On 29 July, the Australian Bureau of Statistics announced that the Consumer Price Index (CPI) fell 1.9 per cent in the June 2020 quarter, the largest fall in its 72-year history.

For people with an outstanding Higher Education Loan Program (HELP) or similar student loan debt, indexed using CPI, this raises questions about whether the debt will be reduced in line with the CPI reduction.

While there is no immediate effect from the June 2020 quarter fall, the indexation arrangements for outstanding HELP debts, which are intended to maintain the real value of the debt, could result in reduced loan balances in June 2021, depending on CPI movements over the next three quarters.

Indexation arrangements

The arrangements for indexing HELP debt are set out in the Higher Education Support Act 2003 (HESA). They have been in place since HELP was established, and are based on those that applied to the former Higher Education Contribution Scheme (HECS) under the Higher Education Funding Act 1988.

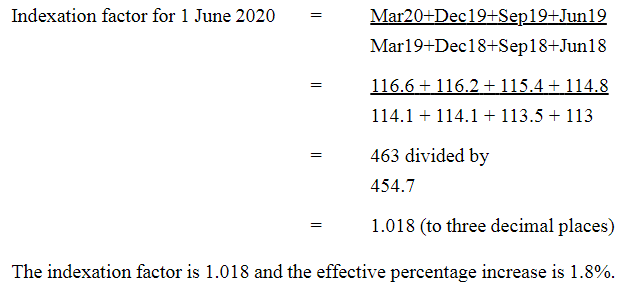

Under section 140-10 of HESA, an ‘indexation factor’ is calculated using the sum of the index numbers for the four quarters to March for the relevant year, divided by the sum of the index numbers for the four quarters to March for the preceding year. On 1 June each year, outstanding HELP debt is calculated (taking into consideration any repayments, additional debts, or other adjustments), and the result is multiplied by the indexation factor.

Schedule 1 of HESA provides that the index number for a quarter is the All Groups Consumer Price Index number, which is the weighted average of the eight capital cities, published by the Australian Statistician for that quarter.

The latest example of these calculations can be seen in the Factor to Index an Accumulated HELP VSL TSL or Financial Supplement Debt 2020 made by the Assistant Commissioner of Taxation on 11 May 2020:

Does this mean debts could fall?

Because outstanding debts that remained unpaid for at least 11 months were indexed on 1 June using the 2020 indexation factor shown above, any effect from falling CPI is at least 11 months away.

If CPI continues to fall, or does not rise enough to make up for the June 2020 quarter decline, an indexation factor of less than 1 could result, which would see student loan debts shrink slightly. The earliest this could occur is the next indexation point, which is 1 June 2021. This does not take into consideration any specific individual circumstances that would have a larger impact on outstanding debt, such as additional debts incurred, repayments, or remittances.

While the conditions for indexed reductions to student loan debts have not been seen recently, they did occur from 1997 to 1998, resulting in an indexation factor of 0.999 in 1998 for outstanding HECS debts. The only other time since 1960 that CPI levels would have led to an indexation factor under 1 using this indexation formula was in 1963, when March to March CPI would have led to an indexation factor of 0.997. This was prior to the introduction of HECS.

In the media release accompanying the June CPI figures, the ABS provided a graph of annual CPI movement and events associated with large changes in CPI levels since 1949. Previous recessions in 1960–61, 1982–83, and 1991 have all led to periods of slowing inflation, including the deflation experienced in 1962–63. While the Asian Financial Crisis did not result in a recession in Australia, it did lead to recessions and falls in exchange rates in many regional trading partners, which contributed to the slowing in inflation in Australia. Given widespread expectations of an Australian recession following COVID-19 lockdowns, there is the potential for a repeat of the experience of subdued inflation in the short-term, which could lead to an indexation factor below 1 on 1 June 2021.

Relevance to other programs

Debt incurred through other student loans is indexed using the same arrangements as HELP. These include VET Student Loans, the former Student Financial Supplement Scheme, Student Start-up Loans including ABSTUDY Student Start-up Loans, and Trade Support Loans.

Other higher education funding programs under HESA are indexed separately from HELP, and have slightly different arrangements. Subsection 198-10(2) provides that these are not indexed if the indexation factor is 1 or less.