Bills Digest no. 59, 2017–18

PDF version [667KB]

Paul Davidson

Economics Section

20 December 2017

Contents

Purpose of the Bill

Structure of the Bill

Background

The exploration development incentive

Explanation of the exploration

development incentive

The junior minerals exploration

incentive

Committee consideration

Selection of Bills Committee

Senate Standing Committee for the

Scrutiny of Bills

Policy position of non-government

parties/independents

Position of major interest groups

Financial implications

Table 1: estimated impact of the Bill

over the forward estimates

Statement of Compatibility with Human

Rights

Parliamentary Joint Committee on

Human Rights

Key issues

Table 2: information about the EDI

for the relevant income tax years

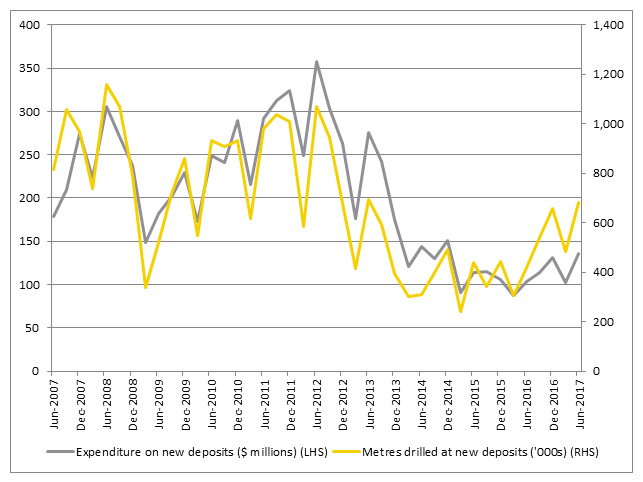

Figure 1: expenditure and metres

drilled at new deposits, June 2007—June 2017

Feedback from stakeholders

Key provisions

Schedule 1—Junior minerals

exploration incentive

Main amendments

Creation of exploration credits

Exploration credits allocation

Issuing exploration credits

Excess exploration credits

Modified capital gains tax treatment

Repeal of the JMEI from 1 July 2023

Part 4—Application, transitional and

saving provisions

Date introduced: 19 October 2017

House: House of Representatives

Portfolio: Treasury

Commencement: Parts 1 and 2 and Division 1 of Part 4 of Schedule 1 to the Bill commence on the first 1 January, 1 April, 1 July or 1 October to occur after Royal Assent. Part 3 and Division 2 of Part 4 commence on 1 July 2023. Schedule 2 commences the day after Royal Assent.

Links: The links to the Bill, its Explanatory Memorandum and second reading speech can be found on the Bill’s home page, or through the Australian Parliament website.

When Bills have been passed and have received Royal Assent, they become Acts, which can be found at the Federal Register of Legislation website.

All hyperlinks in this Bills Digest are correct as at December 2017.

Purpose of

the Bill

The Treasury

Laws Amendment (Junior Minerals Exploration Incentive) Bill 2017 (the Bill)

amends the Income

Tax Assessment Act 1936 (ITAA 1936), the Income Tax

Assessment Act 1997 (ITAA 1997), and the Taxation

Administration Act 1953 (Tax Administration Act) to provide

concessional tax treatment for investors in certain greenfields minerals

exploration entities. The Bill does this by replacing the Exploration

Development Incentive with the Junior Minerals Exploration Incentive (see

below).

Structure

of the Bill

The Bill has two Schedules. Schedule 1 has four parts:

- Part

1 provides for the main amendments to the ITAA 1997 to establish the

Junior Minerals Exploration Incentive

- Part

2 provides for other amendments to the ITAA 1936, ITAA 1997

and the Tax Administration Act to reflect the replacement of the Exploration

Development Incentive with the Junior Minerals Exploration Incentive

- Part

3 provides for the repeal on 1 July 2023 of Division 418 of the ITAA 1997

which covers the junior minerals exploration incentive and

- Part

4 contains application, transitional and savings provisions.

Schedule 2 of the Bill makes consequential

amendments to the Tax

and Superannuation Laws Amendment (2014 Measures No. 7) Act 2015.

Background

The Bill replaces the effectively expired exploration

development incentive (EDI) with the junior minerals exploration incentive

(JMEI).

Background information about a review of the EDI, as well

as data from the Australian Bureau of Statistics and the Australian Taxation

Office are presented in the Key issues section below.

The

exploration development incentive

The EDI was first announced by the Coalition in the

lead-up to the 2013 federal election.[1]

According to the Explanatory

Memorandum to the Bills introducing the EDI, two key problems were

identified:

- a

tax disadvantage junior companies face relative to larger mining and

exploration companies and

- the

general difficulty in attracting the capital necessary to conduct greenfields

exploration.[2]

The objective of the Bills was ‘to increase greenfields

mineral exploration by incentivising investment in junior mineral exploration

companies’.[3]

As stated in the Explanatory

Memorandum:

The Exploration Development Incentive is expected to attract

additional investment in small companies undertaking greenfields mineral

exploration. Additional exploration activity will lead to increased employment.

Stakeholder feedback suggests this increased investment will also have a

significant multiplier effect. Long term benefits include new mineral

discoveries, and in turn, new mines. Such benefits would include the

possibility of new infrastructure in regional areas, new and diversified

employment opportunities, and increases in royalty and taxation revenue. [footnotes

omitted][4]

As the EDI was an election

commitment, the regulation impact statement only considered the implementation

of the commitment, as opposed to alternative measures to achieve the same

objective.[5]

However, it was important to review the effectiveness of the EDI given the

modified regulation-making treatment. This was acknowledged in the Explanatory

Memorandum:

The Department of Industry will monitor greenfields

exploration and the scheme throughout its operation, with a review of the

scheme in 2016. Key performance indicators for the scheme, against which the

review will be conducted, will be finalised by the end of 2014. Subject to the

outcome of the review, the programme may be extended for a further period.[6]

The review is discussed in more detail in the Key

issues section below.

Explanation

of the exploration development incentive

Generally, most small minerals exploration companies’

expenditure would be classified as capital in nature for the purposes of income

tax law. The full value of any expenditure for a depreciating asset (generally

considered to be an asset with a limited useful life) used for minerals

exploration can be immediately deducted under ITAA 1997 section 40‑80.

Other expenditure incurred (whether capital or revenue in nature) can be

immediately deducted under ITAA 1997 section 40-730. Therefore, the vast

majority of expenditure incurred by such companies is likely to be deductable.

As noted in the Explanatory

Memorandum to the Bill:

...smaller companies engaged solely in exploration for minerals

may earn less assessable income in a given income year than they outlay on

exploration or prospecting. Such companies therefore will generally have a tax

loss for the income year. This tax loss will not provide any benefit unless a

company earns sufficient assessable income in a future income year against

which the loss can be deducted.[7]

[...]This is a source of non-neutrality in the tax system that

favours companies with profits against which to offset expenses over companies

that accumulate losses they are unable to utilise. Junior explorers, with no

production and therefore no (or little) assessable income, are unable to offset

their exploration expenditure. While a tax deduction allows a company with

assessable income to reduce its tax liability, a company will not gain any

immediate benefit from its deductions that exceed its assessable income.[8]

In simple terms, the relative benefit that tax

deductibility provides varies depending on whether the entity in question is

making a profit or loss. Where entities are making a profit, they can claim

immediate relief via a tax deduction for such expenditure incurred, thus

lowering their assessable income (and hence tax payable). However, where

entities are not making assessable income, such accumulated losses cannot be

deducted. The losses can however generally be rolled over to future income

years to offset against profits in those future income years.

The EDI commenced in March 2015 and essentially permitted

small mineral exploration companies which undertook greenfields minerals

exploration in Australia to convert some of their tax losses into exploration

credits. In turn, those exploration credits could be distributed to investors

as a tax offset, or as a franking credit, depending on the investor entity.[9]

The concessional tax treatment under the EDI was to last

for three years, with maximum concessions of $25 million, $35 million, and

$40 million for each year, respectively.

The EDI was introduced as an amendment to the ITAA 1997

as Division 418. Section 418-1 provides a general overview of the Division. The

Division comprises six subdivisions:

- Subdivision

418-A sets out the object of the Division to provide for concessional tax

treatment for investors who invest in small mineral exploration companies which

undertook greenfields minerals exploration in Australia.

- Subdivision

418-B contains the entitlement to receive the EDI tax offset, which is dependent

upon the type of investor entity (for example, there are different rules

depending on whether the investor is a life insurance company or a member of a

trust). It also covers the amount of the tax offset.

- Subdivision

418-C covers EDI franking credits, which again differ depending on the type of

investor entity.

- Subdivision

418-D covers the creation of exploration credits, in particular the entities

which are eligible to create exploration credits, as well as a number of

important related definitions. The Subdivision provided that an entity cannot

create exploration credits in excess of their maximum exploration credit

amount. The maximum exploration credit amount was calculated on either the

estimated or actual tax loss or estimated or actual greenfields mineral

expenditure (whichever was the smallest), multiplied by the corporate tax rate,

which was then multiplied by the modulation factor. The modulation factor was

in turn calculated where the exploration credits were expected to exceed the

exploration cap (the values are listed above), otherwise it was set at a value

of one.

- Subdivision

418-E covered the issue and expiry of exploration credits, which could be

provided to member shareholders of the entity, proportionately in accordance

with their shareholding.

- Subdivision

418-F covered excess exploration credits—entities which issued exploration

credits in excess of their maximum exploration credit amount were liable to pay

excess exploration credit tax. This subdivision also provided for a range of

related administrative measures such as when payment of excess exploration

credit tax fell due, whether interest was also payable, refunds for overpaid

amounts, and general record keeping requirements. In the event that an entity

was liable to pay excess exploration credit tax that entity may have been

excluded from accessing the EDI in the future.

The EDI ceased to have effect after the 2016–17 income

year, although exploration credits accrued could be distributed in the 2017–18

income year.

The junior

minerals exploration incentive

The 2017–18 Budget let the EDI run its course, and as such

did not extend it. This decision was reported to have angered industry

participants,[10]

and, perhaps as a result of industry feedback, the JMEI was first announced by

the Prime Minister and Deputy Prime Minister on 2 September 2017.[11]

It was reported that the reason for changing from the EDI to the JMEI was

because the EDI ‘had not been as effective as hoped’.[12]

As noted in the Explanatory

Memorandum to the Bill, the JMEI operates in substantially the same way as

the EDI, and has three main components:

First, the amendments establish a framework for eligible

companies to give up a portion of their tax losses attributable to greenfields

minerals exploration to create and issue exploration credits to investors where

they have received an allocation of credits from the Commissioner.

Secondly, the amendments entitle an entity that invests in a

greenfields minerals explorer and receives an exploration credit to either a

refundable tax offset (the JMEI tax offset) or (for corporate tax entities

other than in some cases life insurance companies) an additional franking

credit.

Finally, the amendments extend the application of the excess

exploration credit tax rules.[13]

The Explanatory

Memorandum to the Bill provides that the government intends to review the

operation of the JMEI by 30 June 2020 ‘to assess both its uptake and efficacy

in attracting investment’.[14]

However, it is not clear whether the review will be public.

The Key issues and provisions section below

explains the operation of the Bill in more detail.

Committee

consideration

Selection

of Bills Committee

The Committee for the Selection of Bills recommended that

the Bill not be referred to a committee for inquiry.[15]

Senate

Standing Committee for the Scrutiny of Bills

The Committee for the Scrutiny of Bills made no comment in

relation to the Bill.[16]

Policy

position of non-government parties/independents

At the time of writing, the position of non-government

parties is not known. However, the Labor Party supported the Bills which

introduced the EDI in 2015.[17]

Greens Senator Whish-Wilson expressed ‘disbelief’ at the introduction of the original

Bills,[18]

and the party unsuccessfully sought to amend Schedules 1 and 6 of the Tax and

Superannuation Laws Amendment (2014 Measures No. 7) Bill 2014, which would have

had the effect of removing the EDI entirely.[19]

Position of

major interest groups

Concerns had been raised by the mining industry at the

budget decision to let the EDI expire.[20]

Chief Executive of the Association of Mining and

Exploration Companies, Simon Bennison, has reportedly said there is appetite

among junior companies for exploration and stated ‘...we are looking forward to this

new initiative turning [one of the worst periods of greenfield exploration]

around’ and that ‘[i]t will give those companies with some highly prospective

and clearly identified quality assets a much better chance of raising that

capital’.[21]

Acting Chief Executive Officer of the Association of

Mining and Exploration Companies, Graham Short, said:

The Federal Government’s recently announced $100m over 4

years Junior Mineral Exploration Tax Credit (JMETC) is a timely and important

step to boosting that investment in exploration. This will allow eligible

companies to renounce their losses in the form of tax credits back to their

shareholders.[22]

The South Australian Chamber of Mines & Energy was

reported to have welcomed the JMEI initiative.[23]

Financial implications

The Explanatory

Memorandum to the Bill states that the measure is expected to reduce government

revenues by $100 million over the forward estimates.

Table 1: estimated

impact of the Bill over the forward estimates

| 2017–18 |

2018–19 |

2019–20 |

2020–21 |

| -$15m |

-$25m |

-$30m |

-$30m |

Source: Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, p. 7.

Although not directly related to the Bill, the financial

impacts of the EDI have been less than anticipated when the EDI was first

introduced (see below). It remains to be seen whether the Bill will result in

similar financial impacts.

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the

Bill’s compatibility with the human rights and freedoms recognised or declared

in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[24]

Parliamentary

Joint Committee on Human Rights

The Joint Committee on Human Rights considered that the

Bill did not raise human rights concerns.[25]

Key issues

As noted above, the key issues are whether the EDI has

worked as intended, and whether it (or an alternative, such as the JMEI)

remains necessary, especially given the modified regulation-making treatment

afforded to the Bills that introduced the EDI. A review of the EDI could

evaluate both of these issues.

A review of the EDI had been foreshadowed on numerous

occasions,[26]

and a review was signalled by (then) Resources Minister Josh Frydenberg in

mid-2016.[27]

Pursuant to freedom of information documents, it appears that the Department of

Industry, Innovation and Science was responsible for conducting the review, and

had engaged consultants to prepare a report.[28]

However, the budget decision to let the EDI expire at the end of its three-year

period was heavily criticised by the Association of Mining and Exploration

Companies national policy manager Graham Short:

The Government has had a non-transparent and unpublished

internal review but it has been based on a short time frame and limited data...

It appears as though the Government just doesn't understand,

or its advisors just don't understand the importance of this program.[29]

Given that the review has not been made public, it is

difficult to evaluate the efficacy of the EDI. It was reported that the

Government decision not to extend the scheme was because few businesses took

advantage of the scheme and that the number of participants significantly fell

between the first and second years of operation.[30]

Resources Minister Matt Canavan stated that ‘[t]he

review did consider options to improve the scheme but found these would have

benefited only a small number of participants rather than improving the

scheme’s overall operation’.[31]

Available information suggests that the EDI has not been

as attractive to junior minerals companies as intended. It was estimated that

approximately 200 entities would participate in the EDI annually,[32]

yet data from the Australian Taxation Office (ATO) indicate that participation

in the EDI was not that successful (table 2).

Table 2: information

about the EDI for the relevant income tax years

| Income year |

No. of applications |

Total notified exploration expenditure |

Modulation factor |

Exploration credit cap |

Estimated maximum exploration credits issued |

| 2014–15 |

84 |

$70,323,723 |

1.00 |

$25 million |

$21.1 million |

| 2015–16 |

54 |

$45,672,570 |

1.00 |

$35 million |

$13.7 million |

| 2016–17 |

40 |

$44,482,118 |

1.00 |

$40 million |

$13.3 million |

Source: Australian Taxation Office (ATO), ‘Exploration

development incentive’, ATO website, last modified 28 November 2017.

As shown in table 2, less than half of the estimated

number of applications were received in 2014–15, falling to almost a quarter of

the estimated applications in 2015–16. Despite the relatively low take-up, over

84 per cent of the $25 million cap in 2014–15 was allocated to applicants,

suggesting that had there been 200 applicants, the modulation factor would have

been substantially less than one,[33]

resulting in a smaller return (in the form of a tax concession) to investors.

The number of applications fell by over a third between

2014–15 and 2015–16, with commensurate falls in both exploration expenditure

and exploration credits issued. In 2015–16, the take-up was only 27 per cent of

that originally estimated, with 54 applications.

In the 2016–17 income year, the number of applications

fell further, to just 20 per cent of the estimated number of applications. The

results in 2016–17 compared with 2014–15 indicate that the EDI has become

relatively less important to eligible entities.

The relatively low take-up rate by junior minerals

companies would indicate that the existence of the EDI is not critical to

decision-making about whether to incur greenfields exploration expenses. This

conclusion is also supported by data from the Australian Bureau of Statistics

(ABS) on expenditure and metres drilled for new deposits in Australia (figure

1). The reason for focussing on new deposits is because the EDI is only

available to greenfields minerals exploration.

Figure 1 illustrates that expenditure and metres drilled

for new deposits have historically been quite volatile. Since the introduction

of the EDI, some of that volatility has reduced, but it is not possible to

conclude that the reduction is due to the EDI’s existence. Nor is it possible

to state that the existence of the EDI has resulted in additional expenditure

and/or metres drilled at new deposits. In order to test that statement,

information would be required about the extent of expenditure and metres

drilled which would have occurred in the absence of the EDI.

The ABS data also represents the entire greenfields

minerals exploration industry, rather than only those with taxable losses,

which are the relevant entities for the purposes of the EDI.

The Henry

Tax Review considered the implementation of an exploration tax credit, as

part of a flow-through share scheme. The Review stated:

There are no strong grounds to believe that exploration

generates unusually large positive spillovers that would justify a subsidy.

Exploration does produce information of public value, and explorers are

required to make such information publicly available. However, nearly all

activities generate information that is of benefit to others; for example, that

a particular business model does or does not work.[34]

Based on the above information, it is questionable whether

the EDI has worked as intended when it was first announced in 2013. It is also

unclear whether an EDI (or an alternative such as the JMEI) is necessary to

induce greenfields minerals exploration that would otherwise not go ahead. As

part of consultations when the EDI was introduced:

Some stakeholders have expressed the view that no market

failure exists preventing an efficient level of investment in greenfields

projects. Accordingly these stakeholders consider there will only be limited

take-up of the Exploration Development Incentive. This appears to be a minority

view based on the consultation that has been undertaken.[35]

Figure 1: expenditure

and metres drilled at new deposits, June 2007—June 2017

Source: Based on Australian Bureau of Statistics, Mineral and petroleum

exploration, cat. no. 8412.0, ABS, Canberra, 2013.

The minority view of stakeholders however appears to more

accurately reflect the outcomes of the EDI than that of the majority which identified

that the ‘main limitation’ was the exploration credits cap which was ‘generally

considered too small based on the expected demand for the scheme’.[36]

This is because in the three years that the EDI operated, the cap was not

reached.

Feedback

from stakeholders

The Explanatory

Memorandum to the Bill notes that stakeholders provided feedback on the

EDI. Two key issues identified were that the benefits to new investors were

diluted, and that the modulation factor created uncertainty.[37]

The Bill remedies the issue regarding diluted investor

returns by ensuring that where credits are issued they are issued to the

investors which contributed to the capital raisings.[38]

The Bill remedies the latter issue as a result of the proposed repeal of

section 418-90, which covers the modulation factor. However, the removal of the

modulation factor is substituted by the determination process by the

Commissioner of Taxation.[39]

Whether this process creates uncertainty (or additional uncertainty compared to

the modulation factor) is yet to be seen.

Key

provisions

Schedule

1—Junior minerals exploration incentive

Main amendments

Part 1 of Schedule 1 amends Division 418 of the ITAA

1997, which currently provides for the EDI. The amendments reflect the

changes introduced by the JMEI. The main changes are:

- in

relation to the timing of both the creating and issuing of exploration credits

- the

removal of the modulation factor and introduction of the Commissioner of

Taxation being responsible for allocating exploration credits

- the

ability to rollover an unused allocation of exploration credits (which

currently does not exist)

- the

introduction of rules to ensure that exploration credits are provided proportionately

to all investors, based on the size of their investment and

- allocations

of exploration credits are on a first come first served basis (which is

currently not the case due to the operation of the modulation factor).

Item 1 repeals and substitutes section 418-1 which

provides for an overview of Division 418. Proposed section 418-1

reflects the legislative changes from the EDI to the JMEI in summary form, similar

to those listed above.

The JMEI maintains Subdivisions 418-A, 418-B, and 418-C,

which cover the object of the Division, as well as the entitlement to receive a

tax offset or franking credit, depending on the type of investor entity.

Creation of

exploration credits

Item 2 repeals and substitutes Subdivision 418-D

which deals with the creation of exploration credits. Proposed

subsection 418-70(1) reflects the changes to the timing in relation to the

creation of exploration credits. Currently, eligibility is based

on being a greenfields minerals explorer in the previous income

year, as well as the provision of a declaration estimating both their tax loss

and greenfields minerals expenditure for that previous income

year. Proposed subsection 418-70(1) now permits entities to create exploration

credits in the income year, and (as opposed to requiring a declaration)

the entity must have an exploration credits allocation[40]

for the income year (or an unused allocation of exploration credits

from the immediately preceding income year).[41]

Proposed subsection 418-70(2) reflects necessary

changes as a result of the repeal of the modulation factor (see below). Proposed

subsection 418-70(3) provides that exploration credits cannot

be created for the 2021–22 income year (or any later income year).

The definition of greenfields minerals explorer

(under section 418-75) is unchanged, meaning that the JMEI will apply to the

same entities as did the EDI. The definition of greenfields minerals

expenditure (under section 418‑80) is extended to include

transferees under farm-in farm-out arrangements.[42]

The effect of this change is to broaden the application of the JMEI compared to

the EDI. This extension is acknowledged in the Explanatory Memorandum to the

Bill, but no reason for its extension is provided.[43]

An equivalent to proposed section 418-81 did not

exist under the EDI. It provides for the definition of exploration

credits allocation for an income year. An entity has an exploration

credits allocation for an income year if the Commissioner of Taxation

makes a determination (under proposed section 418-101) allocating that

entity with exploration credits for the income year. If no

determination is made, the allocation is nil. The allocation process is set out

in proposed Subdivision 418DA, as discussed further below.

An equivalent to proposed section 418-82 did not

exist under the EDI. It provides for the definition of unused allocation

of exploration credits for an income year. An entity has an unused

allocation of exploration credits from an income year if the exploration

credits allocation for the income year exceeds the exploration

credits created by the entity for the income year. The amount of unused

allocation of exploration credits from the income year is the amount of

the excess.

Section 418-85 currently provides that exploration

credits must not exceed the maximum exploration credit amount.

In summary, the maximum exploration credit amount is currently

defined to be:

- the

smallest amount of:

- the

entity’s estimated tax loss

- the

entity’s actual tax loss

- the

entity’s estimated greenfields minerals expenditure or

- the

entity’s actual greenfields minerals expenditure.

- multiplied

by the corporate tax rate that applied in the previous income

year and

- multiplied

by the modulation factor.[44]

Proposed subsection 418-85(2) replaces this

calculation method by providing that an entity’s maximum exploration

credit amount for an income year (the credit year) is the

smallest of the following amounts:

- the

entity’s greenfields minerals expenditure for the credit

year, multiplied by the entity’s corporate tax rate for

the credit year

- the

entity’s tax loss for the credit year, multiplied

by the entity’s corporate tax rate for the credit year

or

- the

sum of the entity’s exploration credits allocation for the credit

year and the entity’s unused allocation of exploration credits

from the income year immediately preceding the credit year.

The changes reflect the policy decision to alter the

timing of the JMEI compared to the EDI.[45]

The removal of the requirement for an entity to provide estimates of their tax

loss and greenfields minerals expenditures, respectively,

reflects this change.[46]

That change is also reflected in bringing forward the relevant year to which

the corporate tax rate relates. Proposed paragraph 418-85(2)(c) reflects

the policy decision to allow entities to distribute their unused

allocation of exploration credits from the income year immediately

preceding the credit year.

Current subsection 418-85(3) provides the method for

calculating an entity’s tax loss for the purposes of subsection 418-85(2). Proposed

subsection 418-85(4) maintains the definition and contains necessary

consequential amendments which reflect the changes to the timing of the

creation of exploration credits. Proposed subsection 418-85(5)

(which is equivalent to the current subsection 418-85(4)) contains analogous

necessary amendments in terms of the changes relating to timing. Analogous changes

are also contained in proposed subsection 418-85(3) in relation to calculating

an entity’s greenfields minerals expenditure for the purposes of

subsection 418-85(2).

As explained earlier in this Digest, the EDI currently

relies on modulation factors. Section 418-90 covers the modulation factors and

is proposed to be repealed by item 2. The reason for repealing the

modulation factor was due to industry feedback that it created additional

uncertainty as to the amount of exploration credits which could be issued.[47]

Exploration

credits allocation

Item 2 also inserts proposed Subdivision 418DA

which deals with the exploration credits allocation. As outlined earlier, under

proposed section 418-70, an entity must have been a greenfields

minerals explorer in the income year, and the entity must have an exploration

credits allocation for the income year or an unused allocation of

exploration credits from the immediately preceding income year—in order

to be able to create exploration credits. An entity can therefore

only create exploration credits if exploration credits have been

allocated to it.[48]

The process of gaining an exploration credits allocation

involves:

- An

application to the Commissioner of Taxation (proposed section 418-100)—an

entity may apply to the Commissioner for Taxation for a determination to

allocate exploration credits to the entity for an income year.

The application must be made within one month from the start of the financial

year corresponding to the income year for which the application is sought,[49]

and must include estimates of the entity’s greenfields minerals

expenditure, tax loss, and corporate tax rate.

- A

determination by the Commissioner of Taxation (proposed section 418-101)—the

Commissioner may make a determination allocating exploration credits

of a specified amount for an income year. The Commissioner must not make a

determination if the Commissioner[50]

is not satisfied that there is a reasonable possibility that the entity will

have greenfields minerals expenditure, applicable tax loss,

and applicable corporate tax rate of the amount estimated or

greater,[51]

and that the entity meets any other prescribed requirements.[52]

The amount of exploration credits specified in the determination

must be the smallest of:

- the

entity’s estimated greenfields minerals expenditure for the

income year, multiplied by the entity’s estimated corporate tax rate

for the income year or

- the

entity’s estimated tax loss for the income year, multiplied by

the entity’s estimated corporate tax rate for the income year or

- either:

- five

per cent of an amount equal to the annual exploration cap for the

income year or

- if

another amount, or a method for working out another amount is prescribed—the

other amount.[53]

The method for calculating the first two amounts relating

to an entity’s greenfields minerals expenditure and tax

loss is analogous to the current process under section 418-85 (as far

as the entity’s estimated values are concerned). However the introduction of

five per cent of the annual exploration cap is a new provision

unique to the JMEI. The Explanatory Memorandum provides that this provision

‘ensures that there is a broad spread of the benefit of the JMEI amongst

exploration companies each income year’.[54]

Given the annual exploration cap (see proposed section 418-103

below), five per cent of each annual cap (assuming that there are no unused

allocations or different amounts prescribed) would mean a maximum allocation of

exploration credits to just 20 entities of:

- $750,000

for the 2017–18 income year

- $1.25

million for the 2018–19 income year and

- $1.5

million for each of the 2019–20 and 2020–21 income years.

It should be noted that this would only apply in the event

that the greenfields minerals expenditure and the tax loss

were such that more than five per cent of the annual exploration cap

would be allocated to a particular entity. If there were 20 such entities then

the cap would breached, and accordingly each entity would receive

five per cent of the annual exploration cap, and the

associated investors would receive a resultant smaller tax offset. The

likelihood of such an event is unknown at present, but the limited information

about various greenfields minerals explorers that does exist in relation to the

EDI indicates that the majority of entities would be below the five per cent

threshold.[55]

Additional aspects of proposed

Subdivision 418DA are:

- Compliance

with the general allocation rules (proposed section 418-102)—the total

amount of exploration credits must not exceed the annual

exploration cap. The Commissioner of Taxation must consider

applications on a first-come, first-served basis; with the possibility that

entities which apply later than others may not receive their full entitlement

of exploration credits as a result of the process outlined above.[56]

- The

definition of annual exploration cap (proposed section 418-103)

with the amounts allocated to each income year as follows:

- $15

million for the 2017–18 income year

- $25

million for the 2018–19 income year and

- $30

million for each of the 2019–20 and 2020–21 income years.

- A

safeguard provision in the event of a failure by the Commissioner of Taxation

to comply with the requirements in proposed Subdivision 418DA.[57]

This is to ensure that any inadvertent error by the Commissioner of Taxation in

relation to any one application does not affect all subsequent determinations.

Issuing

exploration credits

Item 2 also repeals and substitutes Subdivision

418E which deals with issuing exploration credits. In summary, the issuing of

exploration credits relates to the tax treatment of certain investments by

investors in minerals explorers.

Proposed section 418-110 is the operative provision

that provides that an entity that has created exploration credits

(called the minerals explorer) may issue an exploration credit

for that income year to another entity (called the investor). The

exploration credit issued to the investor may

relate to one of two things: an exploration investment made by

the investor in the minerals explorer in the:

- income

year or

- immediately

preceding income year.

This is subject to a number of limitations (see below).

An exploration investment has been made if:

- shares

in the mineral explorer are issued to the investor

by the minerals explorer on or after the day the Commissioner of

Taxation makes a determination (under proposed section 418-101)

allocating exploration credits to the minerals explorer

for the income year and

- the

shares are issued before the end of the income year and

- those

shares are equity interests.[58]

In practice this means that the shares must be newly issued

shares by the minerals explorer, they cannot be via the (secondary)

traded market. This helps to ensure that the policy of attracting new capital

funds is met. Additionally, the exploration credit is based on

the value of the exploration investment so as to ensure that the

credits are solely as a result of the entity undertaking eligible expenditure.

This is an integrity measure to ensure that the capital raising is only

directed to eligible activities which can then receive concessional tax treatment

in the hands of the investor.

Proposed section 418-115 provides for a priority

order for the receipt of exploration credits and introduces an issue

pool concept to facilitate the order. It provides for three possible

scenarios. Under one scenario, for example, if there is an unused

allocation of exploration credits from a preceding year and further

exploration credits are then created in the following year, the investors

who made an investment in the preceding income year are entitled to receive exploration

credits ahead of investors who made an investment in the current year (in

the event that such credits are created). This reflects the fact that entities

are effectively provided with two years to incur relevant expenditure, and

without having first incurred the expenditure, exploration credits cannot be

created.

Proposed section 418-116 provides that each

investor is entitled to a distribution that is proportionate to the value of

their investment, as a percentage of the total value to be distributed in the

relevant issue pool. This helps to ensure that each investor is

treated equally, whilst also ensuring that those investors who have funded the

capital raising are the ones receiving the tax benefit (since entitlement to a

distribution is based on initial capital contribution and not current

shareholding). As noted in the Explanatory Memorandum, this is a superior

approach to that which applied under the EDI ‘where all shareholders were

entitled to receive a proportion of the exploration credits that were

received’.[59]

Excess

exploration credits

Item 4 inserts proposed section 418-151

which relates to the complying exploration credit amount.

Entities are liable to pay excess exploration credit tax where

they have issued exploration credits in excess of the complying

exploration credit amount.[60]

In the event that an entity issues exploration credits that it is

not entitled to (for example, an entity issued credits where it did not

undertake qualifying expenditure) then that entity is liable to pay excess

exploration credit tax. Items 3 and 5-6 make minor consequential

amendments to reflect the changes in terminology and timing in relation to the

JMEI.

Modified

capital gains tax treatment

Items 13–15 amend the ITAA 1997 to provide

for modified capital gains tax (CGT) (see box 1) treatment in the event of a

disposal of shares issued to an investor by a minerals

explorer. The modified CGT treatment reflects the fact that investors

are entitled to a share of exploration credits that are distributed

in the income year, provided that the other requirements are met (see above).

As a result of having access to the exploration credits—which

cannot be transferred—investors may have paid a premium for the

shares, and that premium is not reflected in the sale price in the event that

the shareholder decides to sell their shares. In effect, that means that the

sale price would be ‘too high’. Since the sale price cannot be reduced (that is

simply the market price paid for the shares), items 13–15 have the effect

of reducing the reduced cost base of the shares, which thereby affects the

amount of capital loss incurred. The reduced cost base is reduced by the corporate

tax rate that applied to the minerals explorer when the

share was issued, multiplied by the amount paid up by the investor

on the share during the investment period.[61]

This has the effect of lowering the reduced cost base of the shares, which in

turn lowers the amount of capital loss that can be claimed by the investor.

Other amendments

Items 7–10 in Part 2 of Schedule 1 make

consequential amendments to the ITAA 1936 as a result of the change in

the name from EDI to JMEI. Items 11–12 and 16–26 make similar

changes to the ITAA 1997. Items 27 and 28 make similar changes to

the Tax Administration Act.

|

Box 1: summary of capital gains tax (CGT)

In simple terms, if a capital asset is disposed of, the

disposal usually results in either a capital gain or a capital loss. Shares

would be considered a capital asset, and the sale of shares would qualify as

a disposal.

The initial purchase price of shares would generally be

considered to be the cost base of the shares, and the sale price of

the shares would be considered to be the capital proceeds. A capital

gain is the difference between the capital proceeds and the cost base.

Capital gains tax (CGT) is the tax that is payable on such gains.

Where the capital proceeds are less than the cost

base (which is called a reduced cost base), a capital loss is

generated. Generally, capital losses can be rolled over and can be offset against

future capital gains.

The Bill proposes to modify the CGT treatment of

exploration investments in junior mineral explorers by amending the usual

rules which would apply in calculating the reduced cost base, which in turn,

affects the amount of capital loss.

|

Sources: ITAA 1997,

Parts 3-1 and 3-3, section 995-1; Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, pp. 33–5.

Repeal of

the JMEI from 1 July 2023

Items 29–41 repeal cross-references to Division 418

of the ITAA 1997 (which is the Division where the JMEI is inserted by Parts 1

and 2) in the ITAA 1936. Items 42–44 and 46–52 repeal

Division 418 and references to that Division in the ITAA 1997. Item

45 ensures that the future disposal of shares by investors

after 1 July 2023 remain subject to a reduction in the reduced cost base, as

was introduced by items 13–15 of Schedule 1. Items 53–64

repeal cross-references to Division 418 of the ITAA 1997 in the Tax

Administration Act. These amendments will commence on 1 July 2023 and

reflect that the JMEI is time-limited and only applies to the 2017–18 to

2020–21 income years.

Items 1 and 2 of Schedule 2 repeal and substitute

two table items of the Tax and

Superannuation Laws Amendment (2014 Measures No. 7) Act 2015. That Act

provided for the introduction of the EDI. Item 1 repeals and substitutes

Table item 12 of subsection 2(1) of that Act, which currently provides for

the repeal of Division 418 on 1 July 2020 as it relates to the EDI. Instead, item

1 proposes that the repeal of Division 418 does not commence if

Parts 1 and 2 of Schedule 1 to the Treasury Laws Amendment (Junior

Minerals Exploration Incentive) Act 2017 commence before 1 July 2020. This

ensures that Division 418—as it would then relate to the JMEI—is repealed on 1

July 2023 as outlined above in relation to Schedule 1.

Item 2 of Schedule 2 similarly repeals and substitutes

table item 14 in subsection 2(1) of the Tax and Superannuation Laws

Amendment (2014 Measures No. 7) Act 2015.[62]

Part

4—Application, transitional and saving provisions

Item 66 of Schedule 1 provides that an

application to the Commissioner of Taxation for an allocation of exploration

credits for the 2017–18 income year must be made on or after 1 February 2018

but before 1 March 2018, as opposed to the usual time of one month prior to the

start of the financial year. This reflects the fact that the 2017–18 financial

year has already commenced and the JMEI was not announced until September 2017.

Item 67 provides that greenfields minerals

explorers in the 2016–17 income year can still create and issue exploration

credits under the EDI, despite the fact that the EDI is repealed and replaced

with the JMEI in Parts 1 and 2 of Schedule 1.

[1]. Liberal

Party of Australia and the Nationals, The

Coalition’s Policy for resources and energy, Coalition policy document,

Election 2013.

[2]. Explanatory

Memorandum, Tax and Superannuation Laws Amendment (2014 Measures No. 7)

Bill 2014 and Excess Exploration Credit Tax Bill 2014, pp. 114–15. For

simplicity, references are only made to the Tax and Superannuation Laws

Amendment (2014 Measures No. 7) Bill 2014 and associated materials from

hereon. A greenfields minerals explorer and greenfields

minerals expenditure are defined in sections 418-75 and 418-80 of the ITAA

1997, respectively.

[3]. Explanatory

Memorandum, Tax and Superannuation Laws Amendment (2014 Measures No. 7)

Bill 2014, p. 119.

[4]. Ibid.,

p. 120.

[5]. Ibid.

[6]. Ibid.,

p. 129.

[7]. Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, p. 11.

[8]. Ibid.,

p. 45.

[9]. For

more information on the background and anticipated impacts of the EDI, see: K

Swoboda and L Nielson, Tax and Superannuation Laws Amendment (2014 Measures

No. 7) Bill 2014 [and] Excess Exploration Credit Tax Bill 2014, Bills

digest, 75, 2014–15, Parliamentary Library, Canberra, 2015, pp. 22–31. A greenfields

minerals explorer and greenfields minerals expenditure

are defined in sections 418-75 and 418-80 of the ITAA 1997,

respectively.

[10]. See,

for example: S McKinnon, ‘Scheme

axing angers juniors’, The West Australian, 12 May 2017, p. 62; B

Harvey, ‘Feds

throw explorers a bone’, The West Australian, 7 June 2017, p. 33.

[11]. M

Turnbull (Prime Minister) and B Joyce (Deputy Prime Minister), Investing

in the future strength of the Australian resources sector, joint media

release, 2 September 2017.

[12]. S

Martin, ‘$100m

mining boost’, The Weekend West, 2 September 2017, p. 1.

[13]. Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, p. 16.

[14]. Ibid.,

p. 12.

[15]. Senate

Standing Committee for Selection of Bills, Report,

13, The Senate, 16 November 2017, p. 3.

[16]. Senate

Standing Committee for the Scrutiny of Bills, Scrutiny

digest, 13, The Senate, 15 November 2017, p. 60.

[17]. G

Gray, ‘Second

reading speech: Tax and Superannuation Laws Amendment (2014 Measures No. 7)

Bill 2014, Excess Exploration Credit Tax Bill 2014’, House of

Representatives, Debates, 24 February 2015, p. 1184. See also T Hammond,

Delivering

a stable policy environment: Labor’s approach to the resources sector,

speech delivered to the AMEC Convention 2017, 7 June 2017.

[18]. P

Whish-Wilson, ‘Second

reading speech: Tax and Superannuation Laws Amendment (2014 Measures No. 7)

Bill 2014, Excess Exploration Credit Tax Bill 2014’, Senate, Debates,

3 March 2015, p. 943.

[19]. Australia,

Senate, Journals,

80, 2014–15, 3 March 2015, p. 1026. The effect of the amendments would have

entirely removed the provisions relating to the EDI.

[20]. See

below for further information, but also see, for example, A Hobbs, Exploration

incentive axed for 2018 media release, 11 May 2017.

[21]. Martin,

‘$100m

mining boost’, op. cit.

[22]. G

Short, Exploration

crucial for the future of mining, media release, 16 October 2017.

[23]. L

Griffiths, ‘Explorer

spend up $1m in SA’, The Adelaide Advertiser, 5 September 2017, p.

29.

[24]. The

Statement of Compatibility with Human Rights can be found at page 39 of the Explanatory

Memorandum to the Bill.

[25]. Parliamentary

Joint Committee on Human Rights, Twelfth

report of the 45th Parliament, 28 November 2017, p. 96.

[26]. See,

for example: Explanatory

Memorandum, Tax and Superannuation Laws Amendment (2014

Measures No. 7) Bill 2014, p. 82; Senate Economics Legislation

Committee, Answers to Questions on Notice, Industry Portfolio, Budget Estimates

2014–15, Question

BI-64; Senate Economics Legislation Committee, Answers to Questions on

Notice, Industry Portfolio, Budget Estimates 2014–15, Question

BI-84.

[27]. J

Lucas, ‘Tax

scheme under review’, The West Australian: Kalgoorlie Miner, 26 May

2016, p. 7.

[28]. Treasury,

FOI disclosures, ‘Exploration

development incentive’, Review of the Exploration Development Incentive,

28 July 2017.

[29]. B

Fitzgerald, ‘Mining

exploration companies say Federal Government “betrayal” will cost jobs in

regional WA and Queensland’, ABC News, 12 May 2017. See also, B

Pearson, Budget

investment focus welcome but reform challenge remains, media release, 9

May 2017.

[30]. Harvey,

‘Feds

throw explorers a bone’, op. cit.

[31]. Ibid.

[32]. Calculation

based on Explanatory

Memorandum, Tax and Superannuation Laws Amendment (2014 Measures No. 7)

Bill 2014, pp. 125–6.

[33]. The

modulation factor is determined by the Commissioner of Taxation so as to ensure

that the total amount of exploration credits created by eligible entities is no

greater than the annual cap of exploration credits that may be issued (see

table 2 for the exploration credit cap amounts).

[34]. K

Henry, J Harmer, J Piggott, H Ridout, and G Smith, Australia's

future tax system: report to the Treasurer, (Henry Tax Review), pt 2,

vol. 1: detailed analysis, [The Treasury], [Canberra], December 2009, p. 177.

[35]. Explanatory

Memorandum, Tax and Superannuation Laws Amendment (2014 Measures No. 7)

Bill 2014, p. 128.

[36]. Ibid.

[37]. Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, p. 44.

[38]. Proposed

section 418-110.

[39]. Proposed

section 418-81 and proposed Subdivision 418DA.

[40]. An

exploration credits allocation is explained below.

[41]. An

income year is defined in section 995-1 of the ITAA 1997.

[42]. Proposed

paragraph 418-80(3)(b). A Farm-in farm-out arrangement is

defined in section 40-1100 of the ITAA 1997.

[43]. Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, p. 28.

[44]. See

above for the explanation of the modulation factor.

[45]. The

decision for amending the timing is explained in: Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, pp. 31–3.

[46]. Although

it should be noted that entities do need to provide these estimates when

applying for an exploration credits allocation under proposed section

418-100.

[47]. Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, p. 44.

[48]. See

proposed subsections 418-70(1) and 418-81(1).

[49]. Proposed

subsection 418-100(2).

[50]. A

discussion about where such a situation may arise is noted in: Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, pp. 21–2.

[51]. Proposed

paragraph 418-101(2)(a).

[52]. Proposed

paragraph 418-101(2)(b).

[53]. Proposed

subsection 418-101(3).

[54]. Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, p. 19.

[55]. Lucas,

‘Tax

scheme under review’, op. cit., p. 7.

[56]. Proposed

subsection 418-102(4).

[57]. Proposed

section 418-104.

[58]. Proposed

subsection 418-111(1).

[59]. Explanatory

Memorandum, Treasury Laws Amendment (Junior Minerals Exploration Incentive)

Bill 2017, p. 27.

[60]. Item

3 amends section 418-150 to reflect the introduction of the complying

exploration credit amount by proposed section 418-151.

[61]. Proposed

section 130-110 as inserted by item 15.

[62]. There

appears to be a small error in the drafting of item 2 of Schedule 2 to the

Bill. The replacement provision is incorrectly identified as table item 12,

rather than table item 14.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth

Coat of Arms, and to the extent that copyright subsists in a third party,

this publication, its logo and front page design are licensed under a Creative Commons

Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and

communicate this work in its current form for all non-commercial purposes, as

long as you attribute the work to the author and abide by the other licence

terms. The work cannot be adapted or modified in any way. Content from this

publication should be attributed in the following way: Author(s), Title of

publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists

in third party quotes it remains with the original owner and permission may

be required to reuse the material.

Inquiries regarding the licence and

any use of the publication are welcome to webmanager@aph.gov.au.

Disclaimer: Bills Digests are prepared to support the work of the Australian Parliament.

They are produced under time and resource constraints and aim to be available

in time for debate in the Chambers. The views expressed in Bills Digests do

not reflect an official position of the Australian Parliamentary Library, nor

do they constitute professional legal opinion. Bills Digests reflect the

relevant legislation as introduced and do not canvass subsequent amendments

or developments. Other sources should be consulted to determine the official

status of the Bill.

Any concerns or complaints should be

directed to the Parliamentary Librarian. Parliamentary Library staff are

available to discuss the contents of publications with Senators and Members

and their staff. To access this service, clients may contact the author or

the Library’s Central Enquiry Point for referral.