The Australian Taxation Office (ATO) has released new data on the Higher Education Loan Program (HELP, formerly HECS) debts.

This FlagPost summarises the ATO HELP data. Previous versions were published for the 2017–18 financial year release, and the 2016–17 financial year release.

All figures are at 30 June for the relevant financial year. Figures have not been adjusted for inflation.

Total amount of outstanding HELP debt

This release updates the total amount of outstanding HELP debt to nearly $67.0 billion in 2018–19, up from $62.0 billion in 2017–18.

Figure 1: Total amount of outstanding HELP debt 2009–10 to 2018–19 financial years ($m)

(Source: ATO, HELP statistics 2018-19, Table 6, updated 24 October 2019.)

However, since HELP is an asset on the Government's balance sheet, the proportion of outstanding debt not expected to be repaid (DNER) is arguably more important than the overall size of the loan portfolio. The latest DNER estimate from the Australian Government Actuary is 15.76 per cent (according to the Department of Education Annual Report 2018–19 (p. 32)). This is a significant decline from the DNER estimate of 18 per cent provided last year (according to the then Department of Education and Training’s Annual Report 2017–18 (p. 44)), which the Department attributes partly to the introduction of new HELP repayment rates and thresholds, including a lower minimum repayment threshold of $45,881, from 2019–20.

The ‘fair value’ of HELP debts, which calculates the value of the loans as an asset, taking into account DNER and the concessional nature of HELP loans (as HELP debt indexation is set at the Consumer Price Index, which is generally lower than the Government’s cost of borrowing), was estimated at $46.1 billion at 30 June 2019 in the 2019–20 Budget papers (p. 6-20).

Number of people with outstanding HELP debt

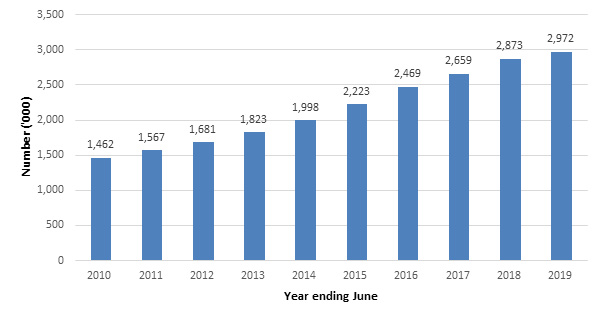

The number of people with outstanding HELP debts reached 3.0 million in 2018–19, up from 2.9 million in 2017–18. This includes people who borrowed for Commonwealth supported (HECS-HELP) or full-fee (FEE-HELP) higher education qualifications, and vocational education qualifications (VET Student Loans, previously VET FEE-HELP). It also includes SA-HELP, for higher education students to defer the cost of their student services and amenities fees, and OS-HELP, for higher education students to defer the cost of eligible overseas study.

After rapid growth in the number of people with outstanding debt in 2013–14 (10 per cent), 2014–15 (11 per cent) and 2015–16 (11 per cent), growth during 2016–17 was down slightly to 8 per cent, and remained at 8 per cent for 2017–18. In 2018–19, the number of people with HELP debts continued to grow, but only by 3 per cent.

This is likely at least partly attributable to the stricter provider compliance requirements that have applied to student loans for VET since the introduction of VET Student Loans as a replacement for VET FEE-HELP in 2017. The number of unique students accessing VET FEE-HELP peaked at 272,026 in 2015. In comparison, 57,874 unique students used the replacement program, VET Student Loans, in 2018.

Figure 2: Total number of people with outstanding HELP debt 2009–10 to 2018–19 financial years

(Source: ATO, HELP statistics 2018-19, Table 6, updated 24 October 2019.)

Size of outstanding HELP debts

The number of debts above $50,000 also continued to grow in 2018–19, reaching 244,201, up from 208,146 in 2017–18. Among people with debts above $50,000, 22,514 have debts above $100,001, up from 18,729 in 2017–18. More detail is provided in Table 1 below.

The average amount of outstanding debt is much lower at $22,425, up from $21,557 in 2017–18.

The time taken to repay HELP debts has also been steadily rising, reaching 9.2 years in 2018–19, up from 9.1 years in 2017–18.

Table 1: Number of people with outstanding HELP debt, by size of outstanding balance 2009–10 to 2018–19 financial years

Outstanding

HELP debt |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

Up to

$10,000 |

657,876 |

696,577 |

723,714 |

768,048 |

799,772 |

827,484 |

851,313 |

893,574 |

910,732 |

910,821 |

$10,000.01

to $20,000 |

471,039 |

471,194 |

495,681 |

524,986 |

566,386 |

619,799 |

665,697 |

679,259 |

706,962 |

713,363 |

$20,000.01

to $30,000 |

224,071 |

252,253 |

269,787 |

296,244 |

338,949 |

403,064 |

473,584 |

509,360 |

548,229 |

563,779 |

$30,000.01

to $40,000 |

71,669 |

91,733 |

114,051 |

131,384 |

157,758 |

195,492 |

242,240 |

281,594 |

328,753 |

350,824 |

$40,000.01

to $50,000 |

21,976 |

31,679 |

42,338 |

53,877 |

67,468 |

84,863 |

110,455 |

135,795 |

169,781 |

189,044 |

Over

$50,000 |

15,141 |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

n.a. |

$50,000.01

to $60,000 |

n.a. |

11,978 |

17,444 |

23,705 |

32,258 |

43,096 |

56,919 |

70,265 |

87,380 |

99,389 |

$60,000.01

to $70,000 |

n.a. |

4,601 |

7,322 |

10,589 |

15,002 |

21,035 |

29,235 |

37,363 |

50,425 |

58,675 |

$70,000.01

to $80,000 |

n.a. |

2,429 |

3,507 |

5,009 |

7,433 |

10,629 |

15,164 |

19,996 |

27,393 |

33,374 |

$80,000.01

to $90,000 |

n.a. |

1,515 |

2,126 |

2,943 |

4,147 |

5,827 |

8,120 |

10,809 |

14,850 |

18,772 |

$90,000.01

to $100,000 |

n.a. |

1,034 |

1,391 |

1,851 |

2,527 |

3,563 |

5,216 |

6,996 |

9,369 |

11,477 |

$100,000.01

and above |

n.a. |

2,107 |

3,339 |

4,652 |

6,273 |

8,189 |

10,996 |

14,046 |

18,729 |

22,514 |

(Source: ATO and Parliamentary Library calculations, HELP statistics 2018-19, Table 5, updated 24 October 2019.)

Note amounts of debt up to $20,000 have been aggregated for Table 1—more detail is available in the source tables from the ATO.