Audit quality

2.1

This chapter explores the ongoing concerns that the committee has with

the quality of company auditing, particularly for large businesses. Given the

relatively small number of companies that can undertake audits for large

business, reasonable concerns about conflicts of interest are examined.

The function of auditing

2.2

A principal/agent problem exists with the corporate form of business. As Adam

Smith recognised, a corporation using and managing other people's money could

not be trusted to be as prudent with that money as they would be if it were

their own.[1]

2.3

In addition, a profound and unavoidable asymmetry of information exists between

the management of a company and the investors, or potential investors, in it.

Of necessity, management has access to far more detailed information about the

company and its operations than an ordinary investor can hope to have.

2.4

These are problematic issues not just for individual investors but also

for the existence of open, fair and efficient markets and, ultimately, for

capitalism itself. If investors do not have access to accurate,

risk-weighted information about the prospects of a firm, the risks of corporate

collapse may remain undisclosed and investors may be unable to make fully

informed and rational investment decisions.

2.5

In the final analysis, if investors cannot properly assess the value of

firms and investments, there is a risk of systemic failure, as happened in the

Global Financial Crisis (GFC).

2.6

The function of an audit is to provide an independent review of the

financial statements and compliance plans of the company or financial entity

and certify that they are a true and fair view of the business. By rigorously examining

corporate accounts, an audit should expose false accounting and detect business

risks and potentially serious problems, thereby presenting an accurate picture

of business fundamentals and reducing the asymmetry of information between the

management of a company and investors.

2.7

This chapter begins by considering the core objectives for regulators in

a 'light touch' regulatory system, the requirements of auditors, Australia's

auditing arrangements, and concerns about the auditing system. It then

considers various limitations of the auditing system including the inherent

difficulties of the task, the structure of the industry, and associated

conflicts of interest. The chapter concludes by canvassing some of the options

for improving audit quality.

A light touch system of regulation

2.8

The three core objectives for regulators defined by the International

Organization of Securities Commissions (IOSCO) are:

-

the protection of investors;

-

ensuring that markets are fair, efficient and transparent; and

-

the reduction of systemic risk.[2]

2.9

There can be a tension within the regulatory system for corporations between,

on the one hand, promoting efficient, open and flexible markets in order to

attract capital, create wealth, stimulate growth, and promote Australia as a

global financial centre, and, on the other hand, the degree of regulation—which

is intended to constrain behaviour—necessary to protect investors (particularly

retail investors).[3]

2.10

Since the market-oriented reforms of the 1980s, Australia, like other

English speaking countries, has opted for 'light touch' regulation. Consequently,

it has relied on market forces to ensure honest behaviour towards shareholders

and consumers.

2.11

The auditing arrangements described in the following sections form part

of the gatekeeper framework of 'light touch' regulation in the financial

services sector. The key gatekeepers in the financial services system include

financial planners and financial advisers, custodians, research houses, trustees,

responsible entities, directors, and auditors. The various gatekeepers have particular

roles and responsibilities, exercised both separately and, in some instances,

in concert.

2.12

At the outset, it is worth noting that auditors play a critical and

unique role in the gatekeeper system. As has been previously recognised,

gatekeepers such as financial planners and financial advisers, custodians,

research houses, trustees, and responsible entities may all be part of large

corporate conglomerates. By contrast, auditors should be external parties that stand

alone. Their independence is essential to the proper functioning of the system.

And yet, as this chapter reveals, this notion of independence is under

question.

Requirements of auditors

2.13

Under section 307 of the Corporations Act 2001 (Corporations Act),

it is the auditor's responsibility to form an opinion about whether:

-

the financial report being audited or reviewed complies with

accounting standards and gives a true and fair view of the financial position

and performance of the entity;

-

the auditor has been given all information, explanation and

assistance necessary for the conduct of the audit;

-

the entity has kept financial records sufficient to enable a

financial report to be prepared and audited; and

-

the entity has kept other records and registers required by the

Corporations Act.[4]

2.14

The Auditing and Assurance Standards Board (AUASB), whose function is

described below, has developed guidance as to how an auditor should operate. An auditor

requires:

-

independence;

-

professional scepticism;

-

professional judgement; and

-

sufficient appropriate information on which to base an opinion

with an acceptable level of risk.[5]

Australia's auditing arrangements

2.15

Auditing standards in Australia are governed by the Corporations Act

2001. Audits must be conducted in accordance with legally enforceable

auditing standards that were introduced for financial reporting periods from 1

July 2006 following the Corporate Law Economic Reform Program (Audit Reform

and Corporate Disclosure) Act 2004 (CLERP 9).

2.16

Australia's financial reporting system is established by Part 12 of the Australian

Securities and Investments Commission Act 2001 (the ASIC Act). One of the

main objects of section 224 of the ASIC Act is to develop auditing and

assurance standards that:

-

provide Australian auditors with relevant and comprehensive guidance

in forming an opinion about, and reporting on, whether financial reports comply

with the requirements of the Corporations Act; and

-

require the preparation of auditors' reports that are reliable

and readily understandable by the users of the financial reports to which they

relate.[6]

2.17

The AUASB is established by section 227 of the ASIC Act. It is under the

strategic direction of the Financial Reporting Council (FRC), the body

responsible for overseeing the effectiveness of the financial reporting

framework. The AUASB is responsible for developing Australian Auditing

Standards, which in turn are based on the International Standards on Auditing.[7]

Where there are gaps in the international framework, the AUASB develops

principles-based domestic standards and guidance.[8]

2.18

Audit processes are overseen by ASIC. ASIC registers individuals as

company auditors, and conducts inspections of audit firms, including, where

appropriate, inspecting audit files and company financial reports.[9]

The professional accounting bodies, including Chartered Accountants Australia

and New Zealand, CPA Australia and the Institute of Public Accountants, enforce

professional standards.[10]

2.19

The FRC receives information from these bodies on the quality of audits,

what initiatives are being taken to ensure a high standard of auditing, and

what changes to standards are necessary. It provides strategic advice to

government on audit quality.[11]

ASIC's audit inspection program

2.20

ASIC is responsible for the surveillance, investigation and enforcement

of the financial reporting and auditing requirements of the Corporations Act.

As noted in ASIC's report for 2009–10, the aim of ASIC's audit inspection

program is to:

...promote high quality external audits of financial reports of

listed entities and other public interest entities so that users can have

greater confidence in these financial reports and Australia's capital markets.[12]

2.21

ASIC states that its audit firm inspections and auditor surveillances

are 'key compliance tools aimed at educating and influencing the behaviour of

registered company auditors and audit firms'.[13]

Its focus is on 'audit quality and promoting compliance with the requirements

of the Corporations Act, Australian auditing standards, and Australian

accounting professional and ethical standards'.[14]

2.22

ASIC reports on its audit inspection programs for an eighteen month

period. It uses a risk-based method to select firms, engagement files, and

audit areas for review.[15]

Enforcement

2.23

ASIC has enforcement powers, which it appears to have used sparingly, against

auditors where deficiencies are found in their work. In the six years to

February 2018, ASIC took action against 20 registered company auditors and 33

self‑managed superannuation fund auditors. In 2016, ASIC cancelled the

registration of 133 self-managed superannuation fund auditors who had not

lodged annual statements with ASIC after repeated reminders.[16]

Concerns about audit quality

2.24

For some years now the committee has been commenting about the quality

of auditing, generally echoing concerns raised by ASIC.

2.25

In evidence to the committee in 2012, the then ASIC Chairman, Mr Greg

Medcraft, stated that 15 per cent of audit files reviewed in the 2009–10 report

on its audit inspection program had 'inadequate evidence to support an audit

opinion'.[17]

2.26

At that time, Mr Medcraft expressed considerable disappointment and

frustration that the audit quality inspection results were so poor. Mr Medcraft

was firmly of the view that the number of audit files with insufficient

evidence to support an audit opinion should be substantially less than 10 per

cent.[18]

2.27

The issue of audit quality was thrown into sharp relief with the

collapse of Trio Capital in 2010 and the collapse of Victorian debenture issuer,

Banksia Securities Limited (Banksia), in October 2012.[19]

2.28

Mr Medcraft drew the committee's attention to the fact that the auditors

had signed off the accounts of Banksia in September 2012, only a few weeks

before the group collapsed.[20]

2.29

In the committee's inquiry into Trio Capital in 2012, both regulators

and investors expressed frustration at the role of Trio Capital's financial

statement and compliance plan auditors, particularly their inability to verify

information.[21]

2.30

As part of its report into Trio Capital, the committee endorsed 'ASIC's

forward program to improve the rigour of compliance plans, the auditing of

these plans and the composition and governance of compliance committees'.[22]

2.31

However, the audit quality results in ASIC's inspection report for 2011–12

represented a further decline in auditing standards from those that ASIC had previously

reported. In 2011–12, ASIC found that in 18 per cent of the 602 key audit areas

that it reviewed across 117 audit files over firms of all sizes, auditors did

not:

-

obtain sufficient appropriate audit evidence;

-

exercise sufficient scepticism; or

-

otherwise comply with auditing standards in a significant audit

area.[23]

2.32

Commenting on the findings from the 2011–12 report, Mr Medcraft stated

that there was clearly a lack of professional scepticism that pointed to a

cultural problem in the audit profession. Mr Medcraft expressed the view that

unless the audit industry improved its standards, measures such as audit firm

rotation would need to be considered.[24]

2.33

In a later report, the committee remarked that ASIC had put auditing

firms on notice regarding the quality of financial statement audits, and noted

the development by the biggest six audit firms in Australia to action plans to

improve audit quality. This was in response to a request from ASIC that they

address the three broad areas requiring improvement that had been identified in

the inspection report for 2011–12:

-

the sufficiency and appropriateness of audit evidence obtained by

the auditor;

-

the level of professional scepticism exercised by auditors; and

-

the extent of reliance that can be placed on the work of other

auditors and experts.[25]

2.34

With regard to its audit inspection program for 2015–16, ASIC stated:

In our view, in 25% of the total 390 key audit areas that we

reviewed across 93 audit files at firms of different sizes, auditors did not

obtain reasonable assurance that the financial report as a whole was free of

material misstatement. This compares to 19% of 463 key audit areas in the

previous 18-month period ended 30 June 2015.[26]

2.35

ASIC's audit inspection program appears to show an ongoing deterioration

in audit quality. In 2009–10, 17 per cent of audit files did not have adequate

evidence, through to 18 per cent in 2011–12 and 19 per cent in 2014–15, to 25

per cent of cases where auditors 'did not obtain reasonable assurance that the

financial report as a whole was free of material misstatement' in 2015–16. In

2017–18, this figure was 24 per cent.[27]

2.36

However, a decline in audit quality may not be the

only conclusion that could be drawn from these figures. It is important to

recognise that ASIC inspects audit firms and audit files that it believes

to be of higher risk, and the size of its sample varies. The number of key

areas audited also varies, and one might expect that more areas audited would

produce more shortcomings. There is no attempt at randomisation and no

suggestion that statistical comparisons can be made. It is, therefore,

plausible that what may be happening is that ASIC is improving its targeting.[28]

2.37

Further, ASIC has pointed out that the existence of a faulty audit does

not necessarily mean that there is anything wrong in the company's reports, or

with the company's operations.[29]

2.38

Nonetheless, the persistence of the issues raises a question as to why

the quality of audits is still a problem. Mr Medcraft told the committee in

October 2017 that 'audit quality continues to decline, as reflected in our

reports every 18 months. The audit firms themselves are concerned about it'.[30]

2.39

More recently, the committee expressed concern about the quality of

auditing in its report on the 2016–17 annual reports of bodies established

under the ASIC Act.[31]

2.40

In that report, with reference to the annual reports of the FRC and the

AUASB (and the Australian Accounting Standards Board, AASB), the committee

considered that the bodies had fulfilled their annual reporting obligations,

but reserved its judgement about whether they had fulfilled their regulatory

functions, due to concerns about audit quality.[32]

2.41

The committee discussed ASIC's report of its inspections of audit firms

noted above and concluded that it was not satisfied with these outcomes:

The committee recognises the critical importance of audit

quality. The committee has had a long-standing interest in this matter and

is particularly concerned that audit quality continues to deteriorate. This

raises questions about ASIC's response over the past decade and the measures

that ASIC, the FRC and the standards boards have taken thus far.[33]

Limitations of the auditing system

The inherent difficulty of the task

2.42

The information asymmetry referred to earlier between the

management of a company and investors, or potential investors is very difficult

to counter. Even for sophisticated investment companies, 'reading a set of

accounts is like reading a mystery novel'.[34]

Although it is the job of auditors to approach this task with professional

expertise, scepticism and judgement, the difficulties are inherent.

2.43

As a result, many audits tend to focus on whether correct processes have

been followed, and have to rely on assurances that financial reports are

accurate and complete.

2.44

However, if a company chooses to deliberately conceal information and to

mislead an auditor, or indeed has made errors it is unaware of, it may

difficult for an auditor to detect issues.

2.45

Even the claimed existence of an offshore asset may be difficult to

challenge. For example, in the inquiry into Trio Capital, the auditors cited

the limitations on their role and pointed out that the primary responsibility

for detecting fraud rests with the responsible entity. Auditors noted that they

can only obtain reasonable assurance that a financial report is free from

material misstatement, whether caused by fraud or error.[35]

2.46

Further, in some circumstances, it is unlikely that an auditor will have

the expertise to question some information. Valuations of some assets such as

listed securities, which have a known market price, are relatively

straightforward—though even here, the value is accurate only for a point in

time. However, for more complex assets, such as unlisted securities and going

concerns that are taken over, it is much more difficult to confirm a valuation.

The misadventures of Bunnings and National Australia Bank in the United Kingdom

(UK) show that even 'experts' with the best will in the world and the best

information available cannot necessarily assess value accurately. Sometimes

valuations are deliberately obscured. For example, valuations of securitised assets

in the period before the GFC were notoriously opaque.[36]

2.47

CPA Australia has summarised the limitations on audits:

Obtaining absolute assurance is not possible in financial

statement audits for a number of reasons, including:

-

It would be impractical for the

auditor to test and audit every transaction.

-

Financial statements involve

judgements and estimates which often cannot be determined exactly, and may be

contingent on future events.[37]

2.48

Thus, there are difficulties and uncertainties in the process of

auditing which might surprise both investors and members of the public. As the

committee has previously noted, there are a series of expectation gaps between

what investors and the public expect of gatekeepers such as auditors, and what

those gatekeepers are legally obliged to do, and what their roles involve in

practice.[38]

Furthermore, the existence of a system of checks may give investors a false

sense of security.

Structure of the audit industry

2.49

The structure of the audit industry gives rise to two further issues,

namely:

-

the concentration of major company auditing in a few hands; and

-

the diversified nature of the operations of the big four

accounting firms and associated conflicts of interest.

First, the industry is dominated both locally and globally by

four big firms: PricewaterhouseCoopers (PwC), KPMG, Deloitte and Ernst and

Young (EY).

2.50

The big four accounting firms audit 97 per cent of United States public

companies and all of the top 100 corporations in the UK. Richard Brooks argues

that the big four accounting firms 'are the only players large enough to check

the numbers for these multinational organisations, and thus enjoy effective

cartel status'. Furthermore, Mr Brooks argues that because there are no serious

rivals to undercut the big four, and because audits are a legal requirement

almost everywhere, the arrangement effectively becomes 'a state-guaranteed

cartel'.[39]

2.51

The dominance of the big four accounting firms therefore raises

questions about the extent to which effective competition operates within the

audit industry with respect to the auditing of major corporations.

2.52

In addition, it appears that there are substantial barriers to entry into

the top tier auditing market, thereby rendering greater competition unlikely,

if not impossible. While the committee is not aware of a detailed study in

Australia, it notes the findings of the UK parliamentary inquiry into the

collapse of Carillion, a large diversified firm with numerous big and vital

government contracts. Its Carillion report found that the market for audit services

was dominated by the big four audit firms and there were barriers to market entry:

Substantial entry is unlikely to be attractive, due to

significant barriers, including the perception bias against mid-tier firms,

high costs of entry, a long payback period for any potential investment,

and significant business risks when competing against the incumbents in the

market.[40]

2.53

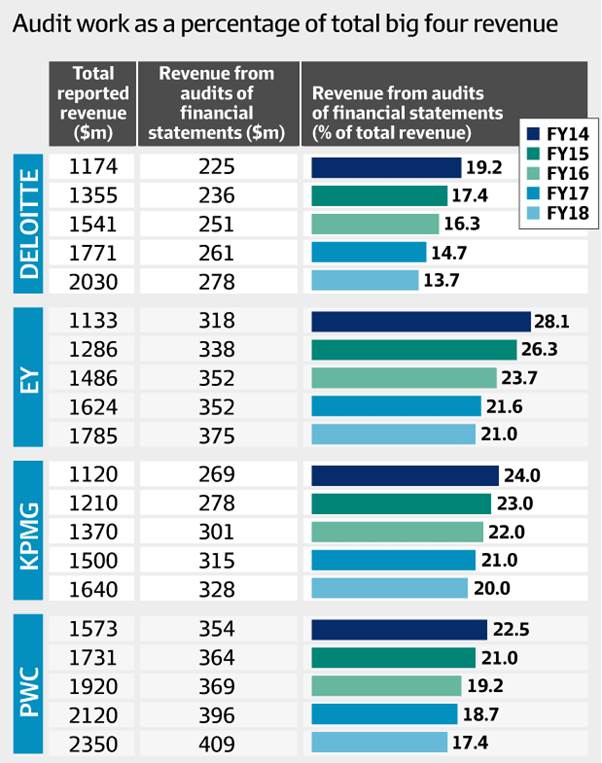

Secondly, these big four companies are integrated professional service

providers. As such, the revenue that the big four accounting firms derived from

auditing is less (and in some cases substantially less) than a quarter of total

revenue, and has declined even further over the last four financial years (see Table

2.1). In 2017–18, the percentage of audit revenue at the big four accounting

firms in Australia was as follows:

-

Deloitte — 13.7 per cent;

-

EY — 21 per cent;

-

KPMG — 20 per cent; and

-

PwC — 17.4 per cent.

Table 2.1: Audit work as a

percentage of total big four revenue

Source: Edmund Tadros and Vesna

Poljak, 'Auditors 'compromised' by providing consulting work: ASIC', Australian

Financial Review, 24 January 2018, https://www.afr.com/business/accounting/auditors-compromised-by-providing-consulting-work-asic-20190124-h1agav

(accessed 12 February 2019).

2.54

The big four accounting firms offer, alongside audit services, research,

human resources, strategic planning, government advice, marketing and a wide

variety of other services.[41]

2.55

While the big four firms are growing rapidly, they are not publicly listed,

so there is less available information about them compared to other firms

of similar size.

2.56

There is at least a theoretical conflict of interest where an auditor is

selected by the directors of a company and is paid by that company, but the investors

which rely on the independence and accuracy of the audit report have no input

into the selection of the auditor. Indeed, there is potential for a serious conflict

of interest where an audit firm sees an unfavourable audit as reducing its

chances of further work with the company being audited. It is important to remember

that, given the current nature of the audit industry, further work is not

restricted to auditing and may include the whole gamut of services provided by

the big four accounting firms to their clients.

2.57

The Carillion Report noted that a big accounting firm could have several

different relationships with a major company at the same time. It also noted

that in the UK 'two-thirds of chief financial officers of large listed and

private companies were Big Four alumni', so their influence was magnified.[42]

2.58

A former forensic investigator with ASIC, Mr Glen Unicomb, was recently

quoted as saying that:

...he believed the 'big four' accounting firms — PwC, Deloitte,

EY and KPMG — risked being exposed to pressure to approve reports to protect

lucrative advisory relationships...Mr Unicomb said today's business model for

accounting firms was potentially conflicted, given the balance between a

traditional pipeline of external audit work with a separate advisory arm which

attracted big fees.[43]

2.59

Mr Brooks argued that the big accounting companies should be examined by

the Royal Commission into Misconduct in the Banking, Superannuation and

Financial Services Industry (Royal Commission):

'They don't just audit, they advise on financial

transactions. They advise on financial products. They package up derivative

products,' he said.

'They are right in there and they are heavily conflicted.

'We are relying on them to tell us everything is sound. You

can't review that industry without looking at the auditors.'[44]

Stability of audit relationships

2.60

It is common for the same audit company to audit a particular firm for

many years running. The UK Carillion inquiry noted that KPMG had been auditing

Carillion for all 19 years of the company's existence.[45]

2.61

This stability can have advantages, because the audit company becomes

familiar with the complexities of the firm's operations and financial

statements. Changing auditors can result in a loss of knowledge and consequent

deterioration in quality of audit.[46]

2.62

On the other hand, stability can lend itself to complacency, personal

relationships which can obscure objectivity, an unwillingness to find an error

that was overlooked the previous year, and even corruption. It is also a

barrier to entry for new firms to the industry.[47]

2.63

It was noted above that Mr Medcraft, then Chairman of ASIC, saw rotation

of auditors as one solution to poor audit quality.[48]

Some countries in the European Union have policies of audit firm rotation.[49]

In Australia, there is a requirement for rotation of the audit partner, but not

the audit firm, roughly every five years.[50]

2.64

The need for auditors to be independent was stressed above. It is a

necessary, though not sufficient, condition for professional scepticism.

Clearly, independence can be jeopardised by recognising that the other business

of the firm can be affected by the outcome of an audit, as discussed above.

Also as suggested above, it can be lessened by familiarity in a longstanding,

stable relationship.

2.65

The process of auditing can also reduce the exercise of scepticism:

Professional scepticism is often an issue around the

complexity of the rules, the accounting standards and the auditing standards

that need to be applied. It's not necessarily because of your familiarity with

the client; it's more that you're so focused on the rules, the different

calculations and the different disclosure modes that sometimes you're not

taking a moment to sit back.[51]

2.66

Finally, it has also been suggested that not enough resources are

devoted to audits. As the Chair of the FRC told the committee, if a company sees

an audit as a commodity and pays the lowest audit fee it can, it will get a

poor standard of audit.[52]

Mr Medcraft put it even more bluntly:

The fundamental driver of [poor audit quality] is, frankly,

they [the audit firms] don't get paid enough to do the job...Whenever they

compete, they cut fees...If you lower the fee, often the audit quality suffers.[53]

Potential solutions

Changing the task

2.67

An auditor's task would be easier if financial reports were made more

transparent. The AASB states that it designs accounting standards (which shape

reporting) with auditability in mind. The standards are principles-based, so

that interpretations sometimes require professional judgement. But the AASB

does not believe that audit quality issues arise from ineffective accounting

standards.[54]

2.68

The FRC believes that Australian accounting standards are 'world's best

practice'.[55]

ASIC is of the view that principles-based standards lend themselves less to

gaming than specific rules.[56]

2.69

Nonetheless, all the bodies involved are constantly working to improve

the standards. In particular, the AASB is about to issue a new revenue standard

and is reviewing impairment testing of goodwill.[57]

2.70

That said, the quality of an audit ultimately depends on the

accessibility and transparency of the company information underlying the

financial statements. If this information is not available, it will be

difficult for any auditor, no matter how diligent or skilled, to be

comprehensive and thorough. Consequently, it would appear that, along with the

continued education of auditors and the updating of audit standards, there

needs to be greater education of company executives and staff to ensure that

the information underlying financial statements is more accessible and

transparent.

Incentives for auditors

2.71

The committee heard that one measure that is known to work is a

remuneration policy where the finding of a deficiency in an audit has an impact

on the income of the partner in the auditing firm.[58]

More generally, the culture of the organisation has a big influence on audit

quality. ASIC believes the big firms are now sending strong messages from

senior management about the importance of audit quality, and are also bringing

in coaching, review processes, and internal accountability measures.[59]

2.72

While there are penalties after the event for poor audits, this appears

to be fairly rare. Were ASIC to enforce appropriate penalties for misconduct,

this would send a strong message to the audit industry and drive standards

higher.

2.73

Where audit firms accept the lowest competitive price and then skimp on

the product, one solution could be to have government set the price and engage

the auditor. This would also reduce the conflict of interest where an auditor

may be concerned about the renewal of their contract with the firm. Apparently,

this solution was canvassed after the Enron debacle.[60]

Structure of the industry

2.74

The dominance of the big four accounting firms in the Australian

auditing market—and indeed markets for other sources—is at least worth

examining. It may be that there is sufficient competition in the provision of

services, and that barriers to entry are not as high as has been suggested. Alternatively,

greater rotation of auditors, and of audit firms, has been discussed above and

would be worth further investigation.

2.75

There is also an argument for structural separation to end the provision

of a variety of services alongside auditing by the same firm. This might be

done by mandating audit-only firms, or making a rule that a firm cannot

purchase other products from the firm that does its audit (although this could also

set up perverse incentives). These questions are being considered in the UK in

the wake of the Carillion collapse.[61]

Committee view

2.76

The committee has been concerned for some years about audit quality in

Australia. While rigorous audits should provide a fair and accurate picture of

business fundamentals, the committee acknowledges the important roles that

other gatekeepers in the financial system, such as directors, must play in

keeping companies honest and transparent.

2.77

The committee also acknowledges that the problem of audit quality is an

international one, and that there is debate about both the severity of the

problem, and the potential solutions.

2.78

Before addressing some of the bigger and more fundamental questions, the committee

considers that the conflicting views on audit quality enunciated by the FRC and

ASIC require further examination. The FRC disputes the view put forward by ASIC

that audit quality in Australia is unacceptably poor. However, one of the

fundamental points of dispute appears to be the risk-based nature of ASIC's

audit inspection program and the inferences and conclusions that may be

reasonably drawn from the results over time. To this end, the committee

considers that it would be useful if ASIC, perhaps in consultation with the

FRC, were to devise and conduct, alongside or within its current Audit

Inspection Program, a study which will generate results which are

comparable over time to reflect changes in audit quality.

Recommendation 1

2.79

The committee recommends that ASIC devise and conduct, alongside or

within its current Audit Inspection Program, a study which will generate

results which are comparable over time to reflect changes in audit quality.

2.80

Acknowledging that issues around the measurement of audit quality may

benefit from being more precisely articulated does not, however, detract from

the seriousness of the various conflicts of interest that are apparent in the

audit industry. For example, the traditional view of the audit firms is that

they operate as independent outsiders scrutinising the accounts of major

corporations. In effect, however, the big four audit firms have become corporate

insiders embedded within the business world. The risk here, of course, is that

the big four audit firms now fail to fearlessly scrutinise the accounts and

risks of the corporations that they audit because it may be detrimental to the

pursuit of their wider business interests.

2.81

Furthermore, it is precisely this diversification into a whole raft of other

professional services, and the attendant conflicts of interest, that calls into

question the view that a lack of competition in the audit industry is the root cause

of poor audit quality. It seems to the committee that this may be too

simplistic an understanding of the problem.

2.82

Indeed, it has been argued that the audit industry is more competitive

than generally portrayed, and that auditing is unprofitable but is used as a

loss-leader to procure more profitable consulting, IT, and other professional

service work. One implication to be drawn from this arrangement is that if

an auditor produces a report that clearly identifies inaccuracies in a

company's financial statements, or identifies previously undisclosed risks

pertaining to the audited entity, there is no guarantee that a senior executive

in the audit firm will support the auditor's findings because it may risk the

audit firm's ongoing business across a whole range of other professional

services.

2.83

And therein lies the dilemma. The incentive to overlook risks in an

audit is inherent when the audit firm is conflicted because it relies so

heavily on the sale of its other professional services to the same corporations

that it audits. In this regard, the committee notes the findings of the UK

parliamentary committee, namely that conflicts of interest cannot be managed

but must in fact be removed. Hence the recommendations of that inquiry that the

audit firms be required to divest themselves of their other businesses and be

required to provide audit services only.

2.84

This is not, however, to suggest there are no problems with the market

dominance of the big four per se. Indeed, following the criminal conviction of

Arthur Anderson and Co for obstructing justice in the wake of the Enron fraud

and the company's consequent loss of its licence, it could be argued that there

are now too few accounting firms for any more to fail. In and of itself, this

is a parlous state of affairs and perhaps explains the lack of scrutiny

directed at the big four accounting firms in the wake of the GFC when major

corporations, such as Lehman Brothers, were bought out and others salvaged with

taxpayer funds despite their books having been audited by the big four accounting

firms.

2.85

In terms of solutions, the committee reserves its judgment on the view

expressed by ASIC that the big accounting firms are now sending strong messages

from senior management about the importance of audit quality, and are also

bringing in coaching, review processes and internal accountability measures.

2.86

However, it appears to the committee that the fundamental question at

this juncture is whether the deep-rooted problems in the audit market can be

resolved by more robust practices aimed at managing conflicts of interest, or

whether action is required to remove those conflicts of interest.

2.87

In this regard, the committee notes that the competition watchdog in the

UK, the Competition and Markets Authority, is currently consulting on some key

proposals including forcing the big four accounting firms to legally separate

their audit staff from the rest of their business, greater regulatory oversight

of the company directors who select auditors, and requiring large listed

companies to each use two audit firms. The committee also notes that the

Competition and Markets Authority is still considering breaking up the big four

accounting firms, or introducing caps on the number of large listed companies

that they can audit.

2.88

Subject to the findings of the Royal Commission, the committee considers

that the structure of the audit industry and associated conflicts of interest

in Australia merit serious review, with particular reference to market

dominance and conflicts of interest arising from the range of other activities also

conducted by the major firms in the industry.

Navigation: Previous Page | Contents | Next Page