Introductory Info

Date introduced: 2 July 2019

House: House of Representatives

Portfolio: Treasury

Commencement: The Bill commences on the day after Royal Assent.

Purpose of the Bill

The Treasury

Laws Amendment (Tax Relief So Working Australians Keep More Of Their Money)

Bill 2019 (the Bill) seeks to implement further reductions in personal

income tax rates announced in the 2019–20 Budget. These proposed changes are on

top of tax cuts already legislated through the Treasury Laws

Amendment (Personal Income Tax Plan) Act 2018 (the PITP Act). The changes in this Bill will be implemented over

three stages, commencing in 2018–19, 2022–23 and 2024–25, timing which is consistent

with the already legislated tax cuts.

Structure of

the Bill

The Bill consists of two schedules:

- Schedule 1 amends the Income Tax

Assessment Act 1997 (ITAA97) to amend the existing low and

middle income tax offset (LMITO) and the existing low-income tax offset (LITO).

and

- Schedule 2 amends the Income Tax Rates

Act 1986 (Rates Act) to enact changes to personal income tax

thresholds for resident and non-resident tax-payers.

Committee consideration

At the time of writing, the Bill had not been considered

by any Parliamentary Committees.

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the

Bill’s compatibility with the human rights and freedoms recognised or declared

in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[1]

Background

Australia has a progressive personal income tax system

where the rate of tax paid on each dollar increases above certain taxable

income thresholds. The Rates Act sets the rates of tax paid on income

within these taxable income thresholds.

An individual’s tax liability can generally be reduced in

two ways, through deductions or tax offsets. Deductions reduce taxable income

to which tax rates are applied to determine a tax liability, whilst offsets are

applied after the tax liability is calculated.

The next stage of the personal income tax plan (PITP) is

being delivered through a combination of tax offsets for low and middle income

earners and changes in taxable income thresholds. The changes are implemented

across three stages commencing in the 2018–19 income year, the

2022–23 income year and the 2024–25 income year.

Stage one:

commencing in the 2018–19 income year

The PITP Act introduced the low and middle income

tax offset (LMITO). The LMITO is a

non-refundable tax offset for resident taxpayers with low and middle incomes

(up to $125,333). The LMITO applies in addition to the existing low income tax

offset (LITO). Under the PITP Act, the tax benefit provided by LMITO is

currently:

- individuals

earning up to $37,000 are entitled to a LMITO amount of $200 per annum

- individuals

earning more than $37,000 but less than $48,000 are entitled to a LMITO amount

of $200 plus three cents for every dollar in taxable income above $37,000, up

to a maximum rate of $530

- individuals

with taxable income between $48,000 and $90,000 receive the maximum value of

LMITO of $530 and

- individuals

earning more than $90,000 have their LMITO amount reduced by 1.5 cents for

every dollar in taxable income above $90,000, until it phases out entirely for

incomes of $125,333 and above.

In addition to introducing the LMITO, the PITP Act

also raised the taxable income threshold for the 32.5 per cent marginal tax

rate from $87,000 to $90,000 from 1 July 2018.

Stage one of the Bill seeks to increase the LMITO. If

passed, the Bill would:

- Increase,

the LMITO to $255 per annum for those with a taxable income of $37,000 or less.

- Between

taxable incomes of $37,000 and $48,000, the value of the offset will increase

at a rate of 7.5 cents per dollar to the maximum offset of $1,080.

- Taxpayers

with taxable incomes between $48,000 and $90,000 will be eligible for the

maximum offset of $1,080.

- For

taxable incomes of $90,000 to $126,000 the offset will phase out at a rate of three

cents in the dollar.

- The

LMITO is temporary and will apply for the 2018–19, 2019–20, 2020–21 and 2021–22

income years. Further tax reductions and increases to LITO commencing from 1 July 2022

will compensate for the cessation of the LMITO.

Table 1 summarises the LMITO as implemented by the PITP

Act and the changes proposed by the Bill, by taxable income range.

Table 1: summary

of changes to LMITO from 1 July 2018

| Taxable income |

Legislated 2018 |

Proposed in the Bill |

| Less than $37,000 |

$200 |

$255 |

| Between $37,000 and $48,000 |

$200 plus 3c per dollar for every dollar between $37,000

and $48,000 |

$255 plus 7.5c per dollar for every dollar between $37,000

and $48,000 |

| Between $48,000 and $90,000 |

$530 |

$1,080 |

| Above $90,000 |

1.5c per dollar reduction from $530 for every dollar above

$90,000 until it reaches zero (above $125,333). |

3c per dollar reduction from $1,080 for every dollar above

$90,000 until it reaches zero (above $126,000). |

Source: Treasury Laws Amendment (Tax Relief So Working

Australians Keep More Of Their Money) Bill 2019 and Treasury Laws Amendment

(Personal Income Tax Plan) Act 2018.

Amount of

tax reduction (stage one)

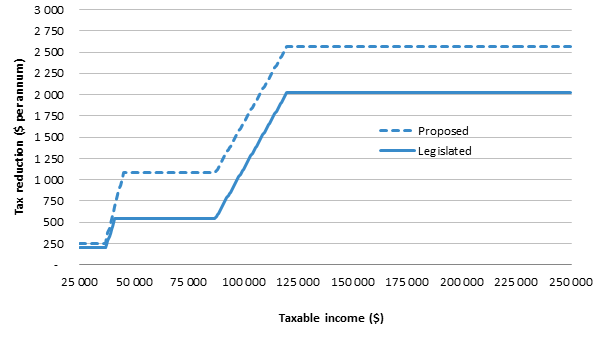

The tax reduction in stage one for individuals at

different taxable income levels is illustrated by figure 1. Figure 1 shows the

tax reduction provided by the PITP Act and the total tax reduction that

would apply if the Bill is passed (compared to tax rates and offsets that

applied in the 2017–18 income year, prior to the implementation of the PITP

Act).

As figure 1 shows, the tax cuts in stage one are targeted

more heavily towards lower and middle income earners—those earning less than

$125,000 in taxable income.

Figure 1: tax reduction ($ per annum) from stage one of the

tax plan

Source: Treasury Laws Amendment (Tax Relief So Working

Australians Keep More Of Their Money) Bill 2019 and Treasury Laws Amendment

(Personal Income Tax Plan) Act 2018.

Stage two:

commencing in the 2022–23 income year

The PITP Act legislated changes to tax rates and

thresholds and to the LITO commencing from the 2022–23 income year. The Bill

proposes further tax reductions, building on those implemented through the PITP

Act.

Income tax

rates and thresholds

Under the changes already implemented by the PITP Act

the upper threshold for the 32.5 per cent marginal tax rate will increase from

$90,000 to $120,000 and the upper threshold for the

19 per cent rate will increase from $37,000 to $41,000 from 1 July 2022.

The Bill would further increase the upper threshold for

the 19 per cent marginal tax rate from $41,000 to $45,000 from 1 July 2022.

LITO

Under the changes already implemented by the PITP Act

commencing from 1 July 2022, the LITO will increase from $445 to $645

per year for individuals with taxable income less than $37,000 (phasing out for

taxable incomes greater than $66,667).

The changes proposed by the Bill would increase the

maximum amount of LITO to $700 for individuals with taxable income less than

$37,500. The LITO will then phase out in accordance with the following schedule:

- individuals

earning between $37,500 and $45,000 will have the new LITO amount reduced by five

cents in the dollar for each dollar of income above $37,500 until their income

reaches $45,000 and

- individuals

earning over $45,000 will have their LITO amount reduced by 1.5 cents in the

dollar until it phases out entirely for individuals earning more than $66,667.

LMITO

LMITO will cease to apply from 1 July 2022 but

the increase in the LITO and the changes to income tax rates and thresholds

would deliver a tax cut commensurate with, or greater than, the tax reduction

provided by LMITO.

Summary of

changes

The changes implemented by the PITP Act and proposed in

the Bill are summarised in table 2.

Table 2: summary

of legislated and proposed tax plans for 2022–23 and 2023–24

|

|

Implemented reforms

(Treasury Laws Amendment (Personal Income Tax Plan)

Act 2018) |

Proposed reforms

(Treasury Laws Amendment (Tax Relief So Working

Australians Keep More Of Their Money) Bill 2019) |

| LITO and LMITO |

LITO increased from a maximum of $445 to $645 per annum

for individuals with taxable income less than $37,000.

LITO phases out by 6.5 cents in the dollar for taxable

incomes between $37,000 and $41,000.

LITO phases out by 1.5 cents in the dollar for taxable

income above $41,000 (to zero above $66,667).

LMITO ceases to apply but increased LITO and personal

income tax changes ‘lock in’ the previous stage’s tax cuts. |

LITO increased from a maximum of $645 to $700 per

annum for individuals with taxable income less than $37,500.

LITO phases out by five cents in the dollar for

taxable incomes between $37,500 and $45,000.

LITO phases out by 1.5 cents in the dollar for taxable

income above $45,000 (to zero above $66,667).

LMITO ceases to apply but increased LITO and personal

income tax changes ‘lock in’ the previous stage’s tax cuts. |

| Income tax rates and thresholds |

Top taxable income threshold for the 19 per cent marginal

tax rate increased from $37,000 to $41,000.

Top taxable income threshold for the 32.5 per cent

marginal tax rate increased from $90,000 to $120,000. |

Top taxable income threshold for the 19 per cent marginal

tax rate increased from $41,000 to $45,000. |

Source: Treasury Laws Amendment (Tax Relief So Working

Australians Keep More Of Their Money) Bill 2019 and Treasury Laws Amendment

(Personal Income Tax Plan) Act 2018.

Amount of

tax reduction (stage two)

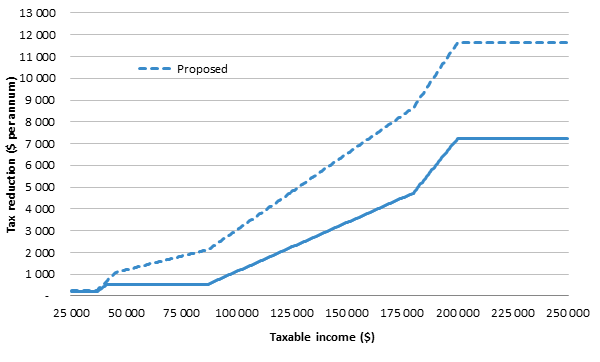

The total tax reduction in stage two for individuals at

different taxable income levels is illustrated by figure 2. Figure 2 shows the

tax reduction provided by the legislated PITP and the total tax reduction that

would apply if the Bill is passed (compared to tax rates and offsets that

applied in the 2017–18 income year, prior to the implementation of the PITP

Act). Stage two provides relatively larger tax cuts to higher income

earners, up to a maximum of $2,565 per annum (for those with taxable incomes

greater than $120,000).

Figure 2: tax

reduction ($ per annum) from stage two of the tax plan

Source: Parliamentary Library analysis based on the Treasury

Laws Amendment (Tax Relief So Working Australians Keep More Of Their Money)

Bill 2019 and Treasury Laws Amendment (Personal Income Tax Plan) Act 2018.

Stage three:

commencing in the 2024–25 income year

The changes proposed in stage three, commencing from 1 July 2024,

are entirely delivered through changes in personal income tax rates and

thresholds.

The PITP Act abolishes the 37 per cent marginal tax

rate entirely from 1 July 2024 and extends the marginal tax rate of

32.5 per cent to all taxable incomes up to $200,000.

The Bill proposes to further reduce the 32.5 per cent rate

to 30 per cent. This will mean that all taxpayers with a taxable income between

$45,000 and $200,000 will pay a marginal tax rate of 30 per cent.

Table 3: summary

of legislated and proposed tax plans for 2024–25 and later income years

|

|

Implemented reforms

(Treasury Laws Amendment (Personal Income Tax Plan)

Act 2018) |

Proposed reforms

(Treasury Laws Amendment (Tax Relief So Working

Australians Keep More Of Their Money) Bill 2019) |

| Tax offsets |

No further changes |

No further changes |

| Income tax rates and thresholds |

Extend the 32.5 per cent marginal tax rate up to taxable

incomes of $200,000, abolishing the 37 per cent marginal tax rate entirely. |

Reduce the 32.5 per cent marginal tax rate to 30 per cent.

All taxpayers with taxable incomes between $45,000 and $200,000 will pay a

marginal tax rate of 30 per cent. |

Source: Treasury Laws Amendment (Tax Relief So Working

Australians Keep More Of Their Money) Bill 2019 and Treasury Laws Amendment

(Personal Income Tax Plan) Act 2018.

Amount of

tax reduction (stage three)

The total tax reduction in stage three for individuals at

different taxable income levels is illustrated by figure 3. Figure 3 shows the

tax reduction provided by the PITP Act and the total tax reduction that

would apply if the Bill is passed (compared to tax rates and offsets that applied

in the

2017–18 income year). Stage three provides relatively larger tax cuts to higher

income earners, up to a maximum of $11,640 per annum (for those with taxable

incomes greater than $200,000).

Figure 3: tax

reduction ($ per annum) from stage three of the tax plan

Source: Parliamentary Library analysis based on the Treasury

Laws Amendment (Tax Relief So Working Australians Keep More Of Their Money)

Bill 2019 and Treasury Laws Amendment (Personal Income Tax Plan) Act 2018.

Financial

implications

According to the Explanatory

Memorandum to the Bill the PITP is estimated to reduce revenue by $19.5 billion

over the budget forward estimates period and by $158 billion over the period to

2029–30.[2]

A break-down of this estimate over each year of the forward estimates period is

included in Table 4.

Table 4: financial

impact of the PITP (forward estimates period) ($m)

| 2018–19 |

2019–20 |

2020–21 |

2021–22 |

2022–23 |

| Nil |

-3,450 |

-3,700 |

-3,750 |

-8,640 |

Source: Explanatory Memorandum to the Treasury Laws Amendment

(Tax Relief So Working Australians Keep More Of Their Money) Bill 2019, p. 3.

The Bill is expected to have a more significant negative

financial impact beyond the forward estimates period as the third step of tax

changes under the Bill commences in 2024–25.

Estimates of the cost of each step of the proposed changes

over ten years were published by the Parliamentary Budget Office (PBO) on 28 June 2019

in response to a request by Senator Richard Di Natale. These figures show

that:

- stage

one is expected to reduce Commonwealth revenue by $14.9 billion over the period

to 2029–30

- stage

two is expected to reduce Commonwealth revenue by $47.6 billion over the period

to 2029–30 and

- stage

three is expected to reduce Commonwealth revenue by $95.4 billion over the

period to 2029‑30.[3]

Distribution

of the tax cuts

The tax reductions implemented through the PITP and

proposed by the Bill initially target those on low and middle taxable incomes,

with step two and step three providing additional tax reductions for those at

higher taxable income levels.

Table 5 shows the estimated tax reduction for selected

taxable incomes from each stage of the already implemented PITP and the

additional tax cuts under this Bill. The highest tax cut currently available

under the legislated PITP is $7,225 per annum. The highest tax cut available

under the Bill would be $11,640 per annum for those with taxable income over

$200,000 from 2024–25 onwards.

Table 5: tax

reduction ($ per annum) under the legislated and proposed tax plans (by taxable

income) – single resident tax payer

| |

Tax reduction provided

by the PITP Act

(already legislated) |

Total tax reduction

provided by the Bill and the legislated tax cuts combined |

|

Taxable income ($)

|

From 1 July

2018 |

From 1 July

2022 |

From 1 July

2024 |

From 1 July

2018 |

From 1 July

2022 |

From 1 July

2024 |

| 30,000 |

200 |

200 |

200 |

255 |

255 |

255 |

| 40,000 |

290 |

455 |

455 |

480 |

580 |

580 |

| 50,000 |

530 |

540 |

540 |

1,080 |

1,080 |

1,205 |

| 60,000 |

530 |

540 |

540 |

1,080 |

1,080 |

1,455 |

| 70,000 |

530 |

540 |

540 |

1,080 |

1,080 |

1,705 |

| 80,000 |

530 |

540 |

540 |

1,080 |

1,080 |

1,955 |

| 90,000 |

665 |

675 |

675 |

1,215 |

1,215 |

2,340 |

| 100,000 |

515 |

1,125 |

1,125 |

915 |

1,665 |

3,040 |

| 110,000 |

365 |

1,575 |

1,575 |

615 |

2,115 |

3,740 |

| 120,000 |

215 |

2,025 |

2,025 |

315 |

2,565 |

4,440 |

| 130,000 |

135 |

2,025 |

2,475 |

135 |

2,565 |

5,140 |

| 140,000 |

135 |

2,025 |

2,925 |

135 |

2,565 |

5,840 |

| 150,000 |

135 |

2,025 |

3,375 |

135 |

2,565 |

6,540 |

| 160,000 |

135 |

2,025 |

3,825 |

135 |

2,565 |

7,240 |

| 170,000 |

135 |

2,025 |

4,275 |

135 |

2,565 |

7,940 |

| 180,000 |

135 |

2,025 |

4,725 |

135 |

2,565 |

8,640 |

| 190,000 |

135 |

2,025 |

5,975 |

135 |

2,565 |

10,140 |

| 200,000+ |

135 |

2,025 |

7,225 |

135 |

2,565 |

11,640 |

Source: Parliamentary library analysis based on the Treasury

Laws Amendment (Tax Relief So Working Australians Keep More Of Their Money)

Bill 2019 and Treasury Laws Amendment (Personal Income Tax Plan) Act 2018.

Policy

position of non-government parties/independents

Australian

Labor Party

The Australian Labor Party has indicated support for stage

1 and stage 2 of the Bill (but not stage 3) and argued that some of the tax

changes made by the Bill should be brought forward to 2019 to provide

additional economic stimulus.[4]

The Shadow Treasurer moved two amendments to the Bill in

the House of Representatives on 2 July 2019:

- The

first set of amendments [sheet 1], would bring forward some of the already

legislated reductions in personal income tax rates from the 2022–23 income year

to the 2019–20 income year. The proposed amendments would increase the income

threshold for the 32.5 per cent marginal rate from $90,000 to $120,000.[5]

- The

second set of amendments would have effectively removed the third stage of

changes in the Bill, so that the marginal tax rate applying for taxable incomes

between $45,000 and $200,000 would remain at 32.5 per cent.[6]

Australian

Greens

The Australian Greens do not support the Bill, arguing that

there are better ways to provide support to low and middle income earners than

tax cuts.[7]

Key

provisions

Schedule 1 –

Low and Middle Income Tax Offset and Low Income Tax Offset

Schedule 1 of the Bill proposes changes to

the ITAA97 to implement increases in the LMITO for the 2018–19, 2019–20,

2020–21 and 2021–22 income years, and increases to the LITO for the 2022–23

income year onwards.

- Item

2 of Schedule 1 of the Bill repeals the existing rates for

the LMITO at subsection 61-107(1) of the ITAA97 and inserts the proposed

higher rates of LMITO.

- Item

3 of Schedule 1 of the Bill repeals the existing rates for

the LITO at subsection 61-115(1) of the ITAA97 and inserts the proposed

higher rates of LITO.

Schedule 2 –

Personal income tax reform

Schedule 2 of the Bill proposes changes to

the Rates Act to implement changes to personal income tax rates and

thresholds.

- Item

1 of Schedule 2 of the Bill implements the new income tax rates and

thresholds that apply to resident individuals in 2022–23 and 2023–24.

- Item

2 of Schedule 2 of the Bill implements the new income tax rates and

thresholds that apply to resident individuals in 2024–25.

- Item

3 of Schedule 2 of the Bill implements the new income tax rates and

thresholds that apply to working holiday makers in 2022–23.

- Item

4 of Schedule 2 of the Bill implements the new income tax rates and

thresholds that apply to working holiday makers in 2024–25.