Tessa Satherley, Economic Policy

Key issue

The 47th Parliament begins with a bipartisan commitment to net zero by 2050, in a world pursuing decarbonisation. To advance this goal, Australia will need to manage substantial structural changes in our economy, including our trade, our energy systems and employment in the mining and energy sectors – all while trying to ensure households and industry have reliable and affordable energy supplies. Many of these challenges will manifest in difficult policy decisions, such as which energy sources and technologies to invest in; whether to authorise new gas development or coal mines; and how best to manage the necessary trade-offs in any course of action.

This article considers the role of coal and gas in

Australia’s economy, and summarises recent relevant policy and legislation. It

provides background on the 2022 east coast energy price crisis, and outlines some

of the policy challenges for the 47th Parliament related to coal and gas employment,

energy affordability, and environmental accountability in a world seeking to

limit climate change (see the article, ‘Climate Change and Emissions Reduction’ in this Briefing book).

Coal and gas in the Australian economy today

The coal and gas industries play a significant role in Australia’s economy and public finances – for good or ill.

They represent a significant share of Australia’s exports (see the article,‘Australian trade in figures’ in this Briefing book). They also underpin much of Australia’s current electricity generation (see ‘Electricity sector: continuing modernisation’ in this Briefing Book). Gas is used for residential heating and cooking and is a key manufacturing feedstock, while coking coal is an input into domestic steel production. The coal and gas industries provide government revenue through royalty payments, the Petroleum Resources Rent Tax (PRRT) and company tax.

Many argue that the coal and gas industries also cause significant economic disbenefits, pointing to the generous subsidies they receive, questioning the adequacy of their tax payments and highlighting their contribution to the growing costs of climate change (see the article, ‘Natural disasters and climate risk’ in this Briefing book).

Coal and gas employment

Direct employment in coal and gas extraction is modest. Australian Bureau of Statistics Labour Account Australia data indicated there were 37,600 people employed in the coal mining industry (0.3% of employed people) and 16,400 in oil and gas extraction (0.1%) in 2021 – compared with approximately 1.4% in Mining overall, 6.4% in Manufacturing, 8.5% in Construction and 10.4% in Retail; the largest share was 14.9% in Health Care and Social Assistance.

There is additional direct employment in closely related industries, for example gas supply (<0.1%); the manufacturing of petroleum and coal products (<0.1%); and the manufacturing of basic chemicals and chemical products (0.3%) and plastic and rubber products (0.3%), which require gas as a feedstock. Primary metal production (0.4%) requires coking coal in the case of steelmaking, and very large amounts of electricity in general (historically mostly from coal).

The indirect employment supported by coal and gas extraction suggests a larger jobs footprint. For example, the Centre for Policy Development recently estimated the direct and indirect jobs just tied to fossil fuel exports,[1] some of which could be vulnerable as the world decarbonises (see the article, ‘Global trade risks and opportunities’ in this Briefing book). It used ‘a regional input-output model’ that accounted for ‘the flow-on effect on connected industries and communities – for instance the shops and pubs surrounding a coal port.’ This analysis found that ‘Global decarbonisation could affect around 300,000 Australian jobs connected to coal, oil and gas exports by 2050’, or approximately 2% of the labour market (p. 4). This was an upper limit; the centre also estimated as few as 100,000 jobs could be affected.

The centre described this as a ‘modest’ overall impact but warned it would be highly concentrated: just 3 regions would ‘bear the brunt’. The Grattan Institute’s 2020 analysis concurred, warning that Central Queensland, the Pilbara in Western Australia and the Hunter Valley in NSW are especially vulnerable to employment shocks as the world decarbonises.

Past Australian parliaments have debated whether the trade, tax and employment benefits of coal and gas justify ongoing government support for these industries, when weighed against the growing environmental, human and economic costs of their greenhouse gas emissions, and the risk of ‘stranded assets’ and employment shocks as trade partners also seek to decarbonise.

As the 47th Parliament commences, the energy price crisis in eastern and southern Australia has also cast a spotlight on the economic risks of relying on coal and gas for domestic energy – as well as on our export arrangements – and has renewed public debate about the transition pathway to zero-emissions electricity.

Australia is self-sufficient in coal and gas, so why

are consumers paying so much for power?

High global coal and gas prices benefit Australia

as an exporter (see ‘Global trade risks and opportunities’ in this Briefing book) but also

increase domestic energy prices.

Gas prices in eastern Australia have been closely linked to international liquefied natural gas (LNG) prices since 2015, when 3 LNG export terminals were constructed in Queensland and began competing for supply with users on the east coast (see this research paper for details). The Institute for Energy Economics and Financial Analysis has contrasted this with the situation in WA, which is also an LNG exporter but has instituted a domestic gas reservation policy – and has significantly lower local gas prices. (In contrast, advocates for new gas development have attributed current tight gas supply and high prices to state

government policies blocking new onshore gas development.)

International coal and gas prices also affect

electricity prices. NSW and especially Queensland experienced earlier and

higher electricity price increases in 2022 than other jurisdictions, commencing

in the first quarter (Q1) of 2022. This was in part due to the greater role

black coal fired power plays as a ‘price setter’ in these states (see Figure 1).

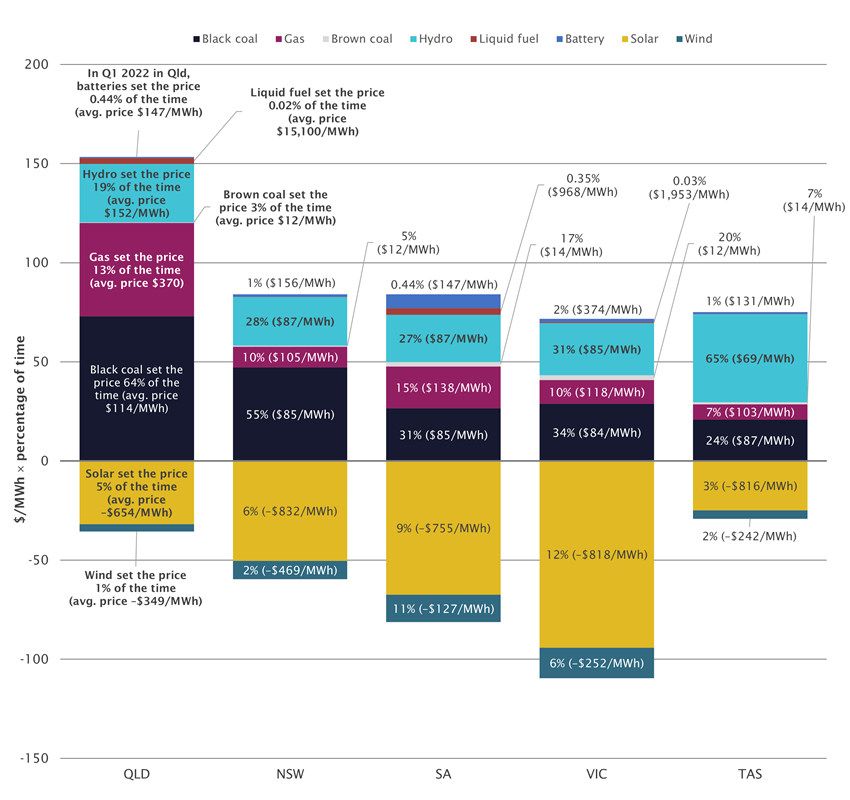

Figure 1 Time-weighted

wholesale electricity price impacts of different fuel sources, Q1 2022

Notes: The figure

shows the percentage of time black coal, gas, brown coal, hydro, battery, solar

and wind generators that set the wholesale electricity price in each National

Electricity Market (NEM) jurisdiction, multiplied by the price set in dollars

per megawatt-hour ($/MWh). This reflects the approximate influence of each

generator type in raising or lowering wholesale prices. The sum of the time

percentages exceeds 100% and the totals differ from Figure 4 because the price

can be set by more than one fuel source at a time.

Source: Australian Energy Regulator (AER), Quarterly Price Setter and Average

Price Set by Fuel Source (Melbourne: AER, 2022); and Parliamentary Library calculations.

As explained in WattClarity’s ‘Beginner’s guide to how dispatch works in the National Electricity Market’: under normal market conditions, the Australian Energy Market Operator (AEMO) receives competing offers from power stations (‘bids’) to supply electricity in each 5-minute electricity trading interval. AEMO selects the cheapest bid first. If more electricity is needed to meet forecast demand, AEMO moves down the ‘bid stack’ and adds the next cheapest offer, and so on. All the power stations chosen in that interval are paid the same price as the highest bidder needed to meet total demand, called the ‘price setter’. In early 2022, wind and solar set negative prices on average, while batteries, black coal and gas set quite high prices (see Figure 1). Wholesale prices are very sensitive to supply and demand. Negative wind and solar prices are often due to excess production on sunny, windy days.

Gas can also play a significant price setter role

through ‘shadow pricing’ (as noted by the Australian

Competition and Consumer Commission in 2018), whereby otherwise cheaper

generators adopt a bidding

strategy that ‘shadows’ the bids of more expensive gas generators.

Both NSW and Queensland export black coal and gas,

as well as using them domestically for power generation. Therefore, local power

stations compete with potential overseas customers on price. In simplified

terms: overseas customers are willing to pay elevated prices due to shortages

created by Russia’s invasion of Ukraine (see ‘Global trade risks and opportunities’ in this Briefing book).

Domestic generators have to match these prices; they pass on their increased

fuel costs through increased wholesale electricity prices; and the impact is

worse in the electricity market regions more dependent on these commodities.

These dynamics are a factor in the 2022 east coast

energy price crisis, as explained in ‘Issues for the 47th Parliament’ below.

Recent Australian policy and legislation

During the 46th Parliament, the Morrison Government

supported the development of Australia’s coal and gas reserves – particularly

gas, under the ‘gas-fired

recovery’ policy announced in September 2020. Throughout its term, it emphasised

the need for affordable and reliable energy while maintaining Australia’s

competitive position as a top coal and LNG exporter, with initiatives

including:

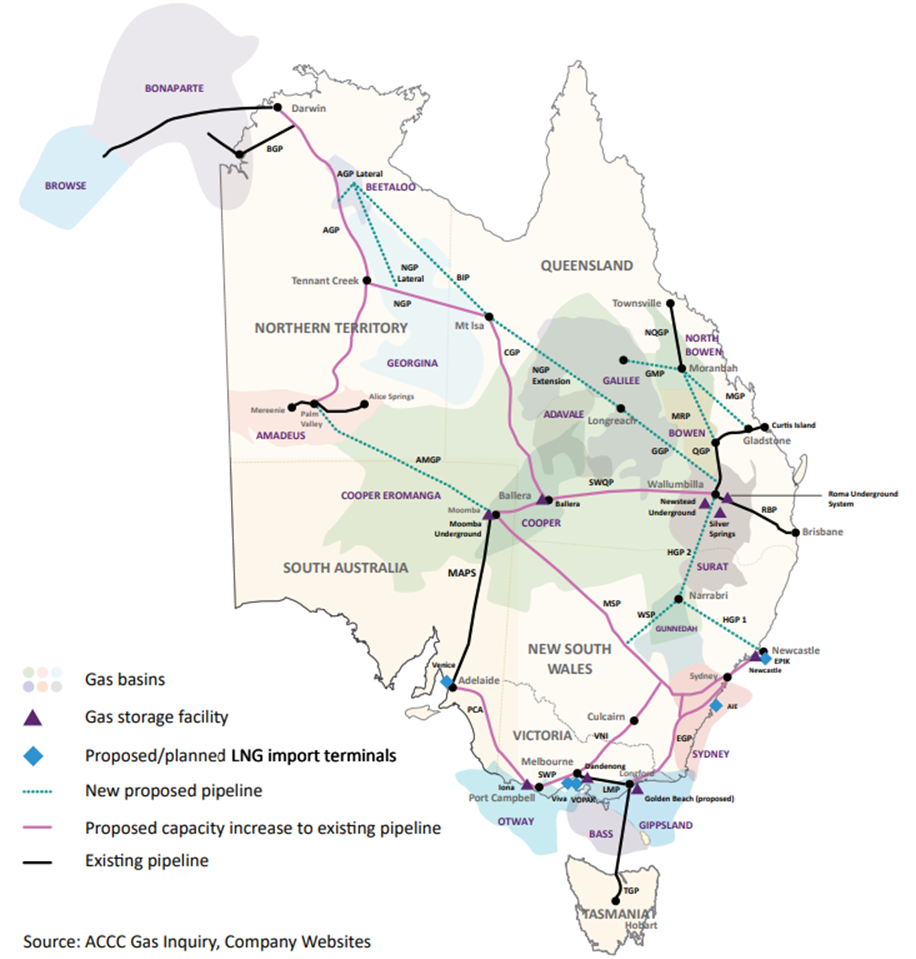

Figure 2 Location of existing and potential future gas

supply and infrastructure options in the 2021 National gas infrastructure plan

Source: Department of Industry, Science, Energy and

Resources (DISER), 2021 National Gas Infrastructure Plan, (Canberra: DISER,

November 2021), 8.

Issues for the 47th Parliament

The 2022 winter energy

crisis

The most immediate issue is energy prices in

eastern and southern Australia – that is, the eastern gas market and the ‘National Electricity Market’ (NEM) – which

are exacerbating inflationary pressures (see the article,

‘Rising inflation and macroeconomic balance’

in this Briefing book).

AEMO had been predicting an east coast gas shortage as early as

winter 2023, but the

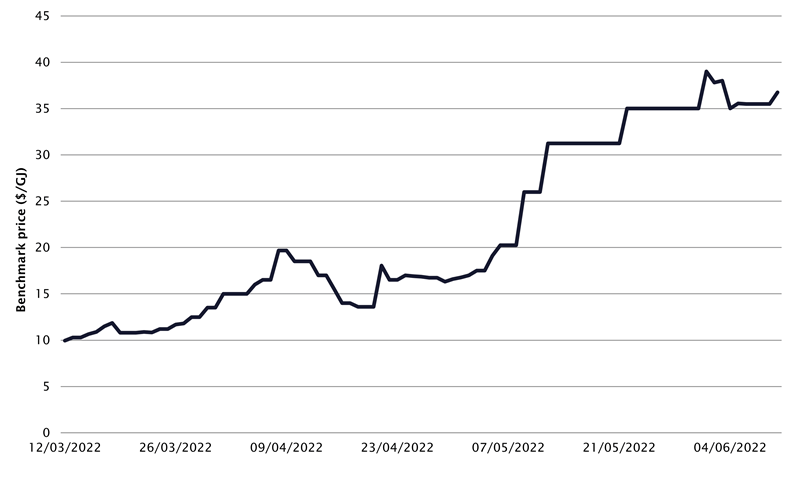

early onset, speed and scale of current price increases (see Figure 3) have

seen a NSW gas retailer collapse and put manufacturing businesses at risk of

closure.

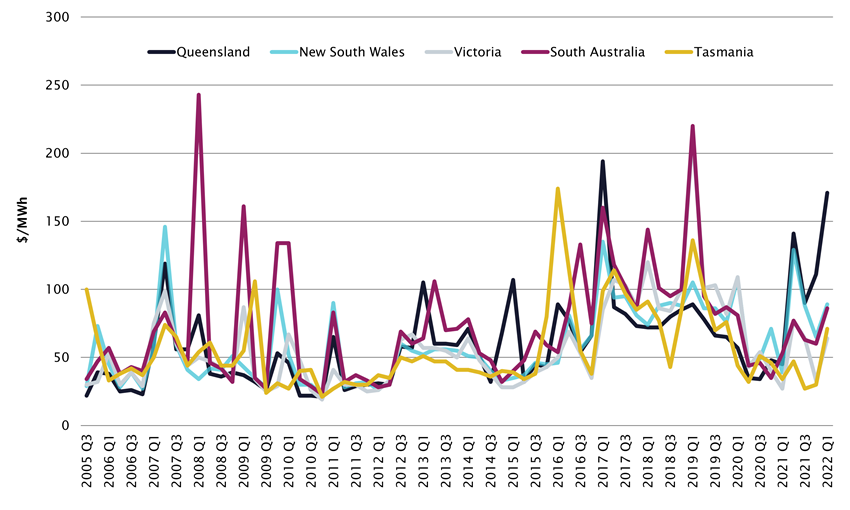

And while electricity price volatility is not historically unusual in the NEM (see Figure 4), the scale of the

current market disruptions has no obvious precedent, and has been described as

the result of more than a

decade of political and parliamentary failure to agree an enduring energy transition

policy.

The energy markets in the south-eastern and north-western parts of Australia follow quite different dynamics. Western Australia and the Northern Territory have their own electricity markets; the remaining states and the ACT are part of the NEM. Similarly, WA and the NT have their own gas markets, whereas an interconnected gas grid connects the eastern and southern states and territories.

Figure 3 Daily benchmark gas prices in $ per gigajoule (GJ)

for the Wallumbilla Gas Supply Hub (east coast wholesale benchmark prices)

Note: The Wallumbilla Gas Supply Hub (GSH)

in southeast Queensland is a trading exchange for the east coast gas market.

Source: Australian Energy Market Operator (AEMO), GSH Data Dashboard (Melbourne: AEMO,

2022).

Figure 4 NEM quarterly volume-weighted average electricity spot

prices ($/MWh), 2005–2022

Source: AER, Quarterly Volume Weighted Average Spot Prices—Regions (Melbourne: AER, 2022).

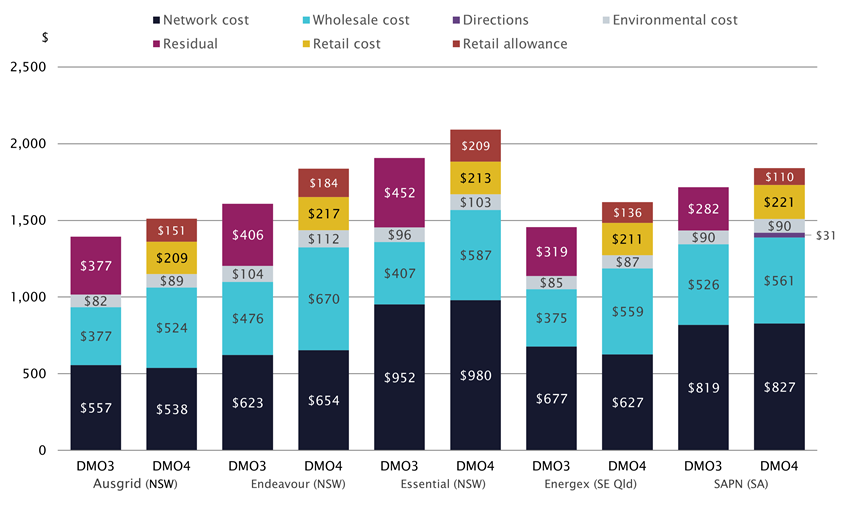

In May 2022, the AER announced a significant

increase to the default market offer (DMO) retail electricity price to apply to most of the NEM (Figure 5). It

explained that ‘Rising wholesale costs are the main cause’, due to ‘unplanned [generator] outages and higher coal and gas

costs … compounded by the ongoing war in Ukraine’, among other factors. It

noted ‘very significant increases in wholesale futures prices for all DMO

regions but in particular NSW and Queensland.’

The default market offer (DMO) is the maximum price an electricity retailer can charge a standing offer customer each year. It is based on the retailer costs:

- to purchase electricity from power stations (wholesale costs)

- to transport that electricity to customers (network costs)

- to comply with government environmental schemes (environment costs)

- associated with serving retail market customers, such as billing and provision of hardship services (retail costs).

Figure 5 Change in the price components of the default

market offer for retail electricity between 2021–22 (DMO 3) and 2022–23 (DMO 4)

Notes: The figure

shows the change in nominal DMO price components for most residential

electricity customers. The names indicate the responsible electricity

distributor(s) in each market region. DMO 3 did not specify separate ‘retail

cost’ and ‘retail allowance’ figures; these were combined under the ‘residual’.

Source: AER, Default Market Offer Prices 2022–23: Final Determination (Canberra: AER, May 2022), 8.

The crisis deepened

and spread to the rest of the east coast over Q2 2022. AEMO intervened extensively in the gas and

electricity markets, capping gas prices in Victoria, Sydney

and Brisbane at $40/GJ, triggering its emergency Gas Supply Guarantee mechanism for the first time and capping wholesale electricity prices at $300/MWh, (at first only in Queensland- but then across all

mainland jurisdictions in the NEM). AEMO suspended the operation of the wholesale

electricity spot market across the entire NEM on 15 June, after enough generators declined to bid at or below the capped

price to risk widespread blackouts – unless AEMO ordered generators to dispatch,

regardless of their commercial preferences. The

imposition of such price caps is rare, and the suspension of the entire NEM spot

market was unprecedented.

At the time of writing, AEMO had just announced plans for a staged return to normal spot market operations. However, the broader price crisis is likely to persist, and the

best policy response is contested.

The Morrison

Government had committed to new gas infrastructure and developing new supply to

address potential shortfalls. However, AEMO warned in March 2022 that the development timescale would be too long

to address the gas shortfalls then forecast for winter 2023. Commentators have asked if the

Australian Government will exercise the ADGSM, requiring LNG exporters to redirect supply

domestically. However, the new Minister for Climate Change and

Energy and ADGSM critics have warned of the mechanism’s limitations

(see ‘The Australian Government’s ability to restrict gas exports: a quick guide’). The architect of the Morrison Government’s

‘gas-fired recovery’ (Andrew Liveris) and the Australian Industry Group have called

for an east coast domestic gas reservation policy. Others have called for additional new gas development to

increase supply and for

the construction of LNG import terminals.

Some policymakers support the inclusion of coal and

gas generators in the Energy Security Board’s proposed ‘capacity mechanism’, which is intended to create an explicit financial incentive for generators

in the NEM to guarantee capacity during at-risk periods, but this is disputed between the NEM states and territories and within the 47th Parliament.

Many also see the

crisis as compelling evidence for why Australia

should accelerate its transition away from coal- and gas-fired electricity and gas-based heating and cooking and into

zero-emissions, cheaper renewables – including investing in batteries and

transmission to support reliability (see the article, ‘Electricity sector: continuing modernisation’, in this Briefing book). At the time of writing, the exception to 2022 east

coast price pressures was the ACT, whose long-term contracts for a 100% renewable

electricity supply shielded it

from issues affecting coal and gas power. The ACT’s Independent Competition and

Regulatory Commission suggested that ‘the average annual bill for Canberrans on standing offers will

be the lowest compared to the

average standing offer bills faced by customers in NSW, Victoria, Queensland

and South Australia’.

Other unresolved issues on the road to net zero

Over the medium to longer term, debate about

whether, where and how Australia should continue to invest in new fossil fuel energy

– for domestic use or export – pivots on whether the benefits justify the

future carbon dioxide and methane emissions. Although ‘ending the climate wars’

was a key narrative during the 2022 election campaign, the 47th Parliament

nonetheless inherits unresolved debates about coal and gas in the context of

decarbonisation, additional to the employment, electricity generation and gas

supply issues canvassed above.

Scope 3 emissions: Under

current Australian legislation, domestic decarbonisation (for example, modernising

the electricity supply to renewable sources) can be pursued without regard to ‘scope

3’ emissions by overseas end consumers of Australian fossil fuel exports.

Existing emissions reduction mechanisms such as the climate

safeguard mechanism apply only to domestic emissions. Fugitive

methane emissions (or leakage) from coal or gas extraction ‘count’ for the

purposes of the safeguard mechanism, but not the much

greater scope 3 emissions released when the fuel is burned by end users

overseas. The Australian

Centre for Corporate Responsibility has called for greater attention to such

scope 3 emissions when assessing corporate carbon footprints. While the

incoming Albanese Government has announced it will strengthen

the safeguard mechanism, there has been no indication it will fundamentally

revise the framework to consider scope 3 emissions. (On emissions reduction

policy generally, see the article, ‘Climate change and emissions reduction’ in this Briefing book.)

CCS: Debates around

Australian Government support for coal and gas industry CCS projects may also

continue. The International

Energy Agency (IEA) and Intergovernmental

Panel on Climate Change (IPCC) have reported that carbon sequestration will

be required on a massive scale to limit warming, including through CCS. The

past few years have seen a surge

in global interest in CCS and other

carbon dioxide removal technologies, but the IPCC’s 6th Assessment report nonetheless

warns that current

global rates of CCS deployment are insufficient to achieve net zero by

mid-century.

In Australia and some other OECD countries, a social

licence for CCS is undermined by perceptions it is being used by fossil fuel

industries as ‘a device for mitigation obstruction’ – or more plainly, ‘greenwashing’.

Australian parliamentary

debate on the merits of CCS has been fraught. Opponents have noted that CCS’s

technical

and commercial track record to date is underwhelming, and Australian critics

particularly note Chevron’s

failure to capture the agreed share of Gorgon project emissions under its WA

environmental approval. Some support CCS research and development in principle,

just

not when used to prolong fossil fuel industries.

Legislation governing new fossil fuel

development: During the 46th Parliament, independents

and minor parties pushed for legislative debate on limits to fossil fuel development

beyond the policies of the incumbent government. This pattern may continue. For

example, the Australian

Greens introduced multiple Bills seeking to stop new fossil fuel development and

increase taxes on big emitters, and sought to bring

climate change considerations into the scope of the Environment Protection

and Biodiversity Conservation Act 1999. An independent introduced

a Bill to block the offshore ‘PEP11’ project, and One

Nation introduced a Bill requiring offshore petroleum regulators to take into

account the benefit to the Australian community when granting new leases or

renewing existing leases.

Environmental

approvals: The Australian

Government’s role in environmental approvals for major fossil fuel projects – particularly

offshore projects where the underlying resource is federally owned (rather than

owned by the states) – is also likely to face growing scrutiny. Opponents have

referred to planned coal and gas development projects as ‘climate bombs’. Further litigation

against Australian Government environmental approvals for new fossil fuel

development on climate change grounds is expected, including an attempt

by Tiwi Islanders to block the offshore Barossa project in the Federal Court,

continuing the trend set by the 2021 case of Sharma v Minister for the Environment.

With this complex political backdrop, and the urgent

problems of both energy costs and climate change, it has the potential to be a

challenging but pivotal Parliament in Australia’s history.

[1] Estimates using Labour Account Australia

data

are slightly higher for coal mining and lower for oil and gas extraction.

[2] This still excluded

indirect employment tied to domestic uses of coal and gas, for example jobs in

local construction projects or manufacturing that use Australian steel as an

input, or jobs in coal- and gas-fired power stations and their satellite

communities.

Back to Parliamentary Library Briefing Book

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.