Budget Review October 2022–23 Index

Dinty Mather

The purpose of the macroeconomic outlook in October Budget

strategy and outlook: budget paper no. 1 2022–23 Statement 2 is to present

the economic forecasts completed by the Australian Government Treasury

(Treasury). These forecasts underlie the Australian Government Budget and are

used to assist in calculating budget year outcomes and projections of

government revenue and expenses over the forward estimates (the fiscal

outcome).

Domestic macroeconomic parameters

Macroeconomic conditions have worsened since the 2021–22

Budget, the Mid-year

economic and fiscal outlook 2021–22 (2021–22 MYEFO), or the 2022–23

March Budget. Accordingly, Treasury forecasts for key domestic

macroeconomic parameters have been revised downwards in the October 2022–23

Budget.

The revisions are largely driven by world events. The International

Monetary Fund’s (IMF) October 2022 Outlook states

that:

Global economic activity is

experiencing a broad-based and sharper-than-expected slowdown, with inflation

higher than seen in several decades. The cost-of-living crisis, tightening

financial conditions in most regions, Russia’s invasion of Ukraine, and the

lingering COVID-19 pandemic all weigh heavily on the outlook.

The continued downward revisions over the past year

illustrate the difficulty of forecasting the development of short term economic

shocks. The revisions to 6 key economic parameters are illustrated in Figure 1

below.

Figure 1 Forecast and projected key economic

parameters for the October 2022–23 Budget, March 2022–23 Budget, 2021–22 MYEFO,

and 2021–22 Budget

Sources: Australian Government, Budget

Strategy and Outlook: Budget Paper no. 1: 2021–22, p. 9; Australian

Government, Mid-Year

Economic and Fiscal Outlook 2021–22, p. 17; Australian

Government, Budget

Strategy and Outlook: Budget Paper no. 1: 2022–23, p. 6; Australian

Government, Budget

Strategy and Outlook: Budget Paper no. 1: October 2022–23, p. 6.

Major trends reflected in the macroeconomic parameters are

due to the following expectations:

- Persistent

inflation and subsequent rising interest rates are expected to put downward

pressure on household spending, leading to a dampened demand for goods and

services in the economy.

- The

current tight labour market is expected to ease as economic activity slows,

resulting in slower employment growth.

- Wages

are forecast to grow in the next 2 years and as inflation dampens, by 2024 real

wages are expected to increase for the first time since early 2021.

- The

upwardly revised growth in nominal GDP is a result of inflation persisting into

2022–23.

- The

highest commodity prices on record during 2021–22, largely reflecting the

disruptions of natural gas flows from Russia to Europe, are expected to remain

high during 2022–23. Prices are then expected fall back to the long term trend,

resulting in a fall in the terms of trade in 2023–24 and creating negative

nominal GDP in that period.

Productivity growth assumptions in Budget

paper no. 1 (p. 6) have been realistically downgraded to reflect a

global trend. Although this assumption increases gross debt and debt servicing,

it is offset by an assumed increase in productivity and participation through

various workforce reforms.

The Parliamentary Budget Office in its online publication 2022–23

October Budget snapshot provides an historical time series of the 6 major

economic parameters including the performance of past forecasts.

Forecasting assumptions, risks, and

sensitivities

Forecasts are outputs from models that aim to emulate the

functioning of the domestic economy within a global context. Macroeconomic

forecasts are notoriously difficult to model from year to year and provide best

attempts to estimate the extent and severity of economic shocks as deviations

from the long term trend.

Because models cannot capture the full complexity of the

domestic economic system, assumptions must be made which will influence the

value of the parameters. This introduces uncertainty into the forecasts

resulting in ‘parameter variations’ in fiscal outcomes. Budget

paper no. 1 (p. 47) states that the detailed parameter forecasts, which

drive the fiscal outlook, are grouped into 3 key categories: prices, technical inputs,

and judgement.

Budget

paper no. 1 (p. 47) sets out price assumptions for key commodities and

their impact on revenues received by the Government. In general, key commodity

prices are expected to decline from current levels by the end of the March

quarter 2023, namely:

- The

iron ore spot price is assumed to decline from US$91/tonne

to US$55/tonne free on board (FOB).

- The

metallurgical coal spot price is assumed to decline from US$271/tonne to

US$130/tonne FOB.

- The

thermal coal spot price is assumed to decline from US$438/tonne to US$60/tonne

FOB.

- Crude

oil prices (TAPIS) are assumed to decline from US$108/barrel to around

US$100/barrel.

Technical assumptions, which influence the behaviours of

participants in the economy, generally impact on budget results too, namely:

- The

exchange rate is assumed to remain around its recent average level – a trade

weighted index of around 61.

- The

US dollar exchange rate is assumed to remain at around 65 US cents.

- Interest

rates in the Treasury forecast are informed by the Bloomberg survey of market

economists.

Expert technical judgements are applied to modelling outputs

to ensure realism. The judgements are about how one part of the economy might

affect other parts of the economy and how the domestic economic system is

affected by events in the international economy.

Forecast errors will always emerge and give rise to a

variance between real outcomes and expected ones. Confidence interval analysis

uses historical errors to assess the degree of uncertainty around current

forecasts. With continued high uncertainty in the world, forecast errors could

potentially be larger than in the past.

Sensitivity analyses are also used to examine uncertainty by

considering a range of values given to the key assumptions. For example,

modelling forecasts stated in Budget

paper no. 1 (pp. 245–46) provide a sensitivity analysis of the iron ore

price on the nominal GDP forecast and tax receipts. Treasury estimates that a

US$10/tonne FOB increase in the iron ore price will result in an increase in

nominal GDP of around $4.4 billion in 2022–23 and an increase in tax receipts

of $0.5 billion in the same year.

Statement 8 of Budget

paper no. 1 provides further information on confidence interval

analyses and sensitivity analyses around the economic parameter forecasts and

how they play out in the fiscal outlook. With the range of global uncertainties

and the general assumption of returns to lower pricing, there will continue to

be significant revisions in the parameter forecasts in the near future and thus

alterations to the overall fiscal outlook and fiscal position.

Modelling climate change

The significant fiscal impact and risk associated with

climate change is well understood and stated in Budget

paper no. 1 (pp. 103–104). However, from an economic forecasting

perspective, which informs the fiscal outcome, it seems as if the economic

effects of weather events, for example the recent October 2022 floods, are

modelled retrospectively as short term shocks to the long term trend (baseline

economy). Although this makes sense, the advent of climate change and the

resulting more frequent and extreme weather events point to a possible change

in the baseline economy. This is complicated to model and as the Australian

Government 2021 intergenerational report states (p. x):

The effects will depend on domestic and global actions, as

well as the pace, extent and impacts of climate change.

Budget

measures: budget paper no. 2: October

2022–23 (p. 190) however provides:

$29.8 million over 4 years from 2022–23 (and $6.9 million per

year ongoing) for the Treasury to restore capability to model climate risks and

opportunities.

Whether the endeavours of the Treasury to extend its capacity

to model climate risks into the base economy will improve accuracy will not be

known until future budget forecast reporting.

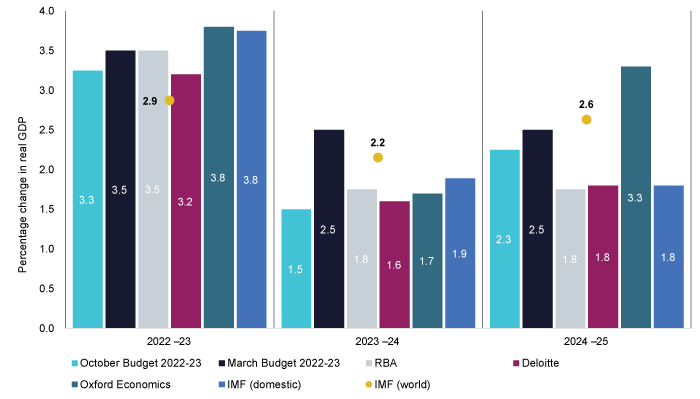

Benchmarking

All organisations and individuals base their macroeconomic

models on their own sets of assumptions and expert opinions. However, most

modellers examine the assumptions of others in an attempt to ‘beat the market’

by creating more predictive models. The following figures show competing model

outputs from 5 organisations for 2 key macroeconomic parameters: economic

growth as measured by real GDP and inflation as measured by the CPI.

Caution should be applied when comparing and benchmarking

the October 2022–23 Budget to other forecasts. The current world and domestic

economic situations are volatile, requiring updates and revisions to model

outputs at very short intervals.

The 5 organisations that the October 2002–23 Budget economic

growth and inflation forecasts are benchmarked against are: the March 2022–23

Budget, the Reserve Bank of Australia August forecasts, the IMF October interim

forecast for both the world and the Australian (domestic) economy, Deloitte’s

October Budget Monitor and the Oxford Economics October update.

In general, the current Treasury modelling is within the

bounds of alternative forecasting results.

Figure 2 demonstrates that although forecast macroeconomic

growth to 2024–25 in the October 2022–23 Budget has

been downgraded by 1% from the March 2022–23 Budget, it is within trend with

other forecasting results.

Figure 2 Real GDP forecast benchmarks

Sources: Australian Government, Budget

Strategy and Outlook: Budget Paper no. 1: 2022–23, p. 6; Australian

Government, Budget

Strategy and Outlook: Budget Paper no. 1: October 2022–23, p. 6;

Reserve Bank of Australia, Statement

on Monetary Policy, 5. Economic Outlook, August 2022; Deloitte Access

Economics, Budget Monitor, 11 October 2022, p. 6.; Oxford Economics, World

Economic Prospects Monthly, 12 October 2022; International Monetary Fund (IMF),

World

Economic Outlook: Countering the

Cost-of-Living Crisis, (Washington, DC: IMF, 2022), p. 125.

The results from all the forecasters indicate that

Australian economic growth is expected to be higher than world economic growth

for 2022–23 but lower for the 2023–24 and 2024–25 periods. The IMF explains

that lower than world growth for Australia from 2023–24 is expected because emerging market and developing economies will grow more

strongly than advanced economies.

Subject to further unexpected macroeconomic shocks and

geopolitical risks emerging, there is some consensus that both world economic

growth and Australian economic growth are expected to recover after 2023–24. In

other words, the world and Australian economic slowdowns are expected to last

for at least another year and a half before they recover.

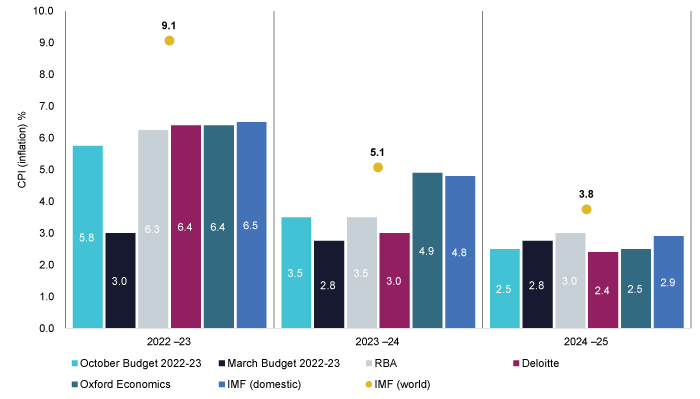

Figure 3 below illustrates that Treasury modelling of

consumer price inflation for the October 2022–23 Budget appears to be broadly

in line with that of other forecasters for 2023–24 and within close bounds for

2024–25.

Figure 3 Consumer price inflation forecast

benchmarks

Sources: Australian Government, Budget

Strategy and Outlook: Budget Paper no. 1: 2022–23, p. 6; Australian Government,

Budget

Strategy and Outlook: Budget Paper no. 1: October 2022-23, p. 6;

Reserve Bank of Australia, Statement

on Monetary Policy, 5. Economic Outlook, August 2022; Deloitte Access

Economics, Budget Monitor, 11 October 2022, p. 6.; Oxford Economics, World

Economic Prospects Monthly, 12 October 2022; International Monetary Fund (IMF),

World

Economic Outlook: Countering the

Cost-of-Living Crisis, (Washington, DC: IMF, 2022), p. 125.

There is a consensus among all forecasters that the

Australian CPI will be lower in all periods than world CPI. Again, this is due

to higher inflation forecasts for emerging market and developing economies compared

to advanced economies.

All online articles accessed October 2022

For copyright reasons some linked items are only available to members of Parliament.

© Commonwealth of Australia

Creative Commons

With the exception of the Commonwealth Coat of Arms, and to the extent that copyright subsists in a third party, this publication, its logo and front page design are licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia licence.

In essence, you are free to copy and communicate this work in its current form for all non-commercial purposes, as long as you attribute the work to the author and abide by the other licence terms. The work cannot be adapted or modified in any way. Content from this publication should be attributed in the following way: Author(s), Title of publication, Series Name and No, Publisher, Date.

To the extent that copyright subsists in third party quotes it remains with the original owner and permission may be required to reuse the material.

Inquiries regarding the licence and any use of the publication are welcome to webmanager@aph.gov.au.

This work has been prepared to support the work of the Australian Parliament using information available at the time of production. The views expressed do not reflect an official position of the Parliamentary Library, nor do they constitute professional legal opinion.

Any concerns or complaints should be directed to the Parliamentary Librarian. Parliamentary Library staff are available to discuss the contents of publications with Senators and Members and their staff. To access this service, clients may contact the author or the Library‘s Central Enquiry Point for referral.