Stephen McMaugh, Science,

Technology, Environment and Resources

Key issue

Australia’s electricity system is undergoing a modernising transition. The key challenge will be moving to a system dominated by low-emissions renewable energy while maintaining system security and reliability, amid growing demand.

A changing system

Australia’s electricity system is undergoing a period of modernising

transition, consistent with global trends. Much of this modernisation is being driven by efforts to decarbonise the economy, the falling costs of

renewable energy technology and the need to replace ageing generation

infrastructure.

The global trend was recently exemplified when G7 Ministers of

Climate, Energy and the Environment committed in May 2022 to ‘a goal of achieving predominantly

decarbonised electricity sectors by 2035’ (p. 32) and by the International

Energy Agency’s efforts to set out a pathway of transition from fossil

fuels to a ‘clean, dynamic and resilient energy economy dominated by renewables

like solar and wind’. In Australia, around one third of emissions come from the electricity sector.

The Australian Government’s commitment, along with the states and territories,

to net zero emissions targets, is expected to continue driving change in the

sector.

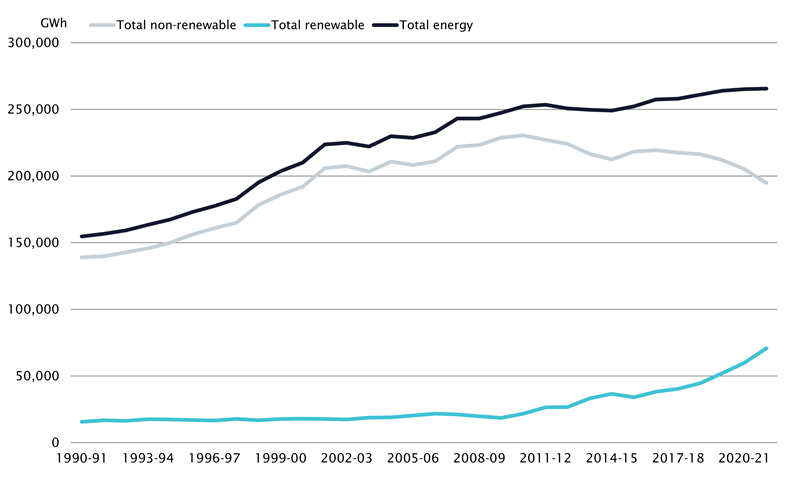

Wind and solar have become the cheapest forms of new generation,

even when integration costs are considered. These lower cost renewable

generators are supplying an increasing share of Australia’s electricity and the

pace of system change has been accelerating (Figure 1). For example, Australia recently reached 3 million small-scale rooftop solar photovoltaic

(PV) systems (around 1 in 4 Australian houses) and

larger utility-scale solar and wind farms continue to be built. Grid-scale

batteries are being installed to store and discharge electricity when needed,

as well as providing other services to the grid, and construction of major pumped hydro projects has

commenced (p. 66). It is expected that Variable Renewable Energy (VRE) will supply the bulk of future electricity

generation, with storage and peaking gas generation providing

support (p. 41).

At the same time, many of Australia’s coal fired power plants are

reaching the end of their service life and their generating capacity will need

to be replaced. Modelling suggests that over half of Australia’s coal generation could withdraw from the

market by 2032 (p. 9). They may also close due to

commercial or policy decisions, such as recently announced in Western Australia.

This replacement of coal fired generators with VRE promises to

deliver a low-emissions electricity system. However, this electrification of transport, heating and industry is expected to require

an expansion of Australia’s electricity system to deliver

almost double the annual electricity generation by 2050 as

electricity becomes the principle energy source (p. 28).

In addition, greater electrification also reinforces the need

for electricity supplies to be reliable and secure against disruption,

including from foreign actors and natural

disasters.

To achieve this modernisation of the electricity system, Australia

will need engineering and planning solutions to maintain reliable supply plus additional

investment in transmission and energy storage. Developing the smart grid of the future will also require a

gradual change, away from a highly centralised one-way flow of electricity, to

a decentralised two-way system that allows consumers’ to participate in the sophisticated

management of demand, generation and storage.

In the shorter term, the Australian electricity market is currently grappling

with a major disruption. As detailed by the Australian competition and Consumer Commission, this has been caused by a

combination of factors, including planned generator outages during a period of

high demand, unexpected outages and restricted fuel supply to coal generators

that forced greater reliance on expensive generation sources such as gas, and

high international prices for gas and coal (p. 1).

The Parliament has unsurprisingly taken a strong interest in these

energy policy issues, which is likely to continue. In March 2021, the

House of Representatives Standing Committee on the Environment and Energy

launched an inquiry into the current circumstances, and the future need and

potential for dispatchable energy generation and storage capability in

Australia. This inquiry lapsed at the dissolution of the 46th

Parliament. This followed the committee’s 2017 inquiry into modernising

Australia's electricity grid and its report, Powering our

future.

Figure 1 Australia’s renewable and non-renewable electricity generation

Source: Australian Energy Statistics 2021 Table O: Australian electricity

generation, by state and territory, by fuel type, physical units.

Australia’s electricity system

Australia has several separate electricity markets.

The National

Electricity Market (NEM) is by far the largest and covers eastern and

southern Australia – Queensland, NSW, the ACT, Victoria, SA and Tasmania. Spanning

around 5,000 km and with about 40,000 km of transmission lines and

cables, the NEM is one of the world’s longest interconnected power systems. It currently

generates around 200 terawatt hours (TWh) of electricity each year,

supplying around 80% of Australia’s electricity consumption. WA and the NT have separate, smaller electricity systems, with different

regulatory arrangements.

Electricity market governance

Governance of the NEM is complex. There are 3 main

market bodies: a rule-maker, a regulator and a system operator, and mechanisms

for ministerial oversight.

The rule maker for Australia’s electricity markets

(except WA) is the Australian Energy Market

Commission (AEMC). It also advises Australia’s energy ministers on

improvements to regulatory design and energy market arrangements.

The Australian

Energy Regulator (AER) regulates electricity networks in all jurisdictions

except WA. It sets the amount of revenue that network businesses can recover

from customers and enforces the laws for the NEM in southern and eastern

Australia. It also enforces the Retail Law in NSW, SA, Tasmania, Queensland and

the ACT.

The system operator is the Australian Energy Market Operator (AEMO), which is

charged with ‘keeping the lights on’. AEMO operates Australia’s largest

electricity markets and power systems, including the NEM

and the Wholesale

Electricity Market within the WA South-West Interconnected System.

The Energy

National Cabinet Reform Committee (ENCRC) (previously the COAG Energy

Council) oversees the energy market institutions. This ministerial forum

includes the Commonwealth, states and territories, and New Zealand.

The Energy

Security Board (ESB) reports to the ENCRC and provides whole-of-system

oversight for energy security and reliability. The ESB has been developing a package of market

reforms aimed at keeping the functions of the NEM fit-for-purpose as the

electricity system undergoes modernisation.

National Electricity Rules and National

Electricity Law

Constitutionally, energy is primarily a

state matter. However, it was made a shared responsibility with the signing of the Australian Energy Market Agreement,

between the Commonwealth, states and territories in 2004, which is coordinated

through the ENCRC. The agreement provides for national

legislation, implemented in each participating state and territory. South

Australia is the lead legislator, with other states and

territories participating in the NEM applying the National Electricity (South Australia) Act 1996 through their own legislation.

The NEL

defines national electricity objectives based on central concepts such as

price, quality, safety, reliability and security of supply of electricity.

Reduction of greenhouse gas emissions is not among the stated objectives.

The NEM is governed by the National

Electricity Rules (NER), made under the National Electricity Law. The NER

set out the regulatory framework for functions including market operations,

power system security, network connections and access, pricing of network

services and national transmission planning. The NER are highly complex and are

regularly updated, with 15 substantive chapters (running to upwards of 1,700

pages). The Northern

Territory applies a modified form of the NER.

Planning for the future

The challenges of modernising the electricity

system require sophisticated system planning. AEMO publishes the foremost

planning document for the electricity system, the biennial Integrated

System Plan (ISP), with the next edition expected to be published on 30

June 2022.

The ISP develops a range of plausible scenarios for

the electricity system’s evolution. These scenarios necessarily make assumptions

about different rates of change and

consider variables including targets for emissions reduction and renewable

energy, technology, fuel and transmission costs, and rates of PV adoption (pp. 28- 29).

The draft

2022 plan set out 4 scenarios: slow change, progressive change,

step change and hydrogen superpower. The ‘step change’ scenario

is considered the most likely (p. 29), described as ‘a consistently

fast-paced transition from fossil fuel to renewable energy in the NEM’ (p. 27).

The draft 2022 ISP also recognises that electrification

will support emissions reduction in the broader economy (p. 35). Electrification

means increasing uptake of battery electric vehicles, heat-pump hot water

systems and other technologies not reliant on fossil fuels. Australia’s

greenhouse gas inventory illustrates the opportunity for further emissions

reduction through electrification, with stationary energy (excluding electricity) and transport the next highest emitting sectors after electricity (21.0% and 18.6%, respectively)). The stationary energy sector

includes emissions from the combustion of fuels (such as natural gas), mostly

in the manufacturing, mining, residential and commercial sub-sectors.

Transmission networks

The draft

2022 ISP foreshadows that 10,000 km of new high voltage transmission links will

be required to support the future electricity system and minimise system

costs (p. 8). This will require significant amounts of land and the draft

ISP draws attention to the importance of gaining appropriate social licence for

new transmission projects and the transition more broadly. During the recent

election campaign, under its Powering Australia plan, the

Australian Labor Party committed to establishing a Rewiring the Nation Corporation

(RNC) to invest $20 billion toward the modernisation of the electricity

grid. Some analysts have argued that investing

in storage would be more effective in ensuring reliable supply. The ISP

acknowledges that the ‘less transmission capacity there is, the more

dispatchable capacity [e.g. storage] is needed, and vice versa’ (p. 44).

The ISP also indicates that, in some cases, the need for social licence may

‘lead to alternative developments that reduce the need for new transmission,

including batteries, gas-fired generation and offshore wind developments that

connect to the existing network easements’ (p. 15).

The AER requires that network businesses meet a regulatory investment test

(RIT) before constructing transmission. This focusses on a cost-benefit

analysis, with the central objective of minimising consumer charges. The AEMC is undertaking a review into the transmission planning

framework, which

includes consideration of the mechanisms available to foster social licence for

transmission development. Labor has also committed to improving the RIT-T process.

Renewable Energy Zones

Renewable Energy Zones (REZ) are areas with

Australia’s best renewable energy resources. They are mostly located in regional Australia but also

include 4 offshore wind zones (p. 40). Much of the expected utility

scale VRE generation will be concentrated within REZs to efficiently use both

the resource and the new transmission lines envisaged to connect the zones with

the electricity network. NSW has moved to accelerate the development of its REZs.

Victoria has moved similarly and the state government has amended the National Electricity (Victoria) Act 2005 to

allow Victoria to depart from parts of the national framework on transmission

approvals to speed up priority projects.

Storage

A VRE-dominated NEM will require large amounts of energy

storage to provide most of its dispatchable capacity (p. 46). Many competing

battery technologies offer different suitability for different uses (pp. 15-24).

For example, fire-safe flow batteries are heavy and are unsuitable for powering

transport, where lighter lithium batteries are preferred. Researchers are

actively working on alternative storage technologies that use readily available

minerals and may deliver lower costs in the longer term. Aside from batteries,

the Snowy 2.0 project is

a prominent example of pumped hydroelectric storage but other technologies for

energy storage are being developed such as hydrogen or ammonia storage,

gravity-based energy storage using large weights, compressed air and thermal

storage. How quickly these technologies are developed will be determined by the

market opportunity, costs, energy density, safety and availability of raw

materials.

Electricity

storage installed in the NEM will range from short duration, of less than

4 hours, to long duration of over 12 hours (p. 49). The bulk of the deep

storage required in the NEM is expected to come from the Snowy 2.0 pumped

hydroelectric storage project (pp. 49- 50).

While the main role of storage technologies will be to move

low-value energy to a time when it is most needed, these technologies can also

play an important role in providing critical system services (for example, frequency control)

through power electronics. These system services have typically been provided

by gas and coal fired generators but are increasingly being provided by grid-scale batteries. AEMO has a coordinated work program that will

address the challenges of obtaining these system services solely through power

electronics. AEMO and the CSIRO are also participating, with

other leading nations, in cooperative global

research efforts to overcome barriers to achieving electricity systems

primarily powered by renewable energy.

Summary

Successfully modernising Australia’s electricity

systems to be both low-emissions and able to generate twice as much electricity

as today, is an extraordinary task that will require high levels of investment

and profound change. The final composition of a future grid that provides all

the system services and energy requirements that consumers expect, while meeting

decarbonisation goals, cannot be precisely defined from current knowledge and will

be reached by iterative actions. Indeed, each successive iteration of the ISP

has shown that change

has exceeded what was previously envisaged (p. 26). Policy makers, together

with industry, the market bodies and increasingly, consumers, must continue to

grapple with this complex problem.

Further reading

Alan Finkel, Getting to Zero: Australia's Energy Transition, Quarterly Essay-, 81.

Drew Clarke et al., Australian Energy Transition Research Plan, report for the Australian Council of Learned Academies, (Melbourne: ACOLA, 2021); and associated briefing papers.

Australian Energy Regulator (AER), State of the Energy Market 2021, (Melbourne: AER, 2021).

Back to Parliamentary Library Briefing Book

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.