Electric vehicles—Definitions, background and projections

Introduction

2.1

This chapter provides a background to the electric vehicle (EV) industry

and projections about the industry's future focusing on:

-

Definition of an EV;

-

EV statistics and projections;

-

Hydrogen, hybrid and electric cars;

-

Autonomous vehicles; and

-

Public and active transport.

What is an EV?

2.2

There are a broad range of views on what constitutes an EV. Some submissions

proposed a narrow approach, defining electric vehicles as vehicles propelled by

one or more electric motors, and that can be plugged-in to charge.[1]

A similar definition was adopted by the Victorian Parliament in its Inquiry

into electric vehicles.[2]

2.3

Two categories of vehicles fit within this definition:

-

Battery-Electric Vehicles (BEVs)—vehicles propelled by one

or more electric motors, with batteries that require recharging from an

external electricity source. Examples: Nissan Leaf, Tesla Model S, and Jaguar

I-Pace; and

-

Plug-in Hybrid

Electric Vehicles (PHEVs)—vehicles

powered by one or more electric motors with batteries that can be recharged

using an external electric source, and a liquid fuel range extender/internal

combustion engine (ICE). Examples: Mitsubishi Outlander PHEV, Mercedes-Benz

C350e, BMW 330e, and Audi A3 e-tron.[3]

2.4

The Committee also received evidence that the following categories of

vehicles should be included in the definition of EVs:

-

Hydrogen Fuel Cell Vehicles or Fuel Cell Electric Vehicles

(FCEVs)—vehicles propelled by one or more electric motors powered by electricity

generated on-board by a hydrogen fuel cell, and that require refuelling with

hydrogen gas. Examples: Toyota Mirai, Hyundai Nexo;[4]

-

Hybrid Electric Vehicles (HEVs)—combine an ICE with one or

more electric motors and batteries, but cannot be plugged-in to an external

electricity source to recharge. Example: Toyota Camry Hybrid.[5]

2.5

In its submission, the Department of the Environment and Energy stated that

'the term "Electric Vehicle" commonly includes PHEVs, BEVs and FCEVs'.[6]

2.6

Throughout this inquiry and for the purposes of this report, the Committee

has been inclined to accept a definition of EVs that includes BEVs, PHEVs and

FCEVs.

Background—current uptake, projections, and policy initiatives

Global uptake, projections and

policies

2.7

Worldwide, in 2017, there has been a 57 per cent increase of new EV

sales from the previous year to 3.1 million electric passenger cars sold. More

than half of global sales of EVs were in China, where electric cars hold a

market share of 2.2 per cent. Sales of EVs in China were more than double that

of the United States, the next largest market.[7]

In 2017, the highest proportion of new EV car sales were in the following jurisdictions:

-

Norway with 39 per cent of new car sales (560 000 units);

-

Iceland with 11.7 per cent; and

-

Sweden with 6.3 per cent.[8]

2.8

The Department of the Environment and Energy stated in their submission

that:

Over one million new EVs have been added to the global fleet

each year for the past three years. By 2030, the International Energy Agency

expects between 125 million and 220 million EVs on the road globally and that

EVs will comprise up to 12 per cent of light vehicle sales. Bloomberg New

Energy Finance forecasts around 28 per cent of global new vehicle sales will be

EVs in 2030, close to 30 million sales a year. Major vehicle manufacturers have

committed to scaling up investments in EV technology in coming years. [9]

2.9

The Electric Vehicle Council pointed towards the EV targets established

by other nations. Some countries such as the UK and France have set a target of

100 per cent of new car purchases being EV by 2040, whilst others like the

Netherlands and Norway aim to achieve the same target by 2025.[10]

Table 2.1: Electric

Vehicle targets of selected markets[11]

| Country |

Target |

Date |

| China |

100% |

'near future' |

| UK |

100% |

2040 |

| France |

100% |

2040 |

| Norway |

100% |

2025 |

| Netherlands |

100% |

2025 |

| Japan |

20–30% |

2030 |

| India |

30% |

2030 |

| New Zealand |

64,000 |

2021 |

| USA |

3.3 million |

2025 |

| Germany |

6 million |

2030 |

| Taiwan |

100% |

2040 |

| Ireland |

100% |

2030 |

2.10

The Electric Vehicle Council emphasised the exponential rise in new

global EV sales from 47 000 in 2011 to over 1.1 million in 2017 and the

automotive sector's intentions to invest '$150 billion in electric vehicles by

2025'.[12]

Many mainstream automotive manufacturers have established their own targets for

EV sales ranging from 15–50 per cent of all sales by 2025 with the VW Group

expected to offer 80 EV models. Whilst two Chinese automotive companies have

set 100 per cent of sales as their benchmark within the same timeframe.[13]

2.11

In addition to targets, many jurisdictions are offering a range of other

incentives to EV owners:

- New Zealand's Electric Vehicle Programme; which includes a

target of 64,000 EVs by 2021, tax exemptions until EVs reach 2% of fleet,

government fleet purchasing, an annual $6m grant fund and $1m annual funding

for a consumer awareness campaign.

- The United Kingdom's Road to Zero Strategy; a target of 50-70%

by 2030 and 100% by 2040, government fleet target of 25% by 2022 and 100% by

2030, financial incentives of up to £4,500 for cars, £7,500 for taxis and

£8,000 for vans, and grant funding for R&D and charging infrastructure.[14]

2.12

One jurisdiction has seen a fall in EV uptake as a result of withdrawal

of incentives. The Victorian Automobile Chamber of Commerce (VACC) observed:

...the dramatic fall of EV sales in Denmark, dropping 60.5

percent in the first quarter of 2017 following the phasing out of its tax incentives

on EVs in 2016. This dramatic reduction suggests clean-energy vehicles are not

currently attractive enough to compete against ICEs, without some form of

subsidy.[15]

Price parity

2.13

The point when an EV purchase price reaches parity with ICE equivalents is

a critical economic precursor to cost competiveness and to higher levels of EV

uptake. Bloomberg New Energy Finance submitted that price parity would be

reached from the year 2024 up to 2040 in different segments of the market (for

example, light passenger vehicle, commercial vehicles) in different countries.[16]

Mr Steve Bletsos of VACC agreed that EV sales would increase once price parity

was achieved.[17]

Table 2.2: Year of EV

up-front price parity with ICE vehicles in selected markets[18]

| Segment |

US |

EU |

China |

Japan |

| Small |

2027 |

2028 |

2030 |

2040 |

| Medium |

2025 |

2024 |

2024 |

2029 |

| Large |

2026 |

2025 |

2029 |

2027 |

| SUV |

2024 |

2026 |

2040 |

2025 |

Australian uptake, projections and

policies

2.14

The most recent data shows that EVs are a relatively small segment of

the total Australian new car market and total vehicle fleet. Of the

approximately 17 million light passenger vehicles in Australia, around 7

300 of these are BEVs and PHEVs.[19]

Recent annual sales figures show that of over a million cars purchased in 2017,

around 2 300 were BEVs or PHEVs, about 0.2 per cent market share.[20]

2.15

In a joint report by ClimateWorks and the Electric Vehicle Council, it is

stated that in 2017, business bought 63 per cent of EVs, private buyers

purchased 34 per cent whilst government bought only 3 per cent.[21]

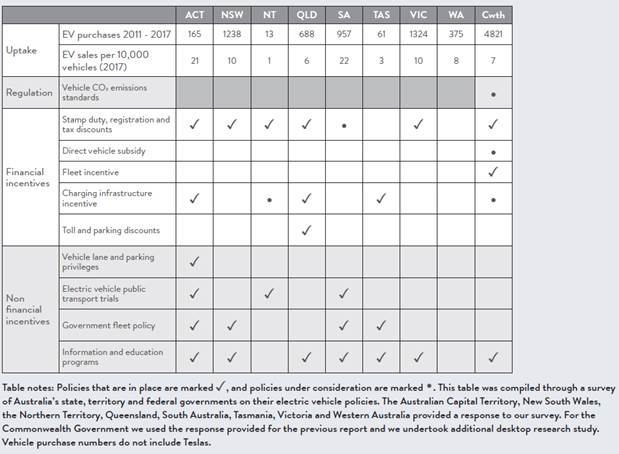

This same report provided a state and territory breakdown of new EV purchases:

Australia's states and territories differ in their rate of

electric vehicle uptake...In the last seven years, Victorians have purchased the

highest number of electric vehicles, with 1,324 vehicles purchased between 2011

and 2017 (excluding Tesla vehicle numbers). When taking into account market

size however, the ACT continues to outperform other jurisdictions: in 2017, ACT

residents purchased 21 electric vehicles for every 10,000 vehicles sold.[22]

2.16

Notwithstanding the recent increase in EV models, the Australian EV

market is characterised by a relatively low number of models that are generally

more expensive than overseas markets:

The number of electric vehicle models available in Australia

increased 44 per cent in the same period, from 16 models in 2016 to 24 in 2017.

Twenty of the 24 electric vehicle models available are in the luxury vehicle

category, priced at over $60 000. The cheapest electric vehicle currently

available in Australia is the Renault Zoe priced at under $50 000.[23]

2.17

The Committee heard that there are a variety of reasons for this,

including less stringent Australian vehicle emission standards,[24]

a lack of direct incentives for consumers to choose EVs,[25]

and the absence of clear Federal Government policy.[26]

2.18

In its submission, the Department of Infrastructure, Regional

Development and Cities outlined some of the current Australian Government policies

supporting the uptake of EVs:

The Australian Government currently offers a discount on the

Luxury Car Tax (LCT) threshold for fuel efficient vehicles, such as electric

vehicles. The 2017-18 threshold for fuel efficient vehicles of $75,526 is

$10,432 higher than for other vehicles. At an LCT rate of 33 per cent, this

effectively translates to a tax saving of up to $3,442.

The Department also administers two measures providing

information to consumers; the mandatory fuel consumption label for new light

vehicles and the Green Vehicle Guide (GVG) website. Both the label and the GVG

help consumers choose more efficient vehicles. All of the top 20 performing

vehicle models currently listed on the GVG are electric or plug-in hybrid

vehicles.[27]

2.19

The Department of the Environment and Energy noted other Australian

Government initiatives supporting EV uptake:

The Australian Renewable Energy Agency [ARENA] is funding

research into consumer preferences for EVs. The Clean Energy Finance

Corporation [CEFC] has made up to $950 million in capital (debt and equity)

available to assist business with investment in low emissions vehicles. The

CEFC and ARENA recently commissioned Energeia to complete an Australian market

study on electric vehicles, helping new businesses understand Australia's

unique market needs.[28]

2.20

The Department of the Environment and Energy also highlighted the work

of the Ministerial Forum on Vehicle Emissions:

The Forum was established to provide a coordinated,

whole-of-government approach to addressing vehicle emissions. It is consulting

on ways to reduce vehicle emissions, including by supporting uptake of low

emissions vehicles.

The Ministerial Forum brings together the Commonwealth

Ministerial members of the [Council of Australian Governments' (COAG)] Energy

Council and COAG Transport and Infrastructure Council. The COAG Energy Council

can coordinate and pursue the regulatory and governance reforms needed to

prepare the electricity system for widespread EV uptake.[29]

2.21

In addition to Australian Government initiatives, ClimateWorks and the Electric

Vehicle Council observed there had been notable policy developments in

Australia over the past 12 months, occurring mainly at a state, territory and

local government levels:

The majority of state and territory governments across

Australia have either announced or are developing an overarching electric

vehicle policy framework or strategy, the ACT Government recently released

their Transition to Zero Emissions Vehicles Action Plan 2018-21; the Queensland

Government has released their electric vehicle strategy The Future is Electric;

the Tasmanian Government outlines a range of electric vehicle action items in

Climate Action 21: Tasmania's Climate Change Action Plan 2017-2021; and the New

South Wales Government's Future Transport Strategy has been released for public

consultation. The South Australian Government is also developing an electric

vehicle strategy and the Northern Territory Government is considering a climate

change framework.[30]

2.22

The ACT Minister for Climate Change and Sustainability, Mr Shane

Rattenbury, explained the key elements of the ACT Government's plan:

Our action plan is very short term—it's only a three-year

plan—partly because we wanted to make sure we'd put something in place that we

just got on with...

The key focus in the three-year action plan is a number of

specific measures. The leading one, we believe, is that the ACT government have

committed to transform our government fleet to 100 per cent electric vehicles

over a three-year cycle...

Our action plan also includes the requirement for the

installation of vehicle-charging infrastructure in new mixed-use and multiunit

developments...it's very expensive to retrofit electric charging points into the

basement of a large multiunit building because if you build it in at

construction point the marginal cost is almost zero. So we've decided to

mandate that into our planning laws so that we essentially future-proof these

buildings that are going up at the moment in Canberra; we are seeing a

significant number of new buildings.[31]

2.23

Mr Rattenbury also referred to financial incentives provided by the ACT

Government to consumers:

We have what I believe are currently the most generous

concessions in Australia for electric vehicles. We have zero stamp duty at the

time of purchase and then an ongoing 20 per cent discount for registration. We

have been very conscious of how we provide subsidies.[32]

2.24

Ms Sally Noonan, Chief Economist, Queensland Department of Transport and

Main Roads (DTMR), explained the approach the Queensland Government is taking

to support EV uptake and noted 'The Future is Electric: Queensland Electric

Vehicle Strategy':

To accelerate the adoption of EVs, effort is needed from

across multiple and diverse stakeholders, from the energy sector to tourism,

fleet operators and industry development leaders. To raise awareness, [DTMR]

has participated in multiple community events across Queensland, including

showcasing the benefits of EVs and the electric superhighway at the recent

Royal Queensland Show in Brisbane...

The Queensland government has committed a further $2.5

million to build additional charging stations at new sites along the Queensland

electric superhighway. Queensland now has the highest number of fast chargers

in any state of Australia. The number of slower charging sites has also

increased.[33]

2.25

Ms Noonan also noted registration concessions that the Queensland

Government offers for EVs.[34]

2.26

Table 2.3 is a summary provided by ClimateWorks and the Electric Vehicle

Council of the current policy approaches of Australian federal, state and

territory governments that support EV uptake.

Table

2.3: Overview of federal, state and territory government policy[35]

2.27

Some submitters were optimistic about the future of EVs in Australia.

The Australia Institute noted the Australian Energy Market Operator's forecasts

that there will be between 526 000 and 3.9 million EVs on Australian roads

by 2030.[36]

Bloomberg New Energy Finance projected by 2025 that 6 per cent of new passenger

vehicles will be EVs rising to 28 per cent by 2030, and 60 per cent by 2040.[37]

The Department of the Environment and Energy observed:

EV uptake has been slower in Australia but is expected to

increase as technology becomes more affordable and evolves to suit consumer

requirements.[38]

2.28

In a 2018 report commissioned by the ARENA, Energeia modelled three EV

uptake scenarios for the Australian market—no intervention, moderate

intervention and accelerated intervention. Energeia forecast by 2030 that

yearly EV sales could range from 22 per cent of new passenger vehicles under a

no intervention scenario to 49 per cent (moderate intervention), and up to 64

per cent (accelerated intervention).

2.29

Energeia stated its assumptions for the moderate and accelerated

scenarios:

Moderate Intervention Scenario: assumes an unco-ordinated mix

of policy support, across several layers of government, including potential

federal policy changes to luxury car tax, fringe benefits tax and vehicle

emissions standards, and a mix of the most likely state and local government [plug-in

electric vehicle (PEV)][39]

support from the list below. This scenario assumes no long-term decarbonisation

target.

-

Australian states with net-zero targets and a history of policy action

to support this in power generation introduce policies to support PEV uptake in

their states. Policies include stamp duty and registration exemptions.

-

Local and state government fleets are pushed to increase fleet

purchases of PEVs where there is a comparable PEV in the class.

-

Removal of restrictions on import of second-hand PEVs drives a

larger second-hand market.

-

Preferential parking and use of transit lanes.

-

Assumes that a range of actors (governments, motoring

associations, private companies) accelerate the roll-out of charging

infrastructure which removes range anxiety, e.g. [Queensland] Superhighway and

the NRMA network.

-

Assumes [Original Equipment Manufacturers] react to this policy

support by increasing PEV model availability.[40]

Accelerated Intervention Scenario: assumes the unco-ordinated

policy and OEM actions in the Moderate Intervention scenario occur earlier and

to a higher level of support, representing a more aggressive push to support

PEVs. In addition, it is assumed that as foreign-produced ICEs model

availability decreases that a total ban in ICE sales is implemented towards the

end of the projection period.

2.30

Energeia described the likely trajectory of EV uptake under a moderate

and no intervention scenario:

In the No Intervention scenario, PEV sales increase slower

over time due to a reduced decline in PEV price premiums and model

availability. Under the No Intervention scenario, the first PEVs to reach the

two-year pay-back do so in 2027, three years later than the Moderate Intervention

scenario. As a result, forecast PEV stock in the No Intervention scenario

reaches almost 832,000 vehicles by 2030, 3.6 times smaller than the Moderate

Intervention scenario. Looking further ahead, the PEV stock under the No

Intervention scenario reaches 6.78 million vehicles by 2040, 48% smaller than

the Moderate Intervention scenario.[41]

2.31

Table 2.4 provides a summary of the forecast model.

Table 2.4: EV uptake by

scenario[42]

2.32

Notwithstanding the projected increasing uptake of EVs, the Federal

Chamber of Automotive Industries (FCAI) remained more circumspect, submitting

its research findings that ICEs will 'remain the predominate [drivetrain] for

Australia light vehicles out to 2030':

The internal combustion engine (ICE) will be the dominant

source of power in passenger cars through to 2030. Hybrids will expand significantly

(but they still have ICEs in them). Pure EVs will be niche.[43]

2.33

FCAI also noted that the 'incremental transition to low-emission power

trains' would be a function of the relatively low replacement rate of the large

Australian light passenger car fleet and that as annual new vehicle sales

currently only represent 6.75 per cent of this fleet (and that new EV

sales represent 0.2 per cent of this) that this would be a gradual process.[44]

Charging infrastructure

2.34

There is a variety of charging infrastructure or electric vehicle supply

equipment (EVSE). Typically, these fall into three categories that are

determined by the amount of charge that can be delivered in a set period of

time which in turn determines how quickly an EV battery can be charged. First,

is the standard household plug (less than 3.7 kilowatts (kW)). Second, is a

slow charger (3.7kW to 22kW). Lastly, there are the fast chargers which can

range from 22kW to 43kW. All of these chargers use alternating current (AC).[45]

2.35

There is now a range of DC chargers with up to 350kW, with higher levels

currently under development.[46]

The benefit of these chargers with a faster charging capacity is that an EV

with a 60kW battery can be recharged in about 15 minutes, with new higher

capacity chargers (up to 475kW) likely to reduce this time further.[47]

Public charging infrastructure generally falls into two categories—fast/ultra-fast chargers

for long-haul applications and slower chargers for destination or convenience

charging, such as at supermarkets or parking stations.

2.36

ClimateWorks and the Electric Vehicle Council observed that in 2018

there were 783 public charging sites in Australia—an increase of 64 per cent

from 476 in 2017—equating to 'one charging station for every six EVs'. The vast

majority of these—714 chargers—are AC chargers.[48]

These public chargers are in addition to chargers found in homes (which in most

countries is estimated to be about one private charger—home or work—per

electric car). [49]

2.37

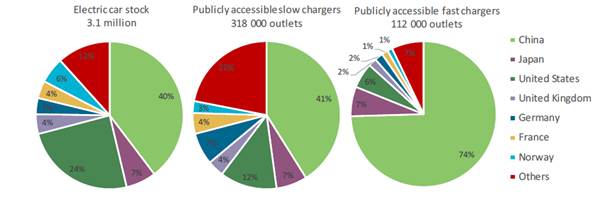

Figure 2.1 shows the total number of chargers found worldwide with China

being the dominant in terms of EV units sold and publicly accessible chargers.

China has nearly three-quarters of the publicly accessible fast chargers despite

holding 40 per cent of EV stock.

Figure 2.1: Electric car

stock and publicly accessible charging outlets by type and country, 2017[50]

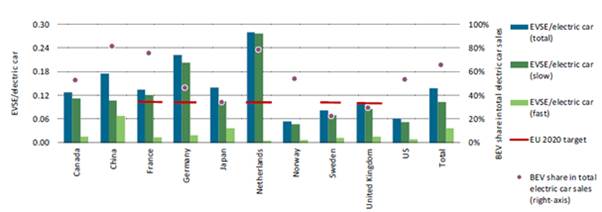

2.38

The Australian ratio of about one charger to every six EVs compares

favourably with other countries, but also reflects the relatively low numbers

of EVs in Australia. A comparison of the ratio of EV chargers to EVs in other

countries with a higher proportion of EVs can be found below in Figure 2.2.

Figure 2.2: Ratio of publicly

available charging outlets per electric car for selected countries[51]

2.39

Charging infrastructure and its interaction with the electricity grid will

be discussed later in the report.

Diverse range of EVs—light passenger, commercial and public transport

2.40

The Committee notes that there is a wide diversity of EV transport types,

from light passenger vehicles, to commercial vehicles, buses, boats, planes, bikes,

and trackless trams. While the Committee received evidence in relation to a

range of EVs, the discussion focussed primarily on light passenger vehicles,

followed by commercial vehicles and buses.

Hydrogen, hybrids or electric only

2.41

Earlier in the chapter, the different types of EVs including BEVs,

PHEVs, and FCEVs (or hydrogen powered vehicles) were described. There were a

range of views put forward as to what the transport fleet of the future would

and should look like, and how this will influence the choices of consumers.

Hydrogen fuel cell vehicles

2.42

Ms Claire Johnson, Chief Executive Officer of Hydrogen Mobility Australia

(HMA) made the following observation about hydrogen as a fuel source:

The use of hydrogen in the mobility sector is being

recognised globally as a solution to reducing greenhouse gas emissions and the

world's reliance upon fossil fuels...

With Australia's competitive advantages in renewable

energies, combined with our automotive expertise from the ongoing R&D post

local manufacturing in the country, we are really well placed to optimise the

electric revolution taking place in the transport sector from both the hydrogen

electric and battery electric perspective. However, in relation to hydrogen

transport, the opportunity is even more significant. Australia is increasingly

being recognised as a potential large-scale exporter of hydrogen to the world,

and the CSIRO technology launched just this week in Brisbane represents a

stepping stone towards fulfilling this exciting objective.[52]

2.43

Ms Johnson explained how hydrogen can be produced on-site at a service

station with an energy source and water. Hydrogen can also be transported and

stored using existing infrastructure:

You can make your own hydrogen on site with an

electrolyser—so generating hydrogen from water—or, alternatively, that hydrogen

can be delivered via a pipeline or via a tube trailer. They are really the

three methods by which the hydrogen is getting to the stations.[53]

2.44

Associate Professor Nerimi Ertugrul, from the School of Electrical and

Electronic Engineering at the University of Adelaide, observed that 'based on

the technical aspects, hydrogen has a future in big trucks, in long distance

travel'.[54]

2.45

Dr Jake Whitehead of the University of Queensland affirmed that hydrogen

FCEVs could play a role in this space, whilst also acknowledging that there are

other non-electric solutions available:

The big challenge, I'll openly admit, is longer-haul travel.

When we're talking about semitrailers that do 2,500 kilometres at the moment,

current battery technology is just not feasible for reaching that distance in

terms of the energy density. So, that's where we've got to try to understand

what other technology's out there. Hydrogen's one option that may make sense,

recognising that it's going to have a pretty high cost for fuel but also for

infrastructure.[55]

2.46

In an answer to a question taken on notice, HMA noted that 'the tank to

wheel efficiency of a hydrogen fuel cell vehicle is less efficient' than a

lithium battery powered EV.[56]

However, Ms Johnson noted that refuelling a FCEV is comparable with a diesel or

petrol vehicle.[57]

Dr Whitehead quantified the difference in efficiency between FCEVs and other

types of EVs such as BEVS and PHEVs:

Every time you change the molecules, you require energy, so

in that process of extracting water, applying electricity to split it and

compress it, transport it and run it through a hydrogen fuel cell vehicle,

there are many more steps, and so, across those steps, there's a far greater

loss. We talk about well-to-wheel efficiencies, and, with hydrogen fuel cell

vehicles, they're a little bit better than petrol and diesel vehicles, but only

by a magnitude of a couple of per cent, whereas electric vehicles are much

higher. That's because you can use that electricity to directly charge a

battery.

2.47

Dr Whitehead also commented on the likely cost differential between the

two technologies:

Based on the current projections of improvements in both

technologies, we expect that EVs are going to stay around $3 per 100

kilometres, whereas hydrogen fuel cell vehicles will be $14 to $16 per 100

kilometres, so that is a significant price differential for consumers as well.[58]

2.48

Dr Whitehead extrapolated on the impact a fully hydrogen powered fleet

versus a fully electric fleet would have on electricity demand:

Let's just play out a hypothetical here where we're talking

about 100 per cent of the passenger vehicle fleet in Australia being based on

hydrogen. That's 14 million cars. That would result in about a 60 to 70 per

cent increase in the national consumption of electricity. That's a major, major

energy increase required for the country to be able to go through. If we

compare that to EVs, we're talking about something around 15 per cent.[59]

2.49

In response to a question on the risks and dangers of using and storing

hydrogen, Ms Johnson said:

Hydrogen fuel cell cars are on sale around the world, and the

regulations, codes and standards have been developed for the handling of

hydrogen gas from a transport perspective. The tanks themselves have been

tested. They are tested in a fire bath, they are dropped from significant

heights and they even do a gunshot test. They're actually made of carbon fibre

that is inches thick.

There have been no issues to date with the number of fuel

cell cars on the roads. As I mentioned, there are regulations in place

overseas, and we see the handling of hydrogen gas as no less safe than petrol

or diesel. Because hydrogen is actually lighter than air, if there is to be a

hydrogen leak, what will occur is that the hydrogen will actually dissipate

into the air itself, unlike LPG, for instance, which is heavier than air, so

that can pool in particular areas. Hydrogen does have some risks, of course,

but they're all manageable, and they've been addressed overseas.[60]

2.50

Energeia acknowledged that FCEVs are seen as a potential challenger to

plug-in electric vehicles, however noted the following downsides with FCEVs:

FCEVs might require an entirely new hydrogen infrastructure

to be developed, compared to PEV's which can rely on the existing electricity

network for energy delivery.[61]

2.51

Energeia continued:

It is worth noting that FCEV development has progressed at a

slower pace than PEVs, and model availability is limited.

The key question for FCEVs then is when FCEV costs, model

availability and refuelling time will come down to benchmark levels, keeping in

mind the rate of PEV improvement in driving range and refuelling time. In Energeia's

view, recent PEV announcements by FCEV stalwarts including Toyota and Honda

signals that even they are finally accepting that PEVs may become the dominant

technology longer-term.[62]

2.52

Table 2.5 sets out plug-in electric vehicle and FCEV performance

relative to ICE.

Table 2.5: Plug-in

Electric Vehicle and FCEV performance relative to ICE[63]

2.53

HMA argued in its submission that 'any discussion pitching one clean

technology against another limits the world's ability to achieve meaningful

emission reductions'.[64]

2.54

Woodside Energy provided the following summary of the global uptake of

hydrogen FCEVs (HFCEVs):

Hydrogen is being used successfully as a fuel in California

where half of the world's private HFCEVs have been adopted. California has 30 refuelling

stations that service 3,430 cars, and plans to build 200 stations by 2025.

In Japan, there are currently 100 hydrogen refuelling

stations. By May 2021, Japan aims to have 160 hydrogen refuelling stations and

40,000 HFCEVs on the country's roads. By 2030, it aims to have 900 stations to

service some 800,000 HFCEVs including buses and forklifts.

...Korea currently has 12 hydrogen refuelling stations with 310

planned for operation by 2022. The Korean government has ordered 5000 Hyundai

Nexo HFCEVs.

Hydrogen vehicle uptake has increased in European countries

such as Germany, Italy, France, and the UK. Hydrogen buses are a core part of

their clean air strategy.[65]

Plug-in hybrid electric vehicles

2.55

Range anxiety was highlighted as a barrier to EV uptake, particularly in

a large country such as Australia. A number of witnesses flagged the role that PHEVs

could play in providing greater certainty for long distance or more remote

trips through maintaining a traditional ICE as a back-up propulsion system.[66]

Mr David Magill, Director of Government Relations and Policy at General Motors

(GM) Holden told the Committee about a recent plug-in hybrid model and the

benefits it provided in relation to alleviating range anxiety:

In 2012 we had the Holden Volt, which was an electric vehicle

with a [petrol] range extender. You could drive that vehicle permanently on

battery, if you charged it up within the range of about 110 kilometres of

driving on the battery. If you wanted to go further, the vehicle annulled range

anxiety because it had a little generator that you could put some petrol in and

extend the range to 650-odd kilometres.[67]

2.56

Mr Bernard Nadal, Senior Manager, Product Planning and Pricing at Toyota

Australia expressed a similar view, supporting plug-in hybrids as an interim

measure bridging the gap between conventional ICEs and fully electric vehicles:

...ultimately, the push to an electrified environment won't

happen overnight, and the purpose of plug-in [hybrids] is to allow people to

experience the technology, become familiar with it and render the benefits of

not just a hybrid system but also the extension of an increased battery range

within the vehicle.[68]

Autonomous vehicles

2.57

The Committee has also heard that the development of autonomous vehicle

technology will occur in parallel with the increased uptake of EVs. The recent

Victorian Parliamentary report on EVs stated that the four pillars underpinning

the future of transport are electric, connected, automated and shared.[69]

Mr Daniel Hilson, Founder and Managing Director at Evenergi put the future of

the transport and energy sectors into context:

In a world where mobility and energy markets are being

completely disrupted, we need to ask ourselves now if we want to be part of a

backwater where old technology and old mobility solutions come to die or we

want to be leading the world in which autonomous, connected, electric shared

vehicles are implemented alongside and integrated with a renewable-powered and

smart grid.[70]

2.58

Mr Tony Wood, Director of the Energy Program at the Grattan Institute

warned that the future of transportation would be characterised by automation

and that must be considered as part of any policy development with respect to

EVs:

the potential for autonomous vehicles is a very different

dimension that adds significantly to the social consequences of transport. The

way in which electric vehicles would then be operated, charged, managed and

owned may very well be different. Again, we need to be careful that we don't

commit our policy to a specific assumption about what the future might hold.[71]

2.59

Mr Wood elaborated:

The consequences of autonomous vehicles which may be owned

not by individuals but rather by companies, from whom we would use the vehicle,

is a completely different paradigm. We'd have fewer vehicles on the road, but

they'd be doing many more kilometres, and their usage and the way they would be

charged and recharged would be completely different to if we had personal

vehicles.[72]

2.60

In Adelaide, the Committee heard from a panel of private companies that

are currently developing and rolling out autonomous vehicle technology both

here in Australia and internationally. Mr Simon Pearce, Head of EasyMile Asia

Pacific told the Committee about the work that his company have been involved

in:

EasyMile, as an organisation, is around 4½ years old. We have

introduced over 260 autonomous electric vehicles around the world. Of those, we

currently have nine in Australia, two from last year and seven this year. We

are continuing to see an expansion in the autonomous electric vehicle market,

which is shared autonomous public transport. To complement that we have

recently partnered with the Transit Australia Group for automation of their

larger electric vehicle, the XDi bus, within Adelaide, for production here.

We'll continue to support not only the EZ10 shuttle but also other electric

vehicles with other original equipment manufacturers, from an automation

perspective, and 95 per cent of our vehicles are electric vehicles which do not

have combustion engines.[73]

2.61

The Committee were told that there are a number of regulatory challenges

with autonomous vehicles, specifically relating to operating driverless

vehicles in public spaces such as roads, and that these vehicles are legally

required to have a driver's seat and dashboard despite their being no

operational requirement for either.[74]

The Committee also heard about a number of other constraints that would impede

the uptake of autonomous vehicles including issues around legal liability and

insurance.[75]

2.62

Mr Christian Reynolds, Director of bus manufacturer, Precision Buses

pointed out that automation offers an opportunity to prevent accidents rather

than simply mitigating the consequences of one:

I think, over the term, product design and architecture has

been led towards management of crash or management of an event. Technology

within autonomous has moved us more towards prevention, which then leaves the

gap in how you engineer a product between and the classifications of product

between. I think that's going to be the interesting place, because autonomous

pods don't have the ANCAP five-star rating that passenger cars would have, but

it prevents more than a historic vehicle would prevent.[76]

2.63

Although automation is starting to become more visible in controlled

environments such as airports, witnesses acknowledged that full automation is

still a number of years away:

A level 5 vehicle, which is fully autonomous—eyes-off,

hands-off—that's at least seven to 10 years away at this stage.[77]

First mile and last mile transport

solutions

2.64

A number of submitters commented on the role that autonomous EVs would

play in delivering first mile and last mile transportation solutions in concert

with a broader public transport network. Sage Automation described the benefits

of this type of transport solution:

Providing enhanced mobility for those with disabilities and

the aged by extending public transport to include the first mile / last mile of

a journey. For example, providing transport from a car park to a hospital

entrance or from a train station to a university.[78]

2.65

In its submission, La Trobe University described how first mile and last

mile transportation augments public transport:

Automated and electric vehicles, particularly when providing

connectivity to public transport for what is referred to as 'first and last

mile connectivity solutions', have the potential to substantially shift

attitudes to mass transit. If an automated vehicle can bridge the gap between

the source (e.g. one's home), the destination (e.g. La Trobe University) and

the closest mass transit transportation hubs already (e.g. train stations or

bus interchanges), then people would be more likely to use the public transport

already on offer.[79]

2.66

The issue of familiarising and educating people on the use of EVs and

AVs is examined further in Chapter 5.

Public and active transport

2.67

Internationally, there is an increased demand for electric buses. The

Bus Industry Federation explained:

Shenzhen, with its fleet of more than 16 300 buses, is

the world's largest and only all-electric bus fleet. Electric bus technologies

featured prominently in Shenzhen Bus Group's Bukit

Merah bus contract bid in Singapore. Volvo has announced that it will only

launch electric and hybrid models starting from 2019. France and the UK have

announced plans to ban sales of diesel and petrol cars by 2040, with local air

quality again a key driver of this change but [greenhouse gas] emission

reduction is also important. The Netherlands and Norway plan earlier phase out

dates.[80]

2.68

In its submission, Doctors for the Environment cited projections from

Bloomberg New Energy Finance which suggested that sales of new electric buses

could be as high as 84 per cent of all new buses by 2030. This trend would be

driven by 'the total cost of electric buses being lower than conventional buses

as early as next year'.[81]

2.69

A number of

witnesses highlighted the need to promote an increased use of public transport

and active transport.[82]

Whilst acknowledging the benefits of increased uptake of EVs, the Public

Transport Users Association (PTUA) has advocated for a focus on a 'greater role

for public EVs and active transport' in order to reduce some of the negative

impacts of vehicle use such as traffic congestion.[83]

Public transport and active transport requires significantly less land for

travel and parking than private vehicles.[84]

The PTUA expressed the opinion that

'the benefits of EVs don't come from EV use per se, but from the non-use of private

ICEVs'.[85]

2.70

Notwithstanding these views on public transport, Mr Shane Rattenbury

MLA, the ACT Minister for Climate Change and Sustainability advised the Committee

of the overwhelming Australian trend to use private vehicles as the primary

means of transport:

Certainly, in this city, we have the lowest public transport

usage of the large cities in Australia, in terms of people getting to work, and

a very dominant use of the private motor vehicle for transport around town.

Ninety-five per cent of those transport emissions come from private motor

vehicle use.[86]

2.71

Ms Sally Noonan, Chief Economist at the Queensland Department of

Transport and Main Roads reported that the Queensland Government was currently

trialling the rollout of eleven electric buses in the Brisbane airport precinct

as part of a collaboration with local government.[87]

The South Australian Government is trialling electric buses[88]

as too is the ACT Government which has recently purchased two fully electric

buses and one hybrid bus.[89]

As a result of a recent hybrid bus trial, which concluded that hybrid buses use

30 per cent less fuel than a standard diesel bus, the Victorian Government has

committed to procuring 50 hybrid electric buses to be delivered by 2022.[90]

2.72

Ms Noonan also described the Queensland government's partnership with

organisations such as James Cook University, Queensland Rail and local

governments to co-locate public charging infrastructure with public transport.[91]

Electric buses

2.73

In its submission, the Sassafras Group was quite supportive of

electrifying buses and heavy vehicles:

The time tables and daily driving distances are well understood,

and the vehicles and charging infrastructure can be readily configured to meet operational

requirements. These vehicles will also provide the greatest public good as

their have high annual driving distances therefore abating more CO2

and harmful exhaust emissions and their low operating cost will either reduce

the cost of public transport subsidisation or lower the cost for commuters.[92]

2.74

Mr Reynolds also noted that buses can, if needed, be charged very

quickly. Notwithstanding some safety and engineering issues to be worked

through, it is technically possible to charge an electric bus in about

10 minutes.[93]

NHP reasoned that the usage pattern of buses is suited to night charging:

Buses form an integral part of the public transport networks

in our cities, with thousands of them on the road every day. Fuel for these buses

is typically diesel. The average bus in Melbourne does around 200km of

stop-start driving in a 24 hour period, with a long period parked at a depot

every night. This usage profile makes buses, especially the ones on shorter

routes, a perfect candidate for transitioning to electric immediately.[94]

2.75

The PTUA also noted

that an increased use of public transport would result in significantly fewer

road fatalities, indicating that use of private EVs would not change the number

of fatalities associated with private internal combustion engine vehicle use.[95]

2.76

The Bus Industry Confederation remarked on some of the challenges for

electric buses including 'road infrastructure impacts of increased bus gross

vehicle mass as a result of batteries'.[96]

Volvo also noted that longevity remains an ongoing issue that manufacturers are

working to resolve:

Our experience shows us that some electric buses last for 3

years—some last for 7 years, but none last for 15 to 20 years yet. Volvo's

philosophy is that the bus we offer must achieve the same levels of

reliability, longevity and service delivery as the diesel bus we replace. In

the electromobility segment, the same principles apply as diesel in relation to

reliability of the driveline, body life, parts support, dealer support and

technical expertise.[97]

2.77

Volvo also highlighted the role that hybrid electric buses could play as

an interim measure on the journey to fully electric buses:

In operation, the Volvo diesel hybrid has proven over many

years to be as reliable, or better than standard diesel buses. The design of

the Volvo hybrid driveline enables the diesel engine to power the bus

independently of the hybrid system if required. In addition, the fact the Volvo

diesel hybrid does not rely on external electricity supply also ensures

transport security in case of power outage, which becomes a critical issue to

consider in the move to full electric buses.[98]

Trackless electric trams

2.78

An emerging type of electrified transport are trackless trams. Professor

Peter Newman AO, Professor of Sustainability at Curtin University described trackless

trams technology in a recent media article:

Trackless trams are neither a tram nor a bus,

though they have rubber wheels and run on streets. The high-speed rail

innovations have transformed a bus into something with all the best features of

light rail and none of its worst features.

It replaces the noise and emissions of buses

with electric traction from batteries recharged at stations in 30 seconds or at

the end of the line in 10 minutes. That could just be an electric bus, but the [autonomous

rail transit] is much more than that. It has all the speed (70kph), capacity

and ride quality of light rail with its autonomous optical guidance system,

train-like bogies with double axles and special hydraulics and tyres.

It can slide into the station with millimetre

accuracy and enable smooth disability access. It passed the ride quality test

when I saw kids running up and down while it was going at 70kph – you never see

this on a bus due to the sway.[99]

2.79

Professor Newman added that:

The autonomous features mean it is programmed,

optically guided with GPS and LIDAR [Light

detection and ranging remote sensing technology], into

moving very precisely along an invisible track. If an accident happens in the

right of way a "driver" can override the steering and go around. It

can also be driven to a normal bus depot for overnight storage and deep battery

recharge.

The standard [autonomous rail transit (ART)]

system is three carriages that can carry 300 people, but it can take five carriages

and 500 people if needed. In three years of trials no impact on road surfaces

has been found.[100]

2.80

Trackless trams can be delivered at a fraction of the cost of

conventional light rail or tram systems—$6–8 million per kilometre as opposed

to $80–120 million for recent projects undertaken in Sydney, Canberra and the

Gold Coast.[101]

Navigation: Previous Page | Contents | Next Page