Bills Digest no. 69,

2016–17

PDF version [823KB]

Kai Swoboda

Economics Section

2

March 2017

Contents

Purpose of the Bill

Background

Relationship to other recent

superannuation Bills

The superannuation system

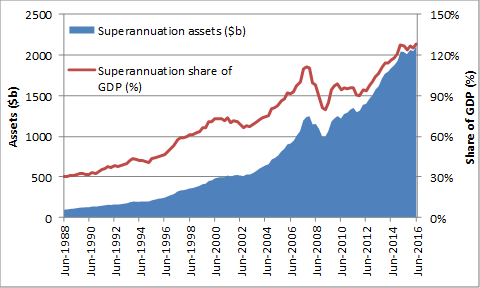

Figure 1: Accumulated superannuation

savings, June 1988 to June 2016

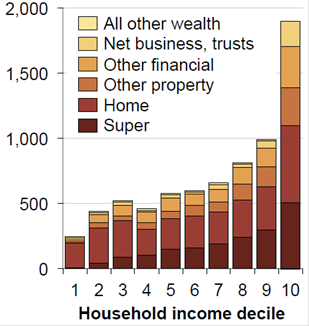

Figure 2: Household mean wealth by

asset class, by household income decile, 2013–14 ($’000)

Interaction between the

superannuation system and Age Pension

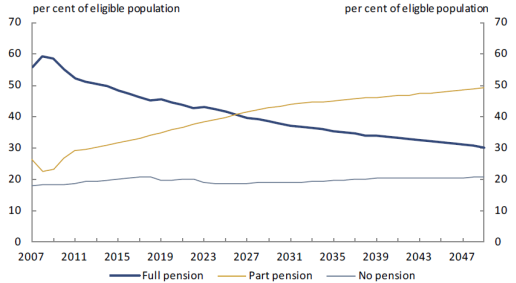

Figure 3: 2012 estimates of the

projected proportion of eligible persons receiving an Age Pension

Policy development

Financial system inquiry

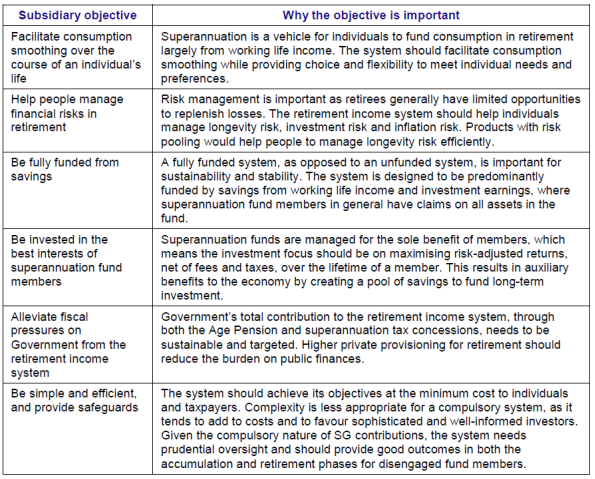

Figure 4: Subsidiary objectives for

the superannuation system suggested by the Financial System Inquiry

Further consultation

Committee consideration

Senate Standing Committee on

Economics

Senate Standing Committee for the

Scrutiny of Bills

Parliamentary Joint Committee on

Human Rights

Policy position of non-government

parties/independents

Australian Labor Party

Other parties/independents

Position of major interest groups

Table 1 Major interest group view

on the objective included in the Bill as put to the Senate Economics Committee

inquiry

Financial implications

Statement of Compatibility with Human

Rights

Key issues and provisions

Why have a legislated objective for

superannuation?

What should the primary objective be?

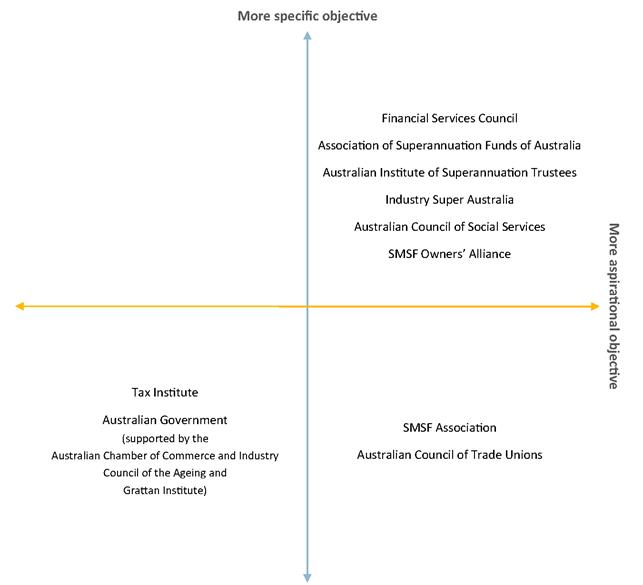

Figure 5: Typology of the ambition

and specificity of selected proposed objectives for the superannuation system

Subsidiary objectives

Objective does not override other

laws

Preparation of statements of

compatibility

Concluding comments

Date introduced: 9

November 2016

House: House of Representatives

Portfolio: Treasury

Commencement: The

first 1 January, 1 April, 1 July or 1 October to occur after Royal

Assent.

Links: The links to the Bill,

its Explanatory Memorandum and second reading speech can be found on the

Bill’s home page, or through the Australian

Parliament website.

When Bills have been passed and have received Royal Assent,

they become Acts, which can be found at the Federal Register of Legislation

website.

All hyperlinks in this Bills Digest are correct as

at March 2017.

Purpose of

the Bill

The purpose of the Superannuation (Objective) Bill 2016

(the Bill) is to establish the primary objective of the superannuation system,

and to provide that subsidiary objectives can be prescribed by regulation. The

Bill will also require the preparation of a ‘statement of compatibility’ for

future Bills or regulations relating to changes in superannuation.

Background

Relationship

to other recent superannuation Bills

The Bill was debated in the House of Representatives in

cognate with the Treasury Laws Amendment (Fair and Sustainable Superannuation)

Bill 2016 and the Superannuation (Excess Transfer Balance Tax) Imposition Bill

2016 in November 2016.[1]

These three Bills are covered by a single Explanatory Memorandum.

When these three Bills were introduced in the Senate on 23 November

2016 the Superannuation (Objective) Bill 2016 was separated from the other two

Bills, both of which passed the Senate on this date.[2]

The

superannuation system

The superannuation system is one part of Australia’s

‘three pillar’ retirement income system. The first pillar is the social

security Age Pension. Compulsory superannuation contributions made under the

superannuation guarantee regime is the second pillar. The third pillar is

additional private savings, often made through additional voluntary

superannuation contributions.[3]

There are a number of key laws that regulate the

superannuation system in Australia. These include:

With the introduction of compulsory superannuation in

1992, many Australians have an interest in superannuation, having contributions

paid on their behalf, making their own contributions, deciding how or where to

invest their superannuation savings or, once eligible to access their

accumulated superannuation, deciding how and when to spend it.

As at 30 June 2014, the Australian Bureau of Statistics

estimated that almost 13 million persons aged 15 and over were covered by

superannuation arrangements, either receiving superannuation contributions or

drawing down a superannuation benefit.[4]

The average superannuation account balance in 2013–14 was $109,000, up from $68,300 a

decade earlier.[5]

The average superannuation balance at the age at which many people are

considering retirement (55–64) in 2013–14 was around $254,700, with a clear

difference between males ($322,000) and females ($180,000).[6]

There have been a large number of changes to the

superannuation system over the last decade or so. A 2013 report commissioned by

the Gillard Government noted that there had been 30 policy changes to the

system since 2005–06 that had impacts of more than $50 million over the

forward estimates and that a large proportion related to contributions, tax and

other concessions.[7]

A review of superannuation policy change by the Parliamentary Library to March 2014

covers these and other changes that were made over this period.[8]

Since the election of the Abbott Government in September 2013, the Parliament

has introduced at least 22 Bills that made or proposed significant changes to

the superannuation system.[9]

As at 30 June 2016, the total value of accumulated superannuation savings in

Australia was around $2.1 trillion.[10]

There has been significant growth in total superannuation savings both in terms

of the value of savings and as a share of GDP since the late 1980s (Figure 1).

Figure 1: accumulated superannuation savings, June 1988 to

June 2016

Source: Parliamentary Library estimates based on Treasury

methodology using data from the Australian

Prudential Regulation Authority (Quarterly superannuation performance, various issues) and Australian Bureau of Statistics

(5206.0—Australian national accounts: national income,

expenditure and product, Sep 2016,

various issues).

The value of superannuation savings is likely to continue

to increase over the medium to long term, with various estimates putting the

value of assets managed by superannuation funds in the order of $6–9 trillion

in the mid‑2030s.[11]

Superannuation assets form an important and growing part

of household wealth. The Australian Bureau of Statistics estimates that

superannuation savings account for around 17 per cent of average household

assets, with property assets (including the value of occupied housing)

accounting for around 56 per cent of household assets.[12]

That said, analysis by the Grattan Institute shows that superannuation assets

held by households are largely held by wealthier households, which also tend to

hold significant wealth outside of the home and superannuation (Figure 2).

Figure 2: household mean wealth by asset class, by

household income decile, 2013–14 ($’000)

Source: J Daley, B Coates and H Parsonage, How

households save for retirement, Background paper, Grattan Institute,

Melbourne, October 2016, p. 5.

Interaction

between the superannuation system and Age Pension

The means testing arrangements that apply to the Age

Pension (which incorporate an income test and an assets test)

provide for an interaction with the superannuation system whereby a person’s

eligibility for the Age Pension, or level of Age Pension payment, are

influenced by the value of a person’s superannuation savings and other assets.

Despite the maturing superannuation system, the proportion

of retirees who will remain eligible for the full Age Pension or a

part-pension, will remain fairly stable over future decades. Estimates prepared

in 2012 included in the 2014 National Commission of Audit report noted that the

share of the eligible population receiving no Age Pension would remain around

20 per cent to 2050, but that there would be a change in the mix between

those eligible for a full and part pension (Figure 3).

Figure 3: 2012 estimates of the projected proportion of eligible persons

receiving an Age Pension

Source: National Commission of Audit (NCOA), Towards

responsible government: the report of the National Commission of Audit: phase one,

NCOA, Canberra, February 2014, p. 81.

Policy

development

Financial

system inquiry

Policy momentum to articulate an objective for the

superannuation system emerged from a recommendation of the Abbott

Government-commissioned Financial System Inquiry (FSI), chaired by David Murray

(December 2013 to December 2014). The Inquiry’s interim report, released on

15 July 2014, noted that there was ‘no legislative or formal

statement of the guiding objectives for the retirement income system’.[13]

In its final report, released on 7 December 2014,

the FSI recommended that the objectives of the superannuation system be

enshrined in legislation and that reporting be required on how policy proposals

are consistent with achieving these objectives over the long term

(recommendation 9).[14]

The rationale for making this recommendation was based on providing a framework

for evaluating the efficiency and effectiveness of the superannuation system

and contributing greater long-term confidence and policy stability through

agreed objectives, against which superannuation policy proposals can be

assessed.[15]

The FSI’s final report also suggested a primary objective

for the superannuation system—‘to provide income in retirement to substitute or

supplement the age pension’.[16]

The final report also included a number of subsidiary objectives, nominating

reasons why the objective was important (Figure 3).

Figure 4: subsidiary objectives for the superannuation system suggested by the

Financial System Inquiry

Source: Financial System Inquiry, Financial

System Inquiry: final report, (Murray report), Treasury, Canberra, November 2014,

p. 95.

In its response to the recommendations of the FSI on 20

October 2015, the Turnbull Government accepted the recommendation to enshrine

the objective of superannuation in legislation, noting that this would ‘help

align policy settings, industry initiative and community expectations’.[17]

The Government response also provided further information about the action to

be taken:

The Government will develop legislation to enshrine the

objective within the superannuation law, where it will serve as a guide to

policy-makers, regulators, industry and the community about superannuation’s

fundamental purpose. The objective will be a valuable yardstick against which

to measure competing superannuation proposals, providing certainty that

measures that do not accord with the objective will be held up to scrutiny. And

it will provide a framework for important discussions Australia needs to have

about fairness, adequacy and dignity in the superannuation system.[18]

Further

consultation

On 9 March 2016, the Government released a discussion

paper, Objective

of superannuation, to provide the basis for further consultation on

establishing an objective for the superannuation system.[19]

In releasing the discussion paper, the Assistant Treasurer, Kelly O’Dwyer

noted:

Having an agreed objective for superannuation is critical to

securing trust and integrity. It is also a means for increasing confidence in

the superannuation system as a whole. ... We want to have a conversation about

the precise wording of the objective—to help frame the broader conversation we

need to have about superannuation.[20]

The Government’s preferred objective, identical to the FSI

recommendation—‘to provide income in retirement to substitute or supplement the

Age Pension’—was re-stated in the consultation paper.[21]

Some of the issues that were to be examined in the consultation process

included:

- views

on the Government’s preferred objective and the implication of any different

preferred objective and

- whether

the objective should be legislated in existing laws (such as the Superannuation

Industry (Supervision) Act 1993) or in a stand-alone Act.[22]

Draft legislation was then released on 7 September

2016 as one part of the Government’s broader superannuation changes.[23]

The draft legislation, which proposed a stand-alone Act in which to express the

objective, included no change to the Government’s preferred objective—‘to

provide income in retirement to substitute or supplement the age pension’.[24]

Committee

consideration

Senate

Standing Committee on Economics

The Bill was referred to the Senate Standing Committee on

Economics for inquiry and report by 14 February 2017.[25]

The Committee’s report, tabled in the Senate on 14 February 2017, included

a majority recommendation that the Bill be passed, with the compliance of

future superannuation reforms with the legislated objective to be periodically

assessed and reported on as part of the Intergenerational Report.[26]

A dissenting report by ALP Senators concluded that the Government should

withdraw the Bill and undertake further consultation.[27]

Senate

Standing Committee for the Scrutiny of Bills

The Senate Standing Committee for the Scrutiny of Bills

had no comments on the Bill.[28]

Parliamentary

Joint Committee on Human Rights

The Parliamentary Joint Committee on Human Rights noted

that the Bill did not raise human rights concerns.[29]

Policy

position of non-government parties/independents

Australian

Labor Party

In April 2013, the Gillard Government, as part of further announcements

for changes to superannuation, responded to concerns about the lack of policy

certainty for superannuation by proposing a ‘Charter of Superannuation Adequacy

and Sustainability’ be developed, which would be overseen by a ‘Council of

Superannuation Custodians’.[30]

This proposal was further developed in a discussion paper

released by the Gillard Government on 9 May 2013.[31]

Issues for consultation included in the discussion paper included the relevant

core principles that could be included in a charter (such as community

confidence, sufficient savings to retire comfortably) and the role of the

custodians.[32]

A policy for legislating a charter of superannuation

remained part of ALP policy prior to the 2013 election under the Rudd

Government, but the policy had not been implemented by the time of the change

of Government in September 2013.[33]

The Australian Labor Party’s (ALP) most recent position on

the Bill, as expressed in the House of Representatives in November 2016, was to

broadly support the intent of legislating an objective, but to not support the

objective in its current form. The shadow treasurer, Chris Bowen, noted:

The Labor Party responded positively to the recommendation in

the Murray review that superannuation should have an agreed, legislated

objective. I have said publicly that it is an idea arresting in its simplicity.

Many people would think that we already had one, but we do not. Superannuation

means different things to different people, in terms of what it is designed to

achieve.

... The objective that the government announced is not

bipartisan and has not been agreed with us and will not meet with our support.

If the government wants to continue those discussions which the minister and I

had before the election, I am very open to that idea. I think we could reach a

bipartisan objective for superannuation. That would be better. But we are not

simply going to sign up to an objective which the government decides and which

we think could be improved and which many in the sector think could be improved.

If you look at the comments on the objective by various groups, ranging from

the Institute of Public Affairs to industry funds, they all have complaints

about the government's proposed objective. We do not think it is fit for

purpose, so we are not just going to blindly vote for something which has not

been the subject of proper consultation and discussion with us and which could

be done so much better.

... I had already outlined previously a proposed objective for

superannuation, but I was not wedded to those particular words. We were not

being obstructionist about it. We could have changed those words, and that is

what the minister and I were discussing; we were getting very close, but, alas,

the Treasurer decided to come in over the top, to intervene and stop those

discussions, in effect, by announcing his own legislation. Well, that is not

legislation that we would support in this House or the other, and I dare say

that that will be the subject of some debate in the other house.[34]

In June 2015, the ALP put forward a specific proposal for

the objective as a ‘starting point’ to see if a bipartisan objective for

superannuation could be agreed to:

Our superannuation system should ensure that as many

Australians as possible have access to the resources for a dignified retirement

without recourse to the full age pension.[35]

At the time of the release of the FSI final report in

December 2014, the ALP broadly supported the recommendation to legislate an

objective of the superannuation system. The shadow treasurer, Chris Bowen,

noted during a doorstop interview at the time:

I will give you some brief comments in response to the

release of the Murray report. Obviously we welcome the release of this report.

It's a substantial and considered report.

... It is important that as far as possible, key matters of

financial regulation be bipartisan.

... I know that the Treasurer has said he will be consulting

widely between now and March with the industry and with consumers. I welcome

that. The Opposition is also obviously planning to consult about the

recommendations of the Murray Inquiry. I particularly welcome the Murray

Inquiry's recommendation in relation to a bipartisan consensus on the

objectives of the superannuation system. Labor established superannuation,

universal superannuation to maximise the retirement incomes of Australians.

That is the objective of Australia's superannuation system and obviously if

that is to be formalised we will participate in that process.[36]

Other

parties/independents

It does not appear that any other non-government parties

or independents have expressed views about the proposals included in the Bill.

Position of

major interest groups

The position of most interest groups has been expressed on

numerous occasions over the past two years in response to the development of

the policy, including:

- submissions

on the FSI interim report[37]

- comments

on the FSI final report[38]

- submissions

on the March 2016 consultation paper[39]

- submissions

on draft legislation released in September 2016[40]

and

- submissions

to the Senate Standing Committee on Economics as part of the Committee’s review

of the Bill.[41]

In general, most major interest groups support the idea

that there should be a legislated objective for the superannuation system. That

said, there are some differences between major interest groups on how this

should be expressed.

The positions of various interest groups in relation to

the objective as specified in the Bill—‘to provide income in retirement to

substitute or supplement the Age Pension’—is outlined in Table 1.

Table 1: major interest group

view on the objective included in the Bill as put to the Senate Economics

Committee inquiry

|

Interest group

|

Supports defining an objective in legislation?

|

Alternative proposal quoted from submission

|

Selected quote from interest group

|

|

Association

of Superannuation Funds of Australia

|

Yes

|

‘The primary objective of the superannuation system is to

provide an adequate income to ensure all Australians achieve a comfortable

standard of living in retirement, supplementing or substituting the Age

Pension.’

(Submission 29, p. 4)

|

‘A concept of adequacy must be incorporated in the

objective. The core purpose of the superannuation system is to deliver income

which affords a dignified and comfortable standard of living in retirement,

over and above what the Age Pension delivers.’

(Submission 29, p. 2)

|

|

Australian

Chamber of Commerce and Industry

|

Yes

|

—

|

‘The Bill is simple and short. ... [The proposed objective]

puts a policy focus on people’s income streams rather than their accumulation

of the supporting assets themselves. The proposed primary objective is

supported.’

(Submission 33, p. 6)

|

|

Australian

Council of Social Services

|

Yes

|

‘The purpose of superannuation is to ensure that as many

people as possible can attain an adequate income in retirement, higher than

the Age Pension, through an acceptable level of compulsory saving, and fair

and sustainable taxation support.’

(Submission 35, p. 2)

|

‘Regrettably, the goal of superannuation has become

confused, with some viewing it (and associated tax subsidies) as a means to

accumulate wealth or pass it on to adult children. Others view superannuation

as an alternative to public funding of essential health and aged care

services. We do not support these views: superannuation, along with the Age

Pension, should ensure that everyone has a minimum adequate income in

retirement.’

(Submission 35, p. 1)

|

|

Australian

Council of Trade Unions

|

Yes

|

‘Superannuation, together with an adequate Aged Pension,

should provide for an Australian worker to maintain his or her standard of

living when he or she retires from the paid workforce or reaches the national

retirement age.’

(Submission 12, Attachment 1, p. 1)

|

‘[The nominated objective] at first instance is not

specific enough in that it deals only with the issue of interaction of

superannuation with the Aged Pension system in a superficial manner and

secondly, sets no aspiration or criteria by which the system might be able to

be judged.’

(Submission 12, Attachment 1, p. 10)

|

|

Australian

Institute of Superannuation Trustees (AIST)

|

Yes

|

‘To provide an adequate income to ensure all Australians

achieve a comfortable standard of living in retirement, supplementing or

substituting the age pension.’

(Submission 31, p. 2)

|

‘AIST strongly supports a legislated Objective of

superannuation (the “Objective”) but in a form and structure that will

genuinely guide the development of future superannuation and retirement

incomes policy: The version proposed in the Bill does not do this.’

(Submission 31, p. 1)

|

|

Chartered

Accountants Australia New Zealand

|

No comment

|

‘To create a national culture of saving and self

sufficiency in retirement.’

(Submission 19, p. 1)

|

‘Chartered Accountants ANZ does not agree that the primary

purpose of superannuation [as proposed in the Bill].’

‘We believe that the purpose of superannuation should

focus on the individual and their family’s needs before the Federal

Government’s financial situation.’

(Submission 19, p. 1)

|

|

Council

on the Ageing (Australia) (COTA)

|

Yes

|

—

|

‘COTA’s own view has developed since April 2016 following

discussion with a wide range of stakeholders and consideration of the debate.

COTA is now prepared to support the objective proposed by the FSI and adopted

by the Government.’

(Submission 42, p. 4)

|

|

Financial

Services Council (FSC)

|

Yes

|

‘To deliver dignity and independence for all Australians

in retirement by providing replacement income that is adequate to provide a

comfortable standard of living.’

(Submission 28, p. 2)

|

‘The FSC supports enacting a clear and concise statement

of the objective of superannuation.’

‘The FSC does not support the proposed objective in the

Bill as it emphasises whether or not a superannuation consumer is reliant on

the age pension.’

(Submission 28, p. 1)

|

|

Grattan

Institute

|

Yes

|

—

|

‘The superannuation system should not aim to fulfil every

objective of the broader retirement incomes system.’

‘[T]he view that superannuation’s objective is to provide

an adequate, or ‘comfortable’ retirement income for all Australians ... could

lead policymakers to force people to save under the Super Guarantee so that

their incomes while working are less than their incomes in retirement.’

(Submission 34, p. 1)

|

|

Industry

Super Australia

|

Yes

|

‘The objective of the superannuation system is to deliver

financial security and dignity in retirement to all Australians by providing

regular income that is, when combined with any public pension and other

sources of income, sufficient to secure a comfortable standard of living by

reasonable community standards.’

(Submission 13, p. 2)

|

‘Seeking to enshrine the objective of superannuation in

law as a means to evaluate the merits of competing proposals affecting our

retirement income system is sound, but the primary objective for

superannuation proposed in the Bill is fatally flawed.’

‘Among other reasons, the primary objective is flawed

because it would not provide a basis for comparing and evaluating future

superannuation policy proposals.’

((Submission 13, p. 1)

|

|

Institute

of Public Affairs

|

No comment

|

‘The objective of the superannuation system is to ensure

that as many Australians as possible take personal responsibility for funding

their own retirement. The Age Pension provides a safety net for those who are

unable to provide for themselves in retirement’.

(Submission 21, p. 9)

|

‘It is of the gravest concern that maximising personal

income in retirement is not deemed to be the primary, or even a subsidiary,

objective of the system.’

‘Given that a bad objective is worse than no objective at

all, the second-best option would be to make no change.’

(Submission 21, p. 9)

|

|

Law

Council of Australia (LCA)

|

No comment

|

Be amended to include ‘providing disablement benefits for

sick or injured members or death benefits to the dependants of deceased

members’ (although the LCA noted this could be ‘addressed in the subsidiary

objectives’).

(Submission 23, pp. 1–2)

|

‘...we note that the subsidiary objectives that are proposed

in the Explanatory Memorandum are not necessarily compatible with the primary

objective. For example, smoothing consumption over the course of a person's

lifetime is not obviously compatible with the provision of income in

retirement to substitute or supplement the age pension. Further, if the

subsidiary objectives include providing death benefits and disability

benefits, among other things, these might also be incompatible with the

primary objective.’ (Submission 23, p. 2)

|

|

SMSF

Association

|

Yes

|

‘To provide income in retirement for a self-sufficient

retirement or to supplement the age pension.’

(Submission 26, p. 3)

|

‘The Association has been a vocal supporter of the

Financial System Inquiry’s recommendation to enshrine the objective of

superannuation in legislation and we are pleased that the Government has

proceeded with this important step that will help provide stability for the

superannuation system.’

(Submission 26, p. 1)

|

|

SMSF

Owners’ Alliance

|

Yes

|

‘The primary objective of the superannuation system is to

give every working Australian the opportunity and encouragement to save

enough so that they can fund an income in retirement that allows them to

maintain to a reasonable degree their living standard after retirement.’

(Submission 7, p. 2)

|

‘The stated objective ... is inadequate and lacks ambition.’

‘It is meaningless to set an objective for superannuation

that does not include even a very general performance goal.’

(Submission 7, p. 1)

|

|

Tax

Institute

|

Yes

|

‘[T]o provide income in retirement and that the primary

objective should endorse all three long-held pillars of income in retirement

- the Age Pension, compulsory superannuation savings, and voluntary

superannuation savings.’

(Submission 10, p. 1)

|

‘Should the primary objective remain as it currently

stands linked solely to the Age Pension, the Bill should not pass.’

(Submission 10, p. 1)

|

|

Women

in Super

|

Yes

|

—

|

‘Women in Super does not support the proposed Primary

Objective of Superannuation. Women in Super believes the objective should

specifically mention men and women and include an aspiration regarding

improving income in retirement.’

(Submission 41, p. 2)

|

Source: Senate Standing Committees on Economics, ‘Superannuation

(Objective) Bill 2016: submissions: submissions received by the Committee’,

Senate Standing Committee on Economics website.

Financial

implications

The Explanatory Memorandum notes that the measure proposed

by the Bill does not have a financial impact.[42]

Statement of Compatibility with Human Rights

As required under Part 3 of the Human Rights (Parliamentary

Scrutiny) Act 2011 (Cth), the Government has assessed the Bill’s

compatibility with the human rights and freedoms recognised or declared in the

international instruments listed in section 3 of that Act. The Government

considers that the Bill is compatible.[43]

Key issues

and provisions

The Explanatory Memorandum contains a summary of each of

the items included in the Bill and readers are referred to pages 25–32 for an

explanation of each provision. Some of the issues related to these provisions are

examined below.

Why have a

legislated objective for superannuation?

The FSI recommendation to legislate a clear objective for

the superannuation system was largely based around concerns of instability in

superannuation policy settings undermining confidence in the system as well as

issues relating to the sustainability of measures that supported the system

(such as tax concessions). The FSI final report noted:

The absence of agreed objectives contributes to short-term ad

hoc policy making. It adds complexity, imposes unnecessary costs on

superannuation funds and their members, and undermines long-term confidence in

the system.

... The lack of an agreed policy framework also increases the

cost of the superannuation system to Government because tax concessions are not

being efficiently targeted at meeting the system’s objectives.[44]

The ALP’s 2013 policy announcements for a ‘Charter of

Superannuation Adequacy and Sustainability’ overseen by a ‘Council of

Superannuation Guardians’ were largely driven by similar concerns.

As noted previously, most superannuation industry groups

support the Government’s broad objective of legislating an objective for the

superannuation system. The reasons given by groups are numerous, but include

issues such as:

- providing

for policy stability

- providing

a basis to assess the need and extent of policy change and

- contributing

to long-term confidence in the system.[45]

What should

the primary objective be?

Clauses 4 and 5 define the term ‘primary

objective of the superannuation system’ as:

To provide income in retirement to substitute or supplement

the age pension.

There are a number of different views as to how the

objective for the superannuation system should be worded. These differences

largely relate to the level of ambition of the system and the degree of

specificity in outlining the objective.

A typology of alternate formulations of the objective preferred

by major interest groups, as assessed by the Parliamentary Library, is set out

in Figure 4 below.

Figure 5: typology of the ambition and specificity of

selected proposed objectives for the superannuation system

Note: The Institute of Public Affairs’ and the Chartered

Accountants Australia and New Zealand’s alternative proposals for the objective

have been excluded from this figure. Each proposes a relatively ambitious

objective that is framed around self-sufficiency and personal responsibility.

Source: Parliamentary Library analysis.

In broad terms, the Government’s proposed objective has a

lower level of ambition and a low degree of specificity relative to other

formulations of the objective.

Some groups, such as the SMSF Owners’ Alliance, consider

the proposed objective as ‘meaningless’, noting:

Defining superannuation as merely to “substitute or

supplement” the age pension sets no benchmark for the performance of

superannuation. It is meaningless to set an objective for superannuation that

does not include even a very general performance goal.[46]

Those major interest groups supporting the Government’s

proposed objective, including the Grattan Institute, and the Council on the

Ageing (Australia), largely do so because they consider that the more ambitious

and specific formulations of the objective may lead to higher levels of tax

concessions or other forms of support than may be required. In its submission

to the Senate Economics Committee inquiry into the Bill, the Grattan Institute

note:

The Committee should reject the view that superannuation’s

objective is to provide an adequate, or ‘comfortable’ retirement income for all

Australians. This view could lead policymakers to force people to save under

the Super Guarantee so that their incomes while working are less than their

incomes in retirement.

This view misleads, because the Age Pension and Rent

Assistance are better tools than super to provide an adequate retirement for

those on low incomes. And this view would support maintaining generous tax

breaks, at substantial budgetary cost, for those whose retirement will be

comfortable without them.[47]

Subsidiary

objectives

One difference between the Bill and the draft legislation

is that the draft legislation was silent on any provisions relating to

subsidiary objectives.[48]

Clause 5 of the Bill includes a provision that will

allow the ‘subsidiary objectives of the superannuation system’ to be prescribed

in regulations. The Explanatory Memorandum notes that the proposed subsidiary

objectives are to:

- facilitate

consumption smoothing over the course of an individual’s life

- manage

risks in retirement

- be

invested in the best interests of superannuation fund members

- alleviate

fiscal pressures on Government from the retirement income system and

- be

simple, efficient and provide safeguards.[49]

These proposed subsidiary objectives largely replicate

those proposed in the FSI final report, with the exception that the FSI

proposal for a subsidiary objective ‘be fully funded from savings’ (which would

align with the Institute of Public Affairs’ proposed primary objective) is not

included (see Table 1).

There are a broad range of views about the appropriateness

of these nominated subsidiary objectives and many groups have proposed others.

These include areas such as:

- adequacy

of savings for women[50]

- best

interests of members, investment, national savings and financial stability[51]

- provision

of insurance.[52]

Objective

does not override other laws

The Bill does not have any effect on the interpretation of

any other laws. This is made clear in subclause 5(3), which has the

effect that the primary and secondary objectives do not impact on the meaning

of other laws.

Preparation

of statements of compatibility

Clause 6 of the Bill introduces requirements for a

‘statement of compatibility’ to be prepared by a Member of Parliament who

introduces a Bill into the Parliament relating to superannuation. Such a

statement must include an assessment of whether the Bill is compatible with the

primary and subsidiary objectives of the superannuation system, as set out in

the Bill and accompanying regulations.

The idea of a requirement for a ‘statement of compatibility’

to be prepared alongside legislation to the Parliament about the impacts of a

proposed law on a specific policy area was first introduced in 2011. At this

time, the Human

Rights (Parliamentary Scrutiny) Act 2011 required statement of

compatibility must include an assessment of whether the Bill is compatible with

human rights. Clauses 6 and 7 of the Bill are largely modelled on these

requirements.[53]

As part of the broader package of measures that were legislated

in November 2016, the Government included in the Explanatory Memorandum for the

Bills an example of what such a statement of compatibility would cover, based

on the proposed primary objective and subsidiary objectives.[54]

The statement is similar in form to a typical statement of compatibility with

human rights. The conclusion made by the Government in this statement is

reproduced below:

The measures in the [Treasury Laws Amendment (Fair and

Sustainable Superannuation) Bill 2016] improve the sustainability, flexibility

and integrity of the superannuation system. The measures better target

superannuation tax concessions to those who need them most, enhance flexibility

and choice in saving for retirement and managing income in retirement, and

improve the integrity of the superannuation system ... This is consistent with

the primary objective of the superannuation system, which is to provide income

in retirement to substitute or supplement the age pension.

The measures are also compatible with the subsidiary

objectives of the superannuation system. The measures increase the ability of

many people to facilitate consumption smoothing over their lifetime and improve

their superannuation savings. The measures as a whole also alleviate fiscal

pressures on government from the retirement income system by better targeting

the tax concessions and increasing superannuation savings which ultimately

reduce reliance on the age pension, though a number of the flexibility measures

do have a fiscal cost. Removing barriers to innovative new products will also

increase the ability of members to manage risks in retirement. While a number

of the measures do involve complexity, this arises from the need to target

assistance and tax concessions, to manage fiscal costs. The measures also do

not raise concerns in relation to being inconsistent with the best interest of

members.[55]

The wording adopted for the primary and subsidiary

objectives will form the basis of an assessment of compatibility and provide another

opportunity for the Government to argue about the merits of a superannuation

policy change. However, it could be that increasing or decreasing a key

parameter impacting on the system, such as a tax concession or mandatory

contribution percentage, could both be found to be compatible with the

objective. For example, Industry Super Australia noted in its submission to the

Senate Economics Committee’s inquiry into the Bill:

Among other reasons, the primary objective is flawed because

it would not provide a basis for comparing and evaluating future superannuation

policy proposals. For example, the proposed objective would provide no guidance

in relation to competing proposals to increase—or to decrease—the

Superannuation Guarantee: both proposals would be consistent with the proposed

objective, because superannuation would continue to provide income in

retirement to supplement or substitute the Age Pension. Eliminating all tax

concessions, or increasing the tax concessions in superannuation, would both be

consistent with the objective.[56]

Concluding comments

The proposed objective for the superannuation system—to provide

income in retirement to substitute or supplement the age pension—is supported

by some groups but is generally seen by others to lack ambition or not be

sufficiently specific to provide guidance or assessment about future policy

decisions.

[1]. C

Bowen, ‘Second

reading speech: Superannuation (Objective) Bill 2016, Treasury Laws Amendment

(Fair and Sustainable Superannuation) Bill 2016, Superannuation (Excess

Transfer Balance Tax) Imposition Bill 2016’, House of Representatives, Debates,

22 November 2016, p. 3875.

[2]. Australia,

Senate, Journals,

18, 2016, 23 November 2016, pp. 572–575, 585.

[3]. Australia’s

Future Tax System Review, Australia’s

future tax system: the retirement income system: report on strategic issues,

(Henry Tax Review), Commonwealth of Australia, May 2009, p. 8.

[4]. Australian Bureau of Statistics

(ABS), Household

income and wealth, Australia, 2013–14, Superannuation of persons:

superannuation coverage, age and sex of persons, 2003–04 to 2013–14, data

cube 24: table 24.1, cat. no. 6523.0, ABS, Canberra, 2 August 2016.

[5]. Ibid.,

Superannuation account balances, persons with superannuation accounts, age

and sex, 2003–04 to 2013–14, table 24.3.

[6]. Ibid.

[7]. Treasury,

A

super charter: fewer changes, better outcomes: a report to the Treasurer and

Minister Assisting for Financial Services and Superannuation, Treasury,

Canberra, 2013, pp. 16–18.

[8]. K

Swoboda, Major

superannuation and retirement income changes in Australia: a chronology,

Research paper, 2013–14, Parliamentary Library, Canberra,

11 March 2014.

[9]. This

is based on the author’s assessment of measures included in the 55 Bills

introduced in the Parliament since November 2013 that included the subject

‘superannuation’.

[10]. Australian

Prudential Regulation Authority (APRA), Statistics:

quarterly superannuation performance, June 2016, APRA, Sydney, 23 August 2016,

p. 7.

[11]. R

Maddock, Superannuation

asset allocations and growth projections, Financial Services Council,

Monash University and Victoria University, 17 February 2014,

p. 6.

[12]. Australian

Bureau of Statistics (ABS), Household

income and wealth, Australia, 2013–14, Income, wealth and debt: low

economic resource households, household assets and liabilities, data cube

3, table 3.7, cat. no. 6523.0, ABS, Canberra,

4 September 2015.

[13]. Financial

System Inquiry (FSI), Financial

System Inquiry: interim report, Treasury, Canberra, July 2014,

p. 2–97.

[14]. FSI,

Financial

System Inquiry: final report, (Murray Report), Treasury, Canberra,

November 2014, p. 95.

[15]. Ibid.,

p. 96.

[16]. Ibid.,

p. 95.

[17]. Australian

Government, Improving

Australia’s financial system: Government response to the Financial System

Inquiry, Treasury, Canberra, 20 October 2015, p. 5.

[18]. Ibid.,

p. 12.

[19]. Treasury,

Objective

of superannuation: discussion paper, Treasury, Canberra,

9 March 2016.

[20]. K

O’Dwyer (Assistant Treasurer), Consultation

on the objective of superannuation, media release, 9 March 2016.

[21]. Ibid.,

p. 2.

[22]. Ibid.,

p. 3

[23]. Treasury,

‘Superannuation

reform package’, Treasury website, September 2016.

[24]. Superannuation

(Objective) Bill 2016: exposure draft, clause 5.

[25]. Senate

Standing Committee on Economics, ‘Superannuation

(Objective) Bill 2016: about this inquiry’, Senate Standing Committee on

Economics website, [November 2016].

[26]. Senate

Standing Committee on Economics, Superannuation

(Objective) Bill 2016 [Provisions], The Senate, 14 February 2017,

p. 19.

[27]. Ibid.,

p. 23.

[28]. Senate

Standing Committee for the Scrutiny of Bills, Alert

digest, 9, 2016, The Senate, 23 November 2016, p. 12.

[29]. Parliamentary

Joint Committee on Human Rights, Human

rights scrutiny report, Report, 9, 2016, 22 November 2016, p. 39.

[30]. W

Swan (Treasurer) and B Shorten (Minister for Financial Services and

Superannuation), Reforms

to make the superannuation system fairer, joint media release,

5 April 2013.

[31]. Treasury,

Charter

of Superannuation Adequacy and Sustainability and Council of Superannuation

Custodians, Discussion paper, 9 May 2013.

[32]. Ibid.

[33]. C

Bowen (Treasurer), Transcript

of speech to the Financial Services Council: Sydney, 23 August

2013, pp. 6–7.

[34]. C

Bowen, ‘Second

reading speech: Superannuation (Objective) Bill 2016, Treasury Laws Amendment

(Fair and Sustainable Superannuation) Bill 2016, Superannuation (Excess

Transfer Balance Tax) Imposition Bill 2016’, House of Representatives, Debates,

22 November 2016, p. 3875.

[35]. C

Bowen, Address

to the Committee for Sustainable Retirement Incomes: speech, Canberra,

3 June 2016.

[36]. C

Bowen, Transcript

of doorstop interview: Sydney Commonwealth Parliamentary Offices: 7 December

2014: Financial Systems Inquiry; Government implosion over PM’s PPL signature

policy; MySuper, 7 December 2014.

[37]. Submissions

on the FSI interim report: FSI, ‘Consultation

and submissions: second round submissions’, FSI website, [2014].

[38]. Comments

and statements by major interest groups are not consolidated and were generally

made via media release or as statements in media reports at the time. See for

example, Association of Superannuation Funds of Australia, Government

response to FSI: considered approach required, media release,

20 October 2015 and J Mather, ‘Super

is not for “excessive wealth”’, Australian Financial Review,

22 October 2015, p. 10.

[39]. Treasury,

‘Objective

of superannuation: submissions’, Treasury website, 2016.

[40]. Treasury,

‘Superannuation

reform package: published responses’, Treasury website.

[41]. Senate

Standing Committees on Economics, ‘Superannuation

(Objective) Bill 2016: submissions: submissions received by the Committee’,

Senate Standing Committee on Economics website.

[42]. Explanatory

Memorandum, Superannuation (Objective) Bill 2016, p. 11.

[43]. The

Statement of Compatibility with Human Rights can be found at pages 33–34 of the

Explanatory Memorandum to the Bill.

[44]. FSI,

Financial

System Inquiry: final report, November 2014, pp. 96–97.

[45]. R

Chomik and J Piggott, ‘Superannuation

and retirement incomes’, Jassa, no. 1, 2015, pp. 43–49.

[46]. SMSF

Owners’ Alliance, Submission

to the Senate Standing Committees on Economics, Inquiry into the Superannuation

(Objective) Bill 2016, submission no. 7, 6 December 2016,

p. 1.

[47]. Grattan

Institute, Submission

to the Senate Standing Committees on Economics, Inquiry into the

Superannuation (Objective) Bill 2016, submission no. 34,

23 December 2016, p. 1.

[48]. Superannuation

(Objective) Bill 2016: exposure draft, clause 5.

[49]. Explanatory

Memorandum, op. cit., p. 27.

[50]. Women

in Super, Submission

to the Senate Standing Committees on Economics, Inquiry into the

Superannuation (Objective) Bill 2016, submission no. 41,

31 December 2016, p. 8.

[51]. Industry

Super Australia, Submission to the Senate Standing Committees on Economics, Inquiry

into the Superannuation (Objective) Bill 2016, submission no. 13,

4 April 2016, Attachment 1,

p. 17.

[52]. Mercer,

Submission

to the Senate Standing Committees on Economics, Inquiry into the Superannuation

(Objective) Bill 2016, submission no. 20, 21 December 2016,

p. 8.

[53]. Part

3, Human Rights

(Parliamentary Scrutiny) Act 2011.

[54]. Explanatory

Memorandum, op. cit., pp. 263–269.

[55]. Ibid.,

pp. 267–268.

[56]. Industry

Super Australia, Submission

to the Senate Standing Committees on Economics, Inquiry into the Superannuation

(Objective) Bill 2016, submission no. 13, 16 December 2016,

p. 1.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

Disclaimer: Bills Digests are prepared to support the work of the Australian Parliament. They are produced under time and resource constraints and aim to be available in time for debate in the Chambers. The views expressed in Bills Digests do not reflect an official position of the Australian Parliamentary Library, nor do they constitute professional legal opinion. Bills Digests reflect the relevant legislation as introduced and do not canvass subsequent amendments or developments. Other sources should be consulted to determine the official status of the Bill.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.