Bills Digest No.

27, 2020–21

PDF version [624KB]

Alex Grove

Social Policy Section

18

November 2020

Contents

Purpose of the Bill

Background

Committee consideration

Policy position of non-government

parties/independents

Position of major interest groups

Financial implications

Statement of Compatibility with Human

Rights

Key issues and provisions

Concluding comments

Date introduced: 21

October 2020

House: House of

Representatives

Portfolio: Health

Commencement: The

later of 1 March 2021 or the day after Royal Assent

Links: The links to the Bill,

its Explanatory Memorandum and second reading speech can be found on the

Bill’s home page, or through the Australian

Parliament website.

When Bills have been passed and have received Royal Assent,

they become Acts, which can be found at the Federal Register of Legislation

website.

All hyperlinks in this Bills Digest are correct as

at November 2020.

Purpose of

the Bill

The purpose of the Aged Care Amendment (Aged Care

Recipient Classification) Bill 2020 (the Bill) is to amend the Aged Care Act 1997

(the Act) to:

- provide

for an alternate system to classify aged care residents into categories. This

will operate alongside the existing classification scheme which will continue

to be used for funding purposes and

- allow

independent assessors to assess residents under this alternate system.

Background

The aged care system supports older people who can no

longer live without assistance in their own homes. Care is provided in people’s

homes, in the community and in aged care homes by a range of not-for-profit,

for-profit and government providers. The Australian Government is the primary

funder and regulator of the aged care system.[1]

Residential aged care is provided in aged care homes on a

permanent or respite (short-term) basis. Services include personal care,

accommodation, laundry and meals, nursing and some allied health services.[2]

Residential aged care is funded by both the Australian

Government and by contributions from residents. The Australian Government pays subsidies

and supplements to approved providers for each resident receiving care under

the Act. In 2018–19, the Australian Government paid $13.0

billion in subsidies and supplements to residential aged care providers. The

majority of this, $12.0 billion or 91.8 per cent, was for the basic subsidy for

permanent residents.[3]

Aged Care Funding Instrument (ACFI)

The basic subsidy for each permanent resident is

calculated using the Aged Care Funding Instrument (ACFI). The ACFI is a tool

used by the provider to assess the care needs of the resident. The ACFI

consists of twelve questions about a resident’s care needs, and two diagnostic

sections (for medical conditions). The answers determine funding across three

domains: Activities of Daily Living (ADL) such as eating, walking

or toileting; Behaviour (BEH) such as wandering, challenging

behaviour, cognitive ability and depression; and Complex Health Care

(CHC) which includes the need for assistance with medication and the need for

ongoing health care procedures. For each domain, a resident’s needs may be

assessed as nil, low, medium or high. The basic subsidy is the sum of the

amount payable in each domain (that is, ADL + BEH + CHC).[4]

For example, as at 20 September 2020, a permanent resident rated ‘high’ on

all three domains would attract a basic daily subsidy of $223.14 ($115.49 +

$37.81 + $69.84).[5]

The ACFI has been a source of controversy, and proposals

for change, for some years. In the Mid-Year Economic and

Fiscal Outlook 2015–16 (MYEFO) and the 2016–17 Budget, the Government made changes to ACFI scoring and

funding due to concerns about higher than expected growth in ACFI

expenditure, particularly in the CHC domain.[6]

The Government argued that the growth in claims could not be explained by an

increase in the frailty of residents, and that some providers were claiming

using ‘sharp practices’ to maximise revenue.[7]

The ACFI savings measures were criticised by aged care providers and unions,

who expressed concerns about ‘the impact of the savings on the quality of care,

staffing levels and service viability’.[8]

The Aged Care Financing Authority (ACFA),

which advises the Government on aged care funding, has outlined a number of

issues with the ACFI. These include fluctuating funding cycles, administrative

burden and perverse incentives:

The Aged Care Funding Instrument (ACFI) has not provided a

stable and effective funding tool for both the Government and providers. Under

ACFI there have been cycles of high growth in payments to providers, followed

by periods of no growth, causing uncertainty for providers, investors and the

Government. ACFI is also administratively complex for both providers and the

Government and has resulted in the sector diverting resources away from

delivering care. In particular, ACFI has perverse incentives that may encourage

outdated modes and types of care and lead to inefficiencies and providers

focusing on maximising ACFI claiming rather than on the needs of residents.[9]

Options for a new

funding model

In the 2016–17

Budget, the Government also announced that it would further consult

with the sector on future options for determining aged care funding, including

the possibility of having funding assessments done by an independent party

rather than providers.[10]

To this end, the Government commissioned two scoping reports in 2017.

Revised ACFI model

The 2017 Review of the Aged Care Funding Instrument

was undertaken by Applied Aged Care Solutions (AACS) to examine options for

redesigning the ACFI to increase sustainability and predictability of funding.[11]

It recommended a Revised Aged Care Funding Instrument (R-ACFI) with changes to

the existing three domains, as well as the addition of a fourth domain to fund

physical therapy.[12]

The Government does not appear to be pursuing the proposed R-ACFI model.

The AACS review also recommended that external assessors

should be trialled for residential aged care funding.[13]

Similarly, the broader Legislated Review of Aged Care 2017 (which did

not specifically review the ACFI) recommended that independent assessors should

be used to reduce the risk of a conflict of interest.[14]

Australian Health Services Research

Institute model

The other commissioned scoping report was the Alternative

Aged Care Assessment, Classification System and Funding Models: Final Report

by the Australian Health Services Research Institute (AHSRI) at the University

of Wollongong. AHSRI examined five options for residential aged care funding,

and recommended a blended funding model taking into account both fixed and

variable costs associated with delivering care:

This option recognises the fixed and variable costs of

delivering care. The two main elements of this model are standard per diem or

fixed payments to cover the cost of ensuring capacity within the facility and

the variable payment to cover the costs of individualised care for residents.

Both the fixed and variable payments under this model would be determined by a

costing study.[15]

Following on from this recommendation, the Government

commissioned AHSRI to undertake a research study to examine costs and cost

drivers in residential aged care, to create a new funding model, and to develop

an assessment tool for use by external assessors.[16]

This national study was called the Resource Utilisation and

Classification Study (RUCS), and was undertaken during 2018.[17] The

primary output of the RUCS study was ‘a new, fit-for-purpose casemix

classification for the Australian residential aged care sector’.[18]

A casemix classification, frequently used in hospital funding, is ‘a consistent

method of classifying types of patients, their treatment and associated costs’.[19]

Australian National Aged Care

Classification (AN-ACC)

The new classification system recommended in the RUCS

study is called the Australian National Aged Care Classification (AN-ACC). The

AN-ACC is based on the separation of resident assessment for funding purposes

and assessment for care planning purposes, with:

- assessment

for funding done by external independent assessors and

- assessment

for care planning done by the aged care facility.

Under the AN-ACC, care funding for each resident is made up

of:

- a

fixed amount per day which will be the same for all residents in a facility

(but may vary between facilities) plus

- a

variable amount for each resident, determined by the cost of their

individualised care and based on their AN-ACC casemix class plus

- a

one off adjustment payment for each new resident when they first enter care.[20]

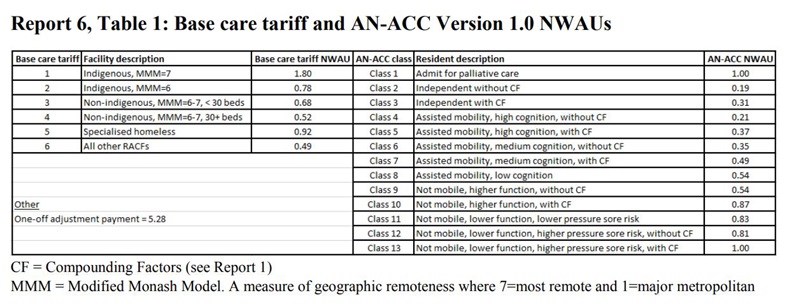

For the variable funding component, a series of assessment

tools are used to sort residents into one of thirteen classes as shown below.

Each class contains residents with similar needs:

Class 1 Admit for palliative care

Class 2 Independent without compounding factors (CF)

Class 3 Independent with CF

Class 4 Assisted mobility, high cognition, without CF

Class 5 Assisted mobility, high cognition, with CF

Class 6 Assisted mobility, medium cognition, without CF

Class 7 Assisted mobility, medium cognition, with CF

Class 8 Assisted mobility, low cognition

Class 9 Not mobile, higher function, without CF

Class 10 Not mobile, higher function, with CF

Class 11 Not mobile, lower function, lower pressure sore risk

Class 12 Not mobile, lower function, higher pressure sore

risk, without CF

Class 13 Not mobile, lower function, higher pressure sore

risk, with CF.[21]

New residents requiring palliative care are automatically

placed in Class 1. Other residents are classified according to their mobility,

and then again according to factors such as cognitive ability, function and

pressure sore risk, and ‘compounding factors’.[22]

Different compounding factors are considered for different classes. CFs include

activities of daily living, palliative function, functional motor and cognitive

independence, daily injections, behaviour, risk of pressure sores, frailty,

falls, complex wound management and obesity.[23]

Funding under the AN-ACC is calculated using a base unit

of price called the National Weighted Activity Unit (NWAU).[24]

Funding is expressed in multiples of the NWAU for different facility types,

resident classes and the one-off adjustment payment for new residents, as shown

in the table below:

Source: DoH, ‘Resource utilisation and classification study – revised

tables’, DoH website.

It can be seen that for the fixed funding component per

resident (which is the same for all residents within a facility), Indigenous

services in very remote areas would receiving the highest amount, and services

not in remote areas nor catering to homeless clients would receive the lowest

amount.

For the variable funding component, residents in Class 2

(independently mobile without compounding factors) would attract the lowest

funding, and residents in Class 1 (admitted for palliative care) and Class 13

(not mobile, lower function, higher pressure sore risk with compounding

factors) would attract the highest funding.

AHSRI notes that the NWAU price is a policy decision for

government. It could be set at a level that would be cost neutral overall

compared to the current system, or it could be set for funding growth.[25]

AHSRI recommends that an annual national costing study should be undertaken to

determine the following year’s NWAU (similar to the work done by the Independent

Hospital Pricing Authority to determine the National Efficient Price for

hospital funding).[26]

Consultation and trial

The Government has consulted extensively on the AN-ACC through

stakeholder forums, an industry reference group, a consultation paper, and now

a stakeholder working group.[27]

The Prime Minister announced $4.6 million in funding for a

trial of the AN-ACC on 10 February 2019.[28]

The purpose of the trial was:

- to

collect data to validate the expected distribution of care recipient

classifications under the AN-ACC and

- to

field test the performance of

- the

AN-ACC assessment tool

- an

independent assessment workforce trained to administer the tool and

- the

training, clinical and IT supports for assessors.[29]

The trial was initially scheduled to run until June 2020,

but concluded early in April 2020 due to the impact of the COVID-19 pandemic on

aged care homes. Sixty registered nurses, occupational therapists and

physiotherapists from four contracted organisations were trained to undertake

AN-ACC assessments in a two-day course. During the trial, these assessors

completed 7,387

AN-ACC resident assessments across 122 nursing homes. [30]

The distribution of residents between the AN-ACC classes

in the trial was similar to that found in the RUCS study. In both, Class 5

(assisted mobility, higher cognitive ability, with compounding factors) was the

most common classification, with more than 20 per cent of residents assigned to

this class.[31]

The trial also found:

- assessors

can complete an average of six assessments per working day

- a

suitably qualified and experienced independent assessment workforce can be

readily contracted to undertake AN-ACC assessments and

- the

training and clinical supports were effective, but could be improved by

increasing the length of training to three days.[32]

Shadow assessments

The 2020–21 Budget included funding of $91.6 million to

support the potential implementation of the AN-ACC funding model. As well as

payment and IT system modifications, this includes funding for one year of

‘shadow assessment’ starting in 2021:

During this year of shadow assessment, all residents will be

assessed by an independent assessor using the AN-ACC assessment tools though

funding will continue to be provided through the existing Aged Care Funding

Instrument during this period.[33]

The Government will continue to consult on the AN-ACC. A

final decision on the AN-ACC and an ongoing assessment workforce has not been

taken.[34]

The Government is progressing work on this new funding model as it prepares to

respond to the recommendations of the Royal Commission into Aged Care Quality

and Safety (the Royal Commission), which is due to hand down its final report

by 26 February 2021.[35]

Counsel Assisting the Royal Commission recently proposed

an extensive set of recommendations for aged care reform. This included a

proposed recommendation to move to a casemix classification system in

residential aged care, such as the AN-ACC, by 1 July 2022:

By 1 July 2022, the Australian Government should fund

approved service providers for delivering residential aged care through a

casemix classification system, such as the Australian National Aged Care

Classification (AN-ACC) model. The classification system should take into

account the above recommendations for high quality aged care. Ongoing

evidence-based reviews should be conducted thereafter to refine the model

iteratively, for the purpose of ensuring that the model accurate classification

and funding to meet assessed needs.[36]

The Bill does not implement the AN-ACC nor make changes to

aged care funding under the ACFI. Rather, the Bill provides for an alternate

system of classification to operate alongside the ACFI (with details of the

alternate system to be specified in subordinate legislation). The Bill also

provides for the delegation of powers to assessors to assess residents under

this alternate system (the so-called shadow assessments described above).

The Government will use the data from these shadow

assessments to ‘ensure that individuals, care workers, providers and the

government all have the information they need to fully understand the new

funding model’.[37]

Committee

consideration

Senate Community Affairs

Legislation Committee

The Bill was referred to the Senate Community Affairs

Legislation Committee for inquiry and report by 2 December 2020. Details of the

inquiry are at the inquiry

homepage.

Senate Standing Committee for the

Scrutiny of Bills

The Senate Standing Committee for the Scrutiny of Bills

(Scrutiny of Bills Committee) expressed concern about the assessment (proposed

section 29C-3) and classification (proposed section 29C-2) of

residents by the Secretary (or delegate). The Committee questioned why the

details of the process to be followed in assessing and classifying residents

were to be left to delegated legislation.[38]

The Committee also expressed concerns about Item 11, which allows the

Secretary to delegate their powers to assess care recipients to a person who

satisfies the criteria specified in the Classification Principles. The

Committee questioned why this delegation is considered necessary, and why the

criteria are to be set out in delegated legislation.[39]

The Scrutiny of Bills Committee requested further advice

as to how the computerised decision-making provided for in proposed section

29C-8 will operate to classify care recipients.[40]

The Committee also expressed concern about the protection of resident’s private

information contained in a care assessment made under proposed section 29C-3.

The Committee accepted that the disclosure of such information for the

purpose of providing care or assessing needs appeared reasonable, but

questioned whether the disclosure of such information for the purposes of

monitoring, reporting on and conducting research into aged care, or assessing

the level of need in the community, was appropriate.[41]

Policy

position of non-government parties/independents

At the time of writing, no comments by non-government

parties or independents specifically on the Bill had been identified.

Position of

major interest groups

At the time of writing, no stakeholder comment

specifically relating to the Bill had been identified.

Many key aged care stakeholders are represented on the

Department of Health’s Residential Aged Care Funding Reform Working Group,

which is considering issues related to the AN-ACC.[42]

Some stakeholders have also commented on the proposed

AN-ACC model through submissions to the Department of Health’s consultation

paper or to the Royal Commission. In 2019, aged care provider peak bodies

Leading Age Services Australia and Aged & Community Services Australia both

supported the trial of the AN-ACC, but called for more information on the pricing

of the NWAU in the model, which would allow providers to estimate how much

funding they would receive under the new model.[43]

The Combined Pensioners and Superannuants Association of

NSW (CPSA) submitted to the Royal Commission in 2020 that it supported ‘the

ongoing development of the AN-ACC as an alternative to the ACFI’.[44]

National Seniors Australia also submitted that it generally supported the

AN-ACC funding model, including the use of independent assessors.[45]

Dementia Australia has expressed support for the AN-ACC

model, while noting that it needs to be funded sufficiently to provide for

best-practice models of care.[46]

Palliative Care Australia (PCA) has expressed concern that the AN-ACC ‘takes a

narrow view of palliative care and does not allow people to be assessed as

eligible for the only palliative care classification after admission’. PCA has

called for a small study to be undertaken to ensure that the model caters for

palliative care needs.[47]

The Australian Nursing and Midwifery Federation supports the implementation of

the AN-ACC, including independent assessments.[48]

Financial

implications

The Bill has no financial impact.[49]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed

the Bill’s compatibility with the human rights and freedoms recognised or

declared in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible. The Government considers that

the Bill promotes the right to an adequate standard of living and the right to

health, because the new classification scheme aims to more accurately classify

care recipients in order to ‘better target the level of care required to meet

their needs’.[50]

Parliamentary Joint Committee on

Human Rights

The Parliamentary Joint Committee on Human Rights had no

comment in relation to the Bill.[51]

Key issues

and provisions

Residential aged care recipients are classified under the

ACFI according to the process set out in Part 2.4 of the Act. An appraisal of

the level of care required is made by the approved provider under section 25-3

of the Act, according to the procedures specified in the Classification Principles 2014

(the Classification Principles). Section 25-1 of the Act provides that if the

Secretary receives an appraisal made under section 25-3, the Secretary (or

delegate) must classify the resident according to the level of care they need. The

Classification Principles may specify the method the Secretary must follow.

The Bill does not amend Part 2.4 of the Act. This means

that the current system of classification using the ACFI will continue. Rather,

the Bill provides for an alternate system of classification which will not be

used for funding purposes, unless further legislation is introduced.

Classification and assessment of

care recipients

Item 3 of the Bill inserts proposed Part 2.4A

into the Act to provide for classification of care recipients on the

Secretary’s initiative. Within new Part 2.4A, proposed section 29C-1

provides that such classification applies to approved recipients of residential

care, and some types of flexible care (with the types of flexible care to be

specified in the Classification Principles).[52]

Proposed section 29C-2 provides that the Secretary

(or delegate) may classify a recipient for respite (temporary) or non-respite

care according to the level of care they need, relative to other care

recipients.[53]

The recipient may only be classified if their care needs have been assessed

under proposed section 29C-3. The Classification Principles may specify

the methods or procedures the Secretary (or delegate) must follow in

determining the appropriate classification level for the recipient.[54]

The Secretary (or delegate) must take into account the assessment under proposed

section 29C-3, as well as any other matters specified in the Classification

Principles.[55]

The Secretary (or delegate) must notify the care recipient and their approved

provider of matters including the classification and the day it takes effect.[56]

Proposed section 29C-3 provides that the Secretary

(or delegate) may assess the level of care needed by a care recipient, in order

to classify them, reclassify them, or to decide whether to reclassify them.[57]

The Classification Principles may specify the procedures to be followed in

making the assessment.[58]

If the care recipient has been approved for respite care under Part 2.3 of the

Act, and the circumstances specified in the Classification Principles apply,

then the Aged Care Assessment Team (ACAT) assessment made under section 22-4 of

the Act is taken to be an assessment of the level of care required, and the

assessment is taken to have been made for the purposes of classifying the care

recipient under proposed Part 2.4A.[59]

Proposed section 29C-4 provides that a care

recipient may have both a non-respite and a respite classification at the same

time.

Proposed section 29C-5 provides that the

Classification Principles may set out the classification levels under proposed

Part 2.4A, may specify the criteria for determining which level applies to

each recipient, and may set out different classification levels for respite and

non-respite care.

Proposed section 29C-6 provides that the

Classification Principles may exclude a class of care recipients from

classification under proposed Part 2.4A. Unfortunately the Explanatory

Memorandum to the Bill does not provide any examples of the circumstances in

which this might occur.

Proposed section 29C-7 provides that if a person

ceases to be a care recipient under proposed Part 2.4A, their

classification is not in effect, but that if they become such a care recipient

again, their classification continues from that time.

Proposed section 29C-8 provides that the Secretary

(or delegate) may use computer programs to make decisions on the classification

of care recipients under proposed Part 2.4A. The decision of the

computer program is taken to be a decision made by the Secretary, and the

Secretary (or delegate) may substitute a decision if satisfied that the

computer program’s decision is incorrect.[60]

Proposed section 29D-1 provides that the Secretary

(or delegate) may reclassify a care recipient if:

- the

approved provider of the care requests a reclassification in writing[61]

and

- the

Secretary is satisfied that the care recipient’s care needs have changed

significantly (according to any criteria set out in the Classification

Principles).[62]

Proposed section 29E-1 provides that the Secretary

(or delegate) must change a classification under this Part if satisfied that

either:

- the

assessment of the level of care was incorrect or inaccurate or

- the

classification was incorrect for any other reason.[63]

Before changing the classification, the Secretary (or

delegate) must review it, having regard to any relevant material on which the

classification was based, any matters specified in the Classification

Principles, and any other relevant material.[64]

If the Secretary (or delegate) changes the classification, the changes take

effect on the same day that the original classification took effect.[65]

Proposed section 29F-1 provides that, unless

expressly provided otherwise, a classification or classification level under proposed

Part 2.4A does not have effect for the purposes of:

- the

Aged Care Act (other than proposed Part 2.4A and one other

paragraph dealing with the transfer of records between providers)

- any

legislative instrument under the Aged Care Act (other than

Classification Principles as they relate to this Part)

- the

Aged Care

(Transitional Provisions) Act 1997 (the Transitional Provisions Act)

and associated legislative instruments or[66]

- any

other law of the Commonwealth.

It further specifies that a classification level under proposed

Part 2.4A cannot affect any subsidy paid to a provider under Chapter 3 of

the Aged Care Act or Chapter 3 of the Transitional Provisions Act

(such as the basic subsidy), nor can it affect any fees that the approved

provider charges a care recipient.

Item 5 provides that decisions of the Secretary (or

delegate) under proposed Part 2.4A to classify, not reclassify or change

the classification of a care recipient are reviewable decisions.

Requirements relating to delegates

making assessments

Approved aged care providers have responsibilities relating

to accountability for the aged care they provide.[67]

Item 4 of the Bill amends the Act to provide that they must allow

delegates of the Secretary to access the service to assess the care needs of

residents under proposed section 29C‑3.

Item 11 of the Bill provides that the Secretary

may, in writing, delegate their powers and function to assess care recipients

under proposed section 29C-3 to a person who satisfies the criteria

specified in the Classification Principles. This could include requirements

relating to ‘professional qualifications, demonstrated experience,

role-specific training and other formal credentials required of a delegate’.[68]

Item 12 of the Bill inserts proposed section

96-2A, which provides that these assessor delegates must be issued with a

photographic identity card, which they must carry and show on request. Failure

by such an assessor to return the card within 14 days of ceasing to be a

delegate (unless the card is lost or destroyed), is an offence of strict

liability carrying a penalty of one penalty unit ($222).[69]

Concluding comments

The Bill provides for an

alternate system for classifying aged care residents. It will operate alongside

the current ACFI system, without making any changes to residential aged care

funding. This should allow the Government and providers to gain more

information on how the proposed AN-ACC system will operate, prior to a final

decision being made on whether to switch to the AN‑ACC for funding

purposes. It also positions the Government to quickly respond to the final

report of the Royal Commission, due in February next year.

[1]. A

Grove, Aged

care: a quick guide, Research paper series, 2018–19, Parliamentary

Library, Canberra, updated 5 June 2019,

p. 1.

[2]. Australian Government, ‘What aged care homes provide’, My Aged

Care website.

[3]. Department of Health (DoH), Report on the operation of the Aged Care Act 1997, 2017–18, DoH, Canberra, 2019, p. 89.

[4]. DoH, ‘The Aged Care Funding Instrument (ACFI)’,

DoH website, last updated 23 April 2020; DoH, Aged Care Funding Instrument (ACFI): user guide, DoH, Canberra, 2016, p. 13.

[5]. DoH, Aged

care subsidies and supplements: new rates of daily payments from 20 September

2020, DoH, Canberra, 2020,

p. 3.

[6]. A Grove and A Dunkley, ‘Aged care’, Budget review 2016–17, Research

paper, 2015–16, Parliamentary Library, Canberra,

4 May 2016, p. 55.

[7]. A Grove, ‘Residential aged care funding: recent developments’, FlagPost, Parliamentary Library blog, 20 March 2017.

[8]. Ibid.

[9]. Aged Care Financing Authority (ACFA), Attributes for sustainable aged care: a funding and financing

perspective, ACFA, October 2019, p. 14.

[10]. DoH, Aged care provider funding – further revision of the Aged Care Funding

Instrument, Health Budget 2016–17 fact sheet, DoH,

3 May 2016.

[11]. R Rosewarne, J Opie, R Cumpston et al, Review of the Aged Care Funding Instrument: part 1: summary report, Applied Aged Care Solutions, [Melbourne], June 2017, p. 15.

[12]. Ibid., p. 49.

[13]. Ibid., p. 58.

[14]. D Tune, Legislated review

of aged care 2017, DoH, Canberra, 2017, pp. 140–141.

[15]. J McNamee, C Poulos, H Seraji et al, Alternative

aged care assessment, classification system and funding models: final report,

Centre for Health Service Development, Australian Health Services Research

Institute, University of Wollongong (UoW), [Wollongong], February 2017, p. 10.

[16]. DoH, ‘Residential aged care funding reform’, DoH

website, last updated 7 October 2020.

[17]. K Eagar, J McNamee, R Gordon et al, AN-ACC: a

national classification and funding model for residential aged care: synthesis

and consolidated recommendations. The resource utilisation and classification study:

report 6, Australian Health Services Research Institute, UoW,

[Wollongong], February 2019.

[18]. Ibid., p. 5.

[19]. UoW, ‘National Casemix and Classification Centre’, UoW website.

[20]. Eagar et al, AN-ACC,

op. cit., pp. 1–2.

[21]. Ibid., p. 6.

[22]. Ibid., p. 25.

[23]. K Eagar, J McNamee, R Gordon et al, The Australian

National Aged Care Classification (AN-ACC). The resource utilisation and classification

study: report 1, Australian Health Services Research Institute, UoW,

[Wollongong], February 2019, p. 37.

[24]. Eagar et al, AN-ACC,

op. cit., p. 11.

[25]. Ibid.,

p. 18.

[26]. Ibid.,

p. 20.

[27]. DoH, ‘Residential aged care funding reform’, op.

cit.

[28]. S

Morrison (Prime Minister), G Hunt (Minister for Health) and K Wyatt (Minister

for Senior Australians and Aged Care), New

$662 million aged care package to support older Australians, media

release, 10 February 2019.

[29]. DoH,

Report

on the trial of the Australian National Aged Care Classification (AN-ACC),

DoH, Canberra, August 2020, p. 2.

[30]. Ibid.,

pp. 2–3.

[31]. Ibid.,

p. 4.

[32]. Ibid.,

p. 7.

[33]. DoH,

Budget

2020–21: stakeholder pack, DoH, Canberra, 6 October 2020, p. 90.

[34]. Ibid.

[35]. Royal Commission into Aged Care

Quality and Safety homepage.

[36]. Royal

Commission into Aged Care Quality and Safety, Counsel

Assisting’s final submissions: proposed recommendations,

22 October 2020, p. 68.

[37]. D

Tehan, ‘Second

reading speech: Aged Care Amendment (Aged Care Recipient Classification) Bill

2020’, House of Representatives, Debates, (proof), 21 October 2020,

p. 6.

[38]. Senate

Standing Committee for the Scrutiny of Bills, Scrutiny

Digest, 15, 2020, The Senate, Canberra, 11 November 2020, pp. 1–3.

[39]. Ibid.,

pp. 3–4.

[40]. Ibid.,

p. 5.

[41]. The

amendments relating to privacy are items 7–9 of the Bill. Ibid., p. 6.

[42]. DoH,

‘Residential

Aged Care (RAC) Funding Reform Working Group’, DoH website, last updated 22

January 2020.

[43]. N Egan, ‘Calls for more transparency around new funding model’, Australian Ageing Agenda website, 6 June 2019.

[44]. Royal

Commission into Aged Care Quality and Safety, Statement

of Paul Versteege, Policy Manager, Combined Pensioners and Superannuants

Association of NSW, 30 June 2020.

[45]. National

Seniors Australia, Policy

development from the base up, Response to Royal Commission into Aged

Care Quality and Safety: Consultation Paper 2: Financing Aged Care, 2020, p. 7.

[46]. Dementia

Australia, Proposal

for a new residential aged care funding model: a response from Dementia

Australia, [review by the DoH of the current residential aged care

funding model], May 2019, pp. 3, 5.

[47]. Palliative

Care Australia, Submission

to the Royal Commission into Aged Care Quality and Safety, 2019, p. 30.

[48]. Australian

Nursing and Midwifery Federation, Submission,

Royal Commission into Aged Care Quality and Safety, 9 September 2019,

p. 25.

[49]. Explanatory

Memorandum, Aged Care Amendment (Aged Care Recipient Classification) Bill

2020, p. 1.

[50]. The

Statement of Compatibility with Human Rights can be found at pages 2–3 of the Explanatory

Memorandum to the Bill.

[51]. Parliamentary

Joint Committee on Human Rights, Human

rights scrutiny report, 13, 2020, 13 November 2020, p. 18.

[52]. Flexible

care caters for older people who need a different type of care than is offered

by mainstream home and residential services. For details see: Grove, Aged

care: a quick guide, op. cit.

[53]. Aged

Care Act 1997, subsection 96-2(1) provides that the Secretary may, in

writing, delegate all or any of the powers and functions of the Secretary under

the Act, the regulations or any Principles made under section 96-1 to a person

engaged by an Agency (within the meaning of the Public Service Act

1999) or an authority of the Commonwealth.

[54]. Aged

Care Act, proposed subsection 29C-2(3).

[55]. Aged

Care Act, proposed subsection 29C-2(4).

[56]. Aged

Care Act, proposed subsection 29C-2(5).

[57]. Aged

Care Act, proposed subsection 29C-3(1).

[58]. Aged

Care Act, proposed subsection 29C-3(2).

[59]. Aged

Care Act, proposed subsection 29C-3(3).

[60]. These

provisions are similar to section 23B-4 of the Act, which provides for the

Secretary (or delegate) to use computer programs to make decisions about

placing people on the home care waiting list (formally known as the national

prioritisation queue). For a discussion of issues raised by computerised

decision making, see C Petrie, Agriculture

Legislation Amendment (Streamlining Administration) Bill 2019, Bills

digest, 77, 2019–20, 4 February 2020, pp. 2—5.

[61]. Aged

Care Act, proposed subsection 29D-1(1).

[62]. Aged

Care Act, proposed subsections 29D-1(2) and (3).

[63]. Aged

Care Act, proposed subsection 29E-1(1).

[64]. Aged

Care Act, proposed subsection 29E-1(3).

[65]. Aged

Care Act, proposed subsection 29E-1(4).

[66]. The

Aged Care

(Transitional Provisions) Act 1997 sets out grandfathering

arrangements for people who have been receiving care continuously since before

1 July 2014.

[67]. Aged

Care Act 1997, section 63-1.

[68]. Explanatory

Memorandum, op. cit., p. 11.

[69]. See

section 4AA of the Crimes

Act 1914 (Cth) and the Notice of Indexation

of the Penalty Unit Amount.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

Disclaimer: Bills Digests are prepared to support the work of the Australian Parliament. They are produced under time and resource constraints and aim to be available in time for debate in the Chambers. The views expressed in Bills Digests do not reflect an official position of the Australian Parliamentary Library, nor do they constitute professional legal opinion. Bills Digests reflect the relevant legislation as introduced and do not canvass subsequent amendments or developments. Other sources should be consulted to determine the official status of the Bill.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.