January 2017;

(f) Further information on the IBNR Indemnity Scheme,

can be found at DHS, ‘Incurred

But Not Reported Indemnity Scheme’, DHS website, last updated 22 February

2019;

(g) Further information on the MIPS, can be found at DHS, ‘Midwife

Professional Indemnity Scheme’, DHS website, last updated 20 September

2019.

Source: DoH, ‘The

Indemnity Insurance Fund Schemes’, op. cit.; Australian National Audit

Office (ANAO), The

management, administration and monitoring of the Indemnity Insurance Fund, DoH

and DHS, Audit report, 20, 2016–17, ANAO, Barton, ACT, 2016, p. 17.

Midwife indemnity

insurance

Before

2009–10

Before 2010, there was no obligation for nurses or

midwives to have professional indemnity insurance as a condition of their

registration to practice. At this time, insurance arrangements for midwives

varied. Midwives employed with the public and private sectors were generally

indemnified under the employer’s insurance policies and, prior to 2001

privately practicing midwives were able to access indemnity insurance through

membership of industrial and professional organisations, such as the Australian

Nursing Federation. In 2000–01 professional indemnity insurance coverage was

withdrawn from privately practicing midwives. This was perceived to be in

response to the medical indemnity crisis of the late 1990s.[10]

As such, privately practicing midwives were unable to access indemnity

insurance as there were no insurers willing to offer suitable products for the

full range of maternity services.[11]

The lack of professional indemnity insurance for privately

practicing midwives was raised as a concern during a 2008 review into maternity

services, which found that the lack of insurance created a barrier to

implementing new models of maternity care. The report further noted that the planned

introduction of the health profession’s National Registration and Accreditation

Scheme in 2010 would pose problems for privately practicing midwives who could

not obtain the cover required for registration under state and territory laws.[12]

It recommended:

... while a risk profile for midwife professional indemnity

insurance premiums is being developed, consideration be given to Commonwealth

support to ensure that suitable professional indemnity insurance is available

for appropriately qualified and skilled midwives operating in collaborative

team-based models. Consideration would include both period and quantum of

funding.[13]

After

2009–10

In response to the review, the Government announced a

$120.5 million package of maternity measures in the 2009–10 Budget aimed at

giving access to Medicare Benefits Schedule and Pharmaceutical Benefits Scheme

benefits for services provided by eligible midwives and providing

government-supported professional indemnity insurance.[14]

The Government subsequently introduced and passed legislation which created a

framework for the Commonwealth’s involvement in an indemnity scheme for

midwives. Relevant legislation includes:

As noted previously, under an exemption in the National

Law, privately practicing midwives who provide intrapartum services (labour

and delivery) for women having homebirths are not required to hold professional

indemnity insurance, as there is currently no indemnity insurance product

available. This exemption applies until 31 December 2019.[15]

MIGA is currently the only provider of professional

indemnity insurance for privately practising midwives in Australia.[16]

Recent

reviews

In February 2014, the National Commission of Audit

recommended that the Commonwealth scale back its subsidies for medical

indemnity insurance. It reported that there was evidence that the market was

normalising, with premiums becoming more affordable and net assets and profits

for insurers increasing.[17]

At the time the Government announced that reforms to medical indemnity would be

considered following the 2014–15 Budget.[18]

Australian National

Audit Office

The Australian National Audit Office (ANAO) conducted a

performance audit of the IIF in 2016. The report made a number of

recommendations which were accepted by the Department of Health:

Recommendation No. 1: The Department of Health should conduct

a ‘first principles review’ of the Indemnity Insurance Fund and related schemes

prior to the 2017–18 Budget.

Health’s response: Agreed with qualification.

Recommendation No. 2: Subject to the outcome of this ‘first

principles review’, the Department of Health should develop and implement a

fit-for-purpose monitoring and reporting arrangement for the Indemnity

Insurance Fund, legislation, and related schemes that provides its Minister

with timely, robust analysis of the Indemnity Insurance Fund’s performance and

risks to government.

Health’s response: Agreed.

Recommendation No. 3: That the Department of Health establish

suitable governance and stakeholder engagement arrangements, including risk

management plans, to support its and other shared responsibilities for the

administration of the Indemnity Insurance Fund and related schemes.

Health’s response: Agreed.

Recommendation No. 4: That the departments of Health and

Human Services review their Indemnity Insurance Fund administrative

arrangements to:

(a) establish

a suitable set of public and internal key performance indicators that allow for

relevant, reliable and complete reporting of the Indemnity Insurance Fund

schemes’ performance;

(b) ensure

that public guidance materials are accurate, consistent and current;

(c) establish

suitable controls to improve data integrity, including monitoring and reporting

of any relevant matters under the bilateral programme agreement; and

(d) consult

with relevant insurers and the Australian Government Actuary to improve the

relevancy, consistency and accuracy of data used to inform projections of the

Commonwealth’s risks.

Health’s response: Agreed.

Human Services’ response: Agreed.[19]

First

Principles Review

In the 2016–17 Mid-Year Economic and Fiscal Outlook

(MYEFO) the Government announced that it would achieve savings of $35.9 million

over three years from 2017–18 by raising the eligibility threshold for claims

under the HCCS from $0.3 million to $0.5 million from 1 July 2018. At the same

time, the Government provided $0.2 million to conduct a review of the IIF and

associated schemes.[20]

Two reviews were conducted by the Department of Health:

-

the First Principles Review (FPR) of the IIF and

- a thematic review of the medical indemnity legislation.

The FPR of the IIF sought to answer three questions:

- To what degree has Commonwealth intervention been successful in

providing stability to the medical indemnity insurance industry, availability

of affordable indemnity insurance, and viability for professions, and patients,

particularly in relation to high cost claims?

- What is the appropriate level of Commonwealth support needed to

continue stability, affordability and accessibility of indemnity insurance for

medical practitioners and eligible midwives?

- Are the seven schemes that collectively comprise the IIF fit for

purpose or might improvements be made?[21]

The report made a number of recommendations aimed at

improving efficiency, targeting and transparency of the IIF. This Bill puts in

place the legislative framework to implement a number of these recommendations.

The complete list of recommendations can be found at Appendix A of this

Bills Digest.

Thematic

Review

The Thematic Review of Commonwealth Medical and Midwife

Indemnity Legislation examined 17 legislative instruments supporting the

IIF. The review focussed on identifying opportunities to:

- consolidate instruments wherever possible

-

remove redundant or inoperable legislation

-

ensure the instruments are consistent with the broader legal and

policy context and with the clearer laws principles and

- simplify the legislation wherever possible.[22]

A summary of the key findings of the review can be found

at Appendix B of this Bills Digest.

Committee consideration

Senate Selection

of Bill Committee

In its report on 17 October 2019, the Senate Selection of

Bills Committee recommended that the Bill not be referred to a committee for

inquiry.[23]

Senate

Standing Committee for the Scrutiny of Bills

In its report on 16 October 2019, the Senate Standing

Committee for the Scrutiny of Bills (the Committee) raised three concerns

relating to the Bill about which it requested further Ministerial advice.

Computerised

decision-making

The Committee noted:

Items 15 and 26 of Schedule 3 to the bill seek, respectively,

to insert sections 76A into the Medical Indemnity Act 2002 (Indemnity

Act) and section 87A into the Midwife Professional Indemnity (Commonwealth

Contribution) Scheme Act 2010 (MPI) Scheme Act) [that would allow the Chief

Executive Medicare] to arrange for the use of computer programs for any purpose

for which the CEM may or must take administrative action.[24]

The Committee questioned whether this was ‘necessary and

appropriate’ and whether consideration had been given to requiring that certain

administrative actions (for example, complex or discretionary decisions) be

taken by a person rather than by a computer.[25]

Reversal of

evidential burden of proof

The Committee noted:

Subsection 77(2) of the Indemnity Act and subsection 88(2) of

the MPI Scheme Act provide that a person commits an offence if they copy,

record, disclose or produce protected information or a protected document to

another person, where the first person is not performing or exercising duties,

powers or functions under specified legislation. The offence is punishable by

two years' imprisonment.

Items 18 and 29 of Schedule 3 to the bill seek, respectively,

to insert subsections 77(2A) and (2B) into the Indemnity Act, and subsections

88(2A) and (2B) into the MPI Scheme Act. The new provisions would provide that,

despite subsections 77(2) and 88(2), certain listed persons may copy, record,

or disclose protected information or a protected document, for the purposes of

monitoring, assessing or reviewing the operation of the medical indemnity

legislation. In this respect, they would create offence-specific defences to

the offences in subsections 77(2) and 88(2). The defences reverse the

evidential burden of proof.[26]

The Committee requested the Minister’s advice as to

whether the proposed reversal of the evidential burden of proof was necessary

and appropriate.[27]

Broad

delegation of legislative power

The Committee also noted that Schedule 6, item 26,

proposed paragraphs 34ZZG(2)(b) and 34ZZZD(2)(b), and proposed subsections

34ZZZF(1) and (2) allow regulations to modify and exempt matters from the

operation of the primary legislation and questioned whether it would be

appropriate to amend the Bill to insert high-level guidance concerning the

making of regulations:

Item 26 of Schedule 6 to the bill seeks to insert new

Divisions 2C and 2D into the Indemnity Act, to provide for the operation of the

allied health high cost claim indemnity scheme and the allied health exceptional

claims indemnity scheme.

Proposed paragraphs 34ZZG(2)(b) and 34ZZZD(2)(b) seek to

allow regulations to provide, respectively, that Divisions 2C and 2D apply,

with specified modifications, to certain liabilities associated with costs

which have been paid.

Additionally, proposed subsection 34ZZZF(1) seeks to allow

the regulations to provide that Division 2D applies, with specified

modifications, in relation to a specified class of claims, a specified class of

contracts of insurance, or a specified class of situations in which a liability

is wholly or partly covered by more than one contract of insurance. Proposed

subsection 34ZZZF(2) further seeks to allow the regulations to provide that

Division 2D does not apply, or applies with specified modifications, in

relation to a specified class of liabilities or payments.

Provisions enabling delegated legislation to modify the

operation of primary legislation are akin to Henry VIII clauses, which

authorise delegated legislation to make substantive amendments to primary

legislation (generally the parent Act). The committee has significant scrutiny

concerns with Henry VIII-type clauses, as such clauses impact parliamentary

oversight and may subvert the appropriate division of powers between the

Parliament and the executive. The committee will also have concerns about

provisions that enable delegated legislation to create exemptions from primary

legislation, as these provisions may have the effect of limiting, or in some

cases removing, parliamentary scrutiny.

In light of these matters, the committee expects a sound

justification in the explanatory materials for any provision that allows

delegated legislation to modify, or to exempt matters from, the operation of

primary legislation. The committee notes that, in this instance, no such

justification is provided in the explanatory memorandum.

The committee requests the minister's advice as to:

- why it is proposed to allow regulations to modify and exempt

matters from the operation of the primary legislation; and

- whether

it would be appropriate to amend the bill to insert at least high-level

guidance concerning the making of such regulations.[28]

At the time of writing the Ministerial response had been

received but not published.[29]

Policy

position of non-government parties/independents

Australian

Labor Party

The Australian Labor Party (Labor) is broadly supportive

of the Bill, but has raised concerns regarding two main issues: the continued

lack of insurance coverage options for private midwives providing intrapartum

services (labour and delivery) for women having homebirths and the continuation

of a single insurance provider for midwives, limiting individual choice.[30]

Independents

The Member for Indi, Dr Helen Haines MP, supports the Bill

but also considered that the inclusion of insurance options for private

midwives providing intrapartum services for homebirths would be beneficial.[31]

Position of

major interest groups

Australian

Medical Association

The Australian Medical Association (AMA) is strongly

supportive of the Bill, noting its continued advocacy in the space since 2002:[32]

The Medical and Midwife Indemnity Legislation

Amendment Bill 2019 will ensure the AMA’s hard-won medical indemnity

reforms of 2002 will continue to provide confidence for doctors, their patients,

and insurers.

...

The ability of doctors to continue to practise medicine

securely into the future has been strengthened.

The AMA played a critical role steering two indemnity reviews

over the past two years.

AMA President Dr Tony Bartone said bringing the reviews to

their conclusions was both challenging and rewarding.

“The AMA has fought hard to maintain the stability of our

medical indemnity system and preserve the underwriting from the Commonwealth,

which we achieved well over a decade ago,” Dr Bartone said.

“In 2016, there was a sudden and substantial cut to medical

indemnity schemes, followed by the announcement of the two reviews.

“Concerned about the Government’s ongoing commitment to these

schemes, the AMA advocated forcefully at each and every consultation, meeting,

roundtable, and re-draft of the schemes.

“On behalf of the entire profession, we have worked with

indemnity insurers, other peak groups, the Department of Health, the Minister’s

office, and the Australian Financial Complaints Authority, to name but a few.”

...

“This should ensure that the premium stability we have

enjoyed continues.”[33]

Financial

implications

The Explanatory Memorandum states that the legislative

changes have nil financial impact.[34]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed

the Bill’s compatibility with the human rights and freedoms recognised or

declared in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[35]

Parliamentary

Joint Committee on Human Rights

At the time of writing, the Parliamentary Joint Committee

on Human Rights has not commented on the Bill.

Schedule

1—Competitive advantage payment and UMP support payment

Part 1 –

Repeals

Items 1 and 2 repeal the Competitive

Advantage Payment Act and the UMP Support Payment Act respectively.

Both Acts are being repealed as they are considered redundant.

The Competitive Advantage Payment Act provides for

an annual tax (competitive advantage payment) to be imposed on a MDO

participating in the Incurred But Not Reported (IBNR) Indemnity Scheme.[36]

The annual tax is imposed to neutralise any competitive advantage the MDO may

have due to its participation in the IBNR Indemnity Scheme.

Avant Mutual Group Limited (Avant) and its predecessor UMP

was the only MDO subject to the competitive advantage payment. According to the

Explanatory Memorandum, in 2006, the only MDO (UMP, now Avant) entered into a

deed of agreement with the Commonwealth, to pay a lump sum in order ‘to redress

the competitive advantage received by the insurer through participation in the

IBNR Indemnity Scheme’.[37]

The effect of this arrangement means that under section 25A of the Medical Indemnity

Regulations 2003, the MDO is exempt from having to make the annual

competitive advantage payment. This has therefore rendered the Competitive

Advantage Payment Act redundant.

The Explanatory Memorandum states:

The Medical Indemnity (UMP Support Payment) Regulations 2002

(established under the Medical Indemnity (UMP Support Payment) Act 2002)

declare that the financial year starting on 1 July 2006 is the last

contribution year for UMP (now Avant). As UMP support payment is no longer

payable, the legislation and regulations are redundant.[38]

Part 2 –

Amendments

Part 2 of Schedule 1 to the Bill amends a number of

statutes which are affected by the repeal of the two pieces of legislation in

Part 1 of Schedule 1 by, among other things, removing reference to the

Competitive Advantage Payment Act and the UMP Support Payment Act.

Amendments are also made as a consequence of changes to the run-off cover in Part

3 of Schedule 2 to the Bill which is discussed below. Other amendments include

changes to the objects of the MI Act, and also to the IBNR annual assessment

and reporting requirements, shifting from a contribution year to a financial

year.

Medical

Indemnity Act 2002

Items 8–52 in Part 2 of Schedule 1 to the Bill

amend the MI Act. Existing section 3 of the MI Act outlines the

objects of the Act.

Item 8 inserts a new subheading ‘Availability of

medical services’ in the Objects provision, just above subsection 3(1), which

refers to the object of contributing towards the availability of medical

services in Australia.

Existing subsection 3(4) states that an object of the MI

Act is to allow the Commonwealth:

- to recover the costs of providing the assistance referred to in

paragraph (2)(c)[39]

by requiring payments from persons who were members of relevant organisations

on 30 June 2000

- to recover the costs of providing the assistance referred to in paragraph

(2)(ab)[40]

by requiring payments from medical indemnity insurers and

-

to require a payment from medical indemnity insurers to ensure

that the assistance referred to in paragraph (2)(c) does not give a competitive

advantage to the organisations that receive that assistance.

Item 9 repeals and replaces subsection 3(4) to re-shape

the currently stated object to provide that it is ‘to allow the Commonwealth to

recover costs of providing the assistance referred to in paragraph (2)(ab) by

requiring payments from medical indemnity insurers’.

Item 21 in Part 2 of Schedule 1 to the Bill inserts

proposed Subdivision G—IBNR exposure into Division 1 of Part 2 of the MI

Act. Within new Subdivision G, proposed section 27C sets out the

process for annually reassessing IBNR exposure. The IBNR Indemnity Scheme funds

the IBNR liabilities of MDOs where they do not have enough reserves to cover

their liabilities. ‘IBNR is a type of reserve account used in the insurance

industry as the provision of funds for claims and/or events that have

transpired, but have not yet been reported to an insurance company.’[41]

An insurer knows neither how many of these losses have occurred, nor the

severity of each loss, thus the IBNR figure is an estimate which is tested

using actuarial and statistical techniques.[42]

Report by

the Actuary

Proposed subsection 27C(1) of the MI Act provides

that for each financial year, the Actuary[43]

must give the Minister for Health a written report that:

- states the Actuary’s assessment of the participating MDO’s IBNR

exposure as at the end of the financial year and

- sets out the reasons for the assessment.

In preparing the report, the Actuary must take into

account any information that the CEM gives the Actuary in relation to the

participating MDO, which has been given by the MDO for the purposes of

preparing the report for the Minister for Health.

Chief

Executive Medicare’s information gathering powers

Proposed subsection 27C(3) of the MI Act provides

that if the CEM believes on reasonable grounds that the participating MDO is

capable of giving information that is relevant to assessing the participating

MDO’s IBNR exposure as at the end of a financial year, the CEM may request the

participating MDO to give him, or her, the information. Without limiting the

type of information that may be requested, by way of example it may include financial

statements, and a report prepared by a suitably qualified actuary assessing the

participating MDO’s IBNR exposure as at the end of a financial year.[44]

Currently section 45 of the MI Act provides that a

failure to provide information under specified provisions gives rise to an

offence of strict liability.[45]

Item 27 of Part 2 of Schedule 1 to the Bill amends subsection 45(1) so

that the failure to comply with a request for information under proposed

subsection 27C(3) is an offence under the MI Act.[46]

Schedule

2—Indemnity scheme payments

Part 1 –

Aggregation of claims for high cost claim indemnity schemes

The provisions in Part 1 of Schedule 2 to the Bill amend

the MI Act.

The MI Act aims to contribute towards the

availability of medical services in Australia, by providing Commonwealth

assistance to support access by medical practitioners to affordable arrangements

that indemnify them for claims arising in relation to their practice of their

medical professions.[47]

It seeks to maintain the affordability of medical indemnity insurance premiums.

The Explanatory Memorandum states that amendments proposed

under this part are aimed at providing greater ‘clarity around the claiming

criteria under the High Cost Claim Scheme (HCCS) when claims [or a claim] have

more than one defendant’.[48]

The amendments will also apply to the new Allied Health High Costs Claim Scheme

(AHHCCS) (see Schedule 6).

Item 1 amends subsection 4(1) of the MI

Act to insert a reference to the definition of eligible related

claims.

Item 2 repeals and replaces section 8A to set out

the criteria for eligible related claims in relation to a high

cost claim indemnity or allied health high cost claim indemnity. A claim or

claims will be eligible related claims for the purposes of aggregation, where

the claim is against the same medical practitioner, in relation to the same

incident, or series of incidents, and either:

- all

the claims are part of the same class action or representative proceeding or

- the

incident, or series of incidents, occurred in connection with a pregnancy or

birth of a child or children (that is, in respect of a single birth event)[49]

and

-

the application is the only application for a high cost claim indemnity

or allied health high cost claim indemnity that has been made in relation to

any of the claims and

-

none of the claims are eligible related claims in relation to another

claim for which an application for a high cost claim indemnity or allied health

high cost claim indemnity has been made.

The Explanatory Memorandum states:

The policy intent is that the aggregation of claims can only

apply in respect of the same individual practitioner. A single high cost claim

threshold cannot be applied across multiple practitioners in relation to the

same event.[50]

Section 30 of the MI Act sets out the circumstances

in which high cost claim indemnity is payable.

Item 3 of Part 1 in Schedule 2 to the Bill repeals and

replaces subparagraphs 30(1)(d) to (f) which provide for a new payability rule.

In addition to the existing criteria for payment of a high

cost claim indemnity to a MDO or insurer, the amendment also requires that:

- the MDO or insurer is first notified of the incident, claim or

eligible related claim between 1 January 2003 and the date specified

in the rules as the termination date for the high cost claim indemnity scheme[51]

- the MDO or insurer has a qualifying payment in relation to the

claim, or qualifying payments in relation to the claim, or the claim and one or

more eligible related claims[52]

and

-

the amount of the qualifying payment, or the sum of the amounts

of the qualifying payments, exceeds what was the high cost claim threshold at

the earliest of the following times:

- when

the MDO or insurer was first notified of the incident

- when

the MDO or insurer was first notified of the claim or

- when

the MDO or insurer was first notified of an eligible related claim.[53]

Subsection 31(1) of the MI Act sets out the

circumstances in which aggregating amounts for eligible claims are paid or

payable by a MDO and insurer. Currently, the section applies if a MDO pays, or

is liable to pay, an amount in relation to a claim, and an insurer pays or is

liable to pay ‘an amount in relation to the same claim (the insurer

amount)’, and the other limbs of that section are satisfied. [Emphasis added]

Item 6 amends paragraph 31(1)(b) by removing the reference

to ‘an amount in relation to the same claim (the insurer amount)’. This

is substituted with a reference to ‘an amount (the insurer amount) in relation

to the same claim or an eligible related claim’. [Emphasis added]

Item 9 inserts proposed subparagraph

31(2)(a)(iii) into the MI Act which deems the MDO to have received

notification of the incident, claim or eligible related claim when the insurer

was first notified. The Explanatory Memorandum clarifies that if the MDO was

first notified (before the insurer), then that time will be the relevant time

of notification for the purposes of satisfying proposed paragraphs 30(1)(d)

and (f) in relation to payability and timing.[54]

Item 10 provides that the amendments made by this

Part of the Bill apply in relation to any application for an indemnity scheme

payment made on or after Schedule 2 commences (whether in relation to a claim

made before or after that commencement).

Part

2—Medical Professions

Medical Indemnity

Act 2002

Part 2 of Schedule 2 to the Bill makes amendments to the MI

Act which clarify the eligibility of medical practitioners, as distinct from

allied health professionals, in relation to the HCCS and the ECS.[55]

Items 12 to 15 make necessary amendments to

relevant provisions of the MI Act by removing reference to individuals

who fall under the rubric of allied health professionals. This is done to

clarify that the HCCS and ECS only have application in relation to medical

practitioners.

Item 16 contains an application provision

specifying that despite the amendments made under this Part, those sections

will continue to apply in respect of a claim if that claim relates to an

incident that occurred prior to 1 July 2020, or a series of incidents, at least

one of which occurred before 1 July 2020, in the course of or in connection

with, the practice by a practitioner of a medical profession (other than

practice as an eligible midwife or medical practitioner). Thus those who were

eligible for the HCCS and ECS prior to 1 July 2020 will continue to have their

claims assessed under the HCCS or ECS.

Part

3—Run-off cover on retirement

Run-off Cover is a niche class of insurance held within a

Professional Indemnity Insurance policy which provides liability cover for work

done by a person or business in the past, prior to adopting the run-off cover. This

type of cover is provided by an insurer when a particular person retires or

when a business is sold.[56]

The ROCS ‘is a scheme designed to provide secure insurance for doctors who have

left private practice’.[57]

Medical

practitioners

Currently, if a medical practitioner retires before the

age of 65, an insurer must offer them run-off cover on the same terms and

conditions as their last cover[58]

(other than terms as to price).[59]

After three years of not engaging in private medical practice, the practitioner

becomes eligible for ROCS and is no longer charged for run-off cover.

Thus, in the interim three year period, insurers can

charge a nominal amount for run-off cover offered to medical practitioners who

permanently retire from private medical practice under the age of 65.

Midwives

A parallel scheme with the same three year waiting period

applies to midwives who permanently retire from private practice before the age

of 65.[60]

Effect of

Amendments

The amendments proposed by this Part of the Bill will have

the effect that on expiry of the medical practitioner's or midwife’s insurance

contract, an insurer will not be able to charge a premium for the run-off cover

despite a medical practitioner or midwife retiring before the age of 65.[61]

The Bill amends the ROCS eligibility requirements to

provide that medical practitioners and midwives who have retired permanently

from private medical practice (regardless of their age) are eligible for the

ROCS, without requiring them to wait three years.

Subsection 39(1A) of the Age Discrimination Act provides

that anything done in direct compliance with a provision of an Act listed in

the table contained in Schedule 2 of the Age Discrimination Act is not

unlawful. This is because the statutes listed in that table are those for which

an exemption is provided by subsection 39(1A). Currently, items 6 and 7 of the

table are the MI(PS&PS) Act (Part 3) and the Medical Indemnity

(Prudential Supervision and Product Standards) Regulations 2003 (Part 3),

respectively.

Item 17 repeals table items 6 and 7 from Schedule 2

of the Age Discrimination Act, thus removing the age discrimination

exemption in relation to run-off cover for medical practitioners and midwives.

Medical

Indemnity Act 2002

Section 34ZB of the MI Act sets out the eligibility

criteria for run-off claims. One of the eligibility criteria in existing paragraph

34ZB(2)(a) is that the person against whom the claim is made is aged 65 years

or over and has retired permanently from private medical practice.

Item 19 amends paragraph 34ZB(2)(a) by removing the

‘aged 65 years or over’ requirement, and simply requiring that the person has retired

permanently from private medical practice regardless of age.

Item 20 contains transitional provisions specifying

that the amendments made to the Age Discrimination Act made by this Part

apply in relation to anything done after the commencement of subitem 20(1).

Subitem 20(2) provides that the amendments to subsection 34ZB(2) of the MI Act

made by this Part apply in relation to:

- any claim made after the commencement of this item against a

person who has retired permanently from private medical practice and

- any requirement under Division 2A of Part 3 of the MI(PS&PS)

Act to provide medical indemnity cover after the commencement of this item

for a person who has retired permanently from private medical practice

whether the person retired before or after the

commencement of this item.

However, if before item 20 commences:

- a person less than 65 years has permanently retired from medical

practice and

-

they have accepted an offer to provide medical indemnity cover

because of a particular event prescribed by the regulations, or they have

accepted an offer to renew because of those circumstances, and that cover has

not expired

that person cannot enjoy relief from premium for that

indemnity until that cover expires.

Midwife

Professional Indemnity (Commonwealth Contribution) Scheme Act 2010

Paragraph 31(2)(a) of the MPICCS Act sets out the

eligibility criteria for run-off claims. One of the eligibility criteria in existing

paragraph 31(2)(a) is that the person against whom the claim is made is aged 65

years or over and has retired permanently from private practice as an eligible

midwife.

Item 21 amends paragraph 31(2)(a) of the MPICCS

Act by removing the ‘aged 65 years or over’ criterion, and

simply requiring that the person has retired permanently from private practice as

an eligible midwife, regardless of age. This amendment enables them to access

the ROCS without paying a premium for the run-off cover.

Item 22 contains an application provision

specifying that midwives who have permanently retired from private practice

under the age of 65 before or after the commencement of item 21, will be

entitled to access the ROCS in relation to claims made after the commencement

of amendments in item 21.

Part

4—Health service incidents

Medical

Indemnity Act 2002

The proposed amendments in this Part are intended to

provide clarification about the purpose and scope of the IIF. The Explanatory

Memorandum states that ‘payments will only be made if the claim relates to the

provision of a health service (for example rather than a workplace or

occupier’s liability issue)’.[62]

Two amendments are made to the definitions subsection 4(1) of the MI Act

to ensure the payment of claims clearly align with this intent.

Item 23 inserts a definition of health

service into subsection 4(1) of the MI Act to more clearly

delimit it to its practical professional meaning. The proposed definition of

health service is ‘any service, care, treatment, advice or goods provided in

respect of the physical or mental health of a person’.

Item 24 repeals the existing definition of incident

in subsection 4(1) of the MI Act and substitutes it with a new

definition so that incident will mean ‘any incident (including

any act, omission or circumstance) that occurs, or that is claimed to have

occurred, in the course of, or in connection with, the provision of a health

service’.

Midwife

Professional Indemnity (Commonwealth Contribution) Scheme Act 2010

Amendments proposed to the definitions section of the MPICCS

Act by items 25 and 26, mirror the amendments

made by items 23 and 24 in this Part. Correspondingly, the intent of the

amendments is to ensure that ‘payments will only be made if the claim relates

to the provision of a health service (for example rather than a workplace or

occupier’s liability issue)’.[63]

Item 27 of Part 4 in Schedule 2 to the Bill contains

an application provision stating that the amendments made by this part apply in

relation to an incident that occurs or is claimed to have occurred after the

commencement of this Part.

Schedule

3—Administration

The Explanatory Memorandum states that the amendments

proposed in this Schedule ‘deal with administrative changes that streamline

and/or clarify the operation of the legislation’.[64]

The Explanatory Memorandum provides a good summary of the

key changes as follows:

- insert subsection headings to improve readability

- enable

the Chief Executive Medicare to treat an application as having been withdrawn

if further information requested is not provided by the date specified (items

4 and 11)

- streamline

the process for annual reporting on the ROCS to enable the Secretary to publish

the Actuary’s report on the Department of Health’s website (items 5-7

and 22-24)

- enable more efficient information

sharing between relevant agencies by specifying the circumstances in which it

will not be an offence to share protected information and documents where it is

for the purposes of monitoring, assessing or reviewing operation of the medical

indemnity legislation (items 18 and 29). Specifically, it will

not be an offence for the Secretary of the Department, the Chief Executive

Medicare, the Actuary, Australian Prudential Regulation Authority or Australian

Securities and Investments Commission to share information where it is for the

purposes of the medical indemnity legislation or the midwife professional

indemnity legislation, in particular to monitor and report to Parliament on the

effectiveness of Government financial support for the medical indemnity sector

- confirm

that the Chief Executive Medicare may use a computer program to make decisions

etc. under the Medical Indemnity Act 2002 and the Midwife

Professional Indemnity (Commonwealth Contribution) Scheme Act 2010 (items

15 and 26)

- confirm

the Secretary’s ability to delegate powers and functions under the Medical

Indemnity Act 2002 and the Midwife Professional Indemnity (Commonwealth

Contribution) Scheme Act 2010 to persons prescribed in those Acts (items

15 and 26).[65]

In 2016, the ANAO released its report on The

Management, Administration and Monitoring of the Indemnity Insurance Fund.[66]

In its report the ANAO made a number of observations and recommendations. Among

its findings was:

The Department of Health does not have fit-for-purpose

monitoring and reporting arrangements in place to assess the impact of the

measures—including regulatory and other legal reforms on the stability of the

indemnity insurance market, the affordability of premiums or importantly, the

government’s exposure to risk.[67]

In response to these findings, particular amendments are

proposed in Schedule 3 to the Bill which make provision for ‘an evaluation of

the affordability and stability of the medical indemnity market’.[68]

The Explanatory Memorandum states:

The intent of these provisions is to evaluate and report to

Parliament on the effectiveness of the Government’s support for medical

indemnity insurance and whether objectives are being achieved.[69]

Item 14 inserts at the end of Part 2 of the MI

Act, proposed Division 8—Monitoring. Under this Division, proposed

section 50 outlines the circumstances under which a medical indemnity

insurer may be required to provide information to the Secretary about any of

the following matters:

- premium costs of medical indemnity cover provided by contracts of

insurance with the insurer[70]

- the income of medical practitioners, or persons who practise an

allied health profession, for whom contracts of insurance with the insurer

provide medical indemnity cover[71]

- the profitability of the insurer[72]

- the insurer’s reinsurance arrangements and costs.[73]

Midwife

Professional Indemnity (Commonwealth Contribution) Scheme Act 2010

Item 25 inserts at the end of Part 4 of Chapter 2

of the MPICCS Act, proposed Division 9— Monitoring.

Under this Division, proposed section 71A outlines the

circumstances under which an eligible insurer may be required to provide

information to the Secretary about any of the following matters:

- premium costs for midwife professional indemnity cover provided

by contracts of insurance with the insurer[74]

- the income of eligible midwives for whom contracts of insurance

with the insurer provide midwife professional indemnity cover[75]

- the profitability of the insurer[76]

- the insurer’s reinsurance arrangements and costs.[77]

Schedule

4—Instruments

Part 1—Amendments

Medical

Indemnity Act 2002

The amendments in Part 1 of Schedule 4 to the Bill are

mainly ‘minor and machinery in nature’.[78]

For example, there are amendments to remove redundant references, but also to

insert new and necessary definitions.

Item 6 repeals the existing definition of participating

MDO and substitutes it with a new definition such that participating

MDO means UMP. This is to provide clarity that there is only one

participating MDO.[79]

As already mentioned, the thematic review of Commonwealth medical

and midwife indemnity legislation identified opportunities to, and recommended

the consolidation and streamlining of multiple instruments, simplifying the law

and ensuring the instruments are properly aligned with the broader legal and

policy context. The amendments in this Part of the Bill enable these changes to

occur, reducing ‘the number of separate legislative instruments used for the

purpose of regulating the Government’s support for medical indemnity’.[80]

Of note is that all matters prescribed under the powers in

the MI Act will be consolidated into one of two instruments: the Medical

Indemnity Rules or Medical Indemnity Regulations.

Minister’s

Rule Making power

Item 138 in Part 1 of Schedule 4 to the Bill inserts

proposed section 80 at the end of the Part 4 of the MI Act titled

‘rules’.

Proposed subsection 80(1) empowers the Minister to

make rules by legislative instrument prescribing matters:

- required or permitted by the MI Act to be prescribed by

the rules or

-

necessary or convenient to be prescribed for carrying out or

giving effect to the MI Act.

Proposed subsection 80(2) of the MI Act states

that these rules may not do any of the following:

- create an offence or civil penalty

- provide powers of arrest, detention, search or seizure

- impose taxes

- set an amount to be appropriated from the Consolidated Revenue

Fund under an appropriation in the MI Act

- directly amend the text of the Act.

Rules that are inconsistent with the regulations will have

no effect to the extent of the inconsistency. Rules are taken as being

consistent with the regulations, where they are capable of operating

concurrently with the regulations (proposed subsection 80(3)).

Records to

be retained for a certain period

Section 40 of the MI Act imposes particular record

keeping requirements on participating MDOs.

Item 122 repeals subsections 40(2) to (4),

replacing them with proposed subsections 40(2) to (3).

Proposed subsection 40(2) of the MI

Act states that records must be retained for a period of five years (or any

other period specified in the rules) starting on the day on which the records

were created. Failure to do so gives rise to an offence of strict liability under

section 47 of the Act.

Proposed section 40(3) provides that

rules made for the purposes of paragraph 40(1)(e)[81]

must not commence earlier than 14 days after the day on which the rules are

registered on the Federal Register of Legislation.

Requirements

for the terms of medical cover

Medical

Indemnity (Prudential Supervision and Product Standards) Act 2003

Section 26A of the MI(PS&PS) Act deals with the

provision of run-off cover to certain medical practitioners. Subsection 26A(4)

provides that this medical indemnity cover must meet the requirements of the

subsection. Existing paragraph 26A(4)(d) requires that the cover is provided on

such terms and conditions (if any) determined, by legislative instrument, by

the Minister administering the MI Act.

Item 141 repeals paragraph 26A(4)(d), substituting

it with a new paragraph 26A(4)(d) which states that medical indemnity cover

meets the requirements of the subsection if it is provided on the terms and

conditions on which the last medical indemnity cover provided for the

practitioner was provided, to the extent they are relevant to the provision of

medical indemnity cover.

Part

2—Application and Transitional

‘Part 2 of Schedule 4 specifies when the various changes

made by Part 1 of Schedule 4 to the Bill will take effect.’[82]

The Explanatory Memorandum provides a good high level explanation of these in

relation to the various proposed changes.[83]

Schedule

5—Universal cover

Medical

Indemnity Act 2002

Item 1 inserts a proposed subsection 3(3A)

into the ‘objects’ section of the MI Act adding:

The Act also supports access by medical practitioners to arrangements

that indemnify them for claims arising in relation to their practice of their

medical professions by limiting when medical indemnity insurers can refuse to

provide medical indemnity cover.

Item 2 inserts new key definitions for the

Australian Financial Complaints Authority (AFCA), Health Practitioner

Regulation National Law, private medical practice, professional indemnity

cover, and risk surcharge. The need for these definitions arises so as to

facilitate the integration of universal cover into the MI Act.

Private medical practice means practice

as a medical practitioner other than:

- practice consisting of treatment of public patients in a public

hospital

- practice for which the Commonwealth, a state or a territory, a

local governing body, or an authority established under a law of the

Commonwealth, a state or a territory, indemnifies medical practitioners from

liability relating to compensation claims

- practice conducted wholly outside both Australia and the external

Territories or

- practice of a kind specified in the rules.

A contract of insurance with a medical practitioner

provides professional indemnity cover if it provides medical

indemnity cover for the practitioner in relation to the practitioner’s private

medical practice.

Item 4 inserts proposed Part 2A—Universal cover

obligation comprising three new Divisions into the MI Act.

This Part imposes an obligation on medical indemnity

insurers to provide medical indemnity cover for medical practitioners in

relation to private medical practice (subject to limited exceptions). It

specifies the circumstances in which a medical indemnity insurer may require a

medical practitioner to pay a risk surcharge, and it imposes record keeping

requirements on medical indemnity insurers in relation to the obligation to

provide universal medical indemnity cover.

Within new Part 2A, proposed section 52 states that

a medical indemnity insurer is not required to comply with Division 2 (Requirements

in relation to providing professional indemnity cover) other than for the

purposes of the AFCA scheme.[84]

The Explanatory Memorandum states:

Universal cover obligations will be managed under existing

AFCA arrangements whereby a practitioner can make a complaint to AFCA about a

potential breach of this Division.[85]

Universal

cover obligation

Proposed section 52A provides that a medical indemnity

insurer must not refuse to enter into a contract of insurance with a medical

practitioner to provide professional indemnity cover unless one of the

following circumstances applies:

-

in relation to a medical professional indemnity insurance

contract between the practitioner and the insurer, the practitioner:

- failed

to comply with the duty of the utmost good faith or the duty of disclosure

(within the meaning of the Insurance Contracts

Act 1984)

- made

a misrepresentation to the insurer during the negotiations for the contract but

before it was entered into

- failed

to comply with a provision of the contract, including a provision with respect

to payment of the premium or

- made

a fraudulent claim under the contract

-

the practitioner places the public at risk of substantial harm in

the practitioner’s private medical practice because the practitioner has an

impairment (within the meaning of the Health

Practitioner Regulation National Law)

- the practitioner poses an unreasonable risk of harm to members of

the insurer’s staff because of persistent threatening or abusive behaviour

towards members of the insurer’s staff

-

the practitioner has persistently failed to comply with

reasonable risk management requirements of the insurer or

- additional circumstances in which cover may be refused may also

be specified in the rules. [86]

These rules made will be a legislative instrument, and

thus subject to Parliamentary scrutiny.

Medical

indemnity insurer to notify of refusal to indemnify

Proposed section 52B requires a medical indemnity

insurer to notify a medical practitioner in writing in relation to a decision

to refuse to enter into a contract for insurance. This notice in writing must

comply with any requirement specified in the rules.

Risk

surcharge requirements

Proposed subsection 52C(1) of the MI Act enables

a medical indemnity insurer to require that a medical practitioner, pays a risk

surcharge as part of the amount payable for professional indemnity

cover provided by a contract of insurance with the practitioner. This risk

surcharge is to reflect the fact that if the practitioner engages, or has

engaged, in conduct that deviates from good medical practice, the

practitioner’s private medical practice is likely to pose a higher risk to

patients than similar practices.[87]

Additional circumstances for the imposition of this surcharge are to be

specified in the rules.[88]

The imposition of the risk surcharge is subject to

parameters contained in proposed subsections 52C(2) and 52C(3). Proposed

subsection 52C(2) provides that the private medical practice of another

medical practitioner (the comparison practitioner) is a similar

practice if the insurer reasonably considers that the practitioner and the

comparison practitioner have similar practice profiles for the purposes of calculating

premiums for professional indemnity cover, except that the comparison

practitioner does not engage, and has not engaged, in conduct that deviates

from good medical practice. Proposed subsection 52C(3) states the risk

surcharge must not exceed the amount articulated in the rules.

Proposed subsection 52D(1) of the MI Act

provides that an indemnity insurer may be required to offer interim cover to a

medical practitioner until complaint to AFCA is finalised, where that

complaint relates to a refusal by the insurer to enter into a subsequent contract

of insurance with a practitioner who has an existing contract for professional

indemnity cover with that insurer.

Proposed subsection 52D(4) specifies that a

complaint is finalised when any of the following circumstances are

applied:

-

the complaint is resolved by agreement between the insurer and

the practitioner

- the complaint is withdrawn

- AFCA closes the complaint or

- the complaint otherwise ceases to be dealt with by AFCA.

Proposed subsection 52D(2) of the MI Act provides

that the interim offer must comply with any requirements specified in the rules.

Records,

reporting and information

New Division 3—records, reporting and information

sets out record keeping requirements and the consequences of a failure to keep

records as required. It also imposes annual reporting requirements on the medical

indemnity insurer in relation to specific matters, and it empowers the

Secretary of the Department of Health (the Secretary) to request particular

information, and imposes a penalty for a failure to comply with such a request.

Proposed subsection 53(1) provides that the rules

may require a medical indemnity insurer to keep records relating to the

following:

-

a refusal to enter into a contract or insurance with a medical

practitioner to provide professional indemnity cover

- a requirement by the insurer that a medical practitioner pay a

risk surcharge.

The subsection contains a note stating that a failure to retain

the records is an offence under proposed section 53A.The offence is an

offence of strict liability.[89]

Medical

indemnity insurer must report annually

Proposed subsection 53B(1) of the MI Act provides

that if, in a financial year, a medical indemnity insurer refuses to enter into

a contract of insurance with a medical practitioner to provide professional

indemnity cover, the insurer must notify the Secretary within two months after

the end of the financial year of:

-

the number of times in the financial year the insurer refused to

enter into a contract of insurance with a medical practitioner to provide

professional indemnity cover and

- any other matter that relates to the insurer’s obligations under

Division 2 of new Part 2A and that is specified in the rules.

The subsection contains a note stating that a failure to notify

the Secretary is an offence under proposed section 53C. The offence is

an offence of strict liability.[90]

Secretary

may request information

Proposed subsection 53D(1) provides that the

Secretary may request a medical indemnity insurer to give the Secretary the

following information, in the form requested by the Secretary:

- the number of times in a period the insurer refused to enter into

a contract of insurance with a medical practitioner to provide professional

indemnity cover

- the number of times in a period the insurer required a medical

practitioner to pay a risk surcharge

- other information that relates to the insurer’s obligations under

Division 2 of new Part 2A and that is specified in the rules.

Proposed subsection 53D(2) sets out the manner and

form requirements in relation to the Secretary’s request for information:

- must be made in writing

- may require the information to be verified by statutory

declaration

- must specify the day on or before which the information must be

given (at least 28 days after the day on which the request is made)

- must contain a statement to the effect that a failure to comply with

the request is an offence.

Schedule

6—Allied health professionals

The Explanatory Memorandum states:

In the 2018-19 MYEFO, the Government decided to continue to

provide support for insurers currently providing professional indemnity

insurance to registered privately practising allied health professionals, and

that these schemes would be independent to schemes available to medical

practitioners.[91]

The provisions in Schedule 6 establish high cost claim and

exceptional claims schemes in new Divisions of Part 2 of the MI Act

specifically tailored for access by allied health professionals (rather than

medical practitioners). The makeup of these schemes significantly reflects ‘the

provisions in the existing HCCS and ECS as they apply to medical practitioners’.[92]

The Explanatory Memorandum further states:

It is Government’s intent that the new allied health schemes

will initially only be accessed by those medical indemnity insurers that are

currently providing medical indemnity cover for both medical practitioners and

for persons who practise an allied health profession. The rules are therefore

intended to prescribe those medical indemnity insurers that currently access

the HCCS.[93]

Medical

Indemnity Act 2002

Item 1 inserts at the end section 3 (the Objects

provision in the MI Act), another objective of the Act, which is:

... to contribute towards the availability of certain health

services in Australia by providing Commonwealth assistance to support access by

persons who practise allied health professions to arrangements that indemnify

them for claims arising in relation to their practices.[94]

Proposed subsection 3(6) of the MI Act states

that the Commonwealth provides that assistance under the MI Act by:

a) meeting

part of the costs of large settlements or awards paid by organisations that

indemnify persons who practise allied health professions and

b) meeting

the amounts by which settlements and awards exceed insurance contract limits,

if those contract limits meet the Commonwealth’s threshold requirements.

Item 2 inserts new definitions relevant to the new

schemes in subsection 4(1) of the MI Act. For example, allied health

exceptional claims indemnity, allied health high cost claim indemnity, allied

health high cost claim threshold, and allied health profession. The inclusion

of these new definitions is necessary in order to integrate the AHHCCS and the allied

health exceptional claims scheme (AHECS) into the medical indemnity legislation.

Allied

health high cost claim indemnity scheme

Item 26 inserts Division 2C—Allied health high

cost claim indemnity scheme into Part 2 of the MI Act.

Within new Division 2C, proposed subsection 34ZY(1)

sets out a Guide to the Allied Health high Cost Claim Indemnity provisions.

Proposed subsection 34ZY(1) states that Division 2C

provides that an allied health high cost claim indemnity may be paid to an

eligible MDO or eligible insurer that pays, or is liable to pay, more than a particular

amount (referred to as the allied health high cost claim threshold[95])

in relation to a claim against a person in relation to an incident that occurs

in the course of, or in connection with, the practice by the person of an

allied health profession.

Proposed subsection 34ZY(2) provides for the making

of regulations and rules to deal with other matters or incidents relating to

incidents covered by the allied health high cost claim indemnity scheme.

Proposed subsection 34ZY(3) of the MI Act provides

a useful table (see below) in relation to where to find the provisions on various

key issues in relation to the scheme, eligibility of MDOs and insurers, claim

threshold, the amount of the AHHCC indemnity etc.

Guide to

the allied health high cost claim indemnity provisions

| Where to find

the provisions on various issues

|

| Item |

Issue |

Provisions |

| 1 |

which

MDOs and insurers are eligible? |

section

34ZZ |

| 2 |

what

is the allied health high costclaim

threshold?

|

section

34ZZA |

| 3 |

what conditions must be satisfied for

an MDO or insurer to get the alliedhealth high cost claim indemnity?

|

sections 34ZZB to 34ZZD |

| 4 |

what happens if the incidents occurred

during treatment of a publicpatient in a public hospital?

|

paragraph 34ZZD(a) and section 34ZZE |

| 5 |

how

much is the allied health highcost claim indemnity?

|

section

34ZZF |

| 6 |

what

regulations can deal with |

section

34ZZG |

| 7 |

how do MDOs and insurers apply for the

allied health high cost claimindemnity?

|

section

36 |

| 8 |

when

will the allied health high costclaim indemnity be paid?

|

section

37 |

| 9 |

what information has to be provided to

the Chief Executive Medicare about allied health high costindemnity

matters?

|

section

38 |

| 10 |

what

records must MDOs andinsurers

keep?

|

section

39 |

| 11 |

how

are overpayments of allied health high cost claim indemnity recovered? |

sections

41 and 42 |

According to the Minister for Health, Greg Hunt, ‘the

allied health schemes will mirror the existing high cost claims and exceptional

claims schemes’.[96]

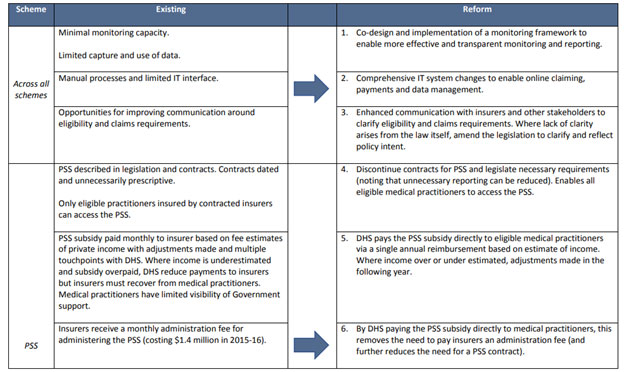

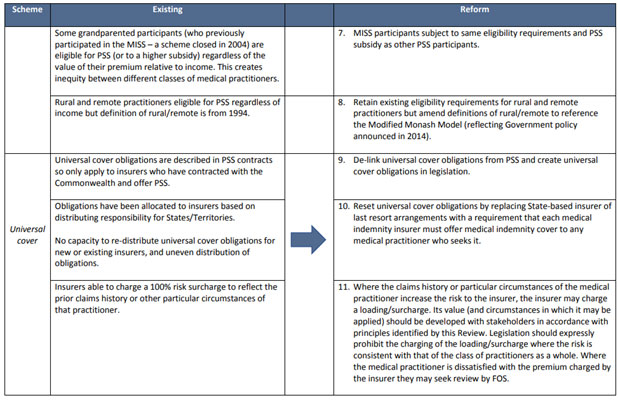

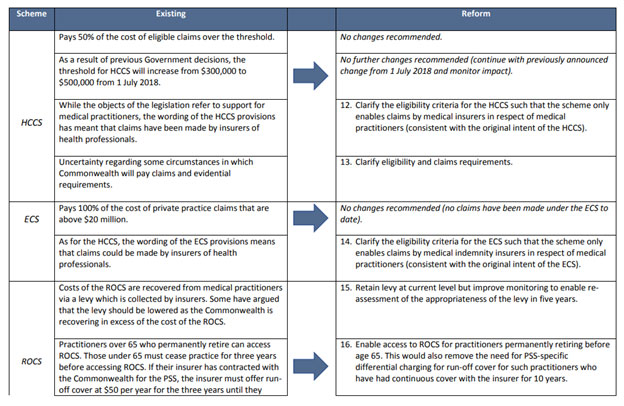

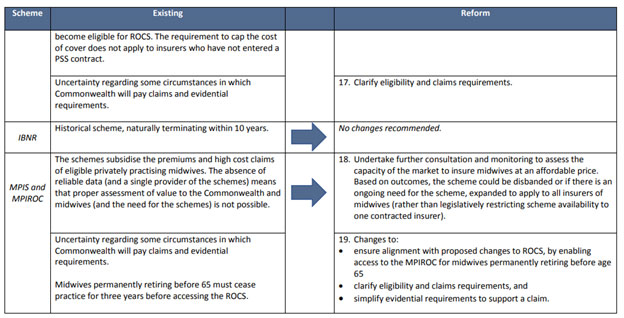

Appendix A: Recommendations

from the First Principles Review (FPR) of

the Indemnity Insurance Fund (IIF)

Source: MP Consulting, First

principles review of the Medical Indemnity Insurance Fund, report

prepared for the DoH, April 2018, pp. 53– 56.

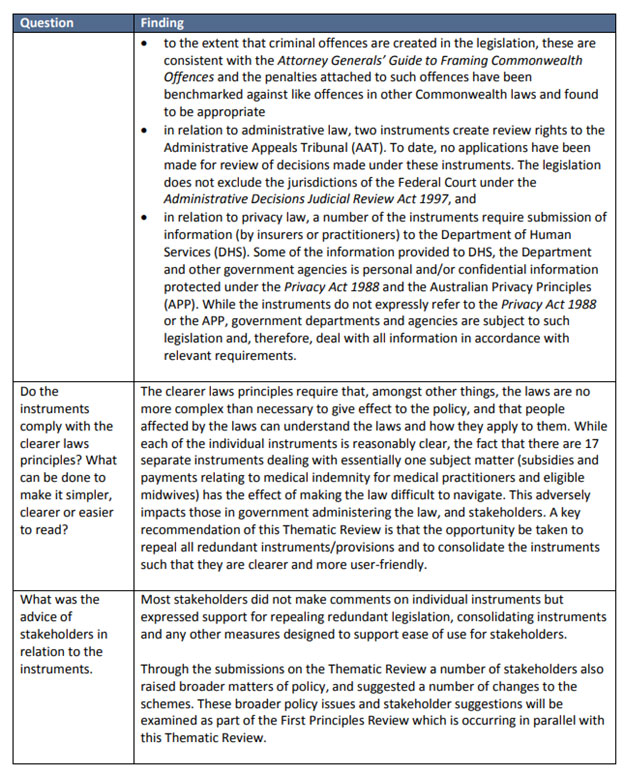

Appendix B: Recommendations from the Thematic Review of Commonwealth