Key issue

The government response to COVID-19 saw unprecedented levels of income support provided to Australians including increased rates, new payments, and expanded eligibility. The use of ad hoc, temporary changes suggests the design of the social security safety net may need to be reconsidered to ensure it can withstand future economic shocks. Long-standing concerns with the adequacy of some payment rates and eligibility criteria have also re-emerged as COVID-19 supports were withdrawn. Addressing these issues at a time when the Government is looking to restrain expenditure will be difficult.

The level and accessibility of Australia’s social

security and family assistance support systems will persist as key issues for

the 47th Parliament. Around 9.4 million Australians accessed payments or

concession cards from

Centrelink in 2020–21 (p. xiii). Social security, veterans and family

assistance payments make up around 25% of government expenditure- estimated

at around $155 billion in 2021–22 (based on Budget

strategy and outlook: budget paper no. 1: 2022–23, pp. 144;

154–158).

This article examines trends, issues and election

commitments in 3 key areas: income support for working-age people, the Age

Pension and family assistance.

Working-age income support

In 2019, the proportion of the population aged

15–64 receiving means-tested income support payments had reached 13.2%- its

lowest level in 40 years (Figure 1). By June 2020, following the arrival of

COVID-19 in Australia and the implementation of policies aimed at containing

the virus and supporting

those affected by the resulting economic downturn, the proportion of the

working-age population receiving payments had reached 18.6%.

Figure 1 shows that while high, the 2020 level did

not reach the high point achieved following the early-1990s recession when

almost a quarter of this age group received government income support. However,

the 2020 numbers would have been much higher were it not for enacted policy

measures, particularly the JobKeeper wage subsidy

paid to employers. Around 3.6 million individuals were subsidised through

JobKeeper in June 2020. If those aged 65 and over (around 230,000 people) and

those receiving another income support payment (around 130,000 people) are

excluded, JobKeeper recipients represented around 20.1% of the working age

population. In total, an estimated 38.7% of the population aged 15–64 was

receiving government income support in mid-2020.

Figure 1 Income

support recipients as a % of estimated resident population aged 15–64

Notes: Data is

at June unless point-in-time data unavailable in source. Excludes JobKeeper and

disaster payments. ‘Low workforce attachment’ includes female Age Pension

recipients aged under 65 years, payments for widows, Bereavement Allowance

(merged into JobSeeker Payment from March 2020), Mature Age Allowance, Partner

Allowance from 1996 and a percentage of estimated dependent partners of

allowance payment recipients 1978–94. ‘Veterans’ includes Service Pension and

Income Support Supplement. Estimates for some populations follow methodology

used in sources.

Sources:

Parliamentary Library calculations based on Department of Social Services (DSS),

‘DSS

Demographics’, and predecessor departments’ statistical papers, Department

of Veterans’ Affairs, ‘Pensioner

summary statistics’, from 2000 onwards; and Department of Education annual

reports. Latest source available assumed to be most accurate where published

data varies. Population data from Australian Bureau of Statistics (ABS), National,

State and Territory Population, (ABS: Canberra, September 2021), Table

59.

The pre-COVID low point in income support receipt

arose from improvements in the labour market and policy

decisions under consecutive governments (pp. 56–57), including:

- an increase in the Age Pension qualifying age for women

- the phasing-out of payments primarily aimed at dependent partners

such as widow and wife pensions

- restricting eligibility for the Parenting Payment to those with younger

children and introducing activity requirements for recipients of this payment

- new qualification requirements for the Disability Support Pension and a

changed method for assessing impairment levels.

In June 2021, while social security payment

recipient numbers declined, the Government introduced a new COVID-19

Disaster Payment to support those affected by state and territory

government COVID-19 lockdowns. By December 2021, around 2.4 million individuals

had received

the COVID-19 Disaster Payment. Factoring in this payment (but excluding the

180,000 recipients receiving

the COVID-19 Disaster Payment and another income support payment from

Centrelink, p. 18) indicates close to 28.7% of the working-age population

were receiving income support in the second half of 2021.

Does the safety net need a rethink?

The use of ad hoc, temporary income support changes

in response to COVID-19 suggests the design of the social security safety net

may need to be reconsidered to ensure it can withstand future economic shocks. These

temporary

changes included (pp. 5–13):

-

the effective doubling of unemployment benefit

payment rates

-

newly created payments

- expanded eligibility conditions

- eased claim requirements to minimise wait-times

and administrative burdens

-

multiple lump-sum payments to boost other income

support recipients’ rates.

Underlying this response to COVID-19 was a lack of

any permanent job

retention scheme in Australia and long-standing issues with the

adequacy of existing payments and their eligibility

conditions.

Some

researchers have suggested the government response to COVID-19 has ‘opened

up the policy space for a more detailed consideration of innovative reform’

such as universal basic income and unemployment

insurance. The Australian

Green’s 2022 election platform included a significant lift in social

security payment rates with reduced conditionality as part of its ‘liveable

income guarantee’ policy. In 2021, the New

Zealand Government announced it would develop a ‘social unemployment

insurance scheme’. New Zealand and Australia currently stand apart

internationally by relying entirely on flat-rate means-tested systems of unemployment

payments rather than contribution-based insurance systems. Neither the

Coalition nor the ALP proposed major changes to working-age income support

policy at the 2022 election.

Many of the COVID-19 response measures were

delivered outside of legislated frameworks. The COVID-19 Disaster Payment and

Pandemic Leave Disaster Payment were authorised

as grant payments through legislative instruments rather than via

legislation (pp. 8–10). Around $14.5 billion was delivered through these

programs but eligibility criteria and payment rate details were left to outdated

grant guidelines that did not reflect policy changes. Similarly, additional payments

to people affected by the early 2022 NSW floods were delivered as grant programs

rather than disaster

payments provided for in the Social Security Act 1991. Not

addressing issues with the existing safety net through Parliament risks the Executive

turning to similar ad hoc, unscrutinised measures during future crises or

disasters.

Age Pension

Income support for the aged is the largest

component of social

security spending, representing over a third of payments in 2022–23 at

$54.2 billion. In

December 2021, a total of 2,556,063 people received the Age Pension and around 110,000

people aged over 65 received the Service Pension or other means-tested pensions

paid by the Department

of Veterans’ Affairs (DVA).

COVID-19 response measures for pension recipients

included 4

lump-sum payments (p. 131) followed by a $250 ‘Cost of Living Payment’ in

the 2022–23

Budget. There were few significant changes to the Age Pension in the 46th

Parliament, although the Morrison Government attempted to change

the residency requirements for pensions and stop supplement payments for

pensioners temporarily travelling overseas for 6 weeks.

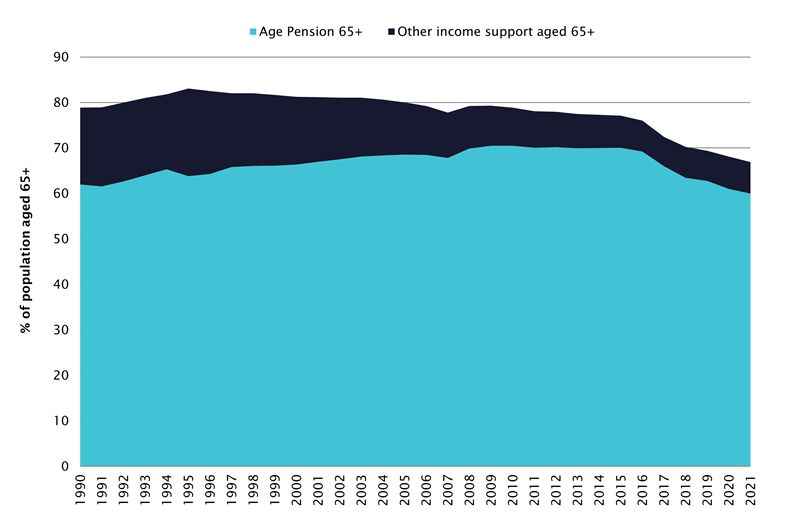

Since 2011 the proportion of Australians aged 65

years and over receiving the Age Pension has dropped significantly, from around

70% to around 60% in 2021 (Figure 2). This is a result of policy changes

including the gradual increase in the Age Pension age (increasing

from 65 in 2017 to 67 by 2023); asset

test changes which commenced in 2017; and increased superannuation balances

and other investments reducing the number of people eligible under the pension means

tests.

Figure 2 Income

support recipients aged 65+ as a % of estimated resident population aged 65+

Notes: Other income

support includes Disability Support Pension, Carer Payment, Service Pension and

Income Support Supplement and closed payments such as Wife Pension but excludes

Widow Allowance due to lack of data for 1990–99. Data is for June of each year.

March 2000 data used for veterans’ payments.

Sources:

Parliamentary Library calculations based on DSS and DVA statistical

publications, and ABS, National,

State and Territory Population, (ABS: Canberra, September 2021), Table

59.

Retirement Income Review

Age Pension policy was considered as part of the

Treasury’s Retirement income review. The Review’s final report,

released on

20 November 2020, observed:

The Age Pension, combined with other support

provided to retirees, is effective in ensuring most Australians achieve a

minimum standard of living in retirement in line with community standards. (p.

18)

However, a significant number of retirees struggle

financially- particularly those renting in the private market, and early

retirees who live on lower-rate payments before qualifying for the Age Pension.

The Treasury report found that around 60% of single retirees who are renting

are living in poverty (p. 32) but determined that increased Rent Assistance would

not have a meaningful impact on income poverty rates. It did not offer an

alternative proposal.

The report found that homeowners could

significantly boost their retirement incomes by drawing on home equity through

reverse mortgages such as the Home

Equity Access Scheme. However, the review found

the current pension asset test exemption for the family home acted as a

disincentive for retirees to draw on this equity (p. 19).

Election commitments

The Coalition made 2 election commitments affecting

Age Pension recipients:

- providing incentives

for homeowners to downsize by extending the assets test exemption for

proceeds from a pensioner’s principal home from 12 to 24 months and assessing a

lower rate of ‘deemed income’ from the proceeds under the income test.

- freezing

the deeming rates used to assess income from financial investments for 2 years.

This will mean pensioners are likely to have less income assessed than what they

are earning on their investments.

The

ALP committed to implementing the same policies (p. 12).

The Coalition

also committed to increasing the income limits to access the Commonwealth

Seniors Health Card. The concession card is for those ineligible for the Age

Pension, usually due to the assets test. Labor

also committed to the same policy (p. 12).

The Greens’ ‘liveable

income guarantee’ election policy proposed lifting pension and other income

support rates. The Greens also announced

a policy to return the pension qualifying age to 65.

Family assistance

Broadly, family assistance includes the Family Tax

Benefit (FTB) program, Paid Parental Leave and the Child Care Subsidy. The

largest component is FTB with an estimated $17.9 billion in payments

budgeted for 2022–23 (p. 31). The Government expected to spend $10.7 billion on

the Child

Care Subsidy in 2022–23 (p. 28) and around $2.7 billion on Paid

Parental Leave (p. 31).

Election commitments

A major

ALP election policy was increased Child Care Subsidy rates and changes to

the income test- estimated to cost $5.1 billion over the forward estimates.

Modelling by Australian

National University researcher Ben Phillips estimated that families using

child care would, on average, gain around $1,600 per year under Labor’s

proposed changes (p. 6). The

Greens proposed spending $19.0 billion, making child care free for all

families.

The Coalition’s

last Budget included a $346.1 million proposal to merge the current Paid

Parental Leave payments available to principal carers and to fathers and

partners so that new parents and carers could choose how they shared a 20-week

payment entitlement. Labor did not indicate its position on this proposal prior

to the election. The

Greens proposed a 26-week Paid Parental Leave scheme paid at pro rata the

parent’s existing wage, up to $100,000 per annum. The policy would also provide

for superannuation contributions to be paid for the leave period and was

estimated to cost $24.5 billion over 10 years.

None of the parties included FTB changes in their

election policies.

Family Tax Benefit no longer for the middle class

The Howard Government

established FTB in 2000, merging a range of different family payments into FTB Part A and

Part B. Part A is paid per eligible child- it is income-tested and rates

vary by the child’s age. Part B is paid primarily to single parents and to

couples with young children where one partner has low or no income. It is paid

per eligible family and is income-tested with rates based on the age of the

youngest eligible child. In

December 2021, around 1.4 million families received FTB for around 2.7

million children. Around 43% of families receiving FTB were also receiving an

income support payment such as Parenting Payment or JobSeeker Payment. These

figures do not include around 4–5% of recipients who are paid FTB

as an end-of-financial-year lump-sum.

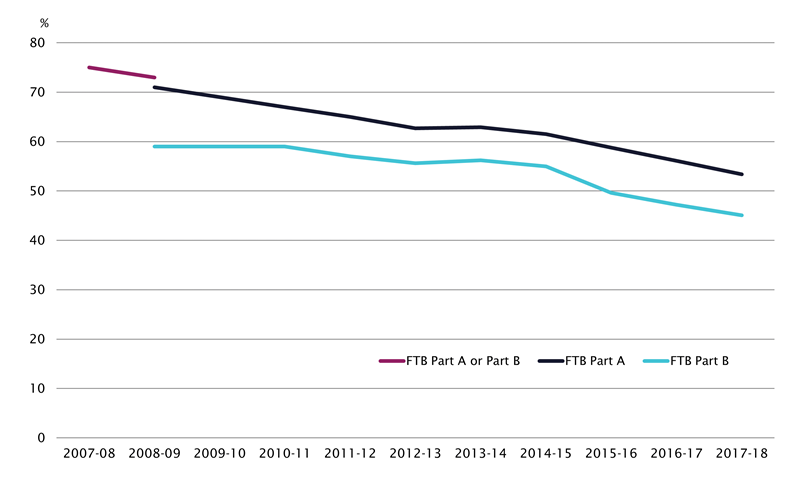

Initially,

most families with dependent children received FTB (p. 17); however, this

almost-universality has eroded via income limits and indexation freezes. In 2007–08

around 75% of families with children under 16 received FTB. By 2017–18, only

around 53% of families received FTB Part A and 45% received FTB Part B (Figure

3). The Department of Social Services (DSS) ceased publishing this measure in its

annual

report in 2020–21, but based on the trend it is likely that fewer than half

of families with dependent children now receive FTB.

DSS has recently changed

the FTB program’s performance measure to explicitly state it is targeted at

low-income families (p. 48). The program now aims to have at least 67% of

FTB paid to families whose income is under the ‘FTB Part A lower income free area’. For 2021–22, this means 67% of FTB being paid to

families with a combined income of under $56,137.

Figure 3 Proportion

of families with children under 16 years of age receiving Family Tax Benefit

Notes: DSS calculations

based on estimates of families with children under 16 years using ABS Survey of

Income and Housing data (excludes families with shared care arrangements). FTB

data is based on reconciled entitlements so 2017–18 data was published in June

2020.

Sources: DSS

and predecessor agencies’ annual reports.

The ALP and Coalition government’s policies have

limited FTB growth despite population and rate increases. The ALP’s savings

measures included freezing

the annual adjustment of some income test thresholds and the rate of

end-of-year supplements; changing

the way adjustments are made to FTB Part A rates; and introducing an income limit

for FTB Part B. These measures were

partly offset by increasing rates of FTB Part A for older children and an

additional ‘Schoolkids Bonus’ payment.

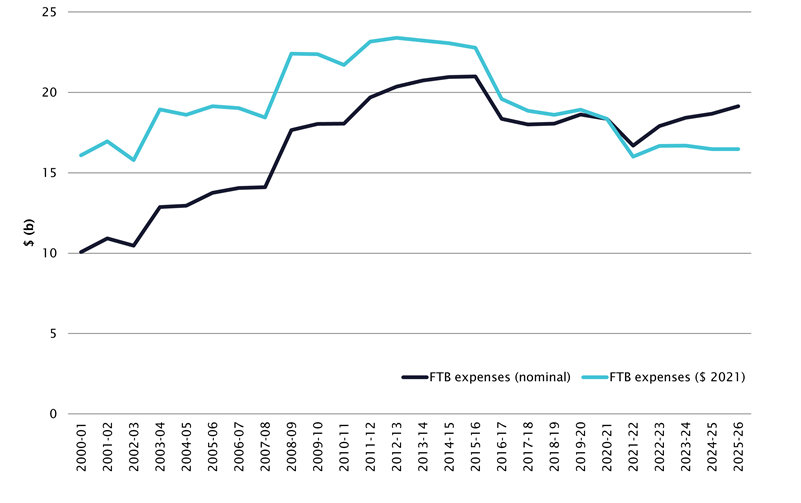

Under the Coalition Government, real FTB expenditure

(adjusted for inflation) has fallen to an estimated equivalent of 2000–01

levels (Figure 4). Measures contributing to this include:

Figure 4 Family

Tax Benefit expenses, nominal and real ($ June 2021)

Notes: 2000–01

to 2020–21 are actual expenses. 2021–22 is estimated actual. 2022–23 onwards

are estimates. 2021 dollars calculated using CPI for June quarter at the end of

the relevant financial year. Expenditure over the forward estimates converted

to 2021 dollarsusing the estimated changes to the CPI published in Australian

Government, Budget

Strategy and Outlook: Budget Paper No. 1: 2022–23, 6.

Sources:

Parliamentary Library calculations based on DSS and predecessor agencies’ Portfolio

Additional Estimates Statements and Portfolio Budget Statements.

Through making the FTB program more targeted,

consecutive governments have achieved significant budget savings. However, previous

savings measures primarily affected high- and middle-income families, and any

further savings measures are more likely to affect low-income families.

Further reading

Michael Klapdor, ‘Social security’, Budget Review 2022–23, Research paper, 2021–22, (Canberra: Parliamentary Library, 2022).

Senate Community Affairs References Committee, Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia (Canberra: The Senate, 2020).

Retirement Income Review, Retirement Income Review: Final Report, (Canberra: The Treasury, 2020).