Increased EV uptake and use—benefits and challenges

Introduction

3.1

This chapter outlines the benefits and challenges associated with

increased uptake in electric vehicles (EVs) and manufacturing opportunities in

Australia.

Benefits

3.2

There are a range of economic, environment and social benefits that would

result from an increased uptake in EVs that are widely known and have been

canvassed in a number of recent reports.[1]

These impacts are briefly summarised below.

Economic

3.3

A number of submissions highlighted the broad economic benefits of an

increased uptake in EVs for both owner-operators of EVs, and the mining and

manufacturing sectors.[2]

A report titled Recharging the economy: the economic impact of accelerating

electric vehicle adoption (PwC Analysis) was recently completed by PwC on

behalf of the Electric Vehicle Council, NRMA and the St Baker Innovation Fund.

This report found that if EVs made up 57 per cent of new car sales by 2030

there could be an increase in real GDP of $2.9 billion and an increase in net

employment of 13 400 jobs, and an additional investment of $3.2 billion in

charging infrastructure. These projections were based primarily on consumer

savings and the rollout of charging infrastructure; however, the report did not

consider the economic benefits to local manufacturing or investment in

Australian electricity generation and transmission assets.[3]

3.4

The Australian Electric Vehicle Association (AEVA) of Victoria also

claimed that significant savings would be made available to the economy as a

reduction in liquid fuel costs:

Direct fuel cost savings of $500M per year and $100M in

maintenance costs for every 1 million electric cars in the national fleet. A

potential $7.8 billion per year saving for 80% penetration. Up to $15

billion per year in fuel import replacement and benefit to the balance of

payments, with $8 billion transferred to the local economy, and a

subsequent improvement to fuel security against disruption.[4]

3.5

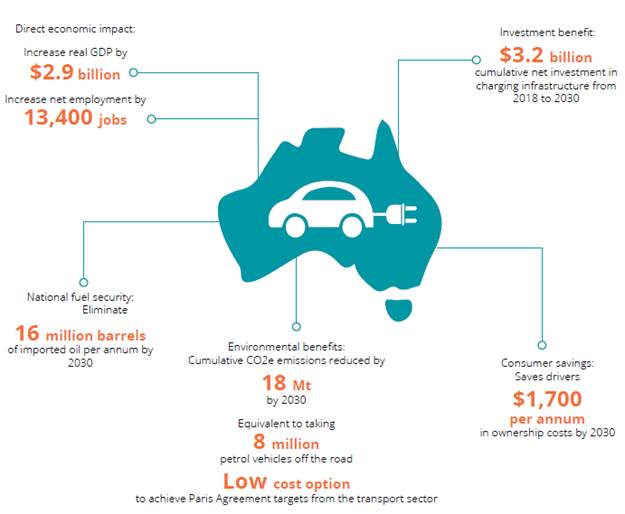

The economic impacts associated with an increased uptake of EVs, as

projected by the PwC Analysis, are summarised in Figure 3.1.

Figure 3.1: Projected

economic benefits of high EV uptake in Australia between 2018 and 2030[5]

3.6

The Queensland Government cited the opportunities for 'new green jobs'

such as those created at local Queensland EV charging infrastructure

manufacturer, Tritium.[6]

The EV owner-operator

3.7

There are also a number of economic impacts at the EV owner-operator level.

Currently, the upfront cost of an electric car exceeds the cost of an internal

combustion engine (ICE) equivalent. The Victorian Department of Environment,

Land, Water and Planning (DELWP) acknowledged the comparatively high upfront

cost as a significant barrier to EV sales.[7]

Mr Daniel Hilson, Founder and Managing Director at Evenergi, explained his

company's research on the cost of owning and operating an EV:

Our research has shown that there's about a $5,000 gap in

terms of the total cost of ownership of electric vehicles over five years, and

that's based on quite an extensive model that we've built.[8]

3.8

Notwithstanding this, the purchase price of EVs is expected to fall in

line with expected decreases in the costs of lithium-ion batteries.[9]

The Victorian Automobile Chamber of Commerce (VACC) reasoned that on current

trends in battery pricing, consumers could expect price parity by 2025 and

could be 'up to 15 per cent cheaper than equivalent' ICE vehicles by 2030[10]

based on EVs 'having a lower cost to produce based on raw materials and a less

complex drivetrain'.[11]

Bloomberg New Energy Finance projected that EVs would reach price parity with

ICE by 2024.[12]

3.9

In their recent report, the Electric Vehicle Council made the following

observation in relation to projected purchase prices of EVs:

Over the coming year, Nissan, Renault and Hyundai will join

Tesla in introducing new electric vehicle models in Australia priced between

$35 000 and $50 000. While a new car is not affordable for many

Australians, the increased availability of vehicles at these prices will

broaden the market, with fleet vehicles then entering the secondary market.[13]

3.10

The Committee also heard evidence that EVs are subject to greater

depreciation of value than their ICE counterparts because of concerns about

rapid technological development rendering older models obsolete and concerns

about the longevity of battery life.[14]

Mr Behyad Jafari, Chief Executive Officer of the Electric Vehicle Council

stated that the global experience is that these issues are resolved with

increased EV uptake:

Depreciation is an issue because there's not a lot of data

available, and people are asking questions like: what is the risk associated with

reselling an electric vehicle? These are things that are being overcome

globally that haven't been overcome in Australia.[15]

3.11

However, once a motorist has purchased a vehicle, the on-going operation

and maintenance costs of an EV are significantly less than that of an ICE

vehicle. The Tesla Owners Club of Australia noted that an EV has 'around 20

moving parts' as opposed to closer to 2000 in an ICE vehicle.[16]

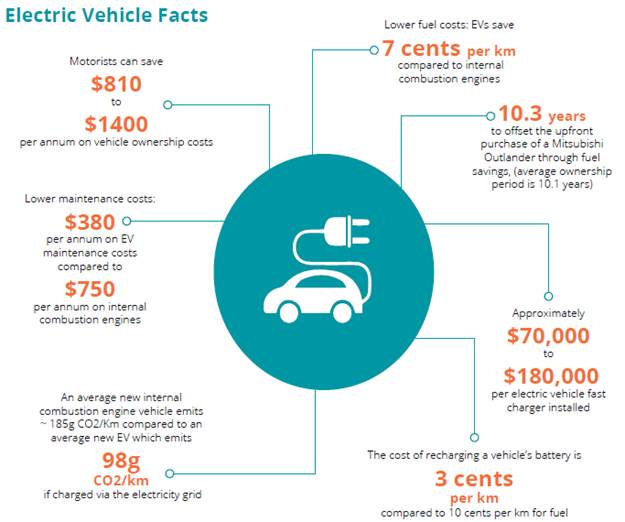

3.12

The Electric Vehicle Council found that drivers could save $2 326 per

annum in ownership costs as 'EVs are less costly to maintain and run'.[17]

Associate Professor Tim Nelson, Chief Economist at AGL Energy remarked:

Over a 10-year ownership period, UBS estimate the total cost

of ownership to be $5,000 less for EVs relative to internal combustion engine

vehicles by 2021, and $11,000 less by 2025 as battery prices fall. This translates

to projected savings of $1,700 per annum by 2030. Total consumer savings over

the entire period are estimated to reach $14 billion.[18]

3.13

Fuel costs are a significant driver of the savings—an EV will cost

around 3 cents per kilometre compared to around 10 cents per kilometre for

an ICE equivalent (see Figure 3.2 below for more costs). Depending on the

electricity price sensitivity (low to high pricing) and based on current petrol

prices, the savings can range from $4.72/100km (high electricity price) to

$11.04/100km (low electricity price) or the equivalent of $0.50 per litre.[19]

3.14

Regenerative braking also brings about operating and cost efficiencies

for EV owners as the car is able to recover battery charge through braking.[20]

Mr Karl Gehling, Head of Corporate Communications and

Government Relations at Mitsubishi Motors Australia explained:

Basically what happens is, if the car is ever on a downhill

descent or in a coastal situation, then it collects the kinetic energy from the

electric motors and puts that back into the batteries. That increases the EV

driving range, which is amazing technology.[21]

3.15

Although these vehicle operating savings flow to the consumer, it does

result in less business for automotive service and fuel retailers, which is discussed

later in the chapter.

3.16

The Committee also heard that EV owners and drivers were being penalised

through the application of additional demand charges on the use of public

charging infrastructure. Mr Rodger Whitby, Chief Executive Officer of St Baker

Energy Innovation Fund argued that if an EV 'plugs in at home versus down the

street, it should aggregate to only one payment and not be two separate

payments'.[22]

Furthermore, Fast Cities Australia reasoned that a demand charge exemption for

public chargers would assist in encouraging EV uptake.[23]

Figure

3.2: Projected electric vehicle operation costs and savings for Australian motorists[24]

Mining and manufacturing

3.17

The Committee has heard that Australia has a number of natural

advantages that could support mining and manufacturing opportunities in

relation to EV lithium-ion batteries. In its submission, the Association of

Mining and Exploration Companies highlighted that Australia has large reserves

of the minerals required to make lithium-ion batteries and outlined the

advantages that Australia has in this area:

-

Australia currently mines over 60 per cent of the world's lithium

by value;

-

Australia has all of the other minerals necessary to progress

further down the lithium ion battery value chain;

-

Lithium spodumene, which is mined in Australia, is over 10%

cheaper to process to lithium hydroxide than brine, which is more common

internationally;

-

The economics of developing further lithium hydroxide processing

facilities in Western Australia is sufficient for four companies, including two

of the world's largest lithium companies (Tianqi and Albermarle), to have

invested;

-

Currently, independent research suggests 89% of the battery precursor

material processing occurs in China, thus Australia may stand to benefit from

any international interest in geopolitical diversification; and

-

The processing and manufacturing of battery precursors,

components and final products is dependent on quality, precision and robotics

rather than cheap labour and assembly line processing.[25]

3.18

Professor Peter Newman affirmed this view, and expanded on the

value-adding opportunities beyond commodity mineral extraction and export

activities, referring to a 2018 report titled Lithium Valley: Establishing

the Case for Energy Metals and Battery Manufacturing in Western Australia:

The need for quality battery metals means that processing of

minerals is now happening in WA close to the mining so that shipping is minimised

and high quality product can be made through highly automated production

systems. Three new plants are being built.

The next phase of this remarkable opportunity for Australia

is to continue to develop the full value chain of battery metals from mining

and processing to battery manufacture, battery use and battery recycling as set

out in the report.[26]

3.19

The Committee also heard about the development of lithium-ion battery

manufacturing facilities in the Northern Territory and Queensland (Townsville).[27]

Mr Brian Craighead, Director of Renaissance Energy, spoke optimistically about

the advantages that Australia has and the future of manufacturing in this

country:

I have personally been in several different electronic

vehicle start-up manufacturing facilities around the world. They're small,

they're lean, they're clean and they are more about smarts [than] design

beauty. Scale isn't the advantage it once was. It's intelligence and design and

customisation for market. For me, that works perfectly with the advantage here

in Australia, We have very smart folks. We have the raw materials we need all

within our walled garden. Pretty much every single raw material required to

construct an electronic vehicle is within our walled garden of Australia, and

that's quite unique. We've got the smarts, certainly. So, for me, it was really

about: if the opportunity is there, the demand is there.[28]

3.20

Several witnesses and submitters expressed a view that Australia should

look at its advantages and strategically manufacture in areas of competitive

advantage in the supply chain.[29]

Professor Mainak Majumder, Department of Mechanical and Aerospace Engineering

at Monash University argued:

The next question is: should we manufacture EVs in Australia?

My opinion would be no, because there are already companies rolling out

products, but we can be selective about this opportunity. We can identify and

support areas of strength instead of joining the mass manufacturing bandwagon.

In summary, I believe opportunities may lie in leveraging the strengths we have

in our innovation and intellectual capability by finding and developing niches

which can play well in this upcoming world.[30]

3.21

Throughout this inquiry, the Committee has visited and heard from a

number of successful Australian manufacturers associated with the EV industry. The

Victorian Branch of the AEVA highlighted that electric trucks and buses were

currently being assembled in Australia by companies such as Victorian-based

AVAAS and SEA.[31]

The issues in relation to developing mining and manufacturing industries

associated with EVs are explored further in chapter 4.

Environment—reducing greenhouse gas emissions

3.22

The Department of the Environment and Energy stated that 'transport,

predominantly light vehicles, is the second largest source of greenhouse gas

emissions (GHG) in Australia behind electricity', contributing about 19 per

cent of Australia's total emissions.[32]

The department further noted that:

Under current policies, transport sector emissions are

projected to steadily increase to 112 million tonnes CO2-e by 2030 (a 15 per cent increase from present levels)...due to

population and economic growth, with cars and light commercial vehicles

projected to remain the sector's

largest source of emissions.[33]

3.23

Primarily these emissions reflect the combustion of petroleum-based

fuels with 58.4 per cent of fuels being used by light passenger vehicles; and

the balance, 41.6 per cent, being used by commercial and heavy vehicles.[34]

3.24

The PwC Analysis observed that Australia's transport sector would have

to reduce its emissions profile in order for Australia to meet its commitments

under the United Nations Framework Convention on Climate Change as agreed in

Paris on 12 December 2015:

Assuming the electricity sector meets its target emissions

reductions, further contributions from transport and other sectors would be

required to meet the overall national Paris commitment, as emissions from the

electricity sector make up one third of total emissions.[35]

3.25

The PwC Analysis found if 57 per cent of new cars were EVs by 2030,

there would be a cumulative reduction in CO2 emissions of 18 million

tonnes—the equivalent of removing 8 million petrol vehicles off the road.[36]

Analysis from the International Energy Agency noted that in Europe, electric

cars 'emitted about 50 per cent less than gasoline cars and 40 per cent

less than diesel cars' when their fuel use (electricity or gasoline) was taken

into account. Importantly, when the entire life-cycle of the car (including

manufacturing, use and disposal) was considered, there was a reduction in GHG

emissions of 30 per cent for EVs.[37]

3.26

The Queensland Government submitted that 'EVs charged on Queensland's

current electricity grid, emit around 25 per cent less than a fossil fuel

vehicle' noting that this will improve as Queensland 'works towards its target

of 50 per cent renewable energy by 2030'.[38]

3.27

Although increased uptake of EVs leads to a reduction in GHG emissions

from direct fossil fuel combustion as alluded to above, an important

consideration becomes the source of electricity used to recharge the EVs. A NSW

Parliamentary Research Paper highlighted that currently 'electricity generation

in Australia is highly reliant on coal and other fossil fuels'.[39]

Furthermore, 'charging EVs from high fossil fuel electricity networks generates

more GHG emissions than charging EVs from low fossil fuel electricity

networks'.[40]

In the Australian context, Tasmania emits the lowest GHG emissions due to its

high reliance on hydroelectricity and other renewable sources for its

electricity generation.[41]

Whilst Victoria is the only jurisdiction where an EV's GHG emissions slightly exceed

that of an average ICE due to the state's high reliance on brown coal

generation.[42]

3.28

The Australia Institute (TAI) acknowledged the impact of electricity

generated from brown coal on EV emissions:

Critics of electric vehicles claim that they would perversely

increase emissions when compared with business as usual, when the vehicle fleet

is overwhelmingly dominated by internal combustion engines. For example, a very

powerful electric vehicle [Teslas] charged in Victoria today will be

responsible for relatively high emissions compared with the national fleet

average for internal combustion engine vehicles, because brown coal burned in

that state produces a lot of carbon dioxide per unit of energy generated.[43]

3.29

TAI has put forward the counter-argument noting that an increased demand

for electricity stemming from increased EV uptake would lead to a requirement

for additional or marginal electricity production. TAI observed:

What we do know is that almost universally around the world

new generation capacity is mainly renewable and old coal-fired power plants are

being junked. So to the extent that new generation capacity is required to meet

increases in demand (and to replace coal-fired generation) then the marginal

response to an increase in demand has a very low emissions intensity and may

well be zero.[44]

Air pollutants and public health

3.30

The Committee has heard that increased use of EVs can also lead to a

reduction in local air pollutants. Hobsons Bay Council noted that 'electric

vehicles due to their electric motors emit less air pollutants than' ICE

vehicles.[45]

The Centre for Air pollution, energy and health Research expanded:

Conventional vehicles with internal combustion engines are a

major source of ground level air pollutants such as carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter (PM). Air pollution has severe adverse

effects on health that can lead to premature mortality. The replacement of

conventional vehicles with electric vehicles may result in a range of

environmental, health, and climate benefits due to possible reductions in

ground level pollutants as well as greenhouse gas emissions.[46]

3.31

Dr Liz Hanna set out the impact of air pollution on health at a global

scale:

The World Health Organisation (WHO) reports that over 4.2

million deaths a year are linked to exposure to outdoor air pollution, and

children are particularly susceptible. The WHO 2018 Fact Sheet on Air Pollution

finds 9 out of 10 people worldwide breathe polluted air, almost all urban

residents on the planet. Air pollution causes 24% of all stroke deaths (1.4 million

deaths annually), 25% of global heart disease deaths (2.4 million deaths

), and 43% of all lung disease and lung cancer deaths (1.8 million deaths every

year).[47]

3.32

Dr Ingrid Johnson stated that 'air pollution from vehicle emissions

results in thousands of deaths and yet the technology exists to massively

reduce this pollution through the use of no-emissions [EVs]'.[48]

ClimateWorks referred to research demonstrating the impact reduced vehicle

emissions could have:

Through reducing air pollution, the transition to electric

vehicles will also have benefits for health. In their submission to the

Australian Government's discussion paper on fuel quality standards, the Clean Air

and Urban Landscape Hub and the Melbourne Energy Institute estimate that air

pollution due to vehicle emissions caused 1 715 deaths in Australia in 2015, a

number larger than the national road toll for the same year. Given that

electric vehicle adoption is likely to be concentrated in metropolitan areas of

Australia, where population densities are at their highest, there is strong

potential for reductions in urban air pollution and meaningful benefits to

community health.[49]

3.33

Dr Hanna estimated that the economic cost of air pollution from the

transport sector to be as high as $17.4 billion in 2018. This cost takes

into account:

the economic burden on families for days, weeks and years and

from premature deaths. It means (a) they lose their earning capacity (b) the

society misses all the effort and cost that was put into their training and

expertise, and (c) the society misses the additional contribution that people

make to society not only as productive workers but in mentoring, parenting and

caring et cetera.[50]

3.34

Dr Hanna noted that some of the long term negative effects of air

pollution on humans still remain unknown:

You can draw the corollary to lead and lead petrol.

Initially, we thought blood lead levels were okay and kiddies wouldn't have

cognitive impairment. Of course, as more and more research came out, the safe

levels in the regulations came down and down. We realised that exposure was

harmful even at lower levels. Again, it gets back to...actually needing the work

to be able to do it. It would be impossible to think that, as new research was

done, we'd find out that it's actually less harmful. Without question, with

everything we do, when we go and find out we find it's not as safe as we

thought.[51]

3.35

Concerns were expressed that the benefits of using no-emissions EVs may

be reduced if the electricity were sourced from fossil fuels. The panel argued

that if the power generated to recharge the EVs is from fossils fuels, then

'that's only going to remove the health effects from one site [roads] to

another site [fossil fuel power generator]'.[52]

Noise

3.36

Many submitters and witnesses pointed out that EVs have the benefit of

emitting less noise than their ICE equivalents.[53]

A NSW Parliamentary Research Paper also highlighted the potential for reduced

traffic noise due to increasing EV uptake:

EVs at slower speeds are virtually silent, as they have no

internal combustion engine and the only noise emitted from their electric motors

is a barely perceptible high-pitched frequency. EVs do produce noise from wind

resistance and tyre-road contact, but this noise only becomes perceptible at

higher speeds.[54]

3.37

However, low levels of noise may 'pose an additional risk to pedestrian

safety'. A recent paper identified that EVs are 'very difficult for [pedestrians

who are vision impaired] to detect and respond to as they are unable to rely on

their other sensory modalities such as hearing, to navigate when it is safe to

cross roads. Similarly, detection concerns have also been raised about

cyclists'.[55]

The paper also put forward a broad range of recommendations to address this

issue including regulatory reform to fit acoustic alert systems and advanced

driver assistance systems to EVs in order to avoid collisions with pedestrians.[56]

Fuel security—national security and

resilience

3.38

A number of submitters highlighted the economic and national security

implications of Australia's current reliance on imported oil.[57]

The Victorian Government Department of Environment, Land, Water and Planning (DELWP)

noted that 'Australia is increasingly reliant on imports for its liquid fuels'

with 91 per cent of transport oil and 67 per cent of total oil imported. This

makes 'Australia vulnerable to potential supply disruptions and to unexpected

changes in demand from other customers in Asia'.[58]

DELWP described the impact of EV uptake on Australia's reliance on oil imports:

Electric vehicle adoption can help address the issue of fuel

security. As Australia is vulnerable to a disruption to transport fuel supplies

due to the current and increasingly high oil and fuel import dependency, local

production of electricity as [a] fuel source for electric vehicles will

decrease our international reliance on oil and enhance our fuel security.

Analysis developed by ClimateWorks in its 2016 report, The path forward for

electric vehicles in Australia[,] indicates that the increase of

electric vehicles into the Australian fleet, consistent with the pathway to

zero net emissions by 2050, would increase fuel stocks from 18 to 21 days in

2030, and 16 to 20 days in 2050 compared to a business as usual baseline.

Oil/fuel imports would decrease 16% in 2030 and 28% in 2050.[59]

3.39

Air Vice-Marshall John Blackburn AO (Retired), a noted fuel security expert,

told the Committee that:

Electric vehicles could play a significant role by improving

our energy security by reducing the demand for foreign sourced oil and fuels

and by providing a significant increase in the transport system resilience in

the event of a fuel supply disruption.[60]

Challenges

3.40

Notwithstanding the considerable benefits of increased EV uptake, there

are a number of associated challenges including range anxiety, a declining fuel

excise revenue base, changes to demand and supply on the electricity grid, and

industry transition including a reshaping of the job market.

Range anxiety

3.41

Concerns have been raised about range anxiety linked to limited charging

infrastructure, particularly in non-metropolitan areas.[61]

Although it is expected that most EV recharges are undertaken at home or at a

workplace, concerns stem from the relatively shorter driving ranges of current

model EVs—ranging from 150km to 489km on one charge—and the current dearth of

charging infrastructure, both geographically and in total—there are 783 public

charging stations compared to 6 400 petrol stations with multiple bowsers.[62]

The majority of these stations are 'slow charging AC stations', with a little

under one-tenth being 'fast charging DC stations'.[63]

As noted in Chapter 2, newer fast charge stations enable close to full charging

in as little as 15 minutes allowing travellers to recharge and undertake the

next leg of their journey.

3.42

Mr Ali Asghar, Senior Associate at Bloomberg New Energy Finance told the

Committee that many automakers are 'introducing more cars with longer driving

ranges', further noting that 'greater model availability and reduced range

anxiety should attract a larger consumer base for electric vehicles'.[64]

The Committee notes the imminent release to market of a number of more

affordable, longer range EVs such as the Hyundai Ioniq Electric, Nissan Leaf,

and the Volkswagon I.D.[65]

3.43

Plug-in Hybrid Electric Vehicles (PHEV) can be seen as a viable

transition technology to alleviate range anxiety as public charging

infrastructure is built:

PHEVs with electric range aligned with the typical day-to-day

usage of the vehicle should be given especially close consideration in this

respect. They will deliver the vast majority of benefits (economic,

environmental, and social), without any issues around range anxiety caused by a

lack of public charging infrastructure in the early days of the transition.

Beyond its electric range, a PHEV functions very much like a typical petrol

vehicle. The PHEV can be considered a stepping-stone on the journey to a future

which is more fully electric.[66]

3.44

The issue of public charging infrastructure and consumer education will

be discussed later in the report.

Fuel excise revenue

3.45

The Committee heard that one of the consequences of an increasing EV

fleet and the corresponding reduction in liquid fuel consumption would be a

decrease in the federal fuel excise tax. Mr Adrian Dwyer, Chief Executive

Officer of Infrastructure Partnerships Australia noted that more EVs would 'drive

a rapid and terminal decline in the major funding base for Australia's road

network'.[67]

Mr Dwyer noted recent trends associated with fuel excise:

According to the [Parliamentary Budget Office], fuel excise

has fallen from 1.6 per cent of GDP in 2001–02 to one per cent in the year

2016–17. At the same time, the number of vehicle kilometres travelled on

Australian roads has increased to 250 billion. In short, revenue is going down

while consumption is going up. This is the exact opposite of a good funding

model. While fuel excise is not directly hypothecated, it's clear that a

declining revenue base will not support the investment required to meet

increasing demand for our road networks.[68]

3.46

Mr Steve Bletsos, Senior Research Analyst at VACC highlighted that fuel

excise is 'roughly $16 billion per annum and that money has to come from

somewhere' if it is not coming from excise.[69]

The Committee has received evidence on a replacement scheme known as a road

user charge—a distance based tax that would apply to all vehicles regardless of

propulsion type.

3.47

The federal government has acknowledged the challenges around revenue in

this space, and, in 2016 instigated a study into how road user charging might

be implemented as a replacement to fuel excise.[70]

The Committee has not received evidence indicating significant progress since

2016.[71]

3.48

Dr Jake Whitehead of the University of Queensland identified 'public

resistance' as the main challenge to implementation of a road user charge.[72]

Dr Whitehead explained the current system and how it would translate into

a road-user charge, and the challenges that a road user charge would need to

overcome:

At the moment we have fuel excise in terms of standard fossil

fuel vehicles, and that effectively is a proxy for both how far people travel

and how fuel-intensive their vehicles are. With electric vehicles, obviously

they don't pay fuel excise, so there's been a lot of discussion about bringing

in a per-kilometre charge. But what you see is that, in cases where that has

been undertaken, you can have some pretty significant equity impacts.

Obviously, in a country like Australia, where we have a significant population

outside of urban areas, if we are charging them purely based on how far they

travel, that's going to have a much more significant financial impact on them

as opposed to those individuals who are driving in urban areas. The reality is,

though, that it's those drivers in urban areas who are causing the greatest

cost to society through congestion but also much higher emissions through that

kind of stop-start-idle traffic.[73]

3.49

Road user charging will be discussed further in Chapter 5.

The electricity grid—energy demand

and grid stability

3.50

An increased uptake of EVs would displace the transport sector's fuel

source from petroleum to the electricity network, placing a range of

unprecedented demands on the grid. The International Energy Agency made the

point that 'power demand and road mobility demand are both characterised by

peaks during morning and evening hours and a period of low demand during night

time'.[74]

The former Minister for the Environment and Energy, Hon Josh Frydenberg MP

quantified this extra demand:

An extra one million electric cars is the equivalent of 5.2

terawatt hours of power demand. This is about a 2 per cent increase in overall

grid demand.[75]

3.51

In its supplementary submission, Infrastructure Australia (IA) stated

that EVs will have 'negligible effects on grid consumption' over the next five

years, but that this demand is then expected to grow over the next 5–10 years:

[Australian Energy Market Operator] AEMO [forecasts] that

electric vehicles will begin to have sizeable impacts on consumption. In this

period, consumption is forecast to increase at an annual average rate of

approximately 1.3%. [The Independent

Review into the Future Security of the National Electricity Market

conducted by the Chief Scientist Dr Alan Finkel] found a 20% EV uptake could

account for 4% of grid demand. Extrapolating on that figure, 100% uptake could

account for [an additional] 20% of grid demand.[76]

3.52

It is likely that most of the power for EVs will be drawn from the

grid—unless it is powered by on-site solar panels and batteries. During week

days, most of the charging events are likely to occur when people return home

from work for the day, potentially resulting in peak EV charging coinciding

with the peak energy use period of the day.[77]

This raises questions about additional generating capacity and how EV owners

can be incentivised to charge during off-peak periods.

3.53

In addition to the abovementioned issues there will also be an impact on

the transmission system as more electricity is demanded by households and

public chargers. This may push the grid to its operating limits, hence

requiring upgrades to substations and transmission infrastructure. Equally,

this may lead to, and require a more coordinated approach to vehicle charging.

3.54

Energy Networks Australia (ENA), the peak national body representing gas

distribution, electricity transmission and distribution businesses, noted that

'Australia's distribution networks were not designed for any significant uptake

of electric vehicles and the consequential demand for charging'.[78] ENA flagged mass EV charging events at

existing peak times such as when people arrive home from work at 5–6pm on an

extremely hot day as a potential issue with the following effects:

-

Exacerbation of electricity consumption peaks.

-

Exceedance of low voltage (suburban) network capacity, causing

poor reliability or restrictions on EV charging.[79]

3.55

IA stated that 'making sure EVs do not contribute to peak demand is

crucial to keeping network costs down for consumers and taxpayers'.[80]

3.56

AEMO stated that the lack of visibility on the location of distributed

energy resources (DER) such as EVs, solar panels and home batteries make it

difficult for AEMO to 'manage power system security in the short term and

longer term'.[81]

AEMO elaborated:

Impacts of lack of visibility include barriers to operational

planning and inefficiencies in asset utilisation, market operation, or

investment decision-making, which ultimately lead to additional costs borne by

consumers.[82]

3.57

AEMO is currently 'undertaking a broad [DER] work program to assess and

address the challenges and opportunities of changing consumer behaviour'.[83]

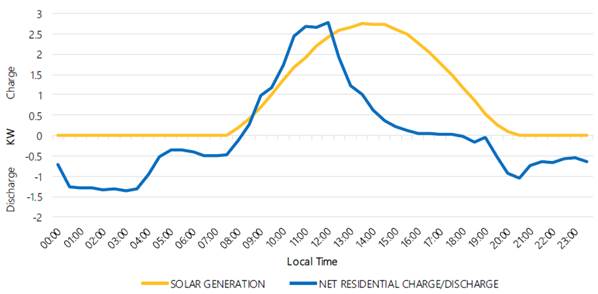

3.58

There is an expectation that increased small-scale and large-scale solar

photovoltaic (PV) will lead to an accentuated generation peak during the day.[84]

There is also a potential role for EVs to charge during periods of low demand

and discharge battery power into the grid at times of high demand.[85]

In an answer to a question on notice, AEMO provided the Committee with a graph

that outlined how the use of batteries (both stationary and mobile EVs) could

assist in flattening out the demand and supply curve.

Graph 3.1: National Energy

Market battery charge and discharge profile overlaid with PV generation[86]

3.59

IA flagged that by 2030, there would be significant residential

(small-scale) generation and storage:

By 2030–31 AEMO estimates that consumers could have as much

as 33,136 MW of solar PV and 4,969 MW of battery storage, as well as the

battery capacity of their electric vehicles.[87]

3.60

ENA advised that changing consumer behaviour around charging would need

to involve the use of incentives through changes to tariffs. For instance, modifications

to flat tariff structures are required to incentivise consumers to move away

from convenience charging at peak times to making vehicle batteries available

for both charging during peak generation times and discharge during lower

generation and higher demand periods.[88]

3.61

In addition to a projected increase in peaking requirements and overall electricity

demand AEMO also raised the challenges in locating and establishing public

charging equipment. [89]

3.62

Using fast chargers 'requires on-demand power similar to an industrial

facility'.[90]

For example, 'a large, fast charging station in a rural area will have a much

greater impact on the surrounding network than charging stations in

metropolitan areas' noting the following considerations:

The planning of public charging infrastructure needs to be

closely coordinated with AEMO and network operators in order to:

-

Understand any limitations on the local network.

-

Determine technical requirements to effectively interface with

the network at each location.

-

Understand requirements for any supporting technical

infrastructure such as batteries.

-

Identify network areas where public charging infrastructure may

provide benefits.

-

Determine efficient network connection processes.

-

Standardise regulation and technical standards for

infrastructure.[91]

3.63

In its submission, TAI affirmed this view focusing on the need for

coordinated EV charging to optimise the supply and demand of electricity.

Coordinated charging would prevent [EV] charging from increasing the size of

afternoon and evening peaks' and would 'shift the charging periods overnight to

"fill" the demand "valley", when electricity is cheaper'.[92]

3.64

The Electricity Network Transformation Roadmap: Final Report found

'that there is a need to redefine the structure and architecture of the

electricity system to meet the requirement for flexibility and agility in the

future grid'.[93]

IA highlighted that 'there could be a need for an [electricity sector]

investment between $2.2 billion and $9.7 billion by 2046'.[94]

3.65

IA argued:

With the right frameworks in place, electric vehicles will be

useful grid assets whose benefits will increase the more electric vehicles are

adopted. EVs used in a smart network could be used as a short-term storage of

excess, off-peak electricity generated from renewable sources that could

flexibly be dispatched [to] counteract peak demand. They could also be used for

local, residential consumption.[95]

3.66

Transgrid suggested that by 2040 EVs could provide up to 350GWh of

storage, and observed:

If aggregated effectively, this level of storage could play a

significant role in providing grid stability and ancillary services, with 350

GWh[,] equivalent to the proposed capacity of the Commonwealth Government's

Snowy 2.0 project.[96]

3.67

The impact of EV charging on the grid will be explored further in Chapter

5.

Industry transition

3.68

Earlier in the report, the Committee highlighted the projected net

increase of 13 400 jobs as a result of an increased uptake in EVs.[97]

Notwithstanding the increased job opportunities in EV sales, servicing,

components and charging infrastructure, the paradigm shift away from an oil-based

logistics, parts and servicing transportation system will result in job losses

and negatively affect some businesses in these sectors.

3.69

Motor Trades Association of Queensland (MTAQ) explained the fundamental

changes to the automotive sector resulting from the uptake of EVs:

Business models in most cases will require profound changes

to adapt to the progressive change in vehicle propulsion technology. There is

likely to be extensive structural change needed within the automotive value

chain that will have repercussions for the transport sector and the national

economy.[98]

3.70

One submitter described a 'seismic shift in the fuel distribution

network in Australia' arguing that major fuel retailers will be significantly

affected:

Fuel retailers will have difficulty competing with the

convenience and cost of cheap home charging even if they install DC charging

stations in local service stations. Most local service stations will disappear

because electric cars will charge in homes.[99]

3.71

An August 2018 report from Infrastructure Victoria into automated and

zero emissions vehicles infrastructure found that there would be a 25 per cent

reduction in ongoing maintenance requirements for battery electric vehicles and

nearly 11 000 job losses nationally in the fuelling sector.[100]

3.72

The VACC submission put forward a Victorian perspective on projected job

losses of up to 6 000 as EV uptake increases and lower demand is

experienced in sectors associated with ICE vehicles and then not replaced in

the sectors associated with EVs. VACC highlighted that nearly 6 000 job

losses and 2 000 automotive business closures are projected by 2030 if

there is a high uptake of EV (20 per cent). These losses are projected

across fuel retailing (910 jobs), automotive repair and maintenance (1 900

jobs), motor vehicle parts retailing (1 370 jobs) and car wholesaling and

car retailing (1 200 jobs). The projected losses and closures are about

halved under a scenario where 10 per cent of new cars are EVs by 2030.[101]

The primary reasons for the net loss of jobs relate to lower liquid fuel demand

and lower servicing requirements for EVs discussed earlier in the chapter.

3.73

Noting the risk of job losses, the City of Adelaide highlighted the

importance of supporting and encouraging the 'motor trades sector to transition

to electric vehicle sales, servicing and potentially business models, such as

car share and mobility as a service, which may result in lower levels of

private car ownership'. Notwithstanding this commercial and industrial

transformation, MTAQ was mindful that there would be significant new opportunities

through the new propulsion technologies combined with emerging trends such as

automation and car sharing.[102]

Concluding comment

3.74

Australia is on the cusp of the most significant disruption and

transformation of our transport system since the advent of the internal

combustion engine. Taking into account the evidence received during this

inquiry, the Committee is optimistic about the environmental, economic, public

health and national security benefits that increased uptake of EVs will bring

to Australia. Reductions in greenhouse gas emissions, cost savings for vehicle

owner-operators, increased job opportunities and economic growth, improved

health outcomes and increased fuel security are just some of the benefits that

Australia can realise as EV use begins to climb.

3.75

Notwithstanding the overwhelming benefits of increased EV use, the Committee

is cognisant of some of the challenges that are emerging as Australia moves

away from an oil-based transportation system towards EVs. A continued erosion

of the fuel tax excise, questions about how we plan and manage our electricity

generation and transmission, and transitional arrangements for employees and

businesses reliant on the ICE vehicle are just some of the challenges that need

to be met.

3.76

The Committee considers that the benefits of EV uptake are not to be

taken for granted; likewise, the challenges that we now face will also not be resolved

in the absence of a coordinated strategy. The pathway forward that seizes the

opportunity and manages the risks of an EV future is discussed in Chapter 5.

Navigation: Previous Page | Contents | Next Page