Bills Digest no. 5 2015–16

PDF version [766KB]

WARNING: This Digest was prepared for debate. It reflects the legislation as introduced and does not canvass subsequent amendments. This Digest does not have any official legal status. Other sources should be consulted to determine the subsequent official status of the Bill.

Kai Swoboda

Economics Section

10 August 2015

Contents

The Bills

Digest at a glance

Purpose of

the Bill

Structure of

the Bill

Background

Committee

consideration

Policy

position of non-government parties/independents

Position of

major interest groups

Financial

implications

Statement of

Compatibility with Human Rights

Key issues

and provisions

Date introduced: 25

June 2015

House: House of

Representatives

Portfolio: Defence

Commencement: On Royal

Assent.

Links: The links to the Bill,

its Explanatory Memorandum and second reading speech can be found on the

Bill’s home page, or through the Australian

Parliament website.

When Bills have been passed and have received Royal Assent, they

become Acts, which can be found at the ComLaw

website.

Purpose of the Bill

-

The Australian Defence Force Superannuation Bill 2015 is one Bill

in a package of three Bills that establish a new superannuation scheme for

members of the Australian Defence Force (ADF) who join the ADF after

1 July 2016. The proposed new superannuation scheme—Australian Defence

Force Superannuation Scheme (or ADF Super)—will replace the existing Military

Superannuation and Benefits Scheme (MSBS).

- This

Bill, and the Defence Legislation Amendment (Superannuation and ADF Cover) Bill

2015, include the necessary provisions in relation to closing the MSBS and

establishing ADF Super.

-

As

the MSBS scheme also includes incapacity and death cover arrangements, these

elements are being separated from the ADF Super scheme by the Australian

Defence Force Cover Bill 2015, which is designed to be consistent with the

death and disability benefits provided under the MSBS scheme.

Background

-

The MSBS scheme is a defined benefit superannuation scheme that consists

of a member funded component (from employee contributions) as well as a defined

benefit that in broad terms is based on years of service and final salary. In

contrast, private sector employees and more recently engaged public sector

employees are generally members of accumulation superannuation schemes—where

the final benefit is related to the value of employer and employee

contributions as well as associated earnings over time.

-

Some features of the MSBS, which generally provides a greater

benefit for longer serving ADF members, may be incompatible with general

superannuation arrangements and penalise members who serve for shorter periods.

-

A 2007 review of military superannuation arrangements recommended

that the MSBS scheme be closed and replaced by an ADF-specific accumulation

superannuation scheme.

Key elements

-

This Bill contains the arrangements for the establishment of the

Trust Deed for ADF Super, the administration of the scheme by the Commonwealth

Superannuation Corporation, eligibility requirements for the scheme and other

provisions relating to the variation of the Trust Deed and legislation relating

to ADF Super.

-

Although not a provision of this Bill, the proposed employer

contribution rate of 16.4 per cent is an important element in assessing

whether a new superannuation scheme is desirable, balanced against the other

changes.

Stakeholder concerns

-

While organisations representing current and former ADF personnel

support the establishment of a fully funded accumulation scheme for ADF

members, they are opposed to some of the specific elements of the proposed

scheme, such as the employer contribution rate and the exclusion of part-time

reservists.

-

These organisations were generally opposed to the closure of the

MSBS scheme in 2008 when the Rudd and Gillard Governments were considering the

recommendations of the 2007 review.

Key issues

-

The defined benefit nature of the MSBS leads to the Commonwealth

having an unfunded future liability. There has been a move away from defined

benefit schemes in recent time to reduce risks to the budget of the unfunded

liabilities generated by such arrangements. The avoidance of such risks is an

important consideration in the decision to close the MSBS scheme.

-

Another threshold issue is whether the proposed ADF Super scheme,

which will apply to ADF personnel who commence from 1 July 2016 and allow some

existing personnel to transfer part of their accrued superannuation savings,

provides for improved superannuation arrangements as a whole.

The main purpose of the Bill is to establish arrangements

for a new superannuation scheme from 1 July 2016—to be known as the

Australian Defence Force Superannuation Scheme (or ADF Super)—for certain

members of the Australian Defence Force (ADF). The Bill also provides that the

new scheme is to be administered and managed by the Commonwealth Superannuation

Corporation (CSC).

The Australian Defence Force Superannuation Bill 2015 is

one Bill in a package of three Bills related to the establishment of ADF Super.

As the existing superannuation scheme—the Military Superannuation Benefits

Scheme (MSBS)—also includes incapacity and death cover arrangements, these

elements are being separated from the ADF Super scheme. The key elements of

each Bill are shown in Table 1.

Table 1: Key elements of the package of Bills relating to

the establishment of the Australian Defence Force Superannuation Scheme

|

Bill

|

Key elements

|

|

Australian

Defence Force Superannuation Bill 2015[1]

|

- Outlines

eligibility for a new superannuation scheme to be known as the Australian

Defence Force Superannuation Scheme (or ADF Super).

- Provides

for ADF Super to be established under a trust deed (a legislative instrument

that is not disallowable).

- Specifies

that the Commonwealth Superannuation Corporation will be the trustee for ADF

Super.

|

|

Defence

Legislation Amendment (Superannuation and ADF Cover) Bill 2015[2]

|

- Specifies

the employer contribution rate of 16.4 per cent for ADF Super as an

amendment to the Defence Act 1903.

- Includes

consequential and transitional arrangements involved with establishing ADF

Super.

- Introduces

flexible service conditions for permanent members of the ADF.

|

|

Australian

Defence Force Cover Bill 2015[3]

|

- Introduces

standalone statutory death and invalidity cover (ADF Cover) for members of

ADF Super and those ADF personnel who would have been members of ADF Super

but for choosing their own superannuation fund.

|

The Bill is divided into a number of parts:

-

Part 1 provides that the Act is to commence on the day of Royal

Assent, provides a simplified outline of the ADF Super scheme, and includes

various definitions

-

Part 2 includes the requirement for the relevant Minister to

establish the Trust Deed for the ADF Super scheme, which may include

requirements to allow the splitting of superannuation interests for family law

purposes

-

Part 3 covers the eligibility requirements for the ADF Super

scheme, including how ADF personnel employed as at 30 June 2016 will be

eligible to participate in the scheme

-

Part 4 provides for the administration and management of ADF

Super by the CSC and

-

Part 5 covers various matters including those who are subject to

the Trust Deed, termination and variation of rights by later legislation, and the

making of certain rules by the Minister.

Existing superannuation

arrangements

Existing members of the ADF are generally members of one of

two superannuation schemes:

- the

Defence Force Retirement and Death Benefits Scheme (DFRDB) — established in

1973 and closed to new members from 30 September 2001 or

- the

MSBS (also referred to as ‘Military Super’) — which opened to new members from

1 October 1991.

A key feature of each of these two schemes is that rather

than providing a superannuation benefit that is related to the value of

employer and employee contributions as well as associated earnings over time,

they provide a benefit that consists of a member funded component (from

employee contributions) as well as a defined benefit that in broad terms is

based on years of service and final salary. These two schemes also include

arrangements for superannuation payments to be made in cases of incapacity and

death.

The MSBS is established under the Military Superannuation

and Benefits Act 1991.[4]

As at 30 June 2014, there were around 56,500 contributing members,

96,000 ‘preservers’ (who do not contribute to their scheme because they

are no longer ADF members) and 11,000 pensioners in the MSBS.[5]

The key features of the MSBS include:

-

member contributions — the basic contribution rate is five per

cent of salary, including higher duties and the qualification and skills

element of certain environmental allowances. Members can contribute up to ten per

cent of their super salary. Ancillary contributions are also accepted,

including both pre- and post-tax contributions such as additional personal,

salary sacrifice and spouse contributions. These form the ‘member component’ of

the benefits paid from the scheme

-

investment choice — members can make limited choices about the

investment strategy for the member component

-

benefits on or after age 55 — a member financed benefit equal to

member contributions accumulated with fund earnings plus an employer financed

lump sum benefit based on a multiple of final average salary and total service.

On age retirement, the employer financed lump sum may be wholly or partially

converted to a CPI-indexed pension

-

resignation benefit (before age 55) —on resignation, the member

would be entitled to an immediate lump sum of the member component and a

preserved employer benefit. The preserved employer benefit is paid at age 55,

or earlier in certain circumstances. The unfunded portion of the preserved employer

benefit is increased in line with movements in the CPI between the date of exit

and the date of payment. When this benefit is paid the member has the same

pension option as applies to retirement benefits and

-

invalidity benefit paid depending on the level of assessed

incapacity (60 per cent or more, 30 per cent to 59 per cent and

less than 30 per cent).[6]

Policy development

2007 review of military

superannuation

In February 2007, the then Minister Assisting the Minister

for Defence in the Howard Government announced a review of military

superannuation arrangements.[7]

The broader context to the review included concerns about the tax treatment of

military superannuation payments following changes to broader superannuation

taxes announced in the 2006 Budget, improving recruitment and retention to the

ADF and growing unfunded liabilities associated with the MSBS.[8]

In announcing the review, the Minister noted:

Superannuation benefits are a key component of the total

remuneration package for Australian Defence Force members and the overall aim

of the independent review is to ensure that the military schemes continue to

meet the needs of our people and reflect contemporary superannuation standards

in a sustainable manner.

... The last review of military superannuation was undertaken

in 1990 and since then, there have been many changes in the wider community

superannuation environment and in the demographics and career aspirations of

ADF members.[9]

The review team, chaired by Mr Andrew Podger (and

therefore sometimes cited as the Podger Review), delivered its report to the

Minister on 31 July 2007.[10]

The report was released by the newly elected Rudd Government in December 2007.[11]

The Podger Review established its own principles to guide

the assessment of the MSBS, which included flexibility to meet individual

member preferences and to respond to future changes to the broader

superannuation or ADF environments, support retention, adequacy over both short-term

and long-term, and financial sustainability for the Government over the long

term.[12]

The key findings of the Podger Review were that while the

MSBS compared ‘reasonably well’ with most overseas military schemes and with

other Australian schemes for uniformed bodies, it ‘falls well short’ of best

practice contemporary superannuation and does not contribute significantly

towards recruitment and retention.[13]

The review recommended that the MSBS be closed and the establishment of a new

scheme, which would have the following features:

-

individual accumulation accounts with ‘generous employer

contributions’ increasing with length of service at 16 per cent (first six

years), 23 per cent (next nine years of completed service) and 28 per cent

(after 15 years) of superannuable salary

-

flexibility for members to set their own contribution rate, if

any (with a default rate of five per cent from after tax salary), select their

investment risk profile and to make contributions following separation from the

ADF

-

members to have choice over the superannuation scheme into which

their contributions will be invested whilst maintaining membership of the

mandated death and disability benefits under the new scheme

-

options for members with 15 years or more service, from age 55,

to purchase indexed pensions (with a choice of indexation factors, at an

unsubsidised price determined periodically by a Government-approved actuary)

and/or an account based pension and

-

a range of options for the way members can access their benefits

after preservation age, including through an account-based pension. This would

allow members to take advantage of the Government’s transition to retirement

provisions.[14]

Following the release of the report and a further period

of consultation by the Rudd Government, veterans groups were opposed to the

recommendations for a new scheme as proposed by the Podger Review.[15]

2013 National Commission of Audit

On 22 October 2013, the Coalition Government

announced the establishment of the National Commission of Audit (NCOA).[16]

Included in the terms of reference for the NCOA was a review of ‘the long-term

sustainability of the budget position, identifying key policy areas where

trends in expenses and revenue pose risks to the structural integrity of the

budget’.[17]

This was relevant to the MSBS due to its unfunded nature.

In its report released in February 2014, the NCOA noted

that the MSBS was now the only major Commonwealth superannuation scheme with

unfunded defined benefits that remains open to new members, and was ‘generating

uncapped and increasing unfunded liabilities’ to be paid for by future

generations.[18]

In recommending closure of the MSBS, the NCOA noted:

Steps should be taken now to better manage [liabilities]. Any

changes must, however, recognise the obligation Australia has to look after our

serving personnel. The Commission recommends that the Military Superannuation

and Benefits Scheme be closed to new members and replaced by an accumulation

scheme for new Australian Defence Force personnel. The new scheme should be

designed in a way that recognises the special contribution these Australians

make to the defence of the nation. Any new scheme should continue to provide a

defined benefit where a member dies or is medically discharged from the Defence

Force. This death and disability element will complement the accumulation

component of the scheme.[19]

2014–15 Budget announcement

As part of the 2014–15 Budget, delivered on 13 May

2014, the Government announced that from 1 July 2016, a new accumulation

scheme for new members of the ADF would be established and that the MSBS would

be closed to new members from this date.[20]

The main media release announcing the change related mainly to the impact on

ADF members, not mentioning a policy rationale based on reducing future

unfunded liabilities. However, in a separate 2014–15 Budget media release

relating to the status of the NCOA recommendations, the Minister for Finance

and Treasurer noted in relation to the recommendation to close the MSBS and

replace it with an accumulation scheme that ‘[s]tructural reforms to manage

unfunded superannuation liabilities are in the 2014–15 Budget’.[21]

The Budget Papers noted that the introduction of new fully

funded arrangements was estimated to reduce the Government’s unfunded superannuation

liability by $126 billion by 2050.[22]

Some detailed elements that were included in the budget announcement were:

-

no change to the superannuation arrangements for existing MSBS

members, but they may elect to be covered by the new arrangements

-

a 15.4 per cent contribution rate to a member’s chosen fund,

with the rate increasing to 18 per cent ‘for any period in which members are

serving in war-like operations’ and

-

serving ADF personnel covered by the new arrangements will also

be covered by statutory death and disability arrangements consistent with the

defined benefit arrangement currently in place under the MSBS.[23]

At the time of writing, the Bill had not been referred to a

committee. Also, no Parliamentary Committees that report on the provisions of

Bills, including the Senate Standing Committee for the Scrutiny of Bills or the

Parliamentary Joint Committee on Human Rights had reported on the Bill or

elements of the Bill.

Australian Labor Party

The Australian Labor Party (ALP) has not indicated that it

supports the proposed arrangements as a whole. In June 2015, the Shadow Parliamentary

Secretary for Defence noted that ‘Labor will now carefully consider the

legislation ... to ensure it achieves the best possible outcome for all ADF

personnel’.[24]

When the ALP released the Podger Review of military

superannuation arrangements on 24 December 2007, the then Minister for

Defence Science and Personnel noted that it had been a pre-election commitment

to publicly release the review report within four weeks of forming government

and that this commitment had been met.[25]

In releasing the review report, the Minister foreshadowed a period of further

consultation that would continue until 31 March 2008.[26]

As noted above, ex-service organisations were opposed to

the recommendations of the review for a new accumulation scheme.[27]

A further one and a half years after the release of the report by the Rudd

Government, the Shadow Minister for Defence Science, Personnel and Assisting

Shadow Minister for Defence noted that the Government had yet to release its

response to the review.[28]

The shadow spokesman noted that:

Since the findings of the review were made public on the 24

December 2007 we haven’t heard anything from the Rudd Labor Government ... ADF

members, both past and present, deserve to know what the government is going to

do with their superannuation.[29]

On 2 June 2010, the Minister for Defence Personnel

confirmed in the House of Representatives that the Government would not be

implementing the recommendations of the review, noting that:

[T]he overwhelming response through that consultation process

was that the military community and the ex‑services community did not

want Podger because the changes involved were not in line with what they saw as

the best way to maintain the uniqueness of military service and a proper

beneficial system for military superannuants into the future.

That produced a problem for this government. We had a report

from the previous government outlining a set of recommendations which clearly,

once we consulted, the community did not want.[30]

Other parties/independents

At the time of writing, the views of independent Members and

Senators and other parties on the proposals included in the Bill have not been publicly

expressed.

The Defence Force Welfare Association (DFWA) broadly supports

the closure of the MSBS and the establishment of an accumulation scheme for ADF

members.[31]

However, the DFWA has expressed some concerns with aspects of the proposed

arrangements including:

- it

does not adequately recognise the unique nature of military service—‘the ADF is

not the public service’ and the proposed contribution rate of 15.4 per

cent is the same as the public service superannuation scheme and

- strongly

supports superannuation contribution for service in the ADF Reserves, with no

offsetting provisions —‘part-time ADF members should not be discriminated

against’.[32]

The Alliance of Defence Service Organisations—whose

membership includes the DFWA and a number of other organisations—considered at

the time of 2014–15 Budget that the proposed employer contribution was ‘inadequate’

and that it would lobby for an increased percentage ‘that recognises the

uniqueness of the military profession’.[33]

The Returned & Services League of Australia (RSL) supports

the establishment of a separate superannuation scheme for ADF members and for a

fully funded scheme that will allow portability of superannuation entitlements

when members of the ADF finish their service.[34]

Specific issues highlighted by the RSL included not supporting two-tier

contribution rates (15.4 per cent for non-warlike service and 18 per

cent for periods of war‑like service) and a view that governance

arrangements should be also separated out from other public sector

superannuation schemes.

Just prior to the 2014–15 Budget announcement in response

to the NCOA recommendations, the Australian Defence Association warned that the

proposed changes ‘could affect the Defence Force’s ability to recruit and

retain personnel’.[35]

In commenting on the proposal following the 2014–15 Budget, the Association

noted:

I think defence welfare groups have every right to feel let

down by the inclusion of this in the budget when assurances were given ahead of

the budget that it would not be there and groups would be consulted about any changes.[36]

The Explanatory Memorandum for the Bill does not include

an estimate for the financial impact of the changed arrangements, noting that

‘the establishment of ADF Super is a 2014/15 Budget Measure’.[37]

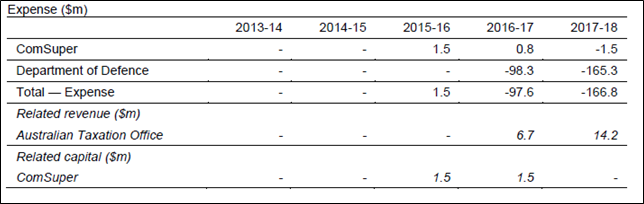

The 2014–15 Budget included the following estimates for the

changed superannuation arrangements (Figure 1). It should be noted that the

change to an accumulation superannuation scheme involves a cost to the budget

as it effectively recognises the superannuation liability as an expense as it

is incurred rather than as the benefit is paid under the defined benefit scheme

arrangements.

Figure 1: 2014–15 Budget impact of establishing new

military superannuation accumulation

Source: Australian Government, Budget

measures: budget paper no. 2: 2014–15, p. 75, accessed 1 July

2015.

However, these estimates were based on establishing a new

scheme with different contribution rates for non‑warlike and war-like

service. It is unclear how the decision to have a single contribution rate of

16.4 per cent has impacted on the estimated cost of the changed

arrangements.

As required under Part 3 of the Human Rights

(Parliamentary Scrutiny) Act 2011 (Cth), the Government has assessed the

Bill’s compatibility with the human rights and freedoms recognised or declared

in the international instruments listed in section 3 of that Act. The

Government considers that the Bill is compatible.[38]

What are the arguments in favour of

establishing a new military superannuation scheme?

Part 2 of the Bill includes the key

provisions to establish the Australian Defence Force Superannuation Scheme

(also to be known as ‘ADF Super’) by a deed, which will be a non-disallowable

legislative instrument (clause 7). The Minister will be empowered to, by

writing, amend the trust deed subject to the trustee—specified to be the

Commonwealth Superannuation Corporation—consenting to the amendment, or in

other certain circumstances (clause 8).

There are a number of arguments used in favour of

establishing a new military superannuation scheme. These include a general

preference for accumulation superannuation arrangements as well as changed

labour market and superannuation arrangements and career patterns for ADF

personnel.

Unfunded liabilities of defined

benefit schemes

There has been a trend away from defined benefits

superannuation schemes for the private and public sector in Australia and also

around the world. Contributing to the decline in some other countries were

factors such as increased job mobility, more women in the paid workforce

(entailing less family attachment to particular employers), fewer workers in

unions, lower interest rates (entailing higher defined benefit liabilities,

especially for defined benefit plans offering pensions), and increased

longevity.[39]

In Australia, many of the same factors applied, but changed tax arrangements

and strengthened regulatory arrangements were also an important factor.[40]

For Commonwealth public sector employees, the last

remaining defined benefit scheme, the Public Sector Superannuation (PSS) scheme,

was closed to new members from 30 June 2005.[41]

From this time, Commonwealth public servants have been eligible to be members

of an accumulation scheme, the Public Sector Superannuation Accumulation Scheme

(PSSap) and receive an employer contribution rate of 15.4 per cent.[42]

The underlying rationale for the closure of the PSS and the

move to accumulation superannuation arrangements were concerns about the

intergenerational equity of making future taxpayers fund the defined benefits

of former public servants when they retired. Indeed, the establishment of the

PSSap in 2005 occurred at around the time of the establishment of the ‘Future

Fund’—a separate fund, to be contributed to by budget surpluses and assets

sales, to pay for the unfunded defined benefit superannuation of Commonwealth

public servants. Introducing the Bill to establish the Future Fund, the then

Treasurer noted that:

When the fund is eventually drawn down to pay superannuation

liabilities—some of which are accruing now—taxpayers will face a lighter burden

than would have been the case if this fund had not been established. The fund

represents a sensible financial policy now for the benefit of future

generations. The fund will be needed in the future because we know that future

generations will have the costs of the ageing of the population on their hands within

20 years time. The fact that the current generation is funding its liabilities,

and also funding liabilities accrued in the past, will give future taxpayers a

much better chance to cope with these challenges.[43]

The National Commission of Audit’s recommendation to close

the MSBS and establish an accumulation superannuation scheme largely reflected

concerns about budget sustainability and intergenerational equity. In making

the recommendation, the NCOA noted:

Unfunded superannuation liabilities on the Commonwealth’s

balance sheet represent a significant risk to the long‑term financial

position of the Commonwealth. The unfunded liability for defined benefit

schemes is currently estimated at some $150 billion rising to over $350 billion

by 2050. These liabilities will have to be paid for by future generations.

Steps should be taken now to better manage them ... The

Commission recommends that the Military Superannuation and Benefits Scheme be

closed to new members and replaced by an accumulation scheme for new Australian

Defence Force personnel.[44]

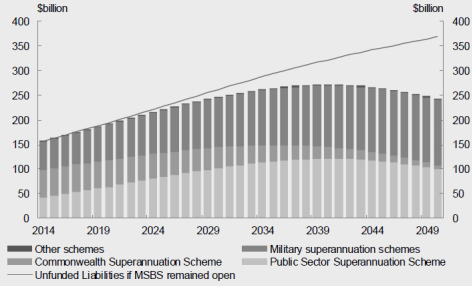

Information presented in the 2014–15 Budget papers

showed the reduction in the Commonwealth’s unfunded superannuation liabilities

as a result of the decision to close the MSBS from 1 July 2016 (Figure 2).

The impact of the decision was to reduce the unfunded superannuation liability

by $126 billion by 2049–50.[45]

Figure 2: Change in unfunded Commonwealth Government superannuation liability

projections with the closure of the MSBS from 1 July 2016, 2013–14 to

2049–50

Source: Australian Government, Budget

strategy and outlook: budget paper no. 1, 2014–15, p. 7–24,

accessed 1 July 2015.

Modernising superannuation

arrangements

Criticisms of the MSBS itself have also been made on a

number of grounds. Many of these criticisms are based on comparisons with

features associated with contemporary accumulation superannuation arrangements

that apply across the workforce more generally.

The Podger Review noted a number of issues with the MSBS including:

- ‘very

generous benefits’ to long-serving members with a choice of an indexed pension

or lump sum or both but ‘a substantially less generous level of employer

benefit’ for shorter serving members due to the preservation requirements. For

shorter serving members the benefit ‘may be less than necessary to contribute

to the full maintenance of living standards in retirement’

- the

scheme is complex for members to understand and does not allow members to exert

control over employer-funded benefits, and

- the

scheme ‘has not, in practice, contributed to recruitment or retention because

the complexity undermines the potential benefits of the scheme’s structure’.[46]

Some of these issues have also been raised by organisations

representing current and former ADF personnel, which have also identified a

number of shortcomings of the MSBS—although not all of these issues are

addressed by the package of Bills—which in the view of these organisations can

disadvantage some MSBS members:

-

there are no portability provisions and members cannot get access

to the employer benefit component until they reach preservation age. For

shorter term members ‘[if] they were able to roll over the employer benefit to

a complying super fund of their choice they would be significantly better off

over the long term’

-

the indexation of the MSBS superannuation benefit to the consumer

price index results in ‘the purchasing power of the pension [being] continually

eroded over time. That is because, as most know, CPI is a measure of inflation

not purchasing power’[47]

and

-

long-term ADF members contributing to MSBS are subjected to a

Maximum Benefit Limit (MBL). The effect of this is to ‘force these most

experienced and valuable service personnel to stop contributing to the

accumulation component of their fund while at the same time the government

ceases contributing as well due to the member’s total payout having peaked’.[48]

Comparison of MSBS with ADF Super

With the Minister noting that ADF Super would represent a

‘modern’ superannuation arrangement, the shift away from a defined benefit to

an accumulation scheme addresses a number of criticisms of the MSBS in terms of

its flexibility, portability and choice available to ADF members compared to

their counterparts in the private sector and more recent public sector

employees.

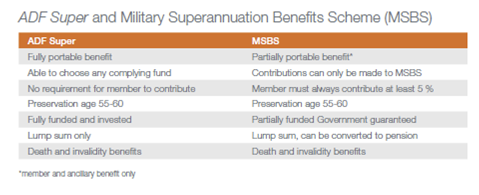

A comparison of the proposed ADF Super arrangements with

the MSBS was published by the Department of Defence in June 2015 (Figure 3). On

this comparison, key benefits to ADF members compared to the MSBS are in giving

choice about where superannuation contributions are made, the removal of the

mandatory employee contribution requirement and a benefit that is portable upon

leaving the ADF.

Figure 3: Department of Defence comparison between ADF Super and MSBS

Source: Department of Defence, ‘ADF Super’,

Department of Defence website, accessed 3 July 2015.

This comparison does not address the relative value of the

employer contribution of rate of 16.4 per cent, when compared to the

workforce generally at the superannuation guarantee rate of 9.5 per cent

(rising gradually to reach 12 per cent from July 2025) and other selected

superannuation schemes. Any comparison on the relative benefits for ADF members

will therefore need to consider the benefits associated with flexibility, less

complexity and portability traded off against a lower employer contribution

rate.

16.4 per cent contribution rate—Too

high, too low, or about right?

Item 2 of Schedule 1 to the Defence Legislation Amendment

(Superannuation and ADF Cover) Bill 2015 inserts new section 52A into the Defence

Act 1903 to specify that the employer superannuation contribution rate for

ADF Super members (or those that would be members had they not chosen their own

superannuation fund) is 16.4 per cent of ordinary time earnings, to be

paid into the fund for each pay period.[49]

This is a more regular payment than under the superannuation guarantee, which

generally requires payments to be made quarterly.

The proposed 16.4 per cent employer contribution rate

is higher than the contribution rate under the superannuation guarantee and for

the current Commonwealth public sector scheme (PSSap), but is lower than the

notional employer contribution rates under the existing schemes covering ADF

members (MSBS and DFRDB), the scheme covering Commonwealth judges, and the

scheme that covers federal members of Parliament elected prior to the 2004

election (PCSS) (Table 2).

Table 2: Employer contribution rates, selected

Commonwealth public sector superannuation schemes and superannuation

arrangements

|

Scheme

|

Features

|

Employer contribution rate (%) (a)

|

|

Superannuation guarantee

July 2016

|

Payment to accumulation

scheme. Generally applies to all employees.

|

9.5%

|

|

Superannuation guarantee

July 2025

|

Payment to accumulation

scheme. Generally applies to all employees.

|

12%

|

|

Public Sector Accumulation

Scheme (PSSap)

|

Generally applies to all

Commonwealth public sector employees who commenced after July 2005.

|

15.4%

|

|

Parliamentary

superannuation accumulation scheme

|

Payment to accumulation

scheme. Applies to Parliamentarians joining the Parliament who were not

sitting Parliamentarians on 31 August 2004.

|

15.4%

|

|

Australian Defence Force

Superannuation Scheme (ADF Super)

|

Payment to accumulation

scheme. Proposed to apply to ADF members who join from 1 July 2016.

|

16.4%

|

|

Public Sector

Superannuation Scheme (PSS)

|

Closed defined benefit

scheme. Generally covers Commonwealth public sector employees who commenced

employment between 1 July 1990 and 30 June 2005.

|

18.8% (last estimated in

2011)

|

|

Commonwealth Superannuation

Scheme (CSS)

|

Closed defined benefit

scheme. Generally covers Commonwealth public sector employees who commenced

employment between 1 July 1976 and 30 June 1990.

|

20.3% (last estimated in

2011)

|

|

Military Superannuation

Benefits Scheme (MSBS)

|

Defined benefit scheme.

Generally covers members of the ADF who commenced service from 1 October

1991. Remains open to new members.

|

30.4% (last estimated in

2011)

|

|

Defence Force Retirement

Defined Benefits scheme (DFRDB)

|

Closed defined benefit

scheme. Generally covers members of the ADF who commenced service up to 30 September

1991.

|

35.5% (recalculated in 2014

to reflect changed indexation arrangements)

|

|

Parliamentary

Superannuation Scheme (PCSS)

|

Closed defined benefit

scheme. Generally covers Members and Senators elected to the federal

parliament. Closed to new members from 9 October 2004.

|

40% (last estimated in

2011)

|

|

Judges Pension Scheme

|

Defined benefit scheme. Remains

open.

|

68.9% (last estimated in

2011)

|

Note: (a) The employer contribution rate for defined benefit

schemes is calculated by an actuary based on the experience of members under

the scheme, assumptions about inflation, wages and member experiences and calculates

the estimated contribution rate that would be required to fund the benefits

accruing to contributors.

Source: Superannuation

Guarantee (Administration) Act 1992, subsection 19(2); Department of

Finance and Deregulation, PSS

and CSS Long Term Cost Report 2011, Prepared by Mercer Consulting

(Australia) Pty Ltd using data as at 30 June 2011, 2012, p. 2; Department

of Finance and Deregulation, Parliamentary

Contributory Superannuation Scheme — Long Term Cost Report 2011, Prepared

by Mercer Consulting (Australia) Pty Ltd using data as at 30 June 2011, 2012,

p. 18; Department of Finance and Deregulation, The

Judges’ Pension Scheme Long Term Cost Report 2011, Prepared by Mercer

Consulting (Australia) Pty Ltd using data as at 30 June 2011, 2012, p. 18;

Explanatory Memorandum, Defence

Forces Retirement Benefits Legislation Amendment (Fair Indexation) Bill 2014,

p. 7; Australian Government Actuary, Military

Superannuation and Benefits Scheme Defence Force Retirement and Death Benefits

Scheme and Defence Forces Retirement Benefits Scheme: A report on long term

costs prepared by the Australian Government Actuary using data to 30 June 2011,

2012, p. 29; Parliamentary

Superannuation Act 2004, subsection 8(2), all accessed 30 June

2015.

As originally announced in the 2014–15 Budget, the

contribution rate was proposed to be 15.4 per cent with an additional

amount of a 2.6 per cent (that is, to a rate of 18 per cent) ‘for any

period in which members are serving in war-like operations’.[50]

Defence groups including the Defence Force Welfare

Association (DFWA) and the Returned & Services League (RSL) were opposed to

a two-tier contribution rate. This opposition was based on a number of

arguments including:

-

contribution rate at 15.4 per cent did not differentiate between

ADF and civilian superannuation arrangements and ‘fails to match the Government’s

stance of treating members of the ADF separately’

-

the higher rate for war-like operations differentiated between

ADF members who were part of a ‘team’ and such a distinction weakened this and

could be a ‘corrosion of morale’ and

-

ADF members on peacekeeping missions are exposed to danger and

yet their service may not be categorised as ‘war-like’.[51]

Both the RSL and DFWA proposed a single rate of at least

18 per cent.[52]

The ALP has welcomed the single rate of 16.4 per cent

rather than a two-tiered rate, which ‘would have undermined the team ethos of

the ADF, and served as an administrative nightmare’.[53]

The ALP also notes that this rate ‘clearly recognises the unique nature of

military service’.[54]

In his second reading speech, the Minister noted that the

employer contribution rate took account of the nature of military service and

was higher than applied generally:

In recognising the unique nature of military service, the

government has agreed to a single employer contribution rate of 16.4 per cent,

which is a generous rate well above community standards.[55]

Comparisons of this 16.4 per cent rate with other

arrangements will need to take into account a range of factors, including the

military service, the general standard applying to employees under the

superannuation guarantee scheme and the appropriateness of comparisons with

members of parliament and the judiciary.

Eligibility for membership of ADF

Super

Part 3 of the Bill sets out the eligibility requirements for

membership of ADF Super. Broadly, a person is eligible to be a member of ADF

Super from 1 July 2016 if:

- they

are a member of the ‘Permanent Forces’ or are a ‘continuous full-time Reservist’[56]

or

-

they are a member of the MSBS (whether they are currently

contributing or receiving a benefit) or are a former contributing member of the

DFRDB scheme (clause 11).

These arrangements effectively exclude only those existing

ADF personnel who were engaged prior to October 2001 and are therefore members

of the DFRDB scheme from becoming ADF Super members. To become a member of ADF

Super, a contributing DFRDB member would have to resign from the ADF and then

rejoin the permanent force or serve a period of full-time continuous service as

a reservist.[57]

Choice of fund

An eligible person becomes an ADF Super member by making a

conscious choice to join the fund or by virtue of not making a choice, with the

fund effectively being the sole ‘default’ fund under the Superannuation

Guarantee (Administration) Act 1992 (clause 12). It is important to

note that eligible ADF Super members can therefore choose any complying

superannuation fund (including a self-managed superannuation fund) under these

arrangements.[58]

Transfers from MSBS and DFRDB schemes

As noted above, a contributing DFRDB member is not eligible

to join the ADF Super scheme. However, contributing MSBS members have a choice

to transfer to the ADF Super scheme but this transfer only applies to their

member and ancillary benefits and not their employer contribution (which

remains preserved in the MSBS). In addition, once an MSBS member makes the

choice to move to ADF Super they will not be able to move back to the MSBS

scheme (subclause 12(3) of the Bill and proposed subsection 7(3) of the Military

Superannuation and Benefits Act 1991, to be inserted by item 58 of Schedule

1 to the Defence

Legislation Amendment (Superannuation and ADF Cover) Bill 2015).[59]

Veterans groups have had a longstanding position that the

employer component in the MSBS should also be available for transfer to another

superannuation fund when a person leaves the ADF rather than remain preserved

in the MSBS. In relation to the proposed arrangements, the Defence Force

Welfare Association (DFWA) noted that:

MSBS contributors serving when the new ADF Super scheme comes

into force may join the new scheme. They will be able to transfer their

personal compulsory MSBS contributions (and earnings accrued) to the new scheme

if they wish. However they will not be able to access their employer’s

contributions to MSBS, either at that time or when they leave the ADF. Instead,

their government MSBS contributions will be preserved within MSBS until they

retire finally from the workforce, indexed only to the totally inadequate

Consumer Price Index (CPI).

The DFWA strongly opposes this arrangement. No other

Australian in a modern superannuation scheme is unable to access their

employer’s contribution in order to transfer to a scheme of their choice.[60]

In choosing to transfer to the ADF Super scheme from the

MSBS, ADF members will need to potentially balance several factors including

that they:

-

are no longer required to pay the mandatory five per cent

contribution as required under the MSBS and therefore may experience an

equivalent increase in take home pay

-

are able to gain more control over their accumulated employer

component by potentially choosing their own superannuation fund

-

exclude themselves from the potential benefits provided (which

depend on period of service, possible promotions, et cetera) under the defined

benefit element of the MSBS.

Treatment of part-time reservists

The Superannuation

Guarantee (Administration) Act 1992 includes a specific exclusion

regarding superannuation contributions for reservists, with the tax-free pay

part-time reservists receive excluded from an employer’s liability to make the

minimum mandatory superannuation payments.[61]

The rationale for this exclusion, which has been in place since the

commencement of the superannuation guarantee scheme in 1992, was that tax-free

payments should be excluded from also receiving superannuation contributions.[62]

Reservists who are not considered to be a ‘continuous full-time

Reservist’ are also excluded from being a member of ADF Super (clauses 4 and

11).

Veterans groups are opposed to the arrangements that

continue to exclude part-time reservists from receiving superannuation

contributions for their service. The RSL noted that:

... there is good reason to offer membership of the new ADF

superannuation scheme to members of the army, navy and air force reserve forces

as a choice for each individual on a once only decision basis. The RSL

appreciates that this proposal may entail an administrative cost and that some

members of the reserve may decline an offer of membership of the proposed new

ADF superannuation scheme for taxation or other reasons. However, because of

the ADF total force concept now evolving the RSL contends that each member of

the ADF reserve should be given the choice of opting in or out of the new ADF

superannuation scheme.[63]

This view is also supported by the Defence Force Welfare

Association, who note that:

The government says that ADF Super will not extend to part

time members of the ADF Reserves. Given that all major political parties in

Australia are committed to compulsory universal superannuation for all work

performed, part time or full time, the government’s position is indefensible.

DFWA strongly supports ‘employer’ superannuation for service

in the ADF Reserves, with no offsetting provisions. Part-time ADF members

should not be discriminated against.[64]

Trustee and administration arrangements

As previously noted, the CSC will become the trustee of ADF

Super, with the trust deed to also set out the functions and powers of CSC in

relation to ADF Super and to make rules for the administration of ADF Super.

Part 2 and Part 4 of the Bill provide for

various arrangements for the administration and functions of the CSC to manage

the ADF Super scheme, including that the costs of administration of the Act

and trust deed are to be paid by CSC out of the ADF Super Fund in accordance

with the trust deed (clause 19). Other matters include the provision of

rules for the payment of fees so that these are not considered to be a tax for

constitutional purposes (clause 20). Arrangements for the splitting of

superannuation in the event of a relationship breakdown are also included (clause

9).

In broad terms, the arrangements relating to the splitting

of superannuation, the establishment of a Trust Deed for the scheme, the

appointment of CSC as the trustee and the framework for the administration of

the scheme by CSC are comparable to those established for the existing public

sector scheme, the PSSap, as set out in the Superannuation Act 2005.[65]

The cost of administration arrangements included in clause

19 provide that ADF Super members will pay for the administration of the

scheme. This is consistent with the recent changes to the PSSap scheme made by

the Governance of Australian Government Superannuation Schemes Legislation

Amendment Act 2015 that shifted the cost of administration from the

Commonwealth to members of the PSSap scheme.[66]

Other

Part 5 of the Bill includes provisions relating to

persons who are subject to the Trust Deed, termination and variation of rights

by later legislation and the making of rules.

Clause 28 allows the Minister to make rules that

are required or permitted by the Bill, or necessary or convenient for giving

effect to the Bill. In most cases, the CSC must consent to proposed rules (subclause

28(2)). Subclause 28(3) sets out limits on the Minister’s rule‑making

powers, such that the rules cannot, for example, create an offence or civil

penalty, or impose a tax.

Subclause 29(1) specifies that the rules may

contain provisions that ensure that ADF Super is able to satisfy conditions or

requirements imposed under a number of specified Acts (including the Income

Tax Assessment Act 1997 and the Superannuation Industry (Supervision)

Act 1993). Of note, subclause 29(2) provides that in the event that

the rules made for the purposes of subclause 29(1) are inconsistent with a provision

in the Bill (when enacted) or the Trust Deed, the rules will prevail. It

appears that no other Commonwealth legislation contains a provision of this

type. The Explanatory Memorandum to the Bill states:

This provision is necessary because the conditions or

requirements of the above laws are usually promulgated by regulations or other

instruments made under those laws. Allowing rules to be made under this Bill

would allow those conditions or requirements to be met more quickly than if Act

amendments were required. It is intended that should it be necessary to make

rules under this section, legislation would be introduced as soon as possible

to give effect to the relevant provisions.[67]

In commenting on documents that had been made available to

the RSL for review (which appear to have similar provisions to those in the

Bill), the RSL noted the flexibility that the rules would provide for any

Government:

Another matter of concern to the RSL in the draft

documentation was that normally any delegated rules or regulations or

instruments cannot be inconsistent with the main legislation; whereas our

examination suggests this is reversed in this case. Thus we understand that

where there is any inconsistency between the draft documentation and the Rules,

the Rules prevail.

We advised that this contrasts with what is normal practice

and that we do not agree with it. We noted that if this was allowed to stand

one of the ways of changing ADF Super would be to use the power to amend the

rules. Our concern is that such action could be effected without having to pass

amending legislation through Parliament. That would mean no consultation and no

debate. The RSL opposed this aspect of the draft documentation and asserted

that any Rules must be subservient to legislation.[68]

This issue could be expected to be addressed by the Senate

Standing Committee for the Scrutiny of Bills when it presents its examination

of the Bill.

Members, Senators and Parliamentary staff can obtain

further information from the Parliamentary Library on (02) 6277 2500.

[1]. Parliament

of Australia, ‘Australian

Defence Force Superannuation Bill 2015 homepage’, Australian Parliament

website, accessed 7 August 2015.

[2]. Parliament

of Australia, ‘Defence

Legislation Amendment (Superannuation and ADF Cover) Bill 2015’, Australian

Parliament website, accessed 7 August 2015.

[3]. Parliament

of Australia, ‘Australian

Defence Force Cover Bill 2015’, Australian Parliament website, accessed

7 August 2015.

[4]. Military Superannuation

and Benefits Act 1991, accessed 10 August 2015.

[5]. Commonwealth

Superannuation Corporation, Annual

report 2013–14, p. 54, accessed 3 July 2015.

[6]. Commonwealth

Superannuation Corporation, Militarysuper

book: a summary of the Military Superannuation Benefits Scheme, 30 June

2012; Australian Government Actuary, Military

Superannuation and Benefits Scheme Defence Force Retirement and Death Benefits

Scheme and Defence Forces Retirement Benefits Scheme: A report on long term

costs prepared by the Australian Government Actuary using data to 30 June 2011,

2012, both accessed 3 July 2015.

[7]. B

Billson (Minister Assisting the Minister for Defence), Review

of military superannuation, media release, 27 February 2007,

accessed 1 July 2015.

[8]. A

Bartlett, Bartlett

welcomes Governments [sic] belated examination of defence force superannuation,

media release, 27 February 2007; N Sherry and A Griffin, Government

not to be trusted on military super review, media release,

27 February 2007; B Toohey, ‘Opinion:

Terror doesn’t hang on defence’, West Australian, 28 August

2006, p. 19, all accessed 1 July 2015.

[9]. B

Billson (Minister Assisting the Minister for Defence), op. cit.

[10]. A

Podger, D Knox and L Roberts, Report

of the review into military superannuation arrangements: Military

Superannuation Review, Department of Defence, Canberra, 31 July

2007, p. i, accessed 1 July 2015.

[11]. W

Snowden (Minister for Defence Science and Personnel) and A Griffin (Minister

for Veterans’ Affairs), Review

of military superannuation, media release, 24 December 2007,

accessed 1 July 2015.

[12]. Podger

Review, op. cit., p. 12.

[13]. Ibid.,

p. ix.

[14]. Ibid.,

pp. 17–18.

[15]. D

McLennan, ‘Defence

groups attack super plan’, Canberra Times, 22 March 2008,

p. 7, accessed 10 July 2015.

[16]. M

Cormann (Minister for Finance) and J Hockey (Treasurer), Coalition

commences Commission of Audit, joint media release, 22 October

2013, accessed 1 July 2015.

[17]. Ibid.

[18]. National

Commission of Audit, Towards

responsible government: the report of the National Commission of Audit, Phase 1,

National Commission of Audit, Canberra, February 2014, p. 60, accessed

1 July 2015.

[19]. Ibid.

[20]. M

Cormann (Minister for Finance) and D Johnston (Minister for Defence), New

military superannuation scheme arrangements, joint media release,

13 May 2014, accessed 1 July 2015.

[21]. M

Cormann (Minister for Finance) and J Hockey (Treasurer), Our

response to the National Commission of Audit report, joint media

release, 13 May 2014, accessed 1 July 2015.

[22]. Australian

Government, Budget

measures: budget paper no. 2: 2014–15, p. 75, accessed 1 July

2015.

[23]. Ibid.

[24]. G

Brodtmann, Labor

welcomes Government’s back down on ADF super, media release,

25 June 2015, accessed 10 July 2015.

[25]. W

Snowden (Minister for Defence Science and Personnel) and A Griffin (Minister

for Veterans’ Affairs), Review

of military superannuation, media release, op. cit.

[26]. Ibid.

[27]. D

McLennan, op. cit.

[28]. B

Baldwin, Still

no word on the review into military superannuation, media release,

29 July 2009, accessed 7 August 2015.

[29]. Ibid.

[30]. A

Griffin (Minister for Veterans’ Affairs and Minister for Defence Personnel), ‘

Second reading speech: Governance of Australian Government Superannuation

Schemes Bill 2010, Comsuper Bill 2010 and the Superannuation Legislation (Consequential

Amendments and Transitional Provisions) Bill 2010’, House of

Representatives, Debates, 2 June 2010, p. 4948, accessed

10 July 2015.

[31]. Defence

Force Welfare Association, ‘The

proposed new military superannuation scheme, the DFWA position—February 2015’,

DFWA website, accessed 1 July 2015.

[32]. Ibid.

[33]. Alliance

of Defence Service Organisations (ADSO), ‘ADSO

update 5/2014 – Year 2014 in review – 04 August 2015’, ADSO website,

accessed 4 August 2015.

[34]. Returned

& Services League of Australia (RSL), National

President’s newsletter no 2 of 2015, RSL website, pp. 1–4,

accessed 3 July 2015.

[35]. J

Strachan, ‘Super

in the line of fire’, Sunday Canberra Times, 4 May 2014, p. 1,

accessed 5 August 2015.

[36]. J

Kerin, ‘Fire

returned over military super changes’, Australian Financial Review,

15 May 2014, p. 16, accessed 5 August 2015.

[37]. Explanatory

Memorandum, Australian

Defence Force Superannuation Bill 2015, p. 3, accessed 7 August 2015.

[38]. The

Statement of Compatibility with Human Rights can be found in the Explanatory

Memorandum to the Bill.

[39]. H

Bateman and G Kingston, ‘Restoring

a level playing field for defined benefits superannuation’, paper presented

at the Melbourne Money & Finance Conference, 1 and 2 July 2013, p. 4,

accessed 1 July 2015.

[40]. Ibid.

[41]. Commonwealth

Superannuation Corporation (CSC), ‘PSS:

About us’, CSC website, accessed 5 August 2015.

[42]. Commonwealth

Superannuation Corporation (CSC), ‘How PSSap works’, CSC

website, accessed 5 August 2015.

[43]. P

Costello (Treasurer), ‘Second

reading speech: Future Fund Bill 2005’, House of Representatives, Debates,

7 December 2005, p. 3, accessed 5 August 2015.

[44]. National

Commission of Audit, Towards responsible government: the report of the

National Commission of Audit, Phase 1, op. cit., p. xvi.

[45]. Australian

Government, Budget

strategy and outlook: budget paper no. 1, 2014–15, p. 7–24,

accessed 1 July 2015.

[46]. Podger

Review, op. cit., pp. 14–15.

[47]. The

same issue was relevant to DFRB/DFRDB benefits. However, the Government changed

indexation arrangements for the DFRB/DFRDB superannuation benefits for

recipients aged 55 and over from 1 July 2014 so they would be indexed according

to the greater of the increase in the CPI or the Pensioner and Beneficiary

Living Cost Index, subject to meeting the specified floor percentage (27.7 per

cent of male total average weekly earnings for the single pension) (Defence Force

Retirement Benefits Legislation Amendment (Fair Indexation) Act 2014,

Schedule 1, accessed 3 August 2015).

[48]. Defence

Force Welfare Association (DFWA), ‘Letter

to the Editor Canberra Time [sic] 9 May 2014’, DRWA website, accessed

3 August 2015.

[49]. Parliament

of Australia, ‘Defence

Legislation Amendment (Superannuation and ADF Cover) Bill 2015’, Australian

Parliament website, accessed 7 August 2015.

[50]. Australian

Government, Budget

measures: budget paper no. 2: 2014–15, p. 75, op. cit.

[51]. Returned

& Services League Australia, National

President’s newsletter no 2 of 2015, p. 3, op. cit.; Defence Force

Welfare Association, ‘The

proposed new military superannuation scheme, the DFWA position—February 2015’,

op. cit.

[52]. Ibid.

[53]. G

Brodtmann, Labor

welcomes Government’s back down on ADF Super, op. cit.

[54]. Ibid.

[55]. S

Robert (Assistant Minister for Defence), ‘Second

reading speech: Australian Defence Force Superannuation Bill 2015’, House

of Representatives, Debates, 25 June 2015, p. 7584, accessed

30 June 2015.

[56]. The

terms ‘Permanent Forces’ and ‘continuous full-time Reservist’ are defined in

clause 4 and cover certain ADF personnel engaged under the Naval Defence Act

1910, the Defence Act 1903 and the Air Force Act 1923.

[57]. Explanatory

Memorandum, paragraph 34.

[58]. Ibid.,

paragraph 54.

[59]. Department

of Defence, ‘ADF

Super: Frequently asked questions’, Department of Defence website, accessed

9 July 2015.

[60]. Defence

Force Welfare Association, op. cit., p. 5.

[61]. Superannuation

Guarantee (Administration) Act 1992, section 29, accessed 7

August 2015.

[62]. J

Kerin (Treasurer), Superannuation

guarantee levy: an information paper, The Treasury, Canberra, December

1991, p. 6, accessed 9 July 2015.

[63]. Returned

& Services League of Australia (RSL), op. cit., p. 2.

[64]. Defence

Force Welfare Association, op. cit., p. 5.

[65]. The

Superannuation Act

2005 (accessed 10 August 2015) has a similar structure and provisions

relating to how the CSC will be empowered to administer the fund.

[66]. Governance of

Australian Government Superannuation Schemes Legislation Amendment Act 2015,

Schedule 3, accessed 9 July 2015.

[67]. Explanatory

Memorandum, Australian

Defence Force Superannuation Bill 2015, op. cit., paragraph 83.

[68]. Returned

& Services League of Australia (RSL), National

President’s newsletter no 3 of 2015, RSL website, p. 4, accessed

10 August 2015.

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

Disclaimer: Bills Digests are prepared to support the work of the Australian Parliament. They are produced under time and resource constraints and aim to be available in time for debate in the Chambers. The views expressed in Bills Digests do not reflect an official position of the Australian Parliamentary Library, nor do they constitute professional legal opinion. Bills Digests reflect the relevant legislation as introduced and do not canvass subsequent amendments or developments. Other sources should be consulted to determine the official status of the Bill.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Entry Point for referral.