Purpose and structure of the Bill

The purpose of the Customs Tariff Amendment (Incorporation of Proposals) Bill 2023 (the Bill) is to amend the Customs Tariff Act 1995 to retrospectively validate tariff changes that have been implemented by the Executive branch of the government.[1] These tariff changes were initiated by Customs Tariff Proposals tabled in Parliament during 2022.

The Bill has one Schedule comprising five Parts:

- Part 1 validates Customs Tariff Proposals in regard to a temporary increase in tariff for goods from Russia and Belarus

- Part 2 validates a temporary decrease in tariff rates for goods from Ukraine

- Part 3 validates a permanent decrease in tariff rates for certain hygiene and medical products

- Part 4 validates a reduction in tariff for electric, hydrogen and plug-in hybrid vehicles

- Part 5 validates minor amendments to correct tariff references.

Background

How are tariff changes enacted in Australia?

All goods (above a set minimum value) imported into Australia, whether by air, sea or post, must be cleared through Australian Border Force. A customs duty (also known as an ‘import tariff’ or ‘customs tariff’) is often levied on imported goods and is payable by importing businesses to the Australian Government as a rate or percentage of the total value of the imported goods.

Tariff rates typically range from 0% to 10%. Different goods are taxed at different tariff rates according to Australia’s tariff classification system, which is codified in the Customs Tariff Act. Goods imported from Australia’s free trade partners are often subject to preferential tariff rates.

To propose a new tariff or change existing tariff rates, the Australian Government must introduce a Bill to amend the Customs Tariff Act. However, because of the time considerations in the drafting and passage of legislation, waiting for a Bill to be passed before applying the tariff change is usually unsuitable ‘as it would permit importers and manufacturers to bring forward future importations or production in order to avoid the proposed increase’.[2]

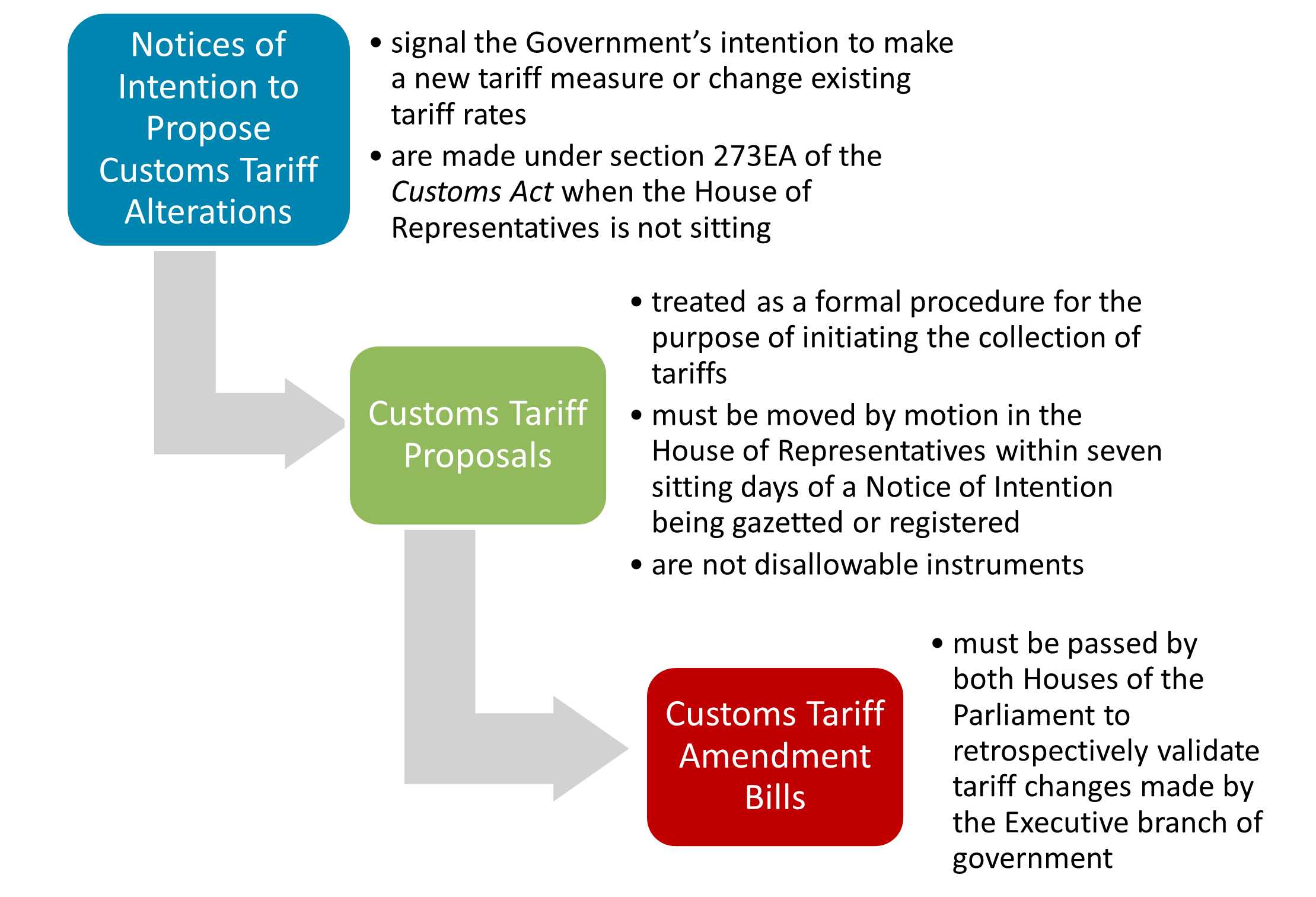

When the Parliament is not sitting, section 273EA of the Customs Act 1901 allows the relevant Minister to announce a new tariff measure, by publishing in the Commonwealth of Australia Gazette, a Notice of Intention to Propose Customs Tariff Alterations.[3] Subsection 273EA(2) provides that the Notice is to be treated as though it was proposed in Parliament, thereby allowing enforcement of the tariff measure to commence immediately.[4]

Then, when the Parliament resumes sitting, the Minister must move a Customs Tariff Proposal as a motion in the House of Representatives, within seven sitting days of the Notice being published in the Gazette (or, in accordance with section 56 of the Legislation Act 2003, registered on the Federal Register of Legislation). Generally, these motions are not further debated and not resolved.[5]

In effect, the Executive branch of government relies on the authority of Customs Tariff Proposals to collect tariffs, in anticipation of subsequent validation by the Parliament authorising the tariff collection. The House of Representatives Practice confirms that:

The moving of a customs tariff (or excise tariff) proposal is normally treated as a formal procedure for the purpose of initiating the collection of the duty. … Collection of duties is thus commenced on the authority of an unresolved motion, and this has been accepted as a convention.[6]

After the Minister moves a Customs Tariff Proposal in the House of Representatives, the practice is for the Executive branch of government to introduce a Customs Tariff Amendment Bill to incorporate the Customs Tariff Proposal into the Customs Tariff Act.[7] The passage of the Customs Tariff Amendment Bill would retrospectively validate the tariff changes initiated by the Customs Tariff Proposal.

The practice of introducing Customs Tariff Amendment Bills to retrospectively validate Customs Tariff Proposals also gives the Parliament an opportunity to scrutinise tariff changes initiated by the Executive. There have been few instances (for example, the 2009 ‘alcopop’ tax controversy) where the Parliament did not support the Executive’s decisions to levy new tariffs or change existing tariff rates.

Figure 1 Overview of the Customs Tariff Proposal process

Source: Parliamentary Library.

Key issues and provisions

The Bill intends to retrospectively validate five tariff changes initiated by the Executive.

1. Imposition of additional tariff for goods from Russia and Belarus

Part 1 of Schedule 1 retrospectively validates tariff changes initiated by Customs Tariff Proposal (No. 3) 2022 and Customs Tariff Proposal (No. 6) 2022.

On 31 March 2022, then Prime Minister Scott Morrison announced that Australia would join like-minded countries in imposing an additional tariff of 35% on all imports from Russia and Belarus.[8] The imposition of this additional tariff is a response to Russia’s invasion of Ukraine.[9]

Ordinarily, goods from Russia and Belarus would be subject to the general tariff rate, most commonly 5% or ‘Free’.[10] Instead, the Bill validates the additional duty imposed by the Customs Tariff Proposal (No. 3) 2022 and Customs Tariff Proposal (No. 6) 2022 to provide that Russian and Belarusian goods are subject to a temporary tariff of 35% in addition to the general tariff rate that would have ordinarily applied to the goods. The additional 35% tariff rate serves as a disincentive for Australian business to import Russian and Belarusian goods.

The temporary additional tariff applies to all Russian and Belarusian goods that left on or after 25 April 2022 for direct shipment to Australia and that are imported into Australia between 25 April 2022 and 24 October 2023.[11] The additional tariff does not apply to certain goods that are otherwise eligible for tariff concessions provided under Schedule 4 to the Customs Tariff Act.

2. Tariff reduction for goods from Ukraine

Part 2 of Schedule 1 retrospectively validates tariff changes initiated by Customs Tariff Proposal (No. 4) 2022.

On 4 July 2022, Prime Minister Anthony Albanese announced that Australia would remove tariffs on imports from Ukraine.[12] In other words, a ‘Free’ rate of customs duty will temporarily apply to most goods imported from Ukraine to Australia.

This tariff measure aims to assist Ukraine’s continued participation in international trade.[13] Additionally, the measure complements the additional 35% tariff rate applied to Russian and Belarusian goods and seeks to assist the economic recovery of Ukraine.[14] The temporary ‘Free’ duty rate is an incentive for Australian businesses to import more Ukrainian goods.

The temporary ‘Free’ duty rate applies to most Ukrainian goods imported between 4 July 2022 and 3 July 2023 that are the produce or manufacture of Ukraine. It does not apply to Ukrainian tobacco, alcohol and petroleum products.[15]

3. Tariff reduction for medical and hygiene products

Part 3 of Schedule 1 retrospectively validates tariff changes initiated by Customs Tariff Proposal (No. 2) 2022.

In May 2020, the Australian Government put in place a temporary tariff concession that reduced the tariff rates for certain medical and hygiene products to ‘Free’.[16] The tariff concession applies to goods including masks, soap, gloves, protective clothing and testing kits. Ordinarily, a tariff rate of 5% would apply to most of these goods.[17] The ‘Free’ tariff rate is intended to ensure continued supply of medical and hygiene products to treat and prevent COVID-19 cases.[18]

The temporary concession on medical and hygiene products has been extended several times via Customs Tariff Proposals, most recently to 30 June 2022.[19] These earlier Customs Tariff Proposals have been validated in the Customs Tariff Amendment (Incorporation of Proposals and Other Measures) Act 2021 and the Customs Tariff Amendment (Incorporation of Proposals) Act 2021.

In the March 2022–23 Budget, the former Government announced that the tariff concession would be made permanent.[20] Furthermore, the scope of the concession would expand to provide a ‘Free’ tariff rate for ingredients and primary containers used in the manufacture of COVID-19 vaccines and treatments.[21] The Customs Tariff Proposal was moved by motion in the House of Representatives on 2 August 2022.[22] It removed the requirement for ingredients and primary containers used in the manufacture of pharmaceutical products to be capable of use in combatting COVID-19 (the COVID-19 connection remains applicable to the goods originally covered by the May 2020 tariff concession) and has no end date.[23]

4. Tariff reduction for electric, hydrogen and plug-in hybrid vehicles

Part 4 of Schedule 1 retrospectively validates tariff changes initiated by Customs Tariff Proposal (No. 5) 2022.

Prior to 1 July 2022, a 5% tariff rate applied to new passenger motor vehicles.[24] Customs Tariff Proposal (No. 5) 2022 provides that from 1 July 2022, the 5% tariff rate has been reduced to a ‘Free’ tariff rate for electric, hydrogen fuel cell and plug-in hybrid vehicles that are below the luxury car tax threshold ($84,916 for fuel efficient vehicles in 2022–23).[25]

The Government said it is supporting the uptake of no-emission and low-emission vehicles.[26] Prior to the 2022 federal election, the Australian Labor Party announced its ‘Electric Car Discount’ policy to exempt (in other words, reduce to a ‘Free’ rate) electric vehicles from import tariff and fringe benefits tax.[27]

The retrospective validation of the tariff reduction for EVs fulfils this election promise. The exemption of eligible EVs from fringe benefits tax has already been legislated in the Treasury Laws Amendment (Electric Car Discount) Act 2022.[28]

5. Minor amendments to correct tariff references

Part 5 of Schedule 1 retrospectively validates tariff amendments initiated by Customs Tariff Proposal (No. 1) 2022.

The Proposal makes minor and technical amendments to correct tariff references originally set out in the Customs Tariff Amendment (2022 Harmonized System Changes) Act 2021 and the Customs Tariff Amendment (Regional Comprehensive Economic Partnership Agreement Implementation) Act 2021.[29]

Committee consideration

Senate Standing Committee for the Scrutiny of Bills

The Senate Standing Committee for the Scrutiny of Bills has not yet considered the Bill.[30]

Policy position of non-government parties/independents

The Coalition

At the time of writing this Digest, the Coalition has not made official comments on the Bill.

Given that the following customs tariff alterations were initiated during the Morrison Government, it is likely the Coalition will continue to support them:

- imposition of additional tariff on Russian goods[31]

- permanent extension of tariff reductions for certain medical and hygiene products.[32]

The Coalition is also likely to support the tariff reduction measure for Ukrainian goods.

It is unclear whether the Coalition will support the Bill’s retrospective validation of tariff reduction for electric, hydrogen and plug-in hybrid vehicles.

As discussed, it is a Labor Party election promise to exempt electric cars from import tariff and fringe benefits tax. Coalition senators voted against passage of the Treasury Laws Amendment (Electric Car Discount) Bill 2022 which implements the fringe benefits tax component of the Labor policy.[33] This may be indicative of the Coalition’s policy position regarding tax exemption (including exemption of import tariff) for EVs.

The Age reported that Coalition finance spokesperson Senator Jane Hume spoke against Labor’s plan to exempt EVs from import tariff and fringe benefits tax. Senator Hume argued:

The Coalition has looked at this very closely and it’s just not good policy… There are better ways to encourage the take-up of EVs, particularly building infrastructure.[34]

Senator Hume added that one of the Coalition’s concerns is that the supply of EVs from overseas is significantly constrained, and that tax breaks in Australia would not overcome the supply problems.[35]

Australian Greens

The Australian Greens are broadly supportive of the tariff measure contained in Customs Tariff Proposal (No. 5) 2022, which reduces the tariff rate for EVs from 5% to ‘Free’. However, the Greens have also expressed concerns about reducing tariffs for plug-in hybrid vehicles.[36]

Plug-in hybrid electric vehicles (PHEVs) refer to vehicles that can be plugged in and charged with electricity to power the battery motor but also contain an internal combustion engine powered by liquid fuels.[37]

When compared with battery electric vehicles that exclusively rely on battery power and use no gasoline, some people believe PHEVs are ‘less environmentally friendly’.[38] A few commentators go as far as claiming that ‘hybrids are even worse than the gasoline-powered vehicles they were meant to replace’.[39]

In September 2022, the Senate Economics Legislation Committee released its report regarding the Bill for the Treasury Laws Amendment (Electric Car Discount) Act 2022, which exempted EVs from fringe benefits tax. The Greens made additional comments regarding the tariff measure contained in Customs Tariff Proposal (No. 5) 2022. The Greens recommended that:

- Customs Tariff Proposal (No. 5) 2022 should be withdrawn and reissued to remove PHEVs so that benefits from tariff reductions are restricted to zero-emissions vehicles

- the savings from removing PHEVs from the Treasury Laws Amendment (Electric Vehicle Discount) Bill 2022 and Customs Tariff Proposal (No. 5) 2022 should be redirected to support further electric vehicle uptake.[40]

At the time of writing this Digest, the Greens’ recommendations have not been adopted by the Parliament.

Other Independents

At the time of writing, the position of other Independents with respect to the Bill could not be determined. However, their position in regard to the Treasury Laws Amendment (Electric Car Discount) Act 2022 may be indicative of their opinion about tariff reduction for EVs.

Position of major interest groups

Electric Vehicle Council

The Electric Vehicle Council, a national body representing the EV industry in Australia, supports the tariff reduction measure for EVs.

In a report released in October 2022, the Electric Vehicle Council said:

… the new Federal Government is in the process of implementing its electric car discount [policy]…

While many EVs in the Australian market are already exempt from import duty (5% of the retail price) under existing free trade agreements, this policy levels the playing field by removing this tariff from EVs primarily imported from the EU and UK.[41] [emphasis added]

Federal Chamber of Automotive Industries

The Federal Chamber of Automotive Industries supports the tariff reduction measure for EVs. The organisation represents companies that distribute new passenger vehicles and light commercial vehicles in Australia.[42]

The Federal Chamber of Automotive Industries said:

The [Albanese] Government’s Electric Vehicle Discount policy comprising the FBT [fringe benefits tax] exemption… combined with the tariff reduction are worthy initiatives and are welcomed by the industry.[43]

Financial implications

The Explanatory Memorandum to the Bill provides an estimate of the financial cost associated with the five tariff measures.[44]

|

2021-22

$million

|

2022-23

$m

|

2023-24

$m

|

2024-25

$m

|

2025-26

$m

|

| Increase to customs duties on goods from Russia and Belarus |

.. |

6.0 |

3.0 |

- |

- |

| ‘Free’ rate of duty for goods from Ukraine |

- |

-2.0 |

- |

- |

- |

| Expanded medical and hygiene goods concession |

- |

-1.7 |

-1.7 |

-1.7 |

-1.7 |

| ‘Free’ rate of duty for certain vehicles |

- |

-20.0 |

-25.0 |

-40.0 |

-55.0 |

| Minor amendments to correct tariff references |

- |

- |

- |

- |

- |

Source: Explanatory Memorandum, 3.

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights (Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the Bill’s compatibility with the human rights and freedoms recognised or declared in the international instruments listed in section 3 of that Act. The Government considers that the Bill is compatible.[45]

Parliamentary Joint Committee on Human Rights

At the time of writing, the Parliamentary Joint Committee on Human Rights has not yet considered the Bill.

Commencement date

As discussed, the Bill retrospectively validates tariff measures that have been implemented by the Executive branch of government. Clause 2 of the Bill provides a table that sets out the date on which provisions of the Bill, if enacted, will commence. Anything in the Bill not elsewhere covered by the table commences on the day the Bill receives the Royal Assent.[46]

| Provisions |

Tariff measure |

Commencement date |

| Part 1 of Schedule 1 |

Imposition of additional tariff on goods from Russia and Belarus |

25 April 2022 |

| Part 2 |

Tariff reduction for goods from Ukraine |

4 July 2022 |

| Part 3 – items 6 to 8 |

Tariff reduction for medical and hygiene products to combat the spread of COVID-19 cases |

1 July 2021 |

| Part 3 – items 9 and 10 |

Expansion of the scope of tariff reduction to include ingredients and primary containers used in the manufacture of COVID-19 vaccines and treatments |

1 July 2022 |

| Part 4 |

Tariff reduction for EVs |

1 July 2022 |

| Part 5 |

Minor amendments to correct tariff references |

1 January 2022. Part 5 of Schedule 1 of the Bill commences immediately after the commencement of Schedule 1 to the Customs Tariff Amendment (Regional Comprehensive Economic Partnership Agreement Implementation) Act 2021, which commenced on 1 January 2022. |

Source: clause 2 of the Bill.

Concluding comments

The Bill retrospectively validates five tariff measures, most of which have received bipartisan support. Notwithstanding bipartisan commitment to net zero by 2050, tax cuts (including tariff reductions) to promote electric vehicle adoption in Australia remains a divisive issue. It is unclear whether the Opposition and Greens will support the retrospective validation of Customs Tariff Proposal (No. 5) 2022 that has reduced the tariff rates for EVs, including plug-in hybrid electric vehicles.