Bills Digest No.

53, 2020–21

PDF version [1133KB]

Kaushik Ramesh and Jaan Murphy

Law and Bills Digest Section

16

March 2021

Contents

The Bills Digest at a glance

Purpose of

the Bill

Structure of

the Bill

Commencement

details

Background

Committee

consideration

Policy

position of non-government parties/independents

Position of

major interest groups

Financial

implications

Statement of

Compatibility with Human Rights

Key issues

and provisions

Schedule 1 -

Casual employment reforms

Schedule 2 –

Modern Award reforms

Schedule 3 -

Enterprise agreements reforms

Schedule 4 -

Greenfields agreement reforms for major projects

Schedule 5:

Compliance and enforcement measures

Schedule 5:

changes to small claim dispute resolution processes

Schedule 5:

criminalising certain forms of wage theft

Schedule 6 –

Fair Work Commission amendments

Appendix A

Date introduced: 9

December 2020

House: House of

Representatives

Portfolio: Industrial

Relations

Commencement: The

majority of the Bill’s substantial amendments commence on the day after Royal

Assent. Further detail is set out on page 7 of this Bills Digest.

Links: The links to the Bill,

its Explanatory Memorandum and second reading speech can be found on the

Bill’s home page, or through the Australian

Parliament website.

When Bills have been passed and have received Royal Assent, they

become Acts, which can be found at the Federal

Register of Legislation website.

All hyperlinks in this Bills Digest are correct as at

March 2021.

The Bills Digest at

a glance

What the Bill

does

The Fair

Work Amendment (Supporting Australia’s Jobs and Economic Recovery) Bill 2020 (the Bill) amends the Fair Work Act 2009 (Fair

Work Act or the Act) with the aim of improving the operation and usability

of Australia’s national industrial relations system. The Bill has been

introduced in the context of, and is intended to respond to, Australia’s

ongoing economic recovery in the wake of the COVID-19 pandemic.

The Bill’s proposed reforms primarily relate to casual

employment, flexibility under modern awards for industries impacted by

COVID-19, the making and approval of enterprise bargaining agreements,

greenfield agreements for major projects and compliance and enforcement

(including responding to wage theft). The Bill’s amendments can be grouped as

follows:

- Schedule

1 makes amendments to insert a definition of casual employment, provide for

a casual conversion process and to address issues around ‘double dipping’ with

respect to casual loading

- Schedule

2 makes amendments providing that employers covered by identified modern

awards can offer additional hours to part-time employees and issue flexible

work directions to employees

- Schedule

3 makes amendments to the current requirements around enterprise agreements

including in relation to the operation of the Better Off Overall Test (BOOT) and

agreement approval processes

- Schedule

4 make amendments to allow eight year greenfields agreement for major

projects

- Schedule

5 makes amendments in relation to compliance and enforcement including by

introducing new penalties and criminalising certain forms of wage theft

- Schedule

6 makes amendments in relation to when the FWC can dismiss applications and

vary or revoke its own decisions.

- Schedule

7 provides for relevant application, saving and transitional provisions

with respect to other parts of the Bill.

Committee

The Bill was referred to the Senate Education and Employment

Legislation Committee for inquiry and report

by 12 March 2020. The Committee recommended the Bill be passed. Dissenting

reports from the Australian Labor Party Senators and Australian Greens Senators

opposed the Bill.

Position of non-Government

parties/independents

The Bill is politically controversial. The Australian

Labor Party and the Greens oppose the Bill. Centre Alliance supports some

aspects of the Bill, but not others. Pauline Hanson’s One Nation does not

support the casual employment reforms that the Bill proposes.

Stakeholder views

The Bill has had a polarised reception from major interest

groups and stakeholders. On the whole, stakeholders on the employer side of the

debate broadly supported those amendments relating to casual employees, additional

hours agreements and flexible work directions, enterprise agreement

requirements (including amendments to the operation of the BOOT), greenfields

agreements and the FWC’s ability to deal with applications.

Employee interest groups broadly opposed the above

amendments, but did indicate broad support for those amendments relating to

wage theft and compliance and enforcement.

Purpose of

the Bill

The Fair

Work Amendment (Supporting Australia’s Jobs and Economic Recovery) Bill 2020 (the Bill) amends the Fair Work Act 2009

(Fair Work Act or the Act) with the aim of improving the operation

and usability of Australia’s national industrial relations system. The Bill has

been introduced in the context of, and is intended to respond to, Australia’s

ongoing economic recovery in the wake of the COVID-19 pandemic.[1]

The Bill’s proposed reforms primarily relate to:

- casual

employment

- flexibility

under modern awards for industries impacted by COVID-19

- the

making and approval of enterprise bargaining agreements

- greenfield

agreements and major projects and

- compliance

and enforcement (including in relation to wage theft).

Structure of

the Bill

The Bill contains seven Schedules. These Schedules

primarily make the following amendments:

- Schedule

1 makes amendments to insert a definition of casual employment, provide for

a casual conversion process and to address issues around ‘double dipping’ with

respect to casual loading

- Schedule

2 makes amendments providing that employers covered by identified modern

awards can offer additional hours to part-time employees to be paid at ordinary

rates of pay, and issue flexible work directions to employees

- Schedule

3 makes amendments to the current requirements around enterprise

agreements, in particular:

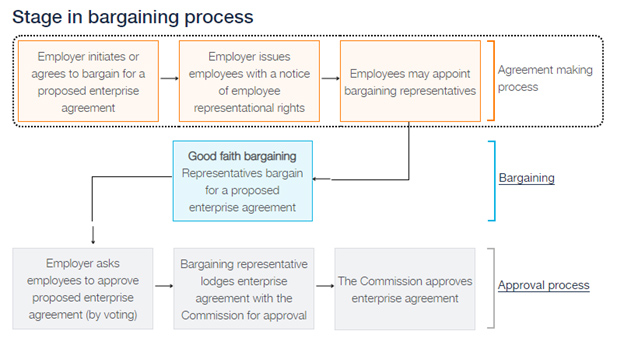

- Parts

2-4 make amendments to pre-approval and voting requirements in the

enterprise agreement bargaining process

- Part

5 makes amendments to the Better Off Overall Test (BOOT)

- Part

6 provides for new National Employment Standards interaction terms to be

inserted into agreements

- Part

7 provides for the variation of single enterprise agreements to cover

eligible franchisee employers and employees

- Part

8 changes requirements as to when an application to terminate an agreement

can be made

- Part

9 limits who has standing to appear before the Fair Work Commission (FWC)

with respect to enterprise agreement matters

- Part

10 sets a time limit for the approval or variation of agreements by the FWC

- Part

11 makes amendments that provide that the FWC must perform its functions

and exercise its powers in a way that recognises the outcome of bargaining at

enterprise level

- Part

12 makes amendments in relation to how a transfer of business affects

employees

- Part

13 provides for the cessation of so-called legacy agreements

- Schedule

4 make amendments to allow eight year greenfields agreement for major

projects

- Schedule

5 makes amendments in relation to compliance and enforcement including by

introducing new penalties and criminalising certain forms of wage theft

- Schedule

6 makes amendments in relation to when the FWC can dismiss applications and

vary or revoke its own decisions and

- Schedule

7 provides for relevant application, saving and transitional provisions

with respect to other parts of the Bill.

Commencement

details

The majority of the amendments in the Bill commence on the

day after Royal Assent. The exemptions to this are as follows:

- the

amendments that will repeal the proposed flexible direction provisions (Part

3 of Schedule 2) commence two years from the day after Royal

Assent

- amendments

to the small claims procedures (Division 1 of Part 2 of Schedule

5) commence six months after Royal Assent

- amendments

that are contingent on the commencement of the Federal Circuit

and Family Court of Australia Act 2021 (Division 2 of Part 2

of Schedule 5) commence at the later of six months after Royal Assent or

the commencement of the Federal Circuit and Family Court of Australia Act

2021

- amendments

relating to prohibiting advertising employment at less than the minimum wage (Part

3 of Schedule 5) commence six months after

Royal Assent

- amendments

relating to the functions of the Fair Work Ombudsman and the Australian

Building and Construction Commissioner (Part 6 of Schedule 5)

commence six months after Royal Assent

- transitional

amendments relating to advertising employment at less than the minimum wage and

ongoing small claims proceedings (items 2 and 3 of Schedule 7)

commence six months after Royal Assent.[2]

Background

Brief history of IR

Prior to 2005, ‘Australian employers and workers were

covered by a patchwork of federal, State or Territory laws or instruments’.[3]

The Workplace

Relations Amendment (Work Choices) Act 2005, also known as the

WorkChoices reforms, represented the first attempt to bring the majority of the

industrial relations landscape under Commonwealth legislation. The then

Coalition Government intended to use the WorkChoices reforms to move towards a

national system where employers would only have to comply with one set of laws,

instead of several.[4]

To do this, the Government primarily relied on the Parliament’s corporations

power under the Constitution. This approach was upheld in the 2006 Work

Choices case.[5]

In 2007, the Labor Party won government partially on the

back of an election campaign of reversing the WorkChoices reforms.[6]

The Workplace

Relations Amendment (Transition to Forward with Fairness) Act 2008 was

a piece of transitional legislation introduced by the Rudd Government as a

precursor to the introduction of the Fair Work Act. While key aspects of

the WorkChoices reforms were removed, the concept of a national industrial

relations system remained.

The Fair Work Act subsequently replaced the

previous industrial relations framework under the Workplace Relations Act

and is the basis of the current industrial relations system, or ‘national

system’, in Australia. One key aspect of the national system framework is the

National Employment Standards (NES) – these are the ten minimum standards and

entitlements that apply to ‘national system employees’.[7]

The NES include minimum entitlements, for example in relation to maximum weekly

work hours, leave and redundancy pay.[8]

While most Australian employees are covered by the

national workplace relations system, there remain certain categories of

employees that are covered by state laws, such as certain public sector and

local government workers.[9]

It should be noted that employees and employers that fall outside the national

workplace relations system will not be affected by the reforms in the Bill.

While there have been several amendments to the Fair

Work Act, there have been only two wholesale and major reviews of the

framework. In its 2012 evaluation of the Fair Work legislation (the Fair

Work Act and the Workplace Relations Amendment (Transition to Forward

with Fairness) Act 2008), Towards more productive and equitable

workplaces, the Review Panel made 53 proposals for reform. The Review Panel

however noted that the laws were working well and the system of enterprise

bargaining that underpins the NES and modern awards was delivering fairness to

employers and employees.[10]

The Productivity Commission

similarly conducted a review into the workplace relations system in 2015.[11]

The Inquiry report produced a long list of recommendations, however again noted

that Australia’s industrial relations system was not ‘systemically

dysfunctional’ and only required ‘repair’ in certain respects, not replacement.[12]

Some of the recommendations in these reviews have been

actioned, whereas others have not.[13]

The Government contends that some of the amendments in the Bill are aimed at

addressing concerns put forward by these two comprehensive reviews.[14]

For the most part however, the amendments in the Bill are not made in response

to the recommendations in these reviews.

Context of Bill

The Bill’s introduction comes in the wake of the broader

response to the COVID-19 pandemic and the Government’s desire to address the

‘economic crisis’ that the pandemic has caused.[15]

The proposed reforms to Australia’s industrial relations system as part of the

Government’s wider response to COVID-19 were flagged relatively early in the

pandemic year. In a speech to the National Press Club on 26 May 2020, the Prime

Minister noted:

Our industrial relations system has settled into a

complacency of unions seeking marginal benefits and employers closing down

risks, often by simply not employing anyone.

The system has lost sight of its purpose - to get the

workplace settings right, so the enterprise, the business can succeed, so everybody

can fairly benefit from their efforts and their contributions.

…

The extent of the damage wrought by Covid-19 on the

Australian economy, and the enormity of the challenge we now face to get

Australians back into jobs, means the policy priorities for recovery will be

different to those in place before this crisis.

We now have a shared opportunity to fix systemic problems

and to realise gains as a matter of urgency to get more people back into work.[16]

(Emphasis added)

During this address, the Prime Minister announced that the

Minister for Industrial Relations would lead and chair five working groups to

formulate a practical reform agenda for the industrial relations system.[17]

The five working groups and their membership were as

follows:

Group 1 – Casuals

Employer organisations: Australian Chamber of Commerce

and Industry (ACCI), Ai Group, Council of Small Business Associations of

Australia (COSBOA), Australian Retailers Association (ARA), Australian Higher

Education Industrial Association.

Unions: Australian Council of Trade Unions (ACTU),

National Tertiary Education Union (NTEU), Australian Nursing and Midwifery

Federation (ANMF), United Workers Union (UWU), Health Services Union (HSU).

Group 2 – Award Simplification

Employer organisations: ACCI, Ai Group, COSBOA,

Australian Hotels Association (AHA), National Retail Association (NRA).

Unions: ACTU (2 reps), UWU, Australian Workers Union

(AWU), Shop Distributive and Allied Employees Association (SDA).

Group 3 – Enterprise Agreement Making

Employer organisations: ACCI, Ai Group, AMMA

Australian Resources and Energy Group, Business Council of Australia (BCA),

Master Builders Australia (MBA).

Unions: ACTU, SDA, Community and Public Sector Union

(CPSU), Transport Workers Union (TWU), Electrical Trades Union (ETU).

Group 4 – Compliance and Enforcement

Employer organisations: ACCI, Ai Group, National

Farmers Federation (NFF), COSBOA, AHA.

Unions: ACTU (2 reps), Finance Sector Union (FSU),

Australian Services Union (ASU), Independent Education Union (IEU).

Group 5 – Greenfields Agreements

Employer organisations: ACCI, AMMA, Minerals Council

of Australia (MCA), Australian Constructors Association (ACA), MBA.

Unions: ACTU, Construction Forestry Mining Maritime

and Energy Union (CFMMEU), AWU, Australian Manufacturing Workers Union (AMWU),

ETU.[18]

The five working groups reflect the subject matter of the

five substantive reform related schedules in the Bill.

Even though the context for the current Bill is the

response to the COVID-19 pandemic, it should be noted that the proposal for

reform to industrial relations under this Government predates the pandemic. In

2019, the Attorney-General and Minister for Industrial Relations launched a

review of the industrial relations system, particularly in relation to casual employment

related reforms.[19]

Similarly, the Government consulted on wage theft reforms in 2019.[20]

Both of these subject matters are addressed by the Bill.

Not wholesale reforms

As noted above, the most recent comprehensive reviews of

the Australian industrial relations framework have pointed out that while there

are opportunities for reform, the system as a whole is broadly operating well.

Perhaps because of this, and because of the politically fraught nature of

pursuing substantive industrial relations reforms, the Government is not

pursuing wholesale reforms in this Bill. The Minister for Industrial Relations argues

that the reforms are:

… founded on a series of practical, incremental solutions to

key issues that are known barriers to creating jobs.[21]

The Minister has also noted that the amendments are aimed at

what the Government considers to be a middle ground:

So the ideological IR brigade will write that it's, you know,

just tinkering around the edges and it's too modest. Some people will describe

it as radical. It's clearly neither of those two things. It's very

consequential change, but it's clearly not revolutionary change to the system.

It's incremental consequential change that can possibly - in fact we think

hopefully - have a passage through Parliament, create jobs by removing barriers

to job growth.[22]

The industrial relations debate

Any more than minor reform to the industrial relations

framework in Australia is politically controversial and often causes a clash of

ideological views. Professor Andrew Stewart notes the following around the

purpose of employment laws which may be useful to consider in the context of

the current Bill:

The view that employment regulation needs to avoid imposing

undue burdens on businesses or hampering attempts to lift productivity and competitiveness

has been widely accepted …

Nonetheless, a clear divide has opened up. On one side are

those who continue to espouse the need for protective regulation of one sort or

another. They reject the idea that labour is a commodity, and consider ‘decent’

working conditions as a fundamental human right. On the other are business and

political groups … who believe that radical reforms are necessary to promote

greater ‘freedom’ and ‘choice’.[23]

This difference in opinion on the purpose of regulating the

industrial relations framework reflects the views of various stakeholders as

discussed in this Digest.

Committee

consideration

Senate Education and Employment

Legislation Committee

The Bill was referred to the Senate Education and

Employment Legislation Committee for inquiry and report by 12 March 2020.

Details of the inquiry are at the inquiry

homepage.

The majority Committee report recommended that the Bill be

passed – arguing that the Bill will address barriers to job creation, wages and

economic growth in the context of the COVID-19 pandemic.[24]

The Committee noted that it was encouraged by the broad support for the Bill

‘from those stakeholders who will be responsible for decisions around whether

to hire workers and pay higher wages in coming months and years, and their

confirmation that the measures in the bill will assist in delivering these

outcomes’.[25]

The Labor Senators produced a dissenting report

recommending that the Bill be rejected in its current form, arguing that the

Bill does not meet a ‘holistic public interest test’.[26]

The Labor Senators argued that the Bill ‘panders’ to big business and will only

benefit a small set of stakeholders in the Australian economy.[27]

The Australian Green Senators also produced a dissenting

report opposing the Bill on the basis that it will entrench insecure work,

reduce wages and increase the power of employers.[28]

The Australian Greens Senators recommended the Senate instead pass the

Australian Greens Bills: the Fair

Work Amendment (Tackling Job Insecurity) Bill 2018 and the Fair

Work Amendment (Making Australia More Equal) Bill 2018.[29]

Senate Standing Committee for the

Scrutiny of Bills

The Senate Standing Committee for the Scrutiny of Bills

(Scrutiny of Bill Committee) noted that the Bill provided for some significant

matters in delegated legislation. The Committee requested the Minister’s

detailed advice on why it was necessary and appropriate for delegated

legislation to be used for:

- the

prescription of the model NES interaction term (Part 6 of Schedule 3 of

the Bill)

- the

prescription of matters relating to the content or form of, and manner of

providing to employees, a Casual Employment Information Statement (item 5 of

Schedule 1 of the Bill) and

- other

purposes for which additional agreed hours are to be treated as ordinary hours

of work (proposed paragraph 168Q(4)(e) as inserted by item 5 of Schedule

2 of the Bill).[30]

The Scrutiny of Bills Committee also drew proposed

subsection 23B(5) of the Act, as inserted by Schedule 4

of the Bill to the attention of Senators and left it to the Senate to consider

the appropriateness of this provision.[31]

This provision allows the Minister to declare major projects in a non-disallowable

instrument (the provision is discussed further in the key issues and provisions

section below, under the Schedule 4 subheading).

The Scrutiny of Bills Committee also requested the

Minister’s justification for amendments removing the requirement for the

consent of parties to conduct an appeal or review by the FWC without a hearing

(amendments made by item 3 of Schedule 6 of the Bill).[32]

The Committee further requested advice from the Minister around the necessity

for retrospective application in relation to the casual employee amendments (proposed

clauses 45 and 46 of Schedule 1 to the Act, as inserted by

item 1 of Schedule 7) – the Committee has asked for advice on the

extent to which the retrospective effect may have an adverse impact on

individuals.[33]

All of these provisions are also discussed in the ‘Key issues and provisions’

section of this Digest.

Policy

position of non-government parties/independents

The Australian Labor Party (ALP) strongly opposes the

Bill. The ALP’s initial criticism of the Bill focused on its amendments

relating to a new exemption to the BOOT, arguing that the amendments to the

test would lead to wages for certain employees being lowered.[34]

As discussed below in this Digest, the Government subsequently decided to

remove these controversial amendments. The ALP however has made clear that even

with the removal of the amendments to the BOOT, it will not support the Bill.[35]

The ALP’s concerns include the following:

- the

Bill’s amendments in relation to casual employees will actually entrench

casualisation

- the

additional hours agreement provisions are not voluntary in a ‘real world’ sense

as the hours would just go to someone who does agree to them

- flexibility

direction provisions in relation to certain awards represent a removal of

protections for workers

- the

enterprise agreement amendments represent a ‘permanent cut to rights’

- the

amendments relating to greenfields agreements that would lock in an agreement

for eight years would have negative impact on wages, conditions and workforce

rights

- the

wage theft provisions weaken existing laws in Victoria and Queensland

- on

the whole the Bill ‘attacks job security and attacks pay’.[36]

The Australian Greens (the Greens) strongly oppose the

Bill. The Greens leader, Adam Bandt, argues in his second reading speech that

the measures in the Bill would increase insecure work:

… because … this bill does three key things. The first is

that it lets employers call you casual even if you're not, and there's nothing

you can do about it. The second is that it spells the beginning of the end of

full-time work contracts, because it introduces into the system a new form of

contract where the employer can employ you part time and then put your hours up

or down as the employer wants. And the third thing it does that the government

doesn't tell you about is take an already difficult process of bargaining for

better wages and conditions and tilt it even further in the employer's favour,

making it harder for you to ask in your workplace for what you're entitled to.[37]

Mr Bandt also proposed amendments in the House of Representatives

aimed at tackling job insecurity.[38]

Pauline Hanson’s One Nation (PHON) has argued that the

Bill does not represent ‘genuine reform’ and is aimed at ‘big business’ and the

‘IR Club’ rather than small to medium employers.[39]

PHON’s Industrial Relations spokesperson, Senator Malcom Roberts, noted that

the Bill’s casual employee related provisions in particular have the effect of “trashing

the ‘long term flexible but predictable’ casual employment arrangements that

suited many small business employers and employees”.[40]

Senator Roberts has argued that the Bill will hurt business and affect pay and

working conditions – he has called for substantial amendments to the Bill.[41]

Independent MP Zali Steggall flagged some issues with the

Bill, but noted that these issues were not outweighed by its benefits,

especially by benefiting small businesses through making the industrial

relations system more streamlined and efficient.[42]

Ms Steggall therefore gave her support to the Bill but asked the Government to

look at further changes proposed by the Law Council of Australia and the

Business Council of Australia.[43]

Conversely, independent MP Helen Haines opposed the Bill, noting that she did

not think it was ‘unsalvageable’, but felt there was more work on the Bill to

be done.[44]

Bob Katter of Katter’s Australian Party voted against the Bill in the House of

Representatives.[45]

Rebekha Sharkie, of the Centre Alliance, noted in relation

to the Bill: ‘there appear to be elements that have merit and some that I

believe must be addressed and/or rejected outright’.[46]

Ms Sharkie supported the proposed definition of casual employee and some of the

compliance and enforcement provisions in the Bill. Ms Sharkie however did not

support the additional hours agreement provisions, noting that while these

agreements require consent, that does not recognise ‘the power imbalance

between workers and employers. The government's defence that any additional

hours must be by agreement I just don't believe is correct’.[47] Ms

Sharkie urged the Government to ‘pull apart’ the Bill in the House of

Representatives given its many ‘fair and reasonable’ elements, noting that she

could not support the Bill if this did not occur. She has also urged the Government

‘to go back to the table, sit down with unions and sit down with employer

groups’ in relation to the Bill.[48]

Position of

major interest groups

The Bill has had a polarised reception from major interest

groups and stakeholders. This polarisation largely reflects the traditional

split between peak bodies and groups that represent employer and industry

interests against those groups who represent employee interests. As such, few

parts of the Bill have received wholesale support from across this spectrum.

On the whole, stakeholders on the employer side of the

debate broadly supported those amendments relating to casual employees (Schedule

1 of the Bill), enabling additional hours agreements and flexible work

directions under identified modern awards (Schedule 2), changes relating

to enterprise agreement requirements (including amendments to the operation of

the BOOT – Schedule 3 of the Bill), amendments relating to greenfields

agreements (Schedule 4) and amendments relating to the FWC’s ability to

deal with applications (Schedule 6). Conversely, reflecting the

polarisation in the industrial relations debate, employee interest groups

broadly opposed these amendments.

The amendments in Schedule 5 relating to wage theft

and compliance and enforcement had general support from employee interest

groups, however did not have this support from employer interest groups.

The Senate Education and Employment Legislation Committee

received 132 submissions in response to the inquiry to the Bill, perhaps

indicating the high level of interest in the Bill as one of the more

significant industrial relations reform proposals in recent years.[49]

Comments by certain significant stakeholders on specific

proposed sections of the Bill are noted in the relevant Key Issues and

Provisions sections below. This Digest attempts to provide a balance by

providing views from both employer representative and employee representative

sides of the spectrum on the Bill’s various amendments. For the most part this

Digest has taken the Australian Council of Trade Unions (ACTU) submission as

generally reflective of the employee representative side of the debate – this

is because the ACTU is the peak body for Australian unions; multiple employee

representative groups endorsed the ACTU’s submission in their own submission.[50]

Where possible, this Digest has also discussed other views on the Bill from

think tanks and academics.

Financial

implications

The Government advises that the measures in the Bill are

estimated to have a minor financial impact and will be reported once costings

have been finalised.[51]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the

Bill’s compatibility with the human rights and freedoms recognised or declared

in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[52]

Parliamentary Joint Committee on

Human Rights

The Parliamentary Joint Committee on Human Rights (PJCHR)

reported on the Bill in its second report of 2021.[53]

The PJCHR sought the Minister’s advice on some specific amendments in the Bill.

In particular, the PJCHR:

- sought

further advice from the Minister on a range of matters in order to assess

whether the proposed additional hours agreements are compatible with the rights

to work, just and favourable conditions of work and equality and

non-discrimination (including whether the measure will have a disproportionate

impact on women)[54]

- sought

further advice from the Minister on a range of matters in order to determine

whether the flexible work directions proposal is proportionate in relation to

human rights[55]

- sought

further advice from the Minister on a range of matter to assess whether the

greenfield agreements amendments are compatible with human rights[56]

- sought

further advice from the Minister on a range of matters to assess whether the

amendments in Schedule 6 would be compatible with the right to a

fair hearing.[57]

As of the time of writing this Digest, the Minister’s

response to these matters had not been published.[58]

Key issues

and provisions

Schedule 1 -

Casual employment reforms

Background on how casual employment

is defined

Modern awards, enterprise agreements and employers usually

define casual employment as employment where the employee is paid and engaged

as a casual employee. The FWC has noted that as a matter of practice:

… most modern awards permit persons to be employed as casuals

on the basis that they are engaged and paid as such – that is, casual

employment for award purposes is usually no more than a method of payment

selected by the employer and accepted by the employee at the point of

engagement … the evidence of the practical position is overwhelmingly that

persons engaged on a casual basis are not afforded the NES entitlements we have

referred to [that is, paid annual leave, paid personal/carer’s leave, paid compassionate

leave, payment for public holidays not worked, notice of termination of

employment or payment in lieu thereof, and redundancy pay], and are paid an

award casual loading in lieu of these entitlements.[59]

(Emphasis added)

The Attorney-General’s Department (AGD) also notes that

historically, general industrial practice has aligned with this description of

casual employees in most modern awards – namely being employees that are

engaged as casuals and paid a casual loading.[60]

The categorisation of an employee is important as it

determines what sort of statutory entitlements are available (and not

available) to them, in particular in relation to the NES.

Currently, there is no legislative definition of a ‘casual

employee’ or a ‘casual worker’. However, there is a long standing definition of

casual employment at common law. A long line of cases, going back to at least

1936,[61]

has considered the question of how casual employment should be defined. Terms

such as ‘casual worker’ are not precise terms, but rather ‘colloquial

expressions’[62]

– in effect this means that the true legal relationship between the parties needs

to be determined on a case by case basis. A number of criteria can be

considered, including whether the employment consists of irregular work

patterns, discontinuity, uncertainty, intermittency of work and

unpredictability.[63]

For example, whether or not employees have consistent start and finish times

may affect whether or not they are considered casual employees.[64]

In short, the common law definition of casual employment is

employment where there is the absence of a firm advance commitment as to the

duration of the employee’s employment or the days (or hours) the employee will

work, as determined by the actual conduct of the parties.[65]

Despite definitions in the modern award, simply being engaged as a casual does

not mean that a person is a casual employee under the common law.

Two recent court cases in particular – Workpac v Skene

(Skene) and Workpac v Rossato (Rossato) have brought the

common law approach to casual employment to the fore. The amendments in Schedule

1 of the Bill can be seen in part as a direct response to these two

decisions.

|

The Workpac v Skene case (Skene)

WorkPac operated a labour hire

business which employed Mr Skene as a dump-truck operator on a fly-in fly-out

basis. Mr Skene was provided with a "Notice of Offer of Casual

Employment" and executed a document titled "Casual or Fixed Term

Employee Terms and Conditions of Employment". He was firstly employed at

Anglo Coal. Subsequently, he was placed at Rio Tinto's Clermont mine, where

his hours were 12.5 hours per shift, seven days on, seven days off. He was

provided with a 12-month roster in advance and worked in accordance with his

roster.[66]

Mr Skene claimed that he was a

permanent full time employee and sought his entitlements under the NES.

WorkPac on the other hand argued that Mr Skene was a casual employee and so

these entitlements were not available to him.[67]

In a Full Federal Court

decision, a decision of the lower court was upheld that Mr Skene was in fact

a permanent employee, despite being engaged as a casual employee. Amongst the

factors considered by the primary judge were the regularity, predictability,

certainty and continuity of the pattern of Mr Skene’s work – this

reasoning was upheld by the Full Federal Court.[68]

|

In Skene, the Federal Court held that definitions

of employment in modern awards cannot override the common law definition of

casual employment. This is because:

It ought to be presumed that where Parliament

is prepared to cede control over a significant definition used in the National

Employment Standards to the FWC or to industrial parties making enterprise

agreements, it would do so expressly. That is particularly so given the

consequences which that course is likely to entail. Delegating to the FWC and

to the makers of enterprise agreements the power to define who is a casual

employee for the purposes of the National Employment Standards would likely

result in a substantial differentiation in the accessibility of those Standards

to some employees as opposed to others, despite the fact that the true nature

of the employments of all is the same. Alternatively, it may result in the

access of the same employees varying over time, as new enterprise agreements

are made, despite the fact that the true nature of those employments has not

altered.[69]

As noted in the case summary above, the Skene case

found that an employee who was characterised as a casual worker was in fact not

a casual worker under the common law and so could access certain entitlements

under the Fair Work Act. Specifically, Mr Skene was found to be entitled

to annual leave as provided for by the NES, despite the fact that he had been

engaged as a casual worker.

In May 2020, the Rossato case upheld the reasoning

in the Skene case, in finding that the Court should look to the

substance over the form of an employment relationship when determining access

to statutory entitlements – the Court held that this is best achieved by

assessing the facts as they stand at the time (as opposed to the written

contract entered into at the outset of the relationship).[70]

The decision is currently being challenged in the High Court.[71]

|

The Workpac

v Rossato case (Rossato)

Mr Rossato, a production

employee in the open cut black coal mining industry, was engaged by Workpac

as a casual employee over a three-and-a-half-year period – he was employed

continuously under six separate contracts of employment over this period.[72]

Following the Skene decision,

Mr Rossato claimed that he was in fact not a casual employee (despite

WorkPac’s treatment of him as such), and made claims for his outstanding

entitlements.[73]

The Full Court of the Federal

Court, relying on the reasoning in Skene, found that Mr Rossato was

not a casual employee (for the purpose of the Fair Work Act and the

relevant enterprise agreement). The Court found that the parties had agreed

on employment of indefinite duration which was stable, regular and

predictable such that the postulated firm advance commitment was evident in

each of his six contracts.[74]

On 26 November 2020, the High

Court granted special leave to appeal the Federal Court decision with the

Minister for Industrial Relations also intervening in the case.[75] At the time of writing this

Digest, the appeal has not yet been heard.

|

Both cases reinforced the idea that casual employment was

based on the lack of a firm advance commitment to continuing and indefinite

work according to an agreed pattern of work, as determined by the actual

conduct of the parties.[76]

These cases triggered significant commentary and concern from some stakeholders

(largely representing the views of employer interests).[77]

Proposed definition – casual

employee

In the context of the above court decisions, the Bill

introduces a definition of casual employee into the Fair Work

Act for the first time. Proposed section 15A of the Act (at item

2 of Schedule 1 to the Bill) stipulates that a person is a casual

employee of an employer where:

- there

is an offer of employment made on the basis that the employer makes no firm

advance commitment to continuing and indefinite work according to an agreed

pattern of work

- the

person accepts the offer on that basis and

- the

person is an employee as a result of that acceptance.

The definition contains one of the key features that the

courts have determined defines casual employment – namely the absence of a firm

advance commitment to continuing and indefinite work. However, the

definition departs from the common law in that it prioritises the form of the

employment relationship over its substance.

In determining whether there is no such firm advance

commitment, only the following criteria can be considered:

- whether

the employer can elect to offer work and whether the person can elect to accept

or reject work

- whether

the person will work only as required

- whether

the employment is described as casual employment and

- whether

the person will be entitled to a casual loading or a specific rate of pay for

casual employees under the terms of the offer or a fair work instrument.[78]

The first two criteria align closely with how no firm

advance commitment may be found at common law.[79]

The last criteria however explicitly goes against the findings in Skene and

Rossato as those two cases found that a person was a casual employee,

even where they may have received a loading rate.

In addition, the third criteria again privileges the

employment contract and the nature of engagement in relation to the

employee over any substantive analysis of the employment relationship. This is

reinforced by proposed subsections 15A(3) and 15A(4) that provide for

the avoidance of doubt:

- a

regular pattern of hours does not of itself indicate a firm advance

commitment to continuing and indefinite work according to an agreed pattern of

work and

- the

question of whether a person is a casual employee of an employer is to be

assessed on the basis of the offer of employment and the acceptance of that offer,

not on the basis of any subsequent conduct of either party.

Proposed subsection 15A(3) in particular overturns

the current approach at common law where an agreed pattern of ordinary hours of

work is central in determining whether casual employment does not exist.[80]

These amendments are aimed at providing certainty to

employers by ensuring that an employee’s status is determined at the point of

engagement rather than an assessment of the employment relationship over time.[81]

The AGD notes the common law approach to defining casual employment means that

an employee’s legal status can shift over time, leading to the requirement to

pay certain NES entitlements at a certain point.[82]

This means that employees and employers have to

continuously evaluate their relationship to understand their relevant

entitlements and obligations.[83]

The AGD argues that the proposed definition of casual employment would lead to

significant regulatory cost savings for employers who would no longer have to

assess the nature of an employment relationship on an ongoing basis.[84]

This proposed statutory definition of casual employment

will extend to offers of employment made before the commencement of the

provision.[85]

However the amended definition will not apply to employees who have been the

subject of a binding court order made before commencement in relation to their

employment status.[86]

This means that the decision with respect to the employee in the Skene case

for example cannot be overturned. While the Rossato decision is being

appealed to the High Court, the High Court would need to consider the legality

of what would otherwise have been a binding decision of the Federal Court – any

addition of a legislated definition of casual employment in the interim would likely

also not affect this case.

Background to casual conversion

Following its decision to reverse the WorkChoices reforms,

the then Labor Government introduced the Workplace Relations Amendment

(Transition to Forward with Fairness) Act 2008 as a transitional piece of

legislation ahead of the introduction of the Fair Work Act. Part 10A of

the Workplace Relations Act, as amended by this transitional

legislation, required the Australian Industrial Relations Commission (AIRC) (a

precursor to the FWC) to ‘modernise’ industrial awards – with the aim of making

them simple to understand and easy to apply.[87]

As part of this award modernisation process, the AIRC

indicated that provisions for casual conversion would be maintained in awards

where they had become an ‘industry standard’ (such as in manufacturing).[88]

In July 2017, the FWC decided to include a model casual

conversion clause in 85 modern awards that did not already provide for

conversion.[89]

These award variations took effect on 1 October 2018.[90]

The model casual conversion clause provides that a casual employee who has

worked a regular pattern of hours in the previous 12 months can request to

have their employment converted to full time or part time.[91]

The request can only be refused by the employer on reasonable grounds,

including the following:

- it

would require a significant adjustment to the casual employee’s hours of work

in order for the employee to be engaged as a full-time or part-time employee

- it

is known or reasonably foreseeable that the regular casual employee’s position

will cease to exist within the next 12 months

- it

is known or reasonably foreseeable that the hours of work which the regular

casual employee is required to perform will be significantly reduced in the

next 12 months

- it

is known or reasonably foreseeable that there will be a significant change in

the days and/or times at which the employee’s hours of work are required to be

performed in the next 12 months which cannot be accommodated within the days

and/or hours during which the employee is available to work.[92]

Casual conversion under the Bill

Item 3 of Schedule 1 inserts proposed

Division 4A into Part 2-2 of the Fair Work Act, which

provides a legislated process for offers and requests for conversion for casual

employees.

Proposed subsection 66B(1) provides that an

employer must make a casual conversion offer where:

- the

employee has been employed for a period of 12 months and

- during

at least the last six months of that period, the employee has worked a regular

pattern of hours on an ongoing basis which, without significant adjustment, the

employee could continue to work as a full-time or part-time employee.

The process differs from the model casual conversion

clause in two key ways. Firstly, the process centres on the employer making the

offer for conversion, as opposed to an employee making a request. Secondly, the

proposed amendment shortens the period of service required to show a regular

pattern of work.

The AGD argues that the amendments strengthen the ability

to access casual conversion and that by eliminating barriers to conversion for

employees, conversion to ongoing employment will likely increase.[93]

The requirement for an employer offer for conversion responds to concerns that

workers may be reluctant to make a request due to perceived negative

consequences.[94]

In addition, while many awards already have casual conversion clauses, the

proposed process will also extend to those employees covered by awards and

enterprise agreements with no such clause as well as to award/agreement free

employees.[95]

A casual conversion offer is not required where there are

reasonable grounds not to make the offer. This includes where it is known or

foreseeable:

- the

employee’s position will cease to exist within 12 months

- the

hours of work which the employee is required to perform will be significantly

reduced in that period

- there

will be a significant change in the days or times of work (or both) which

cannot be accommodated within the days or times the employee is available to

work or

- making

the offer would not comply with a recruitment or selection process required by

or under a law of the Commonwealth or a state or a territory.[96]

These grounds are similar to those found in the model

conversion clause, with the addition of the criteria around public sector

employment laws. The Explanatory Memorandum notes that this provision is for

the avoidance of doubt to ensure that offers for casual conversion are not

required where they would be inconsistent with statutory obligations relating

to public sector recruitment.[97]

The Bill’s amendments also require the Fair Work Ombudsman

to prepare and publish a Casual Employment Information Statement that includes

information on the meaning of casual employee and the operation of the casual

conversion provisions.[98]

An employer must give this statement to employees who are engaged as casual

employees at the start of their employment.[99]

The regulations can prescribe matters that should be in the statement or the

way in which the statement should be given to employees.[100]

Residual right to request casual

conversion

The Bill provides casual employees with the right to make

a request for casual conversion where they have been employed for at least 12

months and have worked a regular pattern of hours during the previous six

months on an ongoing basis which, without significant adjustment, the employee

could continue to work as a full-time or part-time employee.[101]

This request can be made provided that, in the six months prior to the

employee’s request:

- an

employer offer has not already been made and rejected

- the

employer has not notified the employee that a conversion offer would not be

made on reasonable grounds or

- the

employer has not already rejected a conversion request.[102]

The employer must give the employee a written response

within 21 days of receiving the request for casual conversion, stating whether

the request is granted or refused.[103]

It is not clear however if there are any consequences if an employer does not

respond within this timeframe.

The employer must not refuse this request unless the

employee has been consulted with and there are reasonable grounds to reject the

request. These grounds reflect those set out above in relation to where an

offer of casual conversion is not required.[104]

Dispute resolution

Proposed section 66M provides a process for

resolution of disputes between an employer and an employee in relation to the

casual conversion provisions. In the first instance, the parties must attempt

to resolve the dispute at the workplace level through discussion between the

parties.[105]

If these discussions fail, then a party can refer the dispute to the FWC, which

is required to deal with the dispute by any method it considers appropriate, including

by mediation, conciliation, making a recommendation or expressing an opinion.[106]

The dispute can also be dealt with by arbitration with the parties’ consent.[107]

This requirement for consent to arbitration has been a point of criticism from

the ALP, who have stated that this may mean that if conversion is refused an

employee’s only remedy may be to take the matter to the Federal Court.[108]

The proposed dispute resolution provisions however do not

apply where a procedure is provided for under an employee’s contract, written

agreement or the fair work instrument under which they are covered.[109]

The dispute resolution provisions in the Bill appear to be consistent with procedures

set out in modern awards. The Hospitality Industry (General) Award 2020

and the Fast Food Industry Award 2010 for example both provide that

disputes should first be resolved through workplace discussion if possible, and

failing this the dispute can be referred to the FWC to be dealt with (including

by consent arbitration).[110]

Both of these awards would likely cover a large number of casual workers.[111]

Casual loading amounts and ‘double

dipping’

Background to casual loading

In the first part of the 20th century, it became standard

practice for awards to impose a ‘loading’ on the wage rate for casuals in order

to deter employers from engaging too many casual workers.[112]

The casual loading rate has since been standardised at 25% under the modern

award system.[113]

The FWC’s National Minimum Wage Order, made under section 285 of the Fair

Work Act, provides for a casual loading for employees not covered by an

award or an agreement – this rate is similarly set at 25%.[114]

The payment of casual loading rates was an issue in both

the Skene and Rossato cases. In Skene, one of WorkPac’s

arguments against the employee’s (Mr Skene) argument that he was a permanent

full-time employee was in relation to ‘double dipping’. Workpac essentially argued

that as casual employees are paid loading rates under the relevant award to

compensate for the NES entitlements that are not available to them, if the

general law meaning of ‘casual employee’ is used then ‘double dipping’ can occur

where employees engaged as casual are still held to be entitled to NES

entitlements.[115]

WorkPac argued that this was unlikely to have been the intention of the

legislature.[116]

The Court noted in Skene that it was not clear

whether Mr Skene had been paid a casual loading at all.[117]

In any case, the Court noted that the payment of casual loading alone does not

provide a basis for excluding employees from the NES.[118]

The Court noted however that if Mr Skene was paid a loading in lieu of his

annual leave entitlements, it could be said that he was paid twice for the same

entitlement.[119]

In response to the Skene decision, the Government

introduced the Fair

Work Amendment (Casual Loading Offset) Regulations 2018 (Offset Regulations) which formalised the ability

for employers to offset any loadings paid in lieu of NES entitlements to

employees who were engaged as casuals but who were in fact non-casual

employees. It has been noted that the Offset Regulations do ‘little more than

capture the current common law position’ as the decision in Skene ‘contemplated

that an employer may make a claim to offset a casual loading in an appropriate

case’.[120]

In the Rossato case, WorkPac sought to claim back

casual loading amounts paid to its employee Mr Rossato on the basis of the

common law right to ‘set off’ as well as on the basis of the Offsetting

Regulations. In relation to the WorkPac’s reliance on the Offsetting

Regulations, the Court found that the Offsetting Regulations apply where an

employee is making a claim to be paid an amount ‘in lieu of’ an NES

entitlement.[121]

The Court found that Mr Rossato was in fact not making claims for amounts ‘in

lieu of’ NES entitlements, but instead was seeking payment of the entitlements

themselves.[122]

The Court found therefore that the Regulations could not apply to allow

offsetting to occur in this case.[123]

WorkPac’s common law argument to set off the casual

loading amounts also failed, with the Court noting that there was no close

relationship between the payments made to Mr Rossato and his leave

entitlements.[124]

Amendments to casual loading

The Rossato decision led to a negative reaction

from employer groups, and in particular highlighted that loading given to employees

needs to clearly identify the entitlements that are being set off. Similarly,

the case highlighted the limitation of the Offsetting Regulations in providing

the ability for employers to offset loading paid to employees who they had

engaged as casuals.[125]

The Minister for Industrial Relations reportedly noted the following in the

wake of that decision:

Given the potential for this decision to further weaken the

economy at a time when so many Australians have lost their jobs, it may also be

necessary to consider legislative options.[126]

Item 6 inserts proposed section 545A into

the Fair Work Act to address these concerns around ‘double dipping’. Proposed

section 545A applies where:

- an

employee is engaged as a casual employee and is paid an identifiable loading

amount to compensate for not receiving relevant entitlements

during their employment period[127]

and

- is

subsequently found not to be a casual employee during the employment period and

makes a claim for their entitlements.

In these circumstances a court, when making orders in

relation to the claim, must reduce any amount payable by the

employer to the person for the relevant entitlements by the loading amount,

however the amount payable must not be below zero.[128]

Proposed subsection 545A(3) further provides that

the claim amount can also be reduced by an amount equal to a proportion of the

loading amount if the court considers it appropriate, having regard only to:

- the

terms of the fair work instrument/ contract which specifies the entitlements that

are being compensated by the loading amount and the proportion of the loading

that can be attributed to these entitlements. If a proportion is not specified,

the Court can consider what would be an appropriate proportion of the loading

attributable to the relevant entitlements that are outlined or

- if

there are no such terms, all of the relevant entitlements and the

proportion of the loading amount that is considered appropriate to attribute to

these entitlements.

In effect, proposed subsection 545A(3) appears

aimed at employers who provide a ‘single rate’ of loading, such as was the case

in Rossato. As highlighted above, in the Rossato case the Court

could not find a sufficient link to the loadings paid and the entitlements

claimed – the amendments however allow the Courts to consider the appropriate

proportion of the loading that should be attributed to the entitlements

claimed.

The amendments in the Bill are drafted in similar language

to the Offsetting Regulations, and so may have similar limitations in

preventing ‘double dipping’ in light of the Rossato decision.[129]

However, it should be noted that proposed section 545A does not apply

where an employee is seeking payment ‘in lieu’ of their entitlements as

non-casual employees, but instead applies where an employee is simply seeking

payment for their entitlements. The removal of the phrase ‘in lieu’

which seemed central to the decision in Rossato could arguably create a

different outcome.

Transitional arrangements and

application provisions

Schedule 7 of the Bill provides for application and

transitional provisions for the Bill as a whole. Of particular note are the

transitional arrangements provided for the casual employee reforms in Schedule

1. Some of the key aspects of these provisions are as follows:

- Proposed

clause 45 of Schedule 1 to the Act, at item 1 of Schedule 7 to

the Bill provides that employers, employees or employee organisations can apply

for the FWC to make a determination to vary an enterprise agreement made

before commencement of the reforms to resolve any uncertainty regarding the

interaction of the agreement with the proposed definition of casual employee

and proposed casual conversion process

- Proposed

clause 46 of Schedule 1 to the Act, at item 1 of Schedule 7 provides:

- existing

employees that would have met the proposed statutory definition of casual

employment when engaged (or when given an offer of employment) will be

considered casual employees both at the commencement of the Bill and retrospectively

(this does not apply to employees who were the subject of a binding court

decision or converted their status prior to commencement)

- employees

that are retrospectively deemed casual employees, who could have otherwise made

a claim for accrued entitlements, will not be able to do so

- Proposed

clause 47 of Schedule 1 to the Act, at item 1 of Schedule 7 provides

a six month transitional period where employers musts assess existing casual

employees against conversion eligibility criteria (this includes employees

designated as ‘casual’ but who may not meet the proposed statutory definition)

and offer conversion, unless reasonable not to do so

- Proposed

clause 48 of Schedule 1 to the Act, at item 1 of Schedule 7 requires

the FWC, within a six month period after commencement, to review modern awards

in force at commencement that make provision for casual employment, and vary

their terms which are inconsistent with the proposed amendments.

The Government argues that retrospectivity with respect to

some of the transitional amendments is important as the reforms :

… will address the issue of widespread reliance by employers

and employees on a mistaken belief about the nature of the parties’ casual

employment relationships. Without these amendments, significant costly and

time-intensive court processes would be needed to determine the appropriate

rights and obligations of employers and employees in these situations, imposing

significant burdens on both employers and employees.[130]

The Law Council argues however that while the

retrospective application of these amendments will create greater certainty for

employers, it will have the effect of altering the status of current employees

(including those entitled to leave) and will remove the rights of employees who

have matters before the court, but where a binding decision has not yet been

made.[131]

The Law Council also points to the general principle against the enactment of

retrospective laws in opposing these amendments.[132]

Stakeholder views

The National Retail Association was supportive of the

amendments relating to casual employment, noting the Bill provides certainty by

giving paramountcy to the intention of the contracting parties.[133]

The Association is of the view however that the Bill should follow the general

awards process for conversion where a request is made by an employee for casual

conversion (as opposed to an offer made by an employer).[134]

The Restaurant and Catering Industry Association strongly supports the casual

conversion provisions, noting that it has long relied on large numbers of

casual employees across its workforce.[135]

The Minerals Council of Australia is supportive of the Bill’s casual employee

reforms.[136]

Similarly, the Council of Small Business Organisations Australia supports the

amendments and notes the proposed definition provides certainty to employers.[137]

The Chamber of Commerce and Industry WA is broadly supportive

of the casual employee amendments but wants the casual conversion provisions to

be simplified to reduce unnecessary administrative burden on employers.[138]

The Chamber also wants the reasonable grounds for refusal of conversion to be

based on probable rather than definitive outcomes (for example the criteria to

be satisfied should be whether the employee’s position is likely to cease in 12

months, rather than whether it will cease).[139]

The Australian Chamber of Commerce and Industry is

supportive of the amendments but recommended some legislative ‘improvements’.[140]

Australian Industry Group also broadly supports the amendments in Schedule 1

but recommends some amendments to improve the operation of the provisions and

reduce their regulatory burden on business.[141]

Business SA is supportive of the proposed definition of

casual employment and the provisions that address ‘double dipping’, although it

would like the wording of the latter changed to ensure it covers past

employees.[142]

Business SA however does not support the Bill’s casual conversion provisions,

noting the low uptake of conversion for award covered employees – Business SA’s

own survey results indicate that for two-thirds of employers only one third or

less of staff accepted conversion, while for nearly half of employers this rate

was less than 10% of employees.[143]

The Western Australian Government noted that in the

Western Australian Department of Mines, Industry Regulation and Safety’s

experience, many casual employees are made offers of employment orally or in

any case not in clearly defined terms that reflect the proposed definition of

casual employee. The WA Government argues that this means that even with the

insertion of the statutory definition of casual employee, there may be significant

confusion among employers and employees about their employment relationship and

corresponding entitlements.[144]

The Western Australian Government submission further noted

several issues with the proposed definition including that employers who fail

to meet the prescriptive terms of the definition may have offered permanent

employment by default (even if they intended to offer casual employment) and

that the definition fails to meet the need for an employer/employee

relationship to be flexible and evolve.[145]

The ACTU supports a statutory definition of casual

employment but does not support the Bill’s proposal – the ACTU argues that the

way the definition limits the enquiry as to whether a firm advance commitment

exists ‘strips away the rights of workers who are historically and currently

mislabelled as casual employees’ and allows for employers to engage workers as

casual through the careful drafting of employment contracts (where these

employees may have otherwise been considered permanent).[146]

The ACTU is also supportive of casual conversion

provisions in legislation, but is not supportive of the Bill’s specific

proposal in this regard.[147]

The ACTU argues that the qualifying period for conversion (12 months) is too

long and the ability for an employer to refuse a request for conversion is too

broad.[148]

The ACTU also notes that the fact that the FWC can only exercise its arbitral

powers on agreement of the parties is another limitation of the scheme as

employers ‘may simply avoid their compliance obligations by declining to allow

the independent umpire to make a binding determination.’[149]

Schedule 2 –

Modern Award reforms

Background to modern awards

Historically, tribunals at the federal and state level set

minimum conditions for Australian workers in awards – these awards operate with

the force of legislation and govern the terms on which specified workers can be

employed.[150]

As noted above in this Digest, an award modernisation process took place to

coincide with the introduction of the industrial relations scheme provided for

by the Fair Work Act. On commencement of the Fair Work Act, 122

modern awards replaced more than 1,500 awards reviewed by the AIRC.[151]

This award modernisation process is ongoing.[152]

Modern awards generally provide the minimum terms and

conditions around a range of workplace conditions including leave entitlements,

overtime and shift work and the ordinary hours of work for employees in

particular industries or occupations.[153]

Modern awards are governed by Part 2-3 of the Fair Work Act. The modern

awards objective provides that the FWC must ensure that modern awards (together

with the NES) provide a fair and relevant minimum safety net of terms and

conditions taking into account various factors including the relative living

standards and the needs of the low paid and the need to promote social

inclusion thorough increased workforce participation.[154]

Impact of the COVID-19 pandemic on

certain industries

The Bill introduces amendments to award provisions in the

context of the COVID-19 pandemic and is aimed at assisting industries

negatively impacted by the pandemic.[155]

The industries most affected by employment loss in Australia between February

and August 2020 were accommodation and food services (down 18.2%), arts and

recreation services (down 17.9%), other services (down 11.3%), administrative

and support services (down 11.1%) and information, media and telecommunications

and transport and, postal and warehousing (both down 8.2%).[156]

The retail trade sector had an employment loss of 5.1% during this period (a

loss of around 64,000 jobs).[157]

More details around some of the sectors that suffered job

loss between February 2020 and August 2020 is provided in the below table:

Table 1: Change in employment by industry,

February to August 2020

| Industry |

February 2020 (‘000) |

August 2020 (‘000) |

Change in employment –

February-August 2020 (‘000/%) |

| Accommodation and Food services |

929.8 |

760.7 |

-169.1 (-18.2%) |

| Arts and recreation services |

251.9 |

206.7 |

-45.2 (-17.9%) |

| Other services |

493.2 |

437.6 |

-55.6 (-11.3%) |

| Administrative and support services |

450.2 |

400.2 |

-50.0 (-11.1%) |

| Information media and telecommunications |

211.7 |

194.2 |

-17.4 (-8.2%) |

| Transport, postal and warehousing |

667.1 |

612.5 |

-54.6 (-8.2%) |

| Manufacturing |

909.6 |

843.9 |

-65.7 (-7.2%) |

| Retail trade |

1 261.1 |

1 196.7 |

-64.4 (-5.1%) |

Excerpted from: G Gilfillan, COVID-19:

Labour market impacts on key demographic groups, industries and regions,

Research paper series, 2020–21, Parliamentary Library, Canberra, 2020, p. 18.

The COVID-19 pandemic gave rise to certain industries

needing to rapidly change their operating arrangements – due to both changed

business conditions and restrictions on trading itself.[158]

The FWC made a range of temporary award variations in response to applications

seeking greater flexibility in awards as a result of the pandemic.[159]

By way of just one example, the FWC varied the Clerks – Private Sector Award

2010 to, amongst other things, broaden the span of permitted ordinary hours

(given employees working from home) and allow employers to require employees to

take annual leave with one week’s notice in the event of a close down.[160]

In a letter on 9 December 2020, the Minister for

Industrial Relations identified four key awards as being in distressed industry

sectors and requested the FWC consider creating greater flexibility in these

awards.[161]

These awards are the:

- General

Retail Industry Award 2020

- Hospitality

Industry (General) Award 2020

- Restaurant

Industry Award 2020

- Registered

and Licenced Clubs Award 2010.[162]

The FWC is currently in the process of considering the

inclusion of loaded rates and exemption rates clauses in these awards as well

as potentially simplifying the classification structures.[163]

This process is ongoing and is taking place independently of the Government’s

proposed legislative reforms under the Bill. However it highlights the broader

debate around the adequacy of awards in specific sectors in light of the

COVID-19 pandemic.

Proposed amendments – Additional

hours agreement

Item 5 of Schedule 2 inserts proposed

Division 9 at the end of Part 2-3 of the Fair Work Act, providing

for a new category of additional hours agreement to be made between employees

and employers. An additional hours agreement allows employees, on agreement

between both parties, to work hours that are additional to those set out in the

employee’s modern award.[164]

The agreement can only be made where the employee is part-time and works at

least 16 hours a week (whether in actual terms or averaged over a roster

cycle).[165]

The additional hours agreement must identify the

additional agreed hours to be worked on one or more days and must be entered

into before the first period of additional hours.[166]

The period of additional hours must be a continuous period of three hours or be

part of a three hour period (for example an additional hour directly after a two

hour shift).[167]

A break provided for by the relevant modern award does not break up the period

of additional hours, and the employee is entitled to take breaks provided for

in the relevant award.[168]

The agreement can be terminated by the employee or the employer on giving

written notice of at least seven days before termination, or at any time if

both parties agree.[169]

The additional hours agreement provisions (with the

exception of the provisions stipulating what is and is not an identified modern

award) are taken to be terms of an identified modern award (these

are discussed further below).[170]

However agreements will have no effect to the extent that it contradicts terms

of a modern award that:

- limit

the maximum number of consecutive days that the employee has to work

- require

the employee not work on a day

- provide

that certain terms cannot be varied or voided by an agreement/arrangement

between the employer and employee.[171]

Additional hours agreement only

restricted to certain industries

The proposed additional hours agreement amendments only

apply to part-time employees who are engaged under certain identified

modern awards. The proposed flexible work direction powers (discussed

further below) also only apply to identified modern awards. These

awards are the:

- Business

Equipment Award 2020

- Commercial

Sales Award 2020

- Fast

Food Industry Award 2010

- General

Retail Industry Award 2020

- Hospitality

Industry (General) Award 2020

- Meat

Industry Award 2020

- Nursery

Award 2020

- Pharmacy

Industry Award 2020

- Restaurant

Industry Award 2020

- Registered

and Licensed Clubs Award 2010

- Seafood

Processing Award 2020

- Vehicle

Repair, Services and Retail Award 2020.[172]

As discussed above, certain industries have been

disproportionately and negatively impacted by the ongoing pandemic. The

Government’s reforms in Schedule 2 are aimed at two sectors in

particular – the accommodation/food services sector and the retail trade sector.[173]

The awards inserted into the Bill have been chosen on the

basis that these awards have been ‘mapped’ to these industries by the FWC. In